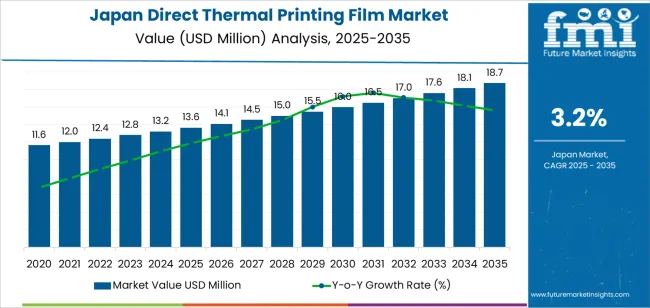

The demand for direct thermal printing film in Japan is expected to reach USD 18.7 million by 2035, reflecting an absolute increase of USD 5.1 million over the forecast period. The demand, valued at USD 13.6 million in 2025, is expected to grow at a steady CAGR of 3.2%. This growth is primarily driven by the increasing demand for direct thermal printing solutions in industries such as retail, logistics, and healthcare, where high-volume, cost-effective printing solutions are essential for labeling, barcoding, and product identification.

Direct thermal printing film is widely used for applications like price labels, shipping labels, and receipts, offering businesses an efficient and reliable printing solution without the need for ink or ribbons. As Japan's retail and logistics industries continue to expand, particularly with the growth of e-commerce, the demand for direct thermal printing films is expected to rise. Advancements in printing technology, improved durability, and the growing preference for eco-friendly and cost-effective labeling solutions are also contributing to the demand for direct thermal printing films.

The healthcare sector is another major driver, where the need for accurate, legible, and durable labels for pharmaceutical products, medical equipment, and patient identification continues to grow. As businesses across various sectors continue to prioritize efficiency, convenience, and environmental responsibility, the adoption of direct thermal printing technology is expected to accelerate.

Between 2025 and 2030, the demand is expected to grow moderately, increasing from USD 13.6 million to USD 14.1 million, representing approximately 9.8% of the total forecasted growth. This growth will be driven by industries such as retail, logistics, and healthcare, where the demand for cost-effective, efficient, and environmentally friendly labeling solutions will continue to rise. During this phase, businesses will increasingly adopt direct thermal printing solutions for their ease of use, lower operational costs, and environmental benefits.

From 2030 to 2035, the demand will experience robust growth, expanding from USD 14.1 million to USD 18.7 million, accounting for about 90.2% of the total growth over the forecast period. This accelerated growth will be driven by the rapid expansion of e-commerce, which will significantly increase the volume of shipments requiring efficient and reliable labeling solutions. Innovations in thermal printing technology and a growing emphasis on sustainability will contribute to the surge in demand. The logistics sector, in particular, will see a sharp rise in adoption, as businesses continue to streamline their operations and embrace more advanced packaging and labeling solutions.

| Metric | Value |

|---|---|

| Japan Direct Thermal Printing Film Value (2025) | USD 13.6 million |

| Japan Direct Thermal Printing Film Forecast Value (2035) | USD 18.7 million |

| Japan Direct Thermal Printing Film Forecast CAGR (2025-2035) | 3.2% |

The demand for direct thermal printing film in Japan is growing due to the increasing need for efficient and cost-effective printing solutions, particularly in retail, logistics, and packaging industries. Direct thermal printing films are widely used for barcode labels, receipts, and shipping labels, where high-quality printing is essential without the need for ink or toner. The demand for these films is being driven by the rise in e-commerce, retail automation, and the need for more efficient supply chain management.

Japan’s advanced retail sector, which heavily relies on barcode and point-of-sale systems, is a major contributor to the growth in demand for direct thermal printing films. The widespread use of direct thermal printers for producing receipts and labels is driving the need for these films in retail environments. As logistics companies focus on improving inventory management and order fulfillment, the use of direct thermal printing for shipping labels and barcode identification is increasing.

The push toward more sustainable and eco-friendly solutions is fueling the demand for direct thermal printing films, as these systems do not require ink cartridges, reducing waste. Technological improvements in the quality and durability of direct thermal printing films, as well as their growing application in various industries, are further contributing to industry growth. As Japan continues to lead in technological advancements and automation, the demand for direct thermal printing solutions is expected to rise steadily.

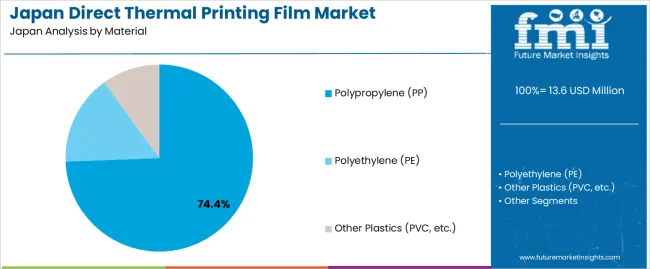

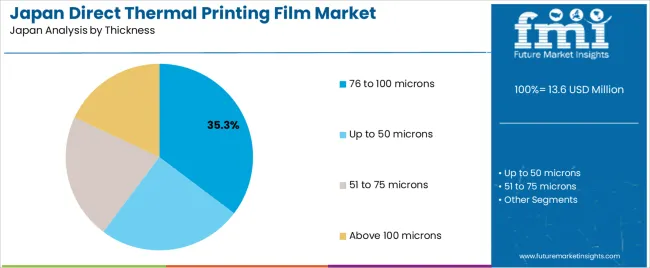

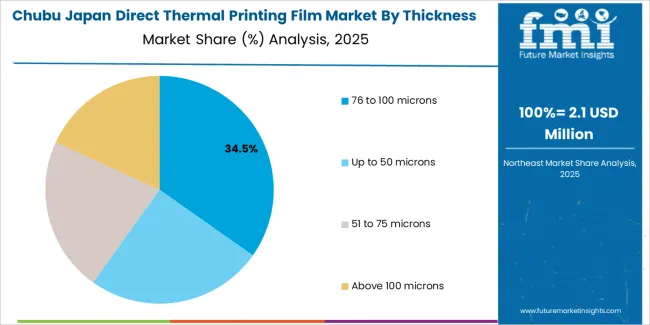

By material, demand is divided into polypropylene (PP), polyethylene (PE), and other plastics such as PV. Based on thickness, demand is categorized into 76 to 100 microns, up to 50 microns, 51 to 75 microns, and above 100 microns. Regionally, demand is distributed across Kanto, Kinki, Chubu, Kyushu & Okinawa, Tohoku, and the Rest of Japan.

Polypropylene (PP) accounts for 74% of the demand for direct thermal printing film in Japan. PP is highly preferred due to its cost-effectiveness, durability, and excellent printability, making it ideal for a wide range of applications, including retail labeling, packaging, and logistics. Polypropylene provides superior resistance to moisture, chemicals, and UV exposure, which is particularly important in ensuring the longevity of printed information.

PP offers excellent adhesion for thermal printing, allowing for clear, durable prints on a variety of surfaces. The growing demand for high-quality labels and packaging materials across industries such as e-commerce, food, and retail further drives the preference for polypropylene. Its ability to provide consistent performance, coupled with cost-efficiency, ensures that PP remains the leading material type for direct thermal printing films in Japan.

The 76 to 100 microns thickness range holds 35.3% of the demand for direct thermal printing film in Japan. This thickness is preferred because it strikes an ideal balance between durability and flexibility, making it suitable for a wide range of applications. Films within this thickness range are strong enough to resist tearing and punctures during handling and transportation, while still being light enough to maintain efficiency in high-speed printing operations.

This makes it particularly well-suited for retail and logistics labels, product packaging, and other labeling applications that require both durability and clear print quality. The 76 to 100 microns thickness also offers excellent compatibility with a variety of thermal printers, ensuring optimal performance and print clarity. As the demand for reliable and high-quality printed labels continues to rise in Japan, this thickness range remains the leading choice for manufacturers and businesses across multiple sectors.

The Kanto region holds the largest share of demand for direct thermal printing film in Japan, driven by its concentration of manufacturing, retail, and e-commerce industries. Kanto, particularly Tokyo and Yokohama, serves as the economic hub of Japan, where a significant portion of industrial production, logistics, and retail activities take place. The high demand for direct thermal printing films in this region is primarily driven by the need for labeling and packaging solutions in the retail and logistics sectors.

With a large number of distribution centers, e-commerce companies, and commercial facilities operating in the Kanto region, the demand for high-quality, cost-effective thermal printing solutions remains strong. The rapid growth of e-commerce and retail businesses in Kanto continues to increase the need for efficient and durable printing films, ensuring that the region maintains its dominance in demand for direct thermal printing films in Japan.

Direct thermal films allow ink‑free printing of barcodes, labels and etc., with increasingly high expectations for speed, reliability and environmental performance. Key drivers include growth in e‑commerce shipments, more automated packaging lines in Japan, and reformulation of labeling to more efficient film substrates. Restraints include higher unit cost of specialty coated films compared with basic thermal paper, limited durability of some direct‑thermal films under harsh conditions and the inertia of legacy label systems in some Japanese manufacturing.

In Japan, demand is growing because more manufacturers and retailers seek cost‑effective, print‑ready substrates for fast‑moving logistics, automated packaging and variable printing tasks. With the rise of e‑commerce and last‑mile delivery, variable labels and tags that can be printed on demand using direct‑thermal film are increasingly adopted. Also, Japan’s emphasis on production efficiency and minimal‑waste packaging supports switching from traditional label systems to film‑based direct‑thermal substrates. The shift toward clean‑label packaging and elimination of additional consumables (ribbon, ink) also supports the uptake of film alternatives.

Technological and material advances are enabling wider use of direct‑thermal films in Japan by improving print quality, substrate durability and compatibility with high‑speed printers. Innovations include top‑coated polypropylene (PP) or polyester films with better abrasion and moisture resistance, making them suitable for demanding labeling on food trays, logistics tags or industrial labels. Some Japanese firms are applying these films to food packaging trays with direct printing of variable data, reducing secondary labels and improving process efficiency. These innovations allow Japanese manufacturers to adopt film substrates for direct thermal printing in cases where previously only cheaper paper solutions were used.

Despite growth potential, adoption in Japan faces several hurdles. One challenge is higher cost of specialty film substrates with direct‑thermal coating compared with conventional thermal paper, which may deter cost‑sensitive applications. Another is performance limitations some film‑based direct‑thermal materials may not yet match the durability or archival stability of traditional alternatives under all conditions, requiring education and testing. Some production lines and labeling systems in Japan remain built around legacy paper‑based thermal rolls or ribbon‑based printing, making change‑over investment and process adaptation a barrier. Film supply‑chain constraints or occasional raw‑material price volatility may limit rapid expansion.

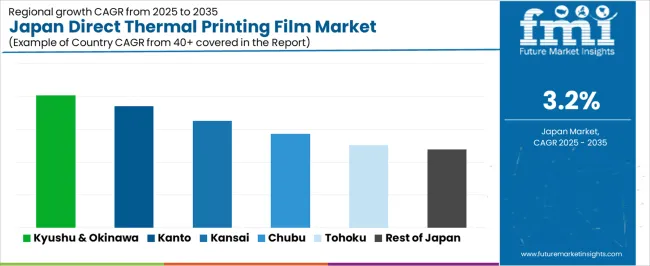

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 4.0% |

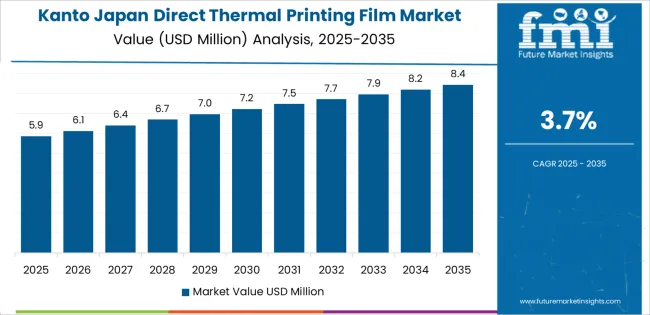

| Kanto | 3.7% |

| Kinki | 3.3% |

| Chubu | 2.9% |

| Tohoku | 2.5% |

| Rest of Japan | 2.4% |

The demand for direct thermal printing film in Japan is growing steadily across regions, with Kyushu & Okinawa leading at a 4.0% CAGR. This growth is supported by the increasing use of direct thermal printing in retail, logistics, and labeling applications. Kanto follows closely with a 3.7% CAGR, driven by the high concentration of businesses and industries in Tokyo and surrounding areas. Kinki records a 3.3% CAGR, fueled by the region's growing manufacturing and retail sectors. Chubu shows a 2.9% CAGR, while Tohoku and the Rest of Japan experience slower growth rates of 2.5% and 2.4%, respectively, as the demand for direct thermal printing film continues to expand in both urban and rural areas.

Kyushu & Okinawa is experiencing the highest demand growth for direct thermal printing film in Japan, with a 4.0% CAGR. This growth is primarily driven by the region’s expanding retail and logistics sectors, which rely on efficient labeling and printing solutions. Kyushu, with cities like Fukuoka, is witnessing an increase in e-commerce and retail operations, both of which use direct thermal printing for barcodes, shipping labels, and product information.

The growing trend toward digitalization and automation in the retail and logistics industries is pushing the demand for direct thermal printing film in Kyushu & Okinawa. With businesses looking for cost-effective and high-quality labeling solutions, direct thermal printing, which does not require ink or ribbons, has become a preferred choice. As these industries continue to scale and innovate, the demand for direct thermal printing solutions in the region will continue to grow.

Kanto, home to Japan’s capital Tokyo, is seeing strong demand for direct thermal printing film with a 3.7% CAGR. The region's concentration of businesses, including retail, logistics, and manufacturing industries, plays a major role in driving this growth. Tokyo, being a hub for e-commerce and business operations, has a high demand for efficient printing solutions. Direct thermal printing is widely used for labeling, shipping, and inventory management, making it essential in the region’s logistics and retail sectors.

The increasing adoption of automated processes and the growing need for speed and efficiency in product labeling are contributing to the rise in demand for direct thermal printing film. As companies in Kanto continue to prioritize operational efficiency and sustainability, the demand for direct thermal printing solutions is expected to remain strong. The region's high adoption of technology and digital solutions further supports the continued growth of direct thermal printing in the area.

Kinki, which includes Osaka and Kyoto, is experiencing steady demand growth for direct thermal printing film, with a 3.3% CAGR. The region's strong retail and manufacturing sectors are key drivers of this growth. Kinki has a well-established retail infrastructure, and as e-commerce continues to expand, the need for efficient and reliable labeling solutions increases. Direct thermal printing is increasingly used in retail and logistics for its ease of use, cost-effectiveness, and environmental benefits.

The rise in local and global distribution networks within Kinki’s commercial sector is also contributing to the growing demand for direct thermal printing film. As businesses seek to streamline their logistics operations and reduce operational costs, the adoption of direct thermal printing systems is expected to increase. Kinki’s continued emphasis on innovation in manufacturing and packaging ensures that direct thermal printing remains an essential solution for product labeling and identification.

Chubu, including cities like Nagoya, is seeing moderate growth in demand for direct thermal printing film, with a 2.9% CAGR. The region’s strong industrial base, particularly in manufacturing, automotive, and logistics, is driving the adoption of direct thermal printing solutions. As companies in these industries continue to expand their operations, the need for cost-effective, high-quality printing solutions for labeling and packaging is growing.

While Chubu is not experiencing as rapid growth as other regions like Kyushu or Kanto, there is still a steady rise in the adoption of direct thermal printing film. As the region's logistics networks become more advanced and consumer demand for products with clear labeling increases, the demand for these printing solutions will continue to grow. Chubu’s emphasis on technological innovation in industrial sectors further supports this trend, as businesses seek more efficient ways to manage product labeling and packaging.

Tohoku is experiencing slower but steady growth in the demand for direct thermal printing film, with a 2.5% CAGR. Known for its rural and less densely populated areas, Tohoku is gradually modernizing its healthcare, retail, and logistics sectors. As businesses in this region work to expand their operations and improve efficiency, there is an increasing adoption of advanced printing technologies, including direct thermal printing solutions. The need for efficient and low-maintenance labeling solutions in industries such as logistics and retail is driving the demand for direct thermal printing film.

While the growth rate in Tohoku is slower compared to more urbanized regions, the trend toward modernization and technological adoption is evident. The increased focus on cost-effective, sustainable packaging solutions in various industries, such as food and healthcare, is further contributing to the demand for direct thermal printing film. As infrastructure investments continue and businesses seek to improve their labeling processes, the demand for direct thermal printing in Tohoku will continue to grow, albeit at a moderate pace.

The Rest of Japan, which includes smaller and more rural regions, is also experiencing steady growth in the demand for direct thermal printing film, with a 2.4% CAGR. The ongoing investments in infrastructure and the push to modernize industries like healthcare, food, and retail are key factors driving this trend. As businesses in these regions expand and improve their logistics and operations, there is an increasing need for efficient and cost-effective labeling solutions, which are fueling the adoption of direct thermal printing.

Though growth in the Rest of Japan is slower compared to the more urbanized regions, the rising focus on sustainable packaging and cost-effective solutions is helping to drive the use of direct thermal printing film. As businesses across these smaller regions look for ways to enhance their product packaging and labeling processes, the demand for this technology will continue to grow, providing a steady boost to the regional industry.

The demand for direct thermal printing film in Japan is experiencing steady growth, driven by the country’s highly advanced retail, logistics, and packaging industries. As more businesses adopt efficient, ink-free printing solutions for labeling, tagging, and receipt printing, especially in e‑commerce, food retail and healthcare settings, the need for high‑performance direct thermal printing films continues to rise. These films coated to react to heat from a print head rather than using ribbons or ink are valued for their simplicity, cost‑effectiveness and compatibility with compact printers.

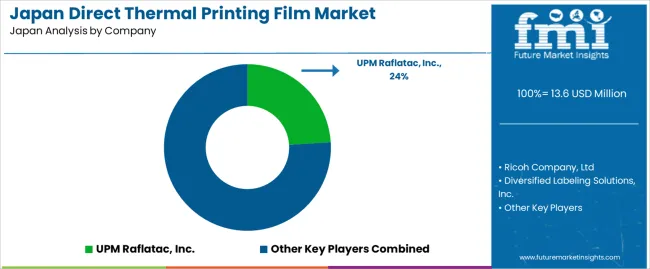

Within the Japanese demand landscape, UPM Raflatac, Inc. holds a leading share of approximately 24.0%, reflecting its strong supply position, broad film portfolio and relationships with label converters, packaging specialists and printers across Japan. Other key suppliers including Ricoh Company, Ltd., Diversified Labeling Solutions, Inc., McCourt Label Company, and Stylerite Label Corporation also contribute to fulfilling demand, offering a variety of film types, coatings and services.

A range of factors support the demand in Japan: the modernization of supply chains in retail and logistics, increasing adoption of thermal printing for on‑the‑fly labeling in manufacturing and warehousing, and growing regulatory requirements for traceability and on‑pack information in the food and healthcare sectors. At the same time, opportunities exist to expand use beyond traditional applications into flexible packaging, shelf‑edge labels and integrated smart packaging. While price pressures and competition from alternative technologies (e.g., thermal transfer or inkjet) persist, the outlook remains positive, with continued uptake of direct thermal printing film solutions anticipated in Japan’s highly developed industrial and retail ecosystem.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Material | Polypropylene (PP), Polyethylene (PE), Other Plastics (PVC, etc.) |

| Thickness | Up to 50 microns, 51 to 75 microns, 76 to 100 microns, Above 100 microns |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Players Profiled | UPM Raflatac, Inc., Ricoh Company, Ltd, Diversified Labeling Solutions, Inc., McCourt Label Company, Stylerite Label Corporation |

| Additional Attributes | Dollar sales by material, thickness, and region categories, regional adoption trends, competitive landscape, advancements in direct thermal printing film technologies in Japan. |

The global demand for direct thermal printing film in japan is estimated to be valued at USD 13.6 million in 2025.

The market size for the demand for direct thermal printing film in japan is projected to reach USD 18.7 million by 2035.

The demand for direct thermal printing film in japan is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in demand for direct thermal printing film in japan are polypropylene (pp), polyethylene (pe) and other plastics (pvc, etc.).

In terms of thickness, 76 to 100 microns segment to command 35.3% share in the demand for direct thermal printing film in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Direct Fast Dyes Market Size and Share Forecast Outlook 2025 to 2035

Directional Drilling Service Market Forecast Outlook 2025 to 2035

Direct Methanol Fuel Cell Market Size and Share Forecast Outlook 2025 to 2035

Direct Operated Poppet Valve Market Forecast and Outlook 2025 to 2035

Direct Burial Fiber Optic Cable Market Size and Share Forecast Outlook 2025 to 2035

Directed Energy Weapons Market Size and Share Forecast Outlook 2025 to 2035

Direct To Chip Liquid Cooling Market Size and Share Forecast Outlook 2025 to 2035

Direct Write Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Direct Oral Anticoagulants Market Size and Share Forecast Outlook 2025 to 2035

Direct-to-Shape Inkjet Printer Market Size, Growth, and Forecast 2025 to 2035

Directed Energy-Based Surgical Systems Market Growth – Forecast 2025 to 2035

Direct-to-Consumer Genetic Testing Market Analysis - Trends & Outlook 2025 to 2035

Assessing Direct-to-shape Inkjet Printer Market Share & Industry Trends

Direct Drive Wind Turbine Market Growth - Trends & Forecast 2025 to 2035

Direct Reduced Iron Market Growth – Trends & Forecast 2024-2034

Directional Luminaire Market

Direct-To-Consumer Test Market

Direct-Fed Microbial Products Market

Direct-acting Antiviral Medicines Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA