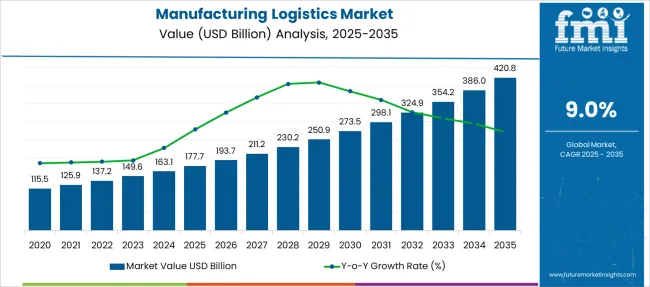

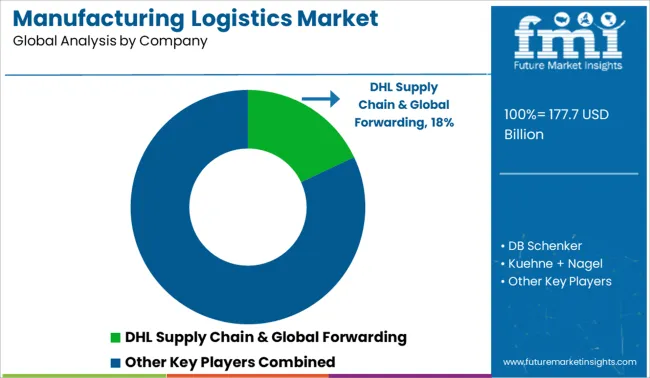

The Manufacturing Logistics Market is estimated to be valued at USD 177.7 billion in 2025 and is projected to reach USD 420.8 billion by 2035, registering a compound annual growth rate (CAGR) of 9.0% over the forecast period.

| Metric | Value |

|---|---|

| Manufacturing Logistics Market Estimated Value in (2025 E) | USD 177.7 billion |

| Manufacturing Logistics Market Forecast Value in (2035 F) | USD 420.8 billion |

| Forecast CAGR (2025 to 2035) | 9.0% |

The Manufacturing Logistics market is undergoing accelerated growth as manufacturers seek to optimize operational efficiency, reduce lead times, and meet increasing demand for real-time visibility across supply chains. Greater emphasis on digital transformation, sustainability targets, and on-demand production is reshaping logistics strategies across industrial sectors. The integration of advanced technologies such as IoT, robotics, and predictive analytics has enabled enhanced asset tracking, dynamic routing, and proactive risk management.

Rising complexities in global manufacturing, combined with increasing expectations for rapid delivery, have created strong demand for adaptive and scalable logistics services. Furthermore, labor shortages and geopolitical uncertainties have heightened the need for automated and resilient logistics infrastructure.

Investment in next-generation transportation networks and technology-driven logistics solutions is expected to remain a key enabler of market growth. The ability to synchronize factory output with real-time transportation and inventory data is projected to be a critical determinant of future competitive advantage in the manufacturing logistics space..

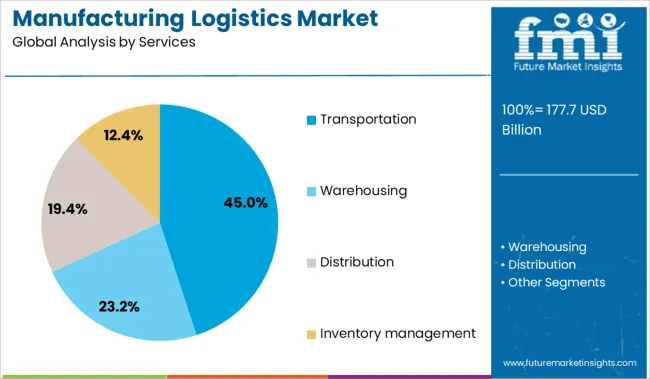

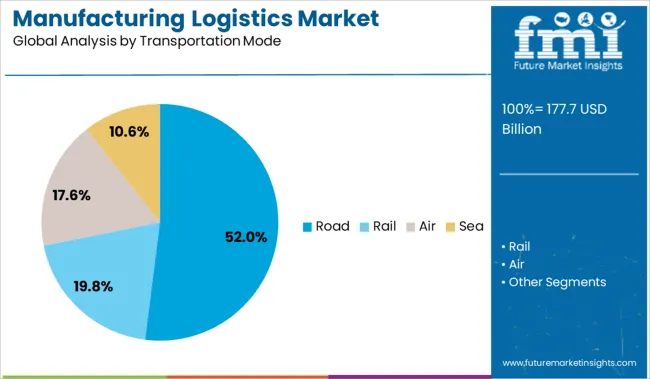

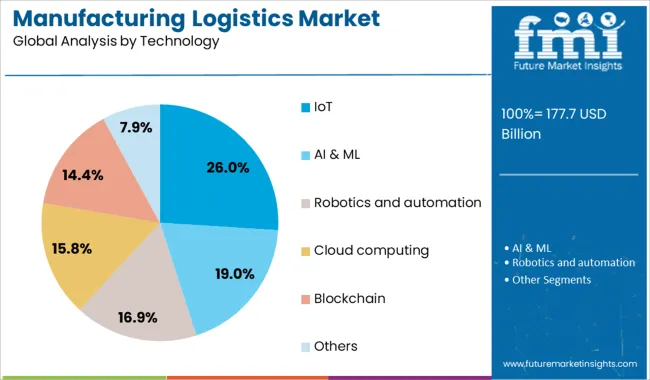

Services, transportation mode, technology, and industry and geographic regions segment the manufacturing logistics market. The services of the manufacturing logistics market are divided into Transportation, Warehousing, Distribution, and Inventory management. In terms of transportation modes, the manufacturing logistics market is classified into Road, Rail, Air, and Sea. The manufacturing logistics market is segmented based on technology into IoT, AI & ML, Robotics and automation, Cloud computing, Blockchain, and Others. The manufacturing logistics market is segmented by industry into Automotive, Aerospace, Electronics, Pharmaceuticals, Food & beverage, Textiles, and Others. Regionally, the manufacturing logistics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The transportation segment is expected to account for 45% of the manufacturing logistics market revenue share in 2025, positioning it as the leading services category. This growth has been supported by its central role in connecting production hubs with distributors, retailers, and end users. As manufacturers expand their operations across multiple geographies, reliable and time-sensitive transportation services have become essential to maintaining production flow and minimizing supply disruptions.

The segment has also benefited from growing reliance on third-party logistics providers that offer specialized transportation capabilities, route optimization, and real-time shipment tracking. Digital platforms and automation tools are being widely adopted within this category to improve delivery accuracy and enable proactive logistics management.

As cost pressures intensify and service expectations rise, transportation services have remained the backbone of efficient supply chains, contributing significantly to the segment's leading share. The evolution of transportation strategies to align with just-in-time manufacturing models is further strengthening the segment’s position within the overall market..

The road transportation mode is projected to hold 52% of the manufacturing logistics market revenue share in 2025, making it the most utilized transportation mode. This dominance has been attributed to the flexibility and accessibility that road networks offer for both short-haul and last-mile deliveries. In many regions, road transport provides the most direct and cost-effective means of moving goods between factories, distribution centers, and retailers.

The ability to reach remote manufacturing locations and deliver with high frequency has favored road logistics in highly dynamic production environments. Advances in fleet management, telematics, and real-time tracking technologies have further enhanced efficiency and reliability across road transport operations.

Additionally, growing investments in road infrastructure and the expansion of cross-border trade routes have reinforced the value of this mode. The role of road transport in enabling agile, demand-driven manufacturing supply chains has contributed to its leading share in the logistics ecosystem..

The IoT segment is anticipated to capture 26% of the manufacturing logistics market revenue share in 2025, establishing itself as the leading technology category. This growth has been driven by the increasing need for real-time data across all stages of the logistics process. IoT-enabled devices have been widely implemented to monitor shipment conditions, track asset locations, and detect inefficiencies in warehouse and fleet operations.

In manufacturing logistics, the integration of IoT solutions has enabled predictive maintenance of equipment, intelligent route planning, and dynamic inventory control. The ability to synchronize production schedules with transportation updates through connected systems has led to improved responsiveness and reduced downtime.

Additionally, IoT adoption has been instrumental in enhancing safety, ensuring compliance, and achieving transparency in complex logistics networks. As manufacturers strive to build more adaptive and resilient logistics systems, the strategic value of IoT continues to increase, supporting its prominence within the technology landscape..

Demand for manufacturing logistics is intensifying due to real-time supply chain orchestration, warehouse automation, and nearshoring trends. Sales of integrated logistics platforms and robotics-driven solutions are rising as OEMs aim to reduce lead times, optimize inventory, and gain predictive control over factory-to-warehouse flows.

Demand for automated intra-factory logistics rose 29% in 2025 as Tier-1 manufacturers accelerated smart factory deployments. Autonomous mobile robots (AMRs) with adaptive routing and IoT coordination reduced line-feeding delays by 37% across auto and electronics plants. Pick-and-place precision improved via AI-driven vision systems, enabling sub-5-second item sorting in packaging centers. Integrated warehouse execution systems (WES) helped reduce redundant human material touches by 42%, while uptime for conveyorized zones rose to 96.3%. Europe and Japan led robotic palletization adoption, especially for SKUs with volatile demand profiles. Micro-fulfillment models within large production hubs cut staging area needs by 18%, unlocking space for high-mix low-volume operations.

Sales of integrated freight orchestration tools increased 34% in 2025 as manufacturers realigned regional networks to reduce dependency on long-haul trans-Pacific shipments. In Mexico and Poland, multi-modal hubs linking rail, truck, and short-sea freight gained traction, reducing average lead times by 22%. Cloud-based transport management systems (TMS) with real-time carrier APIs helped automate 65% of spot rate bids. Electronics and machinery sectors shifted to bonded logistics parks near assembly clusters, slashing customs clearance times by 36%. Predictive ETAs and delay-risk scoring supported tighter just-in-sequence manufacturing, while flexible slot booking on regional rail reduced demurrage penalties by 19%.

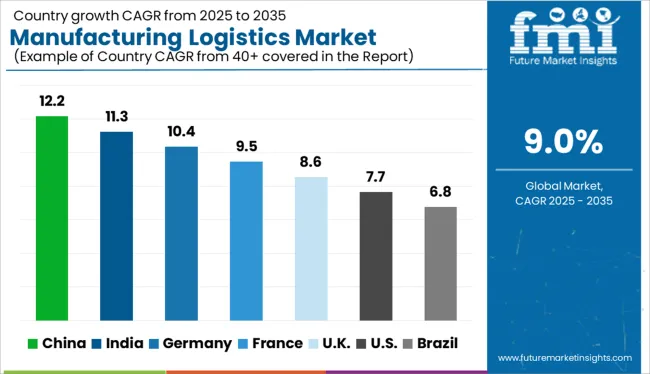

| Country | CAGR |

|---|---|

| China | 12.2% |

| India | 11.3% |

| Germany | 10.4% |

| France | 9.5% |

| UK | 8.6% |

| USA | 7.7% |

| Brazil | 6.8% |

The global manufacturing logistics market is projected to expand at a CAGR of 9.0% from 2025 to 2035. Leading the charge, China (BRICS) records a robust 12.2% growth rate, outperforming the global average by 3.2 percentage points, driven by its large-scale industrial base, export-driven economy, and investments in smart logistics infrastructure. India (BRICS) follows at 11.3% (+2.3 pp), supported by government initiatives such as Make in India, improved connectivity, and demand for supply chain digitization. Among OECD countries, Germany posts 10.4% (+1.4 pp), propelled by advanced automation in manufacturing and high-efficiency logistics networks. The UK records 8.6% (–0.4 pp), while the United States trails at 7.7% (–1.3 pp), reflecting a more mature logistics landscape with slower incremental improvements. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is forecast to lead the global manufacturing logistics market with a CAGR of 12.2% from 2025 to 2035. Between 2020 and 2024, growth was largely driven by rising export volumes and digital freight solutions. Over the next decade, China is scaling smart logistics platforms powered by AI, robotics, and IoT to manage rapid production turnover. Industrial zones in Zhejiang and Guangdong are evolving into intelligent logistics ecosystems with integrated warehouse and delivery nodes.

The market in India is expected to grow at a CAGR of 11.3% through 2035, supported by regional production-linked incentives and corridor-based infrastructure. From 2020 to 2024, demand was fragmented but began consolidating with the rollout of e-logistics and warehouse digitization. Looking forward, multimodal logistics zones and just-in-time supply models will support expansion in key sectors such as electronics, auto parts, and heavy machinery.

Germany’s manufacturing logistics industry is projected to expand at a CAGR of 10.4% between 2025 and 2035, as industrial automation and sustainability mandates reshape operations. From 2020 to 2024, emphasis was placed on warehouse robotics and packaging optimization. In the coming decade, carbon-reduction logistics frameworks and synchronized transport solutions will drive growth, particularly in mechanical engineering and industrial machinery hubs across Bavaria and Baden-Württemberg.

The United Kingdom is set to grow its manufacturing logistics market at a CAGR of 8.6% through 2035, fueled by nearshoring efforts and smart warehousing adoption. During 2020–2024, post-Brexit trade flow adjustments pushed investment into bonded storage and port-centric logistics. Now, digitized customs procedures and resilient domestic distribution models are supporting the reshoring of electronics, medical devices, and aerospace component manufacturing.

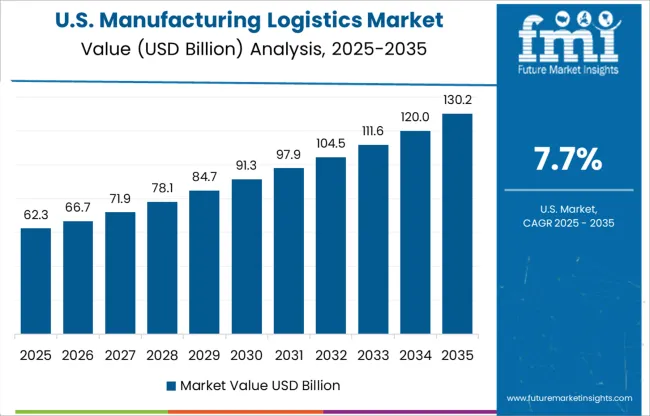

The United States is projected to witness a CAGR of 7.7% in the market between 2025 and 2035, anchored by industrial nearshoring and regionalized warehousing strategies. From 2020 to 2024, third-party logistics and smart inventory systems laid the groundwork for scalable supply chain models. Over the next decade, high-tech fulfillment centers and energy-efficient logistics vehicles will power logistics in industrial hubs across the Midwest and Southern states.

Sales of manufacturing logistics services in 2025 are being driven by automation, just-in-time production cycles, and regional supply chain diversification. DHL Supply Chain & Global Forwarding leads the global market with a significant share, leveraging its integrated warehousing and transportation solutions across Europe and Asia. DB Schenker and Kuehne + Nagel are scaling up contract logistics capabilities to meet rising demand for customized, tech-enabled distribution. Demand for manufacturing logistics from XPO Logistics continues to grow in North America due to advancements in AI-powered route optimization and freight visibility. CEVA Logistics is expanding its footprint across automotive and industrial verticals. The market is increasingly shifting toward predictive analytics, smart warehousing, and sustainable fleet operations to reduce downtime and enhance delivery precision.

In May 2024, DHL Supply Chain opened a carbon‑neutral logistics center at its Leipzig/Halle multi-user campus in Germany. Spanning 34,000 m² with 55,000 pallet spaces, the facility supports multi-modal transport and sustainability goals.

| Item | Value |

|---|---|

| Quantitative Units | USD 177.7 Billion |

| Services | Transportation, Warehousing, Distribution, and Inventory management |

| Transportation Mode | Road, Rail, Air, and Sea |

| Technology | IoT, AI & ML, Robotics and automation, Cloud computing, Blockchain, and Others |

| Industry | Automotive, Aerospace, Electronics, Pharmaceuticals, Food & beverage, Textiles, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DHL Supply Chain & Global Forwarding, DB Schenker, Kuehne + Nagel, XPO Logistics, and CEVA Logistic |

| Additional Attributes | Dollar sales by logistics service type and manufacturing vertical, demand dynamics across just-in-time and just-in-case models, regional trends in smart warehousing and automation adoption, innovation in AI-driven route optimization and real-time tracking systems, environmental impact of transportation emissions and packaging waste, and emerging use cases in circular supply chains and Industry 4.0 integration. |

The global manufacturing logistics market is estimated to be valued at USD 177.7 billion in 2025.

The market size for the manufacturing logistics market is projected to reach USD 420.8 billion by 2035.

The manufacturing logistics market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in manufacturing logistics market are transportation, warehousing, distribution and inventory management.

In terms of transportation mode, road segment to command 52.0% share in the manufacturing logistics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Manufacturing Scale Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Manufacturing Execution Systems (MES) Market Analysis - Growth, Demand & Forecast 2025 to 2035

Manufacturing Test Systems Market

Manufacturing Analytics Market

Wafer Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Micro Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Glass Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

India Manufacturing Execution System Market – Industry 4.0 & Smart Factories

IoT in Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Battery Manufacturing Machines Market

Mining Remanufacturing Component Market Forecast Outlook 2025 to 2035

In Space Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Additive Manufacturing With Metal Powders Market Size and Share Forecast Outlook 2025 to 2035

Additive Manufacturing and Material Market Trends - Growth & Forecast 2025 to 2035

Satellite Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Unit Dose Manufacturing Market Trends – Growth & Industry Outlook 2024-2034

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Electronic Manufacturing Services Market Analysis by Industry and Region, and Forecast from 2025 to 2035

Enterprise Manufacturing Intelligence Market Analysis by Deployment Type, Offering, End-use Industry, and Region Through 2035

Fill Finish Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA