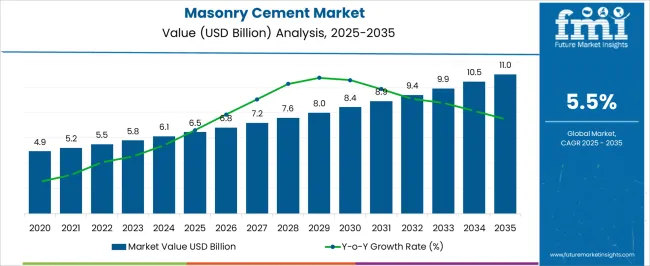

The masonry cement market is projected to grow from USD 6.5 billion in 2025 to USD 11.0 billion in 2035, reflecting a CAGR of 5.5%. This translates into an absolute dollar opportunity of USD 4.5 billion over the ten years. The market will steadily expand, reaching USD 6.8 billion in 2026, USD 7.6 billion in 2029, USD 8.4 billion in 2031, and USD 10.5 billion in 2034. This consistent trajectory highlights rising demand for masonry cement across infrastructure and construction, creating opportunities for manufacturers and investors to secure incremental revenue and strengthen market presence throughout the forecast horizon.

From an absolute dollar perspective, annual increments begin at around USD 0.3–0.4 billion in the early years and rise to nearly USD 0.6 billion in later years, ultimately leading to USD 4.5 billion in additional value by 2035. Intermediate benchmarks such as USD 6.1 billion in 2025, USD 8.0 billion in 2030, and USD 9.9 billion in 2033 illustrate steady expansion phases. This predictable growth allows stakeholders to plan investments, expand capacity, and align supply chain strategies effectively. Capitalizing on both steady annual increments and the cumulative USD 4.5 billion opportunity ensures long-term gains in the masonry cement market.

| Metric | Value |

|---|---|

| Masonry Cement Market Estimated Value in (2025 E) | USD 6.5 billion |

| Masonry Cement Market Forecast Value in (2035 F) | USD 11.0 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

A breakpoint analysis identifies critical periods of accelerated growth. Between 2025 and 2027, the market rises from USD 6.5 billion to USD 6.8 billion, marking the early growth phase where adoption and construction activity begin to build momentum. Another significant breakpoint occurs around 2029–2031, as the market grows from USD 7.6 billion to USD 8.4 billion, reflecting a period of faster expansion and higher absolute dollar gains.

These stages are pivotal for manufacturers and investors to optimize production, manage distribution channels, and capture incremental revenue during key periods of market growth. The final major breakpoint is observed between 2033 and 2035, when the market increases from USD 10.5 billion to USD 11.0 billion, representing the largest absolute dollar growth in the later stage of the decade. Intermediate years, such as 2030–2032, show steady expansion from USD 8.0 billion to USD 9.9 billion, acting as bridging periods to sustain market momentum.

The masonry cement market is experiencing robust growth driven by increasing construction activities worldwide, particularly in residential and commercial infrastructure. The current market scenario is characterized by a steady rise in urbanization, which is fueling demand for durable and cost-effective construction materials.

The growing preference for sustainable building practices and materials with improved workability and strength is supporting market expansion. Investments in affordable housing projects and infrastructure development, especially in emerging economies, are further propelling demand.

Additionally, innovations in cement formulations that enhance durability and reduce environmental impact are influencing the future outlook. The market is expected to benefit from rising construction modernization efforts and government initiatives aimed at improving housing quality and infrastructure resilience.

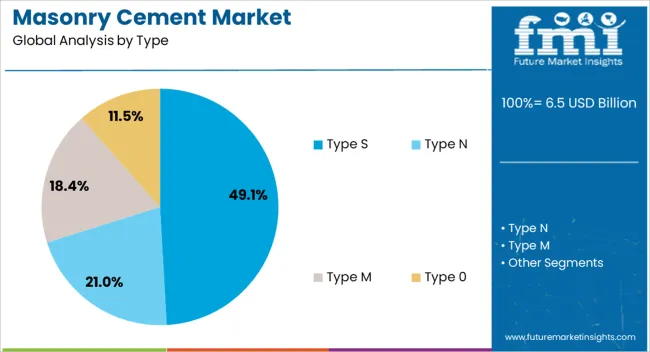

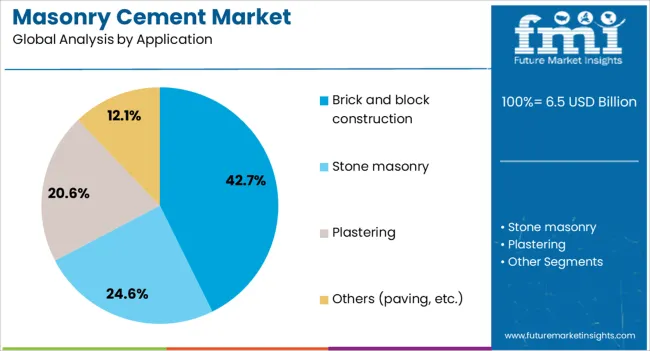

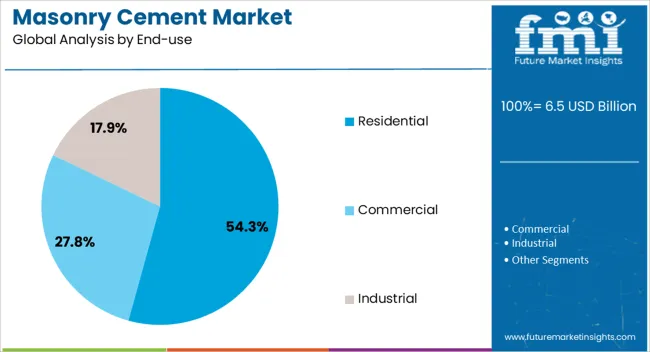

The masonry cement market is segmented by type, application, end-use, distribution channel, and geographic regions. By type, masonry cement market is divided into Type S, Type N, Type M, and Type 0. In terms of application, masonry cement market is classified into Brick and block construction, Stone masonry, Plastering, and Others (paving, etc.). Based on end-use, masonry cement market is segmented into Residential, Commercial, and Industrial.

By distribution channel, masonry cement market is segmented into Indirect and Direct. Regionally, the masonry cement industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Type S segment is projected to hold 49.1% of the Masonry Cement market revenue share in 2025, establishing it as the leading type in the market. This prominence is attributed to its superior strength and versatility, which make it suitable for load-bearing applications and structural masonry.

The segment’s growth has been supported by the increasing demand for materials that offer enhanced bonding and durability in both new constructions and renovation projects. Additionally, Type S cement’s adaptability to various environmental conditions has encouraged its adoption across diverse geographic regions.

The availability of Type S formulations with improved setting times and workability has further contributed to its widespread use, especially in areas focusing on long-lasting and resilient construction.

The Brick and Block Construction application segment is estimated to account for 42.7% of the Masonry Cement market revenue in 2025, making it the dominant application area. This leadership stems from the ongoing popularity of brick and block as preferred building materials due to their thermal efficiency, fire resistance, and cost-effectiveness.

The segment’s growth is bolstered by increased residential and commercial building projects that favor brick and block masonry for structural and partition walls. The compatibility of masonry cement with a variety of brick and block types facilitates its widespread application.

Moreover, construction trends emphasizing sustainable and energy-efficient building techniques have enhanced the demand for masonry cement in this application, further solidifying its position as the largest segment.

The Residential end-use industry segment is anticipated to capture 54.3% of the Masonry Cement market revenue in 2025, positioning it as the foremost end-use sector. This dominance is driven by the rapid expansion of housing developments fueled by population growth and urban migration.

Residential construction is increasingly prioritizing the use of masonry cement for its cost-effectiveness, ease of application, and durability. The segment’s growth has also been supported by government initiatives promoting affordable and quality housing.

Additionally, the rising demand for residential renovations and extensions is contributing to sustained consumption of masonry cement in this sector. The increasing focus on building resilient homes capable of withstanding environmental stresses is further encouraging the adoption of masonry cement, maintaining the segment’s leading market position.

The masonry cement market is expanding as demand for durable, aesthetic, and cost-effective building materials grows across residential, commercial, and infrastructure projects. Masonry cement, blended with Portland cement, plasticizers, and other additives, is widely used for mortar, plastering, bricklaying, and stonework. Rising urbanization, population growth, and government investment in housing and public infrastructure fuel adoption. The material’s benefits, including improved workability, water retention, and bonding strength, make it a preferred choice in construction. Sustainability initiatives are also driving demand for masonry cements with lower carbon footprints and supplementary cementitious materials. Manufacturers offering consistent quality, region-specific formulations, and environmentally friendly production processes are positioned to benefit from global construction sector growth.

The market faces challenges from raw material price fluctuations and environmental concerns. Masonry cement production relies on limestone, clay, gypsum, and energy-intensive kiln processes, all of which are subject to price volatility. Rising energy costs directly impact production expenses, while raw material scarcity in some regions adds supply chain risks. Environmental concerns related to carbon dioxide emissions during cement production create additional regulatory and reputational challenges. Stricter emission standards and carbon reduction commitments require manufacturers to invest in carbon capture, waste heat recovery, and alternative fuels. These factors increase capital and operational costs. Until sustainable production methods become more widespread and cost-efficient, raw material and environmental concerns will continue to challenge market expansion.

Market trends are driven by innovation in sustainable formulations and advanced construction technologies. Manufacturers are increasingly blending masonry cement with supplementary cementitious materials such as fly ash, slag, and natural pozzolans to reduce carbon emissions. Advances in admixtures and plasticizers improve workability, durability, and resistance to weathering. Lightweight and high-strength masonry cements are gaining traction in modern construction for faster installation and enhanced structural performance. The growing adoption of prefabricated building systems and 3D printing in construction also supports demand for specialized mortar mixes. These trends highlight a shift toward sustainable, high-performance, and versatile masonry cement products, aligning with global efforts to reduce environmental impact while meeting modern construction needs.

Opportunities in the masonry cement market are driven by rapid urbanization, population growth, and infrastructure development worldwide. Large-scale housing projects, commercial complexes, and public infrastructure investments create sustained demand for masonry cement. Emerging markets in Asia-Pacific, Africa, and Latin America present significant growth potential due to expanding construction activities and rising disposable incomes. Government initiatives promoting affordable housing and smart cities further accelerate adoption. Manufacturers offering localized production, cost-effective distribution, and region-specific product formulations can strengthen their market presence. Long-term opportunities also lie in sustainable and eco-friendly masonry cements, as construction stakeholders increasingly prioritize green building materials and certifications.

The market faces restraints from intense competition and regulatory compliance requirements. Global and regional producers compete on price, quality, and distribution networks, leading to margin pressures. Smaller players often struggle to match the economies of scale of large cement companies. Regulatory compliance related to environmental emissions, worker safety, and quality standards adds operational complexity and costs. Non-standardized products in unregulated markets may also create issues of inconsistency and consumer mistrust. Furthermore, the availability of substitutes such as ready-mix mortars and polymer-modified adhesives can limit growth in specific applications. Until manufacturers address regulatory challenges and strengthen differentiation through innovation and sustainability, competition and compliance will remain key market restraints.

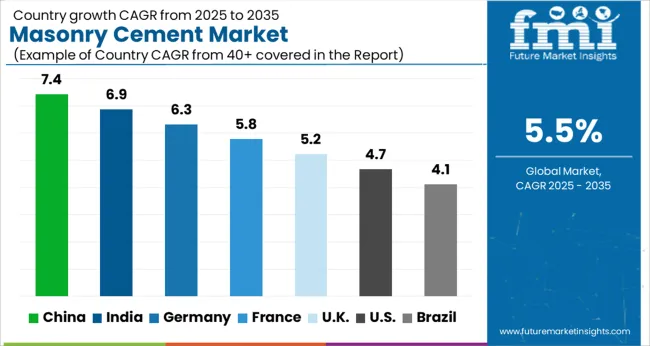

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The global masonry cement market was projected to grow at a 5.5% CAGR through 2035, driven by demand in construction, infrastructure, and residential projects. Among BRICS nations, China recorded 7.4% growth as large-scale manufacturing facilities were commissioned and compliance with building material quality standards was enforced, while India at 6.9% growth saw expansion of production units to meet rising regional construction demand. In the OECD region, Germany at 6.3% maintained substantial output under strict industrial and safety regulations, while the United Kingdom at 5.2% relied on moderate-scale operations for residential and commercial construction applications. The USA, expanding at 4.7%, remained a mature market with steady demand across infrastructure and building projects, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The masonry cement market in China is growing at a CAGR of 7.4% due to rising construction activity in residential, commercial, and infrastructure projects. Builders and contractors are increasingly using masonry cement for brickwork, blockwork, and plastering due to its durability, strength, and ease of application. Growth is supported by urban expansion, infrastructure development, and government initiatives promoting construction projects. Manufacturers are offering high quality, consistent, and cost effective cement products suitable for large scale and small scale construction needs. Suppliers focus on improving compressive strength, workability, and setting time to meet industry standards. Distribution channels, including wholesale and retail construction supply stores, as well as e-commerce platforms, are improving accessibility across urban and semi-urban regions. Rising demand for energy efficient and durable construction materials is further supporting market expansion, making China a key growth region for masonry cement products.

India is witnessing growth at a CAGR of 6.9% in the masonry cement market due to increasing residential, commercial, and infrastructure development. Builders and contractors are adopting masonry cement for brickwork, plastering, and blockwork due to its strength, durability, and ease of use. Growth is supported by rising urbanization, government housing projects, and increasing private construction investments. Manufacturers focus on producing high quality, consistent, and cost effective cement that meets industrial and household requirements. Suppliers are emphasizing compressive strength, workability, and setting time to ensure quality performance. Retail and wholesale construction supply channels, along with e-commerce platforms, are improving product availability across cities and semi-urban areas. Adoption is further driven by demand for energy efficient and long lasting construction materials. Expansion of both domestic production and import options ensures steady supply to meet growing construction sector requirements in India.

Germany is growing at a CAGR of 6.3% in the masonry cement market, supported by demand from residential, commercial, and industrial construction projects. Builders prefer masonry cement for brickwork, plastering, and blockwork due to its strength, reliability, and workability. Growth is also supported by renovation and infrastructure projects requiring high quality cement materials. Manufacturers are producing masonry cement with consistent quality, improved compressive strength, and controlled setting time to meet industry standards. Suppliers provide durable and reliable products suitable for a variety of construction applications. Distribution through construction supply stores, wholesalers, and online platforms ensures broad availability. Adoption is further influenced by growing demand for energy efficient and sustainable building materials. Continuous investment in construction technology and high quality material sourcing supports steady growth in Germany’s masonry cement market.

The United Kingdom market is expanding at a CAGR of 5.2% due to rising residential, commercial, and infrastructure development. Builders and contractors are using masonry cement for brickwork, blockwork, and plastering due to its workability, strength, and long term durability. Growth is supported by new housing projects, urban development initiatives, and commercial construction. Manufacturers are offering high quality, consistent, and cost effective cement products with improved compressive strength and optimized setting time. Suppliers focus on providing reliable materials suitable for various construction applications. Distribution networks, including construction supply stores and online platforms, ensure steady availability across urban and semi-urban regions. Adoption is further supported by demand for long lasting and energy efficient construction materials. Companies are introducing product bundles and customized solutions to cater to the requirements of contractors and builders in the United Kingdom.

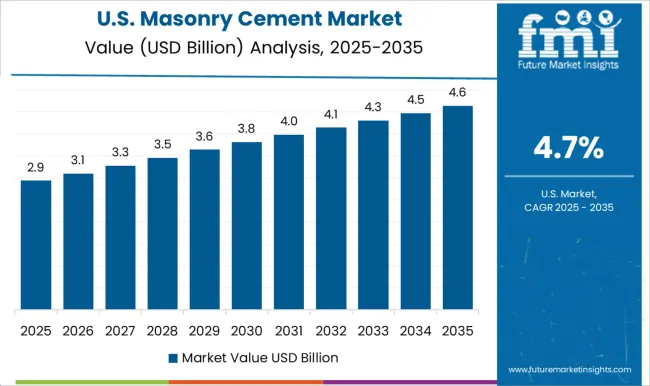

The United States market is growing at a CAGR of 4.7% due to increasing construction of residential, commercial, and infrastructure projects. Builders and contractors prefer masonry cement for brickwork, blockwork, and plastering because of its strength, durability, and ease of use. Growth is supported by housing projects, urban development, and commercial construction activity. Manufacturers provide high quality, consistent, and cost effective masonry cement products suitable for large scale and small scale construction. Suppliers focus on compressive strength, workability, and setting time to meet industry standards. Distribution through construction supply stores, wholesalers, and online platforms ensures availability across multiple regions. Adoption is further encouraged by the need for durable, long lasting, and energy efficient building materials. Expansion of domestic production and imports helps meet the rising demand from construction and infrastructure projects across the United States.

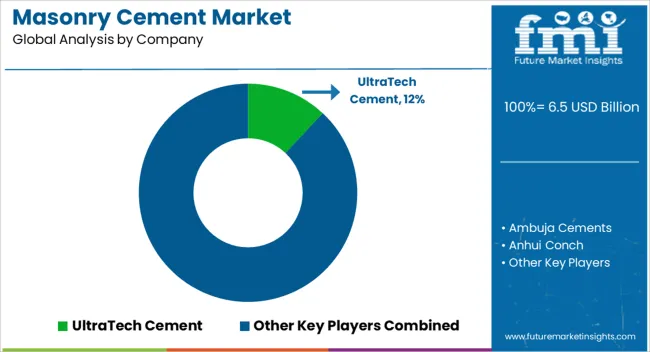

The masonry cement market is dominated by suppliers such as UltraTech Cement, Ambuja Cements, Anhui Conch, Birla, Buzzi Unicem, Cemex, China National Cement Corporation, CRH, Dangote Cement, Heidelberg, Holcim, J.K. Cement, Siam Cement, Sinoma, and Taiheiyo. Products are promoted as pre-blended, high-quality masonry cements designed for mortar applications, block laying, plastering, and general construction use. Brochures emphasize consistent compressive strength, workability, setting times, and compatibility with various aggregates. Products are often tested for water retention, adhesion, and durability under different climatic conditions to meet local and international construction standards. Competition is largely focused on product performance, regional availability, and supply chain efficiency. UltraTech Cement and Ambuja Cements highlight locally optimized blends for Indian construction needs, while Anhui Conch and China National Cement Corporation emphasize high-volume supply and integration with infrastructure projects in China and Asia. Buzzi Unicem and Cemex leverage international distribution networks and standardized quality control to maintain consistency across multiple regions. CRH and Heidelberg focus on premium masonry cement lines with enhanced workability and environmental compliance (observed industry pattern).

Dangote Cement positions products for Africa with attention to affordability and climatic resilience, and Holcim offers multi-purpose masonry cements adaptable for both residential and commercial projects. Market strategies focus on product differentiation, technical support, and regional penetration. Suppliers provide detailed technical datasheets specifying mixing ratios, setting characteristics, and mechanical properties to guide contractors and masons. Product innovation includes formulations resistant to efflorescence, improved water retention, and reduced shrinkage. Many companies, including J.K. Cement and Siam Cement, offer training programs and on-site advisory services to improve construction efficiency. Taiheiyo and Sinoma highlight consistent quality monitoring and R&D for region-specific cement blends. Partnerships with distributors, construction companies, and infrastructure developers are emphasized to ensure supply reliability and customer loyalty.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.5 Billion |

| Type | Type S, Type N, Type M, and Type 0 |

| Application | Brick and block construction, Stone masonry, Plastering, and Others (paving, etc.) |

| End-use | Residential, Commercial, and Industrial |

| Distribution Channel | Indirect and Direct |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | UltraTech Cement, Ambuja Cements, Anhui Conch, Birla, Buzzi Unicem, Cemex, China National Cement Corporation, CRH, Dangote Cement, Heidelberg, Holcim, J.K. Cement, Siam Cement, Sinoma, and Taiheiyo |

| Additional Attributes | Dollar sales vary by product type, including Type N, Type S, and Type M masonry cement; by application, such as residential construction, commercial buildings, and infrastructure projects; by end-use, spanning masonry units, plastering, and mortar production; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by urbanization, infrastructure investment, and rising demand for durable, cost-effective construction materials. |

The global masonry cement market is estimated to be valued at USD 6.5 billion in 2025.

The market size for the masonry cement market is projected to reach USD 11.0 billion by 2035.

The masonry cement market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in masonry cement market are type s, type n, type m and type 0.

In terms of application, brick and block construction segment to command 42.7% share in the masonry cement market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cement Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cement Consistometer Market Size and Share Forecast Outlook 2025 to 2035

Cement Paints Market Size and Share Forecast Outlook 2025 to 2035

Cement Sacks Market Growth – Demand & Forecast 2025 to 2035

Cement Kiln Co-Processing Fuels Market Growth – Trends & Forecast 2024-2034

Europe Cement Packaging Market Analysis – Trends & Forecast 2024-2034

North America Cement Packaging Industry Analysis – Trends & Forecast 2024-2034

Cement Boards Market

Cement and Mortar Testing Equipment Market Growth – Trends & Forecast 2018-2027

Biocement Market Size and Share Forecast Outlook 2025 to 2035

GCC Cement Market Growth – Trends & Forecast 2025 to 2035

Replacement Sheets Market Analysis - Size, Share & Forecast 2025 to 2035

Bone Cement Delivery System Market Trends – Growth & Forecast 2024-2034

Bone Cement Mixers Market

Green Cement Market Size and Share Forecast Outlook 2025 to 2035

Resin Cement for Luting Market Size and Share Forecast Outlook 2025 to 2035

Fiber Cement Market Analysis by Raw Materials, End User, Application, and Region through 2025 to 2035

Fiber Cement Board Market Growth - Trends & Forecast 2025 to 2035

Qatar Cement Market Analysis by Product Type, End Use, and Region Forecast Through 2025 to 2035

Competitive Overview of White Cement Market Share

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA