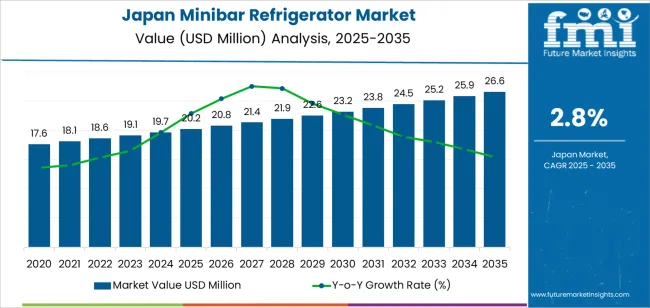

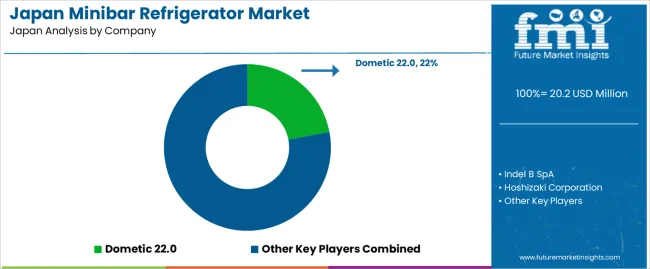

The Japan minibar refrigerator demand is valued at USD 20.2 million in 2025 and is projected to reach USD 26.6 million by 2035, reflecting a CAGR of 2.8%. Demand is driven by sustained procurement from hotels, serviced apartments, business lounges, and premium hospitality facilities. Growth is also influenced by refurbishment cycles, standardization of guest amenities, and increased adoption of compact refrigeration units in office suites, hospital rooms, and small commercial spaces. Energy-efficiency requirements and noise-reduction expectations further shape purchasing decisions.

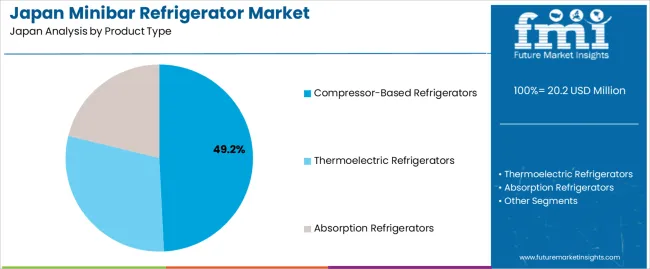

Compressor-based refrigerators lead the product landscape. These units are preferred for reliable cooling performance, faster temperature recovery, and stable operation under varied ambient conditions. Their durability, compatibility with different installation layouts, and lower operating costs across extended usage periods support continued selection by hospitality operators and facility managers.

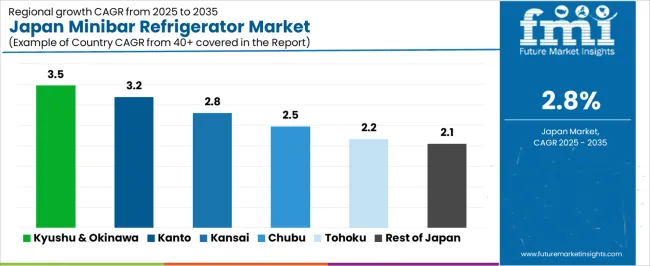

Kyushu & Okinawa, Kanto, and Kinki account for the highest utilisation levels due to the dense concentration of hotels, tourism establishments, and commercial facilities. These regions also maintain robust distribution networks, service teams, and equipment-maintenance providers that support uninterrupted deployment across hospitality and institutional environments.

Key suppliers include Dometic, Indel B SpA, Hoshizaki Corporation, Panasonic, and Haier Japan. These companies offer compressor-based minibar units and absorption-type alternatives designed for hotel rooms, cruise cabins, office suites, and other compact-space applications.

The early growth curve for Japan’s minibar-refrigerator segment reflects steady but modest expansion driven by predictable demand from hotels, business accommodation, and hospitality refurbishments. Early-period growth is supported by cyclical replacement of older units, incremental upgrades toward quieter and more energy-efficient models, and consistent procurement linked to hotel renovation schedules. Adoption patterns in this phase are uniform because purchasing decisions follow planned maintenance cycles rather than rapid shifts in technology or consumer preference.

The late growth curve shows a more restrained trajectory as the segment approaches maturity. Most commercial properties already operate with established minibar infrastructure, which limits the scope for large-scale expansion. Late-period gains primarily come from selective upgrades to compact, low-noise, or energy-rated units, with demand tied to operational efficiency rather than expansion of installed capacity. Growth becomes more uniform as replacement intervals lengthen and procurement focuses on incremental performance improvements rather than major product transitions. The comparison shows that early growth is slightly more active due to refurbishment activity, while late-stage growth reflects a stable, mature segment shaped by predictable replacement cycles across Japan’s hospitality sector.

| Metric | Value |

|---|---|

| Japan Minibar Refrigerator Sales Value (2025) | USD 20.2 million |

| Japan Minibar Refrigerator Forecast Value (2035) | USD 26.6 million |

| Japan Minibar Refrigerator Forecast CAGR (2025 to 2035) | 2.8% |

Demand for minibar refrigerators in Japan is increasing because hotels, business accommodations and serviced apartments require compact refrigeration units that support guest convenience and efficient room layouts. Growth in domestic travel, short-stay business trips and inbound tourism encourages facilities to upgrade appliances that meet noise, energy and safety standards. Manufacturers offer compact, low-vibration and energy-efficient models suited for small rooms, which aligns with Japan’s emphasis on space optimization.

Minibar units are also used in offices, clinics and shared workspaces where compact cooling supports staff use without occupying large floor areas. Rising interest in premium hospitality services, including in-room beverages and convenience items, supports continued procurement. Constraints include higher cost of energy-efficient compressor and absorption models, limited installation space in older buildings and ongoing pressure in the hospitality sector to reduce operating expenses. Some operators postpone replacement cycles until occupancy levels justify investment.

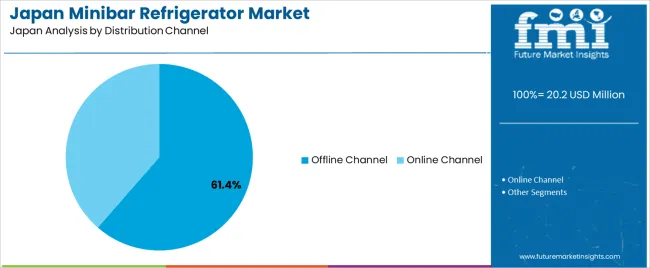

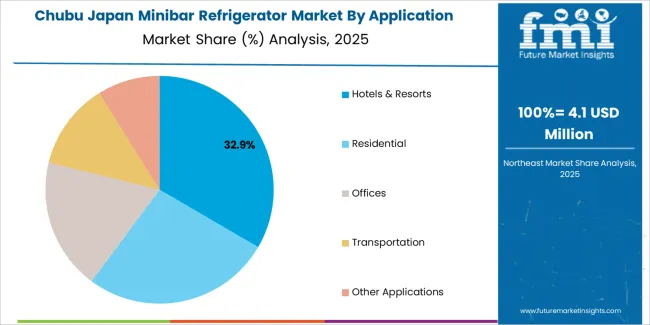

Demand for minibar refrigerators in Japan reflects usage across hospitality settings, residential environments, transportation services, and office spaces. Product selection depends on cooling method, noise levels, energy efficiency, and installation constraints. Application preferences demonstrate how Japanese hotels, households, and commercial facilities integrate compact refrigeration into guest rooms, small kitchens, workspaces, and mobile environments. Distribution channels show how consumers and institutions purchase minibar units through offline appliance retailers or online platforms.

Compressor-based refrigerators hold 49.2% of national demand and represent the leading product type in Japan. These units support rapid cooling, temperature consistency, and stable operation in hotel rooms, offices, and homes. Thermoelectric refrigerators account for 29.6%, offering quieter performance suitable for bedrooms or small accommodation spaces, though with lower cooling intensity. Absorption refrigerators represent 21.2%, providing silent operation and suitability for settings requiring noise minimization. Product-type distribution reflects Japanese preferences for reliability, cooling performance, and compatibility with compact interior layouts in hospitality and residential environments.

Key drivers and attributes:

Hotels and resorts hold 34.5% of national demand and represent the leading application category. Minibar refrigerators support guest-room convenience, beverage storage, and premium room amenities. Residential use accounts for 26.3%, with compact refrigerators placed in small apartments, shared rooms, or personal spaces. Offices represent 18.4%, where units support employee convenience and small-scale refreshment storage. Transportation applications hold 12.1%, covering minibars installed in long-distance buses, ferries, and specialty transport services. Other applications account for 8.7%, including institutional and recreational settings. Application distribution reflects Japan’s hospitality standards, compact living arrangements, and workplace refreshment needs.

Key drivers and attributes:

Offline channels hold 61.4% of national demand and represent the primary purchasing route for minibar refrigerators in Japan. Appliance stores, commercial suppliers, and hospitality-equipment distributors support in-person evaluation and installation planning. Online channels account for 38.6%, used by households and small offices for direct delivery and wide product selection. Channel distribution reflects Japan’s preference for physical evaluation of appliance size, noise level, and build quality, especially within hotels and commercial facilities that require coordinated installation. Online adoption continues to expand due to convenience and broader visibility of compact refrigerator options.

Key drivers and attributes:

Growth of business hotels, refurbishment of regional lodging facilities and rising demand for compact appliances in small apartments are driving demand.

In Japan, minibar refrigerator demand increases as business hotels in Tokyo, Osaka and Fukuoka continue upgrading guest rooms to meet expectations for in-room beverage cooling. Many ryokan and regional hotels undergoing refurbishment add compact refrigerators to align with tourism standards supported by local prefectural tourism grants. Urban housing trends, especially studio and one-room apartments popular among students and single professionals, create steady demand for compact refrigerators that fit limited floor space. Electronics retailers in Japan also promote small-capacity appliances for rental housing, reinforcing consistent sales across high-density metropolitan areas.

High energy-efficiency expectations, limited installation space in older buildings and slower replacement cycles restrain adoption.

Japanese consumers and hotel operators closely evaluate electricity consumption due to long-term utility costs, which can limit purchases of lower-efficiency minibar units. Many older guesthouses and rental properties have small cabinetry layouts or limited electrical outlets, making installation of new refrigerators more challenging. Replacement cycles for small appliances in Japan tend to be long because users maintain appliances carefully and avoid disposal unless necessary. These factors moderate rapid expansion of minibar refrigerator sales despite strong interest from newer facilities.

Shift toward energy-saving inverter models, increased adoption of ultra-quiet units and broader use in non-hospitality applications define key trends.

Manufacturers in Japan are expanding energy-saving minibar models with inverter technology to meet household and hotel efficiency requirements. Ultra-quiet units are gaining popularity in both hotels and small apartments where noise reduction is valued. Convenience stores, coworking spaces and capsule hotels increasingly use compact refrigerators to provide shared chilled storage for beverages or guest amenities. Some offices and clinics adopt small refrigerators to support employee refreshment areas without allocating space for full-sized units. These trends reflect diversified usage patterns and steady, incremental growth for minibar refrigerators in Japan.

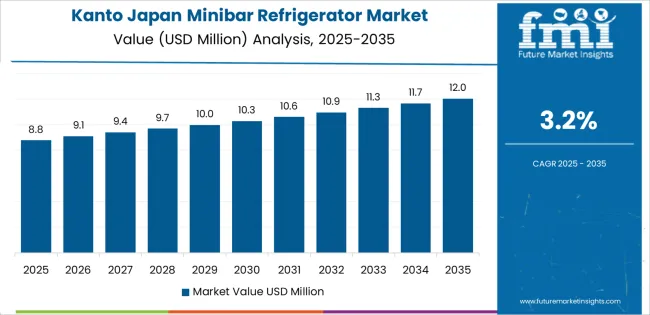

Demand for minibar refrigerators in Japan is increasing through 2035 as hotels, business inns, ryokan properties, serviced apartments, and institutional lodging facilities upgrade room amenities and improve energy efficiency. Compact refrigeration units support guest convenience, beverage storage, and standardized hospitality service levels. Adoption patterns vary according to regional tourism flows, accommodation density, renovation cycles, and the scale of business-travel activity. Local manufacturers and distributors supply energy-efficient, low-noise, and compact-format minibar units suited to Japan’s room-size constraints. Kyushu & Okinawa leads at 3.5%, followed by Kanto (3.2%), Kinki (2.8%), Chubu (2.5%), Tohoku (2.2%), and Rest of Japan (2.1%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 3.5% |

| Kanto | 3.2% |

| Kinki | 2.8% |

| Chubu | 2.5% |

| Tohoku | 2.2% |

| Rest of Japan | 2.1% |

Kyushu & Okinawa grows at 3.5% CAGR, supported by strong tourism flows, extensive hotel networks, and hospitality modernization across Fukuoka, Kumamoto, Nagasaki, Kagoshima, and Okinawa. Resort and business hotels in Fukuoka and Okinawa frequently upgrade minibar units to maintain guest-room standards, reduce energy consumption, and enhance room amenities. Ryokan accommodations adopt compact low-noise refrigerators to match traditional room layouts while meeting guest expectations for beverage storage. Property renovation cycles in major tourism areas increase procurement of energy-efficient units. Local distributors supply models optimized for small rooms and island-region electricity-cost considerations. Institutional lodging facilities use minibar units for visitor rooms in training centers and public-sector accommodations.

Kanto grows at 3.2% CAGR, driven by dense hotel concentrations, business-travel activity, and frequent refurbishment cycles across Tokyo, Kanagawa, Chiba, Saitama, and Ibaraki. Urban hotels upgrade minibar refrigerators to meet consistent guest expectations, emphasizing quiet operation, compact dimensions, and low energy usage. Business hotels near major transit hubs require high-volume procurement to support standardized room formats. Serviced apartments in Tokyo and Kanagawa adopt minibar units for short-stay guests who need small-format cooling solutions. Retail and commercial properties offering visitor suites integrate compact refrigerators in private rooms. Regional distributors supply multiple capacity formats aligned with metropolitan space constraints.

Kinki grows at 2.8% CAGR, supported by tourism centers, convention districts, and varied accommodation formats across Osaka, Kyoto, Hyogo, Nara, Wakayama, and Shiga. Osaka’s business hotels and convention-area properties require frequent room upgrades, including minibar replacements. Kyoto’s ryokan and boutique hotels adopt quiet, compact refrigerators suited to traditional interior layouts. Hyogo’s coastal resorts maintain minibar units across guest suites and premium rooms. Regional distributors provide energy-efficient models designed for compact hotel rooms common in urban districts. Renovation programs in Osaka and Kyoto promote adoption of low-consumption refrigerators that reduce operational costs.

Chubu grows at 2.5% CAGR, influenced by steady hotel development, manufacturing-region business travel, and tourism across Aichi, Shizuoka, Gifu, Mie, and Nagano. Business hotels in Aichi procure minibar units to maintain consistent amenity standards for corporate travelers. Shizuoka and Nagano tourism centers adopt compact refrigerators for guest rooms in resorts and lodges, particularly in areas serving seasonal visitors. Ryokan properties across Gifu and Mie integrate low-noise minibar units that suit traditional layouts. Regional distributors supply durable, energy-efficient models that meet long operational cycles in mid-range hotels.

Tohoku grows at 2.2% CAGR, shaped by regional tourism, public-sector lodging facilities, and moderate hotel-upgrade cycles across Miyagi, Aomori, Fukushima, Akita, Iwate, and Yamagata. Hotels adopt minibar refrigerators to improve guestroom consistency and support beverage storage in compact spaces. Public lodging facilities, including training centers and municipal accommodations, maintain steady procurement. Tourism operators upgrade room amenities in onsen towns and scenic-area resorts. Smaller ryokan facilities adopt compact units aligned with traditional interior constraints and energy-efficiency considerations.

Rest of Japan grows at 2.1% CAGR, supported by small hotel clusters, regional inns, and community-level lodging facilities across prefectures outside major tourism and metropolitan areas. Local hotels adopt minibar refrigerators during periodic renovation cycles. Community inns integrate compact refrigerators to maintain basic guest-room standards. Municipal accommodation centers and training facilities use small refrigerators for visitor rooms. Retail distributors offer entry-level and mid-range models suited to smaller properties with modest budgets.

Dometic holds an estimated 22.0% share, supported by controlled absorption-cooling technology, silent-operation units, and extensive deployment across business hotels and premium properties. The company maintains stable service access and long-standing relationships with Japanese hospitality groups. Indel B SpA contributes steady demand through compressor-based and absorption minibars distributed via authorized Japanese partners, offering reliable temperature stability and compact formats suited to limited room spaces.

Hoshizaki Corporation, a major domestic supplier of commercial refrigeration, holds strong presence with compact hotel refrigerators characterized by dependable cooling performance, low-noise output, and nationwide service coverage. Its integration with Japanese hotel chains positions it as a core domestic competitor. Panasonic supports additional demand through compact refrigerator units used in business hotels and serviced apartments, emphasizing stable energy performance and consistent quality standards.

Haier Japan maintains a role with cost-efficient compact refrigerators selected by mid-scale hotels and accommodation facilities requiring reliable basic cooling. Competition in Japan centers on noise control, energy efficiency, cooling stability, durability, and access to domestic service networks. Demand remains steady as hotels prioritize low-noise, compact, and energy-reliable minibar units suited to dense urban accommodation settings.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Product Type | Compressor-Based Refrigerators, Thermoelectric Refrigerators, Absorption Refrigerators |

| Application | Hotels & Resorts, Residential, Offices, Transportation, Other Applications |

| Distribution Channel | Offline Channel, Online Channel |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Dometic 22.0, Indel B SpA, Hoshizaki Corporation, Panasonic, Haier Japan |

| Additional Attributes | Dollar sales by product type, application, and distribution channel; regional demand patterns across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; competitive landscape of minibar refrigerator manufacturers and suppliers; developments in energy-efficient compressor designs, compact thermoelectric units, and low-maintenance absorption systems; integration with hospitality procurement, residential convenience solutions, office amenities, and in-transit refrigeration applications in Japan. |

The demand for minibar refrigerator in japan is estimated to be valued at USD 20.2 million in 2025.

The market size for the minibar refrigerator in japan is projected to reach USD 26.6 million by 2035.

The demand for minibar refrigerator in japan is expected to grow at a 2.8% CAGR between 2025 and 2035.

The key product types in minibar refrigerator in japan are compressor-based refrigerators, thermoelectric refrigerators and absorption refrigerators.

In terms of application, hotels & resorts segment is expected to command 34.5% share in the minibar refrigerator in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Minibar Refrigerator Market by Product Type, Application, Distribution Channel, and Region 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Refrigerator Water Filter Market Growth & Trends 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA