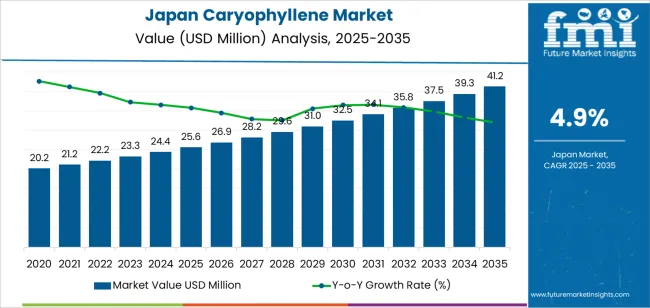

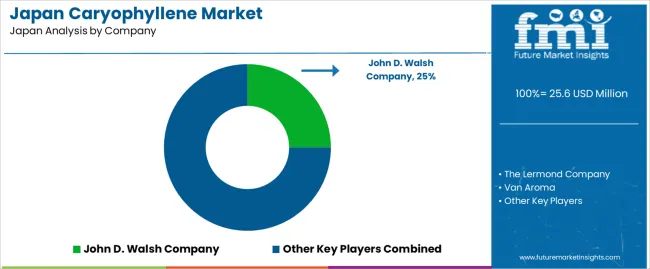

The demand for caryophyllene in Japan is valued at USD 25.6 million in 2025 and is projected to reach USD 41.2 million by 2035, reflecting a CAGR of 4.9%. Over the forecast period, the growth rate volatility index highlights consistent growth with relatively low fluctuation. Between 2025 and 2030, demand increases steadily from USD 25.6 million to approximately USD 32.5 million. This period sees a smooth and predictable growth curve, driven by the expanding use of caryophyllene in natural wellness and health-related industries. The moderate pace of growth during this phase indicates a stable market environment, with little disruption or significant variability in demand.

From 2030 to 2035, the growth rate remains relatively stable, with the demand reaching USD 41.2 million by 2035. The volatility index continues to suggest that the market will experience incremental growth, as caryophyllene’s applications in pharmaceuticals, food, and cosmetics become increasingly established. The long-term demand for caryophyllene in Japan will be influenced by steady adoption in wellness products and natural remedies, supported by consumer trends favoring plant-based and sustainable solutions. This predictable growth pattern reflects a market that is stabilizing after the initial rapid adoption phases, with fewer disruptions expected during the later years of the forecast period.

The peak-to-trough analysis of Caryophyllene demand in Japan from 2020 to 2035 illustrates gradual growth punctuated by a sharp upward movement. The market value begins at USD 20.2 million in 2020 and rises modestly to USD 25.6 million by 2025. This period represents a gradual increase in demand, driven by heightened interest in natural ingredients and wellness products. However, the demand sees a significant surge from 2025 to 2030, climbing from USD 25.6 million to USD 26.9 million. This phase, while showing a steady increase, represents a minor peak in the overall market growth trajectory.

From 2030 to 2035, the market experiences its sharpest increase, reaching USD 41.2 million, marking a dramatic rise of USD 14.3 million. This phase represents the peak in the demand cycle for Caryophyllene in Japan, driven by increased consumer adoption, research into its health benefits, and growing applications in various industries like health supplements and fragrances. The market's growth trajectory follows a clear pattern of gradual increases, with a sharp acceleration in the final years of the forecast period, showing strong potential for continued growth well into the next decade.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 25.6 million |

| Forecast Value (2035) | USD 41.2 million |

| Forecast CAGR (2025 to 2035) | 4.9% |

The demand for Caryophyllene in Japan has grown due to its increased use in food additives, fragrances, and personal care products. Traditionally, the compound’s uptake was driven by the food and beverage sector seeking natural flavouring agents and by perfumery incorporating botanical aromas. Japanese manufacturers and brands responded to consumer preferences for ingredients labelled as natural or plant derived. In recent years, domestic firms specialising in flavour and fragrance chemicals have broadened portfolios to include terpenes such as caryophyllene, leveraging existing supply chains and regional botanical resources to meet evolving market requirements.

Looking ahead, future demand in Japan is expected to be supported by regulatory encouragement of naturally sourced compounds, expanded application of caryophyllene in functional cosmetic formulas, and rising interest in wellness oriented ingredients within the consumer goods segment. In addition, the shift toward lighter regulatory burdens for plant derived flavour and fragrance compounds may lower entry barriers and reduce costs for producers and formulators in Japan. These factors combined will likely lead to sustained expansion of caryophyllene adoption across multiple end use industries.

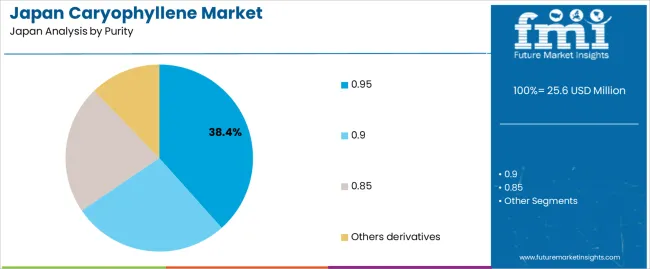

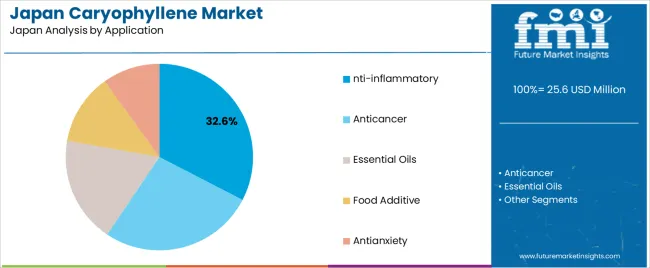

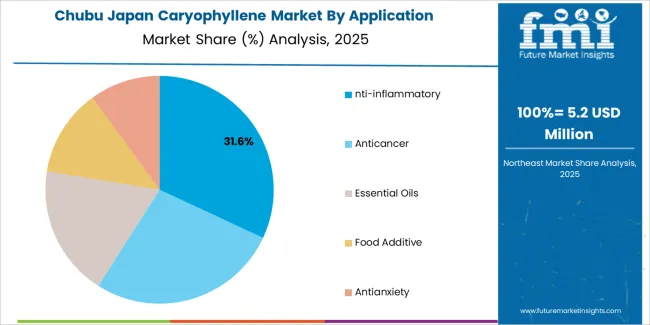

The demand for caryophyllene in Japan is segmented by both purity and application. In terms of purity, the main concentrations are 0.95, 0.9, and 0.85, each serving distinct market needs. The highest demand is seen for caryophyllene with a purity of 0.95, which accounts for approximately 38% of the market. Application-wise, caryophyllene is primarily used for anti-inflammatory purposes, which takes the largest share at 32.6%, followed by anticancer, essential oils, and food additives. These segments reflect the diverse therapeutic and functional uses of caryophyllene, with demand driven by its increasing adoption in both traditional and modern health applications.

Caryophyllene with a purity of 0.95 dominates the demand in Japan, accounting for around 38% of the total market share. This concentration is particularly valued for its potent therapeutic properties, especially in the anti-inflammatory and anticancer sectors. The high purity ensures the efficacy of the compound, making it the preferred choice for pharmaceutical applications. This demand is largely driven by Japan’s growing interest in natural products for health management, as well as an increasing shift toward plant-based therapeutics. The versatility and potency of 0.95 purity caryophyllene also contribute to its broad use in various applications, from essential oils to food additives.

The market for 0.95 purity caryophyllene benefits from rising consumer awareness of natural remedies for inflammation, pain management, and cancer treatment. This has led to increased adoption of caryophyllene in both medicinal and wellness products. The trend of using high-purity essential oils in therapeutic products further boosts its demand. Additionally, Japan’s reputation for advancing natural health practices plays a key role in sustaining the market for highly pure caryophyllene. As more consumers seek natural alternatives for inflammation and related health concerns, the demand for 0.95 purity caryophyllene is expected to remain strong.

Anti-inflammatory applications represent the largest share of caryophyllene demand in Japan, with approximately 32.6% of the market. This demand is driven by the increasing awareness of inflammation’s role in a variety of health conditions, including chronic pain, arthritis, and autoimmune diseases. Caryophyllene is recognized for its potential to alleviate these symptoms, and its anti-inflammatory properties make it a sought-after ingredient in both pharmaceutical and over-the-counter health products. The popularity of natural and herbal treatments for managing inflammation further contributes to its demand, especially in a market like Japan where traditional medicine often emphasizes holistic care.

The growing adoption of anti-inflammatory products containing caryophyllene is also influenced by the increasing prevalence of chronic diseases that involve inflammation. As healthcare systems in Japan focus on improving the quality of life for individuals with chronic conditions, the demand for caryophyllene as an adjunct or alternative treatment continues to rise. This trend is supported by the shift toward natural health products, particularly among aging populations seeking alternative remedies with fewer side effects. As the understanding of caryophyllene's therapeutic benefits expands, its demand for anti-inflammatory purposes is expected to grow in the coming years.

The demand for caryophyllene in Japan is influenced by local market conditions, regulatory dynamics, and consumer preferences. Key drivers include growing interest in natural bioactive compounds for cosmetics and food uses. Cost pressures on extraction and supply chain complexity act as restraints. Emerging trends reflect increasing integration of caryophyllene into functional skincare, flavouring and aromatherapy products. Together, these factors will determine the growth path of the caryophyllene market in Japan.

In Japan the ingredient regulation environment is tightening for synthetic additives, which is motivating formulation shifts toward naturally derived compounds such as caryophyllene. The domestic cosmetics and food industries show increasing interest in ingredients with bioactive claims and botanical origins. Japan’s ageing population and growing wellness oriented consumer segment are also boosting uptake of natural compounds in dietary, topical and flavouring applications. These developments are driving caryophyllene demand across cosmetics, personal care and food sectors.

Japan’s reliance on imported botanical raw materials for caryophyllene means supply chain logistics and currency fluctuations raise cost burdens for formulators. The specialised extraction and purification required for high purity caryophyllene add to production cost and complexity. Smaller domestic firms may lack scale to absorb these overheads. These cost and sourcing constraints limit adoption of caryophyllene in lower margin product ranges and restrict market expansion to premium segments.

Japanese manufacturers are increasingly embedding caryophyllene in skincare formulas targeting anti inflammatory effects, aromatherapy blends and functional flavouring in beverages. The consumer base in Japan shows greater awareness of plant based and bio active ingredients, and is receptive to botanical marketing claims. Retailers are also promoting premium niche botanical products, giving caryophyllene a growing platform. These trends are shaping how caryophyllene is positioned and increasing its appeal in Japanese product portfolios.

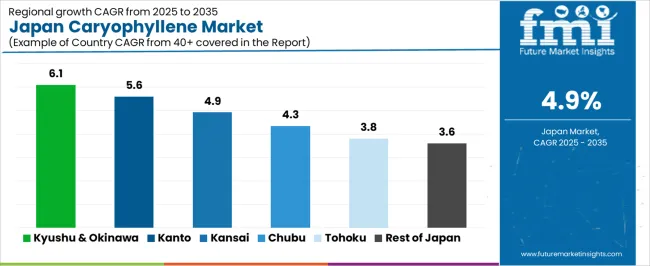

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 6.1% |

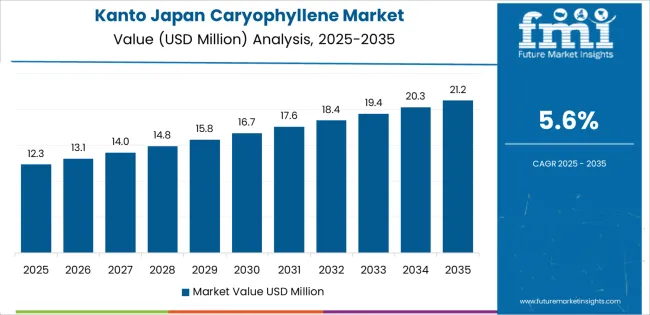

| Kanto | 5.6% |

| Kinki | 4.9% |

| Chubu | 4.3% |

| Tohoku | 3.8% |

| Rest of Japan | 3.6% |

The demand for Caryophyllene in Japan is rising at differing rates across regions. In Kyushu & Okinawa the CAGR is 6.1 %, driven by local ingredients sourcing and growing wellness product innovation. The Kanto region follows at 5.6 %, supported by cosmetic manufacturers and high income consumers. Kinki reports a 4.9 % CAGR as industrial and personal care applications expand. Chubu shows 4.3 % growth tied to manufacturing clusters and functional ingredients demand. Tohoku grows at 3.8 % with gradual uptake in natural extracts. The Rest of Japan records 3.6 % growth, reflecting slower adoption in less urbanised areas. Each region’s pattern reflects local consumer behaviours, industrial base and supply chain dynamics.

In Kyushu & Okinawa, the demand for Caryophyllene is growing at a CAGR of 6.1% through 2035. This strong growth is driven by expanding applications in industries such as food, cosmetics, and pharmaceuticals. As consumer preferences shift towards natural ingredients, the demand for Caryophyllene in these regions is increasing. The tourism sector in Okinawa also plays a role, with demand for local products featuring this compound rising in the hospitality and wellness industries. Manufacturers are responding by increasing supply to meet this growing market need for Caryophyllene-based products.

In Kanto, the demand for Caryophyllene is projected to grow at a CAGR of 5.6% through 2035. As Japan’s economic hub, Kanto is home to significant manufacturing and industrial activity. The rising interest in natural and functional ingredients is contributing to the increased demand for Caryophyllene in various sectors, especially in food and health-related products. The region’s robust retail and distribution networks also play a key role, making Caryophyllene-based products more accessible to a broader audience. The shift in consumer behavior towards wellness and natural solutions continues to propel market growth.

In Kinki, the demand for Caryophyllene is expected to grow at a CAGR of 4.9% through 2035. The region's established food processing and cosmetic industries are key drivers of this demand. As the popularity of natural and plant-derived ingredients increases, Kinki is seeing a rise in the use of Caryophyllene in various products. Additionally, regional research and development efforts in pharmaceuticals and wellness products are boosting demand. This trend aligns with the broader push for clean, green, and functional ingredients across multiple industries in the region.

In Chubu, the demand for Caryophyllene is projected to grow at a CAGR of 4.3% through 2035. This growth is driven by the region's focus on pharmaceutical, food, and cosmetics sectors, where Caryophyllene is increasingly valued for its functional properties. The region’s well-developed manufacturing infrastructure supports the production and distribution of products containing Caryophyllene. As consumer awareness of the benefits of natural ingredients continues to rise, manufacturers are investing in Caryophyllene-based formulations to meet growing market demand.

In Tohoku, the demand for Caryophyllene is expected to grow at a CAGR of 3.8% through 2035. The demand in this region is supported by the increasing use of natural ingredients in both food and health products. Tohoku’s emerging wellness market, particularly in rural areas, is contributing to the adoption of Caryophyllene. As the trend towards plant-based and functional ingredients grows, manufacturers in Tohoku are increasingly incorporating Caryophyllene into their product offerings, addressing both local and national demand for natural solutions.

In the rest of Japan, the demand for Caryophyllene is projected to grow at a CAGR of 3.6% through 2035. As regional markets outside the major industrial centers expand, the demand for natural and functional ingredients is steadily increasing. The food and health industries are leading the adoption of Caryophyllene, driven by rising consumer awareness of wellness products. Local manufacturers are increasingly incorporating Caryophyllene into their offerings to meet the growing consumer preference for clean-label, plant-based ingredients.

The demand for caryophyllene in Japan is primarily driven by its increasing use in the fragrance and flavor industries. As an important terpene with a distinct peppery aroma, caryophyllene is gaining traction in various consumer goods, including perfumes, essential oils, and food products. Japan’s growing preference for natural and plant-based ingredients in fragrances and flavors is a significant factor fueling the demand. Additionally, the rising awareness of the potential health benefits of caryophyllene, such as its anti-inflammatory properties, is driving its inclusion in wellness and cosmetic products. These trends align with the global push towards cleaner, more sustainable ingredients in the consumer goods market.

Key players such as John D. Walsh Company, The Lermond Company, Van Aroma, Vigon International, and Takasago are shaping the caryophyllene industry in Japan. These companies leverage their extensive networks in the fragrance and flavor markets, offering high-quality caryophyllene derived from natural sources. Takasago, a leading Japanese player, has a strong foothold in the market with its advanced technology in the production of flavor and fragrance compounds. Meanwhile, international companies like Van Aroma and Vigon International bring their expertise in sourcing and producing essential oils and terpenes to meet the growing demand for caryophyllene in Japan. The competition in this market is further influenced by the push for innovation in natural ingredient sourcing and production techniques.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Purity | 0.95, 0.9, 0.85, Others Derivatives |

| Application | Anti-inflammatory, Anticancer, Essential Oils, Food Additive, Antianxiety |

| End Use Industry | Pharmaceuticals, Food, Soaps & Detergents, Others |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | John D. Walsh Company, The Lermond Company, Van Aroma, Vigon International, Takasago International Corporation |

| Additional Attributes | Dollar by sales by purity, application, end-use, and region; regional CAGR and adoption trends; volume and value growth projections; increased interest in wellness products, anti-inflammatory and anticancer applications; growing demand in cosmetics, food, and pharmaceuticals; integration of caryophyllene in natural and plant-based wellness products; adoption driven by regulatory support for natural ingredients; push for sustainable production practices; increasing popularity of natural and botanical ingredients in consumer goods, particularly in fragrances, essential oils, and food additives. |

The demand for caryophyllene in Japan is estimated to be valued at USD 25.6 million in 2025.

The market size for the caryophyllene in Japan is projected to reach USD 41.2 million by 2035.

The demand for caryophyllene in Japan is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in caryophyllene in Japan are 0.95, 0.9, 0.85 and others derivatives.

In terms of application, nti-inflammatory segment is expected to command 32.6% share in the caryophyllene in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA