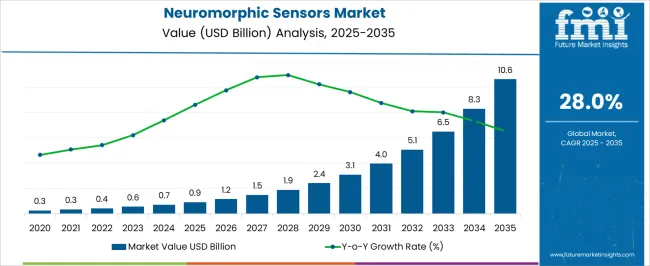

The Neuromorphic Sensors Market is estimated to be valued at USD 0.9 billion in 2025 and is projected to reach USD 10.6 billion by 2035, registering a compound annual growth rate (CAGR) of 28.0% over the forecast period. The YoY growth rate rises sharply from 2024 through 2027, peaking around 2027–2028, where the market records its fastest acceleration. This stage reflects the phase of rapid adoption, fueled by AI, robotics, autonomous systems, and next-generation computing.

Post-2028, the YoY growth curve gradually declines, indicating the beginning of market stabilization. Although total value continues climbing, the rate of annual expansion moderates, suggesting that the technology moves from early adoption toward broader commercialization. By 2032–2035, the curve flattens further, highlighting an approach toward saturation. This phase reflects consolidation, where most high-demand verticals—such as automotive, defense, and advanced electronics—have already integrated neuromorphic sensors, and incremental growth comes mainly from replacements, upgrades, and niche applications.

In saturation analysis terms, the market demonstrates classic “S-curve” dynamics: an early acceleration, a steep adoption phase, and eventual stabilization as penetration matures. The long-term outlook implies that while growth remains strong in absolute dollar terms, percentage growth will increasingly plateau beyond 2032 as the market reaches wider maturity.

| Metric | Value |

|---|---|

| Neuromorphic Sensors Market Estimated Value in (2025 E) | USD 0.9 billion |

| Neuromorphic Sensors Market Forecast Value in (2035 F) | USD 10.6 billion |

| Forecast CAGR (2025 to 2035) | 28.0% |

The neuromorphic sensors market is gaining momentum as industries increasingly adopt brain-inspired computing technologies for faster and more efficient data processing. The ability of these sensors to mimic neural processing has opened new opportunities in image recognition, robotics, and artificial intelligence applications.

Technological advancements have improved sensor accuracy and energy efficiency, making them ideal for real-time edge computing. Rising demand for smart devices that require low latency and high adaptability is fueling market expansion.

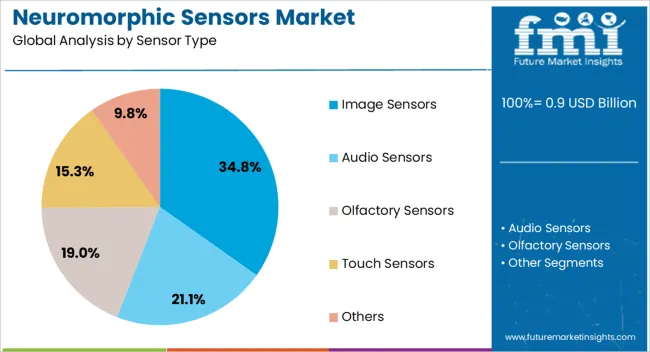

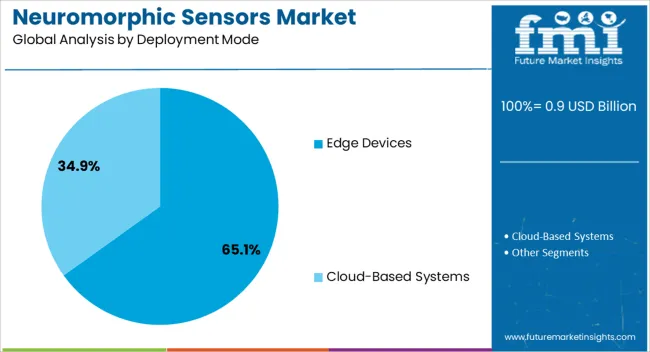

Additionally, integration with IoT ecosystems and the push for autonomous systems are driving the deployment of neuromorphic sensors in various sectors. As industries prioritize faster decision-making and data processing closer to the source, the market outlook remains positive. Segment growth is expected to be led by Image Sensors due to their wide use in vision applications, Hardware components as the core enablers, and Edge Devices which benefit from localized processing capabilities.

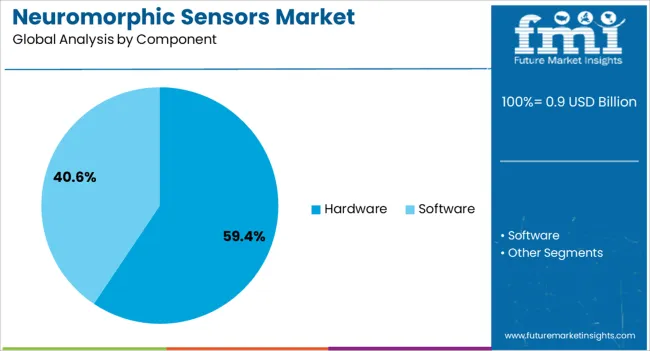

The neuromorphic sensors market is segmented by sensor type, component, deployment mode, technologyapplication, and geographic regions. By sensor type of the neuromorphic sensors market is divided into Image Sensors, Audio Sensors, Olfactory Sensors, Touch Sensors, and Others. In terms of component of the neuromorphic sensors market is classified into Hardware and Software.

Based on deployment mode of the neuromorphic sensors market is segmented into Edge Devices and Cloud-Based Systems. By technology of the neuromorphic sensors market is segmented into CMOS (Complementary Metal-Oxide-Semiconductor) Technology, Event-based Technology, Spike-based Processing, and MROs.

By application of the neuromorphic sensors market is segmented into Healthcare, Automotive, Consumer Electronics, Industrial, Aerospace and Defense, and Others. Regionally, the neuromorphic sensors industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Image Sensors segment is projected to hold 34.8% of the neuromorphic sensors market revenue in 2025, remaining the leading sensor type. This segment’s growth is driven by the increasing adoption of image-based applications such as computer vision, autonomous vehicles, and surveillance systems.

Neuromorphic image sensors offer advantages in processing speed and energy efficiency by replicating how biological eyes and brains process visual information. These sensors enable rapid detection of changes in the environment and reduce the data load sent to central processors.

The growing use of advanced vision technologies in robotics and consumer electronics has further boosted demand. As industries continue to seek enhanced visual sensing capabilities, the Image Sensors segment is expected to maintain its market dominance.

The Hardware segment is expected to account for 59.4% of the neuromorphic sensors market revenue in 2025, leading the components category. This segment includes physical sensor chips and associated electronics essential for neuromorphic computation.

Growth has been supported by improvements in semiconductor fabrication techniques and the miniaturization of hardware modules. Hardware advancements have enabled more complex neural network models to be integrated into compact sensor systems, increasing their applicability across devices.

As software algorithms evolve alongside hardware improvements, these sensors have become more efficient and reliable. Demand from consumer electronics, industrial automation, and automotive sectors has driven the need for high-performance neuromorphic hardware components. The Hardware segment’s prominence is expected to continue as these physical elements are foundational to the overall sensor function.

The Edge Devices segment is projected to capture 65.1% of the neuromorphic sensors market revenue in 2025, securing its position as the primary deployment mode. The increasing preference for decentralized data processing has pushed neuromorphic sensor integration at the edge of networks.

Edge devices benefit from reduced latency, lower bandwidth consumption, and enhanced data privacy by processing information locally. Applications in autonomous vehicles, drones, and smart cameras have driven this trend as they require quick response times and energy-efficient solutions.

The shift toward edge computing is supported by growing investments in IoT infrastructure and demand for real-time analytics in critical environments. As these requirements intensify, the Edge Devices segment is expected to lead adoption of neuromorphic sensor technology in the coming years.

Neuromorphic sensors are gaining traction in AI hardware, healthcare, autonomous systems, and IoT. Their efficiency, adaptability, and bio-inspired processing are reshaping next-generation computing and sensing applications.

Neuromorphic sensors are finding a strong role in artificial intelligence hardware, as they allow data to be processed in a manner similar to biological systems. Their event-driven architecture reduces power usage and improves efficiency for edge devices. This makes them suitable for smartphones, IoT devices, and portable electronics where battery life is critical. Integration with neuromorphic processors enhances real-time decision-making in smart environments. The ability to manage unstructured data inputs such as images, sounds, and environmental patterns strengthens their position in AI ecosystems. As industries shift toward energy-efficient and adaptive systems, neuromorphic sensors are increasingly being positioned as the backbone of next-generation AI hardware adoption.

Healthcare technologies are being transformed by neuromorphic sensors, which offer advanced applications in neuroprosthetics, brain–machine interfaces, and medical imaging. Their bio-inspired design allows accurate recording and interpretation of neural signals, making them valuable for rehabilitation devices. The low-latency processing of these sensors is ideal for responsive medical tools that support patients with sensory or motor impairments. They are also applied in diagnostic equipment for early disease detection and monitoring of neurological conditions. Hospitals and research institutions are adopting neuromorphic solutions for personalized healthcare devices. By bridging the gap between biological signals and computational analysis, these sensors are redefining medical technology capabilities worldwide.

The neuromorphic sensors sector is experiencing rapid integration into robotics, drones, and autonomous vehicles. Their spiking neural network structure provides faster adaptation to dynamic environments, making them critical for navigation and obstacle avoidance. Automotive manufacturers are embedding neuromorphic vision sensors into advanced driver assistance systems to enhance safety. In robotics, these sensors enable real-time recognition of complex environments, allowing machines to operate more independently. Drone platforms also benefit through improved flight stability and environmental awareness. Their contribution ensures autonomous systems can function with reduced computational loads while offering higher responsiveness. This is creating broader opportunities for adoption across multiple industries.

The IoT ecosystem has been strengthened by the inclusion of neuromorphic sensors, which allow always-on functionality with minimal power drain. Their ability to process only relevant stimuli ensures higher efficiency compared to traditional sensors. Smart home devices, wearables, and industrial monitoring tools are incorporating these sensors to provide real-time insights. Energy efficiency, compact designs, and adaptive responses make them highly suitable for consumer electronics. Developers are increasingly exploring neuromorphic platforms for next-generation smart assistants and security systems. Their role in decentralized data processing is particularly valuable in IoT networks, where local computation reduces dependence on cloud resources, boosting responsiveness and reliability.

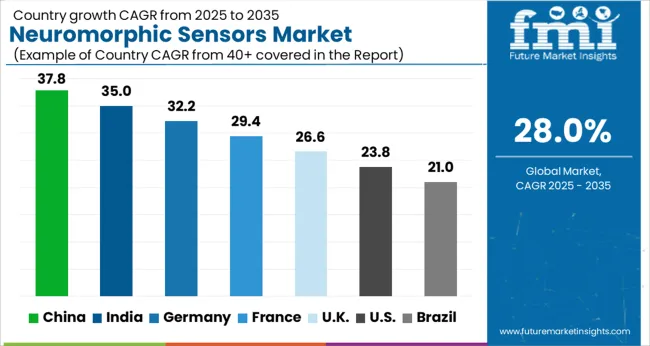

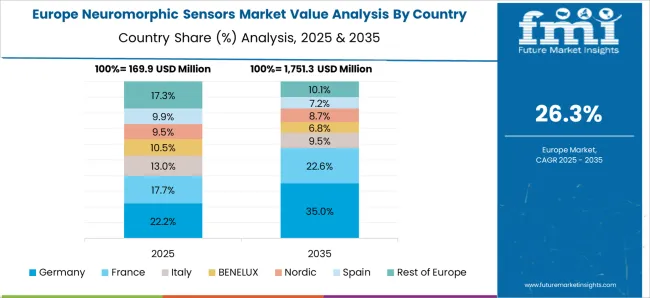

The neuromorphic sensors market is projected to grow globally at a CAGR of 28.0% from 2025 to 2035, supported by rising adoption in AI hardware, robotics, autonomous mobility, and healthcare technologies. China leads with a CAGR of 37.8%, propelled by extensive government funding, large-scale AI research programs, and industrial automation initiatives that integrate brain-inspired sensing. India follows at 35.0%, driven by digital transformation, academic research investments, and adoption of neuromorphic chips in smart city infrastructure. France achieves 29.4%, with expansion tied to healthcare diagnostics, neuroprosthetics, and aerospace research.

The United Kingdom grows at 26.6%, supported by academic research and early-stage commercialization of neuromorphic systems. The United States records 23.8%, reflecting a mature but steadily advancing market focused on edge computing, defense applications, and selective healthcare deployment. This outlook highlights Asia’s dominance in neuromorphic sensor adoption, Europe’s strength in research-driven applications, and the USA maintaining a steady trajectory through advanced but selective integration.

The CAGR for the neuromorphic sensors market in the United Kingdom was measured at 22.1% during 2020-2024 and then advanced to 26.6% for 2025-2035, signaling improved adoption in the next phase. The earlier growth trajectory was steady, influenced by academic-led projects, limited commercialization, and early experiments in robotics and defense applications.

The stronger rate in the latter period is explained by scaling of automotive integration, government-backed AI programs, and edge computing deployments across smart infrastructure. Healthcare adoption also contributed, with neuromorphic vision and auditory sensors being tested in diagnostic systems. This indicates a transition from research-focused projects to broader commercial utilization, reshaping the UK’s competitive standing in neuromorphic technologies.

China’s CAGR for the neuromorphic sensors market was 31.2% during 2020-2024 and accelerated to 37.8% in 2025-2035, showcasing strong upward momentum. The earlier growth was shaped by state-driven research programs and concentrated efforts in neuromorphic computing by domestic universities. The later surge came from industrial automation, smart city projects, and extensive use in defense monitoring systems.

Government-led funding created a thriving ecosystem where local semiconductor firms scaled production capabilities. Demand also rose from AI-driven robotics, consumer electronics, and healthcare wearables. This trajectory emphasizes China’s role as the largest hub for neuromorphic sensor integration globally, benefiting from both scale and state-backed innovation.

The CAGR for the neuromorphic sensors market in India stood at 29.1% during 2020-2024 and climbed to 35.0% during 2025-2035, highlighting stronger expansion in the later period. The earlier rate was fueled by academic institutions, start-up incubation, and integration in small-scale robotics. The improved pace stems from large investments in digital infrastructure, AI adoption in healthcare, and educational programs that encourage local manufacturing.

Government-backed electronics manufacturing schemes created conditions for scaling sensor adoption in smart devices and automotive platforms. The Indian market’s progress reflects a shift from academic and prototype-level work toward full-scale industrial and consumer integration, enhancing its strategic positioning in Asia.

France recorded a CAGR of 24.6% during 2020-2024 and improved to 29.4% for 2025-2035, showing a notable acceleration. Early development was supported by research projects in neuromorphic vision systems and collaboration with European AI frameworks. The stronger growth in the later period is tied to adoption in biomedical devices, aerospace applications, and energy-efficient robotics.

State funding programs directed toward AI-driven healthcare solutions further stimulated deployment. France’s academic ecosystem and partnerships with private industry have been instrumental in bridging the research-to-market gap. The market is advancing toward more practical and commercially relevant applications, broadening its presence in global neuromorphic technology deployment.

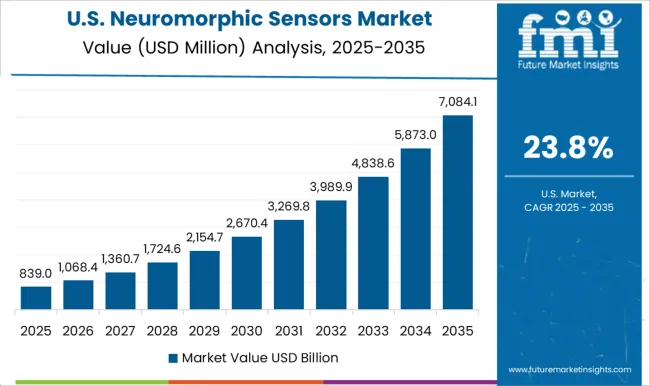

The CAGR for the neuromorphic sensors market in the USA was 19.4% during 2020-2024 and progressed to 23.8% in 2025-2035, indicating steady but moderate improvement. Earlier growth was restrained by high costs, limited large-scale trials, and reliance on niche research initiatives.

The stronger pace in the later phase is supported by defense-related funding, edge computing integration, and gradual deployment in autonomous mobility and medical imaging. The USA market remains research-driven, but corporate partnerships with semiconductor firms are encouraging commercialization. While the pace trails Asia and parts of Europe, the country continues to sustain a vital role through advanced R&D ecosystems and selective defense-led programs.

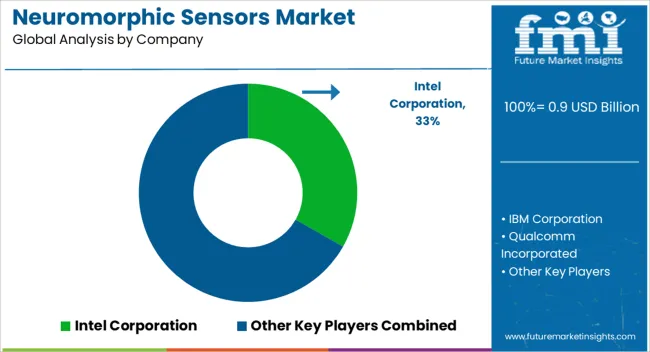

The neuromorphic sensors market is increasingly competitive, characterized by global semiconductor leaders and specialized firms advancing brain-inspired sensing technologies. Intel Corporation plays a leading role with its Loihi neuromorphic research chip, driving applications in edge computing, AI workloads, and adaptive sensor integration.

IBM Corporation contributes through its TrueNorth neuromorphic architecture and partnerships with research institutions, enabling large-scale experimentation in low-power computing and sensory systems. Qualcomm Incorporated is focusing on integrating neuromorphic features into mobile and IoT chipsets, leveraging its strong position in low-power processors and connectivity platforms.

BrainChip Holdings Ltd. specializes in commercializing its Akida neuromorphic processor, targeting applications in vision sensors, cybersecurity, and edge AI solutions. SynSense (formerly aiCTX), a spin-off from ETH Zurich, has developed ultra-low-power neuromorphic vision and auditory processors, with growing deployment in robotics, IoT, and consumer electronics.

Differentiation in this market is shaped by performance scalability, energy efficiency, and adaptability across real-time applications. Leading companies emphasize advancements in event-based vision sensors, spiking neural networks, and integration with AI ecosystems.

Competitive strategies revolve around securing partnerships with system integrators, investing in cross-disciplinary research, and developing application-specific solutions for healthcare, mobility, and defense. This dynamic landscape is reinforced by the race to achieve low-latency processing, reduced power consumption, and broader commercialization of neuromorphic platforms across both consumer and industrial sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 0.9 Billion |

| Sensor Type | Image Sensors, Audio Sensors, Olfactory Sensors, Touch Sensors, and Others |

| Component | Hardware and Software |

| Deployment Mode | Edge Devices and Cloud-Based Systems |

| Technology | CMOS (Complementary Metal-Oxide-Semiconductor) Technology, Event-based Technology, Spike-based Processing, and MROs |

| Application | Healthcare, Automotive, Consumer Electronics, Industrial, Aerospace and Defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Intel Corporation, IBM Corporation, Qualcomm Incorporated, BrainChip Holdings Ltd., and SynSense |

| Additional Attributes | Dollar sales, share, adoption across AI hardware, automotive, healthcare, robotics, IoT, competitive positioning, regional growth hotspots, pricing benchmarks, and R&D investment trends. |

The global neuromorphic sensors market is estimated to be valued at USD 0.9 billion in 2025.

The market size for the neuromorphic sensors market is projected to reach USD 10.6 billion by 2035.

The neuromorphic sensors market is expected to grow at a 28.0% CAGR between 2025 and 2035.

The key product types in neuromorphic sensors market are image sensors, _event-based cameras, _dynamic vision sensors (dvs), audio sensors, _neuromorphic microphones, _event-based microphones, olfactory sensors, touch sensors, others, _proximity sensors and _inertial measurement units (imus).

In terms of component, hardware segment to command 59.4% share in the neuromorphic sensors market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Neuromorphic Chip Market Analysis – Growth & Forecast 2016-2026

Sensors Market Analysis by Type, Technology, End User & Region - Forecast from 2025 to 2035

Biosensors Market Trends – Growth & Future Outlook 2025 to 2035

UV Sensors Market Analysis by Type, End User, and Region from 2025 to 2035

Nanosensors Market Size and Share Forecast Outlook 2025 to 2035

VOC Sensors and Monitors Market Analysis - Size, Growth, and Forecast 2025 to 2035

Rain Sensors Market Size and Share Forecast Outlook 2025 to 2035

Skin Sensors Market Size, Growth, and Forecast for 2025 to 2035

Weft Sensors Market - Size, Share, and Forecast Outlook 2025 to 2035

ADAS Sensors Market Growth - Trends & Forecast 2025 to 2035

PM2.5 Sensors for Home Appliances Market Size and Share Forecast Outlook 2025 to 2035

Image Sensors Market Growth – Trends & Forecast through 2034

Chest Sensors Market

PPG Biosensors Market – Size, Share & Growth Forecast 2025 to 2035

Motion Sensors Market

EMG Biosensors Market

Airbag Sensors Market

Shutter Sensors Market Size and Share Forecast Outlook 2025 to 2035

Printed Sensors Market Size and Share Forecast Outlook 2025 to 2035

Quantum Sensors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA