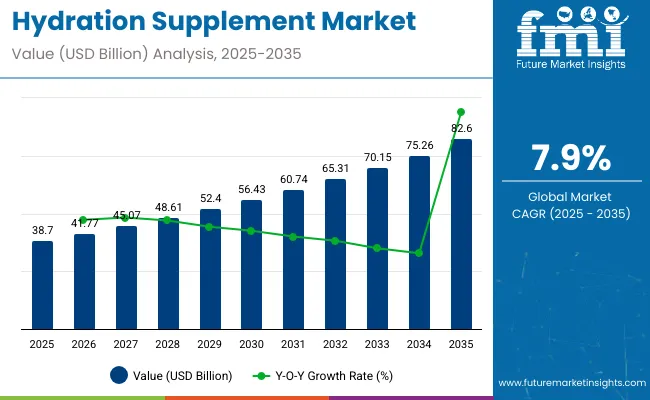

In 2024 the hydration Supplement market was USD 36.0 billion and in 2025 it is expected to be USD 38.7 billion. The market will expand at a compound annual growth rate of 7.9% during the forecast period of 2025 to 2035 reaching USD 82.6 billion in 2035.

The tremendous growth in the hydration supplement market is mainly due to increasing awareness among consumers regarding importance of staying hydrated in order to function at optimal levels and healthy. They don’t only take the form of tablets and powders, but they are also found in liquid-form products, for the athletes to the gym-goers and even the corporate professionals in need of on-the-go hydration products. Demand has been fuelled by the increasing incidences of dehydration-related diseases and the hot weather, particularly in the elderly.

Consumers are becoming increasingly discerning when it comes to hydration products and anticipate beverages with incorporated electrolytes (such as sodium, potassium, and magnesium), vitamins (particularly Vitamin C and B-complex), and functional botanicals.

Natural sweetener blends, reduced sugar content, and clean-label ingredients are of greatest importance in specific. In addition, the functional hydration trend is spreading its reach to new platforms like prenatal well-being, elder health, on-the-job performance, and hangover recovery.

North America is at present the pace-setter of world consumption with the highest level of fitness activity and high-end wellness programs. Asia Pacific will, nevertheless, witness the fastest growth due to urbanization, climatic conditions, and increased demand for preventive medicine. DTC brands and online platforms are now under the spotlight to spearhead awareness and accessibility, especially in Chinese, Indian, and Southeast Asian cities.

| Attributes | Description |

|---|---|

| Estimated Global Hydration Supplement Industry Size (2025E) | USD 38.7 billion |

| Projected Global Hydration Supplement Industry Value (2035F) | USD 82.6 billion |

| Value-based CAGR (2025 to 2035) | 7.9% |

Big brands like Liquid I.V. (owned by Unilever), Nuun Hydration (owned by Nestlé Health Science), SOS Hydration, and DripDrop ORS are shaking up the category with single-serve stick launches, sustainable packaging, and cause branding. They're also transitioning to lifestyle positioning-hydration for exercise recovery, but also energy, mental clarity, and immunity.

As congruence increases among hydration, lifestyle, and tailored nutrition, the market for hydration supplements will continue in solid expansion during the following decade.

Per capita consumption of hydration supplements is influenced by factors such as climate, athletic activity, urban lifestyles, and health awareness. While exact consumption varies across regions, growing demand is evident as more consumers seek convenient ways to maintain electrolyte balance and stay hydrated during physical activity or illness. In many countries, use is expanding beyond athletes to include office workers, travelers, and outdoor laborers, with growing product diversity supporting broader adoption.

Hydration supplements must meet strict labeling and certification requirements to ensure consumer safety, product transparency, and regulatory compliance. Common certifications and marks found on hydration supplement packaging include:

The following table has a comparative analysis of the six months’ base year (2024) and current year (2025) differential CAGR for the international hydration supplement market. The analysis projects notable change in performance and indicates revenue realization patterns, thereby providing the stakeholders with a better picture concerning the trend of growth for the year. The time period January-June is the half year, i.e., H1. January until June, i.e., the first half or H1.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 7.3% |

| H2(2024 to 2034) | 7.5% |

| H1(2025 to 2035) | 7.8% |

| H2(2025 to 2035) | 7.9% |

The first-half (H1) 2025 to 2035 market for the hydration supplement will be expanding at a CAGR of 7.8%, rising incrementally by some small value to 7.9% in the second half (H2). compared to last year, the market saw a 50 BPS pick-up in H1, fueled by an expansion in demand from heat-stressed working segments and increased retail penetration of hydration sticks.

The second half year also saw an extra 40 BPS pick-up, highlighting that steady consumption demand and product diversification activities are in fact generating year-round market performance.

Tier 1 consists of a group of highly competitive firms, which are also large in revenues, leadership sharing, and prevalent market coverage. They all benefit from high brand equity and considerable expenditure on marketing and new product creation. Liquid I.V. differs from other peers in its tier in having its own Cellular Transport Technology (CTT) and extensive reach in retail chain stores and internet sites.

The company has acquired popularity at a quick pace due to its electrolyte-hydrating products and influencer as well as celebrity support. Nuun Hydration is Tier 1 as well, whose line of electrolyte tablets has been designed especially for athletes as well as mass consumers.

There is a stake in Nuun from Nestlé Health Science, which possesses an immense R&D as well as worldwide availability. These brands dominate functional health needs with science-backed formulation and credibility by way of strong brand recall.

Tier 2 are businesses with lower revenues than Tier 1 but enjoy good market visibility. For example, Hydrant offers instant hydration powders, which are formulated in association with nutritionists and are best-sellers with customers looking for a mix of science and ease. Another example of this is DripDrop ORS, filling the gap between consumer-acceptable taste profiles and medical-strength rehydration.

The companies are competing on differentiation, premium, and niche platforms with products appealing to those who are interested in wellness, athletes, and working professionals. The marketing strategy of the companies is clinicaled on performance, clean label ingredients, and performance gains and tends to regularly partner with the fitness category and wellness influencers to promote brand awareness.

Tier 3 includes new and smaller players in the hydrating supplement market. They have low penetration, but the favourable factors being their natural and clean-label approach to hydration or their new and pioneering business culture and point of sale local or online are pushing them toward high growth.

HOIST, the growing brand that is popular with military athletes and endurance sport enthusiasts, and Revitalize, who are experts in natural and clean-label hydration, are examples. Emerging brands place direct-to-consumer wagers, social media advertising, and wellness activity to occupy niche space in the market. Most of the test products in the guise of hydration gels, gummies, or natural flavor infusions to differentiate from the usual powders or tablets.

Shift: Health-aware consumers are now calling for hydration products more than low-level amounts of electrolytes, asking for supplements containing vitamins, minerals, amino acids, and adaptogens. Sports athletes and fitness consumers prefer products that support endurance, energy, and recovery. The trend is prevalent in the USA, Canadian, and UKmarkets, where the recovery process post-workout is seen as a component of peak performance and muscle repair.

Strategic Response:Liquid I.V. introduced Hydration Multiplier energy and immune-boosting flavors to its portfolio. Nuun launched BCAA and caffeine-fortified electrolyte tablets designed for pre-and post-workout rehydration. SOS Hydration introduced a "Sport" series with magnesium and potassium, particularly for endurance sports.

Shift: Customers are now shunning artificial sweetener, dye, or added sugar-containing hydration supplements and embracing clean-label, natural ingredient items with monk fruit, stevia, or zero-sugar versions. Label honesty and limited ingredients are now critical to securing customer trust, particularly among millennials and parents purchasing for children.

Strategic Response: Hydrant re-formulated its hydration sticks to eliminate artificial coloring and added sugar. Cure Hydration brought out USDA-certified organic, non-GMO electrolyte powders with coconut and monk fruit sweeteners. DripDrop ORS launched a zero-sugar flavor with natural flavoring, targeting the diabetic and keto consumer segment.

Shift: Hydration is no longer the sole domain of the sportsman or summer use year-round health and guarding against illness are market leaders of today. Ingredients are being placed on to the market as daily use products with benefits including vitamin C, zinc, and elderberry. Consumers are taking the products along to sustain energy, alertness, and resistance to illness on a year-round basis.

Strategic Response: Nuun introduced its "Immunity" line with electrolytes, zinc, turmeric, and elderberry. Liquid I.V. introduced hydration and immune combo stick with vitamin C and Wellmune. Hydrant introduced daily hydration + immune for workers and commuters in search of everyday value for wellness.

Shift: Parents are better tuned into fluid needs in kids, particularly sport, travel, and sickness. Sweet and tasteless, wholesome, naturally flavored children-only rehydration drinks arrive on a scale, led foremost in North America and segments of Southeast Asia. Pediatricians order more well-tasting quality rehydration drinks than regular oral rehydration salts.

Strategic Response: Pedialyte introduced plain, unflavored, and uncolored children's electrolyte drink powders. Kinderlyte introduced children-friendly hydrating drinks in plain packaging and using all-natural ingredients. Skratch Labs introduced a sodium-reduced hydrating mix using natural fruit flavor.

Shift: Hydration supplements are also becoming a regular fixture in every home, especially among commuters, residents of hot climates, or regular exercisers. DTC models, online purchasing, and auto-ship programs are propelling customers toward frequent hydration solutions. Influencer marketing and TikTok reviews have also fueled online adoption.

Strategic Response: Cure Hydration offers a subscription box feature with personalization on its direct-to-consumer website. Liquid I.V. takes advantage of Amazon Prime for ease and infrequent bundle specials. Nuun created social media-based digital advertising campaigns tailor-made with fitness social influencers and added multipack-only web-only exclusives for frequent buyers.

Shift: White-collar employees, tourists, and evening shift workers now depend on hydration supplements to counteract fatigue, headache, and burnout. Hydration is being thought of as a quick replacement for mental acuity and work performance, especially in drying-out or static environments like airplanes, hospitals, and the office.

Strategic Response: Hydrant introduced a "Focus" line of products containing L-theanine and magnesium to enhance on-the-job alertness. Liquid I.V. created a travel-sized hydration pack with TSA-approved sachets and mood-enhancing adaptogens. Waterdrop introduced small tablets of hydration with caffeine and B vitamins for home workers and office commuters.

Shift:Green consumers are not only judging brands on performance but also on being as green as possible. Packaging-free plastic, compostable sachets, and procurement of sustainable raw materials are the parameters in the existing situation. Young consumers are especially most likely to move towards green brands.

Strategic Response: Cure Hydration uses 100% compostable sticks and offsets carbon. Waterdrop replaced plastic containers with refillable tin cases for its dissolving cubes. Nuun re-engineered packaging for reusable recyclable tubes and transitioned to non-GMO plant-based sweeteners from audited supply bases.

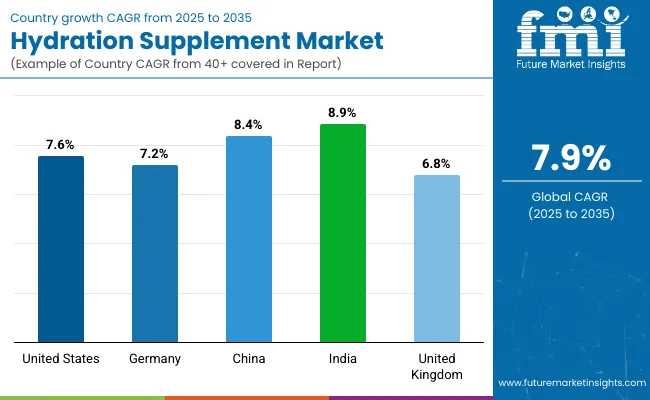

Following is the anticipated growth rate of the leading five nations. They are likely to symbolize effervescent consumption until 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.6% |

| Germany | 7.2% |

| China | 8.4% |

| India | 8.9% |

| United Kingdom | 6.8% |

The US water supplement market is expanding at a fast rate due to a cultural trend toward functional well-being, active lifestyles, and convenience nutrition. USA consumers are adding hydration powders, electrolyte tablets, and ready-to-drink (RD) products to their daily regimen not just during exercise, but for general energy, recovery, and brain function too. Immunity-enhancing, mental-focus, or cleansing brands, coupled with hydration, are extremely popular, usually boosted by the addition of vitamins, adaptogens, or superfoods.

compressed work shifts and in-transit convenience drive continued innovation in small, compact hydrating packaging. There is clean-labeling by manufacturers into sugar-free, keto, and plant-based flavorings. e-commerce-driven distribution with DTC brands leading the charge through subscription, customized hydration pack offer is also successful in driving this in mass markets.

Also successful in launching consumer education into the air, particularly educating on hydration link to mood, digestion, complexion health. Furthermore, young consumers are turning towards influencer-driven wellness brands, creating sustained online and offline traction.

There is growth in hydrating supplement in China, with synergies fueling the business such as increased urbanisation, increased physical activity, and health wellness traditions. The number of people engaged in gym programs and heavy workloads increases each year, and maintenance day-to-day hydration supplementation is extremely critical. Functional hydrating supplements that contain electrolytes are being promoted not only to athletes and body-builders but also to office personnel, students, and senior elders.

Among the Chinese market's virtues is blending traditional Chinese medicine (TCM) and modern nutrition concepts. Hydration supplements make up most of them with a combination of goji berries, chrysanthemum, and ginseng and have perceived energy-boosting and detoxifying effects along with hydration.

Most product discovery and selling are through digital channels like JD.com and Tmall backed by livestream promotion and health influencers. Local innovation is in full swing, with local brands moving into smart hydration products and plant blends to address increasing health literacy among middle-class consumers. This convergence of technology, heritage, and lifestyle needs continues to fuel growth and product diversity.

India's water supplement industry is thriving big due to the twin thrust of rising health-consciousness towards fitness and the country's hot weather, which makes dehydration a more likely hazard. With more young adults participating in sports, body-building, and yoga, sales of rehydration products with extra benefits over electrolytes are gaining steam mineral, antioxidant, and herbal-infused ones are leading the pack.

Herbs of indigenous Indian origin like tulsi (holy basil), ashwagandha, and amla are being combined with hydrating supplements to introduce a new sports drink that is chemically engineered. These supplements are taken daily, especially for defense against excessive sweating and heat-dehydration in cases of hot weather on summer days and while participating in the excesses of celebratory events.

Middle and high-income urban consumers are driving adoption, but it is also growing in Tier 2 and Tier 3 cities through retail pharmacy chains and e-commerce channels like Flipkart and Amazon India. Growing prevalence of diabetes and usage of plant-based products is also compelling the brands to create sugar-free and low-calorie hydration brands. Hydration with immunity, detox, and Ayurveda is transforming India into a highly innovative and culturally unique hydration supplement industry.

Gummies have become popular form in the menopause supplements category, especially among young menopausal consumers (around 40-55 years), who prefer easy to swallow, tasty and convenient presentations instead of standard pills or capsules.

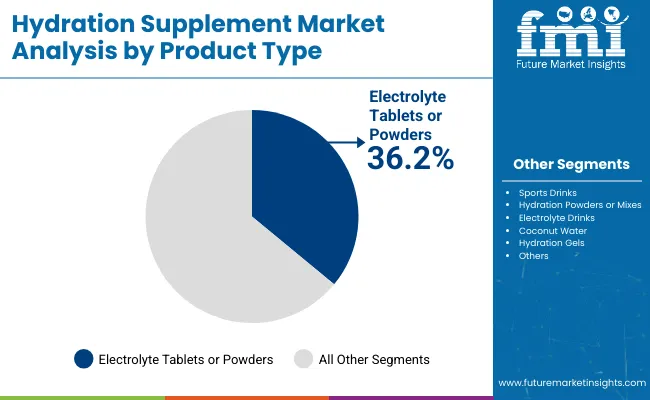

However, palatable, no-pill necessity since lifestyle dependent, considering Electrolye tablets or powder have remained the bestselling in specialty for hydration supplements, they are convenient to take, pack well but also nutrient rich. A perfect option for active and busy lifestyles, offering a mess-free, easy-mix supplement that is easy to include with drinking habits.

Versatile powders and tablets offer longer shelf life, reduced packaging, and precise dosing compared to ready-to-drink hydration beverages features that gravitate toward environmentally conscious and health-oriented consumers. In addition, the products facilitate fluid intake customization, enabling consumers to tailor the strength of taste of flavor, calories and amounts of electrolytes as per individualized hydration requirements.

| Segment | Value Share (2025) |

|---|---|

| Electrolyte Tablets or Powders (By Product Type) | 36.2% |

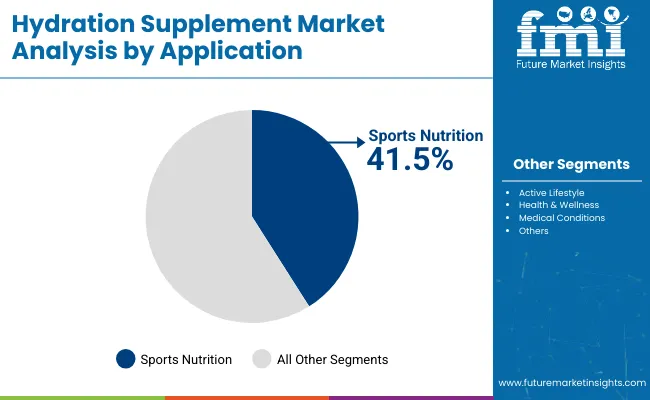

Sports nutrition is the largest application of the hydration supplement market, where fluid upkeep and electrolyte functionality affect performance, exercise recovery, and robustness. Bodybuilders, performers and gym buffs the same are searching for hydration merchandise for replenishing electrolytes misplaced in the course of train, lower spasms and forestall dehydration throughout strenuous exercises.

These days hydration supplements are a staple of pre-workout, intra-workout, and post-workout routines, with specialized products being provided by companies based on the intensity of the workout, sport, and weather! That is also why endurance sport athletes (marathon runners, triathletes and bikers) are the first to reach for high-sodium electrolyte drinks whilst BCAA-rich hydration powders are taken by gym rats and bodybuilders.

by the consumer, particularly those with swallowing difficulties or who are supplement sensitive. Gummies also contain various menopause-supporting nutrients including the vitamins B6, B12 and D3; magnesium; biotin; and botanicals such as evening primrose oil, red clover and chaste berry. They are typically combined to produce multi-symptom relief, which helps ease hot flashes, sleep disturbance, mood disorder, and dry skin.

| Segment | Value Share (2025) |

|---|---|

| Sports Nutrition (By Application) | 41.5% |

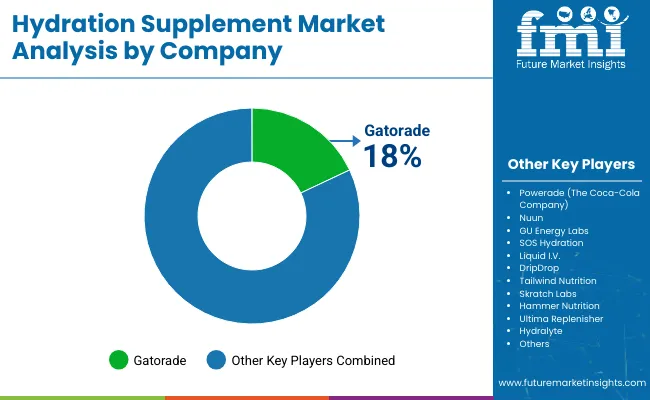

Gatorade and Liquid I.V. are some of the brand leaders successfully expanding their market share of the hydration supplement category through brand heritage, innovation, and targeted strategies. They have also expanded their product lines by launching various functional benefits like immune system support, energy, and rapid rehydration through clean-label offerings. Their strong focus on science-formulated products and influencer marketing have helped them target brand-conscious and athletic communities in equal ratio.

Besides this, such companies are also greenifying packaging, introducing RTD products, and testing sustainable water sources of hydration such as marine minerals and coconut water. Collaborations with health bloggers, gyms, and even government health departments are also pushing such companies towards more consumers and product trust.

The market is segmented into Electrolyte Tablets or Powders, Sports Drinks, Hydration Powders or Mixes, Electrolyte Drinks, Coconut Water, and Hydration Gels.

Applications include Sports Nutrition, Active Lifestyle, Health & Wellness, and Medical Conditions.

Sales are distributed through both store-based channels-which include modern trade, hospital pharmacies, retail pharmacies, and drug stores and online pharmacies.

Industry analysis has been conducted across major regions, including North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and the Middle East & Africa.

The global industry is estimated at a value of USD 38.7 billion in 2025.

Sales increased at a 7.2% CAGR between 2020 and 2024.

Some of the key players in this industry include Gatorade (PepsiCo), Powerade (The Coca-Cola Company), Nuun, GU Energy Labs, SOS Hydration, Liquid I.V., DripDrop, Tailwind Nutrition, Skratch Labs, and Hammer Nutrition.

The Asia-Pacific region is projected to hold a significant revenue share over the forecast period, driven by rising health consciousness and increasing disposable income.

The industry is projected to grow at a forecast CAGR of 7.9% from 2025 to 2035.

Table 1: Global Market Value (US$ billion) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (MT) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ billion) Forecast by Product Type, 2019 to 2034

Table 4: Global Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 5: Global Market Value (US$ billion) Forecast by Application, 2019 to 2034

Table 6: Global Market Volume (MT) Forecast by Application, 2019 to 2034

Table 7: Global Market Value (US$ billion) Forecast by Sales Channel, 2019 to 2034

Table 8: Global Market Volume (MT) Forecast by Sales Channel, 2019 to 2034

Table 9: North America Market Value (US$ billion) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (MT) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ billion) Forecast by Product Type, 2019 to 2034

Table 12: North America Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 13: North America Market Value (US$ billion) Forecast by Application, 2019 to 2034

Table 14: North America Market Volume (MT) Forecast by Application, 2019 to 2034

Table 15: North America Market Value (US$ billion) Forecast by Sales Channel, 2019 to 2034

Table 16: North America Market Volume (MT) Forecast by Sales Channel, 2019 to 2034

Table 17: Latin America Market Value (US$ billion) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (MT) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ billion) Forecast by Product Type, 2019 to 2034

Table 20: Latin America Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 21: Latin America Market Value (US$ billion) Forecast by Application, 2019 to 2034

Table 22: Latin America Market Volume (MT) Forecast by Application, 2019 to 2034

Table 23: Latin America Market Value (US$ billion) Forecast by Sales Channel, 2019 to 2034

Table 24: Latin America Market Volume (MT) Forecast by Sales Channel, 2019 to 2034

Table 25: Europe Market Value (US$ billion) Forecast by Country, 2019 to 2034

Table 26: Europe Market Volume (MT) Forecast by Country, 2019 to 2034

Table 27: Europe Market Value (US$ billion) Forecast by Product Type, 2019 to 2034

Table 28: Europe Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 29: Europe Market Value (US$ billion) Forecast by Application, 2019 to 2034

Table 30: Europe Market Volume (MT) Forecast by Application, 2019 to 2034

Table 31: Europe Market Value (US$ billion) Forecast by Sales Channel, 2019 to 2034

Table 32: Europe Market Volume (MT) Forecast by Sales Channel, 2019 to 2034

Table 33: East Asia Market Value (US$ billion) Forecast by Country, 2019 to 2034

Table 34: East Asia Market Volume (MT) Forecast by Country, 2019 to 2034

Table 35: East Asia Market Value (US$ billion) Forecast by Product Type, 2019 to 2034

Table 36: East Asia Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 37: East Asia Market Value (US$ billion) Forecast by Application, 2019 to 2034

Table 38: East Asia Market Volume (MT) Forecast by Application, 2019 to 2034

Table 39: East Asia Market Value (US$ billion) Forecast by Sales Channel, 2019 to 2034

Table 40: East Asia Market Volume (MT) Forecast by Sales Channel, 2019 to 2034

Table 41: South Asia Market Value (US$ billion) Forecast by Country, 2019 to 2034

Table 42: South Asia Market Volume (MT) Forecast by Country, 2019 to 2034

Table 43: South Asia Market Value (US$ billion) Forecast by Product Type, 2019 to 2034

Table 44: South Asia Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 45: South Asia Market Value (US$ billion) Forecast by Application, 2019 to 2034

Table 46: South Asia Market Volume (MT) Forecast by Application, 2019 to 2034

Table 47: South Asia Market Value (US$ billion) Forecast by Sales Channel, 2019 to 2034

Table 48: South Asia Market Volume (MT) Forecast by Sales Channel, 2019 to 2034

Table 49: Oceania Market Value (US$ billion) Forecast by Country, 2019 to 2034

Table 50: Oceania Market Volume (MT) Forecast by Country, 2019 to 2034

Table 51: Oceania Market Value (US$ billion) Forecast by Product Type, 2019 to 2034

Table 52: Oceania Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 53: Oceania Market Value (US$ billion) Forecast by Application, 2019 to 2034

Table 54: Oceania Market Volume (MT) Forecast by Application, 2019 to 2034

Table 55: Oceania Market Value (US$ billion) Forecast by Sales Channel, 2019 to 2034

Table 56: Oceania Market Volume (MT) Forecast by Sales Channel, 2019 to 2034

Table 57: Middle East & Africa Market Value (US$ billion) Forecast by Country, 2019 to 2034

Table 58: Middle East & Africa Market Volume (MT) Forecast by Country, 2019 to 2034

Table 59: Middle East & Africa Market Value (US$ billion) Forecast by Product Type, 2019 to 2034

Table 60: Middle East & Africa Market Volume (MT) Forecast by Product Type, 2019 to 2034

Table 61: Middle East & Africa Market Value (US$ billion) Forecast by Application, 2019 to 2034

Table 62: Middle East & Africa Market Volume (MT) Forecast by Application, 2019 to 2034

Table 63: Middle East & Africa Market Value (US$ billion) Forecast by Sales Channel, 2019 to 2034

Table 64: Middle East & Africa Market Volume (MT) Forecast by Sales Channel, 2019 to 2034

Figure 1: Global Market Value (US$ billion) by Product Type, 2024 to 2034

Figure 2: Global Market Value (US$ billion) by Application, 2024 to 2034

Figure 3: Global Market Value (US$ billion) by Sales Channel, 2024 to 2034

Figure 4: Global Market Value (US$ billion) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ billion) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (MT) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ billion) Analysis by Product Type, 2019 to 2034

Figure 10: Global Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 13: Global Market Value (US$ billion) Analysis by Application, 2019 to 2034

Figure 14: Global Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 17: Global Market Value (US$ billion) Analysis by Sales Channel, 2019 to 2034

Figure 18: Global Market Volume (MT) Analysis by Sales Channel, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 21: Global Market Attractiveness by Product Type, 2024 to 2034

Figure 22: Global Market Attractiveness by Application, 2024 to 2034

Figure 23: Global Market Attractiveness by Sales Channel, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ billion) by Product Type, 2024 to 2034

Figure 26: North America Market Value (US$ billion) by Application, 2024 to 2034

Figure 27: North America Market Value (US$ billion) by Sales Channel, 2024 to 2034

Figure 28: North America Market Value (US$ billion) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ billion) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ billion) Analysis by Product Type, 2019 to 2034

Figure 34: North America Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 37: North America Market Value (US$ billion) Analysis by Application, 2019 to 2034

Figure 38: North America Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 41: North America Market Value (US$ billion) Analysis by Sales Channel, 2019 to 2034

Figure 42: North America Market Volume (MT) Analysis by Sales Channel, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 45: North America Market Attractiveness by Product Type, 2024 to 2034

Figure 46: North America Market Attractiveness by Application, 2024 to 2034

Figure 47: North America Market Attractiveness by Sales Channel, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ billion) by Product Type, 2024 to 2034

Figure 50: Latin America Market Value (US$ billion) by Application, 2024 to 2034

Figure 51: Latin America Market Value (US$ billion) by Sales Channel, 2024 to 2034

Figure 52: Latin America Market Value (US$ billion) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ billion) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ billion) Analysis by Product Type, 2019 to 2034

Figure 58: Latin America Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 61: Latin America Market Value (US$ billion) Analysis by Application, 2019 to 2034

Figure 62: Latin America Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 65: Latin America Market Value (US$ billion) Analysis by Sales Channel, 2019 to 2034

Figure 66: Latin America Market Volume (MT) Analysis by Sales Channel, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Product Type, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Sales Channel, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Europe Market Value (US$ billion) by Product Type, 2024 to 2034

Figure 74: Europe Market Value (US$ billion) by Application, 2024 to 2034

Figure 75: Europe Market Value (US$ billion) by Sales Channel, 2024 to 2034

Figure 76: Europe Market Value (US$ billion) by Country, 2024 to 2034

Figure 77: Europe Market Value (US$ billion) Analysis by Country, 2019 to 2034

Figure 78: Europe Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Europe Market Value (US$ billion) Analysis by Product Type, 2019 to 2034

Figure 82: Europe Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 85: Europe Market Value (US$ billion) Analysis by Application, 2019 to 2034

Figure 86: Europe Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 87: Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 89: Europe Market Value (US$ billion) Analysis by Sales Channel, 2019 to 2034

Figure 90: Europe Market Volume (MT) Analysis by Sales Channel, 2019 to 2034

Figure 91: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 93: Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 94: Europe Market Attractiveness by Application, 2024 to 2034

Figure 95: Europe Market Attractiveness by Sales Channel, 2024 to 2034

Figure 96: Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: East Asia Market Value (US$ billion) by Product Type, 2024 to 2034

Figure 98: East Asia Market Value (US$ billion) by Application, 2024 to 2034

Figure 99: East Asia Market Value (US$ billion) by Sales Channel, 2024 to 2034

Figure 100: East Asia Market Value (US$ billion) by Country, 2024 to 2034

Figure 101: East Asia Market Value (US$ billion) Analysis by Country, 2019 to 2034

Figure 102: East Asia Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: East Asia Market Value (US$ billion) Analysis by Product Type, 2019 to 2034

Figure 106: East Asia Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 109: East Asia Market Value (US$ billion) Analysis by Application, 2019 to 2034

Figure 110: East Asia Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 113: East Asia Market Value (US$ billion) Analysis by Sales Channel, 2019 to 2034

Figure 114: East Asia Market Volume (MT) Analysis by Sales Channel, 2019 to 2034

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 117: East Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 118: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 119: East Asia Market Attractiveness by Sales Channel, 2024 to 2034

Figure 120: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia Market Value (US$ billion) by Product Type, 2024 to 2034

Figure 122: South Asia Market Value (US$ billion) by Application, 2024 to 2034

Figure 123: South Asia Market Value (US$ billion) by Sales Channel, 2024 to 2034

Figure 124: South Asia Market Value (US$ billion) by Country, 2024 to 2034

Figure 125: South Asia Market Value (US$ billion) Analysis by Country, 2019 to 2034

Figure 126: South Asia Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia Market Value (US$ billion) Analysis by Product Type, 2019 to 2034

Figure 130: South Asia Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 133: South Asia Market Value (US$ billion) Analysis by Application, 2019 to 2034

Figure 134: South Asia Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 135: South Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 137: South Asia Market Value (US$ billion) Analysis by Sales Channel, 2019 to 2034

Figure 138: South Asia Market Volume (MT) Analysis by Sales Channel, 2019 to 2034

Figure 139: South Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 141: South Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 142: South Asia Market Attractiveness by Application, 2024 to 2034

Figure 143: South Asia Market Attractiveness by Sales Channel, 2024 to 2034

Figure 144: South Asia Market Attractiveness by Country, 2024 to 2034

Figure 145: Oceania Market Value (US$ billion) by Product Type, 2024 to 2034

Figure 146: Oceania Market Value (US$ billion) by Application, 2024 to 2034

Figure 147: Oceania Market Value (US$ billion) by Sales Channel, 2024 to 2034

Figure 148: Oceania Market Value (US$ billion) by Country, 2024 to 2034

Figure 149: Oceania Market Value (US$ billion) Analysis by Country, 2019 to 2034

Figure 150: Oceania Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: Oceania Market Value (US$ billion) Analysis by Product Type, 2019 to 2034

Figure 154: Oceania Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 157: Oceania Market Value (US$ billion) Analysis by Application, 2019 to 2034

Figure 158: Oceania Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 159: Oceania Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 161: Oceania Market Value (US$ billion) Analysis by Sales Channel, 2019 to 2034

Figure 162: Oceania Market Volume (MT) Analysis by Sales Channel, 2019 to 2034

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 165: Oceania Market Attractiveness by Product Type, 2024 to 2034

Figure 166: Oceania Market Attractiveness by Application, 2024 to 2034

Figure 167: Oceania Market Attractiveness by Sales Channel, 2024 to 2034

Figure 168: Oceania Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East & Africa Market Value (US$ billion) by Product Type, 2024 to 2034

Figure 170: Middle East & Africa Market Value (US$ billion) by Application, 2024 to 2034

Figure 171: Middle East & Africa Market Value (US$ billion) by Sales Channel, 2024 to 2034

Figure 172: Middle East & Africa Market Value (US$ billion) by Country, 2024 to 2034

Figure 173: Middle East & Africa Market Value (US$ billion) Analysis by Country, 2019 to 2034

Figure 174: Middle East & Africa Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 175: Middle East & Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East & Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East & Africa Market Value (US$ billion) Analysis by Product Type, 2019 to 2034

Figure 178: Middle East & Africa Market Volume (MT) Analysis by Product Type, 2019 to 2034

Figure 179: Middle East & Africa Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 180: Middle East & Africa Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 181: Middle East & Africa Market Value (US$ billion) Analysis by Application, 2019 to 2034

Figure 182: Middle East & Africa Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 183: Middle East & Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 184: Middle East & Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 185: Middle East & Africa Market Value (US$ billion) Analysis by Sales Channel, 2019 to 2034

Figure 186: Middle East & Africa Market Volume (MT) Analysis by Sales Channel, 2019 to 2034

Figure 187: Middle East & Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 188: Middle East & Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 189: Middle East & Africa Market Attractiveness by Product Type, 2024 to 2034

Figure 190: Middle East & Africa Market Attractiveness by Application, 2024 to 2034

Figure 191: Middle East & Africa Market Attractiveness by Sales Channel, 2024 to 2034

Figure 192: Middle East & Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydration Backpack Market Size and Share Forecast Outlook 2025 to 2035

Hydration Boosters Market – Growth, Functional Beverages & Industry Demand

Hydration Infusers Market

Dehydration Monitoring Systems Market Growth – Trends & Forecast 2025 to 2035

Military Hydration Products Market Growth - Trends & Forecast 2025 to 2035

Intravenous Hydration Therapy Market Size and Share Forecast Outlook 2025 to 2035

Gas Desiccant Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Desiccant Natural Gas Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Supplements And Nutrition Packaging Market

Supplementary Protectors Market

ACF Supplements Market Size and Share Forecast Outlook 2025 to 2035

Food Supplement Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Viscosupplementation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

PDRN Supplements Market Size and Share Forecast Outlook 2025 to 2035

Viscosupplementation Industry Analysis in Europe - Size, Share & Forecast 2025 to 2035

Feed Supplements Market Analysis - Size, Share & Forecast 2025 to 2035

Sleep Supplement Market Size and Share Forecast Outlook 2025 to 2035

Gummy Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fiber Supplements Market Size and Share Forecast Outlook 2025 to 2035

Vegan Supplements Market Analysis by Ingredient Type, Form, Customer Orientation , Sales Channel and Health Concer Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA