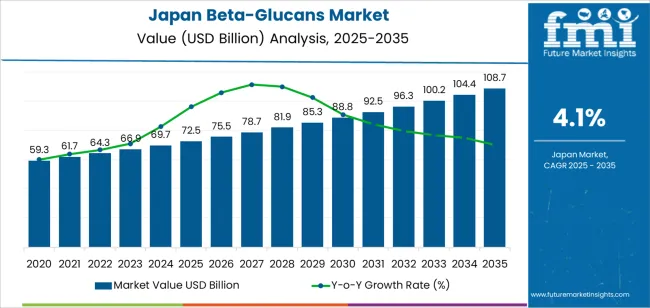

The demand for beta-glucans in Japan is expected to grow from USD 72.5 billion in 2025 to USD 108.7 billion by 2035, with a compound annual growth rate (CAGR) of 4.1%. Beta-glucans, polysaccharides derived from the cell walls of oats, barley, and fungi, are gaining popularity due to their immune-boosting, cholesterol-lowering, and anti-inflammatory properties. They are increasingly incorporated into functional foods, dietary supplements, and beverages as consumers in Japan seek health-enhancing products. The rising demand for natural ingredients and wellness-focused products plays a pivotal role in the industry growth of beta-glucans.

As health-conscious consumers in Japan increasingly prioritize immune support and overall wellness, beta-glucans are being sought after for their ability to help manage cholesterol levels, improve heart health, and boost the immune system. With the country's aging population, the need for products that support preventive healthcare and chronic disease management is growing. Beta-glucans are highly valued for their role in promoting long-term well-being, making them a key ingredient in both the pharmaceutical and nutraceutical sectors. The demand for bioactive ingredients such as beta-glucans is expected to continue its upward trajectory as the functional food industry expands to cater to the needs of health-conscious consumers.

Between 2025 and 2030, the demand for beta-glucans in Japan is expected to grow steadily, increasing from USD 72.5 billion to USD 75.5 billion. This moderate growth will be driven by growing consumer awareness of the functional health benefits of beta-glucans, especially in functional foods and supplements. The period will reflect consistent demand as people increasingly understand the benefits of dietary fibers in reducing the risk of diseases and enhancing overall health. As the wellness trend continues to gain momentum, consumers will seek out foods and products enriched with beta-glucans as part of their healthy lifestyle.

From 2030 to 2035, the demand for beta-glucans is projected to accelerate, rising from USD 75.5 billion to USD 108.7 billion. This sharp increase will be driven by several factors, including the continued rise in personalized nutrition, where beta-glucans are integrated into tailored health solutions. Advances in scientific research supporting their health benefits, particularly in terms of immunity and cardiovascular health, will fuel this acceleration. As nutraceuticals and functional food products become more prevalent in the health-conscious industry, the demand for beta-glucans will expand across new product categories, increasing their adoption in the broader wellness sector.

| Metric | Value |

|---|---|

| Demand for Beta-Glucans in Japan Value (2025) | USD 72.5 billion |

| Demand for Beta-Glucans in Japan Forecast Value (2035) | USD 108.7 billion |

| Demand for Beta-Glucans in Japan Forecast CAGR (2025-2035) | 4.1% |

The demand for beta-glucans in Japan is increasing due to their growing popularity in the health and wellness sector, particularly for their immune-boosting and cholesterol-lowering properties. Beta-glucans, naturally occurring polysaccharides found in foods like oats, barley, and certain mushrooms, are increasingly being incorporated into functional foods, dietary supplements, and beverages. As Japanese consumers become more health-conscious and seek preventive measures for chronic conditions, beta-glucans are being recognized for their potential to enhance immune function, support cardiovascular health, and improve overall wellness.

The rising interest in functional foods and nutraceuticals is a significant driver of this demand. As Japan’s aging population becomes more focused on maintaining health and preventing diseases like heart disease and diabetes, beta-glucans are gaining traction for their ability to support long-term health benefits. The increasing awareness of natural, plant-based ingredients in the Japanese food industry is driving the incorporation of beta-glucans into various food products, including snacks, dairy, and beverages.

Advancements in research and innovation around the potential health benefits of beta-glucans are also fueling demand. With continued studies highlighting their positive impact on immune health and disease prevention, beta-glucans are poised for sustained growth in Japan’s health-conscious industry. As demand for natural and functional ingredients continues to rise, beta-glucans are expected to see steady growth through 2035.

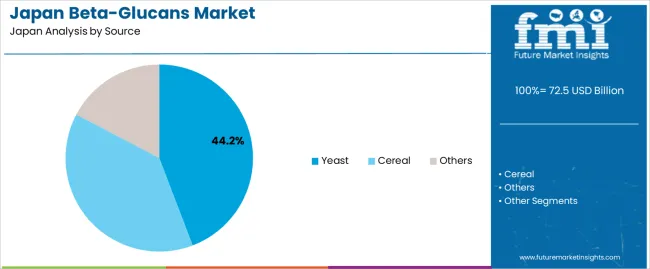

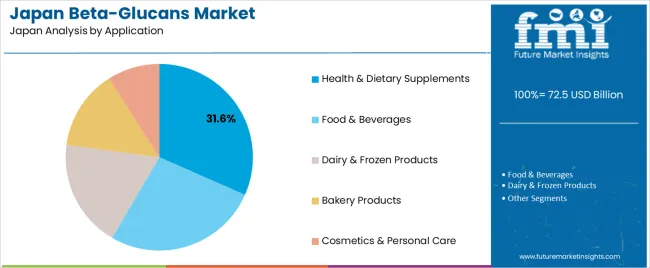

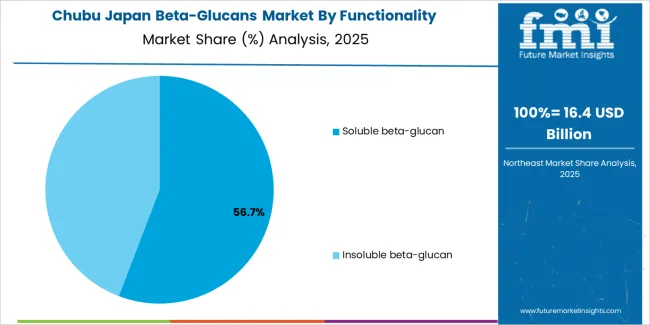

Demand for beta-glucans in Japan is segmented by source, application, functionality, and region. By source, demand is divided into yeast, cereal, and others, with yeast holding the largest share at 44%. The demand is also segmented by application, including health & dietary supplements, food & beverages, dairy & frozen products, bakery products, and cosmetics & personal care, with health & dietary supplements leading the demand at 31.6%. In terms of functionality, demand is divided into soluble and insoluble beta-glucans, with soluble beta-glucans leading the demand. Regionally, demand is divided into Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan.

Yeast accounts for 44% of the demand for beta-glucans in Japan. Yeast-derived beta-glucans are widely used for their high bioactivity and effectiveness in supporting immune health, managing cholesterol, and promoting digestive wellness. They are commonly incorporated into dietary supplements, functional foods, and natural health products due to their proven health benefits. The consistency and purity of yeast-derived beta-glucans make them the preferred choice for manufacturers in the nutraceutical and food industries. This form of beta-glucan is also beneficial for use in food processing, particularly in beverages and baked goods. As the demand for functional ingredients grows, especially in health-conscious consumer segments, yeast-based beta-glucans are poised to remain dominant, ensuring a steady position in the industry place.

Health & dietary supplements account for 31.6% of the demand for beta-glucans in Japan. Beta-glucans, particularly from yeast, are highly valued for their ability to support immune function, improve cardiovascular health, and reduce inflammation. These benefits make beta-glucans a key ingredient in various dietary supplements, from multivitamins to immune boosters. The increasing trend toward preventive healthcare, along with a growing preference for natural ingredients, drives the demand for beta-glucans in the supplement industry. With the rising awareness of the health benefits of beta-glucans in reducing cholesterol levels, regulating blood sugar, and supporting overall well-being, this sector is likely to remain the dominant application. As health-conscious consumers continue to seek natural alternatives to synthetic supplements, beta-glucans will maintain a leading role in dietary and nutritional supplements.

In Japan, demand for β‑glucan is being supported by rising interest in functional dietary fibre, immune‑boosting nutraceuticals and clean‑label, natural‑ingredient products. The ingredient’s identification as a soluble fibre and immune‑modulating polysaccharide appeals to manufacturers of functional foods, beverages, dietary supplements and even cosmetics. Japan’s ageing population and increasing prevalence of lifestyle‑related health concerns (e.g., cardiovascular, metabolic, immune) add to the driver base. Restraints include relatively high extraction and purification costs, variation in raw material sources (yeast, cereals, mushrooms), regulatory hurdles around health claims for novel ingredients, and competition from other dietary fibre or bioactive ingredient alternatives.

Why is Demand for Beta‑Glucan Growing in Japan?

Demand in Japan is increasing because consumers and manufacturers alike are seeking ingredients that support immune‑health, gut‑health and cardiovascular wellness in an ageing society. β‑Glucan whether from cereal grains (oats, barley), yeast or mushroom sources offers scientifically supported functional claims (e.g., cholesterol reduction, immune modulation), making it attractive for inclusion in fortified foods, dietary supplements and personal care formulations. Concurrently, processors and ingredient suppliers are highlighting plant‑derived, “clean‑label” credentials and versatility (soluble vs insoluble fibre formats) which support formulation in beverages, bars, capsules and skincare. These factors underpin rising β‑glucan uptake in Japan.

How are Technological Innovations Driving Growth of Beta‑Glucan in Japan?

Technological advances in Japan are enabling wider use of β‑glucan by improving extraction processes, increasing purity, and enhancing deliverability in consumer‑oriented formats. Improvements include refined extraction from yeast or mushroom sources, development of soluble β‑glucan for improved solubility and absorption, encapsulation techniques enabling inclusion in drinks or snack bars, and better sourcing/tracking of raw materials for consistent performance. These innovations allow ingredient suppliers and food & supplement manufacturers in Japan to more reliably deliver β‑glucan with defined functional activity, which assists broader adoption in food, nutraceutical and cosmetic applications.

What are the Key Challenges Limiting Adoption of Beta‑Glucan in Japan?

The cost of high‑purity β‑glucan production remains elevated compared to standard fibres or less‑processed extracts, which limits use in price‑sensitive formats. Documentation and substantiation of health claims (e.g., immune or cardiovascular effects) are required under Japanese regulatory frameworks, complicating launch of new β‑glucan‑enhanced products. Supply‑chain variability (source, extraction yield, batch reliability) also poses risk for food and supplement makers. Competition from other recognised functional ingredients (e.g., probiotics, other fibres, plant‑sterols) means β‑glucan must sufficiently differentiate to justify premium positioning.

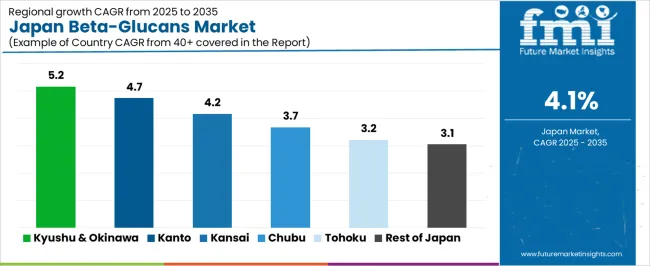

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 5.2% |

| Kanto | 4.7% |

| Kinki | 4.2% |

| Chubu | 3.7% |

| Tohoku | 3.2% |

| Rest of Japan | 3.1% |

Demand for beta-glucans in Japan is growing steadily, with Kyushu & Okinawa leading at a 5.2% CAGR, driven by local agricultural practices and a focus on wellness products. Kanto follows with a 4.7% CAGR, supported by its health-conscious population and strong food industry. Kinki shows a steady 4.2% CAGR, driven by innovation in functional foods. Chubu sees moderate growth at 3.7% CAGR, driven by food fortification and biotechnology. Tohoku experiences 3.2% CAGR, with growth supported by rural agricultural production. The Rest of Japan has a 3.1% CAGR, with steady demand driven by local producers of functional foods and supplements. As consumer interest in health benefits continues to rise, the demand for beta-glucans is expected to grow steadily across Japan.

Kyushu & Okinawa are seeing the highest demand for beta-glucans in Japan, with a 5.2% CAGR. The demand is primarily driven by the region’s strong agricultural focus on functional foods and health products. Okinawa, known for its longevity, has led to a strong local industry for wellness supplements containing beta-glucan, particularly from barley and yeast. The region’s agricultural policies, which encourage sustainable crop production such as barley for beta-glucan extraction, further support this growth. In addition, Kyushu's thriving aquaculture industry uses beta-glucans derived from seaweed, promoting immunity and overall health in the region's popular dietary supplements. As both urban and rural areas focus on food innovation and healthier living, the demand for beta-glucans is expected to rise steadily in Kyushu & Okinawa, driven by both local agricultural practices and the wellness culture.

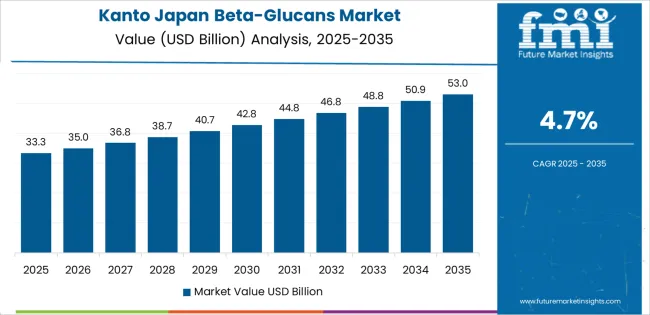

Kanto is experiencing strong demand for beta-glucans, with a 4.7% CAGR. The region’s demand is largely driven by the increasing consumption of functional foods, particularly in Tokyo and surrounding areas. Kanto’s large population, which is becoming increasingly health-conscious, is pushing the demand for ingredients like beta-glucans in dietary supplements, beverages, and fortified foods. Local research hubs in Chiba and Kanagawa have developed advanced formulations of beta-glucan, especially from barley and yeast, targeting immune system health, cholesterol management, and gut health. Kanto’s food and beverage manufacturers are adopting these health trends, adding beta-glucan into product lines, particularly in urban industrys where demand for functional foods is high. As consumer interest in natural health supplements continues to grow, Kanto’s robust food industry and health-conscious consumers will keep driving demand for beta-glucans in the region.

Kinki is witnessing steady growth in beta-glucan demand, with a 4.2% CAGR. The region’s demand is primarily driven by the food processing and wellness industries, particularly in Osaka and Kyoto, which are major hubs for functional foods and supplements. Local manufacturers are increasingly incorporating beta-glucans derived from barley and yeast into their products, such as health drinks, cereals, and snack foods, focusing on the cardiovascular and immune benefits. The region’s robust R&D focus on functional ingredients and local agriculture promoting barley cultivation has created a strong local supply of beta-glucan.Kinki’s population is showing a growing preference for foods that promote long-term health, particularly in urban areas. As the demand for gut health and heart-healthy foods rises, the use of beta-glucans in Kinki’s food sector is expected to grow steadily, contributing to the region’s overall demand.

Chubu is seeing moderate demand for beta-glucans, with a 3.7% CAGR. The region’s demand is mainly driven by its expanding food industry, particularly in agricultural areas like Aichi, where the cultivation of barley for beta-glucan extraction is increasing. In addition to barley, Chubu’s growing biotechnology sector is focusing on extracting beta-glucans from other sources, such as mushrooms and yeast, for use in dietary supplements and functional foods. The region’s dairy industry also uses beta-glucans in food fortification, particularly in yogurt and other fermented products, where beta-glucans are promoted for gut health and immune system benefits. With Chubu’s focus on food product innovation and health trends, the demand for beta-glucans is expected to grow moderately, supported by the region’s strong agricultural and industrial base.

Tohoku is experiencing slower growth in beta-glucan demand, with a 3.2% CAGR. The demand in this region is primarily driven by the use of barley and oats in food production, particularly in rural areas. As the region focuses on developing sustainable agricultural practices and increasing its food production, the demand for beta-glucans is steadily rising. Tohoku’s small but growing health-conscious consumer base is increasingly incorporating beta-glucans into their diets, with a focus on products that promote immunity, heart health, and gut function. Local manufacturers, supported by regional agricultural policies, are also using beta-glucans in functional foods such as breakfast cereals, snacks, and fortified beverages. While the growth is slower compared to other regions, Tohoku’s ongoing commitment to agricultural development and food processing ensures a steady increase in beta-glucan demand.

The Rest of Japan is seeing moderate growth in beta-glucan demand, with a 3.1% CAGR. This demand is largely supported by smaller-scale production in regional agricultural hubs, where barley and oats are cultivated for use in food and supplements. In these regions, local food producers are using beta-glucans to enhance the health benefits of their products, including those targeting gut health, cholesterol, and overall wellness. The Rest of Japan’s demand for beta-glucans is driven by consumer interest in functional foods, with a growing awareness of natural ingredients and their health benefits. As food and beverage manufacturers across smaller regions expand their product offerings, the demand for beta-glucans is expected to rise steadily, contributing to the continued growth in the broader Japanese industry.

In Japan, demand for beta‑glucans is increasing, driven by a growing focus on functional ingredients in food and supplements as well as the aging population’s desire for immune support. Beta‑glucans, which are naturally occurring polysaccharides found in sources such as oats, barley, yeast and mushrooms, are valued for their potential to support cardiovascular health and immune system function.

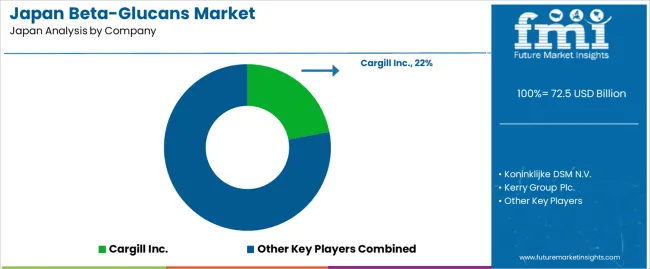

Key suppliers in this domain include Cargill Inc. with a 22.0 % share, Koninklijke DSM N.V., Kerry Group Plc., Tate & Lyle Plc. and Biotec BetaGlucans AS. Cargill’s leading position reflects its strong supply chain, extraction capabilities and partnerships in the Japanese nutrition‑and‑wellness industry. The other firms distinguish themselves by offering specialty beta‑glucan grades, addressing different application segments including dietary supplements, food fortification and personal care.

Several key factors shape the competitive dynamics. One driver is the rising demand for natural, clean‑label ingredients among Japanese consumers, which encourages adoption of beta‑glucans in fortified foods and beverages. A second driver is the increasing volume of research and formulation activity demonstrating the health benefits of beta‑glucans, which enhances industry credibility. At the same time, the segment faces challenges such as variability in source materials (for example differences between cereal‑based and yeast‑based beta‑glucans), the cost of processing and certification, and competition from alternative functional ingredients. Suppliers that can secure consistent high‑purity feedstocks, support formulators with technical expertise, and scale production efficiently will be best positioned to expand their footprint in Japan’s beta‑glucan industry.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Source | Yeast, Cereal, Others |

| Functionality | Soluble beta-glucan, Insoluble beta-glucan |

| Application | Health & Dietary Supplements, Food & Beverages, Dairy & Frozen Products, Bakery Products, Cosmetics & Personal Care |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Cargill Inc., Koninklijke DSM N.V., Kerry Group Plc., Tate & Lyle Plc., Biotec BetaGlucans AS |

| Additional Attributes | Dollar sales by source, functionality, and application; regional CAGR and adoption trends; demand trends in beta-glucans; growth in health supplements, food & beverage, and cosmetics sectors; technology adoption for functional ingredients; vendor offerings including raw materials and formulations; regulatory influences and industry standards |

The demand for beta-glucans in Japan is estimated to be valued at USD 72.5 billion in 2025.

The market size for the beta-glucans in Japan is projected to reach USD 108.7 billion by 2035.

The demand for beta-glucans in Japan is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in beta-glucans in Japan are yeast, cereal and others.

In terms of functionality, soluble beta-glucan segment is expected to command 55.1% share in the beta-glucans in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA