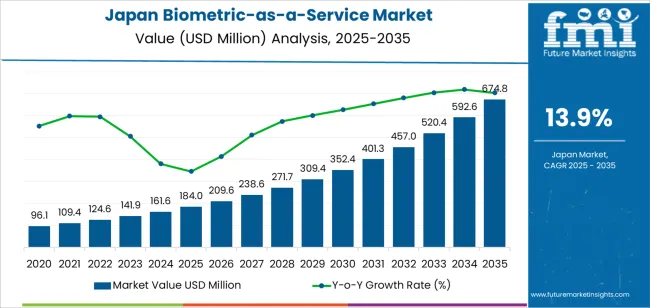

The demand for Biometric-as-a-Service (BaaS) in Japan is projected to grow from USD 184 million in 2025 to USD 674.8 million by 2035, reflecting a CAGR of 13.9%. BaaS solutions, which provide biometric authentication services such as fingerprint scanning, facial recognition, and voice verification, are gaining traction across various sectors, including finance, healthcare, retail, and government. As security concerns continue to rise, especially regarding identity theft and fraud prevention, businesses and government agencies are increasingly turning to biometric systems for secure authentication. The rapid growth of digital transactions, online banking, and the increasing need for contactless authentication will continue to drive the demand for BaaS solutions in Japan.

The rise in smart devices and IoT integration is also playing a key role in driving demand for biometric authentication systems. With the adoption of biometric-enabled devices and the push for enhanced security measures in both physical and digital environments, BaaS is becoming a crucial component in the digital security landscape. Government policies and regulations supporting digital transformation and secure transactions further reinforce the growth trajectory of the market. As the technology matures, the cost-efficiency and scalability of biometric services will make them more accessible to a broader range of industries, propelling the market forward.

From 2025 to 2030, the demand for Biometric-as-a-Service in Japan will grow from USD 184 million to USD 352.4 million, adding USD 168.4 million in value. This period will account for a significant portion of the overall market growth, with the early adoption of biometric services by financial institutions, government agencies, and technology companies. The growth contribution from this phase is largely driven by the rising demand for digital authentication, especially in financial services for secure transactions and identity verification. Increased consumer awareness about the benefits of biometric systems, including ease of use and security, will lead to an accelerated adoption across various sectors. The market will experience a rapid expansion during this phase, as companies seek to implement cost-effective, scalable solutions for their security needs.

From 2030 to 2035, the market will grow from USD 352.4 million to USD 674.8 million, contributing USD 322.4 million in value. This period will reflect the maturity of the market, with more industries adopting Biometric-as-a-Service for multi-factor authentication and advanced security protocols. The growth contribution in this phase will be marked by the widespread integration of biometric solutions into IoT platforms, mobile devices, and cloud services, enhancing digital security and identity management. Despite a slightly slower pace of growth compared to the earlier phase, wider adoption and technological innovation will ensure a significant increase in market value. By this stage, biometric authentication will become a mainstream solution, further expanding the market and driving the overall demand.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 184 million |

| Industry Forecast Value (2035) | USD 674.8 million |

| Industry Forecast CAGR (2025-2035) | 13.9% |

Demand for biometric as a service (BaaS) in Japan is increasing as organisations seek identity verification and access control capabilities without heavy on premises hardware investment. The domestic biometric technology market in Japan was valued at approximately USD 2,465.1 million in 2023 and is forecast to grow at a compound annual growth rate (CAGR) of about 22.4 % through 2030. This expansion covers both hardware and service segments and reflects growing adoption of biometric modalities such as facial, fingerprint, and iris recognition.

Another key driver is the combination of digital transformation initiatives in government and enterprise sectors and rising cybersecurity concerns. Japan’s regulatory environment, including data protection laws, encourages adoption of managed biometric services that support remote and secure authentication. Biometric as a service offers organisations scalable identity solutions via cloud platforms rather than traditional system installations. At the same time, challenges include data sovereignty requirements, integration with legacy systems and privacy concerns related to biometric data storage. Nonetheless, the convergence of compliance needs, digital user authentication trends and mature IT infrastructure positions the BaaS market in Japan for sustained growth.

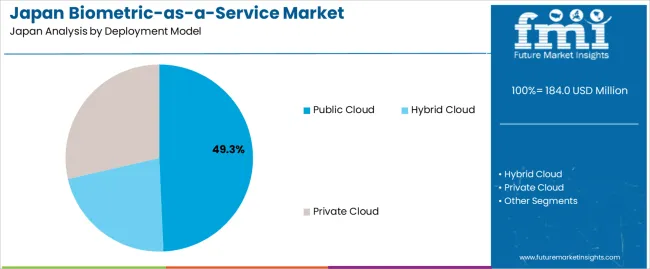

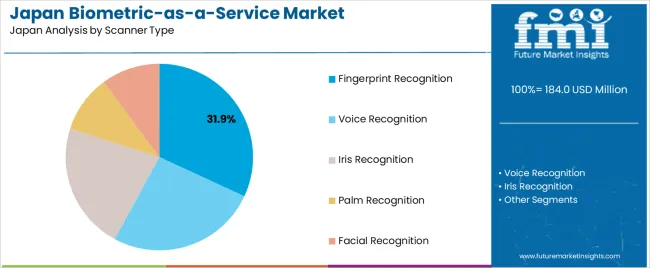

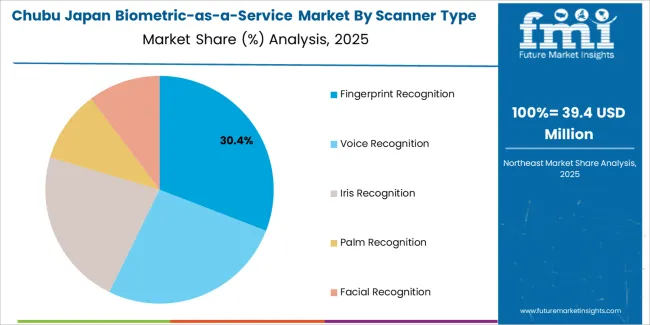

The demand for Biometric-as-a-Service in Japan is primarily driven by deployment model and scanner type. The leading deployment model is public cloud, capturing 49% of the market share, while fingerprint recognition is the dominant scanner type, accounting for 31.9% of the demand. As the need for secure, scalable biometric solutions increases across various industries, cloud-based services and advanced biometric technologies are gaining traction in Japan.

Public cloud is the leading deployment model for Biometric-as-a-Service in Japan, holding 49% of the demand. Public cloud solutions offer scalable, cost-effective, and secure platforms for deploying biometric services. These solutions are increasingly preferred by businesses due to their ability to provide fast deployment, flexible pricing, and low-maintenance infrastructure.

The growing demand for public cloud-based biometric services is driven by the shift toward cloud adoption, which allows organizations to integrate biometric authentication solutions without investing in extensive on-premise hardware or infrastructure. Public cloud services offer a convenient way for businesses across various industries, including finance, healthcare, and government, to implement biometric security measures while maintaining scalability and reliability. As cybersecurity and digital identity verification remain priorities, the demand for public cloud-based biometric services is expected to continue to grow.

Fingerprint recognition leads the scanner type market for Biometric-as-a-Service in Japan, accounting for 31.9% of the demand. Fingerprint-based authentication is widely used due to its reliability, ease of implementation, and cost-effectiveness. It is commonly used in applications ranging from mobile device security to access control in physical and digital environments.

The demand for fingerprint recognition is driven by its simplicity and the broad availability of fingerprint sensors in consumer electronics and enterprise security systems. As fingerprint authentication remains one of the most trusted methods for biometric identification, its widespread adoption across a variety of sectors—especially in secure access and mobile applications—ensures it remains the dominant scanner type in the biometric-as-a-service market in Japan. With ongoing technological advancements and the continued push for enhanced security, fingerprint recognition is expected to retain its leadership in the market.

Demand in Japan for Biometric as a Service (BaaS) is rising as organisations increasingly adopt cloud based identity verification and mobile authentication. The shift toward digitalisation in sectors including healthcare and finance is fuelling interest in biometric systems offering subscriber based models. At the same time, data privacy concerns, integration costs and compliance with local regulatory frameworks moderate the pace of uptake. These factors together shape how BaaS solutions gain traction in Japan’s enterprise and public sector markets.

What Are the Primary Growth Drivers for Biometric as a Service Demand in Japan?

Several drivers support growth. First, Japanese healthcare providers are using cloud based biometric authentication to secure patient records and prevent duplicate registration. Second, mobile device penetration and rising mobile payments increase demand for strong authentication methods such as facial recognition and fingerprint scanning. Third, government initiatives for digital health platforms and smart infrastructure raise requirements for identity verification systems and favour service based biometric models. Fourth, cost sensitivity among enterprises encourages subscription models in BaaS compared with large capital expenditures for onsite biometric systems.

What Are the Key Restraints Affecting Biometric as a Service Demand in Japan?

Despite favourable drivers, several restraints exist. First, biometrics raise privacy and consent concerns, especially when data is processed or stored on cloud servers outside local control. Second, integration of BaaS platforms with legacy IT systems in Japanese organisations can be complex and time consuming. Third, higher upfront investment in capturing devices, hardware calibration and service subscription may discourage small and mid sized firms. Fourth, regulatory uncertainty about cross border data flow, biometric data retention and authentication standards may slow deployment in sensitive sectors such as finance and government.

What Are the Key Trends Shaping Biometric as a Service Demand in Japan?

Key trends include increasing use of multimodal biometric authentication (face, voice, palm) delivered via cloud based service platforms, enhancing security and flexibility. There is also growing adoption of BaaS in mobile first use cases such as e commerce, digital banking and remote enrolment, leveraging smartphone native biometrics. Japanese companies are favouring hybrid deployment models that combine local data processing with cloud service scalability to align with data sovereignty concerns. Finally, vendors are offering bundled BaaS packages with analytics, fraud detection and identity lifecycle management to address use case expansion in sectors such as healthcare, retail and utilities.

The demand for Biometric-as-a-Service (BaaS) in Japan is driven by increasing concerns about security, fraud prevention, and the need for advanced authentication systems across various industries. BaaS provides organizations with the ability to integrate biometric authentication solutions, such as facial recognition, fingerprint scanning, and voice recognition, without investing in complex infrastructure. This service model allows businesses to enhance security, improve user experience, and comply with stringent data protection regulations. Industries such as banking, healthcare, retail, and government are increasingly adopting biometric systems to safeguard sensitive information and streamline access management.

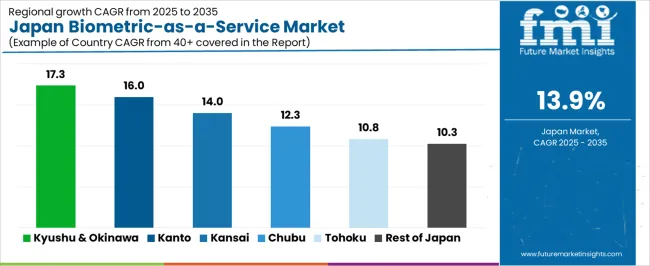

The rising focus on digital transformation, coupled with Japan’s push towards innovation and smart city initiatives, further accelerates the adoption of biometric solutions. Regional variations in demand reflect differences in technological adoption, industrial sectors, and population density, which influence the implementation of biometric services.

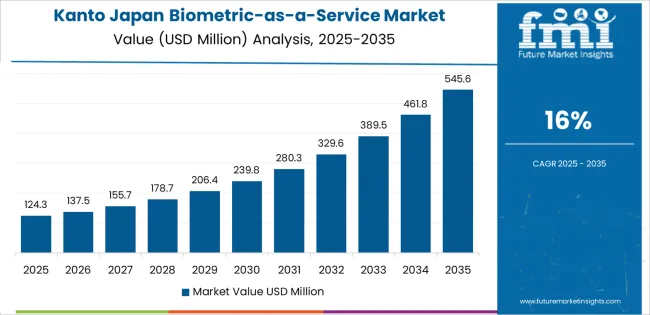

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 17.3% |

| Kanto | 16% |

| Kinki | 14% |

| Chubu | 12.3% |

| Tohoku | 10.8% |

| Rest of Japan | 10.3% |

Kyushu & Okinawa leads the demand for Biometric-as-a-Service in Japan with a CAGR of 17.3%. This high growth rate can be attributed to the region’s growing emphasis on digital transformation, security advancements, and smart infrastructure. The increasing integration of biometric authentication into public services, retail, and tourism in Okinawa has created a surge in demand for BaaS. Additionally, the region’s focus on innovation, especially in sectors such as government, hospitality, and transportation, has made biometric technologies more accessible and sought after.

Kyushu & Okinawa also benefit from high-tech investments aimed at improving security, particularly in response to the global trend of rising cyber threats. As the region accelerates its adoption of smart technologies and secure, contactless solutions, BaaS is playing a crucial role in reshaping the security landscape, contributing to its rapid growth.

Kanto shows strong demand for Biometric-as-a-Service with a CAGR of 16.0%. The region, home to Tokyo, Japan’s financial and technological hub, has a high concentration of businesses and industries that require advanced authentication systems for secure transactions and customer verification. Financial institutions, healthcare providers, and government agencies in Kanto are increasingly adopting biometric technologies to enhance security and improve customer experience.

The high level of technological adoption and infrastructure development in Kanto supports the rapid integration of BaaS. Additionally, the region’s focus on innovation in digital security, combined with growing concerns over identity theft and data breaches, drives the continued demand for biometric solutions. Kanto’s large population and international connectivity further contribute to the increased use of biometric authentication for both consumer and enterprise applications.

Kinki, with a CAGR of 14.0%, shows steady demand for Biometric-as-a-Service. The region, which includes Osaka and Kyoto, is known for its strong industrial base, including sectors such as manufacturing, retail, and tourism. As these industries modernize and adopt more secure methods of access control and customer verification, the need for biometric authentication systems grows.

While the demand in Kinki is not as rapid as in Kyushu & Okinawa or Kanto, the steady growth is attributed to the region’s increasing focus on security, operational efficiency, and compliance with data protection regulations. The rise in e-commerce and the growing need for secure online transactions have also led to a greater reliance on BaaS in the region.

Chubu demonstrates moderate growth in the demand for Biometric-as-a-Service with a CAGR of 12.3%. The region’s strong industrial sectors, particularly automotive, manufacturing, and healthcare, are key drivers of this growth. As companies in Chubu adopt digital transformation strategies, biometric technologies are becoming a preferred solution for enhancing security and streamlining access management.

While the region is not as tech-driven as Kanto or Kyushu & Okinawa, the increasing interest in smart technologies and the need for secure authentication systems is driving demand for BaaS. The integration of biometric services into industrial processes, along with the region's growing emphasis on protecting sensitive data, is expected to sustain moderate growth in the BaaS market.

Tohoku, with a CAGR of 10.8%, and the Rest of Japan, with a CAGR of 10.3%, show slower growth in the demand for Biometric-as-a-Service compared to more urbanized regions. These areas have fewer large-scale tech companies and a less concentrated presence of industries that typically adopt biometric authentication at a high rate. However, both regions are experiencing a gradual increase in the adoption of biometric services as local governments, healthcare providers, and smaller businesses begin to recognize the need for improved security and digital solutions.

The slower growth in these regions is also due to more traditional approaches to security and access management. However, as digital transformation initiatives spread across the country and as industries in Tohoku and the Rest of Japan focus more on security and efficiency, the demand for biometric services is expected to increase, albeit at a more moderate pace.

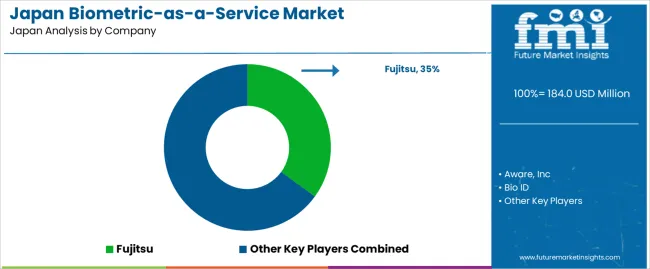

The biometric as a service industry in Japan is driven by growing demand for secure identity verification in sectors such as banking, healthcare, government and enterprise. Companies such as Fujitsu (holding an estimated 35% share), Aware, Inc., BioID, OT Morph, SUPREMA Leidos and Image Ware Systems operate in this space. Industry forecasts indicate strong growth in Japan, where the broader biometric technology market is expected to grow at a compound annual rate of about 22.4% to reach over USD 10 billion by 2030.

Market competition in this field centres on solution flexibility, regulatory alignment and data security. Vendors differentiate by offering biometric solutions delivered via cloud or hybrid models, reducing capital expenditure on on premise infrastructure. They also emphasise support for multiple biometric traits (such as face, fingerprint or voice) and seamless integration with existing IT systems. Another competitive dimension is compliance with Japan’s stringent data protection standards and the ability to localise support services, which enhances user trust and deployment speed. Marketing materials tend to highlight features such as accuracy of identification, latency, ease of onboarding and system compliance. By aligning their offerings with Japan’s push toward digital identity, remote authentication and data security, these companies aim to strengthen their position in the Japanese biometric as a service industry.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Japan |

| Deployment Model | Hybrid Cloud, Public Cloud, Private Cloud |

| Scanner Type | Fingerprint Recognition, Voice Recognition, Iris Recognition, Palm Recognition, Facial Recognition |

| Modality | Unimodal, Multimodal |

| Key Companies Profiled | Fujitsu, Aware, Inc., Bio ID, OT-Morph, SUPREMA Leidos, Image Ware Systems |

| Additional Attributes | The market analysis includes dollar sales by deployment model, scanner type, modality, and company categories. It also covers regional demand trends in Japan, driven by the growing adoption of biometric-as-a-service solutions for security and authentication purposes across industries. The competitive landscape highlights key players focusing on innovations in biometric technology and cloud-based biometric services. Trends in the increasing use of multimodal biometrics and hybrid cloud deployments are explored, along with advancements in scanner technologies such as facial, fingerprint, and iris recognition. |

The demand for biometric-as-a-service in japan is estimated to be valued at USD 184.0 million in 2025.

The market size for the biometric-as-a-service in japan is projected to reach USD 674.8 million by 2035.

The demand for biometric-as-a-service in japan is expected to grow at a 13.9% CAGR between 2025 and 2035.

The key product types in biometric-as-a-service in japan are public cloud, hybrid cloud and private cloud.

In terms of scanner type, fingerprint recognition segment is expected to command 31.9% share in the biometric-as-a-service in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA