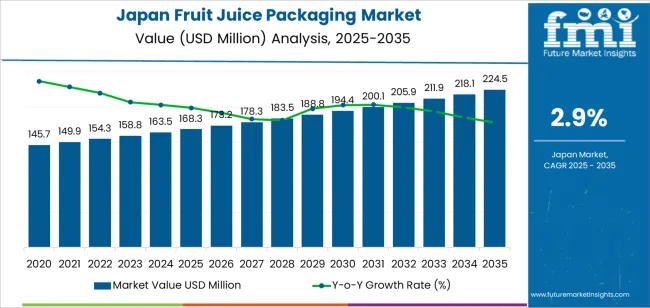

The demand for fruit juice packaging in Japan is valued at USD 168.3 million in 2025 and is projected to reach USD 224.5 million by 2035, reflecting a compound annual growth rate of 2.9%. Growth is shaped by continued interest in packaged beverages across retail channels and the need for formats that protect flavor, freshness and product stability. Cartons, pouches and rigid containers each maintain relevance as manufacturers adjust packaging to support portion control and varied distribution requirements. As juice assortments expand into premium blends, cold-filled products and convenience-focused formats, packaging specifications advance to match filling lines and storage conditions. These trends support measured but steady adoption, reinforcing the importance of reliable, spill-resistant and shelf-ready packaging within Japan’s beverage sector.

The market growth curve shows a consistent rise, beginning at USD 145.7 million in earlier years and reaching USD 168.3 million in 2025 before advancing to USD 224.5 million by 2035. Yearly increases follow a predictable pattern, with values moving from USD 173.2 million in 2026 to USD 178.3 million in 2027 and continuing through later periods with similarly spaced gains. This trajectory reflects stable consumption of packaged fruit juices in households, cafés, schools and vending networks. As producers refine structural strength, sealing performance and ergonomic features, packaging solutions align more closely with modern handling and storage practices. The steady progression suggests a mature category that continues to grow through incremental improvements and consistent demand across Japan’s beverage distribution environment.

Demand in Japan for fruit juice packaging is projected to grow from USD 168.3 million in 2025 to USD 224.5 million by 2035, implying a compound annual growth rate (CAGR) of about 2.9%. Starting from USD 145.7 million in 2020, the value rises each year through USD 168.3 million in 2025, followed by steady increase to USD 194.4 million in 2030 and finally to USD 224.5 million in 2035. Growth is driven by ongoing demand for fruit-juice beverages, leading manufacturers to upgrade packaging formats, adopt premium and convenient packaging options, and respond to consumer preferences for on-the-go and single-serve options in Japan’s mature beverage market.

Over the forecast period the absolute uplift amounts to USD 56.2 million from 2025 to 2035. Early growth is largely volume-led, supported by modest increases in beverage consumption and incremental packaging upgrades. In later years’ value growth becomes more significant as packaging suppliers shift toward higher-specification formats such as lightweight materials, improved barrier performance, and differentiated aesthetics and as retail channels emphasise premiumisation and sustainability. Stakeholders focusing on material innovation, brand differentiation and sustainable packaging options will be positioned to capture the additional value toward USD 224.5 million by 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 168.3 million |

| Forecast Value (2035) | USD 224.5 million |

| Forecast CAGR (2025 to 2035) | 2.9% |

The demand for fruit juice packaging in Japan is being driven by changing consumer habits, especially the preference for ready-to-drink beverages and smaller household sizes. As more urban consumers look for convenience formats, beverage brands are investing in packaging solutions that cater to on-the-go usage, shorter consumption occasions and single-serve formats. The shift toward health-conscious and functional beverages further boosts this trend as packaging must preserve quality, freshness and nutritional integrity, while maintaining visual appeal on shelf.

The regulatory and sustainability environment in Japan is also influencing packaging demand. Brands and packagers are responding to government guidelines on recycling, waste reduction and sustainable materials by exploring lightweight cartons, mono-material pouches, and plant-based or recyclable components. Aseptic carton formats and improved seal technologies are gaining ground because they enable ambient storage, which suits juice distribution in convenience stores and vending channels. At the same time, cost pressures from raw materials, tight margins in beverage categories and logistic challenges of distributing larger pack varieties present constraints. Nevertheless, the combination of convenience-driven consumption, health trends and sustainability imperatives means the demand for fruit-juice packaging in Japan is expected to rise steadily.

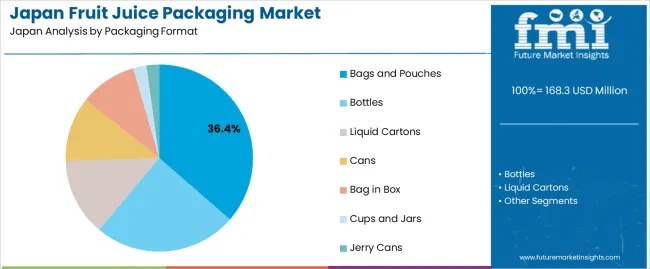

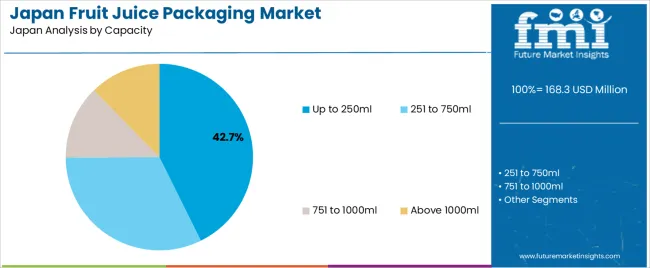

The demand for fruit juice packaging in Japan is shaped by the range of packaging formats available and the capacities selected for different consumption habits. Formats such as bags and pouches, bottles, liquid cartons, cans, bag-in-box, cups and jars and jerry cans support varied needs in retail, foodservice and institutional settings. Capacities including up to 250 ml, 251 to 750 ml, 751 to 1000 ml and above 1000 ml align with single-serve, family-size and bulk-use preferences. As consumers and producers seek durable, portable and shelf-stable options, the combination of format versatility and portion sizing guides overall demand.

Bags and pouches account for 36% of total demand for fruit juice packaging in Japan. Their leading share reflects strong interest in lightweight, flexible formats that support easy storage and transport. These formats suit single-serve consumption and are widely used for children’s drinks, ready-to-go beverages and compact retail products. Their low material weight and efficient sealing options help preserve juice freshness while minimizing breakage risk. Producers value the adaptability of pouches for hot-fill and cold-fill operations, enabling use across a broad variety of juice types. These functional advantages support continued preference for pouch-based solutions.

Demand for bags and pouches also expands due to their convenience in refrigeration and home storage. Consumers appreciate their space-saving form and ease of disposal after use. Designs incorporating tear notches and spouts improve usability for both families and individual buyers. Brands often rely on pouches to launch new flavors or limited editions because the format supports small-batch runs and eye-catching graphics. As retailers highlight portable beverages for varied age groups, bags and pouches maintain visibility across multiple channels. These combined factors reinforce their leading position in Japan’s fruit juice packaging landscape.

Up to 250 ml capacity accounts for 42.7% of total demand for fruit juice packaging in Japan. This leading share reflects strong consumer preference for portion-controlled, single-serve formats used in school lunches, workplace breaks and on-the-go consumption. Smaller capacities reduce waste and match daily drinking habits, especially for buyers who prefer maintaining freshness with each serving. This size is widely used by beverage companies for children’s juices and compact adult portions. Its compatibility with lightweight packaging formats such as pouches and small cartons supports widespread adoption across convenience-focused retail environments.

Demand for up to 250 ml packaging also rises as producers emphasize portability and easy handling. These capacities allow efficient packing for vending machines, convenience stores and travel outlets, which are important distribution channels in Japan. The format supports quick chilling, fast consumption and straightforward disposal in busy urban settings. Brands frequently introduce new flavors or seasonal offerings in this size to encourage trial purchases. As consumer routines increasingly favor quick, manageable servings, the up to 250 ml segment remains the most influential capacity range in Japan’s fruit juice packaging market.

The demand for fruit juice packaging in Japan is influenced by evolving consumer preferences for convenience, premiumisation and sustainability in beverage formats. Growth is supported by increasing production of ready-to-drink juices, expansion of e-commerce channels and stricter recycling and packaging regulations. At the same time, barriers include higher costs of advanced packaging materials, regulatory compliance for packaging waste and competition from alternative beverage formats with simpler packaging. These factors together determine how quickly new packaging formats for juice are adopted across the Japanese market.

How Are Consumer Behaviours and Retail Channels Influencing Fruit Juice Packaging Demand in Japan?

Japanese consumers increasingly look for single-serve formats, portable packaging and premium presentation in fruit juices. Convenience store culture, vending machines and on-the-go consumption drive demand for lightweight bottles, slim cartons and pouches. At the same time, online retail and delivery services require packaging that withstands shipping and maintains integrity. Brands respond by selecting flexible, high-barrier formats and premium finishes. These developments highlight how changing consumption patterns and distribution channels influence packaging requirements in Japan’s juice sector.

Where Are Growth Opportunities Emerging for Fruit Juice Packaging in Japan’s Market?

Key opportunities in Japan lie in premium juice offerings, sustainable or recyclable packaging formats and novel delivery formats such as spouted pouches or multipack combos. Premiumisation means brands seek high-quality finishes, differentiated shapes and materials that enhance shelf appeal. Rising consumer interest in functional juices (vitamin-fortified, low sugar) also creates need for packaging that communicates value, supports longer shelf life and convenience. Suppliers who provide light-weight, recyclable or compostable materials tailored to Japanese regulatory and consumer expectations are well positioned for growth.

What Challenges Are Limiting Wider Uptake of Advanced Fruit Juice Packaging in Japan?

Despite favourable demand drivers, adoption of advanced packaging in Japan faces constraints. Packaging materials with high barrier properties, custom shapes or premium decoration often cost more, which can pressure margins in a mature juice segment. Recycling infrastructure and regulatory alignment remain complex, particularly for multi-material formats. Older vending-machine systems or distribution channels may also favour standard packaging formats, limiting redesign opportunities. These challenges slow faster, broad-scale adoption of innovative juice packaging across all product tiers in Japan.

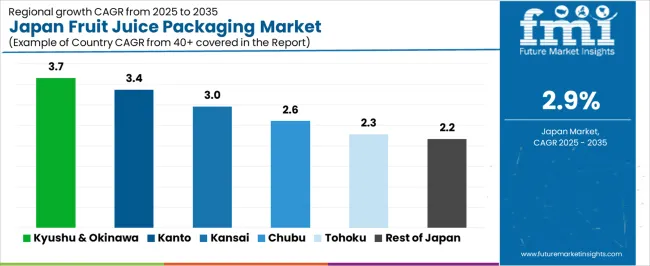

Region CAGR (%) Kyushu & Okinawa 3.7% Kanto 3.4% Kinki 3.0% Chubu 2.6% Tohoku 2.3% Rest of Japan 2.2%

Region CAGR (%) Kyushu & Okinawa 3.7% Kanto 3.4% Kinki 3.0% Chubu 2.6% Tohoku 2.3% Rest of Japan 2.2%

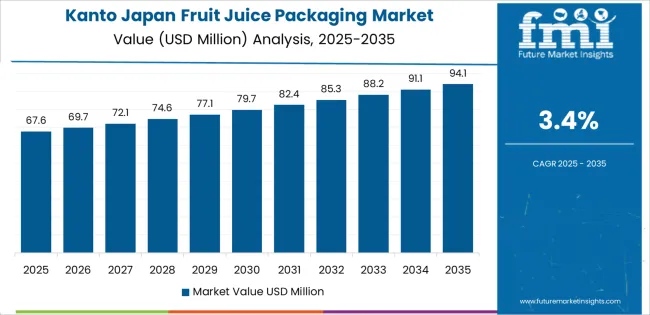

Demand for fruit juice packaging in Japan is increasing across all regions. Kyushu and Okinawa lead at 3.7%, supported by steady production of processed beverages and rising use of convenient packaging formats. Kanto follows at 3.4%, driven by dense urban consumption and strong presence of beverage manufacturers. Kinki records 3.0%, shaped by active retail channels and consistent demand for packaged drinks. Chubu grows at 2.6%, influenced by regional processing facilities and distribution networks. Tohoku reaches 2.3%, where demand rises gradually with expanding retail availability. The rest of Japan posts 2.2%, reflecting modest but steady adoption of packaging formats suited for fruit juice products.

Kyushu & Okinawa is projected to grow at a CAGR of 3.7% through 2035 in demand for fruit juice packaging. Beverage manufacturers in Fukuoka and surrounding areas are increasingly adopting cartons, bottles, and flexible pouches to meet retail and foodservice requirements. Rising demand for convenience, portion control, and shelf stability drives adoption. Suppliers are providing recyclable, durable, and functional packaging solutions. Retailers and distributors ensure widespread accessibility across urban and semi-urban locations. Expansion of fruit juice production facilities and growing consumer consumption trends support steady growth in fruit juice packaging demand across Kyushu & Okinawa.

Kanto is projected to grow at a CAGR of 3.4% through 2035 in demand for fruit juice packaging. Tokyo and neighboring urban centers are increasingly using bottles, cartons, and flexible pouches for fruit juices in retail and foodservice. Rising consumer demand for convenient and durable packaging drives adoption. Suppliers provide recyclable and functional packaging materials compatible with existing bottling lines. Retailers and distributors ensure availability across urban and suburban regions. The combination of growing beverage consumption, retail expansion, and packaging innovation supports steady adoption of fruit juice packaging in Kanto.

Kinki is projected to grow at a CAGR of 3.0% through 2035 in demand for fruit juice packaging. Cities including Osaka and Kyoto are adopting bottles, cartons, and flexible pouches for retail and foodservice beverage applications. Rising consumer preference for convenience, portion control, and durability drives adoption. Suppliers provide recyclable, high-quality, and functional packaging solutions suitable for beverage manufacturers. Retailers and distributors ensure widespread access in urban and suburban locations. The combination of beverage production, urban consumption trends, and packaging innovation supports steady growth in fruit juice packaging demand throughout Kinki.

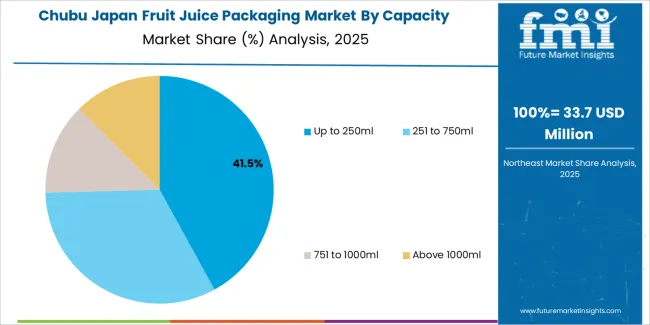

Chubu is projected to grow at a CAGR of 2.6% through 2035 in demand for fruit juice packaging. Urban centers, particularly Nagoya, are adopting bottles, cartons, and flexible pouches for beverage production and retail distribution. Rising demand for convenience, product stability, and portion management drives adoption. Suppliers provide functional, recyclable, and high-quality packaging solutions suitable for local beverage manufacturers. Retail and distribution channels ensure access across urban and semi-urban areas. Steady beverage production, increasing consumer consumption, and packaging innovation support growth in fruit juice packaging adoption across Chubu.

Tohoku is projected to grow at a CAGR of 2.3% through 2035 in demand for fruit juice packaging. Hospitals, schools, and beverage manufacturers in Sendai and surrounding areas are gradually adopting bottles, cartons, and flexible pouches. Rising demand for convenience, shelf stability, and portion control drives adoption. Suppliers provide recyclable and functional packaging solutions compatible with beverage production lines. Retailers and distributors ensure availability in smaller urban and semi-urban areas. Steady production, consumer adoption, and packaging innovation support gradual growth in fruit juice packaging across Tohoku.

The Rest of Japan is projected to grow at a CAGR of 2.2% through 2035 in demand for fruit juice packaging. Smaller towns and rural areas gradually adopt bottles, cartons, and flexible pouches for beverage production and distribution. Rising consumer awareness of convenience, portion control, and product stability drives adoption. Manufacturers supply recyclable, durable, and functional packaging suitable for local producers. Retailers and distributors expand access in semi-urban and rural regions. Steady adoption in smaller towns ensures continuous growth in fruit juice packaging demand across the Rest of Japan.

The demand for fruit juice packaging in Japan is being driven by rising consumption of packaged juice products and the growth of on-the-go beverage formats. Consumers are seeking convenience and ready-to-drink options, which elevates the need for packaging formats that support portability, shelf stability and brand differentiation. At the same time, sustainability regulations and recycling targets in Japan are pushing brands and packagers to adopt more eco-friendly materials and lightweight designs. Packaging suppliers are responding with innovations in paper-based cartons, aseptic fills and recyclable barrier solutions that align with consumer expectations and regulatory demands. These factors combine to stimulate demand for advanced fruit juice packaging solutions within Japan’s beverage sector.

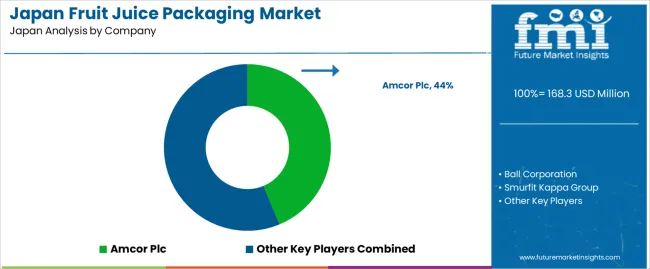

Key companies active in the fruit juice packaging segment in Japan include Amcor Plc, Ball Corporation, Smurfit Kappa Group, Tetra Laval International S.A. and DS Smith Plc. These firms provide packaging formats such as cartons, bottles, metal cans and pouches designed for juice applications. Amcor and Ball focus on rigid and flexible packaging solutions for beverages. Smurfit Kappa and DS Smith contribute paperboard and carton innovations with sustainability credentials. Tetra Laval supplies aseptic carton-packs enabling ambient shelf storage. Through their global scale, materials expertise and service networks in Japan, these companies influence how juice-packaging formats are selected, designed and implemented by beverage brands operating in Japan.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Packaging Format | Bags and Pouches, Bottles, Liquid Cartons, Cans, Bag in Box, Cups and Jars, Jerry Cans |

| Capacity | Up to 250ml, 251 to 750ml, 751 to 1000ml, Above 1000ml |

| Material Type | Plastic, Paper and Paperboard, Glass, Metal |

| Opening Type | Cap Opening, Clip Opening, Straw Hole Opening, Lid Opening |

| Application | Fruit Juice, Vegetable Juice, Cold Pressed Juice, Smoothies |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Amcor Plc, Ball Corporation, Smurfit Kappa Group, Tetra Laval International S.A., DS Smith Plc |

| Additional Attributes | Dollar by sales by packaging format, capacity, material type, and opening type; regional CAGR and growth trends; market share evolution between formats and materials; adoption in retail, foodservice, and institutional channels; volume versus value growth analysis; premium vs standard packaging segmentation; sustainable and recyclable packaging uptake; on-the-go and portion-controlled formats; cold-fill vs ambient-fill packaging; barrier and sealing performance; supply-chain considerations; innovation in design and branding; e-commerce and modern trade influence on packaging choice. |

The demand for fruit juice packaging in japan is estimated to be valued at USD 168.3 million in 2025.

The market size for the fruit juice packaging in japan is projected to reach USD 224.5 million by 2035.

The demand for fruit juice packaging in japan is expected to grow at a 2.9% CAGR between 2025 and 2035.

The key product types in fruit juice packaging in japan are bags and pouches, bottles, liquid cartons, cans, bag in box, cups and jars and jerry cans.

In terms of capacity, up to 250ml segment is expected to command 42.7% share in the fruit juice packaging in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Insights of Fruit Juice Packaging Providers

Fruit Juice Packaging Market Growth – Trends & Forecast through 2035

Japan Stick Packaging Market Insights – Size, Demand & Trends 2025-2035

Japan Sachet Packaging Market Outlook – Share, Growth & Forecast 2025-2035

Japan Blister Packaging Market Trends – Demand & Growth 2025-2035

Fruit And Vegetable Juice Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Premade Pouch Packaging Industry Analysis by Material Type, Closure Type, End Use, and Region through 2025 to 2035

Japan Pharmaceutical Packaging Market Report – Demand, Growth & Innovations 2025-2035

Japan Flexible Plastic Packaging Market Report – Demand, Trends & Industry Forecast 2025-2035

Japan Heavy-duty Corrugated Packaging Market Analysis based on Product Type, Board type, Capacity, End use and City through 2025 to 2035

Japan Industrial Electronics Packaging Market Analysis by Material Type, Packaging Type, Product Type, and City through 2035

Demand for Fruit Snacks in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Fruit Pectin in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Packaging Tubes in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Boxboard Packaging in Japan Size and Share Forecast Outlook 2025 to 2035

Bubble Wrap Packaging Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Molded Fiber Pulp Packaging Market Trends – Growth & Forecast 2023-2033

Plastic Healthcare Packaging Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Moisture-resistant Packaging in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA