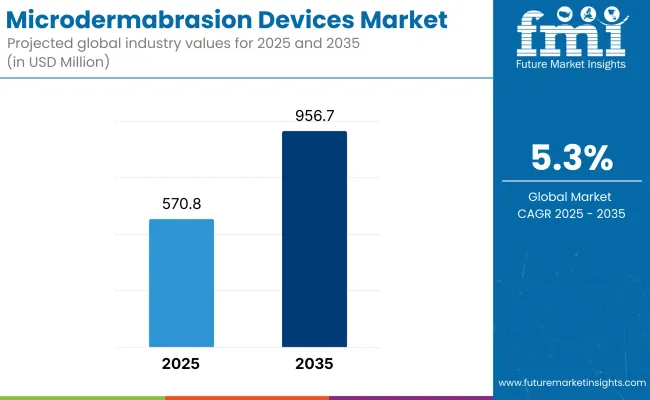

The Microdermabrasion Devices market is expected to reach USD 570.8 Million by 2025 and is expected to steadily grow at a CAGR of 5.3% to reach USD 956.7 Million by 2035. In 2024, Microdermabrasion Devices market have generated roughly USD 542.1 Million in revenues.

Microdermabrasion devices are designated as non-invasive skin devices that remove the outer layer of dead skin cells for rejuvenation and improvement in skin texture, tone, and appearance. This technique has gained popularity for treatment of several conditions, including acne scars, wrinkles, sunspots, and age spots. The growing concern of consumers over skincare and aesthetic therapies has been complemented with an increasing level of interest for, if not invasive, low downtime therapies.

With these advances in technology, it is now possible to manufacture portable, easy-to-use devices for home use. Popularization by the growing beauty market, disposable incomes, and social media involvement have also found their place in attraction toward cosmetic treatments. Lastly, prevention and anti-aging skincare also help to convince commercialism of microdermabrasion as one of the constituents of standard skincare routines and thus propel its market expansion

Key Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 570.8 Million |

| Industry Value (2035F) | USD 956.7 Million |

| CAGR (2025 to 2035) | 5.3% |

A series of historical influences from 2020 to 2024 greatly augmented the use of microdermabrasion devices. The COVID-19 pandemic has affected consumer trends that directed preference toward at-home products due to closure of clinics or salons for a brief period of time, hence giving impetus to the growth of personal care devices, such as portable microdermabrasion machines. At the same time, working from home and increased screen time made consumers conscious about their appearance and skin care regimes.

Besides, after the pandemic, the growing interest in self-care and wellness awoke consumers to pay for facial treatments that are considered non-invasive. Social media and influencer marketing had an upper hand in hyping flawless skin and fast-track demand.

Advancements in technology have remodeled the skin care industry at a fast rate, making devices more sophisticated, safe, and user-friendly. Increasing incidence rates of skin ailments like acne and pigmentation among the broader population are also projected to spur the uptake of microdermabrasion treatments and further induce market acceptance.

The fact that many people have become aware of non-surgical beauty treatments and like to use home products instead of going to a dermatologist or an aesthetic center; perhaps even at disposable income levels at which advanced cosmetic technologies can be accessed by consumers. Most highly concentrated areas of dermatology or aesthetic clinics exist in North America.

It also has an insightful collection of social media influences backed mostly by celebrities and beauty influencers, which imparts flawless skin ideals in consumers to further keep them spending on microdermabrasion, increasing the kind of innovation in devices that make them much safer and faster and easier to use in-home applications.

Population aging, though, contributes significantly since many patients desire non-surgical cosmetic remedies that would treat fine lines and smooth skin texture. The other factor is a favorable regulatory environment, which increases the availability of such devices and confidence in them.

Increased microdermabrasion equipment usage gets popularized throughout Europe with increasing skin care consciousness, requirement for non-surgical aesthetic treatments, and a great beauty and wellness culture. The top countries include Germany, France, and Italy, which then occupy a huge market share in advanced aesthetics including high-end skin rejuvenation solutions because these three countries have well-established dermatology and cosmetic industries.

Proliferation of medical spa and aesthetic clinic popularity in the cities ensures that consumers can easily access such treatments professionally. More importantly, regulatory harmonization within the EU presents assurance in terms of safety and effectiveness in the use of cosmetic devices, which further builds consumer confidence and further attribute contribute to the growth of the market.

Asia-Pacific has witnessed a quick ascent of microdermabrasion devices through a rise in disposable incomes, enhanced beauty awareness, and the culture of Western beauty skincare trends. In terms of the intense growth of aesthetic clinics and dermatology centers offering non-surgical cosmetic treatments, China, South Korea, Japan, and India stand pretty bright. Due to high urbanization and exposure to social media, many young adolescents crowd the skin rejuvenation procedures.

Demand is spurred not only by the fact that South Korea is the leader in cosmeceutical innovation and by Japan's aging population in pursuit of anti-aging procedures but also through the mushrooming of locally based beauty tech startups and e-commerce platforms that will make availability easier, especially with home-use models, thus having an overall effect on market penetration.

Regulatory and Safety Concerns Associated with Microdermabrasion Devices hinders their Market Growth

While non-invasive, microdermabrasion is a mechanical exfoliation of the skin and can turn troublesome with redness, sensitivity, or even infection if mismanaged. The FDA in the USA and the European Medicines Agency (EMA) are formal regulatory bodies that have in place specifications related to safety, efficacy, and manufacturing quality.New manufacturers entering a market have to comply with a multitude of regional requirements, extending the product launch period and increasing operational costs.

Likewise, any mishap during an untrained professional or home-user treatment may backfire on the device's name, prompting recalls and legal obligations with device. This are few of the factors that are limiting the growth of the market.

Rising Demand for Home-Use Aesthetic Devices poses new opportunities in the market

An excellent opportunity for the growth of the microdermabrasion devices market lies in the increase in demand for in-home skincare solutions. Consumer behavior has noticeably shifted in light of COVID-19, and many people now invest in personal care devices that are easy to use and relatively inexpensive compared to the cost of repeated appointments at a dermatology clinic. Portable, simple-to-handle, and cost-effective microdermabrasion devices have generated traction among population seeking for preventive skincare and sustaining aesthetics.

The influencers along with the rising growth of e-commerce have contributed even more toward the visibility and access of these devices. With innovative features like varied suction levels, diamond-tip technology, and app-usage tracking that enhance safety and performance, these devices stand an even higher chance of adoption by new users. Manufacturers that focus their designs on ergonomics, safety features, and clinical value will definitely stand a good chance of securing the lucrative home-use segment.

Surge in Demand from Medical Aesthetic Clinics anticipates the Growth of the Market

The rapid rise in non-surgical cosmetic procedures has witnessed medical aesthetic clinics increasingly adopting microdermabrasion devices. This huge variety of offers appeals to a wider patient base. Clinically, fast treatments enable clinics to maximize profit by increasing through-put.

The CE and market approval of professional machines have boosted the clinical confidence and acceptance of microdermabrasion devices. As an increasing number of people seek consumer-level professional skincare, clinics add the high-end microdermabrasion machines to their product offerings.

Expansion of Product Offerings by Key Market Players demonstrates the Growth of the Market

There is an ongoing diversification of the product line by major actors in the skincare device market to encompass a large selection of microdermabrasion devices for both the professional and home user. Product diversification also covers advances in diamond-tip technology, vacuum suction control and combination therapies. PMD Beauty, Trophy Skin, and Derma glow are investing heavily in R&D with the aim of creating machines that give salon-quality results from the comfort of home.

The combination of ergonomic design and friendly controls makes them easy to use, capturing new segments such as teenage and senior users. In addition, the input of dermatologists and beauty influencers into the process has maximized product awareness and market penetration. These strategic shifts allow companies to establish brand loyalty while conforming to consumer demands for safe, easy, and effective at-home skincare devices.

Rising Demand for At-Home Professional-Grade Devices

A big boost in consumer interest for anything to do with home microdermabrasion was another product that produced almost professional results. Factors like heightened skincare awareness and the need for convenience can be blamed for this, especially in the post-pandemic setting when many in-clinic treatment clients just dropped off like a stone.

Consumers are shelling out cash on products that promise to render spa treatments from the comforts of home. Cost-effective and time-effective home treatments are an added advantage for increasing numbers of users all willing to hop on the bandwagon and introduce microdermabrasion in their skincare regimen.

Increasing Use in Combination Therapy Offerings

Microdermabrasion is rapidly gaining popularity, both professionally and at home, to be paired with other facial treatments such as chemical peels, serums, and light therapies. This is because combined treatments tend to yield the best result - the microdermabrasion exfoliation allows the products and treatments to penetrate better. Spas and clinics now offer combination packages pairing microdermabrasion with vitamin infusion or hydration therapy for maximum skin glow and rejuvenation.

Likewise, product companies are launching special post-treatment serums to be used after microdermabrasion to boost skin healing and improve results. This multi-step approach to skincare has become more widely accepted and preferred by both clients and practitioners interested in obtaining long-lasting and profound effects, therefore widening the scope of application for microdermabrasion devices.

The Microdermabrasion Devices market saw numerous positive growth trends from 2020 to 2024, owing to consumers increasingly attracted to non-invasive beauty treatments, study-at-home demand for beauty supplies resulting from the pandemic, and the steady increase of dermatology clinics. Moving forward, the intervening chances of growth from 2025 to 2035 will mainly be propelled by ergonomic improvements in devices, heightened aesthetic consciousness among individuals, and growing disposable incomes in many parts of the world.

Furthermore, the growing acceptance of combination skin therapies and access to dermatology in the developing world will complement such demand to make microdermabrasion an essential part of modern-day skincare practice.

Shifts in the Microdermabrasion Devices Market from 2020 to 2024 and Future Trends 2025 to 2035

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stepped regulatory endorsement of home-use microdermabrasion equipment, focus on equipment safety, performance, and dermatological clearance |

| Technological Advancements | Expansion in the usage of compact, easy-to-use equipment, better micro-crystal flow technologies, and fusion technology with both exfoliation and light treatment. |

| Consumer Demand | Pandemic-facilitated expansion in home skin care, the trend towards non-surgical anti-aging solutions, and increased clinic visits following the lockdown. |

| Market Growth Drivers | Social media pressure on skincare habits, increased cosmetic procedure acceptance, and increasing disposable incomes, particularly in urban regions. |

| Sustainability | Emphasis on reusable tip devices and minimum packaging waste and demand for minimal-maintenance machinery. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expected introduction of stricter safety labeling, standardization of clinical efficacy claims, and wider international regulatory harmonization for professional and home-use devices. |

| Technological Advancements | Technological progress leading to better durability and performance of devices, providing a crystal-free innovation system allowing cooling functionality and multi-functionality to be included for more comprehensive skin treatment experiences. |

| Consumer Demand | More and more growth in self-care culture and improved dermatological maintenance regimens as well as increased demand for non-surgical cosmetic treatments among different age groups. |

| Market Growth Drivers | Deep penetration of growth markets; wider dermatology service providers; growing awareness on preventive skincare and safe exfoliation practices. |

| Sustainability | Aggressively targeting a robust, eco-friendly device, recyclable product components, and low-energy consuming models for sustainable consumers. |

Market Outlook

Increasingly in the United States, skincare consciousness and increasing numbers of aesthetic treatment facilities are pushing demand for microdermabrasion devices. Studies in technology improvements of the machines-for example, the use of better suction, safety features-are affecting the market. Self-care and non-invasive therapies are said to be pulling the market.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

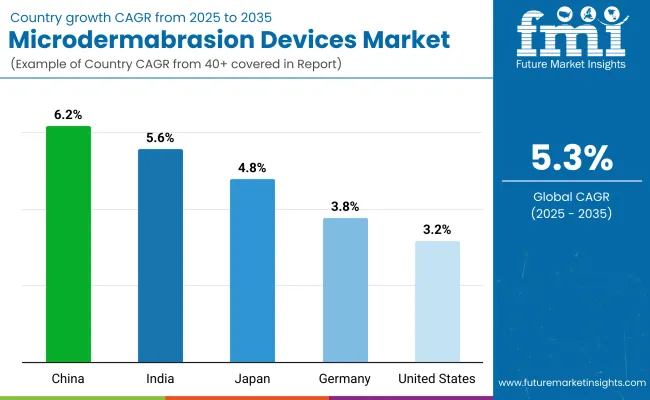

| United States | 3.2% |

Market Outlook

The German Microdermabrasion Devices market is being propelled by the increased demand for non-invasive skincare treatments and a strong trend toward customized aesthetic treatments. Infrastructural support due to good healthcare in Germany and growing numbers of aesthetic clinics are also acting favorably for the market. Demand for skin health by consumers is also becoming a prominent factor.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.8% |

Market Outlook

The booming middle-class population, disposable income, and demand for cosmetic treatments constitute the main drivers for the growth of the Indian microdermabrasion devices market. Emphasizing enhancing the skin aesthetic appeal are aesthetic centers and dermatologists who are increasingly adopting these devices; thus, extra push to the market growth, especially among urban consumers.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.6% |

Market Outlook

Consumer awareness about skincare in China, rising disposable incomes, and demand for non-invasive cosmetic procedures are the major growth factors. With the beauty sector booming in the country and high consumer demand for advanced skincare technology, the adoption of microdermabrasion devices is especially high in urban regions.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.2% |

Market Outlook

The high proportion of aged population and increased demand for anti-aging therapies are the major drivers for the Microdermabrasion Devices market. Moreover, the high consciousness of skincare among Japanese consumers and their interest in advanced beauty technology creates strong demand for such devices. It is also the at-home skincare device trend that helps drive the growth of this market.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

Diamond microdermabrasion devices dominate the market due to their reduced risk of contamination

Diamond microdermabrasion devices are much more precise, safer, and hence share lower contamination possibilities as compared to crystal-based systems. Diamond tipped abrasives allow for controlled ablation even without any residual particles and hence are suitable to treat relatively delicate areas such as around the eyes and mouth.

Because of the ease of maintenance and good reusability, diamond-tipped micro dermbrasion machines are becoming commonly used in professional dermatology clinics and starting to find their way into home-use machines. The ability to regulate the amount of abrasion provides a capacity for effective treatment of all skin types, rendering them the preferred mode of choice for aestheticians and their customers for relatively safer, hygienic, and superior microdermabrasion technology.

Crystal microdermabrasion devices hold a substantial market share due to their proven track record

Crystal microdermabrasion devices have earned an immense market share due to their services and proven track records-exactly what could be desired in a clinical setup. These machines use either of two methods-as either aluminum oxide or sodium bicarbonate crystals to exfoliate the skin, mostly useful for the treatment of scars and pigmentation and deep peeling. For long-term treatments, the dermatologist prefers benefits that offer deeper and better exfoliation.

Even though they may require a bit more maintenance and have a marginally higher risk of cross-contamination, their amazing track record of effecting consistent results in aiding some skin complaints is a primary reason they continue to succeed, particularly in classical clinical settings and value-oriented markets.

Hospitals dominate the market due to their comprehensive infrastructure and ability to offer integrated skincare services

Hospitals hold the dominant share in the microdermabrasion devices market since they possess the complete infrastructure, have advanced equipment, and offer a package of other medical services for which they provide skincare services. Hospitals handle such patients who want treatment supervised by a doctor, especially if someone has complex skin problems requiring dermatological management. In order to increase breadth of treatment, a hospital is usually equipped with high-end, multifunctional microdermabrasion devices.

Also adds to procedure volume is the increasing aesthetic dermatology focus within the hospital dermatology practice. Their high credibility, qualified staff, and insurance-linked availability make hospitals the first options for safe and professional-grade microdermabrasion treatments.

Dermatology clinics hold a substantial share in the market due to their specialization in skin care and cosmetic dermatology

Dermatology clinics account for the biggest share in microdermabrasion because they are qualified in cosmetic dermatology and skin care. They serve a wide population of potential individualized skin care seekers in a less specialized and convenient setting than the hospitals.

They extensively use both diamond and crystal microdermabrasion systems for treatment concerning acne scars, pigmentation, and dull complexion. These days, when awareness about skin-care is more, many prefer professional but non-hospital environments for aesthetic care. Apart from this, dermatology clinics also provide affordably priced packages and faster appointments, which result in their huge popularity and enduring demand for microdermabrasion treatments.

Government authorities that include FDA and CE authorities mandate manufacturers to develop devices according to compliant designs and safety features. From this, market leaders maintain their upper hand by getting into collaborative partnerships with dermatology clinics, wellness centers, and online platforms to expand their market presence.

It is at this level of the marketing mix that local or emerging market players will also take on the global brands with cheaper, superior devices tailored to local needs. Competitive pricing, more focus on home-use segments, and aggressive marketing campaigns gather momentum to mold the ever-changing face of this market.

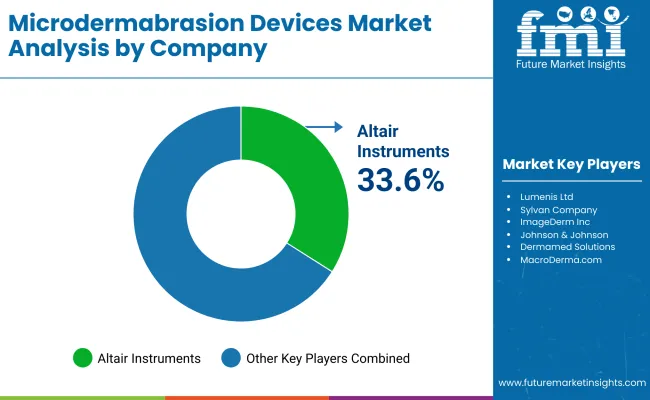

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Altair Instruments | 33.6%-38.5% |

| Lumenis Ltd | 20.4%-22.6% |

| Sylvan Company | 15.1%-17.2% |

| ImageDerm Inc | 4.6%-6.8% |

| Other Companies (combined) | 12.1%-15.4% |

| Company Name | Key Offerings/Activities |

|---|---|

| Altair Instruments | Altair focuses on non-invasive skincare treatments providing professional-level exfoliation. Widely used in dermatology clinics and aesthetic centers for its accuracy, hygienic diamond-tip technology, and low downtime, Altair holds a pioneering position in crystal-free systems. |

| Lumenis Ltd | Lumenis microdermabrasion takes its place with the famous M22™ and ResurFX ™ platforms within an overall portfolio of non-invasive aesthetic treatments |

| Sylvan Company | Sylvan specializes in manufacturing customizable crystal-based systems usable for varying levels of exfoliation. In this endeavor, Sylvan aims to keep its equipment affordable so as to reach smaller clinics and operators of beauty services with instruments that are both reliable and affordable |

| ImageDerm Inc | ImageDerm devotes itself to small, easy-to-use diamond microdermabrasion systems for both professional and personal use. They provide ImageDerm DiamondTome ® systems with a reputation for reliable results and low risk of irritation |

Key Company Insights

Diamond Microdermabrasion Devices and Crystal Microdermabrasion Devices

Acne, Minor Acne Scarring, Enlarged and Clogged Pores, Spots and Blemishes, Fine Lines and Wrinkles, Uneven Skin Tone, Coarse Skin Texture and Saggy Skin

Hospitals, Dermatology Clinics and Spas and Beauty Parlors

North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Middle East & Africa

The overall market size for Microdermabrasion Devices market was USD 570.8 Million in 2025.

The Microdermabrasion Devices market is expected to reach USD 956.7 Million in 2035.

Rising aesthetic awareness, and preference for non-invasive procedures anticipates the growth of the microdermabrasion devices market.

The top key players that drives the development of microdermabrasion devices market are Altair Instruments, Lumenis Ltd, Sylvan Company, ImageDerm Inc and Kosmet, Inc.

Treating cirrhosis causes segment by treatment is expected to dominate the market during the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by End User, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 45: North America Market Attractiveness by Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by End User, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

FBAR Devices Market

Snare devices Market

C-Arms Devices Market Size and Share Forecast Outlook 2025 to 2035

Timing Devices Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Secondary Packaging Market Analysis by Material and Application Through 2035

Hearable Devices Market Size and Share Forecast Outlook 2025 to 2035

Lab Chip Devices Market Size and Share Forecast Outlook 2025 to 2035

Orthotic Devices, Casts and Splints Market Size and Share Forecast Outlook 2025 to 2035

Lacrimal Devices Market Size, Trends, and Forecast 2025 to 2035

Global Ablation Devices Market Trends - Growth, Innovations & Forecast 2025 to 2035

Orthotic Devices, Splints & Orthopedic Braces Market Analysis - Trends & Forecast 2024 to 2034

Ear Tube Devices Market

Pathology Devices Market Size and Share Forecast Outlook 2025 to 2035

Neurotech Devices Market Size and Share Forecast Outlook 2025 to 2035

Skin Care Devices Market Analysis - Trends & Forecast 2025 to 2035

Strapping Devices Market Trends - Size, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA