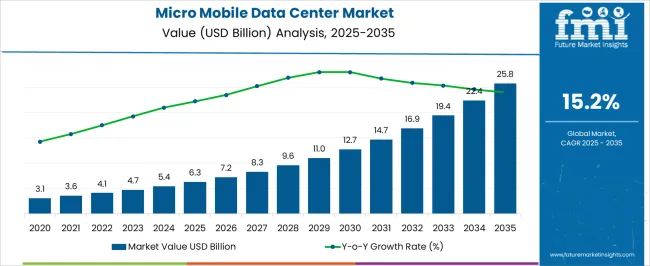

The Micro Mobile Data Center Market is estimated to be valued at USD 6.3 billion in 2025 and is projected to reach USD 25.8 billion by 2035, registering a compound annual growth rate (CAGR) of 15.2% over the forecast period.

| Metric | Value |

|---|---|

| Micro Mobile Data Center Market Estimated Value in (2025 E) | USD 6.3 billion |

| Micro Mobile Data Center Market Forecast Value in (2035 F) | USD 25.8 billion |

| Forecast CAGR (2025 to 2035) | 15.2% |

The micro mobile data center market is undergoing rapid evolution, driven by increased demand for low-latency data processing, decentralized IT infrastructure, and edge computing integration across industries. The shift toward data-intensive applications such as AI inference, IoT analytics, and real-time streaming has accelerated the need for compact, portable, and scalable data center units.

Enterprises are favoring micro data centers to ensure business continuity, local processing, and secure storage near the data source. Advancements in modular designs, integrated cooling systems, and remote management tools have expanded deployment flexibility across urban, rural, and industrial environments.

Supportive regulatory frameworks for data sovereignty and rising infrastructure investments in smart manufacturing, healthcare, and 5G deployments are further supporting market growth. Looking forward, edge-native IT strategies and sustainability-linked deployments are expected to create new opportunities for micro mobile data center vendors.

The market is segmented by Application, Rack Unit, Organizational Size, and Vertical and region. By Application, the market is divided into Edge Computing, Instant Data Center, and Remote Office and Branch Office. In terms of Rack Unit, the market is classified into 20 RU to 40 RU, Up to 20 RU, and Above 40 RU. Based on Organizational Size, the market is segmented into Large Enterprises and Small and Medium-sized Enterprises. By Vertical, the market is divided into IT and Telecommunication, BFSI, Media & Entertainment, Healthcare, Government and Defense, Retail, Manufacturing, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

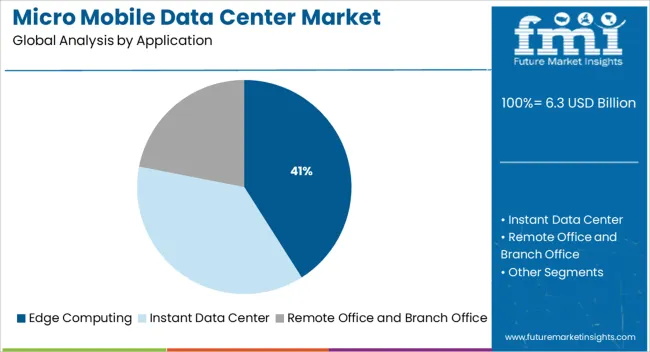

Edge computing is projected to account for 41.0% of the micro mobile data center market revenue in 2025, making it the leading application segment. This dominance is being fueled by the proliferation of data-generating devices and the growing need to process information closer to its origin.

Micro mobile data centers offer a practical solution for real-time analytics and reduced latency in environments where centralized data processing is not feasible. Their compact footprint, rapid deployment capabilities, and self-contained infrastructure make them ideal for edge use cases across retail, manufacturing, and remote field operations.

As businesses adopt edge-first strategies to optimize bandwidth usage and enhance decision-making, micro data centers continue to gain traction as the go-to infrastructure model.

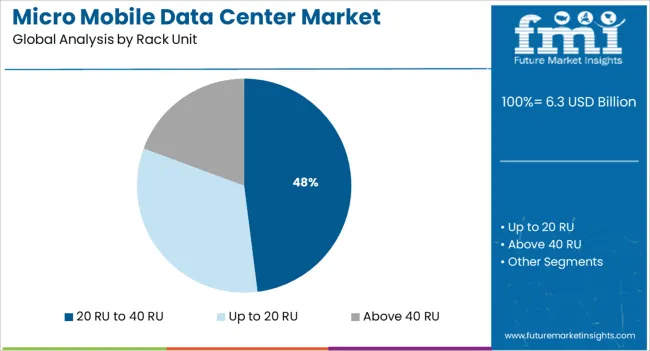

The 20 RU to 40 RU rack unit category is anticipated to hold 48.0% of the total market revenue in 2025, emerging as the most preferred rack configuration. This segment's leadership is being shaped by its optimal balance between capacity, mobility, and power efficiency.

It supports critical IT hardware servers, switches, and storage in a compact structure that is easier to transport and install at edge locations. This form factor offers the scalability needed for enterprise workloads while maintaining lower cooling and energy consumption profiles.

The ability to customize rack designs based on end-user applications while complying with industry regulations has contributed to its widespread adoption across sectors requiring mid-sized, high-performance processing at the edge.

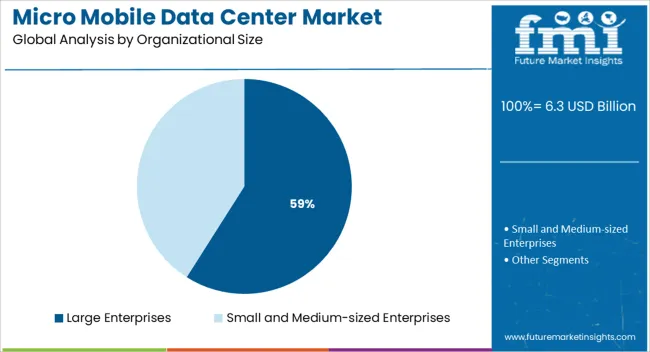

Large enterprises are expected to generate 59.0% of the market revenue in 2025, positioning them as the dominant organizational category in the micro mobile data center landscape. This share is driven by their expansive digital infrastructure needs, distributed workforce, and increasing use of hybrid cloud environments.

These organizations often operate across multiple locations, requiring localized computing power to reduce latency and enhance performance for mission-critical applications. The deployment of micro mobile data centers allows large enterprises to maintain compliance with data sovereignty laws, manage peak loads efficiently, and reduce dependency on distant centralized facilities.

Investment in smart infrastructure and business continuity planning has further accelerated the segment’s growth, making micro mobile units a strategic asset in enterprise IT portfolios.

The North American region will continue to showcase dominance in the micro mobile data center on the backdrop of increasing investments by companies coupled with the availability of enhanced IT infrastructure.

According to market research of micro mobile data centers, North America has the largest market share of USD 5.4 Billion, owing to the widespread adoption of modern technological systems and data centers across all industries. The mobile data center market in North America has developed due to the rise of cloud computing technologies, and the area is expected to grow significantly over the projected period. The rapid growth of cloud-based services across the IT industry and the rising adoption of wireless connectivity are the major drivers for the mobile/micro data center market.

The end-use industry segment of the micro mobile data center market is further segmented as banking and financial institutions (BFSI), telecommunication, government institutes, and military and defense among others. The telecommunication segment for micro mobile data centers is expected to witness tremendous growth in developing economies.

Industries such as distribution warehouses, telecom clouds, offices, and other industries have boosted their adoption and demand for computing capacity. Micro mobile data centers of 8kw to 10kw per cabinet are required by telecommunications companies.

A company's data center is its beating heart. It is the location where vital information is kept and distributed. The necessity for traditional data centers has decreased as the technology environment has progressed and enterprises have become more centralized.

As a result, there is a growing desire for more compact and efficient data centers to be put across offices. Micro data centers with plug-and-play capabilities provide fully integrated and pre-tested solutions.

These data centers can quickly scale up to meet an organization's growing needs. The fact that micro mobile data centers allow for speedier deployment is the most appealing feature. The plug-and-play strategy has proven to be successful, allowing data centers to be deployed quickly.

Traditional data centers are often built-to-order and can be customized to fit the needs of the user. These features allow data center users to deploy data center components from a variety of suppliers and customize them to their own needs and operating environment.

Due to its standardized design and prefabricated modules, micro mobile data center providers do not offer fully customizable solutions or the option of allowing the vendor to choose their service provider. These data centers are outfitted with standardized components from their manufacturers.

As a result, firms using micro mobile data centers are limited to a single vendor, preventing them from incorporating innovative technologies from other vendors to improve the performance of their data centers. This lack of customization and purchasing restrictions

Industries such as distribution warehouses, telecom clouds, offices, and other industries have boosted their adoption and demand for computing capacity. Micro mobile data centers of 8kw to 10kw per cabinet are required by telecommunications companies.

To improve their processes, distribution sectors require high computing capacity to manage transactions, shipping data, and inventory, which is why they prefer a micro mobile data center. Retailers are now focusing on growing their business by giving customers real-time data and advertising the products that they prefer.

In the future years, the micro mobile data center market will be driven by the growing demand for real-time computing. The micro mobile data center is simple to operate and deploy, and it brings a lot of benefits.

Like other industries, the micro mobile data center market has significant hurdles. For data center managers, determining how well a micro mobile data center can integrate with a standard data center has become a difficulty. Using regular data center infrastructure to install tiny data centers might raise total operational costs.

Another problem is replacing the business's traditional data centers. It has become a market challenge since businesses are not ready to modernize their existing data centers. However, in the future term, the market demand is likely to be driven by the growing requirement and desire for micro centers. Even though there are certain obstacles, market drivers and players are working to boost micro mobile data center market demand.

The micro mobile data centers market is segmented into organizational size, applications, rack unit, vertical, and region.

According to FMI, by rack unit Above 40 RU segment is predicted to have the largest market share, with a CAGR of 14% during the forecast period.

Large enterprises have a slew of difficulties, like higher power use and a larger carbon footprint, to name a few. Micro mobile data centers are particularly efficient in terms of power and cooling since they are contained in a box, rather than requiring the whole physical infrastructure that standard data centers require.

Micro mobile data centers near the network's periphery allow for speedier reaction times and the elimination of bottlenecks. Micro mobile data centers also assist businesses with easy and quick deployments, allowing them to extend current data centers rather than build new ones.

They save a lot of time and money when it comes to construction and maintenance. Large businesses have embraced micro mobile data centers due to their benefits and characteristics, with an anticipated CAGR of 13.4% by 2035.

| Regions | CAGR (2025 to 2035) |

|---|---|

| United States of America | 14.5% |

| United Kingdom | 13.7% |

| China | 14.4% |

| Japan | 13.8% |

| India | 13.3% |

North America, Europe, Asia Pacific, and other parts of the world are the primary markets in the micro mobile data center market. According to market research of micro mobile data centers, North America has the largest market share of US$ 5.4 Billion, owing to the widespread adoption of modern technological systems and data centers across all industries.

Due to population growth and the emergence of the e-commerce sector, the Asia Pacific region is rising at a fast rate. In this region, government measures are propelling the market growth. The mobile data center market in Asia has developed due to the rise of cloud computing technologies, and the area is expected to grow significantly over the projected period. Across the coming years, the industry is predicted to expand in all regions.

The development of innovative and efficient goods is the primary focus of players in the micro mobile data center market. Research shows how the competitors are taking advantage of the opportunities present in the micro mobile data center market. Some of the recent developments in the micro mobile data center market are:

The global micro mobile data center market is estimated to be valued at USD 6.3 billion in 2025.

The market size for the micro mobile data center market is projected to reach USD 25.8 billion by 2035.

The micro mobile data center market is expected to grow at a 15.2% CAGR between 2025 and 2035.

The key product types in micro mobile data center market are edge computing, instant data center and remote office and branch office.

In terms of rack unit, 20 ru to 40 ru segment to command 48.0% share in the micro mobile data center market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Micron CBN Powder Market Size and Share Forecast Outlook 2025 to 2035

Microfilm Reader Market Size and Share Forecast Outlook 2025 to 2035

Micro-Dosing Sachet Fillers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Microbial Growth Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Micro Hotel Market Forecast and Outlook 2025 to 2035

Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

Micro-energy Harvesting System Market Size and Share Forecast Outlook 2025 to 2035

Micro CHP Market Size and Share Forecast Outlook 2025 to 2035

Micro Irrigation System Market Size and Share Forecast Outlook 2025 to 2035

Micro Flute Paper Market Size and Share Forecast Outlook 2025 to 2035

Microcrystalline Cellulose Market Size and Share Forecast Outlook 2025 to 2035

Micro Balances Market Size and Share Forecast Outlook 2025 to 2035

Micro Perforated Films Packaging Market Size and Share Forecast Outlook 2025 to 2035

Microbial Coagulants Market Size and Share Forecast Outlook 2025 to 2035

Microserver IC Market Size and Share Forecast Outlook 2025 to 2035

Microplate Handling Instruments Market Size and Share Forecast Outlook 2025 to 2035

Microsclerotherapy Treatment Market Size and Share Forecast Outlook 2025 to 2035

MicroLED Photoluminescence Inspection System Market Size and Share Forecast Outlook 2025 to 2035

Micro-Scale VFFS Modules Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Microscope Digital Camera Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA