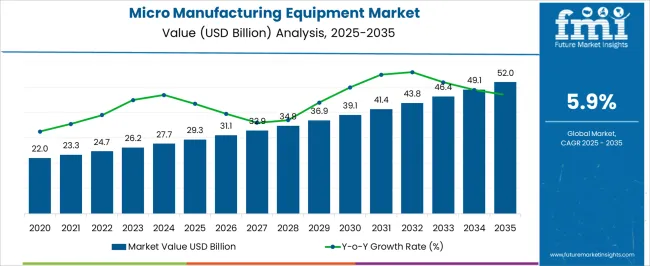

The micro manufacturing equipment market is projected to expand from USD 29.3 billion in 2025 to USD 52.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9%. Growth in this market is driven by a combination of volume expansion and price appreciation, each contributing distinctly to overall revenue gains. The increase in installed equipment units across electronics, precision components, medical devices, and semiconductor fabrication drives the volume effect.

Beginning from USD 22.0 billion in 2020, the market rose to USD 23.3 billion in 2021 and continued steady volume-led expansion through USD 24.7 billion in 2022, USD 26.2 billion in 2023, USD 27.7 billion in 2024, reaching USD 29.3 billion in 2025.

Volume growth is projected to maintain momentum through USD 31.1 billion, USD 32.9 billion, and USD 34.8 billion in 2026–2028, reflecting adoption of higher-capacity, automated microfabrication equipment and broader application deployment. Price growth plays a complementary role by reflecting incremental cost additions from advanced technologies, precision tooling, and process automation integration. The combined effect of volume and price contributions propels the market toward USD 36.9 billion, USD 39.1 billion, USD 41.4 billion, USD 43.8 billion, and USD 46.4 billion during 2029–2033. By 2035, the total market is anticipated to reach USD 52.0 billion, underscoring how strategic equipment upgrades, high-performance modules, and increased unit deployment collectively enhance market value.

| Metric | Value |

|---|---|

| Micro Manufacturing Equipment Market Estimated Value in (2025 E) | USD 29.3 billion |

| Micro Manufacturing Equipment Market Forecast Value in (2035 F) | USD 52.0 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The micro manufacturing equipment market holds specialized positions across several parent domains, with its share reflecting the adoption of precision and small-scale production technologies. Within the precision and advanced manufacturing equipment market, micro manufacturing equipment accounts for nearly 10 to 12%, as micro-milling, micro-drilling, and laser-based machining are increasingly applied for high-accuracy components. In the semiconductor and electronics fabrication equipment market, its share is about 15 to 17%, driven by demand for MEMS devices, sensors, and microelectronic assemblies requiring sub-millimeter tolerances and high repeatability.

The medical device manufacturing equipment market sees micro manufacturing representing roughly 8 to 9%, as surgical instruments, implants, and microfluidic devices require miniature, highly precise components. Within the automotive components manufacturing market, micro manufacturing contributes close to 6 to 7%, applied in sensors, actuators, fuel injection components, and other small engine parts, reflecting selective adoption in high-precision subassemblies. In the aerospace and defense equipment market, micro manufacturing holds around 5 to 6%, as small, high-tolerance parts for avionics, propulsion, and defense systems rely on micro-scale machining for performance and weight optimization.

The market is witnessing consistent expansion, supported by the rising demand for precision-engineered components across high-growth sectors such as healthcare, electronics, and automotive. The increasing miniaturization of devices has driven manufacturers to adopt advanced equipment capable of delivering high accuracy, scalability, and cost efficiency. Integration of automation, robotics, and computer-aided manufacturing systems is further enhancing production efficiency, while technological advancements in tooling and control systems are enabling tighter tolerances.

Global supply chain diversification and the emphasis on localized production are creating additional opportunities for adoption, particularly in industries with stringent performance and quality requirements. Environmental considerations are also influencing equipment design, with energy-efficient systems and material optimization gaining prominence.

The combination of industry-specific demand, innovation in manufacturing processes, and strategic investment in production capabilities is positioning micro manufacturing equipment as a critical enabler of next-generation products. This trajectory is expected to continue as the need for high-precision, complex component fabrication grows globally.

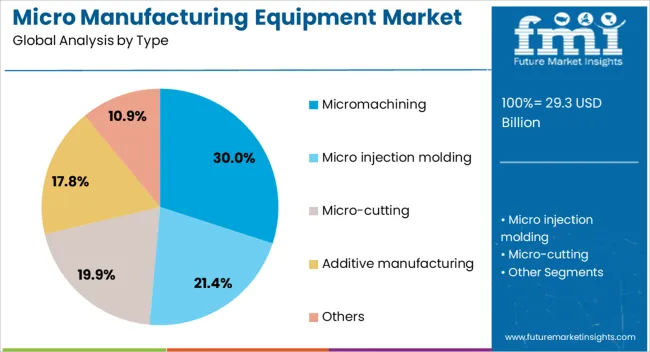

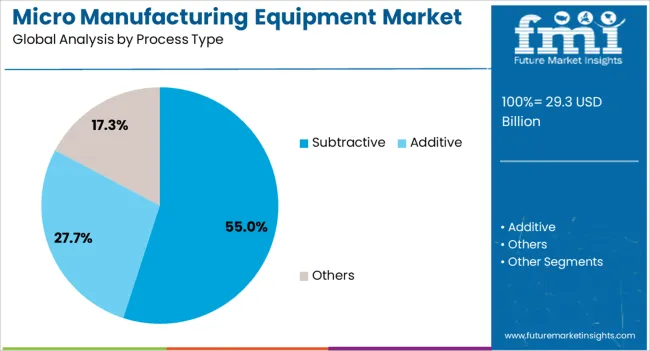

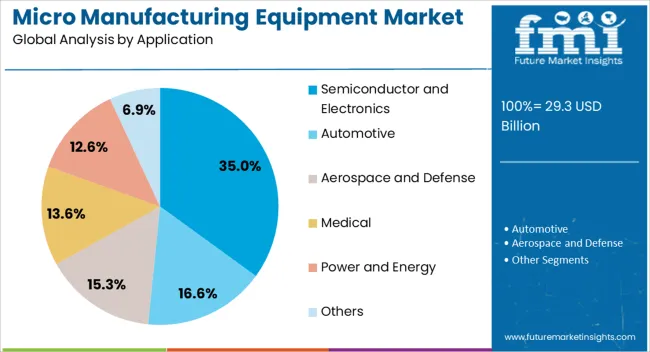

The micro manufacturing equipment market is segmented by type, process type, application, distribution channel, and geographic regions. By type, micro manufacturing equipment market is divided into Micromachining, Micro injection molding, Micro-cutting, Additive manufacturing, and Others. In terms of process type, micro manufacturing equipment market is classified into Subtractive, Additive, and Others. Based on application, micro manufacturing equipment market is segmented into Semiconductor and Electronics, Automotive, Aerospace and Defense, Medical, Power and Energy, and Others. By distribution channel, micro manufacturing equipment market is segmented into Direct sales and Indirect sales. Regionally, the micro manufacturing equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The micromachining type segment is projected to hold 30% of the Micro Manufacturing Equipment market revenue share in 2025, making it the leading equipment type. This dominance has been attributed to its ability to produce highly precise and intricate components that meet the demanding specifications of modern applications.

Micromachining enables manufacturers to work with a variety of materials, including metals, polymers, and ceramics, while maintaining exceptional accuracy at the micron level. The process supports both prototyping and large-scale production, enhancing its relevance across industries that prioritize product consistency and reliability.

The segment’s growth has also been supported by its adaptability to advanced control systems and its integration with automated manufacturing lines, which improves throughput without compromising quality Additionally, the increasing demand for miniaturized devices in sectors such as electronics, medical technology, and optics has reinforced the adoption of micromachining equipment, ensuring its sustained leadership in the market.

The subtractive process type segment is anticipated to account for 55% of the Micro Manufacturing Equipment market revenue share in 2025, establishing it as the dominant process category. This leadership position has been driven by the process’s proven capability to achieve precise material removal and deliver high-quality finishes essential for critical applications. Subtractive processes, including milling, drilling, and turning, are well-suited for creating complex geometries and maintaining tight dimensional tolerances.

The segment’s growth has been reinforced by advancements in computer numerical control systems, which have enhanced process efficiency and repeatability. Widespread adoption across industries such as aerospace, electronics, and medical devices reflects the process’s versatility and reliability.

The ability to work with a diverse range of materials, coupled with cost-effective production capabilities, has further solidified its market presence As industries continue to demand superior component quality and production scalability, subtractive processes are expected to remain a preferred choice in micro manufacturing operations.

The semiconductor and electronics application segment is expected to hold 35% of the Micro Manufacturing Equipment market revenue share in 2025, positioning it as the leading application area. This growth has been underpinned by the increasing complexity and miniaturization of electronic components, which require ultra-precise manufacturing methods. The segment benefits from rising demand for advanced microchips, sensors, and microelectromechanical systems, all of which rely on highly specialized fabrication equipment.

Ongoing investments in semiconductor fabrication facilities and electronics manufacturing hubs have further accelerated equipment adoption. The integration of automation, precision metrology, and cleanroom-compatible systems has enabled manufacturers to achieve consistently high yields and meet stringent quality standards.

In addition, the rapid evolution of consumer electronics, communication devices, and computing technologies has intensified the need for cutting-edge manufacturing capabilities.

Micro manufacturing equipment gains momentum as miniaturized components in medtech, optics, RF, and advanced packaging require tight tolerances, clean edges, and consistent finishes. High capital cost, facility requirements, skill shortages, and narrow process windows restrain scale, making lifecycle economics and support programs decisive. Clear upside appears in microfluidics, implants, diagnostic cartridges, interposers, and micro optics where controlled surfaces and repeatability matter. Hybrid machine cells, parameter libraries, embedded metrology, and regional service hubs define current direction. Vendors that couple precision hardware with application know how, documentation depth, and fast field response are positioned to capture high value programs.

OEM requirements for burr free edges, tight tolerances, and repeatable surface quality have elevated the role of micro EDM, femtosecond laser micromachining, micro milling, and micro injection molding. Cleanroom ready footprints, low vibration frames, and thermal stability are being prioritized to protect process capability. Materials such as PEEK, titanium, stainless steels, silicon, and specialty glasses are being processed on the same lines, so toolchains must handle diverse chemistries without cross contamination. Inline metrology, closed loop motion, and statistical process control are being requested to prevent inspection bottlenecks. Contract manufacturers and integrated device makers treat modular cells as building blocks for rapid capacity adds. As miniaturized components move from pilot runs to volume programs, equipment that guarantees dimensional fidelity and predictable uptime is being positioned as the backbone of profitable scale up.

Ultra precision platforms require isolation from floor vibration, strict temperature control, and clean utilities, which raise commissioning time and total installed cost. Process windows at micro scale are narrow, so tool wear, electrode erosion, thermal damage, and recast layers can trigger yield losses without disciplined maintenance. CAM strategies, laser parameter libraries, and electrode design often need part specific tuning, stretching engineering teams during product ramps. Qualification under medical and aerospace quality systems extends timelines with extensive documentation and sample lots. Metrology capacity can become a choke point, since noncontact inspection, white light interferometry, and high magnification imaging add cycle time if not embedded. Consumables, custom fixtures, and spare subassemblies carry long lead times. These constraints push buyers to vendors that prove lifecycle economics, application depth, and rapid field support.

Medtech programs require microfluidic cartridges, implant features, delivery nozzles, and neuro interfaces that benefit from burr free edges and stable surface chemistry. Diagnostics platforms value repeatable replication via micro molding with precision multi cavity tools and hot runner control. Advanced packaging and interposer work in electronics is expanding adoption of laser drilling, dicing, and fine pitch structuring that improves density without long thermal cycles. Optics and photonics use cases such as micro lenses, gratings, and fiber alignment parts reward equipment that delivers low roughness and tight form error. Machine vision based inspection, recipe libraries, and turnkey cells that bundle fixturing, feeders, and qualification protocols are being requested by teams seeking faster time to validation. Service models that include operator training, remote diagnostics, and guaranteed response windows are being treated as decisive for program awards.

Roadmaps point to hybrid cells that combine laser ablation, micro milling, and micro EDM on a single platform to reduce handling, fixture swaps, and cumulative error. Additive features such as micro LPM and selective plating are being co located with subtractive steps to shorten flow. Vendors are expanding software stacks with toolpath simulation, drift compensation, and traceable parameter sets to stabilize outcomes across shifts. Standards adoption is widening, with medical buyers preferring ISO 13485 capable suppliers and aerospace programs requesting AS quality frameworks. Regionalization is accelerating as medtech hubs and electronics clusters demand local applications labs, parts depots, and demo lines to cut lead time and de risk process transfers. Documentation packs that include maintenance playbooks, spare kits, and calibration schedules are increasingly bundled into purchase agreements. The competitive edge is expected to favor equipment partners that deliver repeatable precision, credible training, and quick recovery from process upsets.

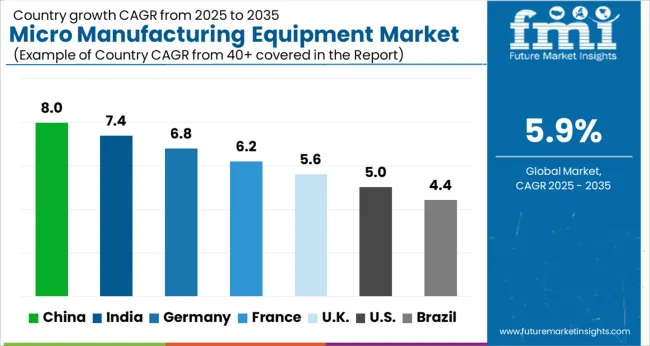

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

The micro manufacturing equipment market is projected to grow globally at a CAGR of 5.9% from 2025 to 2035. China leads at 8.0%, followed by India at 7.4% and Germany at 6.8%, while the UK grows at 5.6% and the USA posts 5.0%. China and India show strong growth premiums of +2.1% and +1.5% above baseline, supported by industrial modernization, high-volume electronics, and automotive component production. Germany benefits from advanced engineering, research collaborations, and export-oriented precision manufacturing. The UK sees steady demand from aerospace and medical sectors, while the USA, though slower, maintains high-value adoption in semiconductors and specialized microfabrication applications. The analysis spans over 40+ countries, with the leading markets shown below

The micro manufacturing equipment market in China is projected to expand at a CAGR of 8.0% from 2025 to 2035, positioning it as the fastest-growing region globally. Industrial modernization, particularly in precision machinery and electronics, is driving demand for highly accurate and scalable equipment. Domestic manufacturers are investing in robotics-enabled micro-fabrication tools, additive manufacturing modules, and high-precision metrology systems. Chinese companies are also increasingly integrating IoT-enabled monitoring and automated quality inspection solutions to improve efficiency. Strong government incentives for advanced manufacturing under national strategic initiatives further support market growth. Cross-border collaborations with global equipment providers are accelerating technology transfer, while rising adoption in automotive, electronics, and medical devices segments contributes to overall expansion.

The micro manufacturing equipment market in India is expected to grow at a CAGR of 7.4% from 2025 to 2035. Industrial sectors such as automotive components, consumer electronics, and medical devices are increasingly demanding high-precision tools to meet tight tolerances and miniaturization trends. Domestic equipment suppliers are focusing on low-cost, modular, and semi-automated solutions to appeal to small and mid-sized enterprises. Adoption is further supported by government initiatives promoting Make in India and advanced manufacturing clusters, enabling access to financing, skilled labor, and technological support. Collaborations with global suppliers are enhancing capabilities for multi-axis machining, micro-injection molding, and precision additive manufacturing.

The micro manufacturing equipment market in Germany is forecast to grow at a CAGR of 6.8% between 2025 and 2035. Growth is supported by a strong industrial base in precision engineering, automotive, and medical devices. Leading German suppliers emphasize advanced multi-axis milling, laser micro-machining, and additive manufacturing solutions with high reproducibility and tolerances. Integration of digital monitoring, automated inspection, and modular setups is prevalent in both domestic and export-focused facilities. Germany also benefits from stringent quality and safety standards, which incentivize adoption of equipment capable of precise microfabrication.Demand is further strengthened by export-driven production, where high-quality micro-manufactured components are critical for global automotive, electronics, and healthcare supply chains.

The micro manufacturing equipment market in the UK is projected to grow at a CAGR of 5.6% from 2025 to 2035. The growth is largely driven by the aerospace, automotive, and medical device sectors requiring high-accuracy and miniaturized components. UK manufacturers focus on modular, automated, and digitally integrated micro manufacturing tools to optimize production efficiency and ensure quality compliance. Import reliance is notable, as domestic suppliers often complement global manufacturers to meet specialized precision needs. Government initiatives supporting advanced manufacturing clusters, coupled with private investment in microfabrication and additive solutions, are enhancing adoption. Aftermarket demand for equipment upgrades and retrofitting older production lines also sustains steady growth.

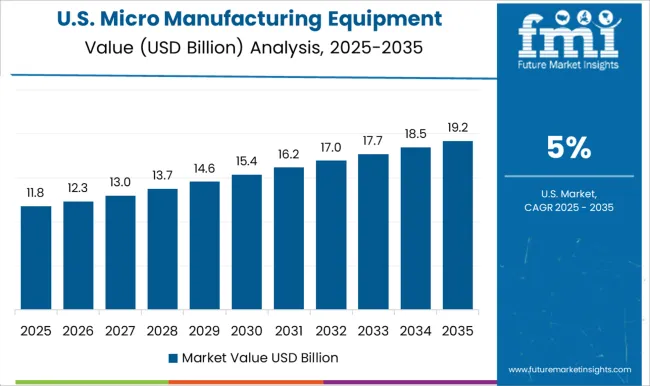

The micro manufacturing equipment market in the United States is expected to expand at a CAGR of 5.0% from 2025 to 2035. Growth is anchored in precision-demanding industries such as aerospace, semiconductors, medical devices, and electronics. Domestic manufacturers emphasize high-performance multi-axis systems, precision additive machines, and automated inspection tools. Technological integration, including real-time monitoring, predictive maintenance, and smart sensors, is enhancing productivity and component quality. The USA market also relies heavily on imported high-end equipment to meet specialized requirements in semiconductor fabrication and aerospace micro-machining. Investment in R&D facilities, coupled with advanced training programs, supports adoption of state-of-the-art machinery.

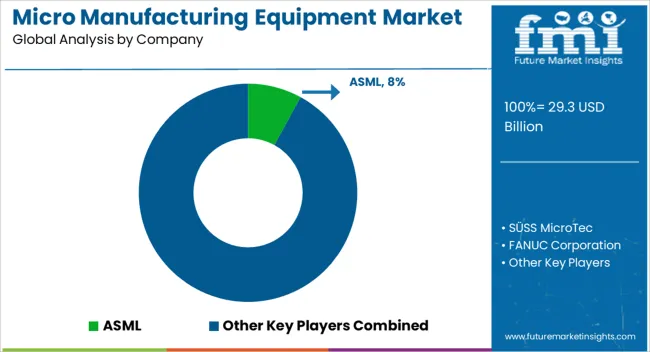

Competition in the micro manufacturing equipment sector has been shaped by precision engineering, automation integration, and process versatility across semiconductor, electronics, and high-precision metalworking applications. ASML has established a leading position by offering advanced lithography systems, enabling extreme ultraviolet (EUV) and deep ultraviolet (DUV) patterning for high-volume semiconductor production. SÜSS MicroTec has focused on wafer processing and photolithography solutions, delivering spin coaters, bonders, and mask aligners optimized for microfabrication efficiency and process consistency. FANUC Corporation has leveraged robotics and automation expertise to provide high-precision CNC machines and robotic handling systems that ensure repeatable micro-scale manufacturing, reducing cycle times while enhancing throughput. Matsuura Machinery has emphasized multi-axis micromachining centers capable of achieving tight tolerances and complex geometries, supporting aerospace, medical, and electronic component production. KUKA AG has strengthened its market presence through industrial robotics with micro-positioning capabilities, flexible automation lines, and integrated software for precise control of micro-manufacturing processes. Makino has concentrated on ultra-high-speed milling, EDM, and grinding systems tailored for micro-scale components, ensuring dimensional accuracy and surface quality in highly intricate parts.

| Item | Value |

|---|---|

| Quantitative Units | USD 29.3 Billion |

| Type | Micromachining, Micro injection molding, Micro-cutting, Additive manufacturing, and Others |

| Process Type | Subtractive, Additive, and Others |

| Application | Semiconductor and Electronics, Automotive, Aerospace and Defense, Medical, Power and Energy, and Others |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ASML, SÜSS MicroTec, FANUC Corporation, Matsuura Machinery, KUKA AG, Makino, GF Machining Solutions (Microlution), TRUMPF, and [Other regional / niche players] |

| Additional Attributes | Dollar sales by equipment type include CNC milling, EDM, laser micromachining, and wafer processing tools. Sales by end use span semiconductor fabrication, medical devices, aerospace components, and micro-electronics. Demand dynamics are influenced by miniaturization trends, high-precision production needs, and adoption of automation. Regional trends indicate strong growth in North America and Europe, while Asia Pacific shows rapid expansion supported by semiconductor manufacturing, electronics assembly, and micro-component production. |

The global micro manufacturing equipment market is estimated to be valued at USD 29.3 billion in 2025.

The market size for the micro manufacturing equipment market is projected to reach USD 52.0 billion by 2035.

The micro manufacturing equipment market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in micro manufacturing equipment market are micromachining, micro injection molding, micro-cutting, additive manufacturing and others.

In terms of process type, subtractive segment to command 55.0% share in the micro manufacturing equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Micron CBN Powder Market Size and Share Forecast Outlook 2025 to 2035

Microfilm Reader Market Size and Share Forecast Outlook 2025 to 2035

Micro-Dosing Sachet Fillers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Microbial Growth Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Micro Hotel Market Forecast and Outlook 2025 to 2035

Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

Micro-energy Harvesting System Market Size and Share Forecast Outlook 2025 to 2035

Micro CHP Market Size and Share Forecast Outlook 2025 to 2035

Micro Irrigation System Market Size and Share Forecast Outlook 2025 to 2035

Micro Flute Paper Market Size and Share Forecast Outlook 2025 to 2035

Microcrystalline Cellulose Market Size and Share Forecast Outlook 2025 to 2035

Micro Balances Market Size and Share Forecast Outlook 2025 to 2035

Micro Perforated Films Packaging Market Size and Share Forecast Outlook 2025 to 2035

Microbial Coagulants Market Size and Share Forecast Outlook 2025 to 2035

Microserver IC Market Size and Share Forecast Outlook 2025 to 2035

Microplate Handling Instruments Market Size and Share Forecast Outlook 2025 to 2035

Microsclerotherapy Treatment Market Size and Share Forecast Outlook 2025 to 2035

MicroLED Photoluminescence Inspection System Market Size and Share Forecast Outlook 2025 to 2035

Micro-Scale VFFS Modules Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Microscope Digital Camera Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA