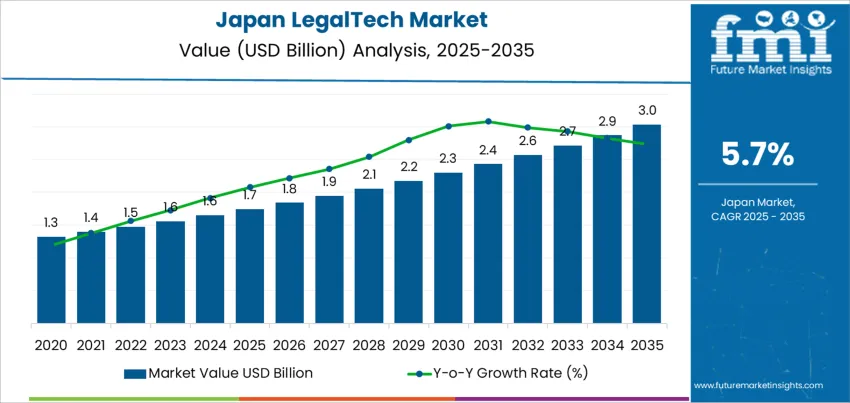

In 2025, legal technology spending in Japan stands at USD 1.7 billion and is projected to reach USD 3.0 billion by 2035 at a CAGR of 5.7%. The early phase from 2025 to 2029 reflects gradual adoption, with demand moving from USD 1.7 billion toward roughly USD 2.1 billion. During this period, usage remains concentrated in contract management, e-discovery, and compliance tracking within large law firms and corporate legal departments. Resistance to full digital migration, reliance on paper-based workflows, and conservative procurement cycles keep growth measured. This stage forms the pre-inflection buildup, where product familiarity increases but large-scale deployment remains limited.

The inflection point becomes visible between 2029 and 2031 as spending accelerates from near USD 2.1 billion to over USD 2.4 billion. This shift is tied to mounting regulatory reporting pressure, labor constraints in legal services, and wider acceptance of cloud based document automation. After this transition, the curve remains steeper through 2035 as demand advances toward USD 3.0 billion. Post inflection growth reflects broader deployment across mid-sized enterprises, local government bodies, and compliance driven industries. Vendor strategies shift toward workflow integration, Japanese language optimization, and direct partnerships with domestic IT service firms to capture this structurally higher demand phase.

Under the half-decade weighted growth lens, the 2020–2025 block carries a relatively lighter weight in total value creation. Demand rises from USD 1.3 billion in 2020 to USD 1.7 billion in 2025, adding USD 0.4 billion over five years. This block reflects early institutional adoption led by large law firms and corporate legal departments experimenting with contract management, e-discovery, and compliance automation. Annual additions remain narrow at about USD 0.1 billion, which keeps the weighted contribution of this block limited despite its strategic importance. Growth during this phase is capability-led rather than volume-led, forming the base layer of the long-term value curve.

The 2025–2030 block carries a heavier growth weight as demand expands from USD 1.7 billion to USD 2.3 billion, adding USD 0.6 billion. This half-decade marks the acceleration zone where LegalTech platforms move beyond pilot usage into standardized procurement across mid-size enterprises and regulated industries. From 2030-2035, the weighted contribution becomes strongest, with demand rising from USD 2.3 billion to USD 3.0 billion, adding USD 0.7 billion. This final block dominates total value creation, driven by litigation workflow automation, AI-driven document review, and regulatory reporting digitization. The weighted structure shows that most absolute value is back-loaded into the final five-year window rather than evenly distributed.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 1.7 billion |

| Forecast Value (2035) | USD 3.0 billion |

| Forecast CAGR (2025–2035) | 5.7% |

Demand for LegalTech in Japan developed slowly at first due to conservative legal workflows, paper based documentation, and strict professional boundaries within law firms and corporate legal teams. Historically, adoption was driven by large corporations managing growing volumes of contracts, compliance files, and internal governance records. Rising cross border trade created pressure for bilingual contract handling and faster review cycles. At the same time, Japan faced a widening gap between legal workload and available legal staff, which made manual review difficult to sustain. Courts and regulators also began accepting digital filings and electronic records, which reduced dependence on physical documentation. These structural shifts pushed early adoption in contract management, document storage, and basic compliance tracking systems.

Future demand for LegalTech in Japan will be shaped by deeper operational needs rather than simple digitisation. Legal departments increasingly require tools for real time contract risk monitoring, automated clause analysis, litigation data management, and regulatory reporting under stricter corporate governance rules. Workforce constraints will intensify as the legal profession ages, increasing reliance on automation for routine review and documentation. Data security, audit trails, and internal control systems will become core buying criteria. Growth will also come from small and mid-sized enterprises that previously relied on manual outsourcing. Rather than replacing lawyers, LegalTech adoption will centre on controlling cost, reducing turnaround time, and managing risk in complex commercial environments.

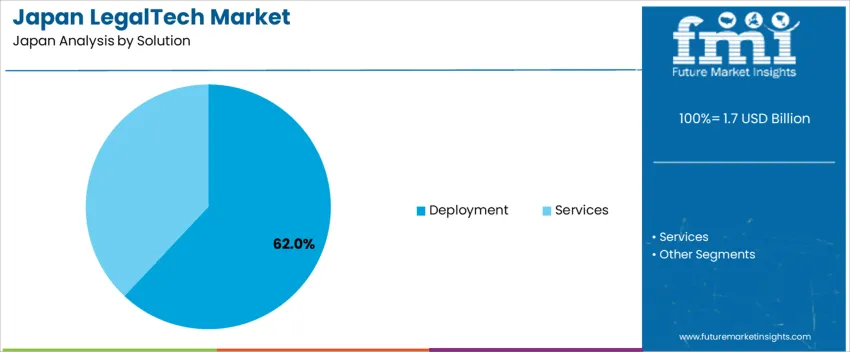

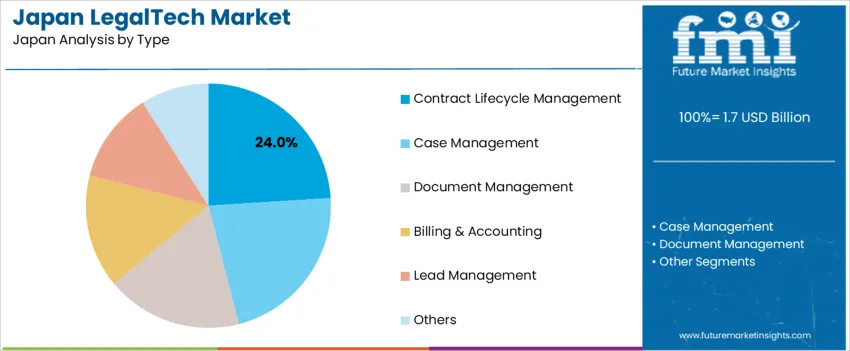

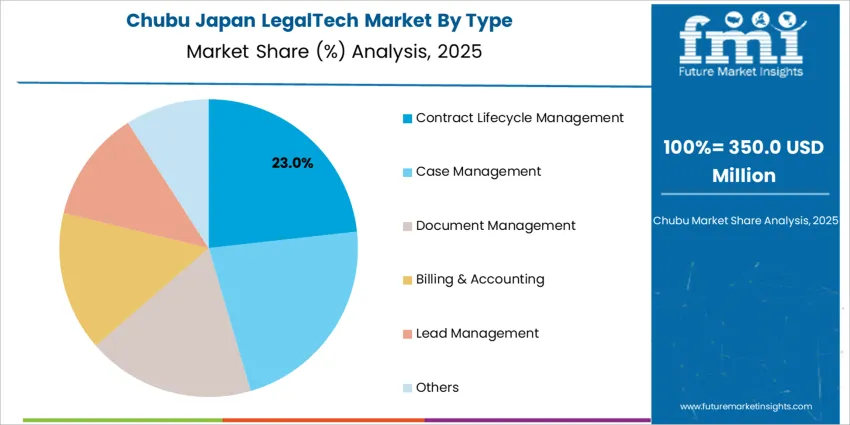

The demand for LegalTech in Japan is shaped by solution format and functional type. Deployment based solutions account for 62% of total demand, while services address implementation, customization, and support needs. By type, contract lifecycle management holds a 24% share, followed by case management, document management, billing and accounting, lead management, and other software categories. Adoption is guided by regulatory compliance requirements, law firm digitization levels, corporate legal department workloads, and data security standards. These segments reflect how workflow automation priorities and software delivery preferences influence procurement across private law practices, in house legal teams, and compliance driven enterprises nationwide.

Deployment based LegalTech solutions account for 62% of total demand in Japan, reflecting the preference for direct software ownership and system control. Law firms and corporate legal departments rely on deployment models to manage sensitive client data within secure internal infrastructures. This approach supports compliance with strict data privacy and cybersecurity standards applied across financial, healthcare, and corporate governance sectors. Deployment solutions allow full customization of access controls, workflow routing, and document permission structures based on internal operational policies.

Long term cost stability also supports deployment preference. One time licensing and predictable maintenance spending offer budget visibility for firms managing multiyear digital transformation programs. Integration with existing enterprise resource planning and document storage systems can be executed without dependency on external service uptime. These operational and regulatory advantages reinforce deployment as the dominant LegalTech solution format across large law firms and regulated corporate legal departments in Japan.

Contract lifecycle management accounts for 24% of total LegalTech demand in Japan, making it the leading software type. This position reflects rising transaction volumes across corporate procurement, supply chain contracting, and compliance reporting. Automated contract drafting, approval routing, version tracking, and renewal alerts reduce administrative burdens across legal teams handling high document flow. Contract management systems also support audit readiness through centralized recordkeeping and timestamped revision histories.

Cross departmental reliance on contracts further drives adoption. Procurement, finance, and operations teams require real time visibility into contractual obligations, payment milestones, and risk exposures. Integration with billing, accounting, and enterprise databases strengthens data consistency across business units. Regulatory scrutiny in sectors such as manufacturing, pharmaceuticals, and financial services raises expectations for contract traceability. These compliance and efficiency pressures continue to position contract lifecycle management as the primary functional anchor of LegalTech deployment in Japan.

LegalTech demand in Japan is driven by internal operational strain rather than headline digital ambition. Corporate legal departments face rising contract volumes tied to supplier networks, data-privacy compliance, and cross-border transactions. At the same time, the supply of junior legal staff is tightening, which forces firms to automate routine review and documentation work. Remote work practices introduced in recent years remain embedded in many firms, making cloud-based legal platforms more practical than physical document handling. Pressure from finance teams for faster compliance reporting also accelerates LegalTech use across manufacturing, finance, and export-driven businesses.

LegalTech expansion in Japan remains restrained by conservative risk culture and sensitivity around legal judgment automation. Many senior lawyers continue to rely on paper-based verification and manual review for litigation, regulatory filings, and arbitration work. Client confidentiality expectations create resistance to third-party cloud platforms, especially in regulated sectors such as finance and pharmaceuticals. Procurement cycles in law firms are slow and consensus-driven, which delays technology approval. Smaller firms often lack internal IT teams capable of vendor evaluation and system integration. These structural and cultural limits slow LegalTech diffusion despite visible efficiency gains.

LegalTech adoption in Japan is shifting steadily from basic document storage toward full workflow control. Contract lifecycle management now anchors many platforms, followed by compliance tracking and internal approval automation. AI-assisted review tools are used mainly for preliminary screening rather than final legal judgment. Systems increasingly integrate with accounting and procurement platforms to support audit readiness and cost attribution. Bilingual contract tools support growing overseas exposure among mid-sized Japanese firms. Product design emphasizes security, long-term data retention, and regulatory traceability rather than rapid feature upgrades. This evolution reflects Japans preference for layered, enterprise-grade digital infrastructure.

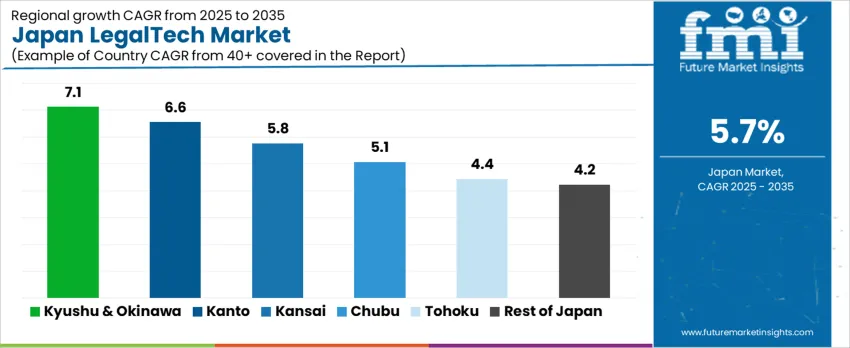

| Region | Assumed CAGR (%)* |

|---|---|

| Kyushu & Okinawa | 7.1 |

| Kanto | 6.6 |

| Kinki | 5.8 |

| Chubu | 5.1 |

| Tohoku | 4.4 |

| Rest of Japan | 4.2 |

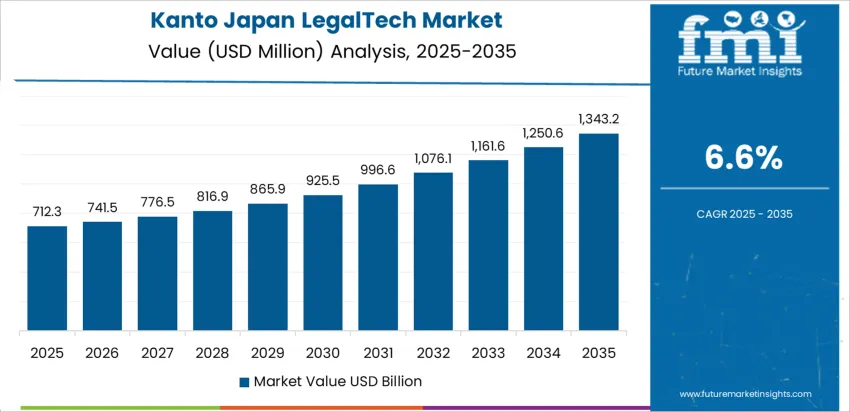

The demand for LegalTech in Japan is rising across regions, with the strongest growth in Kyushu & Okinawa at around 7.1 %. This likely reflects increasing adoption of digital legal solutions and demand for contract-management, legal research, and compliance tools even outside major urban centers. In the Kanto region the 6.6 % rate builds on a dense concentration of corporations, law firms, and regulatory-driven demand for legal efficiencies. Kinki, Chubu and other industrially active regions showing 5.8 %, 5.1 %, and 4.4 % respectively are gradually integrating LegalTech for corporate and commercial legal needs. The lower 4.2 % in Rest of Japan may reflect slower uptake due to limited access, smaller legal markets and lower digital infrastructure penetration. Overall this regional distribution suggests LegalTech growth correlates with corporate density, regulatory complexity, and regional economic activity.

Expansion across Kyushu and Okinawa reflects a CAGR of 7.1% through 2035 for LegalTech demand, supported by rising digital adoption among regional law firms, corporate legal departments, and local government offices. Small and mid sized enterprises increasingly rely on contract management and compliance automation to reduce administrative burden. Tourism, logistics, and cross border trade activity strengthen demand for digital documentation platforms. Cloud based legal software gains share due to limited in house IT staffing. Growth remains structured around workflow digitization rather than advanced analytics, supporting steady subscription based platform deployment across regional professional service networks.

Kanto advances at a CAGR of 6.6% through 2035 for LegalTech demand, driven by Japans largest concentration of law firms, financial institutions, and multinational corporate legal teams. Tokyo based enterprises prioritize e discovery, compliance automation, and regulatory monitoring platforms. Venture funding and software development activity reinforce local platform availability. Large scale litigation management and data security requirements sustain enterprise level deployments. High regulatory workload across finance, real estate, and technology sectors drives continuous platform expansion. Demand reflects enterprise productivity optimization rather than small firm digitization alone within the metropolitan legal services ecosystem.

Kinki records a CAGR of 5.8% through 2035 for LegalTech demand, supported by strong manufacturing, commercial services, and regional headquarters activity in Osaka. Contract lifecycle management, document automation, and internal compliance tools remain core applications. Export oriented manufacturers adopt legal software to manage supplier agreements and regulatory filings. Local law firms expand digital client intake and case management systems. Adoption growth remains methodical due to conservative procurement cycles, yet steady corporate usage sustains reliable revenue flow for domestic LegalTech software providers serving Kansai based professional service markets.

Chubu expands at a CAGR of 5.1% through 2035 for LegalTech demand, shaped by automotive manufacturing, supplier contracting, and regional commercial litigation activity. Legal departments within industrial firms increasingly use digital tools for contract standardization and dispute tracking. Supplier onboarding and compliance audits drive software integration into procurement workflows. Regional law practices adopt cloud based document review systems to manage rising transaction volumes. Platform adoption focuses on operational efficiency rather than litigation scale analytics, aligning demand with steady industrial legal workloads concentrated around manufacturing driven business activity.

Tohoku shows a CAGR of 4.4% through 2035 for LegalTech demand, supported by gradual digitization of municipal legal services, agricultural cooperatives, and regional businesses. Contract documentation, land ownership records, and regulatory reporting remain primary use cases. Smaller law firms adopt digital case filing to manage resource constraints. Adoption remains slower than metropolitan regions due to lower transaction density. Growth is driven by administrative efficiency rather than litigation complexity. Demand remains focused on basic document automation and records management solutions rather than full scale enterprise legal platforms.

The rest of Japan reflects a CAGR of 4.2% through 2035 for LegalTech demand, supported by scattered SME legal operations, municipal governance digitization, and routine compliance management. Demand concentrates on affordable SaaS platforms offering document storage, digital signatures, and basic legal workflow automation. Limited access to specialized legal IT vendors shapes conservative adoption behavior. Growth depends on regulatory reporting obligations and public sector digitization programs rather than private litigation volume. Platform selection favors cost control, data localization, and vendor stability across secondary cities and rural prefectures.

The market for legal technology in Japan is expanding as law firms, corporate legal departments, and in house counsel face growing workloads, a tight supply of legal professionals, and increasing demand for efficiency. Automation of legal research, contract review, compliance monitoring, and document management helps address manpower constraints and rising complexity of regulation. Digital transformation in the broader services sector is encouraging adoption of cloud based tools and AI powered software that streamline workflows. The shift toward e contracting, remote work, and cross border legal operations increases need for scalable, reliable legal software. For 2024, the legal tech market in Japan is estimated at USD 1,016.7 million and is projected to reach USD 1,998.8 million by 2030, corresponding to a growth rate of 12.4% per annum.

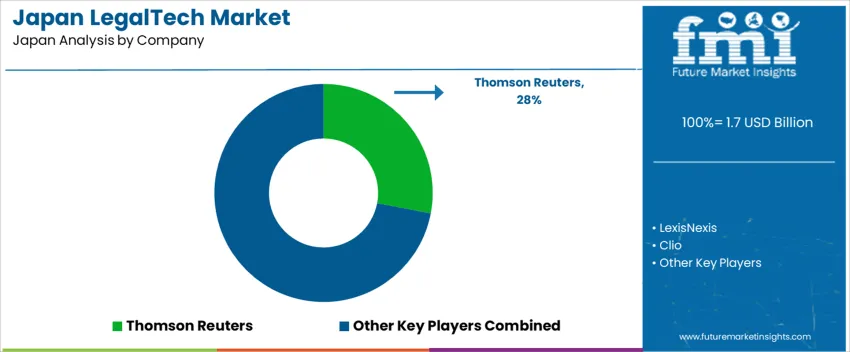

Leading providers such as Thomson Reuters, LexisNexis, Clio, Relativity, and DocuSign play central roles in shaping adoption and standards in Japan. Thomson Reuters holds one of the largest global shares of legal tech revenue, offering comprehensive legal research, document automation, and contract management tools. LexisNexis delivers legal research and compliance solutions widely used by law firms and corporate legal teams. Clio supplies practice management and case management software aimed at small to mid sized firms seeking streamlined operations. Relativity provides e discovery and document review platforms suited for litigation and regulatory work. DocuSign offers e signature and contract lifecycle management systems that support the growing e contract and remote work environment. These firms influence the market by establishing standards for legal workflows, enabling cloud deployment, and fostering digital workflows across legal and corporate sectors.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Solution | Deployment, Services |

| Type | Contract Lifecycle Management, Case Management, Document Management, Billing & Accounting, Lead Management, Others |

| End-user | Law Firms, Corporate Legal Departments |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Thomson Reuters, LexisNexis, Clio, Relativity, DocuSign |

| Additional Attributes | Dollar by sales by solution type and functional category; regional CAGR and adoption rate; deployment vs service solution penetration; leading software type (contract lifecycle management) adoption; SME vs large enterprise uptake; law firm vs corporate legal department usage patterns; cloud vs on-premises adoption; AI-assisted document review and e-discovery integration; regulatory and compliance-driven purchasing trends; subscription vs license model adoption; platform integration with ERP, procurement, and accounting systems; bilingual/legal language support adoption; workflow automation trends and digital transformation impact across regional legal ecosystems. |

The demand for legaltech in Japan is estimated to be valued at USD 1.7 billion in 2025.

The market size for the legaltech in Japan is projected to reach USD 3.0 billion by 2035.

The demand for legaltech in Japan is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in legaltech in Japan are deployment and services.

In terms of type, contract lifecycle management segment is expected to command 24.0% share in the legaltech in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA