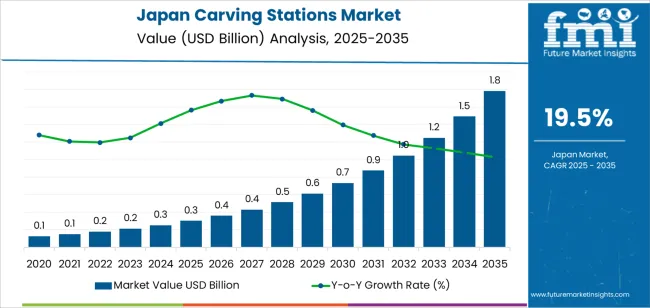

The Japan carving stations demand is valued at USD 0.3 billion in 2025 and is projected to reach USD 1.8 billion by 2035, reflecting a CAGR of 19.5%. Demand is shaped by expanded use of buffet-service equipment in hotels, banquet facilities, premium restaurants, and hospitality chains that prioritize efficient thermal control and improved presentation for carved meats. Growth is further supported by rising tourism activity, increased investment in commercial kitchens, and broader adoption of modular food-service systems.

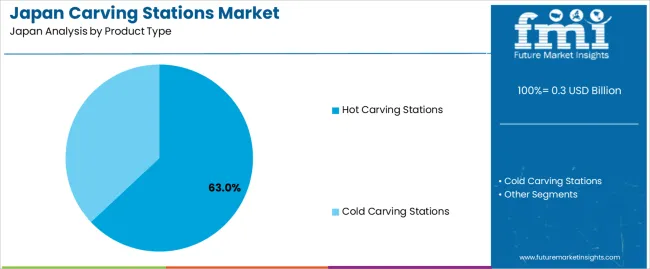

Hot carving stations lead the product landscape. These units are selected for consistent heat retention, suitability for high-volume serving environments, and ability to maintain food safety standards during extended service periods. Integration of adjustable heat lamps, infrared warming systems, and stainless-steel insulation structures elevates operational reliability across hospitality settings.

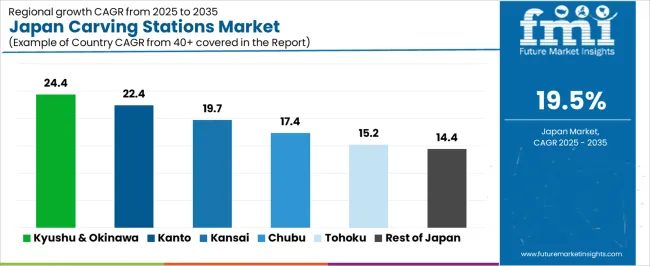

Kyushu & Okinawa, Kanto, and Kinki record the highest utilization due to the concentration of luxury hotels, convention centers, and catering facilities requiring durable and temperature-stable service equipment. These regions also benefit from established distribution networks and continuous refurbishment cycles in the hospitality sector. Key suppliers include Hoshizaki Corporation, Tanico Co., Ltd., Chiyoda Manufacturing Corporation, Maruzen Co., Ltd., and Fujimak Corporation. These companies provide hot carving stations, dual-heat units, and integrated buffet-line equipment used across hotels, commercial kitchens, and institutional food-service environments.

Saturation in Japan’s carving-station segment develops gradually because demand is tied to food-service formats with stable but limited expansion potential. In the early period, penetration increases through hotels, banquet halls, family restaurants, and buffet-style dining, where carving stations support high-volume service and standardized portioning. Growth remains steady because these venues already operate within mature hospitality and catering structures, keeping early expansion controlled rather than rapid.

Mid-period dynamics show the segment moving closer to a semi-mature phase. Most large hospitality operators and institutional kitchens that require carving stations have already adopted them, and additional growth comes mainly from equipment replacement, menu diversification, and periodic upgrades to heating elements or carving-surface materials. The base of new adopter’s narrows, which signals the slow approach toward saturation.

In the later period, saturation becomes more visible as distribution coverage, product familiarity, and operator adoption reach high levels. Gains depend on refurbishment cycles, improved hygiene features, and compact formats designed for smaller kitchens. Competitive pressure from alternative serving equipment further limits late-stage expansion. Overall, saturation progresses slowly but steadily, reflecting the mature structure of Japan’s hospitality sector and the functional, niche-specific nature of carving stations.

| Metric | Value |

|---|---|

| Japan Carving Stations Sales Value (2025) | USD 0.3 billion |

| Japan Carving Stations Forecast Value (2035) | USD 1.8 billion |

| Japan Carving Stations Forecast CAGR (2025-2035) | 19.5% |

Demand for carving stations in Japan is increasing because hotels, banquet facilities and buffet-style restaurants aim to improve food presentation and service efficiency for large groups. Carving stations support freshly sliced meat service at weddings, corporate events and hotel brunches, which aligns with guest expectations for visual appeal and premium dining experiences. Growth in hospitality renovations and expansion of event venues encourages procurement of compact, durable and easy-to-clean carving units.

Operators value equipment that maintains stable heat, preserves moisture and supports continuous service during peak dining hours. Rising interest in Western-style buffets and live-cooking formats also contributes to broader use of carving stations across urban hotels and family restaurants. Constraints include limited storage space in smaller kitchens, high equipment cost for premium heated models and labour requirements for trained staff who carve meat safely and efficiently. Some mid-sized restaurants may avoid installing carving stations due to menu limitations or inconsistent event volume. Seasonal fluctuations in banquet bookings can also affect purchasing decisions.

Demand for carving stations in Japan is shaped by the country’s structured food service sector, where restaurants, hotels, and catering operators require equipment that supports portion control and consistent presentation. Carving stations are used in buffet lines, live-cooking setups, and specialty service counters, and are selected based on heating requirements, durability expectations, and operational efficiency. Japanese establishments prioritize stable temperature control, ease of sanitation, and materials that maintain long service life.

Hot carving stations represent 63.0%, reflecting their widespread use in buffet areas, hotel dining rooms, and restaurant service counters across Japan. These systems support stable warming surfaces and heat lamps that preserve meat texture and temperature during continuous service. Cold carving stations account for 37.0% and are used for chilled dishes, salads, desserts, and items requiring temperature control without heating. Their use is concentrated in catering events and specialty counters offering cold preparations. The distribution reflects operational requirements across Japanese food service environments, where hot dishes constitute a substantial share of buffet and banquet offerings that depend on uniform heat retention, reliable sanitation, and consistent presentation during extended service.

Key points:

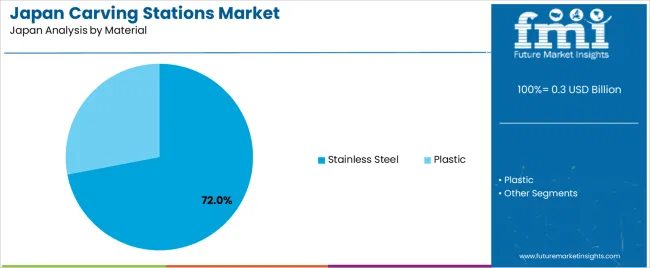

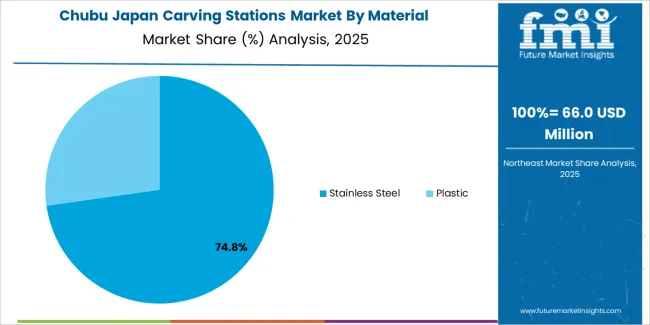

Stainless steel accounts for 72.0% of demand, driven by its durability, corrosion resistance, and ability to withstand repeated cleaning in Japanese commercial kitchens. Stainless steel structures maintain stability during continuous service and align with hygiene standards required in food preparation areas. Plastic materials represent 28.0%, mainly used in lightweight or portable carving station components. These units support smaller catering operations and temporary service setups but offer lower durability than stainless steel. Material distribution reflects Japan’s preference for long-lasting, heat-resistant, and easily sanitized equipment suitable for frequent use in restaurants, hotels, and institutional dining facilities that operate under regulated cleanliness and maintenance practices.

Key points:

Restaurants account for 44.0% of carving station demand in Japan, supported by the use of live-service counters, buffet formats, and open-kitchen displays. Hotels represent 36.0%, driven by banquet halls, all-day dining outlets, and large-scale breakfast service areas requiring equipment that maintains presentation standards during peak hours. Catering companies contribute 20.0%, using both portable and fixed carving stations for corporate events, weddings, and off-site functions. End-user distribution reflects the scale and frequency of service operations across Japanese hospitality settings, where temperature accuracy, hygiene standards, and equipment adaptability influence purchasing decisions.

Key points:

Growth of hotel buffet refurbishments, expansion of premium wedding and banquet services and rising demand for live-cooking formats are driving demand.

In Japan, carving stations see increased adoption as hotels in Tokyo, Osaka and Okinawa upgrade buffet dining areas to attract domestic travelers and inbound tourists. Wedding halls and banquet facilities, especially in metropolitan regions, incorporate carving stations to present roast beef, pork loin and seasonal meats as part of premium course menus. Department-store food halls and high-end restaurants introduce live-cooking counters to differentiate service and enhance customer engagement, creating demand for compact, aesthetically refined carving units. Corporate events and convention centers also use carving stations to support large-scale catering operations.

Limited kitchen space in urban venues, strong preference for pre-plated service formats and higher staffing needs restrain adoption.

Many hotels and restaurants in dense cities such as Tokyo and Yokohama operate within compact kitchen footprints that restrict placement of carving stations during peak service. Japanese diners often prefer pre-portioned, visually consistent dishes, which reduces reliance on live carving in everyday dining. Carving stations require skilled staff to manage slicing, temperature control and food-safety tasks, and labour shortages in the hospitality sector make consistent staffing difficult. These operational constraints limit frequent use outside large hotels or banquet-oriented venues.

Shift toward induction-based heated carving counters, increased adoption in premium supermarket delis and rising interest in seasonal event catering define key trends.

Manufacturers in Japan are promoting induction-heated carving counters that maintain stable temperatures without open flames, aligning with safety requirements in indoor venues. Premium supermarket delis in regions such as Kanto and Kansai are adding small carving setups during weekend promotions or holiday seasons to boost customer traffic. Outdoor catering for regional festivals and department-store rooftop events is increasingly incorporating portable carving stations to serve roast meats and specialty dishes. These trends support gradual but diversified demand for carving stations across Japan’s hospitality, retail and event segments.

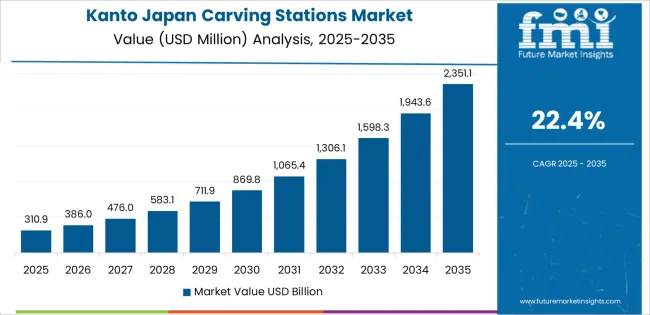

Demand for carving stations in Japan is increasing as hotels, banquet halls, restaurants, catering groups, and buffet-format operators expand their use of heated carving units for meat service, live preparation counters, and premium dining formats. Growth is shaped by hospitality density, event activity, tourism flows, and adoption of high-volume food-service equipment across regional commercial kitchens. Kyushu & Okinawa leads at 24.4%, followed by Kanto (22.4%), Kinki (19.7%), Chubu (17.4%), Tohoku (15.2%), and Rest of Japan (14.4%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 24.4% |

| Kanto | 22.4% |

| Kinki | 19.7% |

| Chubu | 17.4% |

| Tohoku | 15.2% |

| Rest of Japan | 14.4% |

Kyushu & Okinawa grows at 24.4% CAGR, influenced by strong tourism activity, hotel expansion, and rising buffet-style dining across Fukuoka, Kumamoto, Kagoshima, and Okinawa’s resort districts. Large hotels use carving stations for breakfast buffets, banquet service, and live meat preparation counters, increasing equipment turnover and replacement cycles. Fukuoka’s convention and banquet sector maintains year-round event activity that relies on high-capacity food-service infrastructure.

Tourism-heavy Okinawa shows strong adoption of premium carving units for resort dining, where hotels emphasize consistent service temperatures and operational efficiency. Regional catering companies expand equipment inventories to meet rising event bookings. Commercial kitchens rely on electrically heated stations for roast meats, pork dishes, and carved seafood preparations, supported by stable food-service logistics networks connecting equipment distributors with hotels and resorts.

Kanto grows at 22.4% CAGR, supported by dense hospitality corridors, high banquet traffic, and consistent commercial-kitchen modernization across Tokyo, Kanagawa, and Chiba. Tokyo’s large hotels operate extensive buffet, event, and business-dining programs that require heated carving stations for roast beef, pork cuts, and specialty meats. Banquet halls and wedding venues across Kanto depend on scalable food-service equipment to support large guest volumes.

Corporate event facilities and convention centers increase demand for mobile carving units to serve variable seating layouts. Major equipment distributors headquartered in Tokyo supply hotels and restaurants with upgraded stations featuring improved temperature control, carving-surface durability, and safer handling mechanisms. Urban food-service operators replace older stations to meet operational standards, driving steady procurement cycles.

Kinki grows at 19.7% CAGR, supported by strong tourism, active restaurant districts, and consistent event-driven hospitality across Osaka, Kyoto, and Kobe. Osaka’s hotel chains and banquet halls rely on carving stations for premium dining and large buffet operations. Kyoto’s tourism sector increases demand for live-service counters in hotel restaurants, where carving units support Western-style menus served alongside regional dishes. Kobe’s event venues maintain steady procurement of heated carving stations to support business gatherings and large group dining. Commercial kitchens adopt standardized carving equipment to improve portion consistency and service speed. Distributors across Osaka maintain well-developed supply networks that enable timely delivery and maintenance of carving units.

Chubu grows at 17.4% CAGR, shaped by stable hospitality activity across Aichi, Shizuoka, and surrounding prefectures. Nagoya’s hotel and banquet industry uses carving stations for corporate events, weddings, and buffet operations. Hospitality operators in Shizuoka rely on carving units to support tourism flows related to leisure attractions. Regional catering companies adopt mobile carving stations to serve large gatherings in convention facilities and private venues. Commercial kitchens upgrade equipment to ensure temperature consistency and service readiness during peak meal periods. Manufacturing facilities in Aichi provide reliable logistics support for food-service equipment distribution, improving access for hotels and restaurants across central Japan.

Tohoku grows at 15.2% CAGR, supported by developing hospitality networks and steady tourism activity across Sendai, Aomori, Akita, and Fukushima. Hotels in Sendai use carving stations for banquet halls, conference dining, and weekend buffet programs. Rural tourism zones maintain demand for compact carving units in resort restaurants serving mixed Japanese-Western menus. Catering businesses in the region expand inventories to handle seasonal event demand linked to festivals and community gatherings. Food-service operators adopt upgraded carving stations to improve portion uniformity and serve roasted meats reliably during high-volume meal periods. Stable distribution channels supply commercial kitchens with heated carving equipment suited to mid-scale operations.

Rest of Japan grows at 14.4% CAGR, supported by hospitality centers, regional hotels, and event venues outside the major metropolitan zones. Smaller banquet halls use carving stations for weddings, conferences, and hospitality events requiring consistent meat-service capabilities. Regional hotels incorporate carving units into breakfast buffets and weekend dining programs. Local catering operations expand their equipment fleets for municipal events and private gatherings. Food-service outlets adopt standardized carving stations to maintain temperature control and improve service efficiency. Equipment distributors supply heated stations suitable for varied menu formats used in local hospitality settings.

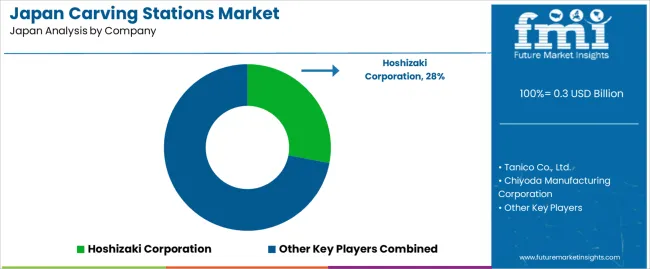

Demand for carving stations in Japan is shaped by commercial-kitchen manufacturers that supply hotels, banquet halls, buffet restaurants, and institutional dining facilities. Hoshizaki Corporation holds an estimated 28.0% share, supported by controlled heating-surface engineering, consistent temperature stability, and broad adoption across hotel and hospitality groups. Its carving units provide steady heat retention and reliable food-holding performance suited to Japanese service standards.

Tanico Co., Ltd. maintains strong participation with carving counters and infrared heating modules used in large food-service operations. Its products offer stable temperature distribution and durable stainless-steel construction aligned with Japanese kitchen requirements. Chiyoda Manufacturing Corporation contributes significant volume through modular buffet equipment, providing predictable thermal control and compatibility with existing serving lines.

Maruzen Co., Ltd. supports demand with heated counters and buffet units designed for continuous operation in banquet environments, emphasizing controlled heating accuracy and robust build quality. Fujimak Corporation adds nationwide coverage with custom buffet stations, integrating infrared lamps and heated cutting surfaces with reliable service support. Imported brands such as Hatco, Vollrath, and Alto-Shaam serve premium hotels and Western-style venues through distributors, holding smaller but steady roles. Competition in Japan centers on temperature consistency, durability, hygiene compliance, modular design, and reliable on-site service support as dining operators prioritize stable, high-performance carving equipment for continuous service environments.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Product Type | Hot Carving Stations, Cold Carving Stations |

| Material | Stainless Steel, Plastic |

| End-User | Restaurants, Hotels, Catering Companies |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Hoshizaki Corporation, Tanico Co., Ltd., Chiyoda Manufacturing Corporation, Maruzen Co., Ltd., Fujimak Corporation |

| Additional Attributes | Dollar sales by product type, material category, and end-user segment; regional demand distribution across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; adoption trends in foodservice equipment for hotels, restaurants, and catering services; growth of buffet-style dining, premium food presentation, and commercial kitchen modernization; competitive landscape of Japanese foodservice equipment manufacturers and their distribution networks. |

The demand for carving stations in Japan is estimated to be valued at USD 0.3 billion in 2025.

The market size for the carving stations in Japan is projected to reach USD 1.8 billion by 2035.

The demand for carving stations in Japan is expected to grow at a 19.5% CAGR between 2025 and 2035.

The key product types in carving stations in Japan are hot carving stations and cold carving stations.

In terms of material, stainless steel segment is expected to command 72.0% share in the carving stations in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carving Stations Market – Premium Buffet & Catering Display 2025-2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA