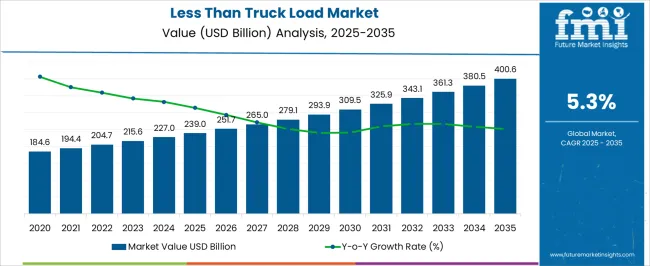

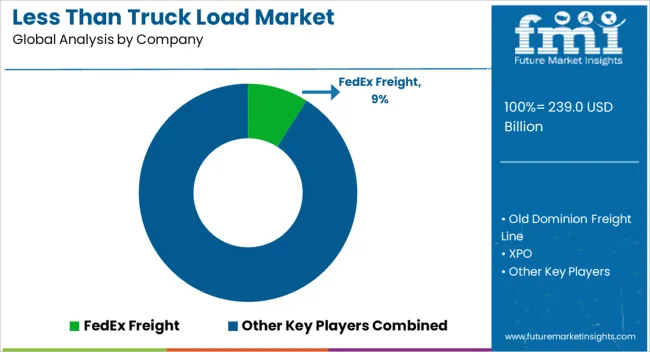

The less than truck load (LTL) market is valued at USD 239.0 billion in 2025 and is projected to reach USD 400.6 billion by 2035, expanding at a CAGR of 5.3% during the forecast period. Growth is supported by the steady rise of e-commerce, omni-channel retail, and demand for flexible shipping solutions where smaller freight volumes need cost-effective transportation. LTL carriers are benefiting from digital freight platforms, route optimization technologies, and dynamic pricing systems that improve efficiency. Increasing adoption of cross-border trade and expansion of third-party logistics (3PL) providers are further driving demand. North America leads with strong retail and industrial shipment flows, while Asia Pacific shows high growth potential from manufacturing exports and urban distribution networks.

| Metric | Value |

|---|---|

| Less Than Truck Load Market Estimated Value in (2025 E) | USD 239.0 billion |

| Less Than Truck Load Market Forecast Value in (2035 F) | USD 400.6 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The Less Than Truck Load (LTL) market is advancing steadily, supported by the increasing need for cost-efficient freight solutions that cater to partial load shipments. Rising e-commerce volumes, growth in small and medium-sized enterprises, and the focus on optimizing logistics networks have fueled demand for LTL services. The market is benefitting from improvements in digital freight matching, route optimization, and real-time shipment tracking, which enhance operational efficiency and customer satisfaction.

Competitive pressures have encouraged carriers to diversify service offerings, integrate advanced tracking technologies, and adopt data-driven strategies for better load consolidation. The expansion of regional and cross-border trade is also contributing to higher utilization rates for LTL networks.

As supply chain strategies shift toward agility and responsiveness, LTL services are being recognized as a vital component of modern distribution systems Continued investment in fleet modernization, sustainability initiatives, and technology integration is expected to drive future growth while meeting evolving customer expectations.

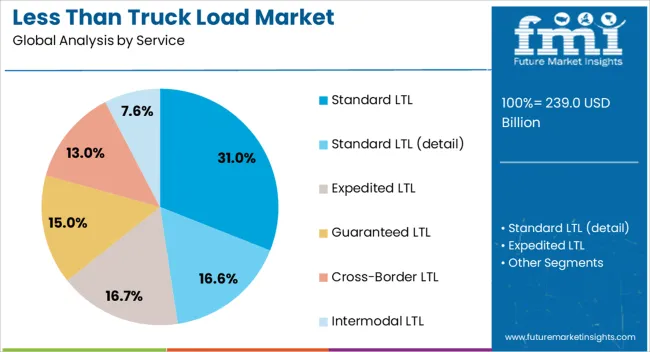

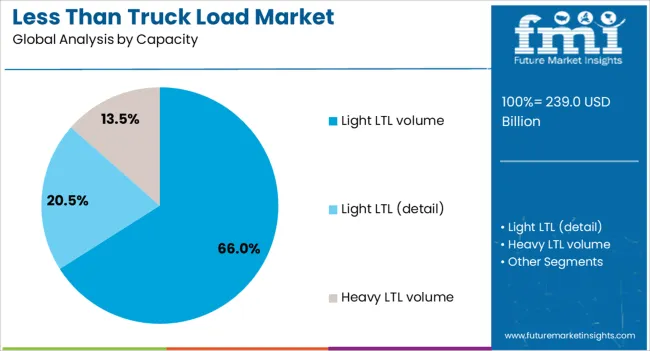

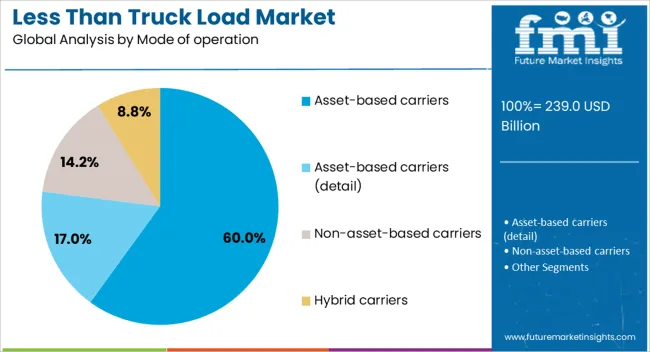

The less than truck load market is segmented by service, capacity, mode of operation, end use, and geographic regions. By service, less than truck load market is divided into Standard LTL, Standard LTL (detail), Expedited LTL, Guaranteed LTL, Cross-Border LTL, and Intermodal LTL. In terms of capacity, less than truck load market is classified into Light LTL volume, Light LTL (detail), and Heavy LTL volume. Based on mode of operation, less than truck load market is segmented into Asset-based carriers, Asset-based carriers (detail), Non-asset-based carriers, and Hybrid carriers. By end use, less than truck load market is segmented into Consumer goods & retail, Consumer goods (detail), Automotive, Healthcare & pharmaceuticals, Industrial & manufacturing, Food & beverage, and Others. Regionally, the less than truck load industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The standard LTL service segment is projected to hold 31% of the Less Than Truck Load market revenue share in 2025, making it the leading service category. Growth in this segment has been driven by the consistent demand for reliable and cost-effective freight transportation for medium-volume shipments. Standard LTL services have been preferred by businesses seeking dependable transit schedules without the premium costs associated with expedited delivery.

The segment benefits from established carrier networks that provide extensive geographic coverage and predictable delivery timelines. Standard LTL also enables better freight consolidation, optimizing truck space and reducing shipping expenses for customers.

The rise in contractual shipping agreements and long-term logistics partnerships has further strengthened its position Enhanced operational efficiency through technology adoption and streamlined hub-and-spoke models has allowed standard LTL carriers to deliver value while maintaining competitive pricing structures, ensuring its continued dominance in the service category.

The light LTL volume capacity segment is anticipated to command 66% of the Less Than Truck Load market revenue share in 2025, positioning it as the dominant capacity category. The segment’s prominence is linked to the rising demand for transporting smaller, lighter shipments more frequently, particularly in response to e-commerce growth and just-in-time inventory strategies.

Light LTL capacity allows businesses to ship goods without the delays associated with waiting to fill a full truckload, improving supply chain responsiveness. Operational flexibility, coupled with the ability to reduce warehouse storage costs, has contributed to the increasing preference for this capacity type.

Carriers offering light LTL services have also leveraged technology to optimize load planning, minimize empty miles, and ensure faster delivery cycles With growing consumer expectations for shorter delivery windows, light LTL capacity has emerged as a critical enabler for businesses seeking to balance cost efficiency with speed of service.

The asset-based carriers segment is expected to account for 60% of the Less Than Truck Load market revenue share in 2025, making it the leading mode of operation. This dominance has been supported by the operational control and reliability that asset-based carriers provide through ownership of their fleet and facilities.

Greater control over assets has enabled these carriers to maintain consistent service quality, optimize fleet utilization, and ensure high compliance with safety and regulatory standards. Asset-based operations have also facilitated investments in modern equipment, advanced telematics, and route optimization tools that enhance delivery efficiency.

In times of market volatility or capacity shortages, asset-based carriers have been better positioned to maintain service commitments compared to non-asset-based competitors Strong brand recognition, established customer relationships, and the ability to offer integrated logistics solutions have further reinforced their leading position, making them the preferred choice for shippers prioritizing reliability and control.

The less than truck load market is expanding as retailers, manufacturers, and logistics providers respond to increasing e-commerce shipments and fragmented order volumes. LTL services provide cost-effective transportation for businesses that do not require full truck capacity, enabling flexible shipping across diverse regions. Growing consumer expectations for faster delivery and smaller order sizes are reinforcing the need for optimized LTL networks. Technology integration, such as route optimization, freight consolidation, and digital tracking, is strengthening adoption. Logistics companies are leveraging e-commerce-driven flows to expand regional hubs and improve distribution efficiency. This demand from retailers and online platforms is expected to remain a dominant growth driver, particularly in urban and suburban corridors where high shipment density supports cost efficiency.

Despite growth opportunities, the LTL market faces challenges from elevated fuel prices, driver shortages, and fluctuating freight rates. Operating costs are higher compared to full truck load shipments due to multiple handling points, complex routing, and last-mile delivery requirements. Infrastructure inefficiencies, including traffic congestion and outdated freight terminals, reduce productivity and increase service delays. Smaller logistics firms struggle to balance operating margins with rising equipment and labor costs, creating entry barriers for new players. Volatility in trade policies and cross-border regulations adds further uncertainty. These restraints emphasize the need for investment in digital freight platforms, fleet modernization, and automation to maintain profitability while meeting growing demand for reliable, cost-efficient LTL services.

Key trends in the LTL market include the adoption of advanced digital platforms, AI-driven route planning, and real-time shipment visibility. Freight matching platforms are connecting shippers with carriers more efficiently, reducing empty miles and optimizing load utilization. Automation in terminals and warehouses is streamlining cross-docking and package handling, lowering delivery times. The push toward sustainability has spurred investment in electric trucks and alternative-fuel fleets within LTL operations. Partnerships between logistics providers and e-commerce companies are deepening, creating integrated supply chain ecosystems. Data analytics and predictive demand forecasting are being leveraged to improve fleet utilization and reduce operational risk. These innovations are shaping the future of LTL services, transforming them into more agile, transparent, and environmentally responsible networks.

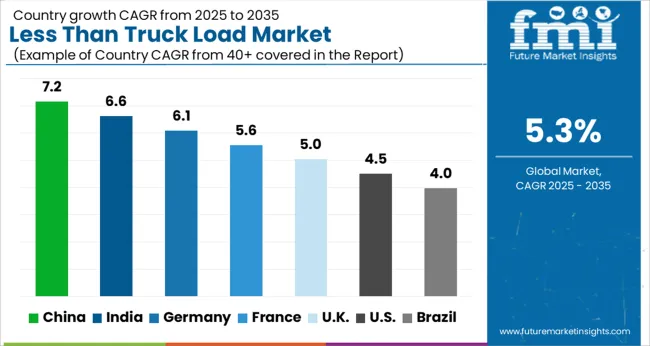

Growth in the less than truck load market in China has been recorded at a CAGR of 7.2%, driven by rapid e-commerce expansion and nationwide logistics modernization. Domestic carriers are investing in digital freight platforms and AI-driven routing systems to handle fragmented order volumes more efficiently. Regional hubs in Shenzhen, Shanghai, and Guangzhou have expanded their terminal infrastructure to serve rising urban and cross-border shipment flows. Government-backed investments in smart logistics corridors and free-trade zones have strengthened adoption of LTL solutions. Local firms are collaborating with technology startups to enhance real-time tracking and load consolidation. International players have also entered the market, partnering with Chinese logistics providers to tap into high-demand distribution corridors.

E-commerce growth accelerates LTL demand nationwide

Investments in smart logistics corridors enhance efficiency

Tech collaborations expand tracking and consolidation capabilities

The less than truck load market in India is advancing at a CAGR of 6.6%, shaped by strong growth in retail, e-commerce, and SME-driven logistics requirements. Domestic operators are adapting LTL models to support multi-city deliveries where full truck load remains cost-inefficient. Major logistics hubs in Delhi, Mumbai, and Bengaluru are expanding to handle increased order fragmentation. Digital freight apps and aggregator platforms are transforming booking, pricing, and tracking processes for SMEs. Public-private partnerships under government infrastructure programs, including dedicated freight corridors, are fueling service adoption. Cost-sensitive shippers continue to prefer hybrid models where carriers consolidate partial loads through regional distribution hubs. Demand for LTL is expected to rise further with deeper penetration of organized retail and supply chain digitization.

Digital freight apps streamline booking and tracking

Dedicated freight corridors support adoption in major hubs

SMEs drive demand for hybrid load consolidation

Germany’s less than truck load market is projected to grow at a CAGR of 6.1%, supported by strong demand from industrial exports and cross-border trade within the EU. LTL providers are optimizing terminal networks in Frankfurt, Hamburg, and Munich to improve turnaround times and reliability. German logistics firms are early adopters of automation and robotics in warehouses, ensuring efficient cross-docking and load handling. Demand is also being reinforced by SMEs engaged in intra-EU shipments where LTL offers cost advantages. Electric and hybrid trucks are entering urban fleets in compliance with EU emission mandates. Partnerships with e-commerce platforms and freight digitalization initiatives are reinforcing Germany’s position as a leading LTL hub in Europe.

Cross-border trade strengthens intra-EU shipment flows

Automation in warehouses improves load handling

Emission mandates encourage adoption of electric fleets

France is advancing at a CAGR of 5.6%, shaped by demand for reliable delivery services from e-commerce, retail, and small-scale industrial exporters. Logistics operators in Paris, Lyon, and Marseille have expanded regional hubs to support fragmented deliveries across urban and suburban markets. Adoption of route optimization software and digital booking tools has improved cost efficiency for LTL carriers. Government initiatives promoting smart logistics infrastructure are contributing to fleet modernization. Specialized LTL solutions have emerged for temperature-sensitive goods, especially in food and beverage distribution. Market activity is also being influenced by cross-border routes into Spain, Italy, and Belgium, where French carriers partner with EU counterparts to broaden their service footprint.

Specialized LTL services expand in food and beverage

Regional hubs strengthen suburban delivery capabilities

Cross-border partnerships support EU connectivity

The United Kingdom’s less than truck load market is growing at a CAGR of 5.0%, reflecting steady demand from retail, healthcare, and e-commerce distribution networks. Logistics operators in London, Manchester, and Birmingham are focusing on digitalization and smart tracking systems to improve load efficiency. Regional carriers are investing in smaller fleets to manage urban last-mile deliveries. Brexit-related supply chain adjustments have created opportunities for LTL operators to handle smaller cross-border shipments to Europe. Local SMEs are increasingly adopting LTL solutions due to flexible pricing structures and consolidation models. Investments in electric delivery fleets are underway, driven by clean transport regulations in major metropolitan areas.

SMEs benefit from flexible LTL pricing models

Smart tracking systems improve delivery transparency

Electric fleets deployed under clean transport rules

The United States LTL market is expected to grow at a CAGR of 4.5%, aligned with gradual adoption of digital platforms and e-commerce-driven demand. Major carriers such as FedEx Freight, XPO, and Old Dominion dominate through extensive terminal networks and advanced load-matching systems. Regional operators provide tailored solutions for industries such as healthcare, automotive, and retail. Technology-driven optimization of routes and freight consolidation is reducing operating inefficiencies across urban corridors. Adoption of electric and autonomous trucks is being piloted in select states to improve fleet sustainability. Cross-border trade with Canada and Mexico also continues to reinforce LTL demand. Overall, the US market benefits from scale but faces pressure from high operating costs and driver shortages.

Large carriers dominate with terminal network expansion

Autonomous and electric trucks piloted in select states

Cross-border trade strengthens North American flows

The less than truck load (LTL) market is highly competitive, shaped by a mix of global carriers, regional operators, and technology-driven entrants. Leading players such as FedEx Freight, XPO, Old Dominion Freight Line, Saia, and R+L Carriers dominate through extensive terminal networks, strong service reliability, and investment in advanced logistics systems. Their strategies increasingly emphasize digital freight platforms, AI-driven routing, and load-matching to improve truck utilization and minimize empty miles. Regional carriers compete by offering localized services, flexible pricing, and specialized freight handling, while partnerships and hub-sharing agreements help extend coverage without heavy infrastructure investment. High capital requirements for fleets and terminals create barriers to entry, making consolidation and acquisitions a common strategy for expanding route density and strengthening market share.

| Item | Value |

|---|---|

| Quantitative Units | USD 239.0 Billion |

| Service | Standard LTL, Standard LTL (detail), Expedited LTL, Guaranteed LTL, Cross-Border LTL, and Intermodal LTL |

| Capacity | Light LTL volume, Light LTL (detail), and Heavy LTL volume |

| Mode of operation | Asset-based carriers, Asset-based carriers (detail), Non-asset-based carriers, and Hybrid carriers |

| End Use | Consumer goods & retail, Consumer goods (detail), Automotive, Healthcare & pharmaceuticals, Industrial & manufacturing, Food & beverage, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | FedEx Freight, Old Dominion Freight Line, XPO, Estes Express Lines, and TForce / TFI / ABF / SAIA etc. |

| Additional Attributes | Dollar sales vary by service type, including standard LTL, expedited LTL, and freight consolidation; by shipment size, spanning small, medium, and large loads; by application, such as retail, manufacturing, e-commerce, and industrial goods; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising e-commerce, demand for cost-efficient logistics, and supply chain optimization. |

The global less than truck load market is estimated to be valued at USD 239.0 billion in 2025.

The market size for the less than truck load market is projected to reach USD 400.6 billion by 2035.

The less than truck load market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in less than truck load market are standard ltl, standard ltl (detail), expedited ltl, guaranteed ltl, cross-border ltl and intermodal ltl.

In terms of capacity, light ltl volume segment to command 66.0% share in the less than truck load market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Less Lethal Ammunition Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Bedless Hospitals Market Size and Share Forecast Outlook 2025 to 2035

Airless Packaging Market Growth - Demand & Forecast 2025 to 2035

Airless Pumps Market Analysis - Size, Demand & Forecast 2025 to 2035

Fogless Mirror Market Growth - Trends & Industry Outlook 2025 to 2035

Market Share Breakdown of Airless Packaging Industry

Competitive Overview of Airless Pumps Market Share

Airless Bottles Market

Codeless Payment Platform Market Size and Share Forecast Outlook 2025 to 2035

Cordless Handheld Cultivator Market Size and Share Forecast Outlook 2025 to 2035

Cordless Bandfile Sander Market Size and Share Forecast Outlook 2025 to 2035

Cordless Long Neck Grinder Market Size and Share Forecast Outlook 2025 to 2035

Cordless Fillet Weld Grinder Market Size and Share Forecast Outlook 2025 to 2035

Wireless EEG Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Slotless BLDC Motor for Medical Device Market Size and Share Forecast Outlook 2025 to 2035

Wireless Refrigerant Charging Scale Market Size and Share Forecast Outlook 2025 to 2035

Slotless BLDC Motor for Industrial Robots Market Size and Share Forecast Outlook 2025 to 2035

Wireless Hydrometer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA