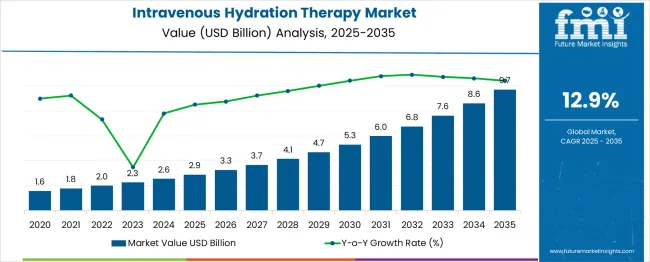

The global intravenous hydration therapy market is expected to grow from USD 2.9 billion in 2025 to approximately USD 9.7 billion by 2035, recording an absolute increase of USD 6.8 billion over the forecast period. This is expected to result in a total growth of 237.2%, with a compound annual growth rate (CAGR) of 12.9% projected between 2025 and 2035.

Market value is anticipated to increase by nearly 3.4 times during the same period, driven by rising consumer awareness of wellness and preventive healthcare, growing demand for mobile IV therapy services, and heightened emphasis on immediate hydration and nutrient delivery. Expansion of service offerings and integration of convenient, on-demand treatment solutions are expected to reinforce market penetration, while increasing adoption of personalized healthcare approaches supports sustained growth across key regions.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2.9 billion |

| Forecast Value in (2035F) | USD 9.7 billion |

| Forecast CAGR (2025 to 2035) | 12.9% |

The intravenous (IV) hydration therapy market is shaped by several parent markets that collectively drive its adoption and growth. The hospital and healthcare infrastructure market contributes the largest share, around 20% to 25%, as hospitals and clinics remain primary sites for IV therapy administration across critical, emergency, and general care settings. The medical devices market, accounting for approximately 15% to 20%, provides essential equipment such as IV pumps, catheters, and infusion sets.

The pharmaceuticals and IV fluids market, with an estimated share of 10% to 15%, supplies saline, dextrose, and electrolyte solutions needed for maintaining patient hydration. Similarly, critical care and emergency medicine, contributing about 10% to 15%, drive demand due to the routine use of IV hydration in ICUs and trauma units.

Emerging segments such as home healthcare, mobile healthcare services, and outpatient or ambulatory care together account for 15% to 30% of the market, reflecting rising demand for convenient and personalized hydration therapy. The sports medicine and wellness clinics market, which accounts for roughly 10% to 15%, has emerged as a niche, driven by the popularity of IV therapy for recovery and wellness purposes.

Modern consumers are increasingly focused on preventive healthcare measures that can enhance energy levels, support immune function, and accelerate recovery from various conditions. IV hydration therapy's proven efficacy in delivering immediate results and supporting overall wellness makes it a preferred treatment option for health-conscious individuals.

The growing emphasis on wellness tourism and personalized healthcare is driving demand for customized IV therapy solutions that address specific health concerns and lifestyle needs. Consumer preference for mobile and convenient healthcare services that can be accessed at home, offices, or events is creating opportunities for innovative service delivery models. The rising influence of social media wellness trends and medical professional recommendations is also contributing to increased adoption across different age groups and demographics seeking optimal health and performance enhancement.

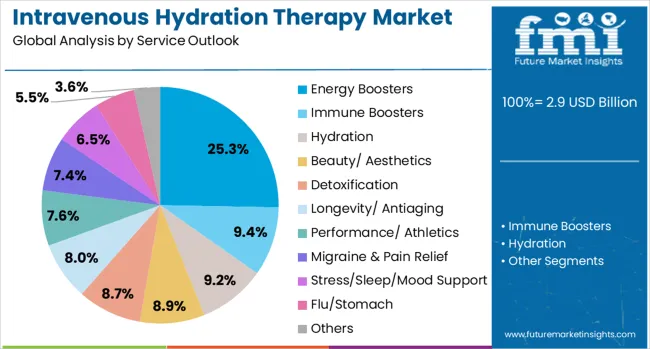

The market is segmented by service outlook, component outlook, provider type outlook, end use outlook, and region. By service outlook, the market is divided into energy boosters, immune boosters, hydration, beauty/aesthetics, detoxification, longevity/antiaging, performance/athletics, migraine & pain relief, stress/sleep/mood support, flu/stomach, and others. Based on component outlook, the market is categorized into medicated and non-medicated solutions.

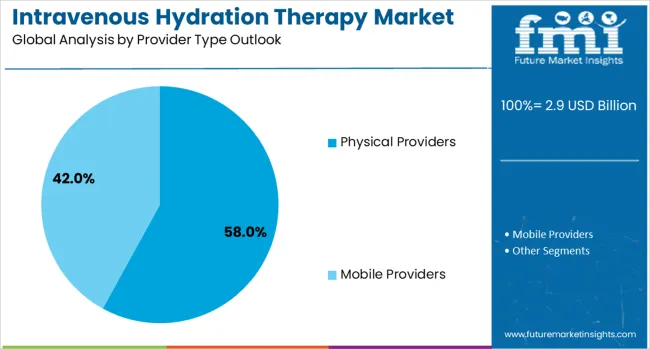

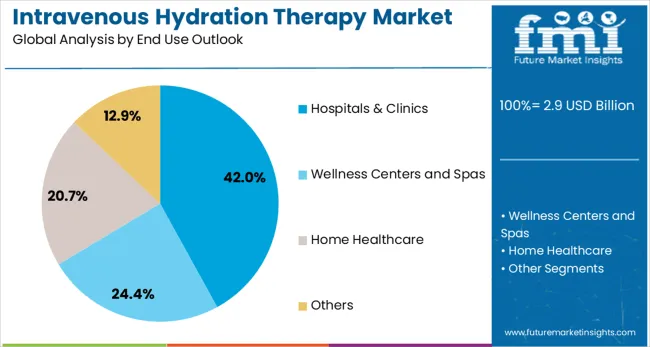

In terms of provider type outlook, the market is segmented into physical providers and mobile providers. By end use outlook, the market is classified into hospitals & clinics, wellness centers and spas, home healthcare, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The energy boosters service is expected to hold 25% of the intravenous hydration therapy market in 2025, reaffirming its position as a leading wellness offering. Consumers increasingly turn to IV energy boosters to combat fatigue, stress, and high-demand lifestyles, seeking rapid revitalization. These formulations typically include B vitamins, amino acids, and essential minerals that support metabolic function, replenish nutrients, and enhance energy levels. Wellness-focused IV centers heavily rely on energy booster services as their most sought-after offering. Endorsements from healthcare professionals and ongoing clinical validation enhance trust in these formulations. With modern routines driving fatigue and sleep deficiencies, energy boosters meet both immediate relief and wellness maintenance needs.

Medicated IV solutions are projected to represent 67% of market demand in 2025, reflecting their dominance as the preferred component type for therapeutic and wellness applications. Healthcare providers and patients favor medicated formulations for targeted effects, clinical-grade treatment efficacy, and the ability to manage specific health or wellness needs. These solutions commonly contain vitamins, minerals, antioxidants, or therapeutic medications, offering preventative and corrective benefits. Medicated components are increasingly central to treatment protocols, allowing personalized IV therapy that meets patient-specific requirements. Their integration into wellness and clinical programs enhances treatment outcomes and justifies premium pricing while reinforcing the segment’s pivotal role in intravenous hydration therapy growth.

Physical providers are expected to account for 58% of the intravenous hydration therapy market in 2025, emphasizing the importance of established healthcare facilities and dedicated IV therapy centers. Patients prefer the credibility, professional oversight, and structured environment offered by physical locations, including hospitals, wellness clinics, and specialized IV lounges. These settings ensure access to trained healthcare professionals, licensed equipment, and clinical-grade treatment administration. Physical providers maintain operational safety standards while supporting patient confidence. Their controlled environments also allow immediate medical intervention if required, meeting consumer expectations for high-quality, safe, and effective IV therapy services, and positioning this segment as a dominant channel for intravenous hydration market growth.

Hospitals and clinics are projected to contribute 42% of the intravenous hydration therapy market in 2025, reflecting their central role in providing medically supervised IV treatments. These facilities serve as primary access points for patients requiring medical-grade hydration, recovery support, or dehydration-related interventions. Trained medical personnel, comprehensive patient care protocols, and clinical oversight ensure safe and effective therapy administration. Hospitals and clinics also provide credibility through professional recommendations, rigorous hygiene standards, and advanced monitoring capabilities. With the growing recognition of IV hydration therapy as a legitimate medical and wellness solution, these end-use settings continue to expand service offerings, meeting increasing demand for supervised, health-focused hydration treatments.

The intravenous hydration therapy market is increasingly popular among consumers seeking quick energy recovery, improved skin health, and enhanced wellness. Busy lifestyles and rising stress levels have led people to pursue fast-acting solutions for fatigue, dehydration, and nutrient deficiencies. Wellness clinics, spas, and concierge services are offering customizable IV drips with vitamins, electrolytes, and antioxidants tailored to consumer needs.

Sports enthusiasts and fitness-conscious individuals also use hydration therapy for faster post-workout recovery. Social media and celebrity endorsements have boosted awareness, making it a mainstream trend in several regions. This growing consumer preference for convenient wellness solutions is a key driver of the market’s expansion and accessibility.

IV hydration therapy has established strong relevance in medical treatments, particularly for patients suffering from chronic illnesses, gastrointestinal conditions, and post-surgical recovery. Hospitals and specialty clinics frequently use IV hydration to correct fluid imbalances and ensure rapid delivery of essential nutrients. Rising cases of migraine, flu, and food poisoning have also increased demand for quick rehydration solutions. Additionally, the therapy is critical for elderly patients who struggle with oral fluid intake. With healthcare providers recognizing its efficiency in managing dehydration-related complications, IV hydration therapy is becoming a standard supportive treatment. The clinical acceptance of this therapy continues to solidify its role beyond wellness, reinforcing its medical importance.

The IV hydration therapy market is becoming highly competitive, with service providers adopting strategic measures to broaden their reach. Mobile and home-based services are gaining popularity, allowing consumers to access treatments conveniently outside clinical settings.

Franchises and wellness centers are expanding into new cities and regions to meet rising demand. Providers also diversify offerings by tailoring therapy menus for athletic recovery, beauty enhancement, and immune support. Partnerships with gyms, hotels, and corporate wellness programs have further strengthened service availability. As companies focus on affordability and accessibility, the market is seeing faster adoption across different consumer groups.

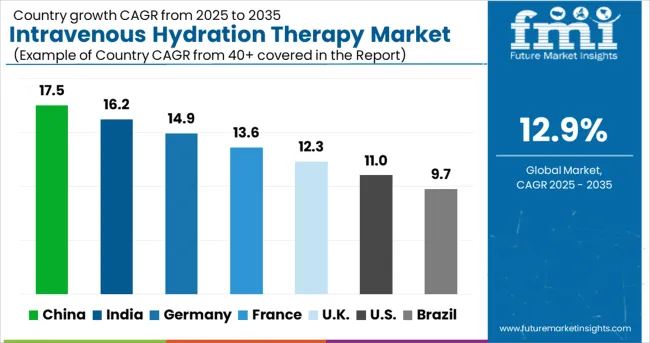

| Countries | CAGR (2025-2035) |

|---|---|

| China | 17.5% |

| India | 16.2% |

| Germany | 14.9% |

| France | 13.6% |

| UK | 12.3% |

| USA | 11% |

| Brazil | 9.7% |

The intravenous hydration therapy market is experiencing robust growth globally, with China leading at a 17.5% CAGR through 2035, driven by rising disposable income, increasing wellness consciousness, and growing penetration of international wellness service providers. India follows closely at 16.2%, supported by expanding healthcare infrastructure, increasing health awareness, and rising demand for preventive healthcare services. Germany shows strong growth at 14.9%, emphasizing clinical-grade treatments and evidence-based wellness solutions. France records 13.6%, focusing on luxury wellness trends and personalized healthcare services. The UK shows 12.3% growth, prioritizing mobile therapy services and innovative healthcare delivery models.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

China leads the intravenous hydration therapy market with a CAGR of 17.5% through 2035. Growth is driven by increasing hospital infrastructure, rising prevalence of dehydration-related conditions, and expanding healthcare access. Competition is intense among domestic and multinational players, with differentiation achieved through advanced IV systems, infusion technologies, and hospital partnerships. Compared with India and Brazil, adoption is faster due to larger patient volume and government healthcare initiatives. Investments in smart infusion pumps, automated monitoring, and training programs have enhanced operational efficiency and safety in clinical settings, reinforcing China’s position as the fastest-growing market in the Asia-Pacific region.

India is projected to grow at a CAGR of 16.2% through 2035, driven by rising hospital admissions, expanding healthcare infrastructure, and increasing awareness of hydration therapy benefits. Competition exists between domestic and international providers, with focus on cost-effective infusion devices and training programs. Compared with China, adoption is slower due to regional disparities, yet market potential remains high due to a large patient base. Integration of smart IV systems, automated pumps, and clinical monitoring has improved therapy efficiency and patient outcomes. Government initiatives to expand healthcare access have further reinforced market growth across urban and semi-urban areas.

Germany is expected to grow at a CAGR of 14.9% through 2035, emphasizing precision healthcare and high-quality infusion technologies. Competition is focused on advanced IV devices, regulatory compliance, and hospital partnerships rather than market scale. Compared with China and India, adoption is regulated and quality-driven, with differentiation achieved through smart infusion pumps, automated monitoring, and integration with electronic health records. Hospitals prioritize patient safety, dosage accuracy, and operational efficiency. Investments in R&D, compliance training, and hospital integration programs create competitive advantage. Germany represents a mature, technologically advanced market, where precision, safety, and innovation drive growth.

France is projected to grow at a CAGR of 13.6% through 2035, supported by hospital modernization, regulatory frameworks, and patient safety initiatives. Competition focuses on high-quality infusion devices, clinical training, and service reliability. Compared with Germany, France emphasizes regulatory alignment and niche clinical applications. Smart infusion systems, automated pumps, and real-time monitoring are being deployed to improve patient outcomes. Investments in hospital infrastructure and healthcare staff training enhance therapy adoption and operational efficiency. France’s market highlights specialized clinical applications and quality-driven growth, offering a contrast to higher-volume markets in Asia-Pacific.

The UK is expected to grow at a CAGR of 12.3% through 2035, driven by hospital expansion, advanced infusion technologies, and patient safety initiatives. Competition is concentrated on quality, technological innovation, and service programs. Compared with China and India, adoption is moderate but focused on high standards and precision therapy. Differentiation arises from smart IV pumps, integration with clinical monitoring systems, and compliance with NHS protocols. Investments in hospital training, automated systems, and clinical infrastructure have improved operational efficiency. The UK represents a mature, quality-driven market, contrasting with the volume-driven, high-growth markets of Asia-Pacific.

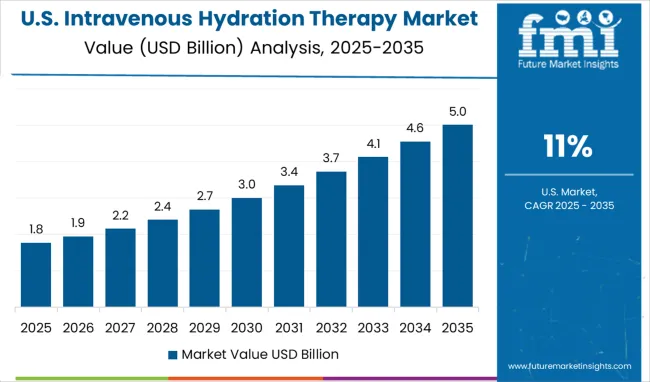

The United States is projected to grow at a CAGR of 11% through 2035, supported by advanced hospital networks, widespread healthcare coverage, and adoption of innovative IV systems. Competition is intense among leading manufacturers, emphasizing smart pumps, automated monitoring, and clinical service programs. Compared with China and India, adoption is moderate due to mature market saturation, but differentiation is achieved through technological sophistication, patient safety, and integration with electronic health records. Investments in hospital infrastructure, clinical staff training, and device innovation have enhanced operational efficiency, ensuring consistent demand and sustained market growth across urban and specialized healthcare facilities.

Brazil is expected to grow at a CAGR of 9.7% through 2035, driven by increasing healthcare access, rising hospital admissions, and demand for hydration therapies. Competition is developing among domestic and international suppliers, focusing on cost-effective devices and training programs. Compared with China, India, and Germany, adoption is slower, but urban healthcare hubs show rising uptake. Differentiation is achieved through modular, lightweight infusion devices, staff training, and monitoring solutions. Investments in hospital infrastructure and government healthcare initiatives have enhanced market penetration, providing steady growth opportunities in both public and private healthcare segments.

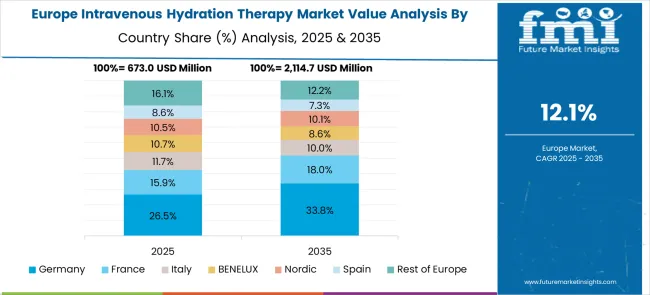

The intravenous hydration therapy market in Europe demonstrates mature development across major economies with Germany showing strong presence through its scientific approach to wellness healthcare and consumer appreciation for clinically-proven therapeutic interventions, supported by providers leveraging medical research to develop effective IV hydration protocols that address energy deficiency, immune support, and recovery enhancement needs.

France represents a significant market driven by its luxury wellness heritage and sophisticated understanding of preventive healthcare, with companies pioneering premium IV therapy services that combine French wellness artistry with advanced hydration delivery systems for enhanced health benefits and aesthetic wellness applications.

The UK exhibits considerable growth through its embrace of evidence-based wellness treatments and healthcare innovation, with providers leading the integration of mobile IV therapy services and comprehensive patient education about hydration therapy benefits. Germany and France show expanding interest in personalized wellness solutions, particularly in premium IV therapy formulations targeting performance enhancement and preventive health maintenance. BENELUX countries contribute through their focus on innovative healthcare delivery and eco-efficient wellness practices, while Eastern Europe and Nordic regions display growing potential driven by increasing awareness of IV therapy benefits and expanding access to premium wellness healthcare services across diverse provider networks.

Companies are investing in advanced treatment protocols, mobile service delivery, premium facility development, and digital marketing strategies to deliver safe, effective, and accessible IV hydration solutions. Service quality, treatment efficacy, and delivery convenience are central to strengthening service portfolios and market presence.

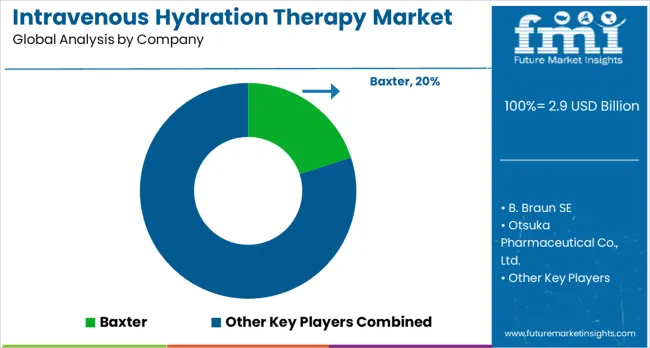

Baxter leads the market with 20% global value share, offering comprehensive IV therapy solutions with a focus on medical-grade hydration products and clinical safety standards. B. Braun SE provides advanced IV therapy equipment and solutions with emphasis on healthcare facility integration and treatment safety. Otsuka Pharmaceutical Co., Ltd. delivers specialized hydration formulations with focus on therapeutic efficacy and clinical applications. Grifols, S.A. focuses on plasma-derived therapies and IV solutions that combine hydration with specialized therapeutic components.

Vifor Pharma Management Ltd. and JW Life Science Corporation, operating globally, provide comprehensive IV therapy products across multiple therapeutic areas and healthcare settings. Amanta Healthcare emphasizes mobile IV therapy services with premium positioning and personalized treatment protocols. NexGen Health offers innovative wellness-focused IV treatments with emphasis on recovery and performance enhancement. Core IV Therapy, LLC, Cryojuvenate UK Ltd., Drip Hydration, and REVIV provide specialized mobile IV therapy services with focus on convenience, wellness optimization, and targeted health solutions.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2.9 billion |

| Service Outlook | Energy boosters, Immune boosters, Hydration, Beauty/aesthetics, Detoxification, Longevity/antiaging, Performance/athletics, Migraine & pain relief, Stress/sleep/mood support, Flu/stomach, Others |

| Component Outlook | Medicated, Non-medicated |

| Provider Type Outlook | Physical providers, Mobile providers |

| End Use Outlook | Hospitals & clinics, Wellness centers and spas, Home healthcare, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Baxter, B. Braun SE, Otsuka Pharmaceutical Co., Ltd., Grifols, S.A., Vifor Pharma Management Ltd., JW Life Science Corporation, Amanta Healthcare, NexGen Health, Core IV Therapy, LLC, Cryojuvenate UK Ltd., Drip Hydration, and REVIV |

| Additional Attributes | Dollar revenue by service type and formulation level, regional demand trends, competitive landscape, consumer preferences for mobile versus facility-based services, integration with wellness/clinical positioning, innovations in treatment protocols, mobile delivery systems, and personalized therapy approaches |

The global intravenous hydration therapy market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the intravenous hydration therapy market is projected to reach USD 9.7 billion by 2035.

The intravenous hydration therapy market is expected to grow at a 12.9% CAGR between 2025 and 2035.

The key product types in intravenous hydration therapy market are energy boosters, immune boosters, hydration, beauty/ aesthetics, detoxification, longevity/ antiaging, performance/ athletics, migraine & pain relief, stress/sleep/mood support, flu/stomach and others.

In terms of component outlook , medicated segment to command 67.4% share in the intravenous hydration therapy market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Intravenous Solution Compounders Market Size and Share Forecast Outlook 2025 to 2035

Intravenous Line Connectors Market Size and Share Forecast Outlook 2025 to 2035

Intravenous Iron Drugs Market Size and Share Forecast Outlook 2025 to 2035

Intravenous Packaging Market Size and Share Forecast Outlook 2025 to 2035

Intravenous Pegloticase Market Insights - Growth, Demand & Forecast 2025 to 2035

Market Share Insights of Leading Intravenous Packaging Providers

Peripheral Intravenous Catheter Market Size and Share Forecast Outlook 2025 to 2035

Hydration Supplement Market Outlook by Product Type, Application, Sale Channels and Others Through 2035

Hydration Backpack Market Size and Share Forecast Outlook 2025 to 2035

Hydration Boosters Market – Growth, Functional Beverages & Industry Demand

Hydration Infusers Market

Dehydration Monitoring Systems Market Growth – Trends & Forecast 2025 to 2035

Military Hydration Products Market Growth - Trends & Forecast 2025 to 2035

Gas Desiccant Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Desiccant Natural Gas Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

IV Therapy and Vein Access Devices Market Insights – Trends & Forecast 2024-2034

Mesotherapy Market Size and Share Forecast Outlook 2025 to 2035

Cryotherapy Market Growth - Demand, Trends & Emerging Applications 2025 to 2035

Aromatherapy Market Size and Share Forecast Outlook 2025 to 2035

Radiotherapy Positioning Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA