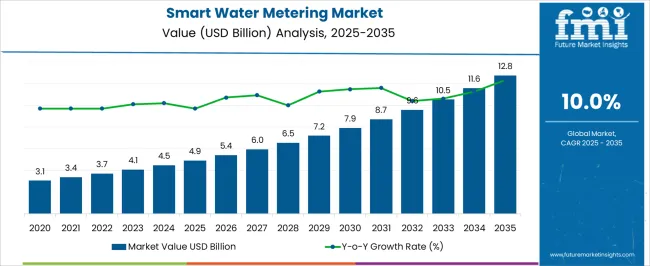

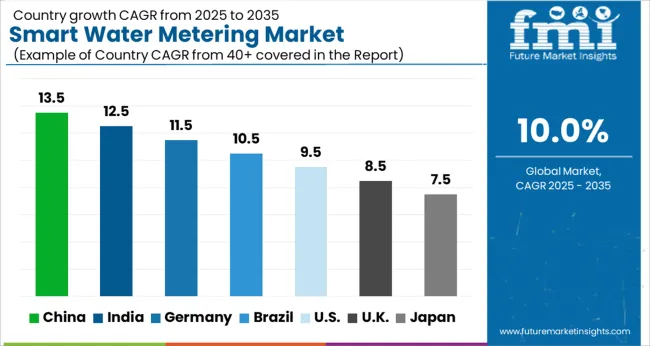

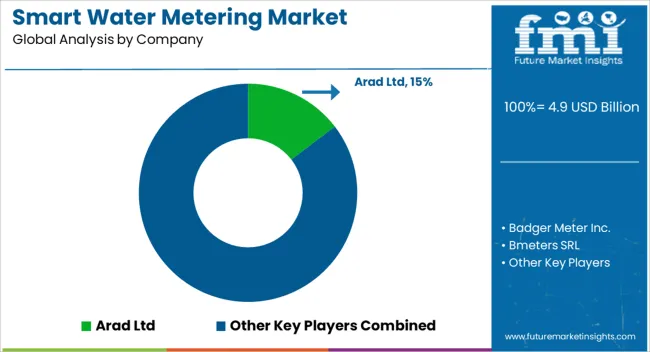

The Smart Water Metering Market is estimated to be valued at USD 4.9 billion in 2025 and is projected to reach USD 12.8 billion by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period.

| Metric | Value |

|---|---|

| Smart Water Metering Market Estimated Value in (2025 E) | USD 4.9 billion |

| Smart Water Metering Market Forecast Value in (2035 F) | USD 12.8 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

The smart water metering market is advancing steadily due to growing concerns around water conservation, efficient utility management, and regulatory mandates promoting digital infrastructure for water distribution. Utilities are increasingly adopting connected solutions to optimize consumption monitoring, detect leakages, and reduce non revenue water.

Advances in IoT integration, data analytics, and wireless communication protocols are enabling real time tracking and predictive maintenance, thereby improving operational efficiency. Rising urbanization and smart city initiatives are accelerating deployment, particularly in regions facing water scarcity and stringent sustainability regulations.

The outlook for the market remains favorable as utilities and municipalities continue to invest in scalable smart infrastructure, driving higher adoption across both residential and commercial end user categories.

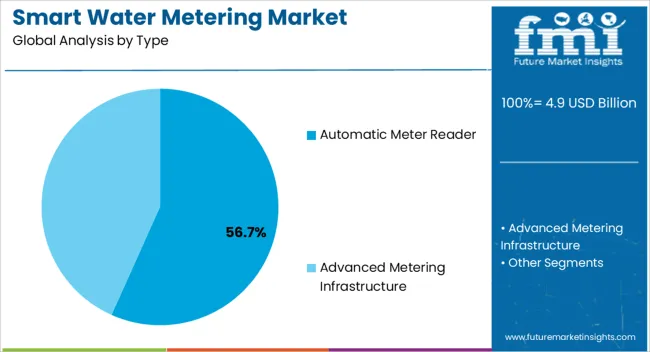

The automatic meter reader segment is expected to represent 56.70% of the total market revenue by 2025, making it the leading type. This dominance is supported by its ability to simplify the collection of meter data through remote communication, thereby eliminating manual reading errors and reducing operational costs.

Its integration with digital platforms enables accurate billing and improved transparency for consumers. Utilities have prioritized this segment as it facilitates faster deployment compared to advanced metering infrastructure and requires relatively lower investment.

The proven reliability, cost efficiency, and ease of integration into existing networks have reinforced the leadership position of the automatic meter reader type within the smart water metering market.

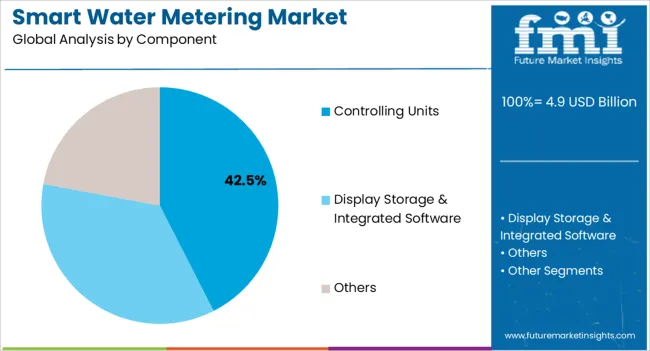

The controlling units segment is projected to account for 42.50% of the total market by 2025 within the component category, positioning it as the leading subsegment. This is attributed to their critical role in regulating water flow, automating shut off functions, and enabling efficient leakage detection.

Utilities have relied on controlling units to improve demand response and ensure better network resilience. Their integration with IoT platforms allows for dynamic adjustments, enhancing both operational control and consumer engagement.

As utilities focus on building smart infrastructure capable of handling water scarcity challenges, controlling units have emerged as indispensable components, driving their leading market share.

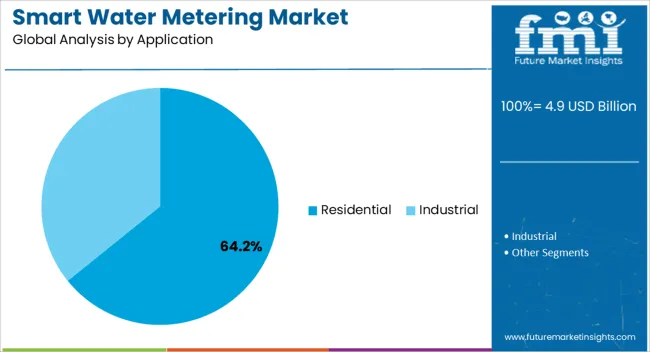

The residential application segment is anticipated to command 64.20% of the market revenue by 2025, making it the largest application category. This prominence is driven by rising consumer awareness around water conservation and the increasing implementation of smart meters in households to monitor usage patterns.

Governments and municipalities are investing in residential smart water metering to address urban water scarcity and improve equitable distribution. The demand is also supported by the need for accurate billing and leak detection in individual households.

The combination of regulatory backing, consumer demand for transparency, and smart home adoption trends has reinforced the dominance of the residential segment in the smart water metering market.

According to recent research by Future Market Insights, the smart water metering market is projected to expand at a rate of 10% during the forecast period from 2025 to 2035. The market outlook could be divided into short-term, medium-term, and long-term influences.

Short-term (2025 to 2025): Across the globe, governments are placing a greater emphasis on the creation of smart cities, which incorporate smart water management systems. As a result, there has been a rise in spending on smart water metering systems, signaling future expansion for the industry. Among these countries is the European Union, which has mandated that 80 percent of all homes install smart meters by 2024.

Medium-term (2025 to 2035): There has been a rise in demand for AMI-based solutions. Data that are more accurate, two-way communication, and greater flexibility in data management are just a few of the benefits that Advanced Metering Infrastructure (AMI) systems provide over traditional Automated Meter Reading (AMR) systems, which are driving their adoption in the smart water metering market. Advanced features like real-time data analytics and remote control are made possible by AMI-based solutions, assisting utilities in streamlining water management operations and cutting costs.

Long-term (2035 to 2035): Smart water metering systems can respond to growing consumer demand for real-time information on water consumption. Smart water meters can increase customer satisfaction and decrease the likelihood of disputes over water bills by giving consumers more control over their water usage and helping them identify wastage.

Governments around the world are taking the necessary steps to encourage the long-term conservation of water. These measures are being implemented because the demand for water has increased dramatically over the past decade due to both population growth and increased urbanization. This has resulted in a rise in the demand for energy, which in turn has spawned new types of businesses and places of employment.

Sustainable water use is now a crucial consideration for meeting current and future water demands. The best available solution is provided by these systems, which can map water usage across a water utility's supply chain. This has fueled the growth of the smart water metering market by increasing the adoption rate among water utilities.

Smart water meters are a viable option for both water utilities and their customers from a financial standpoint. These meters are a one-time purchase that will last for decades with very little upkeep.

Accurate billing is a major selling point because it ensures consumers are only ever paying for the water they actually use. This makes it impossible for the service provider and the customer to misunderstand one another. Industries like the food and beverage industry, the textile industry, and others that use large amounts of water stand to gain the most from such installations.

A failure to educate consumers about the benefits may slow the market.

Despite the many benefits that smart water meters can provide, they are still largely unknown to the general public. Neither developed nor developing countries have adopted smart water metering systems to any significant degree as of yet. This may act as a restraint on the market's expansion during the projected period. In addition, water companies need to put in significant resources to install smart water meters for all of their customers. Inevitably, this means steep price increases for consumers. In the years to come, this could have a negative effect on the market.

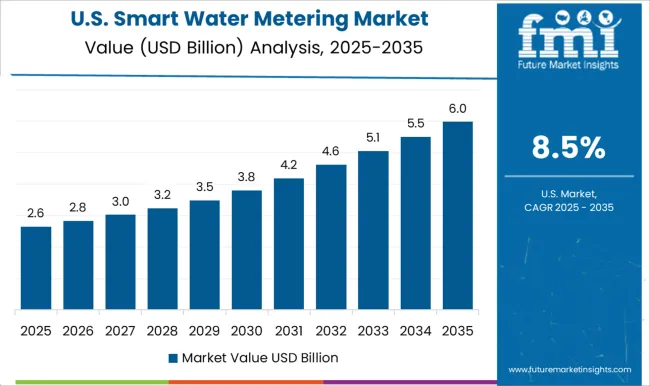

The federal government in the United States has launched a number of programs and mandated standards to encourage the widespread use of smart water meters. For instance, smart water metering systems can be funded at low-interest rates thanks to the Water Infrastructure Finance and Innovation Act (WIFIA). The Environmental Protection Agency's (EPA) WaterSense program promotes the use of water-saving products and practices, such as smart water meters.

Badger Meter, Inc.: Badger Meter is a leading manufacturer of smart water meters, as well as other flow measurement products, such as gas meters and industrial flow meters. Utilities, municipalities, and commercial and industrial customers use the company’s products across the United States and around the world. Badger Meter is known for its high-quality products, innovative technology, and exceptional customer service.

Neptune Technology Group: Neptune Technology Group is a technology company that specializes in smart water flow meter solutions for utilities. The company offers a range of products, including advanced metering infrastructure (AMI) systems, meter data management systems, and leak detection solutions.

The growth of the market in India is mainly attributed to the rising demand for efficient water management solutions due to increasing water scarcity and the need to reduce water wastage. The Indian government is also taking initiatives to implement smart water metering systems to improve water management practices, which is driving the market growth.

Additionally, the adoption of smart city initiatives in India is also expected to fuel the demand for smart water flow meter systems. The increasing focus on digitalization and the use of advanced technologies such as the Internet of Things (IoT) is also expected to contribute to market growth.

Japan has a strong culture of environmental awareness and conservation. This has led to a growing demand for sustainable solutions, including smart water metering systems. Consumers in Japan are increasingly aware of the importance of water conservation and are willing to adopt new technologies to reduce water wastage.

The water system in Japan is outdated and in need of renovation. Over 60 percent of Japan's water supply pipelines are over 30 years old, per the country's Ministry of Land, Infrastructure, Transport, and Tourism (MLIT). As a result, the water supply system has become inefficient and there has been significant water loss. Therefore, smart water flow meter systems and other innovative approaches to water management are in high demand.

In the coming years, the residential sector is expected to continue its historic dominance of the market. The rising population and urbanization of many countries are the primary drivers of this expansion in demand. Since the residential sector typically receives the bulk of the region's municipal water supply, it also consumes the most water. The industrial sector is the second largest user of water after the residential sector, and for good reason: water is used as a raw material and a coolant in a wide variety of manufacturing processes around the world.

Although the advanced metering infrastructure segment currently has a smaller market share than auto meter reading, it is expected to overtake auto meter reading in the coming years because of the operational advantages of two-way communication and greater accuracy. Auto reading meters are not preferred in current smart energy metering roll-outs due to the lack of two-way communication between utilities and customers.

Itron, Kamsturp, and Landis+Gyr dominate the market share, giving the impression of an oligopoly. Their dominance can be attributed to several factors, including the availability of a wide variety of smart water solutions and the companies' dedication to constant innovation, which in turn leads to the introduction of new devices.

Badger Meter, Diehl, Aclara Technologies, Neptune Technology Group, Sensus, BMETER, Datamatic, Honeywell, ZENNER, and Holley Technology are just some of the regional and domestic players who have recently entered the market with innovative technologies and cost-effective answers. This is expected to have a positive effect on the global market as these firms are predicted to increase their market share during the forecast period.

How can Manufacturers Scale their Businesses in the Smart Water Metering Market?

The global smart water metering market is estimated to be valued at USD 4.9 billion in 2025.

The market size for the smart water metering market is projected to reach USD 12.8 billion by 2035.

The smart water metering market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in smart water metering market are automatic meter reader and advanced metering infrastructure.

In terms of component, controlling units segment to command 42.5% share in the smart water metering market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential Smart Water Metering Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Smart Cold Therapy Machine Market Size and Share Forecast Outlook 2025 to 2035

Smart Personal Assistance Devices Market Size and Share Forecast Outlook 2025 to 2035

Smart Speaker Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA