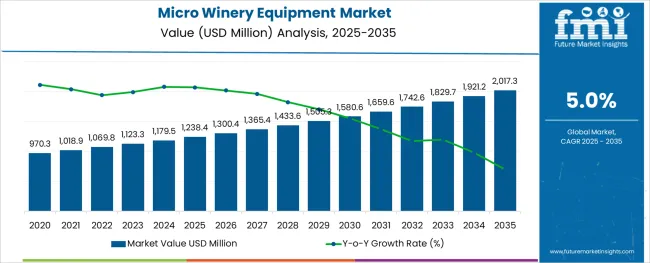

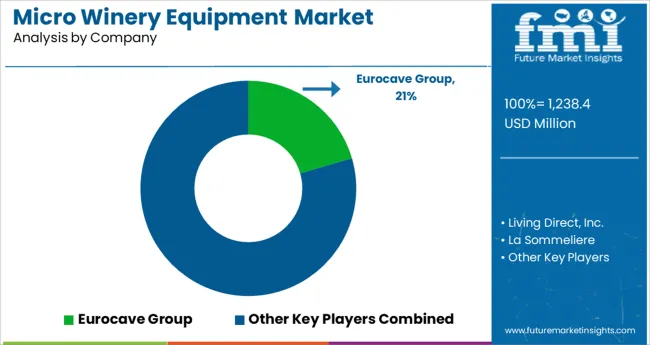

The Micro Winery Equipment Market is estimated to be valued at USD 1238.4 million in 2025 and is projected to reach USD 2017.3 million by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

The micro winery equipment market is steadily gaining traction as small-scale and boutique wineries continue to proliferate, catering to the rising demand for artisanal and locally-produced wines. This growth is being supported by evolving consumer preferences favoring unique, handcrafted beverages, coupled with lower barriers to entry for small producers due to modular and scalable equipment options.

Industry trends indicate that investments in efficient, space-saving, and environmentally responsible equipment have been prioritized by operators to optimize production within limited footprints. The future outlook remains positive, as technological advancements, supportive regulatory frameworks, and increasing tourism associated with wine trails and tasting rooms continue to encourage the establishment of micro wineries.

Opportunities for further growth are being paved by innovations in automation, material durability, and integration of smart monitoring solutions that enhance productivity and product quality in small-batch production environments.

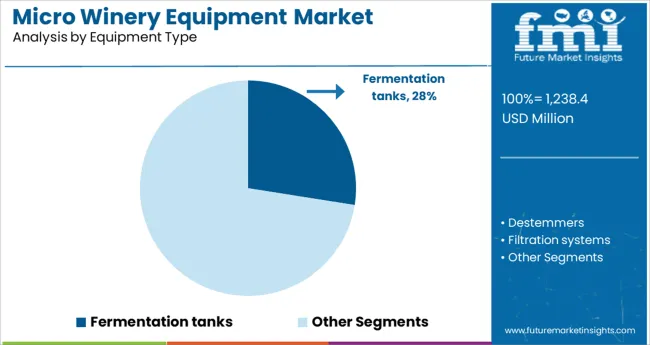

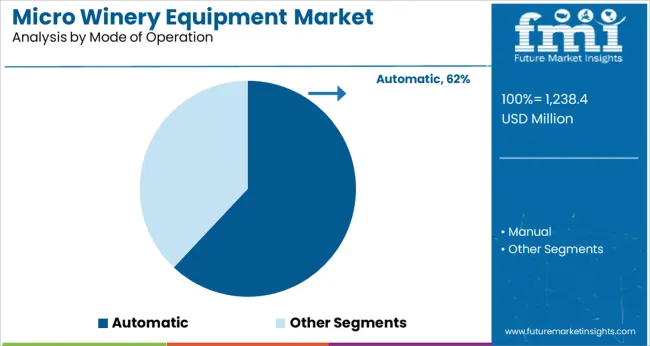

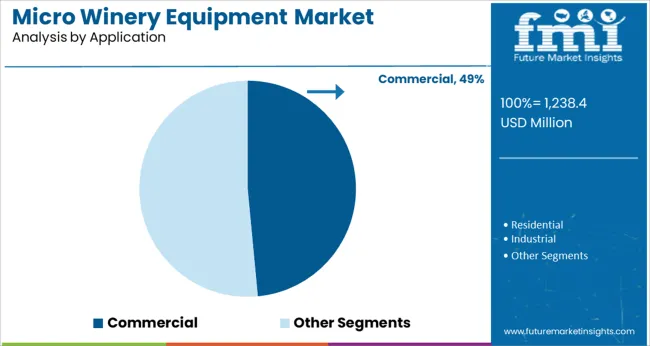

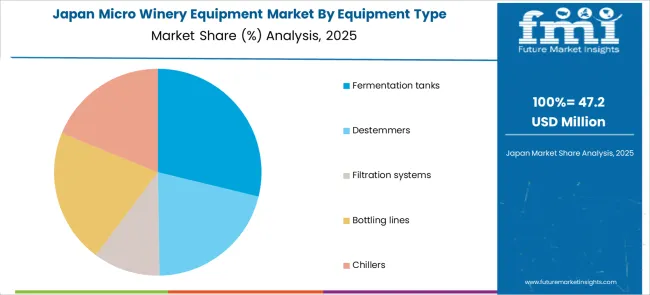

The market is segmented by Equipment Type, Mode of Operation, Application, and Distribution Channel and region. By Equipment Type, the market is divided into Fermentation tanks, Destemmers, Filtration systems, Bottling lines, and Chillers. In terms of Mode of Operation, the market is classified into Automatic and Manual. Based on Application, the market is segmented into Commercial, Residential, and Industrial. By Distribution Channel, the market is divided into Offline and Online. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by equipment type, fermentation tanks are expected to hold 27.5% of the total market revenue in 2025, making it the leading equipment category. This leadership is attributed to the critical role fermentation plays in determining wine quality and the necessity of precise environmental control during this process.

Design enhancements in tank insulation, temperature regulation, and sanitary finishes have significantly improved their operational efficiency and product consistency, driving adoption among micro wineries. Additionally, the versatility of fermentation tanks in handling various grape varieties and wine styles has reinforced their demand.

Their durability and capacity to support both traditional and innovative winemaking techniques have also positioned them as indispensable assets, further consolidating their segmental dominance in the market.

In terms of mode of operation, the automatic segment is projected to account for 62.0% of the market revenue in 2025, securing its position as the most prominent operational category. This prominence has been driven by the need for efficiency, consistency, and labor cost reduction in micro winery operations.

Automation has enabled small-scale producers to achieve precise control over critical parameters such as temperature, pressure, and fermentation timing, thereby ensuring high-quality output with minimal manual intervention.

The integration of programmable controls, smart sensors, and remote monitoring capabilities has enhanced productivity while maintaining artisanal authenticity. The growing preference for reducing operational errors and optimizing resource utilization has further cemented the automatic segment’s leadership in the market.

Segmenting by application reveals that the commercial segment is anticipated to capture 48.5% of the market revenue in 2025, positioning it as the leading end-use category. This dominance has been reinforced by the increasing number of commercial micro wineries that produce wine not only for local consumption but also for broader distribution through retail and hospitality channels.

The commercial application of micro winery equipment has benefited from rising demand for unique, premium wines that emphasize origin and craftsmanship.

Investment in professional-grade equipment has been observed as critical for meeting regulatory standards, maintaining production consistency, and enhancing brand reputation. The ability of commercial operators to scale production while maintaining quality and engaging effectively with consumers has solidified this segment’s stronghold in the market.

The advanced wineries with home-grown grape wines along with the health awareness around it have pushed the demand for a home-based wine production solution.

According to Future Market Insights, the Micro winery equipment market was growing at a CAGR of 5.2% to reach USD 1,069.8 million in 2025 from USD 970.3 million in 2020.

The rising popularity of wine among millennials and the growing number of women drinkers are some of the key factors driving the market growth. In addition, the increasing demand for premium and organic wines is also boosting the market demand. However, the high cost of micro-winery equipment and the stringent regulations regarding alcohol production are some of the major challenges faced by manufacturers in this market. Nonetheless, the growing popularity of home-based wineries is expected to create lucrative opportunities for micro-winery equipment manufacturers in the coming years.

According to research by Future Market Insights, The Micro winery equipment market is anticipated to expand at a CAGR of 5.0% during the forecasted period.

The food and beverage industry is a major contributor to the growth of the micro winery equipment market. The industry provides a wide range of products and services that are essential for the production of wine. In addition, the industry has a significant impact on the economy and job market.

The food and beverage industry is an important part of the economy. The industry employs millions of people and generates billions of dollars in revenue each year. In addition, the industry is a major consumer of natural resources.

The food and beverage industry is also a major contributor to the growth of the micro winery equipment market. The industry provides a wide range of products and services that are essential for the production of wine. In addition, the industry has a significant impact on the economy and job market.

The commercial sector is expected to experience the maximum micro winery equipment growth in the coming years. This is attributed to the increasing demand for wine in the market and the need for efficient and cost-effective production of wine. In addition, the growing popularity of microbreweries and home winemaking is also anticipated to drive the growth of micro winery equipment market.

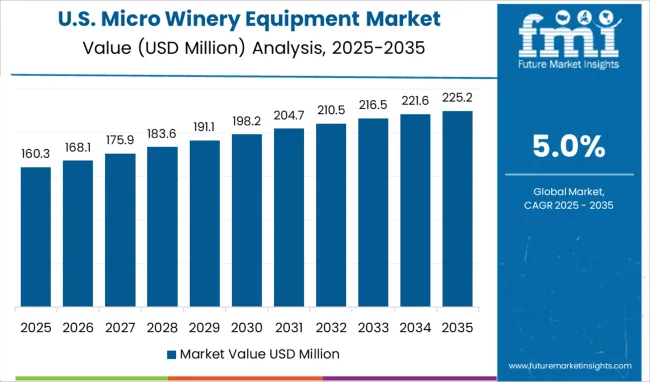

The United States holds the biggest share in the global micro-winery equipment market. The USA has become the biggest region because of the craze for wine consumption, more beverage-based startups, and proliferating number of bars and restaurants that offers native wine in their gardens.

Other than this, the increased awareness around micro wineries, benefitting, is also flourishing the demand for them. The number of small-scale wineries in North America has grown exponentially in recent years. This expansion can be attributed to the growing popularity of wine as well as the numerous advantages of owning a micro-winery. The low cost of entry is one of the primary reasons that North America has the largest market share in the micro-winery equipment market. When compared to traditional wineries, the initial investment for establishing a small-scale winery is relatively low, making it an appealing option for many entrepreneurs.

The United Kingdom, with the latest home-based bars opening, is consuming the most from the micro-winery equipment market. It is due to advanced technology and rising demand for native wine that complements the other cuisines. The local food markets have started applying this equipment to produce wine so that they do not run out of wine. The long-range of wine types present in the United Kingdom, along with experimentation liberty, has limited the demand for micro-winery equipment. Another factor that makes Europe an attractive market for micro-winery equipment is the high level of quality that European consumers expect from their wines. This quality can be achieved with the use of high-quality micro-winery equipment.

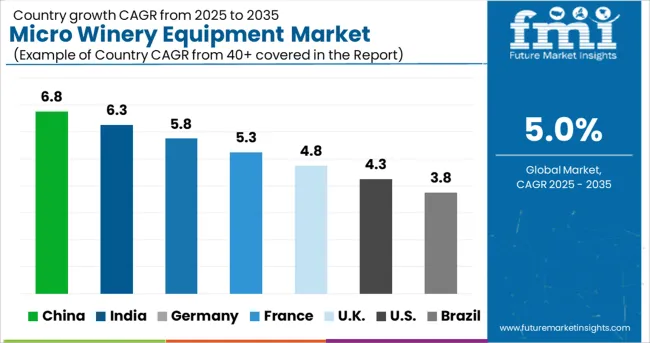

Chinese wine has its special space in the global wine market due to its processing time and way. The demand for wine in China spikes as people get more aware of the benefits of wine drinking. Furthermore, the rising geriatric population indulges in drinking activities at a higher rate, ends up entities, bars, and other beverage-serving outlets have started adopting micro-winery equipment that ferments the grapes and produces fresh wine. Asia Pacific market for micro-winery equipment is growing at the highest CAGR, followed by Europe and North America. The fueling demand for exotic beverages is attributed to the higher demand for rich wine that further flourishes the micro-winery equipment market in the region.

The new and advanced technology in the FMCG sector enhances the beverage intake experience along with higher restaurant and bar penetration. The rising demand for fresh red wine in the urban region, with the rising awareness around the benefits of each type of win fuel, has fueled the demand for micro-winery equipment. The advent of advanced micro winery technology that produces wine efficiently is pushing spaces and even individuals to adopt micro-winery equipment.

The changing consumer preferences towards wine and the growing disposable income are some of the other factors driving the growth of this market. Moreover, various government initiatives, such as setting up special economic zones (SEZs) and tax rebates, are attracting foreign investments in this region, which is further boosting the growth of this market.

The craze for wine has continued and the enthusiasts have started their small wineries with the idea of producing the best wine amongst the wine community. The business starts by producing the equipment that helps these wine enthusiasts in the best possible way. The easy fermentation process, smooth dilution, and precise bottling are what is expected out of one good micro winery equipment.

The micro winery equipment market is a highly competitive landscape. There are a large number of manufacturers offering a wide range of products. The competition is intense, and companies are constantly trying to gain market share.

The micro winery equipment market is growing rapidly. This is due to the increasing popularity of wine and the need for smaller, more efficient equipment. The market is expected to continue to grow in the future.

There are a few key players in the micro winery equipment market. These companies have a strong presence in the market and offer a variety of products. They are also able to offer competitive prices.

Recent Market Developments

| Attribute | Details |

|---|---|

| Forecast period | 2025 to 2035 |

| Historical data available for | 2020 to 2024 |

| Market analysis | million in value |

| Key Regions Covered | North America; Eastern Europe; Western Europe; Japan; South America; Asian Pacific; Middle East and Africa |

| Key Countries Covered | USA, Germany, France, Italy, Canada, United Kingdom, Spain, China, India, Australia |

| Key SegmentsCovered | Equipment type, Mode of operation, Application, Distribution channel, Region |

| Key Companies Profiled | Living Direct, Inc.; La Sommeliere; The Liebherr Group; Climadi; Viking Range Corporation; Sunpentown Inc.; Avintage, Climadiff S.A.; Dometic Group; Electrolux AB; Haier; BSH Home Appliances Group; Avanti Products.; Allavino; Eurocave Group; Shenzhen VRBON Electrical Appliance Co. LTD; Donlert Electrical Co. Ltd; LG Electronics; Siemens AG |

| Report Coverage | Market Forecast, Company Share Analysis, DROT Analysis, Market Dynamics, Competitive Landscape, Challenges, Strategic Growth Initiatives |

| Customization and Pricing |

Available upon request |

The global micro winery equipment market is estimated to be valued at USD 1,238.4 million in 2025.

It is projected to reach USD 2,017.3 million by 2035.

The market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types are fermentation tanks, destemmers, filtration systems, bottling lines and chillers.

automatic segment is expected to dominate with a 62.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Micron CBN Powder Market Size and Share Forecast Outlook 2025 to 2035

Microfilm Reader Market Size and Share Forecast Outlook 2025 to 2035

Micro-Dosing Sachet Fillers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Microbial Growth Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Micro Hotel Market Forecast and Outlook 2025 to 2035

Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

Micro-energy Harvesting System Market Size and Share Forecast Outlook 2025 to 2035

Micro CHP Market Size and Share Forecast Outlook 2025 to 2035

Micro Irrigation System Market Size and Share Forecast Outlook 2025 to 2035

Micro Flute Paper Market Size and Share Forecast Outlook 2025 to 2035

Microcrystalline Cellulose Market Size and Share Forecast Outlook 2025 to 2035

Micro Balances Market Size and Share Forecast Outlook 2025 to 2035

Micro Perforated Films Packaging Market Size and Share Forecast Outlook 2025 to 2035

Microbial Coagulants Market Size and Share Forecast Outlook 2025 to 2035

Microserver IC Market Size and Share Forecast Outlook 2025 to 2035

Microplate Handling Instruments Market Size and Share Forecast Outlook 2025 to 2035

Microsclerotherapy Treatment Market Size and Share Forecast Outlook 2025 to 2035

MicroLED Photoluminescence Inspection System Market Size and Share Forecast Outlook 2025 to 2035

Micro-Scale VFFS Modules Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Microscope Digital Camera Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA