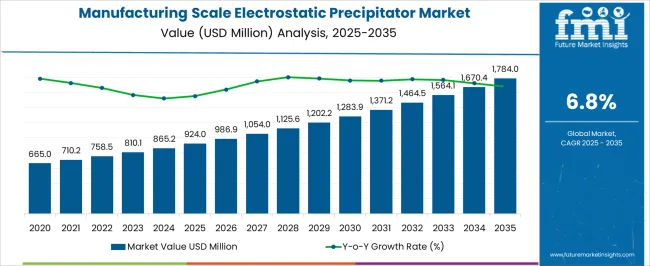

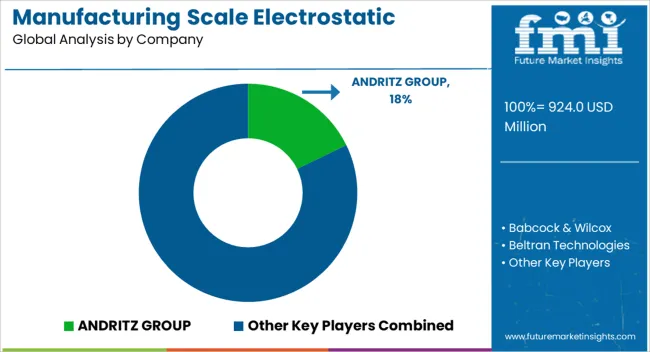

The manufacturing scale electrostatic precipitator market is estimated to be valued at USD 924.0 million in 2025 and is projected to reach USD 1784.0 million by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period. The increasing emphasis on industrial emission control, regulatory compliance, and the need for efficient particulate matter removal in large-scale manufacturing setups has driven initial adoption.

Early adopters, predominantly in heavy industries and power generation facilities, have integrated advanced precipitator technologies to enhance operational efficiency and reduce environmental liabilities. The adoption lifecycle indicates a gradual progression from early adoption to a more widespread implementation across mid- and large-scale manufacturing sectors. From 2025 to 2030, incremental growth suggests a phase of technology validation and integration where firms assess return on investment, energy consumption efficiency, and maintenance requirements. Post-2030, the accelerated growth trajectory points toward a late majority phase, reflecting wider acceptance driven by stricter emission regulations and increasing awareness of environmental sustainability metrics among industrial operators. Technological refinements, including enhanced electrode designs, automated control systems, and improved particulate collection efficiency, are contributing to adoption across geographies.

The market continues to evolve toward saturation in developed regions while exhibiting strong growth potential in emerging economies, where industrial expansion and regulatory frameworks are fostering technology uptake. The market is on a growth-oriented maturity path, with adoption lifecycle trends reflecting both regulatory influence and operational efficiency considerations.

| Metric | Value |

|---|---|

| Manufacturing Scale Electrostatic Precipitator Market Estimated Value in (2025 E) | USD 924.0 million |

| Manufacturing Scale Electrostatic Precipitator Market Forecast Value in (2035 F) | USD 1784.0 million |

| Forecast CAGR (2025 to 2035) | 6.8% |

The manufacturing scale electrostatic precipitator market is regarded as a specialized segment within industrial air pollution control and emission management systems. It is estimated to hold 6.4% of the industrial air pollution control equipment market, reflecting its application in large-scale particulate removal. In power generation emission control, a 5.1% share is observed, supported by coal and biomass-fired plants. Cement and steel manufacturing equipment contributes 4.7%, where precipitators remove fly ash and fine dust. Chemical and petrochemical processing accounts for 3.9%, while industrial filtration and dust collection systems hold a 7.2% share due to integration in multiple manufacturing processes.

The adoption of high-efficiency, low-maintenance precipitators and compliance with stricter emission standards have shaped recent industry trends. Groundbreaking developments include pulse energized and modular precipitator designs that improve collection efficiency and reduce footprint. Key players are investing in digital monitoring systems, predictive maintenance, and automated controls to optimize performance. Strategic initiatives include partnerships with industrial OEMs to retrofit older plants, integration with hybrid pollution control technologies, and adoption of corrosion-resistant materials for extended life. The Asia Pacific leads regional growth due to rapid industrialization, while Europe and North America focus on regulatory-driven upgrades and sustainability programs.

The manufacturing scale electrostatic precipitator market is witnessing steady growth, driven by rising industrial emission control requirements and the enforcement of stricter environmental regulations worldwide. Demand is being supported by increasing adoption in heavy industries such as power generation, cement, steel, and chemical manufacturing, where high particulate matter emissions necessitate robust filtration solutions.

Technological advancements in design, materials, and automation have enhanced operational efficiency, reduced maintenance costs, and extended product lifespans, further boosting market penetration. Manufacturers are increasingly focusing on customization to meet specific process needs, aligning with varied dust load and particle size requirements across industries.

In emerging economies, rapid industrialization coupled with tightening air quality standards is spurring installation rates, while in developed markets, retrofitting and system upgrades are becoming key growth drivers. Over the forecast period, the combination of regulatory enforcement, sustainability initiatives, and advancements in energy-efficient designs is expected to sustain market expansion and reinforce its role as a critical component in industrial pollution mitigation strategies.

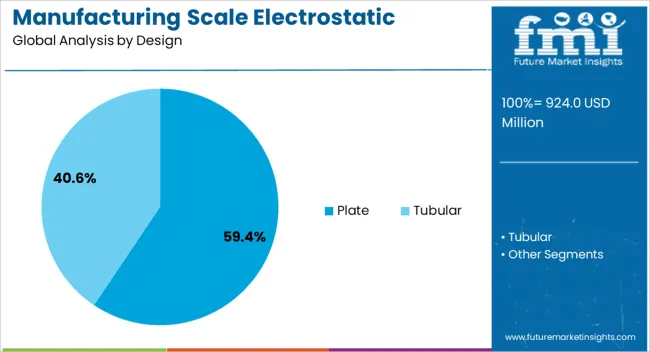

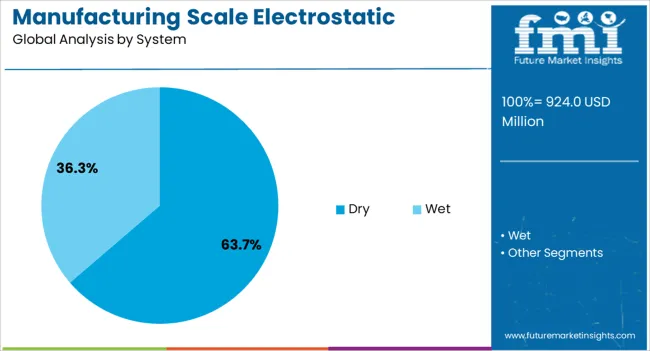

The manufacturing scale electrostatic precipitator market is segmented by design, system, and geographic regions. By design, the manufacturing scale electrostatic precipitator market is divided into Plate and Tubular. In terms of the system, the manufacturing scale electrostatic precipitator market is classified into Dry and Wet. Regionally, the manufacturing scale electrostatic precipitator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plate design segment, holding 59.40% of the design category, remains the dominant configuration in manufacturing scale electrostatic precipitators due to its proven efficiency in handling large volumes of gas and capturing fine particulate matter. A long operational track record, ease of maintenance, and compatibility with diverse industrial applications support its widespread adoption.

The segment benefits from cost-effective manufacturing and the ability to be scaled for various plant capacities, ensuring flexibility in deployment. Operational efficiency is maintained through advanced electrode alignment and improved discharge systems, which enhance particle charging and collection performance.

Its structural robustness and adaptability to high-temperature and high-dust load environments have reinforced its preference in sectors such as cement and power generation. Over time, incremental improvements in material durability and energy consumption have further strengthened its market position, ensuring that the plate design remains a preferred choice for industries seeking reliable, high-capacity particulate control solutions.

The dry system segment, accounting for 63.70% of the system category, leads the market due to its high efficiency in removing fine particles from flue gas streams without introducing additional moisture into the process. Lower operational costs, simpler maintenance requirements, and broader applicability across industries with dry dust emissions support its dominance.

The segment has gained traction in power plants, cement kilns, and metallurgical operations where dry particulate control is preferred for process efficiency and downstream material handling. Technological enhancements in rapping mechanisms, gas distribution plates, and voltage control systems have improved particle removal rates while optimizing energy consumption.

The dry system’s ability to operate effectively under varied load conditions and temperature ranges makes it a versatile solution for large-scale industrial emission management. Anticipated growth is linked to the continued tightening of environmental compliance norms and the rising demand for systems that combine performance reliability with reduced lifecycle costs.

The market has become an essential component in industrial air pollution control, particularly in power generation, cement, steel, and chemical industries. ESPs are widely employed to remove particulate matter from flue gases, enhancing environmental compliance and operational efficiency. The market is influenced by stricter air quality regulations, industrial expansion, and the need for energy-efficient particulate removal solutions. Technological innovations in high voltage power supplies, pulse energization, and modular designs have enhanced system performance. Industrial growth, emission norms, and investment in sustainable manufacturing processes shape regional demand.

The surge in industrial activities across sectors such as power generation, cement, steel, and chemical manufacturing has increased the demand for manufacturing-scale ESPs. These systems are deployed to manage high-volume flue gas streams, ensuring efficient removal of particulate matter and compliance with emission standards. In developing economies, the rapid establishment of manufacturing and energy facilities has created a strong demand base for large scale ESPs. Meanwhile, in developed regions, upgrades and retrofits of older systems are being undertaken to improve efficiency and reduce operational costs. The consistent growth in industrial output has positioned ESPs as indispensable components of modern manufacturing infrastructure.

Stringent air pollution regulations globally have significantly influenced the adoption of ESPs in manufacturing. Governments and environmental agencies have imposed limits on particulate emissions, encouraging industries to invest in advanced air filtration technologies. Compliance with such regulations is critical to avoid penalties and maintain social responsibility. The introduction of stricter standards for industrial emissions has driven the need for high efficiency ESPs capable of handling varying gas volumes and pollutant loads. As emission norms continue to evolve, manufacturers are focusing on designing systems that meet current requirements while allowing adaptability to future regulatory changes, ensuring long-term relevance.

Recent technological advancements in ESP design have enhanced particle removal efficiency, energy savings, and operational reliability. Innovations such as pulse energization, automatic rapping mechanisms, modular configurations, and advanced voltage control systems have optimized collection efficiency. Integration with digital monitoring platforms allows real-time tracking of particulate concentration, system health, and predictive maintenance. Such improvements reduce operational downtime, extend equipment lifespan, and minimize energy consumption. The adoption of high-performance materials and optimized electrode configurations has also improved dust collection across a wider range of particle sizes. These technological developments have made ESPs more adaptable, cost-effective, and aligned with modern industrial sustainability goals.

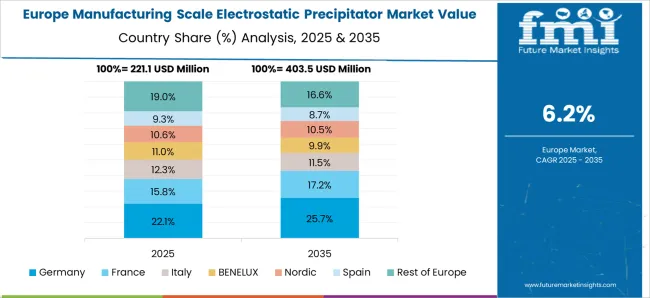

Regional industrial development plays a critical role in the ESP market. Asia Pacific has emerged as a dominant market due to the rapid expansion of power plants, steel manufacturing, and chemical industries. Europe emphasizes retrofitting and upgrading existing facilities to meet strict emission regulations, while North America focuses on advanced technologies and emission control in both existing and new industrial plants. Emerging markets in Latin America and the Middle East are witnessing increased installation of manufacturing-scale ESPs due to new industrial projects and growing environmental awareness. This regional growth pattern reinforces the global importance of ESPs in managing particulate emissions across diverse industrial settings.

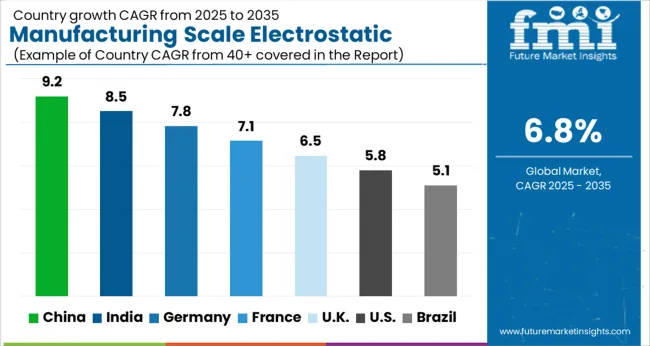

| Country | CAGR |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| France | 7.1% |

| UK | 6.5% |

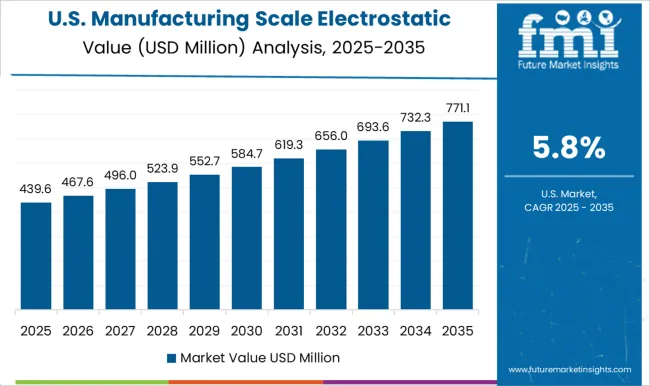

| USA | 5.8% |

| Brazil | 5.1% |

China leads the market with a projected CAGR of 9.2%, driven by industrial emissions control, power plant installations, and adoption of advanced filtration technologies. India follows at 8.5%, supported by rapid industrialization, rising environmental regulations, and deployment in coal-fired power facilities. Germany records 7.8%, reflecting its strong focus on industrial efficiency and clean energy initiatives. The United Kingdom posts 6.5%, influenced by modernization of existing industrial infrastructure and research in high-efficiency precipitators. The United States registers 5.8%, with growth fueled by retrofitting programs, air quality regulations, and adoption in manufacturing and energy sectors. Together, these countries demonstrate robust innovation, scaling, and deployment of electrostatic precipitation technologies globally. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to expand at a CAGR of 9.2% in the market, driven by the rapid adoption of industrial air pollution control technologies. Increasing regulations for emissions in power generation, cement, and steel industries are pushing companies to invest in advanced electrostatic precipitators. Growing environmental awareness and initiatives to improve air quality enhance the demand for large-scale particulate removal systems. Technological innovations and high operational efficiency further attract manufacturers to upgrade or install new units. China remains a dominant market globally due to its extensive industrial base and ongoing focus on clean manufacturing practices.

Growth Analysis of Manufacturing Scale Electrostatic Precipitator Market in India

India is expected to grow at a CAGR of 8.5% in the market, fueled by stricter environmental norms and the expansion of manufacturing sectors. Power plants, cement industries, and metallurgical facilities are increasingly deploying advanced air filtration technologies to comply with emission standards. The government’s focus on sustainable industrial growth promotes the installation of electrostatic precipitators at large manufacturing sites. Rising awareness of occupational health and environmental safety among industries further encourages adoption. The market is expected to witness steady growth as companies seek to optimize operational efficiency and meet regulatory compliance in industrial processes.

Germany is anticipated to register a CAGR of 7.8% in the market, supported by stringent environmental policies and a highly industrialized manufacturing base. Companies increasingly invest in high-efficiency electrostatic precipitators to reduce particulate emissions in chemical, metal, and energy-intensive industries. Innovations in control systems and maintenance automation enhance equipment reliability and productivity. Industrial sustainability goals and adherence to EU emission directives further drive the market. Germany’s strong emphasis on energy efficiency and clean technology ensures that electrostatic precipitators remain a key solution for industrial air pollution management.

The United Kingdom is projected to grow at a CAGR of 6.5% in the market, driven by regulatory enforcement for air pollution control in industrial facilities. The market benefits from the modernization of manufacturing plants and the replacement of legacy systems with advanced filtration units. Companies are focusing on optimizing production efficiency while maintaining environmental compliance. Government incentives and initiatives supporting clean manufacturing technologies further encourage adoption. As industries align operational processes with sustainability requirements, the demand for high-capacity electrostatic precipitators is expected to increase steadily, positioning the UK as a stable growth market in Europe.

The United States is forecasted to expand at a CAGR of 5.8% in the market, supported by environmental regulations and modernization of industrial facilities. Power generation, cement, and steel industries are actively deploying electrostatic precipitators to manage particulate emissions efficiently. Growing emphasis on energy efficiency and emission reduction programs enhances the market demand. Companies are also investing in advanced automation and monitoring solutions for improved performance and reduced operational costs. The US market remains a significant contributor to the global electrostatic precipitator sector due to its large industrial base and regulatory-driven adoption.

The Manufacturing Scale Electrostatic Precipitator (ESP) Market is dominated by companies specializing in industrial air pollution control solutions designed to capture particulate matter from large-scale manufacturing and power generation processes. ANDRITZ Group and Babcock & Wilcox are prominent global providers, delivering advanced ESP systems that combine high-efficiency particle collection with energy optimization. Beltran Technologies and Elex focus on custom-engineered ESP solutions tailored for specific industrial emissions requirements, integrating robust design with process-specific adaptations.

Environ Engineers and GEA Group bring expertise in large-scale installations and retrofit solutions, offering systems that meet stringent environmental regulations while enhancing operational efficiency. Kraft Powercon and Thermax provide technologically advanced ESPs that address high-temperature and high-dust applications in steel, cement, and power plants. VT Corp and Valmet specialize in scalable designs and modular configurations, enabling flexible deployment across multiple industrial sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 924.0 Million |

| Design | Plate and Tubular |

| System | Dry and Wet |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ANDRITZ GROUP, Babcock & Wilcox, Beltran Technologies, Elex, Environ Engineers, GEA Group, Kraft Powercon, Thermax, VT Corp, and Valmet |

| Additional Attributes | Dollar sales by precipitator type and application, demand dynamics across power generation, cement, and industrial manufacturing sectors, regional trends in air pollution control adoption, innovation in collection efficiency, energy optimization, and compact designs, environmental impact of particulate emissions and equipment lifecycle, and emerging use cases in industrial emission compliance and clean manufacturing processes. |

The global manufacturing scale electrostatic precipitator market is estimated to be valued at USD 924.0 million in 2025.

The market size for the manufacturing scale electrostatic precipitator market is projected to reach USD 1,784.0 million by 2035.

The manufacturing scale electrostatic precipitator market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in manufacturing scale electrostatic precipitator market are plate and tubular.

In terms of system, dry segment to command 63.7% share in the manufacturing scale electrostatic precipitator market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Manufacturing Logistics Market Size and Share Forecast Outlook 2025 to 2035

Manufacturing Execution Systems (MES) Market Analysis - Growth, Demand & Forecast 2025 to 2035

Manufacturing Test Systems Market

Manufacturing Analytics Market

Wafer Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Micro Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Glass Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

India Manufacturing Execution System Market – Industry 4.0 & Smart Factories

IoT in Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Battery Manufacturing Machines Market

Mining Remanufacturing Component Market Forecast Outlook 2025 to 2035

In Space Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Additive Manufacturing With Metal Powders Market Size and Share Forecast Outlook 2025 to 2035

Additive Manufacturing and Material Market Trends - Growth & Forecast 2025 to 2035

Satellite Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Unit Dose Manufacturing Market Trends – Growth & Industry Outlook 2024-2034

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Electronic Manufacturing Services Market Analysis by Industry and Region, and Forecast from 2025 to 2035

Enterprise Manufacturing Intelligence Market Analysis by Deployment Type, Offering, End-use Industry, and Region Through 2035

Fill Finish Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA