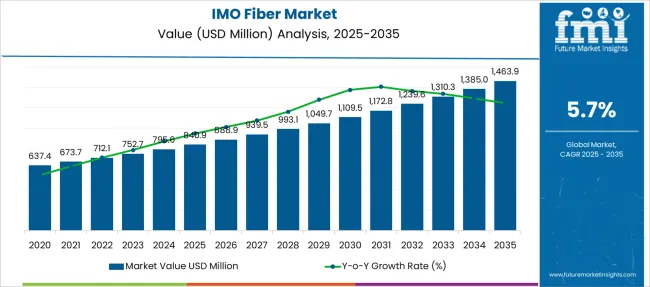

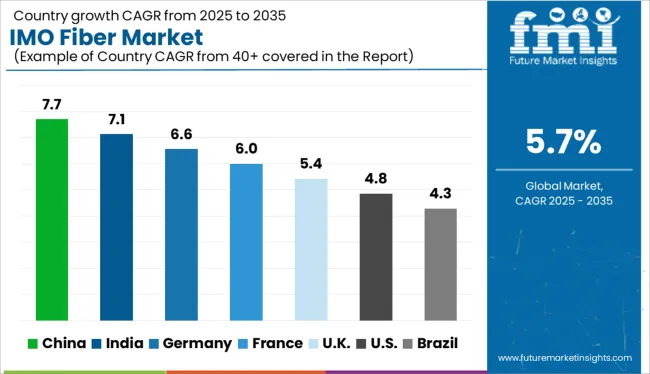

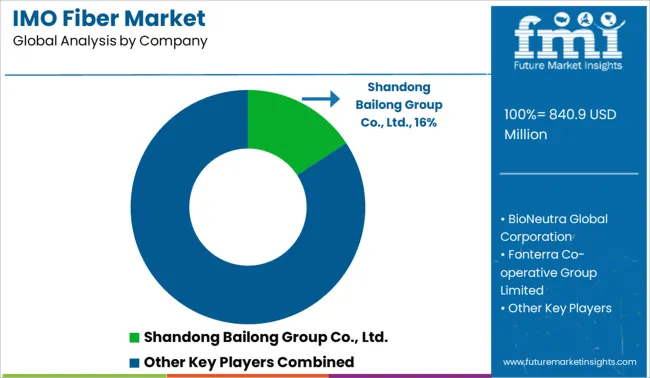

The IMO Fiber Market is estimated to be valued at USD 840.9 million in 2025 and is projected to reach USD 1463.9 million by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

| Metric | Value |

|---|---|

| IMO Fiber Market Estimated Value in (2025 E) | USD 840.9 million |

| IMO Fiber Market Forecast Value in (2035 F) | USD 1463.9 million |

| Forecast CAGR (2025 to 2035) | 5.7% |

The IMO fiber market is witnessing steady expansion, driven by the increased incorporation of functional dietary ingredients across food, beverage, and nutraceutical formulations. The growing consumer awareness around gut health, immunity, and digestive wellness has significantly influenced ingredient selection, leading to heightened demand for functional prebiotic fibers such as isomalto-oligosaccharides (IMO).

Regulatory support for labeling non-digestible carbohydrates as dietary fibers and the industry’s shift toward clean-label and sugar-reduction strategies are supporting broader application across formulations. Additionally, formulators are adopting IMO fibers due to their mild sweetness, stability across processing temperatures, and minimal glycemic response.

Future market growth is expected to be influenced by innovations in soluble fiber technologies, the growing penetration of plant-based products, and increased use in sports nutrition and infant food categories.

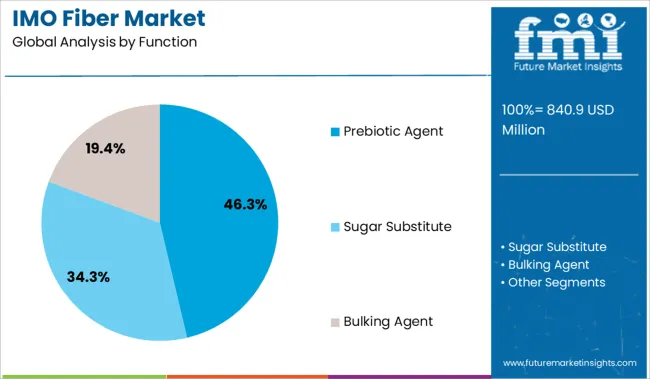

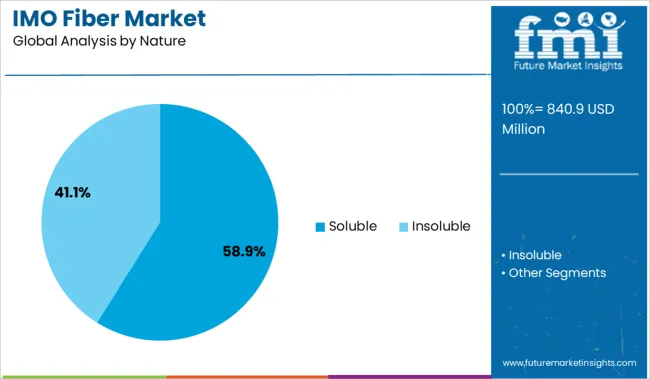

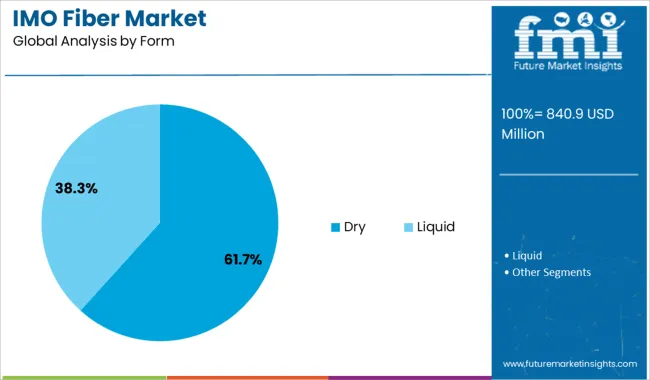

The market is segmented by Function, Nature, Form, Application, and Sales Channel and region. By Function, the market is divided into Prebiotic Agent, Sugar Substitute, and Bulking Agent. In terms of Nature, the market is classified into Soluble and Insoluble. Based on Form, the market is segmented into Dry and Liquid. By Application, the market is divided into Food, Animal Food, Pharmaceutical, and Others. By Sales Channel, the market is segmented into Offline and Online. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Prebiotic agent applications are projected to dominate the IMO fiber market in 2025, accounting for 46.3% of total revenue. This segment's lead is attributed to the growing use of IMO as a functional ingredient that stimulates beneficial gut microbiota.

Increasing consumer focus on digestive health and microbiome balance has elevated demand for functional foods fortified with prebiotic agents. IMO fibers, being non-digestible carbohydrates, have demonstrated selective fermentation in the colon, which supports their regulatory recognition as prebiotics.

Their compatibility with diverse food systems and neutral taste profile has led to widespread inclusion in bakery, dairy, and beverage applications. As the market continues to evolve toward personalized nutrition and gut-centric wellness, the prebiotic agent function remains a core growth driver.

The soluble category is expected to hold 58.9% of the IMO fiber market’s revenue share in 2025, establishing it as the leading segment by nature. This dominance is being fueled by the desirable functional properties of soluble IMO, including improved water retention, low viscosity, and ease of formulation across a broad range of liquid and semi-solid products.

Soluble fibers have gained preference in health-positioned products due to their ability to support satiety and glycemic control. Additionally, their stable behavior during thermal processing has enhanced their usability in high-temperature applications such as baked goods and ready-to-drink beverages.

The segment's growth is further supported by consumer inclination toward transparent labeling and naturally sourced, soluble dietary fiber additives.

Dry-form IMO fiber is anticipated to command 61.7% of the total market share in 2025, making it the most dominant format segment. This leadership is being driven by the superior shelf stability, ease of transport, and cost-effective storage offered by dry powders and granules.

Dry IMO fibers are widely used in powdered drink mixes, dry blends, bakery premixes, and supplements due to their compatibility with existing dry processing equipment and extended product life. Their low moisture content allows for better control over microbial stability and formulation performance, particularly in applications with stringent moisture limits.

As manufacturers seek versatile, high-purity fiber options for low-water activity systems, the dry form continues to serve as the preferred format in commercial production environments.

In the Historical outlook of the IMO Fiber market, the value increased from USD 637.4.0 Million in 2020 to USD 795.6 Million in 2024. The CAGR (2020 to 2024) is observed to be 5%.

Currently, consumers are paying more attention to their nutrition by putting an emphasis on a broad view of health and wellness that encompasses practically every element of life. Additionally, customers are becoming more and more active in healthy behaviors, consuming wholesome organic food and beverages, and adhering to balanced diets.

Global demand for IMO fiber components is increasing as a result, which raises public awareness of health and well-being and the number of customers who are interested in consuming nutritious cuisine.

For the Future projection of the IMO Fiber market, the value increased from USD 840.9 Million in 2025 to USD 1,239.6 Million in 2035. The CAGR (2025 to 2035) is estimated to be 5.7%.

The IMO fiber market in North America is growing at a rapid pace due to the increased demand from the food and beverage industry. The main drivers of this growth are the rising health consciousness of consumers and the need for healthier alternatives to traditional ingredients.

With the rising popularity of plant-based diets, IMO fibers are expected to continue gaining market share in North America. Food and beverage manufacturers are already beginning to experiment with these ingredients in order to create healthier products that meet the needs of their consumers.

The USA contributes 34.2% of the total revenue for the IMO Fiber Market.

The food and beverage industry is increasingly using fibers to improve the nutritional profile of its products. For example, many companies are adding soluble fiber to their products to reduce cholesterol levels and improve digestive health. In addition, insoluble fiber is being used to add texture and bulk to foods.

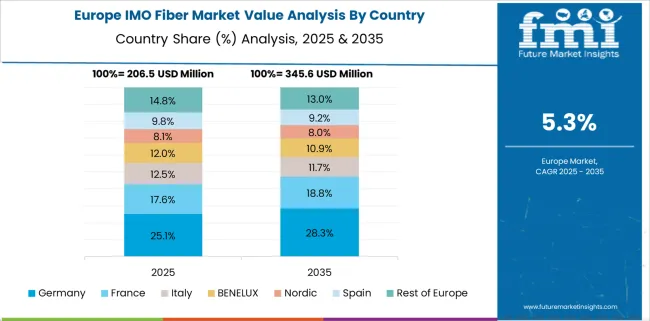

The market for IMO fiber is expected to continue to grow in Europe as consumers become more health conscious and demand more nutritious foods.

Germany contributes 24.4% to the IMO Fiber market and United Kingdom CAGR for the forecast period is 5.3%.

The Asia Pacific region is expected to witness significant growth in the coming years, owing to the growing population and changing lifestyle trends. Additionally, the increasing disposable incomes are further projected to boost the demand for fiber-rich products in the region.

Japan's contribution to the IMO Fiber market is 10.9% of the total market share, India and China are market drivers in the Asia Pacific and their latest CAGR in the IMO Fiber market are 6.0% and 3.6% respectively.

Latin America is one of the key regions for the growth of the IMO fiber market. The region has a large population and a growing economy, which is driving the demand for food and beverage products. In addition, the region has a large livestock population, which is fueling the demand for animal feed.

IMO Fiber is a leading provider of dietary fiber and other healthy ingredients to the pharmaceutical industry in Latin America. IMO Fiber's products are backed by science and have been shown to be effective in promoting gastrointestinal health. IMO Fiber's products are available in a variety of formulations to meet the needs of different customers.

From the Oceania region, Australia is contributing 2.3% of the total revenue of the IMO Fiber market.

The food and beverage industry is the major contributor to the growth of the IMO fiber market in Australia. The rising demand for healthy and functional foods, along with the growing awareness about the benefits of dietary fiber, are some of the key factors driving the growth of this market. Moreover, the increasing demand for plant-based meat products and dairy alternatives is also propelling the growth of this market.

Isomaltooligosaccharide is referred to as IMO. IMO Short-chain carbs make up fiber, which has the ability to resist digestion. Isomalto-oligosaccharides are naturally present in fermented foods including rice miso, soy sauce, and sake, and are a regular component of the human diet. IMO can either take the shape of spray-dried, sweet-tasting syrup or a powder.

Both soluble and insoluble fibers fall under the category of IMO Fiber. While insoluble fiber does not dissolve in water, soluble fiber does. Both kinds of fiber are necessary to keep the digestive tract in good shape.

Foods including oats, beans, and fruits contain soluble fiber. Foods including wheat bran, veggies, and whole grains include insoluble fiber. Both kinds of fiber are necessary to keep the digestive tract in good shape.

Fiber is important for several reasons. First, it helps to keep the digestive system working properly by adding bulk to the stool and helping to move food through the intestines. Second, fiber has been shown to reduce the risk of certain diseases, including heart disease and type-II diabetes. Finally, fiber can help to regulate blood sugar levels and promote feelings of fullness after eating.

There are many benefits to IMO fiber, a type of dietary fiber. For one, it is very soluble, meaning that it dissolves easily in water and other liquids. This makes it ideal for people who have trouble digesting other types of fiber. Additionally, IMO fiber is prebiotic, meaning that it helps promote the growth of healthy bacteria in the gut.

This is important for overall gut health and digestion. Finally, IMO fiber is low in calories and has no sugar, making it a great option for those watching their weight or blood sugar levels.

The demand for functional additives, such as IMO fibers, which provide health advantages without sacrificing the flavor or sensory quality of food items, has increased as a result of the growing consumer demand for functional foods. I believe that fiber serves a purpose in food products that are resistant to digestion.

Over the past few years, there has been an increase in demand for clean-label food all over the world. Customers are becoming more aware of the advantages that products with natural components have for their health.

The market for clean-label products is primarily driven by strong support from international ingredient producers for the creation of such products, as these are extracted without the use of any additions, chemicals, or artificial components and are also very minimally processed.

In order to take advantage of the enormous potential opportunities offered by emerging countries like South Asia and the Middle East and Africa, the IMO fiber market is steadily expanding in regions of Europe and North America. The pharmaceutical business can increase demand for IMO fiber because it has applications in the industry.

Prebiotics are being developed by a number of research organizations in an effort to spur the market for IMO fiber. These reasons have led to an increase in the manufacture of prebiotics made from IMO fiber, which has increased the demand for IMO fibers. As IMO fiber prebiotics can be employed as substitutes and can also have favorable benefits on consumers' health, customers are adopting reduced intake of sugar.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa; RoW |

| Key Countries Covered | USA, Canada, Mexico, Germany, United Kingdom, France, Italy, Russia, Brazil, Argentina, Japan, Australia, New Zealand, China, India, South Korea, South Africa |

| Key Segments Covered | Function, Nature, Form, Application, Sales Channel, Region |

| Key Companies Profiled | Shandong Bailong Group Co., Ltd.; BioNeutra Global Corporation; Fonterra Co-operative Group Limited; Shandong Tianjiao Biotech Co., Ltd.; Nestle S.A.; Associated British Foods plc; Kellogg Company; PepsiCo Inc.; Unilever plc; Anhui Elite Industrial Co., Ltd.; Danone S.A.; General Mills Inc.; Baolingbao Biology, Co. Ltd |

| Report Coverage | Drivers, Restraints, Opportunities, and Threats Analysis, Market Forecast, Company Share Analysis, Market Dynamics and Challenges, Competitive Landscape, and Strategic Growth Initiatives |

| Customization Pricing | Available upon Request |

The global IMO fiber market is estimated to be valued at USD 840.9 million in 2025.

The market size for the IMO fiber market is projected to reach USD 1,463.9 million by 2035.

The IMO fiber market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in IMO fiber market are prebiotic agent, sugar substitute and bulking agent.

In terms of nature, soluble segment to command 58.9% share in the IMO fiber market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bimodal Identity Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Antimony Trioxide Market Size and Share Forecast Outlook 2025 to 2035

Antimony Free Film Market Size and Share Forecast Outlook 2025 to 2035

L-Limonene Oil Market Size and Share Forecast Outlook 2025 to 2035

Agrimony Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Antimony Market Growth - Trends & Forecast 2025 to 2035

Amphimobile Fungicides Market Size and Share Forecast Outlook 2025 to 2035

Hashimoto's Thyroiditis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Cetrimonium Bromide Market Trend Analysis Based on Purity, End-Use, and Region 2025-2035

Multimodal Chromatography Columns Market

Massive MIMO Market

Fluoroantimonic Acid Market

Automotive Multimodal Interaction Development Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Probe Hydrophone (FOPH) Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Centrifugal Fan Market Size and Share Forecast Outlook 2025 to 2035

Fiber to the Home Market Size and Share Forecast Outlook 2025 to 2035

Fiber Based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fiber Lid Market Forecast and Outlook 2025 to 2035

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiber Sorter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA