The Metering Pump Market is estimated to be valued at USD 6.9 billion in 2025 and is projected to reach USD 11.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period. In the early adoption phase from 2020 to 2024, the market expanded from USD 5.5 billion to USD 6.6 billion, driven by initial investments in chemical, water treatment, and pharmaceutical applications. Key breakpoints included pilot installations, growing awareness of precision dosing benefits, and regulatory support for efficient chemical handling. These developments laid the foundation for broader acceptance and set the stage for the next growth phase.

From 2025 to 2030, the market entered the scaling phase, growing from USD 6.9 billion to USD 8.4 billion. Breakpoints during this stage included technological innovations, increased automation, and expanding industrial adoption, which enhanced efficiency and reliability. By 2030–2035, the market will reach consolidation, attaining USD 11.2 billion. Consolidation is characterized by the dominance of established players, standardized solutions, and widespread adoption across industries, with incremental innovations sustaining growth while improving cost-effectiveness, reliability, and compliance with environmental standards, ensuring long-term market stability.

| Metric | Value |

|---|---|

| Metering Pump Market Estimated Value in (2025 E) | USD 6.9 billion |

| Metering Pump Market Forecast Value in (2035 F) | USD 11.2 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The metering pump market is gaining strong traction, supported by the increasing need for precise fluid handling across critical sectors such as water treatment, chemical processing, and food and beverage. Growing industrial emphasis on chemical dosing accuracy, reduced product wastage, and compliance with environmental standards has driven the adoption of metering pumps in both developed and emerging economies.

Rising global concerns around water pollution and the need for wastewater treatment infrastructure expansion have also accelerated demand, particularly in urban and industrial regions. The integration of digital monitoring and remote-control systems in modern metering pump technologies is enabling predictive maintenance and enhancing operational efficiency, which aligns with the global shift toward smart manufacturing practices.

As industries transition toward sustainable practices, the need for energy-efficient and programmable dosing solutions is expected to drive continued innovation and investment in the market This evolution is laying the foundation for broader adoption across a wider range of end-use industries and geographic regions.

The metering pump market is segmented by type, end-use, and geographic regions. By type, metering pump market is divided into Diaphragm Pumps, Peristaltic Pumps, Piston/Plunger Pumps, and Others. In terms of end-use, metering pump market is classified into Water & Wastewater, Pharmaceutical, Food & Beverage, Oil & Gas, Chemical, and Others. Regionally, the metering pump industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Diaphragm pumps are expected to account for 46.2% of the total revenue share in the metering pump market in 2025, making them the leading type in the industry. Their dominance is being influenced by the reliability, leak-free operation, and corrosion resistance offered in applications that handle aggressive or hazardous fluids. These pumps have been widely accepted due to their suitability for precise dosing and compatibility with a range of chemicals and viscosities.

The segment has been further strengthened by the minimal maintenance requirements and extended operational life, making diaphragm pumps ideal for continuous use in remote or automated environments. Adoption has also been supported by technological advancements such as stroke length adjustability and integrated sensors that ensure consistent flow rate and dosing accuracy.

The demand from sectors where fluid purity and accuracy are critical, such as pharmaceuticals and food processing, has reinforced their market position. The ability of diaphragm pumps to comply with stringent environmental and safety regulations continues to sustain their growth trajectory.

The water and wastewater end-use segment is projected to contribute 49.7% of the overall revenue share in the metering pump market in 2025, reflecting its critical role in infrastructure and environmental management. The segment's prominence is driven by the growing global demand for water purification, desalination, and municipal wastewater treatment. Governments and utilities are increasingly investing in centralized and decentralized water systems to meet rising consumption needs while ensuring compliance with evolving water quality standards.

Metering pumps have become essential in dosing coagulants, disinfectants, and pH adjusters, enabling treatment plants to maintain precise chemical balance and process efficiency. Their programmable control and ability to manage varying flow rates with high accuracy are critical in reducing chemical waste and operational costs.

The widespread integration of smart monitoring systems and automation technologies has enhanced real-time visibility and control, further elevating their adoption. As environmental regulations tighten and urban populations grow, the water and wastewater segment is expected to remain the dominant consumer of metering pump technologies.

The metering pump market is growing due to rising demand for precise fluid handling in chemical processing, water treatment, pharmaceuticals, and food & beverage industries. Metering pumps enable accurate dosing of acids, alkalis, and specialty chemicals, ensuring process efficiency and safety. Technological advancements in diaphragm, piston, and peristaltic pumps enhance durability, automation, and corrosion resistance. Asia-Pacific is emerging rapidly due to industrial expansion, while North America and Europe lead in advanced automation and regulatory compliance. Manufacturers focus on smart, energy-efficient, and digitally controlled pumps to meet evolving industrial requirements.

Process industries require precise control of chemical injection to maintain product quality, safety, and regulatory compliance. Metering pumps provide consistent flow rates, minimizing waste and preventing hazardous over-dosing in applications such as water disinfection, chemical synthesis, and pharmaceutical production. Advanced pumps with digital controllers, feedback loops, and variable stroke adjustments improve precision. The challenge lies in selecting materials resistant to corrosive or abrasive fluids, while ensuring long-term reliability. Until universally adaptable, multi-chemical pumps are developed, manufacturers must balance accuracy, material compatibility, and cost to meet diverse application needs.

Municipal and industrial water treatment plants increasingly rely on metering pumps for precise dosing of chlorine, coagulants, flocculants, and pH adjusters. Regulatory requirements for safe drinking water and effluent quality drive adoption. Pumps capable of handling aggressive chemicals, varying viscosities, and intermittent flow are critical. Innovations such as smart metering pumps with IoT integration and remote monitoring optimize operations and reduce downtime. Companies providing reliable, low-maintenance, and automated solutions gain a competitive edge. Until cost-effective digital solutions become standard, market growth will be tied to water infrastructure expansion and regulatory enforcement.

The rise of Industry 4.0 and process automation is transforming metering pump applications. Pumps integrated with PLCs, SCADA systems, and IoT sensors allow real-time monitoring, predictive maintenance, and precise flow adjustments. Automation improves operational efficiency, reduces manual intervention, and enhances safety in hazardous environments. Manufacturers offering smart, connected pumps with customizable interfaces and advanced control algorithms differentiate themselves. Until fully integrated, interoperable metering solutions become widely adopted, market growth will depend on balancing technological sophistication, user-friendliness, and cost-efficiency for diverse industrial processes.

Metering pumps handle corrosive, abrasive, or high-temperature fluids, making material selection critical. Diaphragm pumps often use PTFE, PVDF, or elastomers, while piston pumps may require stainless steel or alloy components. Poor material compatibility can lead to leaks, reduced lifespan, and process contamination. Manufacturers must innovate durable materials resistant to chemical degradation while maintaining accuracy and cost efficiency. Customized solutions for specific chemical profiles are increasingly demanded by industrial clients. Until standardized, universally resistant pump materials are widely available, product differentiation and reliability will remain major market drivers, especially in chemical-intensive industries.

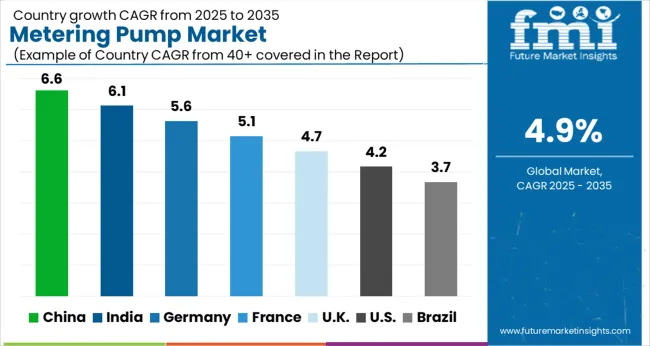

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

| USA | 4.2% |

| Brazil | 3.7% |

The global market is projected to grow at a CAGR of 4.9% through 2035, supported by increasing demand across chemical processing, water treatment, and industrial applications. Among BRICS nations, China has been recorded with 6.6% growth, driven by large-scale production and deployment in chemical and industrial processes, while India has been observed at 6.1%, supported by rising utilization in water treatment and chemical dosing systems. In the OECD region, Germany has been measured at 5.6%, and France at 5.1%, where production and adoption for industrial, chemical, and water treatment applications have been steadily maintained. The United Kingdom has been noted at 4.7%, reflecting consistent use in industrial and treatment operations, while the USA has been recorded at 4.2%, with production and utilization across chemical, water, and industrial sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The metering pump market in China is expanding at a CAGR of 6.6%, driven by growing demand from chemical processing, water treatment, and pharmaceutical industries. Increasing industrial automation and precise dosing requirements are pushing adoption of advanced metering pumps for accurate fluid handling. China’s expanding chemical and pharmaceutical sectors, along with government regulations for wastewater treatment and chemical safety, support market growth. Technological innovations in pump materials, flow control, and automation enhance operational efficiency and durability. Adoption in municipal water treatment, industrial manufacturing, and laboratory processes further strengthens market demand. Rising awareness about accurate dosing and environmental compliance is encouraging the replacement of conventional pumps with modern metering solutions. The combination of industrial expansion, technological advancement, and regulatory enforcement positions China as a key market for metering pumps over the forecast period.

The metering pump market in India is growing at a CAGR of 6.1%, supported by increasing requirements in chemical, pharmaceutical, and water treatment sectors. Industries are adopting metering pumps for precise chemical dosing, improved process control, and enhanced operational efficiency. India’s expanding industrial and municipal infrastructure, including water treatment facilities, is boosting market demand. Government regulations on effluent treatment and chemical safety are accelerating adoption of reliable metering pumps. Technological advancements such as automated flow control, corrosion-resistant materials, and energy-efficient designs improve performance and reduce maintenance costs. Adoption in laboratories, food processing, and industrial plants ensures consistent market growth. With growing awareness about environmental compliance and process optimization, India is emerging as a significant market for metering pump solutions over the forecast period.

The metering pump market in Germany is expanding at a CAGR of 5.6%, driven by stringent industrial safety regulations and the need for precise fluid handling. Key end-users include chemical processing plants, pharmaceuticals, water treatment facilities, and laboratories. Germany’s focus on high-quality manufacturing standards and compliance with environmental regulations encourages adoption of reliable and technologically advanced metering pumps. Innovations such as digital flow control, corrosion-resistant materials, and automated dosing systems enhance operational efficiency and reduce downtime. Industrial modernization and growing awareness of accurate chemical dosing requirements further support market growth. Airports, research facilities, and municipal water plants are increasingly deploying metering pumps to ensure safety and efficiency. The combination of regulatory enforcement, industrial advancement, and technological innovation positions Germany as a stable market for metering pump solutions.

The metering pump market in the United Kingdom is growing at a CAGR of 4.7%, with demand driven by chemical processing, water treatment, and pharmaceutical industries. Industrial automation and precise dosing requirements are accelerating adoption of metering pumps. Regulatory frameworks related to effluent treatment, chemical safety, and environmental compliance support market expansion. Technological advancements in digital flow control, corrosion-resistant materials, and automated systems improve operational efficiency. Adoption in municipal water treatment, laboratories, and industrial plants ensures steady market demand. Industrial modernization, coupled with growing awareness of accurate chemical dosing and environmental sustainability, strengthens the outlook for metering pump solutions in the UK. Manufacturers are investing in R&D to enhance product performance, reliability, and safety, meeting the evolving requirements of end-users.

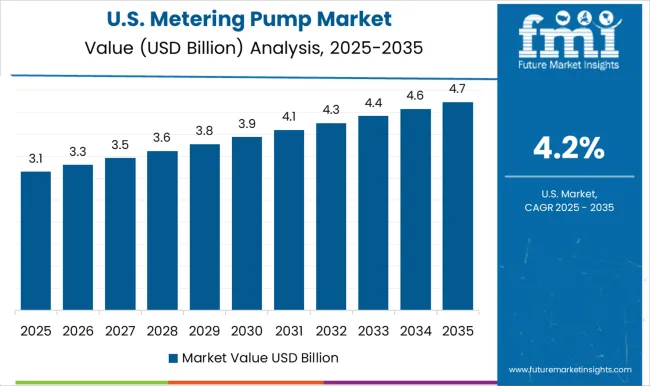

The metering pump market in the United States is growing at a CAGR of 4.2%, driven by chemical, pharmaceutical, water treatment, and food processing industries. Increasing industrial automation and the need for precise chemical dosing enhance adoption of metering pumps. Regulatory frameworks for environmental compliance and effluent management encourage end-users to replace conventional pumps with modern solutions. Technological innovations such as digital flow control, corrosion-resistant materials, and automated dosing systems increase accuracy and operational efficiency. Industrial plants, laboratories, and municipal water treatment facilities are primary adopters. Rising awareness of process optimization and environmental responsibility further supports market growth. Continuous R&D investments by manufacturers ensure metering pump solutions remain reliable, safe, and efficient, positioning the United States as a key market for sustained growth in the coming years.

The metering pump market plays a crucial role in precise fluid handling across industries such as chemical processing, water treatment, pharmaceuticals, food and beverages, and oil and gas. These pumps ensure accurate dosing of liquids, chemicals, and additives, contributing to operational efficiency, safety, and regulatory compliance. Increasing demand for automation and precise flow control, coupled with stricter environmental and safety regulations, is driving market growth globally.

Key market players include IDEX Corporation, known for its high-performance fluidics solutions and a broad portfolio of metering pumps for industrial and municipal applications. Ingersoll Rand and Dover Corporation provide advanced metering pumps designed for durability and accurate chemical dosing. ProMinent offers innovative pumping technologies and smart control systems to enhance process efficiency.

Grundfos Holding A/S and SEKO S.P.A. are prominent global suppliers offering metering pumps for water treatment, industrial processes, and chemical applications. Milton Roy Company, SPX Flow Technology, and Verder Group focus on high-precision pumps and systems for demanding environments. Yamada Corporation and LEWA GmbH deliver technologically advanced diaphragm and piston pumps suitable for critical processes.

Other notable players include Moyno Inc., Nikkiso Co., Ltd., Swelore Engineering Pvt. Ltd., and Wanner Engineering, Inc., offering reliable solutions tailored for various industries, including food, pharmaceuticals, and industrial manufacturing.

The market is expected to grow steadily as industries continue to demand precise, efficient, and automated fluid handling solutions. Innovations in smart pumps, IoT-enabled monitoring, and eco-friendly designs further enhance the adoption of metering pumps, reinforcing their importance in modern industrial processes.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.9 Billion |

| Type | Diaphragm Pumps, Peristaltic Pumps, Piston/Plunger Pumps, and Others |

| End-Use | Water & Wastewater, Pharmaceutical, Food & Beverage, Oil & Gas, Chemical, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | IDEXCorporation, IngersollRand, DoverCorporation, ProMinent, GrundfosHoldingA/S, SEKOS.P.A., MiltonRoyCompany, SPXFlowTechnologyNorderstedtGmbH, VerderGroup, YamadaCorporation, LEWAGmbH, MoynoInc., NikkisoCo.,Ltd., SweloreEngineeringPvt.Ltd., and WannerEngineering,Inc. |

| Additional Attributes | Dollar sales vary by pump type, including diaphragm pumps, piston pumps, and peristaltic pumps; by application, such as water & wastewater treatment, chemicals, pharmaceuticals, and food & beverages; by end-use industry, spanning industrial, municipal, and healthcare sectors; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by increasing demand for precise fluid handling, industrial automation, and chemical dosing applications. |

The global metering pump market is estimated to be valued at USD 6.9 billion in 2025.

The market size for the metering pump market is projected to reach USD 11.2 billion by 2035.

The metering pump market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in metering pump market are diaphragm pumps, peristaltic pumps, piston/plunger pumps and others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power Metering Market

Subcool Metering Device Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Metering Market Size and Share Forecast Outlook 2025 to 2035

India Power Metering Market Insights – Trends & Forecast 2025 to 2035

Residential Smart Water Metering Market Size and Share Forecast Outlook 2025 to 2035

Pump Jack Market Forecast Outlook 2025 to 2035

Pump and Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Pump Testers Market Size and Share Forecast Outlook 2025 to 2035

Pumpjacks Market Size and Share Forecast Outlook 2025 to 2035

Pumps Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Seed Protein Market Size and Share Forecast Outlook 2025 to 2035

Pumped Hydro Storage Market Size and Share Forecast Outlook 2025 to 2035

Pump Tubes Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Pie Spices Market Analysis - Size, Share, and Forecast 2025 to 2035

Pumps and Trigger Spray Market Trends - Growth & Forecast 2025 to 2035

Pump Condiment Dispensers Market - Effortless Portion Control 2025 to 2035

Pumpkin Spice Products Market Trends - Seasonal Demand & Growth 2025 to 2035

Pump Feeders Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in the Pump and Dispenser Industry

Mud Pumps Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA