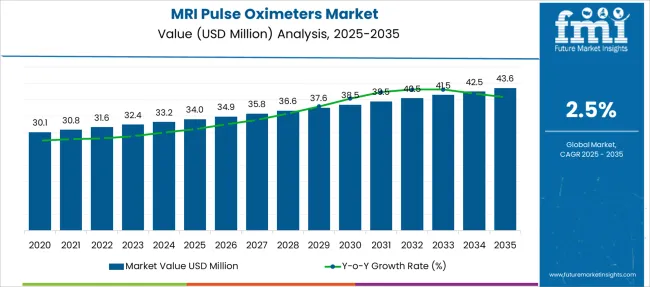

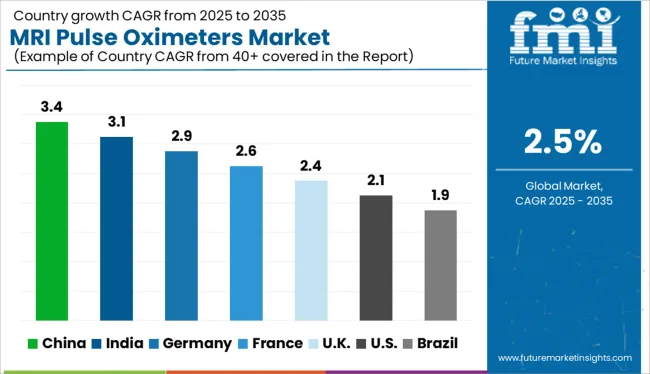

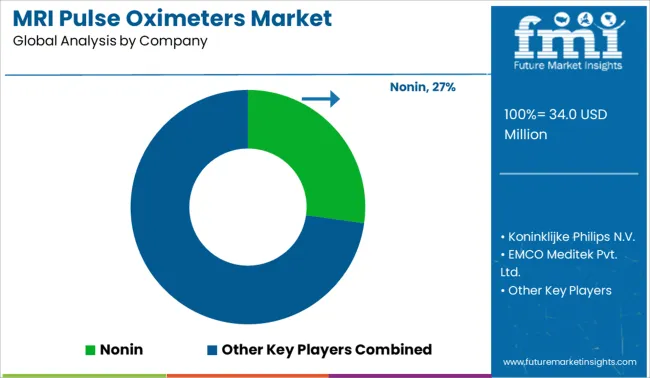

The MRI Pulse Oximeters Market is estimated to be valued at USD 34.0 million in 2025 and is projected to reach USD 43.6 million by 2035, registering a compound annual growth rate (CAGR) of 2.5% over the forecast period.

| Metric | Value |

|---|---|

| MRI Pulse Oximeters Market Estimated Value in (2025 E) | USD 34.0 million |

| MRI Pulse Oximeters Market Forecast Value in (2035 F) | USD 43.6 million |

| Forecast CAGR (2025 to 2035) | 2.5% |

The MRI pulse oximeters market is expanding steadily, supported by the increasing use of advanced monitoring devices in diagnostic imaging centers and hospitals. The demand for reliable oxygen saturation monitoring compatible with MRI environments has risen alongside the growth of MRI procedures worldwide. Developments in wireless technology have made MRI pulse oximeters more convenient, improving patient comfort and clinical workflow.

Healthcare providers are prioritizing devices that offer accurate readings without interfering with MRI scans, leading to widespread adoption of specialized pulse oximeters. Increased hospital investments in patient safety and monitoring equipment have further boosted market growth.

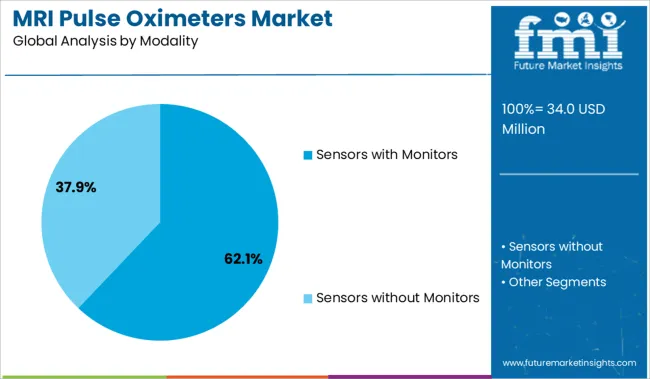

Additionally, the integration of sensors with monitors that provide real-time data has enhanced clinical decision-making. Looking ahead, the market is expected to grow due to technological advancements in sensor accuracy and connectivity and rising diagnostic imaging volumes globally. Segmental growth is anticipated to be led by wireless MRI pulse oximeters, sensors with monitors as the primary modality, and hospitals as the main end user.

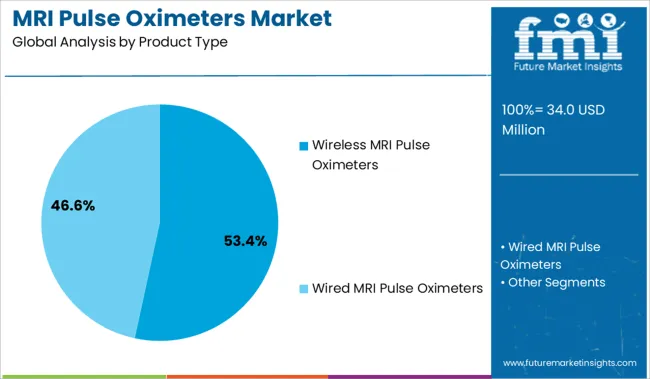

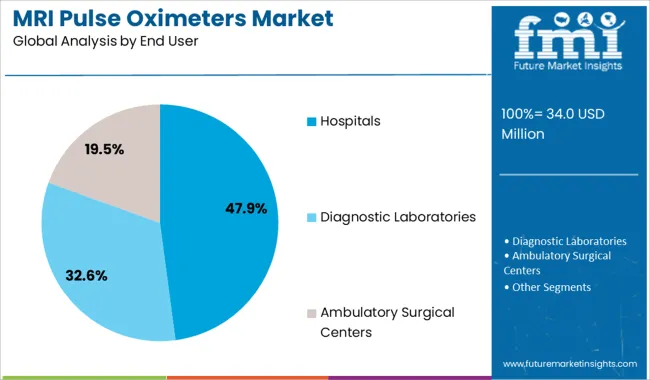

The market is segmented by Product Type, Modality, and End User and region. By Product Type, the market is divided into Wireless MRI Pulse Oximeters and Wired MRI Pulse Oximeters. In terms of Modality, the market is classified into Sensors with Monitors and Sensors without Monitors. Based on End User, the market is segmented into Hospitals, Diagnostic Laboratories, and Ambulatory Surgical Centers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The wireless MRI pulse oximeters segment is expected to contribute 53.4% of the market revenue in 2025, holding the leading position among product types. This segment has grown because wireless devices improve patient mobility and reduce cable-related hazards during MRI procedures. The absence of wires minimizes the risk of interference with MRI signals and enhances the safety of both patients and operators.

Clinical settings favor wireless solutions for their ease of setup and ability to support multiple patient monitoring simultaneously. As hospitals seek to streamline workflow and improve patient experience in diagnostic imaging, the wireless segment continues to gain preference.

The segment’s growth is also supported by ongoing innovations in battery life and signal reliability.

The sensors with monitors modality is projected to account for 62.1% of the MRI pulse oximeters market revenue in 2025, maintaining dominance in monitoring systems. This modality offers comprehensive patient data by integrating sensor readings with visual display units that allow clinicians to observe oxygen saturation levels in real time.

It enhances clinical confidence by providing continuous, accurate monitoring during MRI scans where traditional pulse oximeters may fail. The combination of sensors and monitors supports early detection of hypoxia and immediate clinical response, which is critical during lengthy or complex imaging procedures.

The modality’s widespread adoption is driven by its compatibility with various MRI systems and its user-friendly interface that supports clinical workflows.

The hospitals segment is projected to hold 47.9% of the MRI pulse oximeters market revenue in 2025, positioning it as the leading end user. Hospitals are the primary consumers due to their high volume of MRI procedures and the need for continuous patient monitoring during scans. Investment in advanced diagnostic infrastructure has led hospitals to adopt MRI-compatible pulse oximeters that ensure patient safety and procedure accuracy.

The critical care units within hospitals particularly benefit from these devices as they facilitate monitoring of vulnerable patients in real time. Increasing hospital accreditation standards and regulatory requirements regarding patient monitoring have further pushed adoption.

As MRI usage grows across healthcare systems, hospitals will remain the central end user segment for these specialized pulse oximeters.

| Particulars | Details |

|---|---|

| H1, 2024 | 2.35% |

| H1, 2025 Projected | 2.46% |

| H1, 2025 Outlook | 2.36% |

| BPS Change - H1, 2025 (O) – H1, 2025 (P) | (-) 10 ↓ |

| BPS Change – H1, 2025 (O) – H1, 2024 | (+) 01 ↑ |

The comparative analysis and market growth rate of the global MRI pulse oximeters market as studied by Future Market Insights’ will show a negative BPS growth in the H1-2025 outlook as compared to the H1-2025 projected period by 10 BPS.

The market is subject to changes as per macro and industry standards. Factors that affect the market dynamics are MRI pulse oximeters facing strict regulations and accuracy concerns.

Moreover, the presence of FDA-approved generic pulse oximeters which are widely accepted due to their cost-effectiveness and low maintenance is further responsible for the observed reduction in the BPS values.

However, a positive BPS growth is expected in H1-2025 over H1- 2024 duration with 01 Basis Point Share (BPS). The reasons for the surge in the market is due to prevalence of chronic diseases, a shift in focus towards advanced radiology research, and constant modification with technological innovations.

Additionally, top players are constantly enhancing their product portfolios and collaborating to produce high-end products.

Increasing Prevalence of Chronic Diseases Driving Demand for Medical Monitoring Devices

From 2014 to 2024, the global MRI pulse oximeters market witnessed a CAGR of 1.8%.

With the growing population, the prevalence of chronic disease is increasing among all age groups, and people suffering from chronic diseases such as cancer and HIV are more susceptible to infectious diseases. The rate of prevalence of infectious diseases is directly proportional to the demand for high-end medical monitoring devices such as MRI and CT scans.

At present, cancer treatment and cardiac disease treatment are among the prominent segments of the MRI pulse oximeters market. Around 10 million deaths occur across the world each year that can be attributed to cancer.

Most medical monitoring device manufacturing companies have 7T capacity MRI machines in their pipelines. Such advancements in the medical diagnostic equipment field are expected to be a key factor that will drive the demand growth for MRI pulse oximeters.

Technological advancements in MRI pulse oximetry, partnerships between leading companies, which are boosting research activities in the radiology field, growing demand for advanced SpO2 measuring techniques, and technological advancements in MRI machines are some of the major factors fueling the growth of the global MRI pulse oximeters market.

Overall, the global market for MRI pulse oximeters is predicted to expand at a CAGR of 2.5% from 2025 to 2035.

Continuous Research and development activities Will Create Sales Opportunities for Pulse Oximeter Manufacturers

With a massive shift taking place in the global healthcare sector, Research and Development spending continues to represent a high percentage of market stakeholders’ expenditures.

While existing pulse oximeters work efficiently with 5T MRI scanners, developing and introducing products that are compatible with both, 5T and 7T Magnetic Resonance Imaging machines, should be an important strategy for manufacturers.

MRI-compatible pulse oximeters that are designed using non-magnetic components to facilitate the safe and accurate monitoring of patient’s vital signs during MRI scans have garnered considerable traction in the in-depth analysis of illnesses.

Apart from using them in connection with congenital heart defects (CHD), MRI pulse oximeters are increasingly being used as a standard diagnostic measure in the fields of anesthetics, intensive care, and emergency care.

Innovations in the manufacturing process of MRI pulse reading devices are resulting in higher demand for multifunctional MRI pulse oximeters. Several companies that have a product portfolio of MRI technology are developing high-quality medical diagnostic equipment. These companies are also trying to meet customer demand and GMP compliance for faster regulatory approval.

Strict Regulations and Accuracy Concerns Regarding Vital Sign Monitors Hurting Market Growth

MRI diagnosis continues to be associated with high costs, thereby adding to the reluctance of MRI pulse oximetry testing during MRI scans. In addition, MRI pulse oximeters are sensitive and have relatively high maintenance costs as compared to generic pulse oximeters.

Strict regulations and accuracy concerns of vital sign monitors are key challenging factors for manufacturers.

The emergence of Fiber Optic Pulse Oximeters Keeps the Market Competitive in North America

Heavy investments in Research and Development activities on medical devices and technologies along with favorable reimbursement scenarios in North America are likely to offer lucrative opportunities for MRI pulse reading system market players.

Manufacturers are viewing North America from a target market perspective, considering increasing healthcare expenditure and growing adoption of fiber optic pulse oximeters in the region.

Stakeholders in the market are leveraging new sensor technologies such as fiber optic pulse oximeters to avoid conductive pathways and improve device safety.

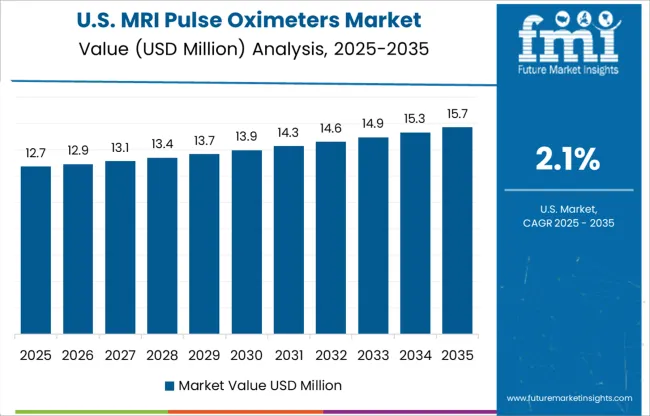

Technological Advancements Elevating Sales of MRI-Compatible Pulse Oximeters

Leading manufacturers of MRI-compatible pulse oximeters are presently prioritizing Research and Development and new product launches to resonate with the booming adoption of MRI pulse oximeters in the USA

The market in the USA continues to offer greater opportunities due to the strong presence of key stakeholders and the growing adoption of cost-effective alternatives, including MRI-compatible pulse oximeters and wrist-worn pulse oximeters.

Increasing Government Spending on Healthcare Driving Demand for Multifunctional MRI Pulse Oximeters

Market growth in China is backed by favorable government initiatives for the expansion of the healthcare sector. With high commercial possibilities in China, enterprises are concentrating on expanding their product portfolios, diversifying their business operations, lowering costs, increasing user satisfaction, and improving the dependability of multifunctional MRI pulse oximeters.

The increasing popularity of medical tourism and favorable health insurance policies in China are likely to attract patients towards expensive, yet efficient MRI scan therapy, and subsequently drive the sales of multifunctional MRI pulse oximeters.

Wireless MRI Pulse Oximeters Extending Traditional Functionality Aspects

Wireless MRI pulse oximeters are expected to account for around 63.7% of the global market share in 2025.

Aligning with the rapid development of state-of-the-art medical devices and technologies, market players continue to increase the production of wireless MRI pulse oximeters that need not be connected to MRI machines.

Operated through infrared (IR) or Bluetooth technology, wireless MRI pulse oximeters have also witnessed higher innovations and investments as compared to wired variants.

Wireless MRI pulse oximeters provide precise SpO2 measurements and are not restricted to MRI environments; hence, manufacturers are specifically focused on this category.

Growing Demand for Patient Monitoring in Hospitals Fueling Market Expansion

Increasing adoption of MRI pulse oximeters in hospitals and growing patient visits for a complete diagnosis of diseases are driving demand for MRI pulse oximeters in hospitals.

The increasing senior population as well as the rising frequency of numerous chronic respiratory disorders are driving the use of monitoring devices such as MRI pulse oximeters in hospitals during the diagnostic and therapy stages.

As current MRI pulse oximeters are organ-specific, requiring different sensors for different organs, manufacturers investing in the development of products that are not organ-specific and provide accurate SpO2 readings equally in all sensor locations are likely to be rewarded in the long run.

MRI pulse oximeter manufacturers remain focused on meeting the needs for pulse oximetry on infants, pediatrics, and adults in fixed-site as well as mobile MRI units.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2014 to 2024 |

| Market Analysis | Value in USD Million, Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East & Africa (MEA) |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Mexico, Argentina, Germany, Italy, France, United Kingdom, Nordic, Spain, Japan, China, India, Malaysia, Thailand, Australia, GCC Countries, South Africa, Turkey |

| Key Market Segments Covered | Product Type, Modality, End User, Region |

| Key Companies Profiled | Koninklijke Philips N.V.; Nonin; IRadimed Corporation; EMCO Meditek Pvt. Ltd.; MIPM; Hamilton Medical; General Electric Company; Turner Medical; Medtronic; Zensorium |

| Pricing | Available upon Request |

The global MRI pulse oximeters market is estimated to be valued at USD 34.0 million in 2025.

The market size for the MRI pulse oximeters market is projected to reach USD 43.6 million by 2035.

The MRI pulse oximeters market is expected to grow at a 2.5% CAGR between 2025 and 2035.

The key product types in MRI pulse oximeters market are wireless MRI pulse oximeters and wired MRI pulse oximeters.

In terms of modality, sensors with monitors segment to command 62.1% share in the MRI pulse oximeters market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

MRI-Guided Cardiac Ablation Market Size and Share Forecast Outlook 2025 to 2035

MRI-based Quantitative Biomarkers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

MRI Transport Market Size and Share Forecast Outlook 2025 to 2035

MRI Compatible Patient Monitoring Systems Market Size and Share Forecast Outlook 2025 to 2035

MRI-Safe CRT Devices Market Size and Share Forecast Outlook 2025 to 2035

MRI Guided Neurosurgical Ablation Market Insights - Demand & Growth 2025 to 2035

MRI-Compatible IV Infusion Pump Systems Market Growth – Trends & Forecast 2025-2035

MRI-Safe Neurostimulation Systems Market Growth - Trends & Forecast 2025 to 2035

MRI Safe Biopsy Needle Market

MRI Compatible Biopsy Devices Market

MRI Safe Defibrillator Market

Memristor Market Size and Share Forecast Outlook 2025 to 2035

Breast MRI Screening Market Size and Share Forecast Outlook 2025 to 2035

Portable MRI Market Analysis - Size, Share & Forecast 2025 to 2035

Preclinical MRI Equipment Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Resonance Imaging (MRI) Contrast Agents Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Resonance Imaging (MRI) Market Trends - Size, Share & Forecast 2025 to 2035

Pulse Ingredient Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredient Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredient Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA