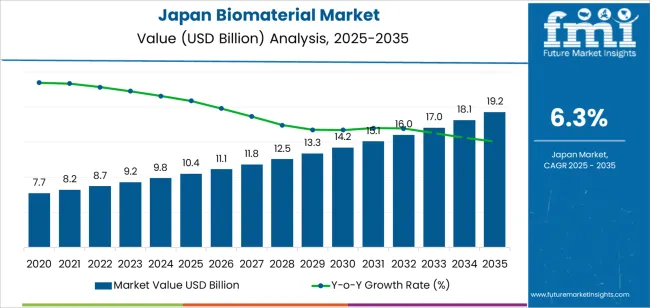

The demand for biomaterials in Japan is projected to grow from USD 10.4 billion in 2025 to USD 19.2 billion by 2035, reflecting a CAGR of 6.3%. Biomaterials are essential in various industries, particularly in medical applications such as implants, prosthetics, and tissue engineering. The increasing demand for biocompatible materials driven by aging populations and advancements in regenerative medicine is expected to drive substantial market growth. Moreover, the rising focus on sustainable materials and eco-friendly solutions will further enhance the adoption of biomaterials in other sectors like electronics and biodegradable packaging.

The market growth will also be supported by technological advancements in nanotechnology, biodegradable polymers, and bioengineering, which enable the creation of new biomaterial products with superior properties. Additionally, Japan’s strong healthcare infrastructure, coupled with its focus on innovative medical technologies, will create a favorable environment for the adoption of biomaterials in medical devices and biomedical applications. As the demand for functional biomaterials grows in drug delivery systems and wound healing applications, the market is set to expand significantly over the next decade.

From 2025 to 2030, the demand for biomaterials in Japan will grow from USD 10.4 billion to USD 14.2 billion, adding USD 3.8 billion in value. This phase represents the early growth period, where the market will experience accelerated expansion due to increasing adoption of biomaterials in medical and healthcare sectors. During this phase, technological innovations, particularly in tissue engineering and biodegradable polymers, will drive the demand for new biomaterial products. Medical device manufacturers will continue to integrate biomaterials into surgical implants and prosthetics, which will create an uptick in volume and value. Additionally, as regenerative medicine advances, the demand for biocompatible materials will further escalate. The early growth period will benefit from initial high investments in research and development and collaborations between healthcare providers and biotechnology firms.

From 2030 to 2035, the market will grow from USD 14.2 billion to USD 19.2 billion, contributing USD 5 billion in value. In this phase, the market will experience a slower growth rate compared to the initial phase, reflecting mature market dynamics. The growth will be supported by wider adoption of biomaterials across multiple industries, including biomedical applications and sustainable product solutions. As regulations become more standardized and technology improves, the adoption of biomaterials will become more widespread. However, growth will be driven by incremental innovations in materials and incremental improvements in biodegradable solutions, rather than the more significant technological leaps seen in earlier years. This phase will reflect a shift toward market stabilization, with differentiation based on product performance and cost-effectiveness driving competition in the market.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 10.4 billion |

| Industry Forecast Value (2035) | USD 19.2 billion |

| Industry Forecast CAGR (2025-2035) | 6.3% |

Demand for biomaterials in Japan is increasing as the country addresses both healthcare and sustainability imperatives. The market size is estimated at USD 10.4 billion and is projected to grow to USD 19.2 billion, reflecting a compound annual growth rate (CAGR) of about 6.3%. Growth is supported by Japan’s ageing population, the rising incidence of chronic conditions, and increasing adoption of implants, tissue engineering products and regenerative medicine solutions.

The expansion of biomaterial use across non medical applications also contributes to demand. Industries such as packaging, automotive and electronics are exploring bio based or hybrid materials to meet sustainability goals and regulatory pressures. At the same time, challenges persist--including high cost of development, complex regulatory pathways and the need for large scale manufacturing of novel biomaterials. Nonetheless, the alignment of demographic shifts, industrial innovation and ecological focus suggests continued growth in demand for biomaterials in Japan.

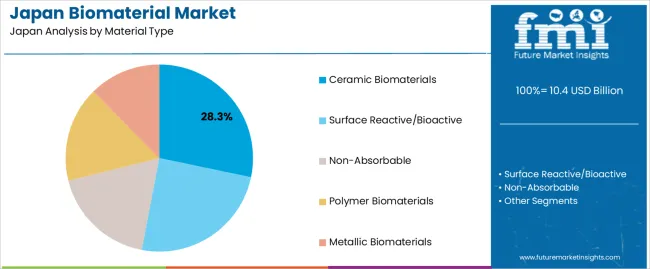

The demand for biomaterials in Japan is primarily driven by material type and application. The leading material type is ceramic biomaterials, capturing 28% of the market share, while cardiology is the dominant application, accounting for 26.9% of the demand. Biomaterials are essential in various medical applications, ranging from implants and prosthetics to tissue engineering, and their demand continues to grow as the healthcare industry advances and more specialized applications emerge.

Ceramic biomaterials lead the demand for biomaterials in Japan, holding 28% of the market share. Ceramic biomaterials are favored in medical applications due to their excellent biocompatibility, mechanical properties, and resistance to wear. They are widely used in orthopedic implants, dental prosthetics, and other applications where long-term durability and compatibility with human tissue are required. Their ability to promote bone growth and integrate with living tissues makes them ideal for use in load-bearing implants, particularly in orthopedics and dentistry.

The demand for ceramic biomaterials is driven by the growing need for reliable, long-lasting solutions in the medical field, particularly in orthopedics and dental implants. As Japan’s aging population continues to increase, the need for joint replacements, dental restorations, and other biomaterial-based solutions is rising. Ceramic materials, particularly those that are bioactive and can stimulate tissue regeneration, are in high demand for these applications. The continued development of advanced ceramic biomaterials with enhanced properties ensures their continued dominance in the Japanese market.

Cardiology is the leading application for biomaterials in Japan, capturing 26.9% of the market share. Biomaterials are extensively used in cardiology for applications such as heart valve replacements, stents, and vascular grafts. The increasing prevalence of cardiovascular diseases in Japan, along with advancements in implantable medical devices, is driving the demand for biomaterials in this field.

The demand from cardiology is driven by the need for high-performance materials that can withstand the mechanical stresses of the cardiovascular system while remaining biocompatible. Materials such as metallic, polymeric, and bioactive ceramics are commonly used in devices like stents, pacemakers, and heart valve prostheses. As Japan’s healthcare system focuses on improving cardiovascular care and managing heart disease, the demand for biomaterials in this field is expected to continue growing. Additionally, innovations in materials that promote healing and reduce complications are expected to fuel further growth in the cardiology biomaterials market.

Demand for biomaterials in Japan is propelled mainly by the country’s ageing population, rising prevalence of cardiovascular and orthopedic disorders, and the intensifying need for implants and regenerative therapies. The healthcare sector’s growth and Japan’s strong research ecosystem support adoption of advanced materials such as biocompatible polymers, ceramics and metallic biomaterials. At the same time, high regulatory standards, elevated development costs and long market entry timelines moderate the pace of uptake. Together, these factors define the landscape of the biomaterials market in Japan.

What Are the Primary Growth Drivers for Biomaterials Demand in Japan?

Several drivers underpin market expansion. First, as individuals aged 65 or older represent a significant share of Japan’s population, demand for joint replacements, cardiovascular implants and wound care solutions expands, increasing need for biomaterials. Second, progress in tissue engineering, drug delivery systems and personalised medicine applications drives demand for biomaterials with advanced functionality. Third, government support for healthcare innovation and regenerative medicine strengthens the institutional backing for biomaterials development and use in Japan. Fourth, sustainability concerns and interest in bio based materials create new demand for eco friendly biomaterials beyond medical device applications.

What Are the Key Restraints Affecting Biomaterials Demand in Japan?

Despite strong impetus, several restraints exist. Development and manufacturing of specialised biomaterials require significant capital investment, which constrains smaller suppliers and slows new product launches. The regulatory approval process in Japan for novel biomaterials is rigorous, adding time and cost before commercialisation. Some segments are reaching maturity- especially in traditional implant materials- limiting room for rapid volume growth. In addition, supply chain volatility for high performance polymers, rare metals and advanced ceramics raises cost and may discourage widespread adoption.

What Are the Key Trends Shaping Biomaterials Demand in Japan?

Notable trends include increased development of natural and bio derived biomaterials that offer improved biocompatibility and lower environmental impact. There is also growing uptake of multifunctional biomaterials- such as bioresorbable scaffolds and drug eluting devices- especially in orthopaedics and cardiovascular fields. Manufacturers in Japan are advancing modular biomaterial systems that combine sensors or connectivity within implantable devices to support longer term outcomes. Furthermore, cross industry collaboration between materials scientists, healthcare providers and device manufacturers is accelerating innovation and commercialisation of next generation biomaterials.

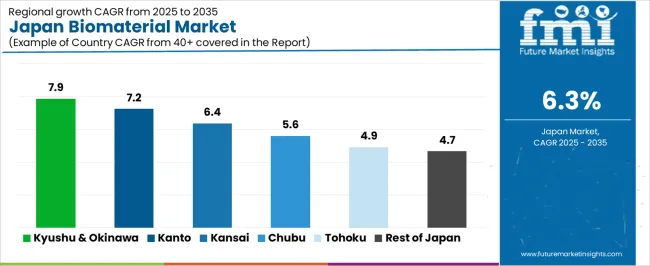

The demand for biomaterials in Japan shows steady growth across various regions, with Kyushu & Okinawa leading at a CAGR of 7.9%. Kanto follows closely with a 7.2% CAGR, driven by its strong healthcare infrastructure and growing demand for medical technologies. The Kinki region shows moderate growth at 6.4%, while Chubu, Tohoku, and the Rest of Japan exhibit slower growth, with respective CAGRs of 5.6%, 4.9%, and 4.7%. These regional differences reflect factors such as healthcare access, population density, and technological advancements, with urbanized regions experiencing stronger demand for biomaterials due to advanced healthcare services and medical innovation.

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 7.9% |

| Kanto | 7.2% |

| Kinki | 6.4% |

| Chubu | 5.6% |

| Tohoku | 4.9% |

| Rest of Japan | 4.7% |

The demand for biomaterials in Kyushu & Okinawa is projected to grow at a CAGR of 7.9%, supported by significant investments in healthcare infrastructure and medical research. The region has seen growing demand for advanced medical devices and treatments, particularly in areas such as orthopedics, tissue engineering, and regenerative medicine, all of which require high-quality biomaterials. The aging population in Kyushu & Okinawa further fuels the demand, as older individuals often require medical treatments that involve biomaterials, such as joint replacements or wound healing therapies. Okinawa’s emphasis on health and longevity also aligns with the growing adoption of advanced biomaterials, as the region focuses on improving healthcare outcomes. Additionally, the expansion of medical technology companies and research institutions in Kyushu & Okinawa contributes to the increasing demand for innovative biomaterials, fostering a favorable environment for market growth.

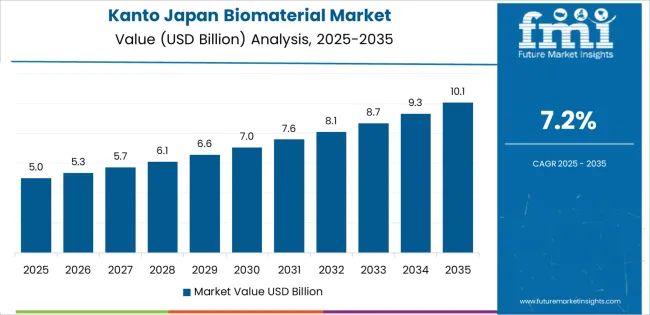

In Kanto, the demand for biomaterials is expected to grow at a CAGR of 7.2%, driven by the region’s extensive healthcare infrastructure and large population. Kanto, which includes Tokyo, is Japan’s economic and medical hub, with numerous leading hospitals, research institutions, and biotech companies that are at the forefront of developing and adopting biomaterials. As Japan’s healthcare system evolves to address the needs of its aging population, the demand for biomaterials used in prosthetics, implants, wound healing, and drug delivery systems is rising. The Kanto region’s concentration of medical professionals, academic institutions, and technological innovators plays a key role in increasing the adoption of biomaterials. Furthermore, the region’s healthcare market is rapidly adopting new and improved biomaterials, driven by advancements in medical technology and a growing focus on personalized treatments, ensuring that demand will remain strong in Kanto.

The demand for biomaterials in the Kinki region is projected to grow at a CAGR of 6.4%, reflecting steady growth driven by the region’s strong medical sector. Kinki, which includes cities such as Osaka and Kyoto, is home to several prominent medical centers, universities, and biotech companies that are investing in the development and application of biomaterials. The region’s population is aging, and as a result, there is an increasing need for medical treatments and devices that require biomaterials, such as orthopedic implants, dental materials, and regenerative therapies. Furthermore, Kinki’s well-established medical research community continues to drive innovation in biomaterials, contributing to the adoption of advanced materials in clinical settings. While the growth rate is slower compared to Kyushu & Okinawa and Kanto, Kinki’s robust healthcare infrastructure and research capacity ensure that demand for biomaterials will continue to grow steadily in the coming years.

The demand for biomaterials in Chubu is expected to grow at a CAGR of 5.6%, driven by the region’s industrial and healthcare sectors. Chubu, home to major cities like Nagoya, has a strong manufacturing base, and the region’s medical industry is expanding to meet the needs of an aging population. The demand for biomaterials in Chubu is particularly influenced by the growing need for medical devices and treatments, such as implants, prosthetics, and tissue engineering, that require biomaterials. However, the growth rate in Chubu is slower compared to more urbanized regions like Kanto and Kyushu & Okinawa, as the region still lags behind in the adoption of cutting-edge medical technologies. Nevertheless, as the healthcare sector in Chubu continues to modernize and new medical technologies are introduced, the demand for biomaterials is expected to rise steadily, particularly in orthopedic, dental, and surgical applications.

In Tohoku, the demand for biomaterials is projected to grow at a CAGR of 4.9%, reflecting slower adoption compared to more developed regions in Japan. Tohoku, with its lower population density and more rural character, faces challenges in terms of access to advanced healthcare facilities. However, as the region’s aging population grows, the demand for medical treatments and devices that utilize biomaterials, such as joint replacements and cardiovascular devices, is increasing. Tohoku is also experiencing improvements in its healthcare infrastructure, which are driving the adoption of biomaterials. The gradual introduction of innovative medical technologies, particularly in rural healthcare settings, is contributing to moderate growth in biomaterial demand. While the growth rate is more modest, Tohoku’s increasing focus on healthcare improvement ensures that the demand for biomaterials will continue to rise as the region adapts to evolving medical needs.

In the Rest of Japan, the demand for biomaterials is expected to grow at a CAGR of 4.7%, reflecting gradual but consistent growth. This region, which includes rural areas and less densely populated regions, has traditionally had lower access to advanced medical technologies compared to urban centers. However, as the aging population continues to grow, there is an increasing need for medical treatments that involve biomaterials, such as orthopedic devices and prosthetics. The introduction of telemedicine, mobile health platforms, and improvements in rural healthcare facilities is contributing to the adoption of biomaterials in these regions. The demand for biomaterials in the Rest of Japan will likely remain steady, though slower, as healthcare accessibility improves and the need for medical devices and treatments continues to rise.

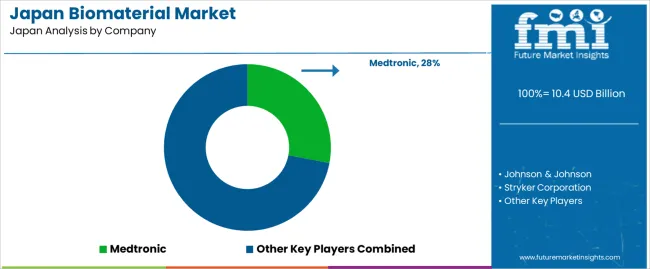

The biomaterials market in Japan is expanding as demand rises for materials used in medical implants, tissue engineering, and regenerative therapies. Companies such as Medtronic (with an estimated 28 % share), Johnson & Johnson, Stryker Corporation, Zimmer Biomet and Evonik Industries play prominent roles in this sector. Growth is supported by Japan’s ageing population, increasing prevalence of chronic and degenerative conditions, and strong domestic research in advanced biomaterials. The market is characterised by multiple material types-metallic, ceramic, polymeric and natural-and applications covering orthopaedics, cardiovascular, dental and wound care. The metallic segment held a large share of revenue in recent years.

Competition in the Japanese biomaterials market centers on high performance material properties, regulatory compliance and clinical support. Suppliers emphasize biocompatibility, durability and integration with medical device systems. Another key aspect is localisation of service and manufacturing, as Japanese healthcare providers favour domestic support, rapid service and material traceability. Companies also target end use applications such as joint replacement, cardiovascular grafts, and dental implants with tailored material systems. Marketing materials typically highlight validated performance, implant life span, compatibility with surgical workflows and support for device manufacturers. By aligning their material portfolios with demands for advanced implants and streamlined clinical adoption, these firms seek to strengthen their position in Japan’s biomaterials industry.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | Japan |

| Material Type | Ceramic Biomaterials, Surface Reactive/Bioactive, Non-Absorbable, Polymer Biomaterials, Metallic Biomaterials |

| Application | Cardiology, Ophthalmology, Dental, Neurology, Orthopaedic |

| End Users | Pharmaceuticals/Biotech Manufacturers, Medical Device Manufacturers, Cosmetic & Aesthetic Products Manufacturers, Tissue Engineering and Regenerative Medicine Companies, Research Laboratories |

| Key Companies Profiled | Medtronic, Johnson & Johnson, Stryker Corporation, Zimmer Biomet, Evonik Industries |

| Additional Attributes | The market analysis includes dollar sales by material type, application, end-user, and company categories. It also covers regional demand trends in Japan, driven by the increasing use of biomaterials in various medical applications, including cardiology, orthopaedics, and dental treatments. The competitive landscape highlights key manufacturers focusing on innovations in biomaterial development for implants, prosthetics, and regenerative medicine. Trends in the growing demand for bioactive, non-absorbable, and polymer-based biomaterials are explored, along with advancements in the integration of biomaterials for tissue engineering and medical device applications. |

The demand for biomaterial in japan is estimated to be valued at USD 10.4 billion in 2025.

The market size for the biomaterial in japan is projected to reach USD 19.2 billion by 2035.

The demand for biomaterial in japan is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in biomaterial in japan are ceramic biomaterials, surface reactive/bioactive, non-absorbable, polymer biomaterials and metallic biomaterials.

In terms of application, cardiology segment is expected to command 26.9% share in the biomaterial in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Biomaterial Tester Market Size and Share Forecast Outlook 2025 to 2035

Biomaterial In Surgical Mesh Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA