The codeless payment platform market is forecast to grow from USD 0.7 billion in 2025 to USD 1.4 billion by 2035, at a CAGR of 6.8%, with regional adoption patterns shaping most of the expansion. Asia Pacific leads, anchored by China at 9.2% and India at 8.5% CAGR, as SME-heavy digital commerce, UPI-style real-time rails, and mobile-first merchants accelerate the adoption of no-code checkouts, payment links, and subscription flows. Local fintech ecosystems bundle drag-and-drop payment builders, KYC, and FX tools, making codeless stacks the default for small online retailers, service platforms, and SaaS startups.

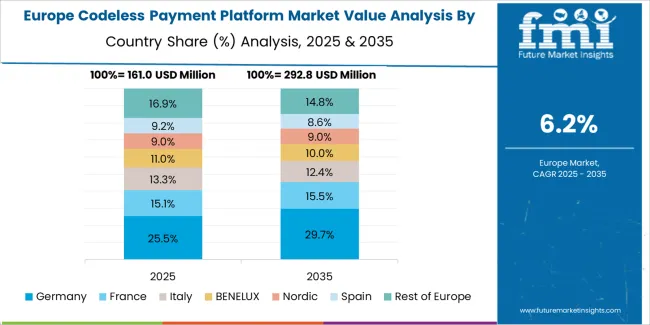

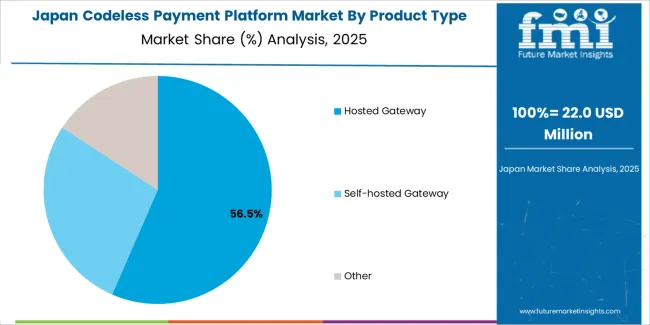

Latin America, led by Brazil at 7.1%, scales on PIX-backed instant payments, marketplace growth, and wide SME appetite for simple, hosted workflows that bypass in-house development. Pre-configured journeys for invoices, installments, and QR-pay flows support rapid onboarding of micro-merchants and solo professionals. Europe advances at mid–high single digits, with Germany at 7.8% and the UK at 5.8% driven by PSD2-aligned, compliance-heavy environments. Here, codeless payment layers are tightly integrated into ERP, accounting, and booking systems, allowing SMEs and mid-market firms to add SCA, multi-currency routing, and recurring billing without custom code. North America records a 6.5% CAGR in the USA, where mature fintech infrastructure and strong subscription/SaaS penetration favor modular, no-code payment logic embedded in low-code apps, CRMs, and vertical SaaS solutions. Japan’s 5.1% CAGR reflects conservative but steady SME adoption focused on security, documentation accuracy, and POS/ERP-linked no-code payment workflows.

Asia Pacific leads market expansion, supported by rapid growth in digital commerce and strong uptake of no-code platforms in China, India, and Southeast Asia. Europe and North America maintain steady demand through established fintech ecosystems and increasing digitalization of small and mid-sized enterprises. Key companies include Stripe, Airwallex, UseePay, Wegic, Bubble, and Airtable, focusing on workflow automation, global payment connectivity, and streamlined merchant onboarding.

The acceleration and deceleration pattern shows an early period of strong growth followed by a gradual move toward stable adoption. Between 2025 and 2029, the market will experience clear acceleration as businesses adopt no-code and low-code tools to streamline payment integration without extensive software development. Rising use of modular APIs, embedded payment functions, and customizable checkout workflows will support faster uptake during this phase. Demand from SMEs seeking rapid deployment and reduced development costs will reinforce early momentum.

From 2030 to 2035, the market will shift into a mild deceleration phase as adoption becomes more standardized across key industries such as retail, subscription services, and digital commerce. Growth will continue but at a steadier pace, driven by system upgrades, security enhancements, and broader compliance alignment. As most enterprises establish mature digital-payment infrastructures, procurement patterns will shift toward refinement rather than rapid expansion. The overall acceleration–deceleration pattern reflects a market evolving from early innovation-led adoption to stable, process-driven maturity supported by usability, integration consistency, and ongoing improvements in payment automation.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 0.7 billion |

| Market Forecast Value (2035) | USD 1.4 billion |

| Forecast CAGR (2025-2035) | 6.8% |

The codeless payment platform market is expanding as businesses and developers seek payment solutions that require minimal or no coding to implement. These platforms allow companies to integrate payment acceptance, processing, and management without extensive software development, which accelerates time-to-market and reduces dependency on specialized technical teams. Growth is driven by increased demand for seamless merchant onboarding, the proliferation of omnichannel commerce and the need for adaptable payment workflows in small-to-medium enterprises (SMEs) and startups.

Advancements in low-code/no-code architecture, pre-built payment modules, plug-and-play integrations with e-commerce and enterprise systems support broader adoption. The rise of embedded finance and business-as-a-service models further enlarges the target market. At the same time, cloud-based deployment and subscription licensing models reduce upfront costs and expand accessibility. Constraints include fewer customisation capabilities compared with fully programmed platforms, concerns around scalability in high-volume use cases and potential vendor lock-in risks. Some enterprises may still prefer traditional programmable payment gateways for maximum control and flexibility.

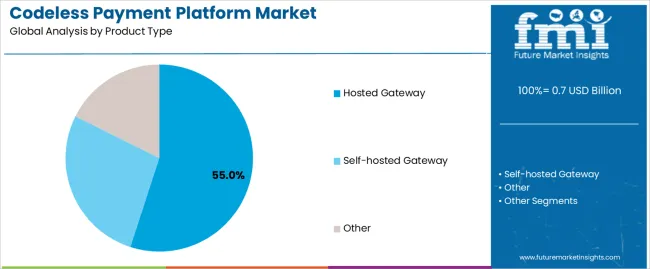

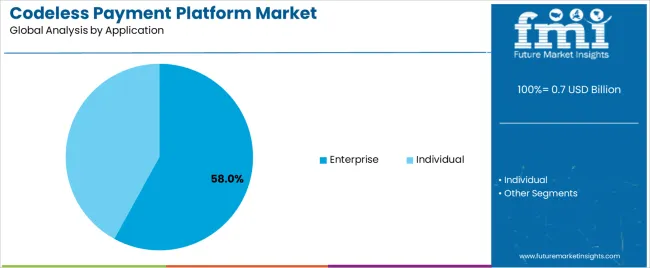

The codeless payment platform market is segmented by product type and application. By product type, the market includes hosted gateway, self-hosted gateway, and other deployment formats. Based on application, it is categorized into individual and enterprise users. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

The hosted gateway segment holds the leading position in the codeless payment platform market, representing an estimated 55.0% of total market share in 2025. Hosted gateways allow users to process payments through pre-built, externally managed interfaces that require minimal technical configuration. These platforms support rapid onboarding, integrated security protocols, and compliance features suitable for organizations lacking in-house development resources.

The self-hosted gateway segment, estimated at 34.0%, is used by enterprises seeking greater control over data handling, payment routing, and interface customization. This model is adopted by businesses with advanced technical capacity or strict compliance requirements. The others category, accounting for about 11.0%, includes hybrid gateways and emerging no-code payment orchestration tools.

Key factors supporting the hosted gateway segment include:

The enterprise segment accounts for approximately 58.0% of the codeless payment platform market in 2025. Enterprises rely on these platforms to streamline multi-channel transactions, manage recurring billing, support cross-border payments, and automate payment workflows without custom coding. Large businesses increasingly integrate codeless solutions to reduce development costs, improve payment scalability, and accelerate deployment timelines.

The individual segment, representing an estimated 42.0%, includes freelancers, microbusiness owners, creators, and personal sellers who use codeless payment tools for small-scale digital transactions, subscriptions, and online service payments.

Primary dynamics driving demand from the enterprise segment include:

Rising digital commerce activity, demand for low-integration payment systems, and growth among small and medium enterprises are driving market growth.

The Codeless Payment Platform Market is expanding as businesses adopt payment tools that can be deployed without software development or complex backend coding. Merchants across retail, services, education, and subscription-based models use codeless platforms to create payment links, hosted checkout pages, and QR-based transactions without relying on in-house technical teams. Rapid growth in online and mobile commerce encourages the use of low-maintenance payment solutions that support multi-channel acceptance. Small and medium enterprises value the ability to set up payments with minimal onboarding time and straightforward configuration. Integration with accounting tools, invoicing systems, and customer relationship platforms further enhances ease of use and encourages continued adoption across emerging digital businesses.

Security concerns, limited customisation options, and dependence on third-party infrastructure are restraining adoption.

Some organisations hesitate to adopt codeless platforms due to concerns about data security, fraud prevention capabilities, and compliance with industry standards such as PCI-DSS. Limited customisation in checkout flows and user interface design may restrict adoption among enterprises that require brand-specific or high-volume transactional experiences. Codeless systems depend on external payment gateways and hosted environments, which can limit control over performance, uptime, and integration depth. Larger businesses with complex billing models may find that codeless tools lack advanced features needed for tailored financial workflows, which slows adoption in enterprise-scale settings.

Growth in low-code and no-code fintech ecosystems, expansion of embedded payment features, and wider adoption across developing markets are shaping industry trends.

Payment providers are adding low-code and no-code toolkits with drag-and-drop interfaces, automated workflows, and simple integration connectors to improve flexibility. Embedded payment features within website builders, CRM platforms, booking tools, and mobile applications are becoming more common, allowing businesses to activate payment functions without coding. Emerging economies across Asia Pacific, Africa, and Latin America are experiencing strong adoption as digital-first small businesses seek cost-effective payment solutions. Advances in analytics dashboards, unified commerce tools, and automated reconciliation support broader market maturity and continued growth of codeless payment platforms.

The global codeless payment platform market is expanding through 2035, supported by increasing no-code adoption, wider digital-payment integration across SMEs, and demand for configurable workflows that reduce development effort. China leads with a 9.2% CAGR, followed by India at 8.5%, reflecting rapid digital-commerce expansion and strong uptake of API-ready payment modules. Germany grows at 7.8%, supported by regulated financial ecosystems and institutional modernization. Brazil records 7.1%, driven by digital-banking penetration and marketplace growth. The United States grows at 6.5%, supported by fintech innovation, while the United Kingdom (5.8%) and Japan (5.1%) sustain stable demand through compliance-aligned, low-code and no-code payment workflows.

| Country | CAGR (%) |

|---|---|

| China | 9.2 |

| India | 8.5 |

| Germany | 7.8 |

| Brazil | 7.1 |

| USA | 6.5 |

| UK | 5.8 |

| Japan | 5.1 |

China’s market grows at 9.2% CAGR, supported by rapid digital-commerce expansion, high mobile-payment penetration, and strong demand for payment-workflow tools that require minimal coding. SMEs adopt codeless platforms to integrate checkout modules, subscription billing, and automated reconciliation without custom development. Domestic fintech firms provide configurable payment interfaces with built-in KYC, fraud screening, and multi-currency support. Growth in cross-border retail, service exports, and marketplace ecosystems strengthens platform usage. Cloud infrastructure and API-ready payment gateways improve scalability for merchants expanding beyond domestic markets. Increased enterprise automation drives demand for drag-and-configure payment workflows.

Key Market Factors:

India’s market grows at 8.5% CAGR, supported by expanding digital-commerce participation, high UPI penetration, and increased use of no-code payment modules by SMEs and service providers. Codeless platforms allow businesses to integrate payment links, form-based checkouts, and automated billing systems without technical development. Fintech providers supply drag-and-drop workflows with embedded KYC and settlement tools. Growth in gig-economy services, subscription businesses, and regional e-commerce increases adoption. Banks partner with no-code payment firms to expand merchant onboarding and streamline settlement tasks. Rising cloud adoption among small enterprises accelerates uptake of standardized workflow-based payment systems.

Market Development Factors:

Germany’s market grows at 7.8% CAGR, supported by regulated financial-services frameworks, strong enterprise-software ecosystems, and increased demand for compliant, configurable payment workflows. Codeless platforms are used by SMEs and mid-sized companies requiring secure, PSD2-aligned payment integration without full-scale software development. Providers focus on automated invoicing, EU-compliant authentication tools, and multi-currency settlement modules. Adoption increases across e-commerce, logistics, and professional-services firms seeking standardized payment automation. Integration with ERP and accounting systems strengthens enterprise adoption.

Key Market Characteristics:

Brazil’s market grows at 7.1% CAGR, supported by digital-banking expansion, strong marketplace activity, and higher adoption of easy-integration payment tools among SMEs. Codeless payment platforms are used for instant checkout deployment, recurring billing, and automated digital-invoice creation. Integration with PIX real-time payments strengthens platform utility for domestic transactions. Fintech companies introduce pre-configured payment journeys allowing businesses to set up digital collection systems with minimal technical requirements. Broader participation in online retail and service-delivery models increases platform usage across urban business corridors.

Market Development Factors:

The United States grows at 6.5% CAGR, supported by mature fintech ecosystems, widespread subscription-economy participation, and strong demand for modular payment workflows. Codeless platforms enable businesses to configure checkout pages, recurring payment streams, and automated authorization without extensive coding. Fintech providers offer systems with programmable logic, secure data handling, and multiple settlement options. Adoption grows among SaaS firms, professional-services providers, and retail merchants. Integration with low-code application builders strengthens the use of codeless payment systems in hybrid development environments.

Key Market Factors:

The United Kingdom’s market grows at 5.8% CAGR, supported by established financial infrastructure, regulated digital-payment standards, and rising SME use of no-code tools for online billing and checkout deployment. Payment platforms embed automated compliance, multi-currency routing, and configurable invoicing aligned with regional regulatory requirements. Adoption increases among accounting firms, digital-service providers, and small retailers integrating online payment systems without developers. Growth in cross-border service activity strengthens use of codeless workflows offering currency conversion and automated settlement.

Market Development Factors:

Japan’s market grows at 5.1% CAGR, supported by established financial networks, gradual digital-payment expansion, and increased uptake of low-code and no-code tools in SME operations. Codeless payment platforms provide automated settlement, domestic payment routing, and simplified checkout integration for small retailers and service operators. Domestic providers focus on security, precision documentation, and reliable compliance modules suited for regulated environments. Adoption increases among e-commerce sellers and subscription-based service providers seeking standardized workflows. Integration with ERP and POS systems supports continued market penetration.

Key Market Characteristics:

The codeless payment platform market is moderately fragmented, with around ten companies offering low-code and no-code tools for building payment workflows, online checkouts, and automated billing systems. Stripe leads the market with an estimated 22.0% global share, supported by its mature API ecosystem, broad integrations, and no-code payment tools designed for users who do not require custom development. Its leadership is reinforced by reliable global acquiring, multi-currency support, and strong documentation suited for rapid deployment.

Airwallex, UseePay, and Wegic follow as emerging competitors, focusing on configurable payment modules, hosted checkout options, and embedded financial services. Their competitive strength lies in cross-border settlement capabilities, compliant merchant onboarding, and adaptable interfaces for SMEs seeking fast payment setup. Airtable, Bubble, Webflow, Adalo, and NocoBase contribute to this market through general-purpose no-code development platforms that integrate with payment gateways. These tools enable non-technical users to assemble payment forms, subscription flows, and automated billing systems through visual builders.

The no-code category, represented by broad ecosystem tools and plugins, expands market accessibility by supporting drag-and-drop payment components compatible with major payment processors. Competitive differentiation across the market depends on integration depth, compliance features, transaction reliability, and ease of configuration. Growth is driven by rising adoption of low-code business automation, increased digital entrepreneurship, and demand for fast deployment of online payments without reliance on specialized software development skills.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Classification | Hosted Gateway, Self-hosted Gateway, Other |

| Application | Individual, Enterprise |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | Wegic, Airtable, NocoBase, Bubble, Adalo, Webflow, Stripe, Airwallex, No-code, UseePay |

| Additional Attributes | Dollar sales by classification and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of no-code payment and automation platforms; advancements in API-free payment integration, low-code workflows, and embedded finance tools; integration with digital businesses, e-commerce sites, SaaS platforms, and enterprise automation systems. |

The global codeless payment platform market is estimated to be valued at USD 0.7 billion in 2025.

The market size for the codeless payment platform market is projected to reach USD 1.4 billion by 2035.

The codeless payment platform market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in codeless payment platform market are hosted gateway, self-hosted gateway and other.

In terms of application, enterprise segment to command 58.0% share in the codeless payment platform market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Codeless Testing Market Size and Share Forecast Outlook 2025 to 2035

Payment Analytics Software Market Size and Share Forecast Outlook 2025 to 2035

Payment Bank Solutions Market Size and Share Forecast Outlook 2025 to 2035

Payment Processing Solutions Market Size and Share Forecast Outlook 2025 to 2035

ePayment System Market Analysis by Component, Deployment, Enterprise Size, Industry, and Region through 2025 to 2035

B2B Payments Platform Market

Mobile Payment Transaction Market Analysis – Growth, Applications & Outlook 2025 to 2035

Crypto Payment Gateways Market Insights - Trends & Growth 2025 to 2035

Mobile Payment Data Protection Market Trends – Growth & Demand 2024-2034

Mobile Payment Security Market Insights – Growth & Demand 2024-2034

Secure & Seamless Digital Payments – AI-Powered Payment Gateways

Mobile Payment Technologies Market

Outdoor Payment Terminal Market Size and Share Forecast Outlook 2025 to 2035

Instant Payments Market Size and Share Forecast Outlook 2025 to 2035

The global QR code payment market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Biometric Payment Cards Market Size and Share Forecast Outlook 2025 to 2035

3D Secure Payment Authentication Market Insights by Components, Application, and Region - 2025 to 2035

Electronic Payment System For Transportation Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Payments Market Size and Share Forecast Outlook 2025 to 2035

In Vehicles Payment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA