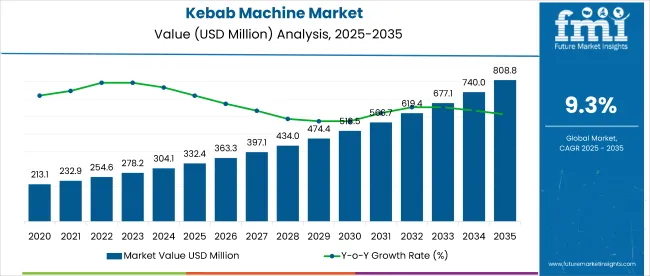

The global kebab machine market is projected to grow from USD 332.4 million in 2025 to USD 805.5 million by 2035, advancing at a CAGR of 9.3%. This robust expansion is being fuelled by the global rise in popularity of Middle Eastern, Mediterranean, and South Asian cuisines, especially in urban and fast-casual dining segments.

As restaurants and commercial kitchens increasingly prioritize speed, hygiene, and cooking consistency, the demand for specialized food machinery such as kebab machines is rising. Factors like urbanization, changing consumer eating habits, and the proliferation of street food outlets and takeaway services are contributing to this market’s momentum across Asia, Europe, and North America.

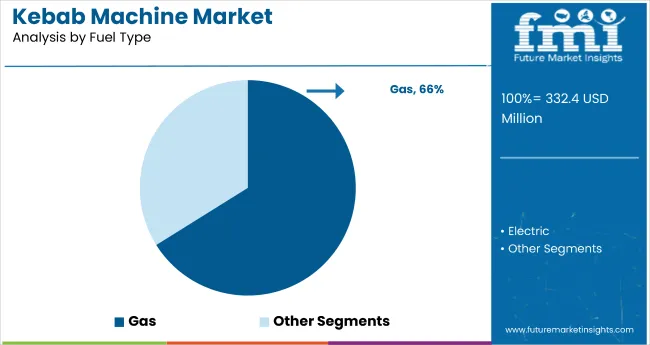

Gas-operated kebab machines will continue to lead the product landscape due to their clean-burning fuel, fast ignition, and affordable operational costs. In 2025, these machines are expected to maintain the highest market share, particularly in high-throughput environments such as street vendors, food courts, and quick-service restaurants.

Their superior heat control and efficiency make them ideal for fast-paced cooking operations. Although electric models are gaining adoption in regions with strict emissions regulations or where clean indoor cooking is essential, gas remains the preferred fuel type in traditional commercial kitchens.

| Attribute | Details |

|---|---|

| Kebab Machine Market Size Value in 2025 | USD 332.4 million |

| Kebab Machine Market Forecast Value in 2035 | USD 805.5 million |

| Kebab Machine Market CAGR Global Growth Rate (2025 to 2035) | 9.3% |

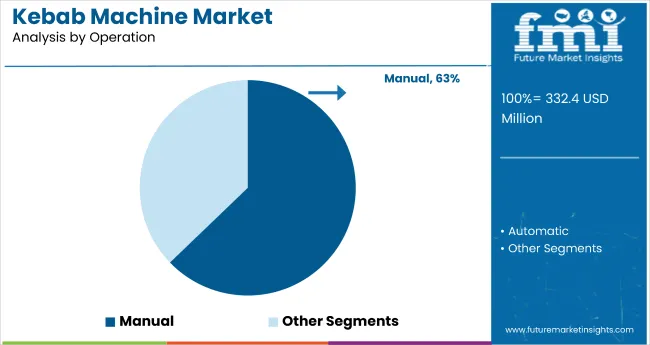

By operation type, manual kebab machines are anticipated to remain dominant, accounting for more than 60% of global sales in 2025. These machines are favored for the precision and control they offer in meat grilling, rotation, and searing-important in culinary settings where customization and consistency are key.

Manual models also appeal to small- and medium-sized food businesses seeking affordable and simple-to-maintain solutions. However, automatic and semi-automatic machines are witnessing growing demand in large commercial chains, institutional kitchens, and franchised fast-food outlets due to their labor-saving capabilities and standardized output.

Recent key developments are shaping the future of the kebab machine market. Manufacturers are integrating automation and AI-driven sensors into their products to optimize cooking performance and reduce human intervention. In 2025, hybrid models supporting both gas and electric operation were launched to cater to varying regional regulations and preferences.

Additionally, companies are introducing modular machines with detachable components for easier cleaning and compliance with food safety standards. Electric models are also advancing, offering cleaner cooking environments and improved energy efficiency, particularly in indoor settings.

The market features several prominent players driving innovation and competition. Key companies include Kebapchef, Lavna, Wellberg, GastroProdukt, Archway Kebab Machine, Fimar, Roller Grill, Empero, INOKSAN, and VIMITEX.

These firms are focused on expanding their product lines with durable, high-performance machines and targeting emerging markets through strategic partnerships and enhanced distribution networks. As automation, energy efficiency, and hygiene become critical purchase drivers, these players are investing in R&D and adopting smart technology to strengthen their global footprint and meet evolving customer expectations.

Europe’s appetite for döner and kebab has created a substantial installed base of vertical broilers, with country-level differences shaped by culinary culture, urban density, and vendor format. While per-shop machine counts vary, a consistent trend emerges: countries with mature fast food infrastructure show notably higher per-capita broiler density.

The Middle East has a high density of döner and shawarma outlets, reflecting a culinary tradition deeply embedded in daily food culture. While granular outlet counts are rare, country-level estimates and known chains support a clear hierarchy in concentration and machine density.

The gas-operated segment is expected to hold a dominant 66.1% share of the kebab machine market by 2025, making it the most preferred fuel type. Gas-powered kebab machines are favored for their quick ignition, consistent flame control, and efficient heating capabilities.

In many regions, especially in the USA and Middle Eastern countries, natural gas is abundantly available and more cost-effective than electricity. Consumers also prefer gas due to its dual compatibility-working seamlessly with both piped natural gas and bottled propane, depending on local utility systems. This adaptability makes it an attractive choice for commercial food service establishments.

Companies such as Roller Grill International and Mainho offer high-performance gas kebab machines designed for large-scale operations with minimal energy wastage. In fast-paced kitchen environments, quick heating and easy regulation make gas units more practical than electric alternatives

The manual operation segment is projected to account for 62.8% of the global kebab machine market by 2025, retaining its top position by automation level. Manual kebab machines are widely used in small and mid-sized eateries, food trucks, and quick-service restaurants due to their simplicity, durability, and cost-efficiency.

Unlike automatic machines that require complex electronics and maintenance, manual units offer reliable performance with minimal upkeep. Brands like Henny Penny, Potis, and Döner Robot are popular among restaurateurs for their manually operated models that provide high user control and customization in grilling. Operators often prefer manual systems for precise control over meat rotation and heat exposure, especially when preparing authentic kebabs with traditional methods.

These machines are also compact and portable, making them ideal for pop-up kitchens and mobile catering services. The rising number of small restaurants and street food vendors in emerging markets like India, Brazil, and Indonesia is further boosting demand for manual kebab machines.

The commercial segment is forecasted to hold a 69.4% share of the kebab machine market in 2025, driven by the rapid expansion of food service businesses globally. Commercial establishments-including quick-service restaurants, fast-casual chains, and independent food outlets-constitute the largest user base for kebab machines.

In developing economies such as India, China, Brazil, and Mexico, increasing urbanization and disposable income levels have led to greater demand for grilled and BBQ-style cuisines. Consumers, particularly working professionals, are opting to dine out more frequently on weekends and holidays, creating opportunities for commercial food chains to cater to this trend.

Leading brands like Hobart, Spinning Grillers, and Autodoner have tailored their commercial-grade kebab machines to meet high-output demands while ensuring energy efficiency and ease of operation. Additionally, innovations such as infrared burners and modular designs are helping restaurants enhance productivity and reduce cooking times.

By 2035, the kebab machines market is predicted to reach over USD 805.5 million. In the first half of 2025, the global kebab machine increased by 8.3%, which is the market share valued at USD 332.4 million Kebab Machine Market Also, in 2022 and 2018, the market share was valued at USD 254.9 Million and USD 185.3 Million. Though not equally distributed throughout all regions, this growth is stronger in developing markets, where it is predicted to reach at the end of 2025 by 9.3%.

Most kebab machines are made of porcelain-enameled cast iron, porcelain-enameled steel, and stainless steel. The lifespan of stainless steel is relatively higher than that of other materials. In contrast, the price is comparatively lower than that of other materials, which is what drives its popularity.

Depending on the type of material used in the construction of the kebab machine, manufacturers provide a one-to-ten-year warranty. High-end products are typically available with a lifetime burner warranty.

As a result of the growing consumption of street food and huge investments by key players in developing economies such as India and China, Asia Pacific is projected to grow at the fastest rate due to the growing consumption of street food. The regional market is also anticipated to grow at a rapid pace in the next few years as a result of the rise in demand for kebabs compared to hot dogs, hamburgers, and pizza in these countries.

It can be attributed mainly to the increase in disposable income that has been experienced in these countries, as well as the increase in urbanization. Additionally, there is a growing market for construction and a thriving hospitality sector that can account for the growth in the economy.

North America held the leading market share in the kebab machine market. Kebabs are part of the lifestyle in countries like the USA and Canada. Consumers prefer kebabs for most celebrations and festive occasions. Over 50% of North American consumers favor kababs for birthday parties, and 24% enjoy kebabs on camping trips. Companies are now investing in cutting-edge product development in order to boost their revenues in this highly competitive market.

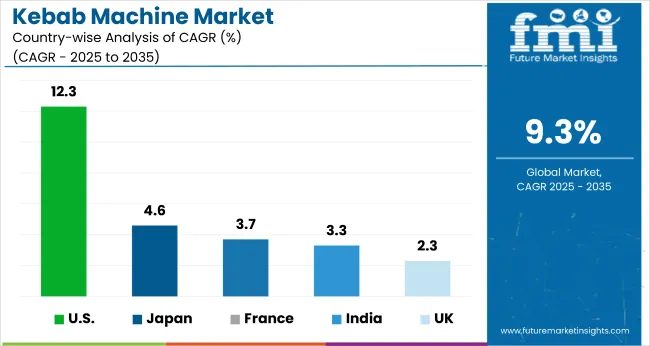

| Country | United States of America |

|---|---|

| Statistics | The kebab machine market in the USA currently holds the maximum number of shares and it is the leading country. It has registered a market share of 12.3%. |

| Growth Propellants | The expanding market shares can be attributed to:

|

| Country | United Kingdom |

|---|---|

| Statistics | Europe is identified to hold a significant market share in the kebab machine market. Currently, the UK is accountable for a market share of 2.3%. |

| Growth Propellants | Elements contributing to the growth of the market in the European region are:

|

| Country | Japan |

|---|---|

| Statistics | Japan is projected to advance at a rapid pace through the forecast period. The country is currently holding a market share of 4.6%. |

| Growth Propellants | Factors contributing to the growth of the kebab machine market in Japan are:

|

| Country | India |

|---|---|

| Statistics | The Indian kebab machine market is anticipated to advance at a slow pace and capture a market share of 3.3%. |

| Growth Propellants | The factors attributing to the growth of the market in India are:

|

Emerging Companies Add an Edge to the Kebab Machine Market Dynamics

New entrants to the kebab machine market are leveraging advances in technology to launch enhanced products and gain a competitive advantage through the introduction of enhanced products. Investing continuously in research and development activities keeps these firms up-to-date with consumer preferences as well as the end-use industry requirements in order to remain competitive. Efforts are being made to strengthen their foothold in the industry. This will enable them to increase their visibility within the kitchen equipment forum as well as help enhance the further development of the kebab machine.

Key players operating the global kebab machines market include

Key Developments for Kebab Machine Market

KING Kebab Machine - A range of professional kebab machines is available from GastroProdukt that include different types of machines that can be used to prepare large amounts of meat at the same time. It is an extremely versatile professional kebab maker that can serve a large number of customers at once.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 332.4 million |

| Projected Market Size (2035) | USD 805.5 million |

| CAGR (2025 to 2035) | 9.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and thousand units for volume |

| Fuel Types Analyzed (Segment 1) | Electric, Gas |

| Operation Types Analyzed (Segment 2) | Manual, Automatic |

| Applications Analyzed (Segment 3) | Commercial, Household |

| Sales Channels Analyzed (Segment 4) | Offline, Online |

| Regions Covered | North America; Latin America; Europe; East Asia; Middle East and Africa |

| Countries Covered | United States, Canada, Brazil, Germany, United Kingdom, France, Italy, China, Japan, India, South Korea, UAE, South Africa |

| Key Players influencing the Kebab Machine Market | Kebapchef, Lavna, Lazada, Wellberg, GastroProdukt |

| Additional Attributes | Dollar sales driven by expanding BBQ culture and restaurant demand, gas machines preferred for fuel versatility and operating efficiency, manual operation favored in developing economies for cost-effectiveness, rising commercial demand from fast-food and outdoor eateries, regional growth led by urban dining trends in Asia-Pacific and Latin America. |

| Customization and Pricing | Customization and Pricing Available on Request |

North America dominates the market for kebab machines.

The global kebab machines market is highly fragmented with the presence of various leading and emerging players including Kebapchef, Lavna, etc.

The kebab machine market is expected to reach a value of USD 332.4 million by 2025 end.

The kebab machine market is expected to increase at a CAGR of around 9.3% over the forecast period.

Table 01: Global Market Operation (US$ Million) and Volume (Units) Forecast By Fuel Type, 2018 to 2023

Table 02: Global Market Operation (US$ Million) and Volume (Units) Forecast By Operation, 2018 to 2023

Table 03: Global Market Operation (US$ Million) and Volume (Units) Forecast By Application, 2018 to 2023

Table 04: Global Market Operation (US$ Million) and Volume (Units) Forecast by Region, 2018 to 2023

Table 05: North America Market Operation (US$ Million) and Volume (Units) Forecast by Country, 2018 to 2023

Table 06: North America Market Operation (US$ Million) and Volume (Units) Forecast By Fuel Type, 2018 to 2023

Table 07: North America Market Operation (US$ Million) and Volume (Units) Forecast By Operation, 2018 to 2023

Table 08: North America Market Operation (US$ Million) and Volume (Units) Forecast By Application, 2018 to 2023

Table 09: Latin America Market Operation (US$ Million) and Volume (Units) Forecast by Country, 2018 to 2023

Table 10: Latin America Market Operation (US$ Million) and Volume (Units) Forecast By Fuel Type, 2018 to 2023

Table 11: Latin America Market Operation (US$ Million) and Volume (Units) Forecast By Operation, 2018 to 2023

Table 12: Latin America Market Operation (US$ Million) and Volume (Units) Forecast By Application, 2018 to 2023

Table 13: Europe Market Operation (US$ Million) and Volume (Units) Forecast by Country, 2018 to 2023

Table 14: Europe Market Operation (US$ Million) and Volume (Units) Forecast By Fuel Type, 2018 to 2023

Table 15: Europe Market Operation (US$ Million) and Volume (Units) Forecast By Operation, 2018 to 2023

Table 16: Europe Market Operation (US$ Million) and Volume (Units) Forecast By Application, 2018 to 2023

Table 17: South Asia & Pacific Market Operation (US$ Million) and Volume (Units) Forecast by Country, 2018 to 2023

Table 18: South Asia & Pacific Market Operation (US$ Million) and Volume (Units) Forecast By Fuel Type, 2018 to 2023

Table 19: South Asia & Pacific Market Operation (US$ Million) and Volume (Units) Forecast By Operation, 2018 to 2023

Table 20: South Asia & Pacific Market Operation (US$ Million) and Volume (Units) Forecast By Application, 2018 to 2023

Table 21: East Asia Market Operation (US$ Million) and Volume (Units) Forecast by Country, 2018 to 2023

Table 22: East Asia Market Operation (US$ Million) and Volume (Units) Forecast By Fuel Type, 2018 to 2023

Table 23: East Asia Market Operation (US$ Million) and Volume (Units) Forecast By Operation, 2018 to 2023

Table 24: East Asia Market Operation (US$ Million) and Volume (Units) Forecast By Application, 2018 to 2023

Table 25: Middle East & Africa Market Operation (US$ Million) and Volume (Units) Forecast by Country, 2018 to 2023

Table 26: Middle East & Africa Market Operation (US$ Million) and Volume (Units) Forecast By Fuel Type, 2018 to 2023

Table 27: Middle East & Africa Market Operation (US$ Million) and Volume (Units) Forecast By Operation, 2018 to 2023

Table 28: Middle East & Africa Market Operation (US$ Million) and Volume (Units) Forecast By Application, 2018 to 2023

Figure 01: Global Market Value (US$ Million) Historical Data and Forecast 2018 to 2023

Figure 02: Global Market Absolute $ Opportunity Analysis, 2018 to 2023

Figure 03: Global Market Historical Volume (Units) & Value (US$ Million), 2018 to 2022

Figure 04: Global Market Volume (Units) & Value (US$ Million) Forecast, 2023 to 2033

Figure 05: Global Market Volume (Units) Forecast by Region, 2023 to 2033

Figure 06: Global Market Share and BPS Analysis by Fuel Type, 2023 to 2033

Figure 07: Global Market Y-o-Y Growth by Fuel Type, 2023 to 2033

Figure 08: Global Market Attractiveness Analysis by Fuel Type, 2023 to 2033

Figure 09: Global Market Absolute $ Opportunity by Gas Segment, 2018 to 2023

Figure 10: Global Market Absolute $ Opportunity by Electric Segment, 2018 to 2023

Figure 11: Global Market Absolute $ Opportunity by Other Segment, 2018 to 2023

Figure 12: Global Market Share and BPS Analysis by Operation, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth by Operation, 2023 to 2033

Figure 14: Global Market Attractiveness Analysis by Operation, 2023 to 2033

Figure 15: Global Market Absolute $ Opportunity by Manual Segment, 2018 to 2023

Figure 16: Global Market Absolute $ Opportunity by Automatic Segment, 2018 to 2023

Figure 17: Global Market Share and BPS Analysis by Application, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth by Application, 2023 to 2033

Figure 19: Global Market Attractiveness Analysis by Application, 2023 to 2033

Figure 20: Global Market Absolute $ Opportunity by Chicken Segment, 2018 to 2023

Figure 21: Global Market Absolute $ Opportunity by Mutton Segment, 2018 to 2023

Figure 22: Global Market Absolute $ Opportunity by Beef Segment, 2018 to 2023

Figure 23: Global Market Absolute $ Opportunity by Others Segment, 2018 to 2023

Figure 24: Global Market Share and BPS Analysis by Region, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth by Region, 2023 to 2033

Figure 26: Global Market Attractiveness Analysis by Region, 2023 to 2033

Figure 27: Global Market Absolute $ Opportunity, 2018 to 2023

Figure 28: North America Market Share and BPS Analysis by Fuel Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth by Fuel Type, 2023 to 2033

Figure 30: North America Market Attractiveness Analysis by Fuel Type, 2023 to 2033

Figure 31: North America Market Share and BPS Analysis by Operation, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth by Operation, 2023 to 2033

Figure 33: North America Market Attractiveness Analysis by Operation, 2023 to 2033

Figure 34: North America Market Share and BPS Analysis by Application, 2023 to 2033

Figure 35: North America Market Y-o-Y Growth by Application, 2023 to 2033

Figure 36: North America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 37: North America Market Share and BPS Analysis by Country, 2023 to 2033

Figure 38: North America Market Y-o-Y Growth by Country, 2023 to 2033

Figure 39: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 40: North America Market Absolute $ Opportunity, 2018 to 2023

Figure 41: Latin America Market Share and BPS Analysis by Fuel Type, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth by Fuel Type, 2023 to 2033

Figure 43: Latin America Market Attractiveness Analysis by Fuel Type, 2023 to 2033

Figure 44: Latin America Market Share and BPS Analysis by Operation, 2023 to 2033

Figure 45: Latin America Market Y-o-Y Growth by Operation, 2023 to 2033

Figure 46: Latin America Market Attractiveness Analysis by Operation, 2023 to 2033

Figure 47: Latin America Market Share and BPS Analysis by Application, 2023 to 2033

Figure 48: Latin America Market Y-o-Y Growth by Application, 2023 to 2033

Figure 49: Latin America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 50: Latin America Market Share and BPS Analysis by Country, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth by Country, 2023 to 2033

Figure 52: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 53: Latin America Market Absolute $ Opportunity, 2018 to 2023

Figure 54: Europe Market Share and BPS Analysis by Fuel Type, 2023 to 2033

Figure 55: Europe Market Y-o-Y Growth by Fuel Type, 2023 to 2033

Figure 56: Europe Market Attractiveness Analysis by Fuel Type, 2023 to 2033

Figure 57: Europe Market Share and BPS Analysis by Operation, 2023 to 2033

Figure 58: Europe Market Y-o-Y Growth by Operation, 2023 to 2033

Figure 59: Europe Market Attractiveness Analysis by Operation, 2023 to 2033

Figure 60: Europe Market Share and BPS Analysis by Application, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth by Application, 2023 to 2033

Figure 62: Europe Market Attractiveness Analysis by Application, 2023 to 2033

Figure 63: Europe Market Share and BPS Analysis by Country, 2023 to 2033

Figure 64: Europe Market Y-o-Y Growth by Country, 2023 to 2033

Figure 65: Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 66: Europe Market Absolute $ Opportunity, 2018 to 2023

Figure 67: East Asia Market Y-o-Y Growth by Fuel Type, 2023 to 2033

Figure 68: East Asia Market Attractiveness Analysis by Fuel Type, 2023 to 2033

Figure 69: East Asia Market Share and BPS Analysis by Operation, 2023 to 2033

Figure 70: East Asia Market Y-o-Y Growth by Operation, 2023 to 2033

Figure 71: East Asia Market Attractiveness Analysis by Operation, 2023 to 2033

Figure 72: East Asia Market Share and BPS Analysis by Application, 2023 to 2033

Figure 73: East Asia Market Y-o-Y Growth by Application, 2023 to 2033

Figure 74: East Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 75: East Asia Market Share and BPS Analysis by Country, 2023 to 2033

Figure 76: East Asia Market Y-o-Y Growth by Country, 2023 to 2033

Figure 77: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 78: East Asia Market Absolute $ Opportunity, 2018 to 2023

Figure 79: South Asia & Pacific Market Share and BPS Analysis by Fuel Type, 2023 to 2033

Figure 80: South Asia & Pacific Market Y-o-Y Growth by Fuel Type, 2023 to 2033

Figure 81: South Asia & Pacific Market Attractiveness Analysis by Fuel Type, 2023 to 2033

Figure 82: South Asia & Pacific Market Share and BPS Analysis by Operation, 2023 to 2033

Figure 83: South Asia & Pacific Market Y-o-Y Growth by Operation, 2023 to 2033

Figure 84: South Asia & Pacific Market Attractiveness Analysis by Operation, 2023 to 2033

Figure 85: South Asia & Pacific Market Share and BPS Analysis by Application, 2023 to 2033

Figure 86: South Asia & Pacific Market Y-o-Y Growth by Application, 2023 to 2033

Figure 87: South Asia & Pacific Market Attractiveness Analysis by Application, 2023 to 2033

Figure 88: South Asia & Pacific Market Share and BPS Analysis by Country, 2023 to 2033

Figure 89: South Asia & Pacific Market Y-o-Y Growth by Country, 2023 to 2033

Figure 90: South Asia & Pacific Market Attractiveness Analysis by Country, 2023 to 2033

Figure 91: South Asia & Pacific Market Absolute $ Opportunity, 2018 to 2023

Figure 92: East Asia Market Share and BPS Analysis by Fuel Type, 2023 to 2033

Figure 93: Middle East & Africa Market Share and BPS Analysis by Fuel Type, 2023 to 2033

Figure 94: Middle East & Africa Market Y-o-Y Growth by Fuel Type, 2023 to 2033

Figure 95: Middle East & Africa Market Attractiveness Analysis by Fuel Type, 2023 to 2033

Figure 96: Middle East & Africa Market Share and BPS Analysis by Operation, 2023 to 2033

Figure 97: Middle East & Africa Market Y-o-Y Growth by Operation, 2023 to 2033

Figure 98: Middle East & Africa Market Attractiveness Analysis by Operation, 2023 to 2033

Figure 99: Middle East & Africa Market Share and BPS Analysis by Application, 2023 to 2033

Figure 100: Middle East & Africa Market Y-o-Y Growth by Application, 2023 to 2033

Figure 101: Middle East & Africa Market Attractiveness Analysis by Application, 2023 to 2033

Figure 102: Middle East & Africa Sodium Chloride Market Share and BPS Analysis by Country, 2023 to 2033

Figure 103: Middle East & Africa Sodium Chloride Market Y-o-Y Growth by Country, 2023 to 2033

Figure 104: Middle East & Africa Sodium Chloride Market Attractiveness Analysis by Country, 2023 to 2033

Figure 105: Middle East & Africa Market Absolute $ Opportunity, 2018 to 2023

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Kebab Machine Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Machine Tool Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Machine Tool Touch Probe Market Analysis - Size, Growth, and Forecast 2025 to 2035

Machine Mount Market Analysis - Size & Industry Trends 2025 to 2035

Machine Control System Market Growth – Trends & Forecast 2025 to 2035

Machine Automation Controller Market Growth – Trends & Forecast 2025 to 2035

Machine-to-Machine (M2M) Connections Market – IoT & Smart Devices 2025 to 2035

Machine Safety Market Analysis by Component, Industry, and Region Through 2035

Key Players & Market Share in Machine Glazed Paper Industry

Machine Vision Market Insights – Growth & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA