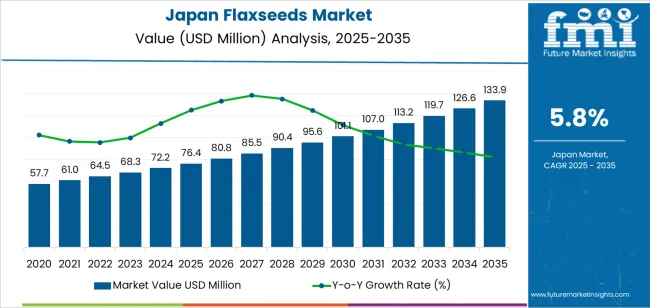

The Japan flaxseeds demand is valued at USD 76.4 million in 2025 and is estimated to reach USD 133.9 million by 2035, reflecting a CAGR of 5.8%. Demand is shaped by increased incorporation of plant-based ingredients in packaged foods, rising use of omega-3-rich seeds in bakery and cereal products, and steady uptake within health-focused consumer segments. Food manufacturers and retail distributors are expanding product lines that feature flaxseed as a functional ingredient due to its fibre content and nutritional profile. Import dependence continues, with supply stability, processing capability, and quality certification standards influencing procurement decisions.

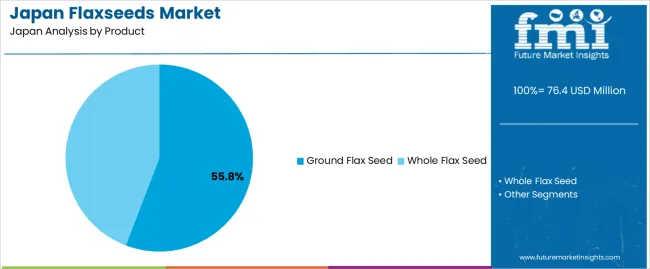

Whole flaxseed leads the product landscape. It is used across bakery products, snacks, cereals, and home-cooking applications where natural texture and nutrient retention are prioritised. The segment benefits from straightforward storage, shelf stability, and broad compatibility with industrial food-processing operations. Increased consumer uses in daily diets, supported by product availability in supermarkets and health-food stores, strengthens demand.

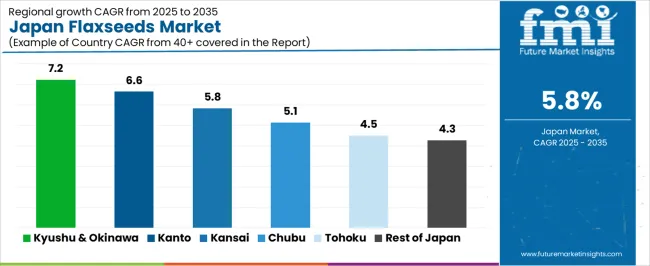

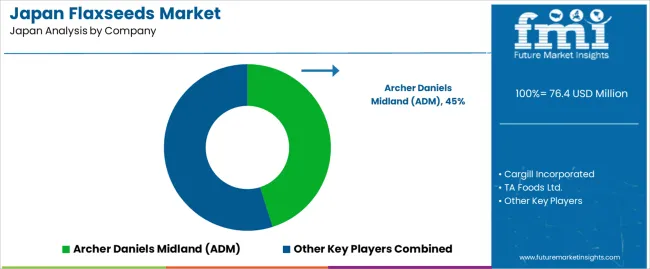

Kyushu & Okinawa, Kanto, and Kinki record the highest utilisation levels due to their concentration of food-processing facilities, large retail networks, and established import channels. These regions also support distribution activities for ingredient suppliers and wholesalers. Key players include Archer Daniels Midland (ADM), Cargill Incorporated, TA Foods Ltd., Richardson International Limited, and Johnson Seeds, which provide whole, milled, and specialty flaxseed formats for food, nutraceutical, and commercial applications.

The early growth curve from 2025 to 2029 shows a steady rise driven by nutrition-focused consumers, functional-food manufacturers, and bakery producers incorporating flaxseeds into fibre-rich and omega-3 formulations. Early growth is supported by consistent retail uptake, broader use in cereals and health snacks, and stable import availability. This creates a predictable early trajectory shaped by dietary-wellness trends and routine integration of flaxseeds into processed and home-use food applications.

From 2030 to 2035, the late growth curve shifts into a more mature pattern. By this period, most large food processors and retailers will have established flaxseed-based product lines, and expansion is shaped by replacement demand rather than large category additions. Growth continues through improvements in milling, stabilized ground-flax formats, and wider entry into fortified beverages and supplement blends, but the pace remains controlled. The comparison shows an early phase characterized by broad functional-food adoption and a later phase defined by stable utilization, long cycle consistency, and incremental product diversification across Japan’s health-oriented food ecosystem.

| Metric | Value |

|---|---|

| Japan Flaxseeds Sales Value (2025) | USD 76.4 million |

| Japan Flaxseeds Forecast Value (2035) | USD 133.9 million |

| Japan Flaxseeds Forecast CAGR (2025 to 2035) | 5.8% |

Demand for flaxseeds in Japan is increasing because consumers and food manufacturers are seeking plant-based, nutrient-rich ingredients for inclusion in health foods, bakery products and functional nutrition. Flaxseeds provide omega-3 fatty acids, dietary fibre and lignans which align with Japanese consumer trends emphasizing preventive health, clean labels and balanced diets. Food‐tech companies incorporate flaxseed into cereals, snacks, breads and smoothies to improve nutritional profile and appeal to wellness-minded buyers.

Import growth and distribution improvements make flaxseed more accessible despite limited domestic production. Constraints include higher price compared with some conventional cereal grains, potential off-flavour or texture issues that require formulation expertise and import dependency which leads to supply vulnerability and cost fluctuations. Some traditional food manufacturers may hesitate to switch until consumer demand for flaxseed‐enriched products is clearly established.

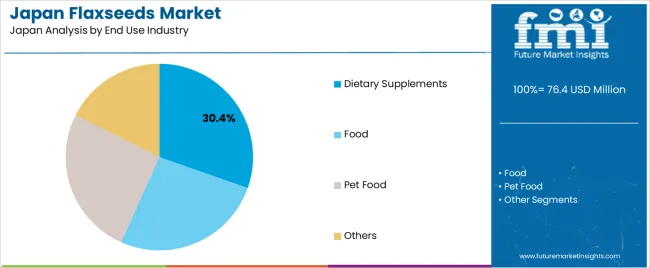

Demand for flaxseeds in Japan reflects increased interest in plant-derived omega-3 sources, fibre-rich ingredients, and functional components used across food, supplement, and pet-nutrition categories. Product-type preferences vary by processing needs, digestive considerations, and formulation characteristics. End-use patterns correspond to how manufacturers and consumers incorporate flaxseeds into supplements, food preparations, and animal diets.

Whole flaxseed holds 55.2% of national demand and represents the leading product type. Whole seeds support long-shelf-life storage, reduced oxidation risk, and versatile use in bakery items, cereals, and home cooking. Their intact structure assists in preserving natural oils and nutrients until processing or consumption. Ground flaxseed accounts for 44.8%, serving applications requiring improved digestibility, faster nutrient absorption, and ease of incorporation into smoothies, supplements, and processed foods. Product-type distribution reflects preferences regarding freshness, stability, and preparation methods across Japanese consumers and manufacturers, who select whole or ground forms based on recipe compatibility, nutrient release, and formulation needs.

Key drivers and attributes:

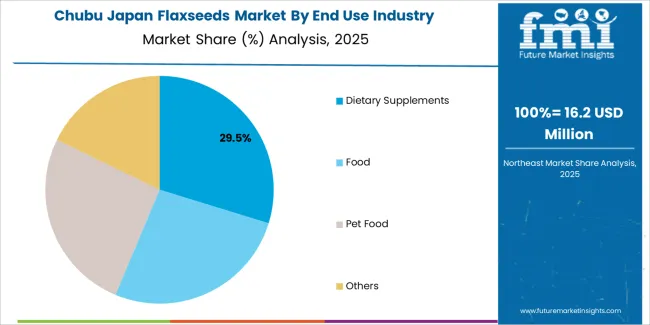

Dietary supplements hold 30.4% of national demand and represent the dominant end-use category. Flaxseeds are used for omega-3 content, fibre support, and nutrient-dense formulations targeting digestive health and general wellness. Food applications account for 26.3%, including baked goods, cereals, and functional food products requiring plant-based fibre and oil content. Pet food represents 25.7%, with flaxseed incorporated for skin health, coat quality, and digestive support in companion animals. Other uses account for 17.6%, covering cosmetics, traditional food preparations, and niche formulations. End-use distribution reflects nutrition preferences, ingredient functionality, and the diverse ways flaxseed components are integrated across Japanese sectors.

Key drivers and attributes:

Rising health awareness, growth in functional food product launches and increased demand for plant-based nutrition are driving demand.

In Japan, demand for flaxseeds is increasing as consumers seek foods rich in omega-3 fatty acids, dietary fibre and plant-based protein. Food manufacturers are incorporating flaxseeds into cereals, bakery items, snacks and smoothies to meet the rising interest in wellness and clean-label ingredients. Vegan and flexitarian diet trends are adding momentum, with flaxseeds offering a recognized source of ALA (alpha-linolenic acid) and lignans. Food-service providers, meal kits and health-food stores in urban regions increasingly stock flaxseed-based products, which supports overall demand growth.

Supply volatility, cost premiums and limited public awareness restrain faster growth.

Although awareness of flaxseed benefits is growing, many consumers remain unsure how to use flaxseeds or distinguish between whole, ground or oil formats, which slows repeat purchase. Flaxseed imports and processing costs, combined with competition from alternative “super-food” seeds such as chia or hemp, create cost pressure and may limit uptake in price-sensitive segments. Supply availability can vary with crop yields, weather and shipping logistics, which impacts continuity of supply and may increase volatility in local inventory and pricing.

Increased use in pet-food and animal-feed applications, development of organic and speciality flaxseed grades, and growth of direct-to-consumer online retail channels define key trends.

Japanese pet-food formulators are adding flaxseeds for skin, coat and general health support in companion animals, which broadens flaxseed application beyond human consumption. Suppliers are introducing higher-purity and certified-organic flaxseed lines that appeal to health-conscious consumers and premium food brands. E-commerce platforms, subscription offerings and meal-kit channels in Japan are helping to raise consumer access and experimentation with flaxseed products. These trends support sustained incremental growth in the flaxseed indsutry in Japan.

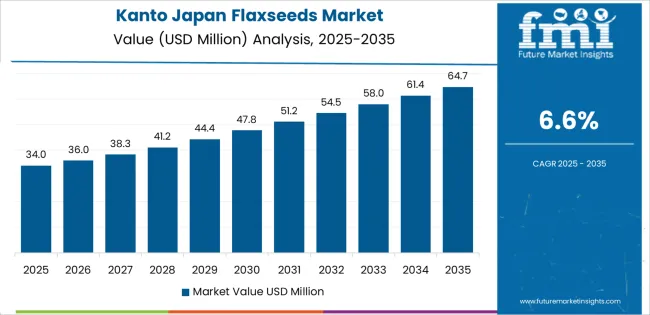

Demand for flaxseeds in Japan is increasing through 2035 as consumers, food manufacturers, and nutrition-focused retailers expand the use of omega-3–rich seeds in bakery products, health foods, supplements, and ready-to-eat items. Rising interest in plant-based nutrition, fiber intake, and heart-healthy formulations strengthens long-term growth. Functional-food producers integrate flaxseeds into cereals, smoothies, fortified snacks, and oil-extraction lines. Regional differences reflect health-food adoption, retail density, and supply-chain integration. Kyushu & Okinawa leads with 7.2%, followed by Kanto (6.6%), Kinki (5.8%), Chubu (5.1%), Tohoku (4.5%), and the Rest of Japan (4.3%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 7.2% |

| Kanto | 6.6% |

| Kinki | 5.8% |

| Chubu | 5.1% |

| Tohoku | 4.5% |

| Rest of Japan | 4.3% |

Kyushu & Okinawa grows at 7.2% CAGR, supported by strong demand for functional foods, expanding health-oriented retail channels, and rising consumer interest in omega-3–rich ingredients. Food manufacturers across Fukuoka, Kumamoto, and Kagoshima integrate flaxseeds into bakery lines, ready-meal products, and blended nutrition mixes. Local supplement brands incorporate flaxseed powder and oil into formulations designed for heart health and digestive support. Hotels and wellness-focused restaurants adopt flaxseed toppings and mixes to meet growing interest in plant-based diets. Distribution networks linked to regional ports improve steady supply from international exporters.

Kanto grows at 6.6% CAGR, driven by Japan’s largest concentration of health-food producers, supermarkets, and specialty retailers across Tokyo, Kanagawa, Chiba, and Saitama. Bakery chains introduce flaxseed-enriched breads and pastries targeted at health-conscious consumers. Beverage and smoothie manufacturers adopt flaxseeds for fiber-enhanced formulations. Supplement brands use flaxseed oil for omega-3 capsules, leveraging strong demand for plant-derived alternatives to fish oil. Urban consumers show higher adoption of functional foods, supporting retail turnover. Research institutions evaluate flaxseed components for new nutraceutical applications.

Kinki grows at 5.8% CAGR, supported by diversified food manufacturing, active bakery industries, and strong nutrition-related consumer interest across Osaka, Kyoto, and Hyogo. Regional manufacturers integrate flaxseeds into cereals, crackers, and blended health snacks. Cafés and specialty health stores incorporate flaxseed toppings and mixes into meal offerings. Supplement firms adopt flaxseed extracts and powders for digestive-wellness products. Growing focus on plant-based ingredients supports increased use in food-service operations.

Chubu grows at 5.1% CAGR, driven by food-processing clusters, retail expansion, and rising consumer interest in functional ingredients across Aichi, Shizuoka, and Gifu. Manufacturers incorporate flaxseeds into granola mixes, confectionery products, and fortified health drinks. Retail chains in Nagoya expand shelf space for functional foods. Household adoption increases as flaxseeds become common in home baking and smoothie preparations. Local supplement and wellness brands use flaxseed powder in digestive-support formulations.

Tohoku grows at 4.5% CAGR, supported by gradual adoption of functional foods and increasing interest in heart-healthy ingredients across Miyagi, Iwate, and Aomori. Food manufacturers add flaxseeds to local snack products and grain blends. Hospitals and community health programs promote diets containing omega-3–rich seeds for elderly populations. Bakeries and small retailers expand flaxseed offerings as awareness increases. Distribution networks improve access to imported seeds for regional suppliers.

The Rest of Japan grows at 4.3% CAGR, shaped by rising awareness of plant-based ingredients, expanding online health-food sales, and increased household experimentation with functional seeds. Smaller manufacturers introduce flaxseed crackers, noodles, and fiber-enhanced mixes. Retailers serving local communities stock flaxseed oils and powders to meet diet-focused consumer interests. Online platforms drive sales growth for organic and cold-pressed flaxseed products.

Demand for flaxseeds in Japan is shaped by a concentrated group of agricultural and oilseed suppliers supporting food processors, health-nutrition brands, bakery manufacturers, and functional-ingredient distributors. Archer Daniels Midland (ADM) holds the leading position with an estimated 45.1% share, supported by controlled seed-cleaning operations, consistent nutrient-profile verification, and reliable export supply. Its position is reinforced by predictable oil content, stable microbial-control standards, and strong integration with Japanese food-ingredient buyers.

Cargill Incorporated and TA Foods Ltd. follow as significant participants. Cargill supplies whole and milled flaxseeds with stable omega-3 levels and dependable moisture control suited to bakery, cereal, and functional-food applications. TA Foods provides cleaned and cold-milled formats characterised by consistent shelf stability and controlled particle size, supporting processors seeking uniform incorporation in blended formulations.

RICHARDSON INTERNATIONAL LIMITED maintains a notable presence with high-quality brown and golden flaxseed grades supported by verified traceability and controlled storage conditions. Johnson Seeds contributes additional capability through specialised seed varieties with consistent yield characteristics and reliable nutrient composition used in industrial and consumer-packaged applications.

Competition across this segment centres on nutrient-profile accuracy, microbial safety, moisture stability, traceability, and supply reliability. Demand continues to expand as Japanese food and nutrition manufacturers incorporate plant-based omega-3s, fibre-rich ingredients, and clean-label seeds into bakery items, cereals, supplements, and functional beverages requiring predictable quality and stable processing behaviour.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Product | Ground Flax Seed, Whole Flax Seed |

| End Use Industry | Food, Pet Food, Dietary Supplements, Others |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Archer Daniels Midland (ADM), Cargill Incorporated, TA Foods Ltd., Richardson International Limited, Johnson Seeds |

| Additional Attributes | Dollar sales by product type and end-use industries; regional adoption trends across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; competitive landscape of flaxseed producers and distributors; developments in cold-milled flaxseed processing, omega-3 enriched seed varieties, and clean-label dietary supplement formulations; integration with functional foods, PET nutrition, bakery applications, and nutraceutical product manufacturing across Japan. |

The demand for flaxseeds in japan is estimated to be valued at USD 76.4 million in 2025.

The market size for the flaxseeds in japan is projected to reach USD 133.9 million by 2035.

The demand for flaxseeds in japan is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in flaxseeds in japan are ground flax seed and whole flax seed.

In terms of end use industry, dietary supplements segment is expected to command 30.4% share in the flaxseeds in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA