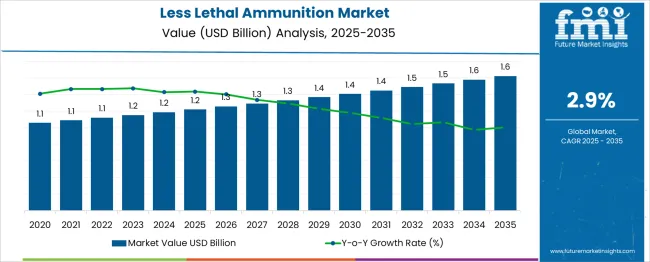

The Less Lethal Ammunition Market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 1.6 billion by 2035, registering a compound annual growth rate (CAGR) of 2.9% over the forecast period.

The less lethal ammunition market demonstrates a gradual and steady growth pattern across the decade, expanding from USD 1.1 billion in 2021 to USD 1.4 billion by 2030, delivering an absolute dollar opportunity of USD 0.3 billion over the period. This reflects a modest CAGR of around 2.6%, highlighting the market’s mature and specialized nature.

Yearly data illustrates consistent but slow increments: the market remains at USD 1.1 billion during 2021, 2022, and 2023, indicating a stable demand base in the early years, primarily driven by procurement cycles in law enforcement and security agencies. By 2024, the market reaches USD 1.2 billion, and continues to hover around this value through 2025 and 2026, reflecting limited expansion in traditional segments. The second half of the forecast period shows moderate upward movement as the market climbs to USD 1.3 billion between 2027 and 2029, eventually reaching USD 1.4 billion by 2030.

Growth is influenced by increasing demand for crowd control solutions, non-lethal riot management options, and global emphasis on reducing fatalities during law enforcement operations. Technological innovation in rubber bullets, bean bag rounds, and impact munitions also contributes to sustaining relevance in defense and homeland security sectors. However, growth remains restricted due to regulatory constraints, ethical concerns, and preference for alternative non-lethal deterrent technologies such as electric stun devices and acoustic systems.

Despite its moderate pace, the market retains strategic importance, especially in regions experiencing civil unrest and rising urban security needs. Manufacturers focusing on safer, compliance-oriented ammunition designs, combined with cost-effective production, are positioned to maintain market share as procurement budgets gradually expand during the forecast horizon.

| Metric | Value |

|---|---|

| Less Lethal Ammunition Market Estimated Value in (2025 E) | USD 1.2 billion |

| Less Lethal Ammunition Market Forecast Value in (2035 F) | USD 1.6 billion |

| Forecast CAGR (2025 to 2035) | 2.9% |

The less lethal ammunition market is witnessing sustained growth, supported by rising demand for non-lethal alternatives to conventional firearms in riot control, peacekeeping operations, and tactical law enforcement missions. Evolving policing standards, combined with increasing civilian protests and public demonstrations, have prompted law enforcement agencies across developed and emerging economies to expand their inventory of less lethal options.

This shift is being encouraged by international advocacy for human rights-compliant defense practices and growing scrutiny over the use of deadly force. Technological advancements in materials science and projectile design have improved the performance, accuracy, and safety of less lethal rounds, enabling better outcomes in high-pressure scenarios.

Military modernization programs and the procurement of dual-capacity response tools have supported the integration of these munitions into both domestic and cross-border operations. The global focus on de-escalation tactics and the rising need for tiered force response strategies are expected to contribute to consistent demand across multiple enforcement tiers in the forecast period.

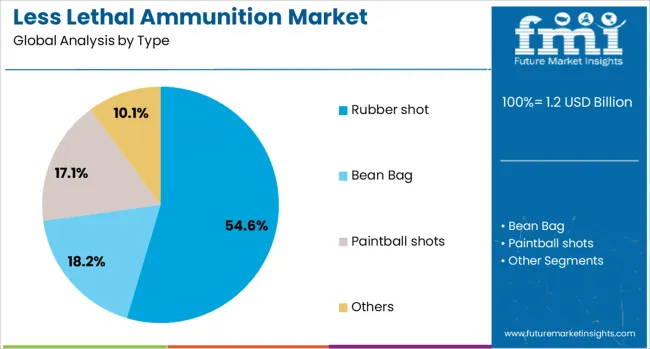

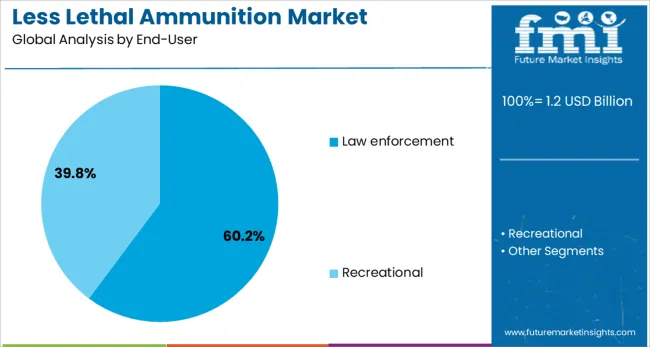

The less lethal ammunition market is segmented by type, end-user, and geographic regions. The less lethal ammunition market is divided by type into Rubber shot, Bean Bag, Paintball shots, and Others. In terms of end-users, the less lethal ammunition market is classified into Law enforcement and Recreational. Regionally, the less lethal ammunition industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The rubber shot segment is projected to account for 54.6% of the total revenue share in the less lethal ammunition market in 2025, establishing it as the dominant type. The prominence of this segment has been driven by its widespread use in riot control, crowd dispersion, and low-intensity conflict zones where non-lethal outcomes are mandated. Rubber shots are favored for their controlled impact and minimal penetration potential, making them suitable for short-range engagements without causing fatal injuries.

Enhanced safety characteristics and ease of deployment have made these projectiles a preferred choice among security forces and tactical response teams. The adaptability of rubber shots to a wide range of delivery platforms, including 12-gauge shotguns and launcher systems, has also contributed to their market leadership.

Recent innovations in aerodynamic stability and kinetic energy calibration have improved the precision and effectiveness of these rounds in diverse field conditions. Increasing training requirements and the emphasis on reducing civilian casualties during unrest have further positioned rubber shot munitions as a critical component in less-lethal defense strategies.

The law enforcement end-user segment is anticipated to capture 60.2% of the overall revenue share in the less lethal ammunition market in 2025, signifying its leading role in market demand. The growing emphasis on non-lethal crowd management tools and the institutional need for compliance with escalating public safety regulations has influenced this dominance. Law enforcement agencies are increasingly deploying less lethal munitions for protests, barricade clearance, and de-escalation scenarios to mitigate risks associated with the use of live ammunition.

The integration of less lethal training modules into police academies and tactical units has enhanced operational readiness and strategic usage. Additionally, expanding urban populations and the frequency of mass gatherings have necessitated scalable and safer crowd control mechanisms.

Governments and municipal authorities have increased their procurement budgets for non-lethal weapons, further reinforcing this trend. The adoption of body-worn camera evidence and stricter scrutiny of force levels has also incentivized police departments to shift toward non-lethal alternatives that ensure compliance, accountability, and proportional response.

Adoption of less lethal ammunition is increasing due to stricter security measures, large-scale government procurement, and the need for effective crowd control with minimal fatalities. Regulatory frameworks and training programs are reinforcing compliance, driving innovation in controlled-impact ammunition types.

Rising Deployment for Civil Security and Riot Control

Stricter public safety measures and crowd control protocols have influenced demand for less lethal ammunition. Law enforcement agencies are prioritizing non-lethal solutions to manage demonstrations without escalating violence. Rubber bullets, bean bag rounds, and tear gas shells have gained adoption in urban policing and border security operations. Their usage is encouraged to minimize fatalities while ensuring effective dispersal tactics.

Governments in several regions have placed large-scale procurement contracts, signaling long-term reliance on non-lethal solutions. Increased civilian unrest and organized protests have emphasized the necessity of advanced riot-control tools that avoid critical injuries yet maintain compliance with legal enforcement frameworks, strengthening the strategic importance of less lethal weapons in operational inventories.

Regulatory Policies and Tactical Training Emphasis

Governmental frameworks and international policing standards have reinforced the adoption of controlled-impact ammunition types. These guidelines mandate force proportionality, compelling agencies to choose weapon systems calibrated for specific threat levels. Procurement programs are pairing ammunition acquisition with tactical training initiatives to ensure operational accuracy and accountability.

Demand is influenced by the integration of specialized ammunition into crowd management protocols and correctional facility security. Product development is leaning toward kinetic energy rounds and chemical irritants optimized for compliance with evolving legal thresholds. This regulatory-driven approach indicates an environment where market expansion depends on policy adaptation, operational efficiency, and advanced formulation techniques that reduce permanent injury risks during enforcement scenarios.

Rising Demand for Crowd Control and Civil Unrest Management

The less lethal ammunition market is experiencing significant growth as governments and law enforcement agencies face increasing challenges in managing civil unrest, protests, and large-scale public gatherings. Countries are adopting strict protocols to minimize casualties, making less lethal options like rubber bullets, bean bag rounds, and sponge grenades a preferred choice for riot control.

This trend is further reinforced by international guidelines promoting the use of non-lethal force for maintaining order. High-profile events and political demonstrations in regions like North America, Europe, and parts of Asia have driven procurement initiatives, boosting demand for advanced impact and chemical ammunition solutions designed for controlled engagement and reduced injury risk.

Growing Demand for Tactical Versatility

Manufacturers are focusing on innovations that enhance accuracy, safety, and adaptability of less lethal ammunition across multiple operational environments. Developments include polymer-based rounds for reduced penetration risk, chemical irritant payloads for dispersal control, and marking projectiles for suspect identification. Integration of smart ballistics technology, which improves trajectory predictability and kinetic energy management, is gaining attention among defense contractors.

Customization for use with standard firearms and launchers is increasing the appeal of less lethal systems to law enforcement and military units. These advancements, combined with stringent regulations on use-of-force policies, position less lethal ammunition as a critical component in modern tactical operations, ensuring compliance with human rights standards while maintaining operational effectiveness.

| Country | CAGR |

|---|---|

| China | 3.9% |

| India | 3.6% |

| Germany | 3.3% |

| France | 3.0% |

| UK | 2.8% |

| USA | 2.5% |

| Brazil | 2.2% |

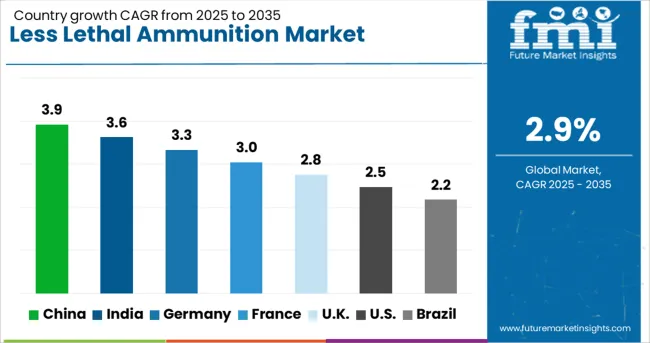

The less lethal ammunition industry, projected to expand at a global CAGR of 2.9% from 2025 to 2035, shows differing growth trends across major economies. A 3.9% CAGR is being recorded in China, a BRICS member, supported by large-scale law enforcement modernization and rising civil security operations.

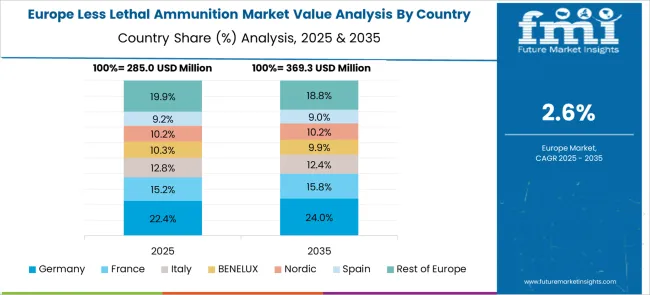

India, another BRICS nation, is showing a 3.6% CAGR as regional unrest and border control strategies elevate procurement programs for non-lethal solutions. Germany, part of the OECD, is reporting a 3.3% CAGR with steady adoption driven by regulatory compliance and advanced training protocols in public security forces.

Slower momentum is evident in the United Kingdom, an OECD economy, with a 2.8% CAGR due to mature defense procurement systems and preference for existing inventories. The United States, also an OECD member, is expected to grow at a 2.5% CAGR, driven by targeted usage in correctional facilities and specific crowd control programs. The industry outlook suggests that BRICS countries represent higher growth potential, while OECD nations maintain stable demand through regulatory-focused adoption and incremental modernization.

The report features in-depth coverage of more than 40 countries, with these five serving as references.

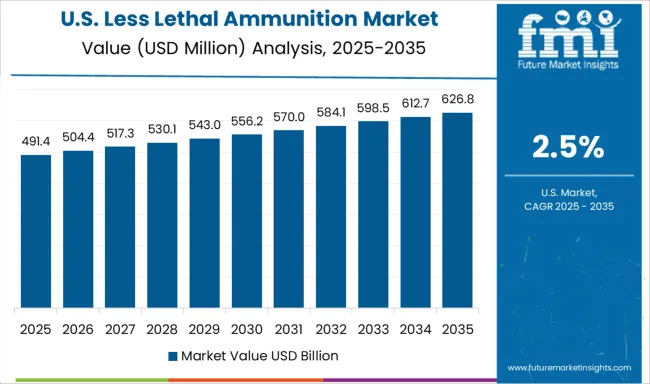

The CAGR of the USA less lethal ammunition market stood near 2.1% during 2020-2024 and is projected to reach 2.5% between 2025 and 2035, signaling a gradual but consistent upward trend. This rise is linked to structured procurement policies in correctional facilities and federal crowd-control initiatives focused on non-lethal options.

Increased emphasis on compliance-driven force application has encouraged law enforcement agencies to incorporate rubber bullets and kinetic energy rounds into standard operations. Market participants in the USA are emphasizing specialized ammunition designed for controlled energy dispersion to reduce litigation risk and fatalities. Emerging partnerships between defense contractors and local agencies indicate continued reliance on impact-minimizing ammunition formats under evolving judicial oversight.

The CAGR in the United Kingdom was around 2.3% from 2020-2024 and is forecasted to reach 2.8% from 2025-2035, driven by legislative changes mandating proportional use of force in public order policing. Greater scrutiny over police tactics has resulted in expanded budgets for non-lethal equipment, particularly kinetic rounds and pepper-based chemical agents.

The Home Office has encouraged advanced tactical training alongside procurement programs to improve operational precision and minimize severe injuries during demonstrations. Incremental replacement of older inventory and expansion of less lethal weapon trials across municipal forces will contribute to steady market acceleration in the coming decade.

Germany’s CAGR remained close to 2.8% during 2020-2024 and is expected to touch 3.3% in 2025-2035, influenced by regulatory compliance with EU safety directives. Federal police and security services have embraced controlled-impact munitions as part of modernization strategies for civil defense. Stringent oversight measures have encouraged the procurement of bean bag rounds and low-energy kinetic cartridges across state agencies.

Expansion of institutional training has enabled the structured adoption of new non-lethal standards across public order units. As European markets move toward integrated security protocols, Germany will maintain its position as a procurement hub emphasizing advanced formulations with predictable ballistic performance.

China recorded a CAGR of 3.2% during 2020-2024 and is anticipated to grow at 3.9% in the 2025-2035 period, supported by intensified crowd-control measures and border security initiatives. Domestic law enforcement upgrades have emphasized broader deployment of non-lethal technologies to reduce international scrutiny of policing tactics.

National-level procurement programs have allocated substantial budgets toward kinetic energy projectiles, tear gas shells, and flexible baton rounds. Manufacturing clusters in industrial provinces are scaling up to meet demand, aided by partnerships with global suppliers transferring proprietary impact-control technology. Regional protests and urban demonstrations have reinforced the strategic adoption of advanced non-lethal tools across law enforcement channels.

India’s CAGR was 3.0% during 2020-2024 and is projected to climb to 3.6% for 2025-2035, supported by heightened security concerns along sensitive borders and civil unrest management. Adoption of non-lethal solutions has accelerated as paramilitary forces receive structured training for proportional response. Procurement agencies have invested in flexible baton rounds, kinetic energy cartridges, and chemical dispersal ammunition for crowd-control environments.

Market development is influenced by the government’s Make in India initiatives, encouraging domestic production of calibrated non-lethal systems. The presence of indigenous defense companies, combined with foreign collaborations, positions India as a fast-growing participant in the global less lethal ammunition industry.

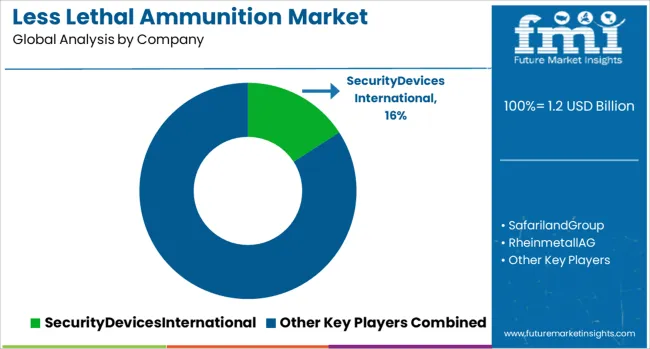

The less lethal ammunition market is shaped by strategic innovation and compliance-focused development, as global security needs continue to prioritize reduced lethality in crowd control and law enforcement operations. Leading companies such as Security Devices International, Safariland Group, and Rheinmetall AG dominate through advanced munitions, including sponge rounds, bean bag cartridges, and chemical irritant-based solutions, engineered to deliver controlled impact while minimizing permanent harm.

These firms are aligning closely with government agencies and military units through long-term supply agreements and simulation-based training programs to enhance operational precision. Federal Ammunition, Combined Systems, and Nonlethal Technologies are strengthening their positions by refining kinetic energy calibration for predictable impact and compliance with human rights regulations, alongside developing advanced dispersal systems for tear gas and smoke munitions used in riot control.

Emerging players like Lamperd Less Lethal, Condor Non-Lethal Technologies, and MAXAM Outdoors are aggressively targeting export markets in Asia-Pacific, Latin America, and the Middle East, leveraging cost-competitive production and strategic distribution partnerships. Sellier & Bellot is expanding its defense-oriented offerings with projectiles optimized for controlled penetration and energy absorption.

Across the competitive landscape, companies are investing in R&D for material innovation, multi-impact rounds, and compatibility with standard firearms and dedicated launchers, ensuring adaptability across tactical environments while meeting evolving global policing and military engagement standards.

In May 2024, EDGE Group announced the acquisition of a 51% stake in Condor Non-Lethal Technologies.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| Type | Rubber shot, Bean Bag, Paintball shots, and Others |

| End-User | Law enforcement and Recreational |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SecurityDevicesInternational, SafarilandGroup, RheinmetallAG, FederalAmmunition, CombinedSystems, NonlethalTechnologies, STEngineering, LamperdLessLethal, CondorNon-LethalTechnologies, MAXAMOutdoors, and Sellier&Bellot |

The global less lethal ammunition market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the less lethal ammunition market is projected to reach USD 1.6 billion by 2035.

The less lethal ammunition market is expected to grow at a 2.9% CAGR between 2025 and 2035.

The key product types in less lethal ammunition market are rubber shot, bean bag, paintball shots and others.

In terms of end-user, law enforcement segment to command 60.2% share in the less lethal ammunition market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Less Than Truck Load Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Bedless Hospitals Market Size and Share Forecast Outlook 2025 to 2035

Airless Packaging Market Growth - Demand & Forecast 2025 to 2035

Airless Pumps Market Analysis - Size, Demand & Forecast 2025 to 2035

Fogless Mirror Market Growth - Trends & Industry Outlook 2025 to 2035

Market Share Breakdown of Airless Packaging Industry

Competitive Overview of Airless Pumps Market Share

Airless Bottles Market

Codeless Payment Platform Market Size and Share Forecast Outlook 2025 to 2035

Cordless Handheld Cultivator Market Size and Share Forecast Outlook 2025 to 2035

Cordless Bandfile Sander Market Size and Share Forecast Outlook 2025 to 2035

Cordless Long Neck Grinder Market Size and Share Forecast Outlook 2025 to 2035

Cordless Fillet Weld Grinder Market Size and Share Forecast Outlook 2025 to 2035

Wireless EEG Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Slotless BLDC Motor for Medical Device Market Size and Share Forecast Outlook 2025 to 2035

Wireless Refrigerant Charging Scale Market Size and Share Forecast Outlook 2025 to 2035

Slotless BLDC Motor for Industrial Robots Market Size and Share Forecast Outlook 2025 to 2035

Wireless Hydrometer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA