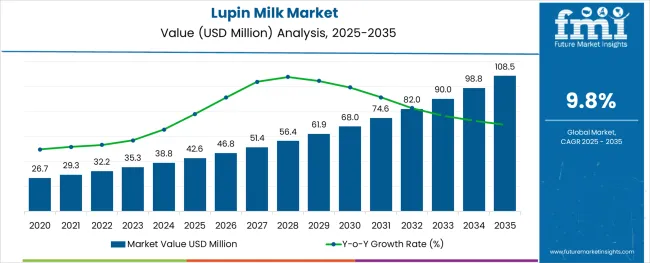

The global lupin milk market is valued at USD 42.6 million in 2025, and it is projected to reach USD 108.5 million by 2035, growing at a CAGR of 9.8%. This growth trajectory reflects increasing global awareness of plant-based and allergen-conscious diets, with products emerging as a viable alternative in the rapidly expanding dairy-free segment.

| Attributes | Description |

|---|---|

| Estimated Global Lupin Milk Industry Size (2025E) | USD 42.6 million |

| Projected Global Lupin Milk Industry Value (2035F) | USD 108.5 million |

| Value-based CAGR (2025 to 2035) | 9.8% |

While still a niche product compared to more established non-dairy milks like almond or soy, lupin milk is attracting health-conscious and environmentally aware consumers seeking high-protein and low-allergen options. The market is witnessing strong uptake in North America, Western Europe, and Oceania, regions that are often the first to adopt new health and wellness trends. The projected growth is also supported by investments in food and better supply chain integration of lupin beans for commercial beverage production.

As of 2025, the lupin milk market registers a modest share of less than 1% in broader parent markets like dairy alternatives and plant-based beverages, which are valued in the multi-billion-dollar range. Within the non-dairy milk market, which includes dominant players like almond, soy, and oat milk, the product accounts for 0.3% to 0.5% due to its niche availability and limited consumer familiarity.

In the vegan and lactose-free food and functional beverage segments, its share is also under 1%, reflecting early-stage adoption. However, its high growth potential (CAGR of 9.8%) suggests that its share will increase steadily over the next decade as more consumers seek allergen-friendly and protein-rich milk alternatives beyond traditional options.

The consumption of lupin milk rose due to a convergence of dietary shifts, supply chain experimentation, and post-COVID wellness priorities between 2020 and 2024. During this period, consumers experimented more with alternative diets, and the demand for lesser-known plant milks gained traction as buyers sought variety beyond soy and almond.

This early-phase adoption was exploratory, driven by niche health food communities, vegan startups, and limited online retail presence. The 2025 to 2035 next few years mark a phase of consolidation and mainstreaming, with better product availability, enhanced sensory appeal, and branding that positions lupin milk not just as an alternative, but a preferred plant-based milk for protein and gut health. This transition from niche curiosity to structured market growth reflects both supply-side and maturing consumer awareness.

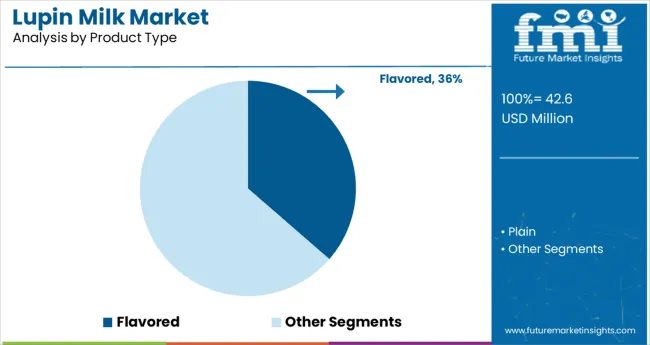

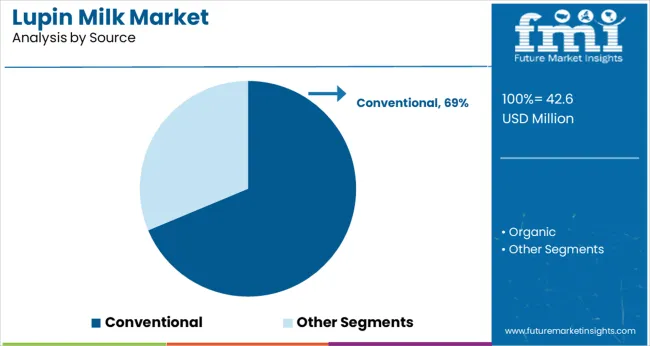

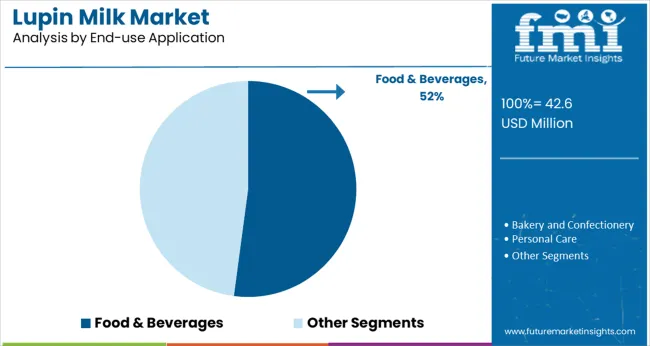

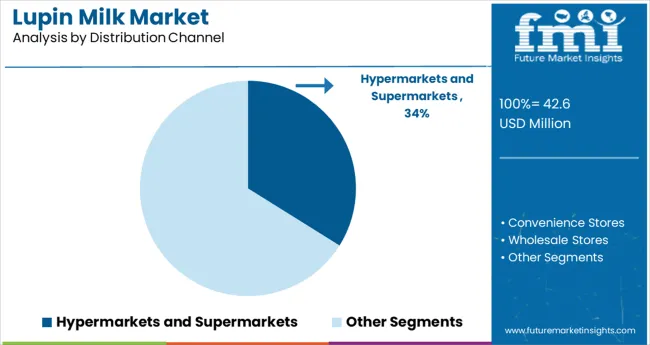

In 2025, flavored lupin milk leads by product type with a 36% share, while conventional variants dominate by source at 69% due to affordability and accessibility. The food & beverages segment captures 52% of end-use, driven by daily consumption patterns, and hypermarkets/supermarkets lead distribution with a 34% share, ensuring visibility and mainstream adoption.

In 2025, flavored milk dominates the product type segment with a 36% market share, emerging as the preferred choice among consumers seeking both health benefits and taste appeal.

Conventional milk holds the leading position by source with a market share of 69% in 2025, significantly outpacing its organic counterpart. This dominance is largely driven by its cost-efficiency, greater availability, and appeal across mainstream retail and foodservice channels.

The food & beverages segment dominates the lupin milk market by end-use application, accounting for a substantial 52% share in 2025. This leadership stems from the growing incorporation of products into everyday consumption patterns, including smoothies, cereals, lattes, and ready-to-drink beverages.

In 2025, hypermarkets and supermarkets represent the most dominant distribution channel for lupin milk, capturing a 34% share of the global market. This is attributed to the visibility, accessibility, and high footfall offered by these retail environments, which are critical for introducing emerging plant-based products like lupin milk to mainstream consumers.

Lupin milk is gaining traction due to its allergen-free, gut-friendly profile and appeal among flexitarian consumers. Retail expansion, strategic shelf placement, and clean-label branding are driving its transition from niche to mainstream.

Rising Demand for Allergen-Free and Gut-Friendly Alternatives

The lupin milk market is gaining momentum as consumers increasingly seek allergen-free, low-carb, and gut-friendly milk alternatives. Unlike nut- or soy-based milks, the product is naturally free from common allergens, making it appealing to consumers with dietary restrictions.

Its high protein and fiber content supports digestive health, resonating with wellness-driven buyers. The growth of lactose-intolerant and flexitarian populations is further accelerating its inclusion in both retail and foodservice menus.

Mainstreaming Through Retail Expansion and Consumer Awareness

Retail accessibility and brand visibility are playing a pivotal role in boosting Lupin Milk’s market share. Prominent placement in supermarkets alongside more familiar plant-based milks helps normalize the product and drive trial among curious consumers.

In-store promotions, clean-label branding, and partnerships with cafés are all helping boost adoption, especially in Western markets. As the plant-based milk aisle expands, the product is emerging from its niche status into a recognized alternative.

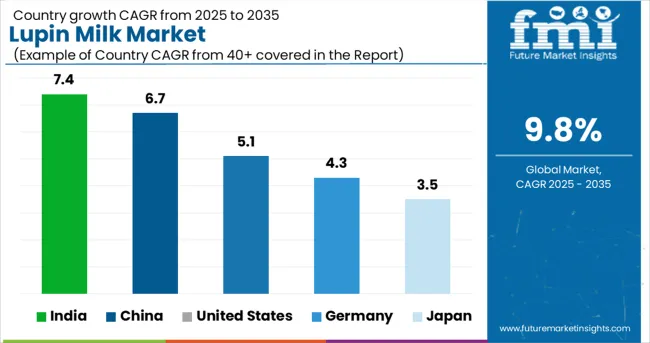

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.1% |

| Germany | 4.3% |

| Japan | 3.5% |

| China | 6.7% |

| India | 7.4% |

The global lupin milk market is projected to expand at a strong 9.8% CAGR from 2025 to 2035, though only select BRICS economies are matching or exceeding this pace. India leads with 7.4%, driven by rising interest in indigenous protein-rich dairy alternatives and government support for pulse-based, yet it still falls short of the global benchmark. China follows at 6.7%, where demand is growing across urban wellness segments, though limited consumer familiarity with lupin constrains faster uptake.

Among OECD countries, the United States posts 5.1%, well below the global average, despite increased shelf presence in natural food channels. Germany stands at 4.3%, and Japan lags at just 3.5%, with cultural preferences and limited product visibility slowing adoption.

ASEAN markets remain nascent but promising, particularly Singapore and Thailand, where protein diversification in alt-dairy is accelerating. Supply chain gaps in lupin processing and consumer awareness are moderating global conversion despite strong macro trends.

The CAGR for the USA lupin milk market increased from approximately 3.2% during 2020 to 2024 to 5.1% over 2025 to 2035, reflecting growing awareness of allergen-free and protein-rich plant-based alternatives. The early phase (2020 to 2024) experienced moderate growth due to limited consumer familiarity, restricted retail presence, and a stronghold of oat, almond, and soy milk.

However, by 2025, retailers began placing products alongside mainstream plant-based milks, with improved formulation and taste varieties boosting demand. Lupin milk’s appeal grew due to its non-nut, non-soy profile, critical for USA consumers with food allergies.

The segment saw expanded placement in organic aisles and specialty cafes targeting flexitarian diets. Increased demand from health-conscious consumers in metro areas like California, New York, and Oregon accelerated category traction post to 2024.

In Germany, the CAGR rose from 3.1% in 2020 to 2024 to 4.3% from 2025 to 2035, driven by stronger demand in lactose-free and gut-health beverage segments. German consumers were slower to adopt the product initially, as soy and oat milk dominated shelf space and brand recognition.

However, from 2025 onward, awareness about lupin’s high protein content, allergen-free nature, and digestive benefits gained ground through organic and natural food chains. Germany’s clean-label regulations favored the inclusion of unsweetened and fortified product variants.

Supermarket chains like Rewe and Edeka began running campaigns highlighting lupin’s low environmental impact and dietary versatility. Demand from fitness-forward and vegan populations in Berlin, Hamburg, and Munich supported its expansion.

The lupin milk market in China experienced a CAGR increase from 4.2% in 2020 to 2024 to 6.7% between 2025 to 2035, positioning the country among the fastest-growing globally. Growth in the early years was driven by demand for soy-free milk among younger urban consumers, but the product remained under the radar due to limited brand visibility.

Post to 2025, however, China's domestic plant-based beverage industry exploded, and products began featuring in wellness cafes and e-commerce platforms like JD.com and Tmall. Its high protein profile resonated well with the expanding fitness and diet-conscious demographic.

Provincial product trials, particularly in Shanghai and Guangdong, received positive feedback, prompting localized production by functional beverage startups. B2B sales to foodservice operators also scaled, with product added to ready-to-drink protein blends.

In Japan, the CAGR grew modestly from 2.4% in 2020 to 2024 to 3.5% from 2025 to 2035, as adoption was restrained by traditional dairy preferences and dominant soy-based alternatives. Early market years saw limited acceptance due to taste unfamiliarity and conservative consumption habits in non-core categories.

However, Japan's interest in functional, low-carb beverages opened space for products, especially in high-end retail and wellness chains. Post to 2025, premium and fortified product variants gained traction among older adults and health-oriented consumers. With increasing gut health awareness and demand for clean-label nutrition, product listings expanded in specialty chains like Seijo Ishii. Growth remains steady rather than exponential, anchored by niche consumers in Tokyo, Osaka, and Nagoya.

India recorded one of the highest lupin milk market growth surges, with CAGR rising from 5.3% in 2020 to 2024 to 7.4% between 2025 to 2035. Early growth was fueled by the limited availability of non-nut, non-soy milk catering to allergen-sensitive consumers and specific religious dietary norms. As awareness about protein-rich plant-based milk alternatives grew, especially among middle-class urban households and fitness-conscious youth, lupin milk carved out its space.

Regional D2C (direct-to-consumer) startups began introducing flavored and unsweetened options suited for Indian palates post to 2024. Its use in high-protein smoothies, dairy-free cooking, and school nutrition programs expanded dramatically. Strong price competitiveness, alongside clean-label branding, helped drive adoption through e-commerce and local hypermarkets in cities like Delhi, Mumbai, and Bengaluru.

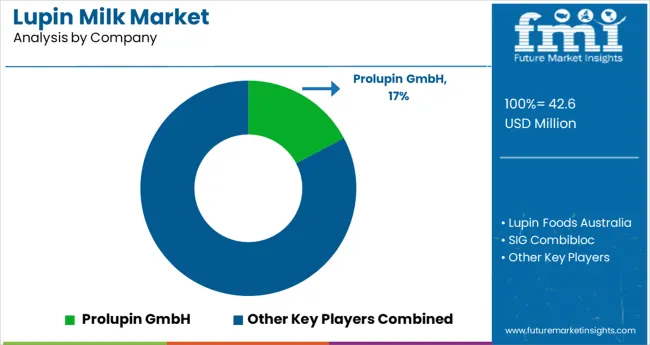

Lupin Foods Australia and Prolupin remain pioneers in commercializing lupin protein ingredients for plant-based dairy, snacks, and meat alternatives. PURIS and Veganergy have accelerated lupin innovation across the USA and EU, focusing on non-GMO and allergen-friendly formats. SIG Combibloc and Azelis support the industry with packaging and advanced distribution platforms. Fraunhofer IVV and GOODMILLS Innovation are investing in refining extraction technologies and taste-masking techniques for broader application.

The competitive landscape is shaped by vertically integrated players like ADM and Prolupin, who control both ingredient manufacturing and application development. These companies benefit from deeper retail partnerships and in-house formulation expertise, especially in high-moisture extrusion and protein fortification.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 42.6 million |

| Projected Industry Size (2035) | USD 108.5 million |

| CAGR (2025 to 2035) | 9.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value |

| Product Type Analyzed (Segment 1) | Plain and Flavored. |

| Source Analyzed (Segment 2) | Organic and Conventional. |

| End-use Application Analyzed (Segment 3) | Food & Beverages, Bakery and Confectionery, Personal Care, and Retail Sales. |

| Distribution Channel Analyzed (Segment 4) | Hypermarket/Supermarket, Convenience Stores, Wholesale Stores, Specialty Stores, and B2B |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Lupin Foods Australia, Prolupin, SIG Combibloc, PURIS, Fraunhofer IVV, Veganergy, Emsland Group, ADM (Archer Daniels Midland), GOODMILLS Innovation, Azelis. |

| Additional Attributes | Dollar sales, share by region, leading formats, growth hotspots, CAGR trends, pricing benchmarks, distribution channel performance, competitor strategies, and regulatory outlook. |

The industry includes plain and flavored.

The industry is segmented into organic and conventional.

The segmentation covers food & beverages, bakery and confectionery, personal care, and retail sales.

These products are distributed through hypermarkets/supermarkets, convenience stores, wholesale stores, specialty stores, and B2B.

The industry is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific.

The industry is valued at USD 42.6 million in 2025.

It is forecasted to reach USD 108.5 million by 2035.

The industry is anticipated to grow at a CAGR of 9.8% during this period.

Conventional is projected to lead the market with a 69% share in 2025.

Asia Pacific, particularly India, is expected to be the key growth region with a projected growth rate of 7.4%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lupine Peptides Market Size and Share Forecast Outlook 2025 to 2035

Lupin Protein Market Outlook - Growth, Demand & Forecast 2024 to 2034

Milk Froth Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Milk Carton Market Size and Share Forecast Outlook 2025 to 2035

Milking Automation Market Size and Share Forecast Outlook 2025 to 2035

Milking Robots Market Size and Share Forecast Outlook 2025 to 2035

Milk Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Clarifier Market Size and Share Forecast Outlook 2025 to 2035

Milk Homogenizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Milk Pasteurization Machines Market Size and Share Forecast Outlook 2025 to 2035

Milk Sterilizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Milk Protein Market - Size, Share, and Forecast 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Milk Mineral Concentrate Market Trends-Demand, Innovations & Forecast 2025 to 2035

Milk Thistle Market Analysis by Form, Distribution Channel and Region through 2035

Milk Powder Market Analysis by Type, Distribution Channel, Region and Other Applications Through 2035

Milk Tank Cooling System Market Growth – Trends & Forecast 2025 to 2035

Milk Alternatives Market – Growth, Demand & Dairy-Free Trends

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA