The demand for built-in hobs in Japan is valued at USD 245.0 billion in 2025 and is projected to reach USD 481.9 billion by 2035, reflecting a compound annual growth rate of 7.0%. Growth originates from intensifying kitchen modernization trends, condominium construction boom and household shift toward induction cooking technology. Residential developers, renovation specialists and individual homeowners progressively embed hobs into countertop designs that eliminate protruding elements while maximizing usable workspace. Kitchen planners now prioritize flush-mounted cooking surfaces that blend with stone or composite counters, creating uninterrupted visual flow valued in compact Japanese living spaces. This design philosophy, combined with safety advantages of contained cooking zones, fuels steady year-on-year increases throughout the projection window.

Values trace an ascending path from USD 189.0 billion in baseline periods, climbing to USD 245.0 billion in 2025 and ultimately touching USD 481.9 billion by 2035. Intermediate milestones include USD 258.0 billion in 2026, USD 271.8 billion in 2027, USD 352.3 billion in 2032 and USD 411.6 billion in 2034. This progression stems from recurring replacement cycles in existing housing, sustained new-build activity in metropolitan regions and accelerating adoption of electric induction systems that replace legacy gas cooktops. The trajectory underscores continuous momentum powered by dual forces: routine product lifecycle turnover and structural shift toward safer, energy-monitoring cooking platforms across Japan's residential and select commercial kitchen environments.

Demand in Japan for built-in hobs is projected to increase from USD 245.0 billion in 2025 to USD 481.9 billion by 2035, reflecting a compound annual growth rate (CAGR) of approximately 7.0%. Starting at USD 189.0 billion in 2020, the value rises steadily: USD 209.7 billion in 2022, USD 232.6 billion in 2024, and USD 245.0 billion in 2025. From 2025 to 2030, demand climbs to around USD 317.5 billion, and by 2035 it reaches USD 481.9 billion. Growth is driven by expanding applications of built-in hobs in residential kitchen renovations, new condominium construction, safety-focused replacements and induction technology adoption in Japan's housing-centric cooking environment.

Over the forecast period, the value uplift from USD 245.0 billion to USD 481.9 billion translates into an incremental opportunity of USD 236.9 billion. Early growth (2025 to 2030) is primarily volume-driven as more homeowners and property developers adopt built-in hob installations. In the latter years (2030 to 2035), value growth becomes increasingly significant: premium built-in hobs with smart connectivity features, zone-flexible induction heating, precision temperature control and designer glass surfaces elevate average selling prices. Suppliers who innovate in cooking technology, safety features and installation simplicity are best positioned to capture the full breadth of this demand growth in Japan.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 245.0 billion |

| Forecast Value (2035) | USD 481.9 billion |

| Forecast CAGR (2025–2035) | 7.0% |

The demand for built-in hobs in Japan has historically been shaped by the strength of domestic condominium construction, where integrated kitchen designs dominated new residential projects across metropolitan areas. Japanese property developers focused on delivering maximized living space, streamlined cooking surfaces and modern appliance aesthetics, which supported steady procurement of flush-mounted hobs from European and domestic manufacturers. Kitchen renovation activity accelerated demand as Japan's aging housing stock required modernization to meet contemporary safety expectations and energy efficiency standards. Historical growth was reinforced by consistent urbanization density, since Japanese cities maintained concentrated housing development that favored space-saving built-in solutions over bulky freestanding ranges. These conditions created predictable, long-term demand for built-in hobs tied closely to the construction volumes of new condominiums and the renovation rates of existing kitchens across urban centers within the country.

Future growth will be influenced by Japan's shift toward all-electric housing policies, aging population safety requirements and the need for cooking appliances that accommodate changing household cooking behaviors. Induction hob installations, which offer automatic shutoff features and cool-touch surfaces suited to elderly users, require advanced sensor technology that enables pan detection and prevents dry heating accidents. This creates a continuing but more safety-focused demand. Long-term challenges arise from the expansion of micro-apartment developments that prioritize portable cooking solutions over fixed installations. As Japan navigates demographic shifts, built-in hob demand will rely increasingly on renovation replacements, safety-driven upgrades and premium product segments rather than broad, volume-driven new construction installations.

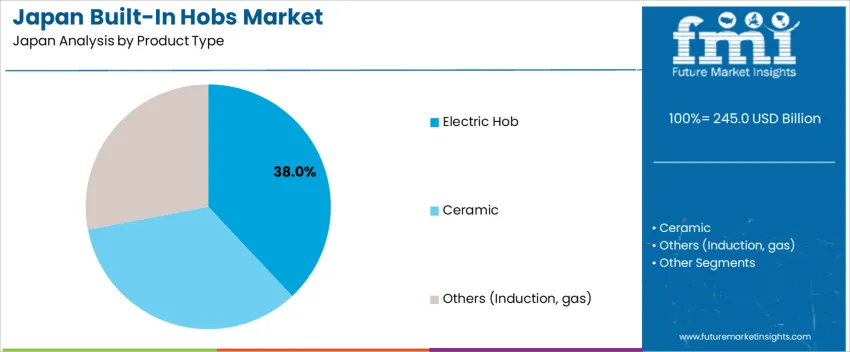

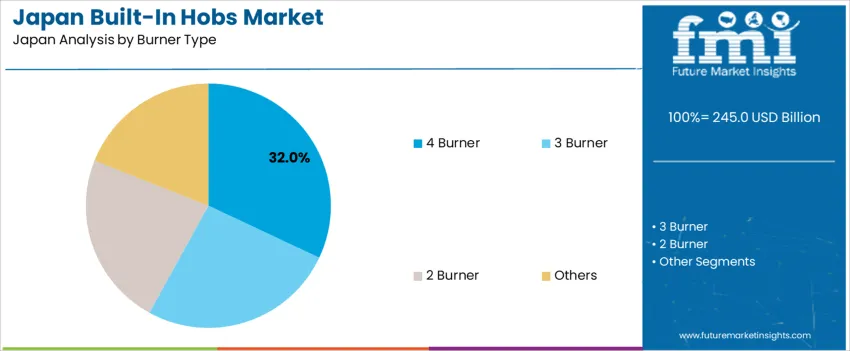

The demand for built-in hobs in Japan is shaped by the product types used for cooking energy delivery and the burner configurations that determine cooking capacity. Product categories include electric hobs, ceramic and others (induction), each offering different heating methods and energy efficiency profiles. Burner configurations such as 4 burner, 3 burner, 2 burner and others support varied cooking workflows and kitchen space constraints. As property developers and homeowners focus on consistent cooking performance and practical space utilization, the combination of heating technology and burner count influences purchasing decisions across Japan's residential construction, kitchen renovation and appliance replacement settings.

Electric hobs account for 38% of total demand across product type categories in Japan. Their leading share reflects straightforward installation requirements, predictable operating costs and suitability for all-electric housing developments. Many condominium builders value electric hobs for consistent performance characteristics that support standardized kitchen packages across multiple housing units. These products offer manageable electrical load requirements and easy integration into existing circuit systems. Their sealed cooking surfaces suit environments that prioritize easy cleaning and maintenance, reinforcing steady use across new housing construction operations.

Demand for electric hobs also grows as municipalities adopt building codes favoring electric cooking over gas installations. Developers appreciate the reduced construction complexity and predictable inspection outcomes associated with these appliances. Their rapid heating response supports contemporary cooking styles, making them practical for busy household schedules. The technology provides sufficient power output for typical family cooking needs, meeting expectations for daily meal preparation. As Japanese housing continues shifting toward electrification, electric hobs maintain a strong presence in residential kitchen installations.

4 burner configuration accounts for 32.0% of total demand across burner type categories in Japan. Its leading position reflects clear advantages in cooking flexibility, simultaneous dish preparation and family meal accommodation. 4 burner hob installations support household cooking patterns that require multiple pots operating concurrently, enabling efficient meal preparation for families and entertaining scenarios. Their expanded cooking surface allows varied pot sizes without interference, supporting Japanese cooking styles that involve rice preparation, soup heating, main dish cooking and vegetable preparation happening simultaneously. Homeowners rely on these configurations for applications that require versatile cooking capacity and workflow efficiency.

Demand for 4 burner hobs grows as detached home construction emphasizes spacious kitchen designs. The configuration supports cooking enthusiasts who value restaurant-style capabilities in home settings. Product developers appreciate the layout's compatibility with zone-flexible induction technology that creates customizable heating areas. Renovation clients seeking premium upgrades appreciate the expanded functionality that emerges from additional burner capacity. As Japan continues to emphasize quality home cooking experiences, 4 burner configuration remains central to built-in hobs adoption in larger residential kitchens.

Demand for built-in hobs in Japan is influenced by compact urban housing formats, strong government push toward residential electrification and a consumer base that values integrated aesthetics in kitchen environments. Japan's residential construction ecosystem favors solutions that offer maximized counter space, seamless cabinetry integration and compatibility with standardized kitchen module dimensions prevalent in Japanese housing, which positions built-in hobs well for condominium projects, detached home construction and comprehensive kitchen renovations. At the same time, product selection remains safety-conscious, and hob installations must meet strict domestic standards for earthquake resistance, electrical safety and compatibility with Japanese cooking vessel characteristics across residential cooking operations.

How Are Japan's Housing Formats and Safety Priorities Encouraging New Adoption Patterns?

Built-in hobs gain traction because Japan's housing density requires cooking solutions that eliminate wasted floor space and create visual continuity in compact kitchens. Property developers and renovation contractors rely heavily on flush-mounted installations for maximized usable area, and built-in hobs align with this long-standing spatial requirement. Japanese building standards also favor appliances that install securely during seismic events, making built-in hobs useful in earthquake-prone regions, new construction projects and renovation upgrades. These patterns reflect Japan's focus on space efficiency and structural safety across residential cooking environments.

Where Are Practical Growth Opportunities for Built-In Hobs in Japan?

Opportunities exist in comprehensive kitchen renovation projects, luxury condominium developments, aging-population safety upgrades and smart home integration initiatives combining hobs with energy management systems. Japan's established housing renovation sector creates openings for specialized built-in hobs that integrate with Japanese cabinetry standards, electrical specifications and seismic mounting requirements. As elderly-focused housing projects expand accessible design features, demand increases for low-profile hobs with intuitive controls suitable for varied user capabilities. Product suppliers offering Japan-specific installation specifications, local service networks and earthquake-resistant mounting systems may find strong adoption.

What Local Factors Are Constraining Wider Adoption of Built-In Hobs in Japan?

Constraints stem from high installation costs compared to portable alternatives, limited renovation capability in older wooden housing and space constraints in micro-apartment developments with minimal kitchen areas. Some homeowners rely on existing portable cooking equipment rather than investing in expensive built-in renovations, limiting replacement demand. Integration challenges with non-standard kitchen dimensions in older housing and the need for alignment with varied electrical panel capacities further delay uptake. In addition, rural housing operations may hesitate due to limited access to professional installation services, creating uneven adoption across Japan.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 6.7% |

| Kanto | 6.1% |

| Kinki | 5.4% |

| Chubu | 4.7% |

| Tohoku | 4.2% |

| Rest of Japan | 3.9% |

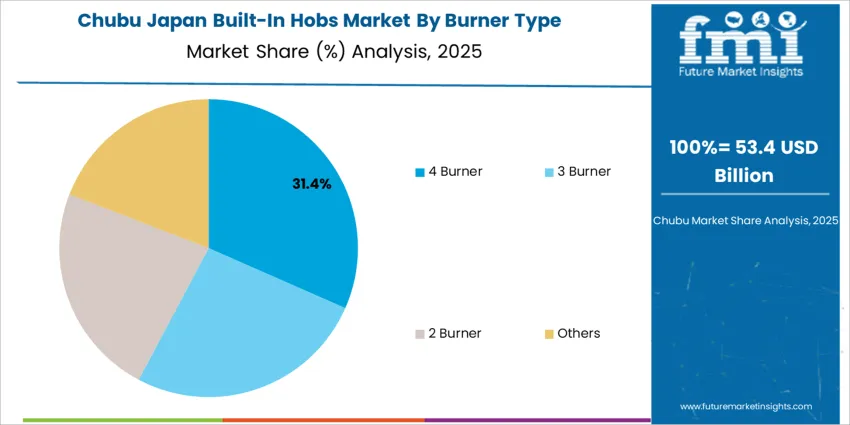

Demand for built-in hobs in Japan is rising across regions, with Kyushu and Okinawa leading at 6.7%. Growth in this region reflects expanding use of integrated kitchen designs in resort developments, urban condominium projects and residential renovation activities. Kanto follows at 6.1%, supported by dense housing construction activity and steady adoption in metropolitan condominium developments. Kinki records 5.4%, shaped by active residential renovation operations and property developers applying built-in solutions in modern housing projects. Chubu grows at 4.7%, influenced by regional housing construction and renovation contractors integrating built-in hobs into kitchen upgrade packages. Tohoku reaches 4.2%, showing gradual but consistent adoption. The rest of Japan posts 3.9%, reflecting broader interest in built-in cooking technologies across smaller housing developments.

Kyushu & Okinawa is projected to grow at a CAGR of 6.7% through 2035 in demand for built-in hobs. Fukuoka housing developments and surrounding residential construction projects are increasingly adopting built-in hob solutions for new condominiums, resort properties and comprehensive kitchen renovations. Rising demand for integrated kitchen aesthetics, space-efficient cooking solutions and modern appliance features drives adoption. Suppliers provide performance-focused, design-compatible and professionally-installed built-in hobs suitable for property developers and renovation specialists. Distributors ensure accessibility across urban, semi-urban and construction sites. Growth in resort property development, urban condominium construction and residential renovation activity supports steady adoption of built-in hobs in Kyushu & Okinawa.

Kanto is projected to grow at a CAGR of 6.1% through 2035 in demand for built-in hobs. Tokyo and surrounding regions are increasingly using built-in hobs for high-rise condominium construction, detached home development and extensive kitchen renovation projects. Rising focus on smart home compatibility, energy-efficient cooking and integrated appliance design drives adoption. Suppliers provide technology-advanced, aesthetically-refined and professionally-supported built-in hobs suitable for large property developers and premium renovation contractors. Distributors ensure accessibility across urban, semi-urban and residential construction networks. Expansion in luxury housing construction, smart home integration and comprehensive renovation activity supports steady adoption of built-in hobs across Kanto.

Kinki is projected to grow at a CAGR of 5.4% through 2035 in demand for built-in hobs. Osaka, Kyoto and surrounding regions are increasingly adopting built-in hobs for residential construction, housing renovation and modern kitchen upgrade projects. Rising demand for streamlined kitchen design, appliance integration and contemporary living spaces drives adoption. Suppliers provide dependable, design-compatible and professionally-supported built-in hobs suitable for housing developers and renovation specialists. Distributors ensure accessibility across urban and semi-urban construction centers. Growth in residential construction activity, kitchen modernization projects and contemporary housing design supports steady adoption of built-in hobs across Kinki.

Chubu is projected to grow at a CAGR of 4.7% through 2035 in demand for built-in hobs. Nagoya and surrounding areas are increasingly adopting built-in hobs for new housing construction, residential renovation and standard kitchen upgrade projects in residential areas. Rising focus on practical integration, cost-effective solutions and basic modernization drives adoption. Suppliers provide functionally-adequate, competitively-priced and installation-supported built-in hobs suitable for regional housing developers and general contractors. Distributors ensure availability across urban and semi-urban residential areas. Expansion in standard housing construction, basic renovation activity and practical kitchen upgrades supports steady adoption of built-in hobs across Chubu.

Tohoku is projected to grow at a CAGR of 4.2% through 2035 in demand for built-in hobs. Sendai and surrounding residential construction operations are gradually adopting built-in hobs for housing development, selective renovation and targeted kitchen improvement projects. Rising focus on basic integration, affordable modernization and gradual lifestyle upgrades drives adoption. Suppliers provide accessible, straightforward and adequately-performing built-in hobs suitable for local housing developers and renovation contractors. Distributors ensure accessibility across urban, semi-urban and regional construction facilities. Expansion in regional housing construction, selective renovation activity and gradual kitchen modernization supports steady adoption of built-in hobs across Tohoku.

The Rest of Japan is projected to grow at a CAGR of 3.9% through 2035 in demand for built-in hobs. Smaller towns and rural housing operations gradually adopt built-in hobs for new home construction, limited renovation and basic kitchen upgrade projects. Rising demand for fundamental integration, budget-friendly options and incremental modernization drives adoption. Suppliers provide basic, affordable and functionally-sufficient built-in hobs suitable for small-scale housing developers, local contractors and individual homeowners. Distributors ensure accessibility across urban, semi-urban and rural residential areas. Expansion in local housing construction, limited renovation activity and gradual lifestyle improvements supports steady adoption of built-in hobs across the Rest of Japan.

The demand for built-in hobs in Japan is driven by the country's active housing construction sector, increasing residential renovation activity and growing consumer preference for integrated kitchen aesthetics that maximize limited living space. Property developers seek reliable built-in cooking solutions to create standardized kitchen packages, deliver contemporary design appeal and meet homeowner expectations for modern appliance integration. Concurrently, safety-focused and smart technology segments expand, pushing interest in built-in hobs capable of providing automatic shutoff features, precise temperature control and connectivity with home energy management systems. Technology improvements such as induction heating refinements, touch control interfaces and sensor integration further enhance suitability of built-in hobs in Japanese condominiums, detached homes and renovation projects.

Key companies active in Japan's built-in hobs space include German manufacturer BSH Hausgeräte GmbH, German family-owned Miele & Cie. KG, Japanese gas appliance specialist Rinnai Corporation, Japanese heating equipment maker Noritz Corporation and Japanese cooking appliance producer Paloma Co., Ltd. BSH Hausgeräte commands a 25.0% share of the Japanese built-in hobs landscape, supplying Bosch and Siemens branded hobs through established distribution networks serving property developers and kitchen specialists. The company's strong position reflects its engineering reputation, product reliability and deep integration with Japanese kitchen design standards. Miele maintains premium positioning with high-end induction hobs targeting luxury housing developments, while Rinnai Corporation, Noritz Corporation and Paloma Co., Ltd. leverage their domestic gas appliance heritage to serve traditional cooking preferences and hybrid gas-induction configurations. This mix of European engineering excellence and Japanese appliance expertise reflects the competitive landscape in Japan, ensuring that built-in hobs adoption is shaped by global technology leadership and localized cooking culture understanding capable of meeting Japan's unique housing specifications and safety expectations.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product Type | Electric Hobs, Ceramic, Others (Induction) |

| Burner Type | 4 Burner, 3 Burner, 2 Burner, Others |

| Sales Channel | Multi-brand Stores, Online Stores, Exclusive Stores, Independent Stores, Others |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | BSH Hausgeräte GmbH, Miele & Cie. KG, Rinnai Corporation, Noritz Corporation, Paloma Co., Ltd. |

| Additional Attributes | Dollar sales by product type and burner configuration, regional CAGR trends, and value–volume shares are assessed alongside residential vs. commercial uptake, induction vs. ceramic vs. electric penetration, evolving e-commerce channels, renovation-led opportunities, installation barriers, and competition among European premium brands, Japanese incumbents, and regional specialists. |

The demand for built-in hobs in Japan is estimated to be valued at USD 245.0 billion in 2025.

The market size for the built-in hobs in Japan is projected to reach USD 481.9 billion by 2035.

The demand for built-in hobs in Japan is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in built-in hobs in Japan are electric hob, ceramic and others (induction, gas).

In terms of burner type, 4 burner segment is expected to command 32.0% share in the built-in hobs in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA