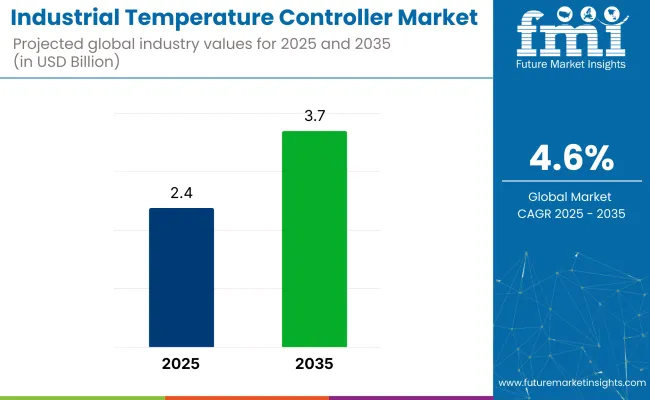

The industrial temperature controller market is expected to grow steadily, with an estimated value of USD 2.4 billion in 2025, which is likely to reach around USD 3.7 billion by 2035, at a CAGR of approximately 4.6%. Growth is driven by increasing automation, process optimization, and need for temperature-sensitive manufacturing across sectors.

Increasing need for precision and energy efficiency is driving demand for advanced temperature controllers. Modern systems integrate programmable logic, PID algorithms, digital interfaces, and IoT connectivity to provide more precise control, remote monitoring, and automatic adjustment over a wide range of applications.

Pharmaceutical and chemical industries are also major consumers.These uses require precise thermal control during reaction, mixing, distillation, and storage. Temperature controllers ensure safety, enhance yields, and comply with process control and validation regulations.

Technological progress is propelling the industry toward smart, flexible controllers. Applications such as AI forecasting control in advance, real-time feedback, multi-zone temperature control, and cloud-based diagnostics are gradually becoming commonplace-lessening manual intervention and reducing production downtime.

However, under Industrial 4.0 trends, energy efficiency, and decarbonization measures, temperature controllers have in fact become most vital among many new challenges. Not only are temperature monitoring being applied by manufacturers for quality assurance but also for energy efficiency as well as predictive maintenance.

Asia Pacific is the leading region, dominated by Chinese, Indian, and Southeast Asian production growth. This is followed by North America and Europe, supported by strong adoption of automation, technology growth, and increased environmental and quality regulations in targeted industries.

The industry for industrial temperature controllers is growing rapidly due to the mounting demand for accurate temperature control across different industrial processes. The market growth is a result of drivers like the need for energy-saving solutions, the stringent regulatory policies of governments, and the broadening applications in developing economies. The industry is dominated by the variety of products available for various applications, industries, and a geographically scattered landscape.

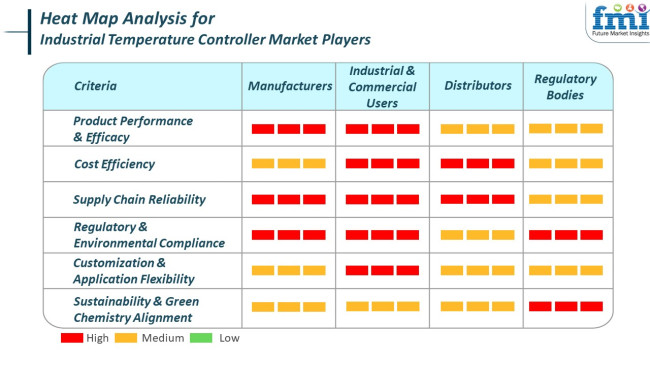

Industrial andcommercial users, such as food and beverage, biology, and chemical industries, consider cost-saving and dependable industrial temperature controllers that provide maximum performance across different applications. Regulatory bodies impose conformity to environmental and safety regulations, encouraging the utilization of green and environmentally friendly industrial temperature controller technologies.

They play a significant industry-shaping role in imposing regulation that encourages the utilization of green technology and reduces the environmental footprint of industrial activities. The industry is characterized by the synergy of efforts of industry stakeholders in producing and utilizing products that meet performance criteria, go through environmental standards, and are appropriate for evolving industry requirements.

From 2020 to 2024, the industry saw moderate yet steady evolution, largely influenced by the growing automation trend across sectors such as manufacturing, pharmaceuticals, and energy. The emphasis this time was on improving accuracy and uniformity of temperature control, and this resulted in greater use of digital and programmable controllers.

The industry also saw growing integration of fundamental connectivity features, as vendors started to set the stage for more integrated industrial systems. However, overall digital transformation had started by now, and even the majority of the plants remained on old analog systems. The energy efficiency question was just then emerging as an important one but was not an important purchasing impetus yet.

Between the years 2025 and 2035, the industry would move to advanced, IoT-enabled temperature controllers with real-time monitoring and remote diagnostic capability. Smart factories will drive demand for integrated temperature control systems that integrate well with overall automation infrastructure.

There will be a high focus on sustainability, driving energy-efficient controller design. There shall also be routine predictive maintenance offerings driven by machine learning and data analytics capabilities that will lead to longer equipment lives and lower downtime.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Serial migration from analog to digital temperature controllers | Accelerated adoption of IoT -based smart controllers with real-time feedback |

| Early confluence with automation systems | Industrial automation and intelligent factory infrastructure extensively integrated |

| Demand for consistency, automation, and production efficiency | Emphasis on connectivity, data-driven operations, and predictive capabilities |

| Increased focus on energy usage but not a key driver of buying decisions | Sustainability takes center stage, with efficiency of energy a key design driver |

| Reactive maintenance the norm | Migration to predictive and condition-based maintenance with analytics |

| Industrial clusters in Asia and North America leading the charge | Broader international reach with major smart industry launches in Europe and Asia |

The industry is growing steadily driven by growing demands for accurate temperature control in all types of manufacturing industries, chemical processing, food and beverage processing, and the pharmaceutical industry. Nonetheless, there are various risks confronting the industry at present as well as which can affect it in the forecasted period.

One of the prevalent current threats includes the significant cost of implementing and maintaining the advanced temperature control systems. The SMEs are most likely to face constraints in their investment in the systems due to their inadequate resources, thereby limiting industry access.

The industry is still at risk of being interrupted by supply chain disruptions caused by geopolitical conflicts and global economic fluctuations that are capable of affecting availability of major components like sensors and controllers. In addition, there can be intricate integration of the temperature controllers in existing industrial environments, reliant on expert human capital and specialized knowledge, access to which might be restricted to some areas.

Also, the growing focus on energy efficiency and sustainability is making government regulations tighter, forcing manufacturers to innovate and shape their products accordingly. Being non-compliant with these changing standards might mean losing out in industry share. Moreover, the rising use of Internet of Things (IoT) and smart technologies brings forth the issue of cybersecurity, as these connected devices might be susceptible to cyber-attacks, risking industrial operations.

Though the industry is poised for considerable growth, the players in the industry will have to contend with issues of high installation costs, supply chain exposure, technological obsolescence, regulatory requirements, and cybersecurity threats. Preemptive measures addressing these vulnerabilities will be critical to continued success in this fast-evolving industry.

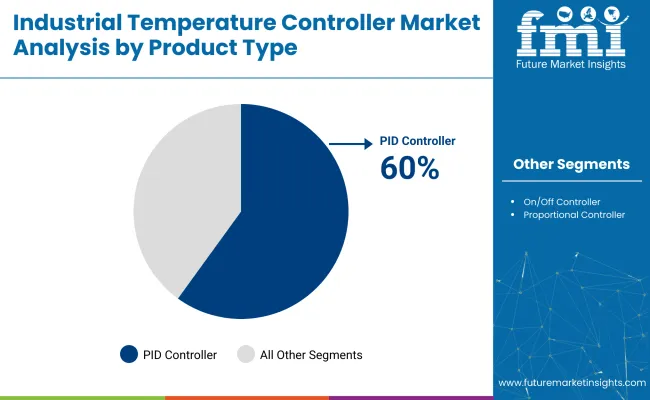

The PID controllers account for 60% of the industry in 2025, followed by proportional controllers at 25%.

Due to their accuracy and flexibility concerning complex industrial environments, PID Controllers account for the major industry share. They are also applied in cases that need strict temperature control, such as those arising in food processing, plastic extrusion, and semiconductor fabrication. The PID controllers create continuous process control and the features of auto-tuning of the parameters that help stabilize and hence reduce the temperature overshoot.

The PID Controller technology is now being digitalized by major organizations such as OMRON Corporation, Eurotherm by Schneider Electric, and Yokogawa Electric Corporation, with interfacing, built-in alarms, and data logging functions that are smart factory-oriented. The industrial need for such systems is growing due to chemical and pharmaceutical industries, where even small deviations in temperature can raise significant concerns about product quality and safety.

Proportional controllers are still technically simple controllers that make up a major share of the marketplace at 25%. These controllers are generally found in less complicated heating and cooling systems, including HVAC applications and small industrial ovens.

Their control action is a steady-state control signal that is in direct proportion to the error signal, with no integral and derivative control action present in the PID type. Companies such as Watlow and Autonics supply low-cost versions of proportional controllers that are fine for industries where reasonable accuracy is acceptable; therefore, they are a cost-effective solution for simple automation tasks.

Smaller new players, such as Delta Electronics and BrainChild Electronics Co., Ltd., are making inroads with compact, programmable controllers for small-scale industries, adding an element of diversity to the competitive arena.

The industry dynamics suggest, indeed, that while PID controllers dominate in high-tech and high-risk applications, the role of Proportional Controllers will remain intact in small, budget-oriented operations.

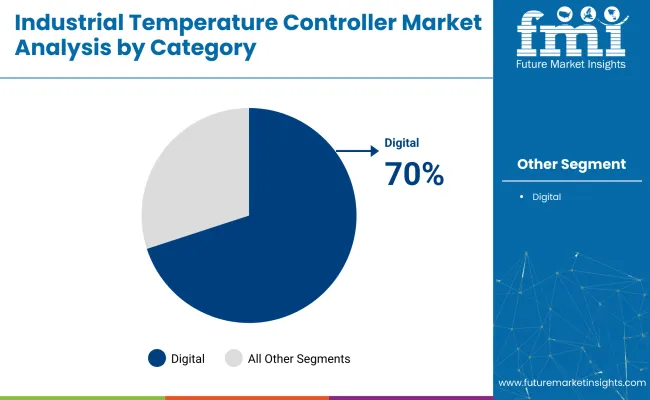

The digital temperature controller was projected to hold a huge industry share of 70% in 2025, while the remaining 30% is expected to be analog ones.

The superiority of digital over analog controllers is due to accuracy, programmability, and easy integration into smart manufacturing systems. These features offer touchscreen displays, real-time data logging, remote monitoring, and communication within Modbus, RS-485, or Ethernet/IP. Thus, they have become crucial to Industry settings.

Companies such as OMRON, Honeywell, Yokogawa, and Fuji Electric are major players. Yokogawa's UT Advanced Series, for example, provides multiloop digital control of temperature for applications with high precision, such as semiconductors and petrochemicals. Similarly, Honeywell's DC1040 Series comes equipped with intelligent diagnostics and plug-and-play for applications in pharmaceuticals and food processing.

Although analog controllers with a 30% industry share hold power, they are oftentimes applicable wherever simplicity, low cost, and robustness are at stake. Their uses in industries that require rudimentary heating and cooling systems, small food units, and agricultural drying systems to non-critical HVAC installations-prefer analog controllers that are user-friendly and durable. West Control Solutions, Watlow, and Chromalox are the suppliers providing reliable analog control units for this niche. For example, Watlow's Series 93 or West's 6100+ analog models are widely used in simple ovens, immersion heaters, and packaging lines.

Because of ongoing automation flows, digital controllers are meant to replace any such analog units. However, for many low-tech or legacy applications, analog options are still a more economical choice, especially in developing industrial regions or installations having basic infrastructure.

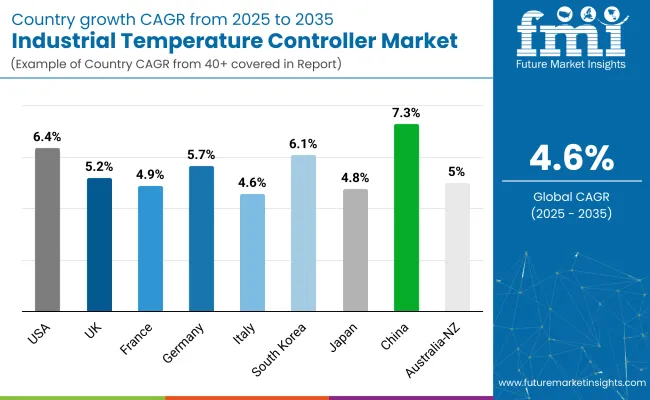

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.4% |

| UK | 5.2% |

| France | 4.9% |

| Germany | 5.7% |

| Italy | 4.6% |

| South Korea | 6.1% |

| Japan | 4.8% |

| China | 7.3% |

| Australia-NZ | 5% |

The USA industry will expand at 6.4% CAGR over the study period. The country has been a trendsetter in the process control and automation industries, which fuels the growing demand for industrial temperature controllers. Increased smart manufacturing activities and investments in advanced process monitoring systems are promoting increased adoption of temperature controllers by major industries, such as pharmaceuticals, chemicals, and food processing.

Particularly, the integration of Internet of Things (IoT) technologies into industrial infrastructure is transforming conventional temperature control systems into intelligent and energy-efficient systems. The USA is also experiencing growing demand from the semiconductor and electronics sector, where temperature control precision is critical to product quality.

Regulatory needs within industrial processes further propel the application of high-precision controllers. In addition, ongoing digitalization and increased energy-efficient systems throughout factories further accelerate the expansion of the industry.

The availability of established manufacturers, as well as government support through legislation supporting technology improvements, further enhances industry penetration. Throughout the projection period, these drivers are set to propel development and encourage the establishment of more sophisticated and adaptable temperature control systems for numerous end-use applications.

The UK industry is expected to grow at 5.2% CAGR during the forecast period. Increasing focus on eco-friendly manufacturing processes and energy-efficient production plants has stimulated demand for industrial temperature controllers across the nation. The manufacturing sector is rapidly shifting towards automation, where temperature control is a significant factor in achieving consistent product quality and system reliability. Aerospace, chemical, and automotive sectors are investing in smart process control systems to meet performance and regulatory goals.

Furthermore, the growth of renewable energy systems and battery manufacturing plants is creating opportunities for precise thermal management solutions. The UK's commitment towards net-zero carbon emission by 2050 has influenced industrial policies, resulting in increased adoption of equipment that minimizes energy wastage. A convergence of computer control interfaces and data-driven monitoring gear is becoming a norm in UK industrial installations.

Therefore, demand for modular and adaptive temperature controllers is likely to increase. Governmental policies favorable to Industry 4.0 technologies are aiding in the growth of the industry by encouraging the replacement of old equipment with new ones. Over the forecast period, advances in connectivity and real-time analysis will likely redefine the way industries interact with thermal control solutions.

France is expected to increase at a 4.9% CAGR during the forecast period. France's manufacturing industry, particularly in sectors such as chemicals, plastics, and food processing, heavily relies on thermal stability, meeting a steady demand for upscale temperature controllers. Modernization efforts in various plants are promoting the adoption of programmable and PID-based controllers for enhanced accuracy and control efficiency.

In addition, heightened awareness of energy conservation is prompting industries to move towards controllers that deliver maximum output with the least amount of energy input. Sustained digitization and the high concentration of the country on Industry 4.0 are also promoting the adoption of smart control systems.

With industries moving towards predictive maintenance and condition-based monitoring, temperature controllers that incorporate advanced feedback mechanisms and diagnostics are proving to be indispensable. Furthermore, the push for localized production and reducing import reliance is likely to drive industrial upgrades, such as control infrastructure.

Government-backed incentives for sustainable manufacturing also foster technologies that support emission reduction and performance enhancement. As such, demand for innovative and adaptable temperature control solutions is anticipated to increase throughout traditional industries and new industries during the forecast period.

Germany's industry is projected to grow at 5.7% CAGR during the study period. Germany is renowned for its robust industrial base, and it still leads in precision engineering and automation, both of which have extensive dependency on industrial temperature controllers.

The industry is supported by the universality of smart factory concepts, where high-efficiency and networked temperature control systems have a crucial role in process reliability and energy savings. Precisely, the machinery, automotive, and electronics sectors demand highly sophisticated controllers to provide high quality and safety ratings. The German industry is also characterized by high competition in thermal systems used for power electronics and green energy solutions.

As more companies join the country's energy transition plan, including shifting to cleaner technologies, temperature control systems with better thermal efficiency are required. Increasing R&D investment and innovation hubs specializing in industrial automation have produced a steady stream of next-generation control products.

Manufacturers are expected to target miniaturization, digital interfaces, and cloud connectivity throughout the forecast period to address the evolving needs of Germany's high-end manufacturing industry.

The Italian industry will increase at 4.6% CAGR during the forecast period. Industrial growth in the nation is supported by ongoing modernization in its key industries like textiles, food & beverages, and chemicals, where precise temperature control is essential to maintain production efficiency and safety.

Italy's SMEs are increasingly using automated systems to enhance process accuracy and lower operational costs, thereby fueling demand for reliable temperature control technologies. The national push for smart manufacturing is revolutionizing industrial automation solution demand patterns.

Italian manufacturers are adopting control systems that provide remote monitoring and predictive diagnostics to embrace global best practices in operational excellence. Further, the focus on sustainable production methods is leading to the adoption of energy-saving and low-emission solutions like optimized temperature controllers.

As the government programs allow technological advancement and international competitiveness, Italian companies will be more likely to exchange old infrastructure with new, flexible solutions. During the forecast period, the sector in Italy will increasingly depend on flexible and interconnected temperature control systems with the ability to cater to economic and environmental goals.

The South Korean industry is expected to grow at 6.1% CAGR during the forecast period. South Korea, as a hub for electronics, semiconductors, and heavy industries, maintains a constant high demand for industrial temperature controllers with the capability to offer micro-level thermal accuracy.

Technological progress and fast-paced industrialization have pressed manufacturers to use intelligent and connected systems to optimize the process. Semiconductor production, particularly, requires rigorous thermal management protocols, which drive demand for high-performance controllers.

In addition, government initiatives on smart manufacturing and digital infrastructure drive the massive deployment of intelligent control systems. South Korean energy efficiency targets also support the usage of systems, reducing operational costs but increasing thermal accuracy.

Integration into AI and IoT platforms has become more common in enhancing the real-time responsiveness of the control units. With industrial processes becoming more performance-driven and complex, temperature controllers with improved data analytics and predictive maintenance capabilities are gaining popularity. In the forecast period, growth will be driven by continuous investment in automation, electronics, and clean energy sectors, where temperature control is a significant parameter.

The Japanese industry is expected to rise by 4.8% CAGR during the forecast period. Japan specializes in high-tech manufacturing and precision engineering and requires industrial temperature controllers to satisfy stringent thermal demands in applications from automotive to robotics to chemical production. With the growth in smart factory implementations in the nation, there is increased adoption of automated and digitalized temperature control that offers enhanced operational efficiency.

Japan's older plant base is being technologically upgraded, with the installation of old systems being replaced by smart, networkable controllers. The growing demand for thermal control solutions with high-load, variable-temperature operation and multifarious applications such as electric vehicle battery production and robot manufacturing is being spurred by the expansion of electric vehicle battery and robotics manufacturing.

In addition, energy conservation efforts in Japan have established a fondness for controllers that improve performance while reducing power consumption. Owing to its strong culture of innovation and quality, the Japanese industry favors highly adaptable and intelligent control systems. During the forecast period, demand is expected to remain strong, driven by evolving industrial needs and constant advancements in sensor technologies and automation platforms.

The Chinese industry will grow at 7.3% CAGR during the forecast period. As the world's leading manufacturing center, China is rapidly adopting automation technology in major sectors such as plastics, chemicals, electronics, and automotive. Greater automation of plants and digitalization initiatives are propelling a high demand for advanced temperature management systems. China's focus on smart manufacturing under its "Made in China 2025" policy program is accelerating the industry further.

Growing environmental concerns and energy efficiency requirements are inducing industries to use temperature controllers with high accuracy at low energy losses. Domestic players are further investing more in R&D to develop cost-effective yet technologically advanced solutions, driving industry competition and affordability.

Growing accessibility of semiconductor foundries and lithium battery plants requires improved performance in temperature control, ensuring constant demand from fast-growing industries. Throughout the forecast period, sustained urbanization, industrial expansion, and government backing of high-tech manufacturing will keep China dominating the global industry.

The Australia-New Zealand region will post a 5% CAGR for the analysis period. The nation is witnessing the gradual adoption of industrial automation solutions by industries like mining, food processing, pharma, and energy.

Temperature control systems are being implemented in larger quantities to meet performance requirements as well as regulatory requirements, particularly in highly regulated applications such as pharma and dairy processing. Both countries are making investments in infrastructure modernization and ecological sustainability in an effort to accelerate the transition towards energy-efficient control technologies.

More and more, renewable energy applications involving industrial temperature controllers in solar thermal systems and bioenergy are in the spotlight. With manufacturing companies targeting higher accuracy and process optimization, digitally controlled and remotely controlled temperature systems are emerging as dominant ones.

Government efforts to facilitate industrial innovation and the adoption of clean energy are also making things positive for industry expansion. Over the forecast period, industry growth in Australia and New Zealand is going to be determined by the fusion of automation, sustainability, and process efficiency targets.

The industry is largely competitive concerning the automation and control system manufacturing companies in that it encompasses a number of well-known companies like Fuji Electric, Panasonic, Omron Industrial, Analog Devices, and Omega Engineering, which are focusing on next-generation temperature control solutions with advanced functionality-dense features for AI-driven automation, IoT connectivity as well as cloud-based analytics that allow high-level accuracy in improvement of processes in industrial sectors.

Fuji Electric continues to develop its industry automation collection by integrating real-time temperature control systems for power plants, chemical processing, and semiconductor production. Small, fast PID controls, which improve accuracy in medical, food, and automotive applications, have been developed by Panasonic. To implement self-regulating temperature controllers in high-precision environments, Omron Industrial uses AI and machine learning algorithms.

Both Analog Devices and Omega Engineering venture into wireless and edge-computing monitoring systems that can be utilized for real-time temperature adjustments in industrial processing lines. Watlow and Siemens developed multi-loop temperature controllers with a greater degree of efficiency for high-temperature applications in metal and plastic processing. Autonics and Schneider Electric, however, continue to improve factory efficiency and automation by incorporating their products into PLCs.

World leaders in innovation are Honeywell for the AI-driven industrial temperature control units, bringing real-time fault detection enhancement alongside efficient temperature uniformity. ABB Ltd. is now rolling out its controller models with extensions for HAN-enabled analytics to give some level of prediction, which eventually reduces energy consumption. Yokogawa Electric and Dwyer target precision controllers for pharmaceutical and chemical processing applications, ensuring stable temperature regulation in highly sensitive locations.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Fuji Electric | 17-21% |

| Panasonic | 14-18% |

| Omron Industrial | 12-16% |

| Analog Devices | 10-14% |

| Omega Engineering | 8-12% |

| Other Players | 24-30% |

| Company Name | Offerings & Activities |

|---|---|

| Fuji Electric | Expanding real-time temperature controllers for power plants, semiconductors, and industrial automation. |

| Panasonic | Developing high-speed PID controllers for medical, food, and automotive applications. |

| Omron Industrial | Enhancing AI-driven self-regulating temperature controllers for high-precision industrial use. |

| Analog Devices | Investing in wireless and edge computing-based monitoring for real-time temperature adjustments. |

| Omega Engineering | Advancing multi-loop controllers and AI-enabled predictive maintenance solutions. |

Key Company Insights

Fuji Electric (17-21%)

Expanding its IoT-based smart controllers, integrating real-time analytics and predictive maintenance for power, semiconductor, and industrial automation sectors.

Panasonic (14-18%)

Developing compact, high-speed PID controllers to enhance temperature precision in medical, food, and automotive industries.

Omron Industrial (12-16%)

Leading in AI-powered self-regulating temperature controllers, improving precision manufacturing and automated processing environments.

Analog Devices (10-14%)

Pioneering wireless temperature monitoring and cloud-based analytics, ensuring automated and efficient process control.

Omega Engineering (8-12%)

Focusing on multi-loop control and AI-enabled predictive temperature regulation for high-performance industrial applications.

Other Key Players

By product type, the industry is segmented into on/off controllers, proportional controllers, and PID controllers.

By category, the industry is categorized into analog and digital.

By end use, the industry is segmented into metals, mining & metallurgy; chemicals; oil & gas; food & beverages; energy & power; general manufacturing; research laboratories; and others.

By region, the industry is segmented into North America, Latin America, Europe, Asia Pacific, and Middle East & Africa (MEA).

The industry is projected to reach USD 2.4 billion in 2025.

By 2035, the industry is expected to grow to USD 3.7 billion, expanding at a CAGR of 4.6% from 2025 to 2035.

Growth is fueled by the rising demand for precise temperature regulation in industries such as plastics, food processing, chemicals, and electronics manufacturing, along with the adoption of Industry 4.0 technologies.

Asia-Pacific leads in growth potential due to industrial expansion and infrastructure upgrades.

Leading companies in the industry include Fuji Electric, Panasonic, Omron Industrial, Analog Devices, Omega Engineering, Watlow, Siemens, Autonics, Dwyer, Schneider Electric, Honeywell, ABB Ltd., Yokogawa Electric, Briskheat, ALTEC and Tempatron.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial High-Temperature Graphitization Furnaces Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

High-Temperature Industrial Burner Market Growth - Trends & Forecast 2025 to 2035

Cryogenic Temperature Controller Market Size and Share Forecast Outlook 2025 to 2035

Hot Runner Temperature Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Grade Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA