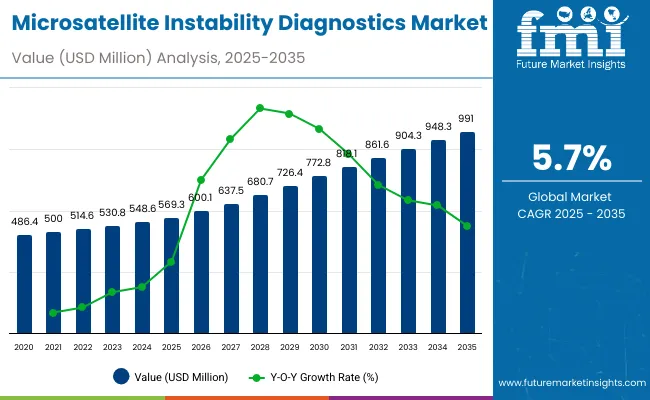

The global Microsatellite Instability (MSI) Diagnostics Market is projected to reach a valuation of USD 569.3 million by 2025 and USD 991.0 million by 2035. This indicates a decade-long increase of USD 421.8 million between 2025 and 2035. The market is expected to expand at a compound annual growth rate CAGR of 5.7%, representing a 1.74X increase over the ten-year period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 569.3 million |

| Industry Value (2035F) | USD 991.0 million |

| CAGR (2025 to 2035) | 5.7% |

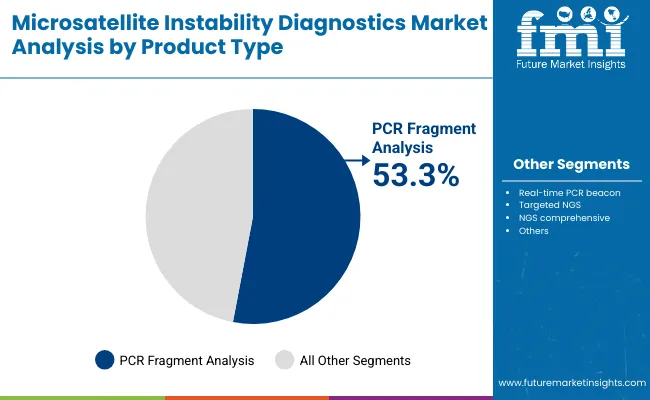

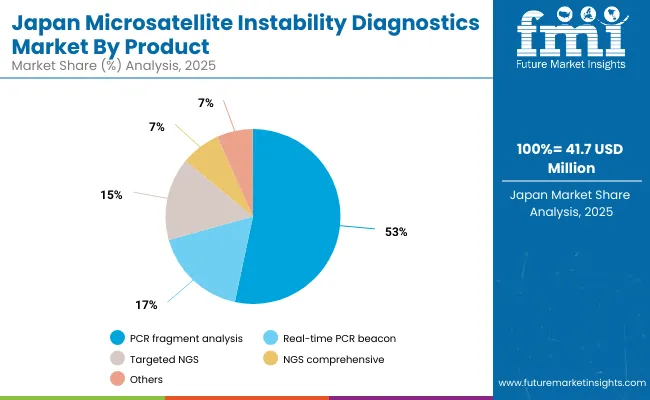

During the first five-year period from 2025 to 2030, the total market value is projected to expand from USD 569.3 million to USD 772.8million, adding USD 203.5million which contributes to 48.2% of the total decade growth. PCR fragment analysis will remain dominant, holding around 53.5% share of the category by 2030 due to its proven reliability and integration in Lynch syndrome testing. The real-time PCR beacon segment is expected to sustain share at around 17.0%, while targeted NGS is positioned near 15%, reflecting growing but measured adoption in precision oncology.

The second half from 2030 to 2035 contributes USD 218.3million, which is equal to 51.8%% of the total growth, as the market jumps from USD 772.8million to USD 991.0million. This acceleration is powered by increased use of MSI diagnostics for immunotherapy stratification and tumor profiling across oncology centers and clinical labs. PCR fragment analysis and real-time PCR beacon together capture more than 70% of share by the end of the decade, while comprehensive NGS workflows rise gradually to 6.6%, reflecting their specialized role in advanced profiling rather than routine screening.

From 2020 to 2024, the overall Microsatellite Instability (MSI) Diagnostics Market grew from USD 486.4million to USD 548.6million. Leading manufacturers such as Promega, Thermo Fisher Scientific, and Bio-Rad Laboratories together account for nearly 52.5% of global revenue through established PCR-based assays, companion diagnostics, and reference lab partnerships. Key strategies deployed by these players include continuous validation of MSI panels for regulatory approval, integration of MSI testing into broader oncology workflows, and collaborations with pharmaceutical companies to link MSI results with immunotherapy treatment pathways.

In 2025, the MSI Diagnostics Market is expected to reach a value of approximately USD 569.3 million, driven by a shift from standalone PCR assays to integrated molecular profiling solutions that combine PCR, NGS, and immunohistochemistry (IHC). Growth will be propelled by expanding adoption of MSI testing in Lynch syndrome screening, immunotherapy stratification, and precision oncology programs. Hospitals and reference laboratories are increasingly investing in platforms that enable high-throughput PCR fragment analysis, automated bioinformatics pipelines, and companion diagnostic approvals to improve testing accuracy, streamline workflows, and guide therapy decisions in colorectal, gastric, and endometrial cancers.

Microsatellite Instability (MSI) Diagnostics are seeing strong growth because oncology practices and healthcare systems worldwide face mounting pressure to improve cancer detection, personalize therapy, and comply with precision medicine guidelines. Major drivers include the rising use of immune checkpoint inhibitors, increasing demand for Lynch syndrome screening, and expanding regulatory recommendations that require MSI testing for colorectal, gastric, and endometrial cancers. Advances such as automated PCR fragment analysis systems, real-time PCR assays, and targeted NGS panels enable faster turnaround, reduce interpretation errors, and provide actionable data for oncologists.

The accelerated uptake of companion diagnostics linked to immunotherapies has amplified demand, positioning MSI testing as a critical decision-making tool. As hospital oncology units and reference labs prioritize comprehensive genomic profiling and therapy guidance, manufacturers offering validated, cost-efficient, and scalable MSI platforms are achieving strong adoption. In emerging healthcare markets across Asia Pacific and Europe, national cancer screening programs and infrastructure upgrades are further boosting demand.

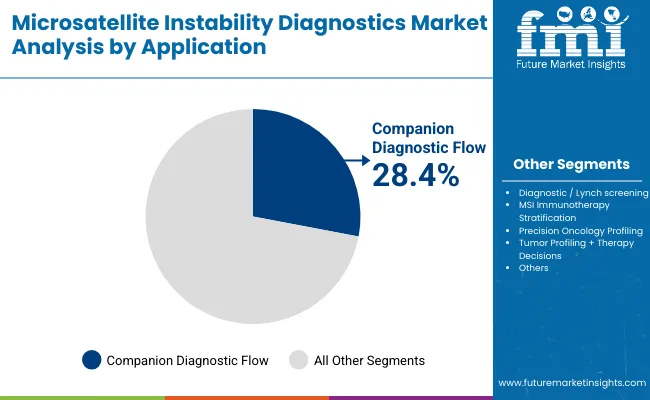

The market is segmented by product type, application, end-user, and region. Product segmentation includes PCR fragment analysis, Real-time PCR beacon, Targeted NGS, NGS comprehensive, and Others, highlighting the core diagnostic technologies shaping adoption trends. Application classification covers Diagnostic / Lynch screening, Companion diagnostic flow, MSI immunotherapy stratification, Precision oncology profiling, Tumor profiling + therapy decisions, and Others, underscoring the role of MSI in cancer detection, treatment guidance, and personalized medicine.

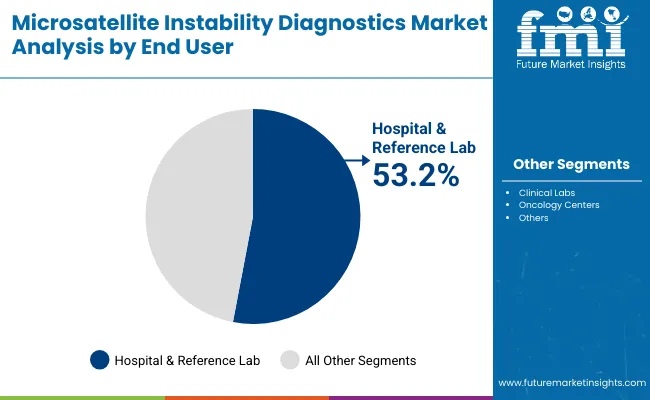

Based on End User, the segmentation includes Hospitals & reference laboratories, Clinical labs, Oncology Centers, and Others, reflecting the diversity of testing environments where MSI diagnostics are performed. Regionally, the scope spans North America, Latin America, Western and Eastern Europe, East Asia, South Asia & Pacific, and the Middle East & Africa, where adoption dynamics vary according to cancer prevalence, reimbursement policies, and molecular diagnostics infrastructure.

| By Product Type | Market Share (%) |

|---|---|

| PCR fragment analysis | 53.3% |

| Real-time PCR beacon | 17.3% |

| Targeted NGS | 15.3% |

| NGS comprehensive | 7.3% |

| Others | 6.7% |

PCR fragment analysis is expected to retain a dominant position and contribute 53.3% in 2025, owing to its established role as the reference method for detecting microsatellite instability. Its adoption has been driven by the rising global emphasis on Lynch syndrome screening and the incorporation of MSI testing into clinical oncology guidelines. Preference has increasingly shifted toward this method due to its accuracy, reproducibility, and cost-efficiency, making it highly suitable for routine diagnostic workflows in hospitals and reference labs.

Regulatory endorsements and its integration as a companion diagnostic tool for immunotherapy approvals have further reinforced its clinical relevance. These factors collectively contribute to the sustained demand for PCR fragment analysis over newer but less standardized technologies, positioning it as the backbone of MSI testing in both developed and emerging oncology markets.

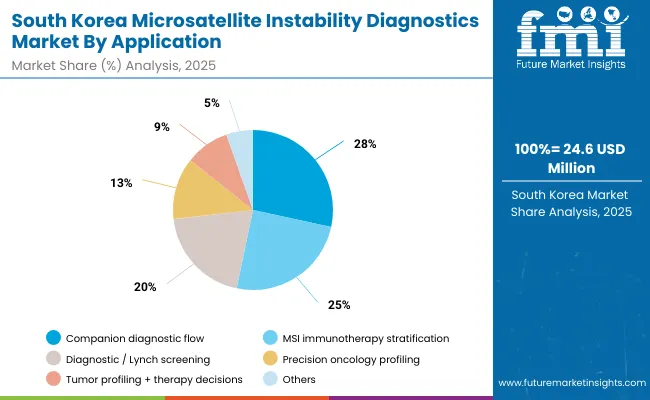

| By Application | Market Share (%) |

|---|---|

| Diagnostic / Lynch screening | 19.89% |

| Companion diagnostic flow | 28.43% |

| MSI immunotherapy stratification | 24.88% |

| Precision oncology profiling | 12.55% |

| Tumor profiling + therapy decisions | 8.88% |

| Others | 5.4% |

Companion diagnostic flow has emerged as the leading application area and is projected to hold around 28.4% in 2025 due to its critical role in guiding the use of immunotherapies and targeted oncology drugs. Regulatory agencies such as the FDA and EMA have mandated MSI testing as part of the approval and clinical use of immune checkpoint inhibitors like pembrolizumab, driving higher adoption in oncology centers and reference labs.

As a result, MSI assays integrated into companion diagnostic workflows particularly PCR and NGS-based panels have become essential for therapy stratification in colorectal, gastric, and endometrial cancers. Additionally, the increasing pipeline of immuno-oncology drugs with biomarker-linked indications is expected to reinforce reliance on MSI companion diagnostics, making this segment the backbone of precision cancer treatment decisions globally.

| End User | Market Share (%) |

|---|---|

| Hospital & reference lab | 53.2% |

| Clinical labs | 22.4% |

| Oncology Centers | 13.3% |

| Others | 11.0% |

Hospitals and reference laboratories are expected to remain the largest end-user segment, contributing around 53.2% in 2025 due to their critical role in handling high-volume cancer diagnostics and complex molecular testing. Most MSI testing for Lynch syndrome screening, immunotherapy eligibility, and tumor profiling is performed in hospital-affiliated labs and large reference centers, where scalability, reliability, and regulatory compliance are paramount.

Demand has been reinforced by guidelines from organizations such as NCCN and ESMO, which recommend MSI testing as part of standard cancer care. Investments in molecular pathology infrastructure and next-generation sequencing capabilities within hospitals are accelerating uptake, particularly in tertiary care and academic institutions. Procurement is also being influenced by favorable reimbursement policies and oncology-driven initiatives aimed at expanding access to biomarker-based diagnostics, ensuring hospitals and reference labs maintain the dominant installed base.

Regulatory Push for Biomarker-Driven Oncology Care

The most significant growth driver in the Microsatellite Instability (MSI) Diagnostics market is the tightening of oncology testing guidelines and regulatory frameworks that mandate biomarker testing to guide therapy. Organizations such as the USA FDA, EMA, NCCN, and ESMO have made MSI testing a standard component in colorectal, gastric, and endometrial cancer care pathways, particularly for determining eligibility for immunotherapies such as PD-1/PD-L1 checkpoint inhibitors.

Hospitals and reference laboratories are compelled to expand their MSI testing capabilities, incorporating PCR fragment analysis kits, targeted NGS panels, and companion diagnostics into their diagnostic workflows. Accreditation bodies and reimbursement agencies are also exerting pressure, with payers increasingly covering MSI testing as part of precision oncology programs. As cancer incidence rises globally and immune checkpoint inhibitors gain broader approvals, the demand for validated, guideline-aligned MSI diagnostics continues to accelerate.

High Test Cost, Technical Complexity, and Infrastructure Dependencies

Despite its clinical value, the high cost of advanced MSI diagnostics and the associated infrastructure needs remain significant restraints. While PCR fragment analysis is relatively affordable, the adoption of targeted and comprehensive NGS panels requires substantial capital investment in sequencers, bioinformatics infrastructure, and skilled personnel. Smaller clinical labs and oncology centers in developing regions often face barriers due to lack of molecular pathology expertise, limited reimbursement coverage, and longer turnaround times.

Standardization challenges also persist, as test results can vary between methodologies (PCR, NGS, or IHC), creating hesitancy in routine adoption. Retrofitting existing pathology labs with NGS capabilities and ensuring compliance with CAP/CLIA standards further add to implementation hurdles, particularly in mid-tier or resource-constrained healthcare systems.

Convergence of MSI Diagnostics with Comprehensive Genomic Profiling Platforms

A rapidly accelerating trend in the market is the integration of MSI diagnostics into broader genomic profiling and precision oncology platforms. Rather than ordering MSI as a standalone test, leading hospitals and oncology networks are bundling it into multi-gene NGS panels, pan-cancer profiling workflows, and therapy-decision support systems. Vendors such as Thermo Fisher Scientific, Illumina, and NeoGenomics are aligning their MSI assay offerings with comprehensive oncology solutions that include tumor mutational burden (TMB), PD-L1 status, and other biomarkers.

This convergence is reshaping procurement decisions labs now seek platforms that offer interoperability, scalability, and integration with electronic health records (EHRs) for streamlined reporting. In parallel, pharmaceutical collaborations are accelerating co-development of MSI companion diagnostics to support immuno-oncology drug pipelines. As hospitals invest in holistic precision medicine infrastructures, MSI testing is increasingly viewed not as a single assay, but as a strategic component of integrated oncology care ecosystems.

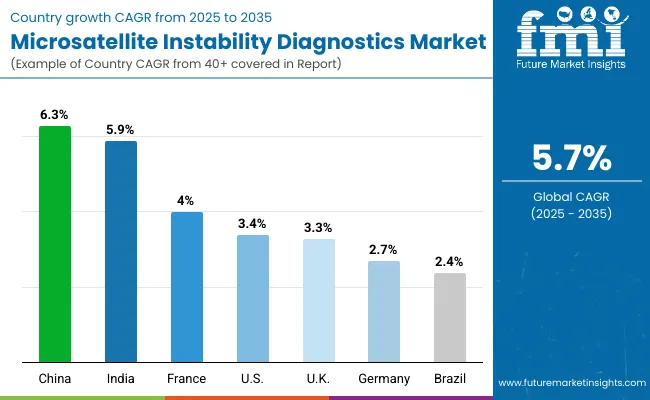

Asia Pacific is emerging as the fastest-growing region in the MSI Diagnostics Market, projected to grow at a CAGR of 6.1% between 2025 and 2035, led by China with 6.3% CAGR and India with 5.9% CAGR. China’s growth is supported by large-scale adoption of precision oncology programs, public sector investment in NGS-based cancer screening, and integration of MSI testing into national reimbursement frameworks for colorectal and gastric cancers.

India is experiencing strong expansion, driven by the establishment of molecular oncology laboratories in Tier 1 and Tier 2 cities, NABL accreditation requirements, and the growth of hospital-based genetic testing services. Across Asia Pacific, government-funded cancer control programs and rising awareness of Lynch syndrome and hereditary cancers are accelerating test volumes, positioning the region as a strategic growth engine for global MSI diagnostics suppliers.

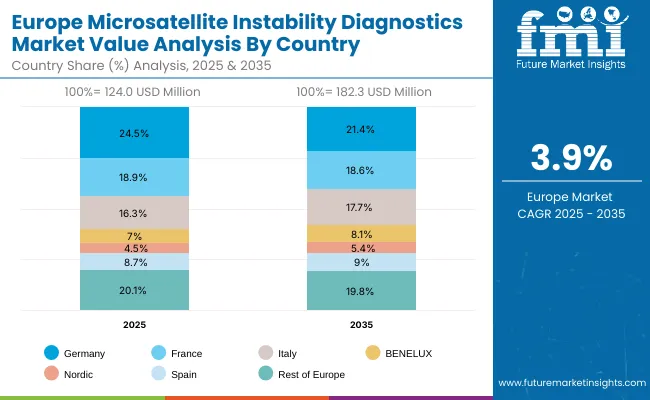

Europe is expected to grow steadily at a 3.9% CAGR through 2035, supported by harmonized oncology testing guidelines and precision medicine initiatives. Germany, projected at 2.7% CAGR, continues to benefit from automation and integration of MSI with broader NGS oncology panels in large academic hospitals. France, growing at 4.0% CAGR, is supported by public investments under the “France Genomic Medicine 2025” initiative, ensuring MSI testing is embedded in national cancer treatment pathways.

The UK, at 3.3% CAGR, is expanding MSI adoption through NHS precision medicine programs and growing partnerships with private diagnostic labs. Southern European countries such as Italy and Spain are also showing consistent gains, supported by EU-level cancer mission projects. Overall, Europe’s share of the market is reinforced by clinical standardization, reimbursement support, and ongoing efforts to expand companion diagnostics in oncology care.

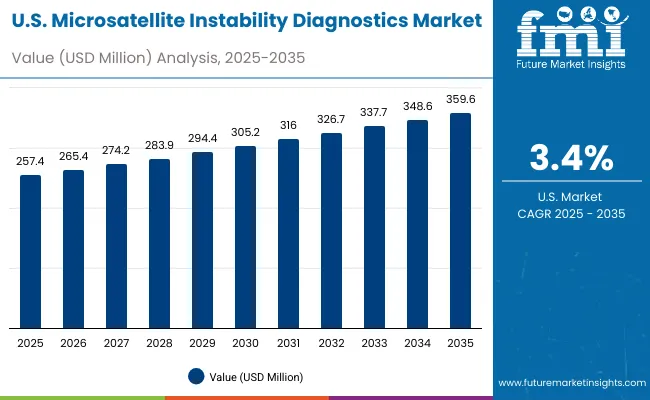

North America remains a mature but innovation-led market, with the USA projected to grow at 3.4% CAGR between 2025 and 2035. Growth is being driven by the replacement of legacy PCR-only testing with integrated PCR-NGS workflows and widespread adoption of companion diagnostics linked to immunotherapy approvals. Hospitals and reference labs in the USA are rapidly incorporating MSI testing into comprehensive genomic profiling panels, supported by payer coverage expansions and FDA-approved platforms such as FoundationOneCDx.

Federal funding under cancer moonshot initiatives and ongoing investments by major academic centers are reinforcing infrastructure upgrades. Despite its maturity, the USA market continues to set the pace for regulatory validation, pharma-diagnostic partnerships, and new MSI assay launches, keeping North America at the forefront of innovation.

The MSI Diagnostics Market in the USA is forecasted to grow at a 3.4% CAGR, primarily driven by the increasing integration of companion diagnostics into oncology treatment pathways and payer coverage expansions. Hospitals and reference laboratories are upgrading from legacy PCR-only workflows to PCR-NGS hybrid assays validated for regulatory compliance, supporting immunotherapy eligibility decisions. Demand is being fueled by clinical guideline mandates and the growth of colorectal, endometrial, and gastric cancer testing volumes in major cancer centers.

The MSI Diagnostics Market in the United Kingdom is projected to grow at a 3.3% CAGR through 2035, supported by NHS England’s precision oncology investments and the roll-out of genomics hubs. National programs under the Genomic Medicine Service (GMS) are embedding MSI testing into standard-of-care for colorectal and hereditary cancers. Adoption is also being driven by rising demand for tumor profiling in academic and private cancer centers.

The MSI Diagnostics Market in Germany is forecast to grow at a 2.7% CAGR, shaped by stringent reimbursement frameworks and gradual adoption of NGS-based oncology profiling. Under federal health digitalization and oncology initiatives, hospitals are progressively upgrading pathology labs to incorporate validated MSI assays into comprehensive cancer panels. Germany’s strong network of university hospitals and private pathology chains is accelerating demand for PCR-based companion diagnostics while cautiously expanding NGS adoption.

The MSI Diagnostics Market in India is expected to grow at a CAGR of 5.9%, making it one of the fastest-growing markets globally. Growth is fueled by the rapid expansion of tertiary care hospitals, oncology-focused medical colleges, and private diagnostic chains across Tier 1 and Tier 2 cities.

Rising cancer incidence, combined with NABL accreditation standards and government-backed cancer control programs, has led to increased adoption of MSI testing as part of molecular diagnostics. Indian hospitals are integrating PCR fragment analysis assays and targeted NGS panels into oncology workflows, while private laboratories are offering MSI testing as part of broader genomic profiling packages.

The MSI Diagnostics Market in China is projected to grow at a CAGR of 6.3% through 2035, supported by aggressive oncology infrastructure investments under the Healthy China 2030 policy. China’s National Health Commission has issued guidelines promoting biomarker testing, accelerating MSI adoption in Class A tertiary hospitals. Urban cancer centers are incorporating MSI into comprehensive NGS oncology panels, while provincial hospitals are adopting PCR-based MSI assays for Lynch syndrome and colorectal cancer diagnostics. Domestic diagnostic companies are scaling up production of MSI kits, while global suppliers are forming joint ventures to expand access.

The MSI Diagnostics Market in Japan is projected to grow at a CAGR of 4.2%, reaching USD 41.7 million by 2025. Adoption is being shaped by Japan’s dual focus on clinical precision and workforce efficiency under the Ministry of Health, Labour and Welfare guidelines. PCR Fragment analysis leads the market with 51.4% revenue share as MSI testing is increasingly integrated into colorectal and endometrial cancer care, supported by national cancer registries and insurance coverage for companion diagnostics. Japan’s push for automation in hospital laboratories is driving demand for validated MSI assays that are compatible with digital pathology systems.

The MSI Diagnostics Market in South Korea is estimated at USD 24.6 million in 2025 and is projected to grow at a CAGR of 5.5% through 2035. Growth is driven by government-led oncology programs under the Ministry of Health and Welfare (MOHW) that promote genetic testing and biomarker-driven therapy. Diagnostic segment account for 20.5% as Hospitals are investing in PCR and targeted NGS assays for Lynch syndrome screening and immunotherapy stratification, supported by national cancer control reimbursement policies.

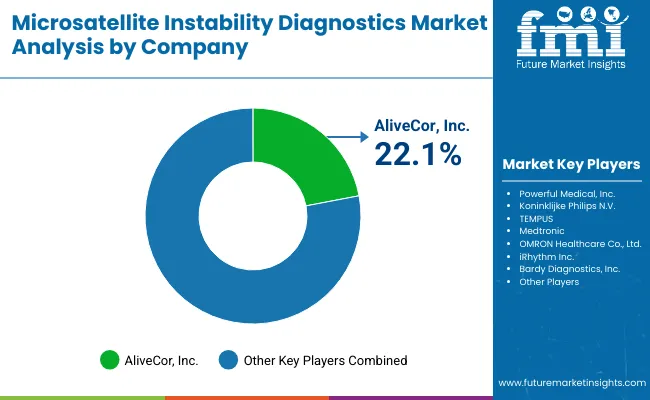

The MSI Diagnostics market is moderately consolidated, with global leaders, established molecular diagnostic firms, and regional innovators competing across PCR, NGS, and companion diagnostic applications. Industry leaders such as Promega hold a significant market share, driven by their proprietary MSI Analysis System, which is widely adopted for regulatory-approved cancer testing and clinical research. Promega’s strength lies in its validated PCR-based assays and partnerships with oncology research institutions, reinforcing its position as the reference standard for MSI testing worldwide.

Global diagnostic giants like Thermo Fisher Scientific and Bio-Rad Laboratories command strong presence through broad molecular oncology portfolios that integrate MSI testing with NGS panels and multiplex PCR solutions. These companies are expanding their footprints via collaborations with pharmaceutical firms to co-develop MSI-linked companion diagnostics, ensuring alignment with immunotherapy drug approvals. Their strategies focus on scalability, automation, and integration with oncology decision-support systems.

Specialized firms such as Genecast, NeoGenomics, Biocartis, and AmoyDx are strengthening their foothold by offering targeted NGS platforms, immuno-oncology biomarker panels, and region-specific MSI solutions. For example, NeoGenomics leverages its clinical lab network in the USA, while Biocartis focuses on integrated molecular testing platforms in Europe. AmoyDx is expanding in Asia with companion diagnostics approved for use alongside immunotherapies. These players are particularly relevant in supporting precision oncology workflows in hospital and reference labs.

Emerging competitors and regional players under the “Other Players” category are driving accessibility through cost-efficient PCR kits, customized MSI testing workflows, and localized service partnerships. Their strength lies in affordability, regional regulatory alignment, and integration with hospital oncology departments.

As the market evolves, competitive differentiation is shifting from standalone MSI assays toward comprehensive genomic profiling, bioinformatics-enabled reporting, and integration with precision oncology ecosystems, where vendors compete not only on accuracy but also on interoperability and clinical decision-making support.

Key Development

| Item | Value |

|---|---|

| Market Value (2025) | USD 569.3 million |

| Product type | PCR fragment analysis, Real-time PCR beacon, Targeted NGS, NGS comprehensive, and Others, highlighting the core diagnostic technologies shaping adoption trends |

| Application | Diagnostic / Lynch screening, Companion diagnostic flow, MSI immunotherapy stratification, Precision oncology profiling, Tumor profiling + therapy decisions, and Others |

| End User | Hospitals & reference laboratories, Clinical labs, Oncology Centers, and Others |

| Regions Covered | North America, Latin America, Western & Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Brazil, China, India, Germany, France, UK etc. |

| Key Companies Profiled | Promega, Thermo Fisher Scientific, Bio-Rad Laboratories, Genecast, NeoGenomics, Biocartis, AmoyDx, and Others. |

| Additional Attributes | Dollar sales by application and regions, adoption trends of NGS-based MSI testing, rising demand in companion diagnostics and immunotherapy stratification, and growing demand across oncology centers and hospital reference laboratories. |

The global Microsatellite Instability (MSI) Diagnostics market is estimated to be valued at USD 569.3 million in 2025.

The market size for Microsatellite Instability (MSI) Diagnostics is projected to reach USD 991.0 million by 2035.

The Microsatellite Instability (MSI) Diagnostics market is expected to grow at a CAGR of 5.7% during this period.

Key product types include PCR fragment analysis, Real-time PCR beacon, Targeted NGS, NGS comprehensive, and Others.

The Companion diagnostic flow segment is projected to command 28.4% of the market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA