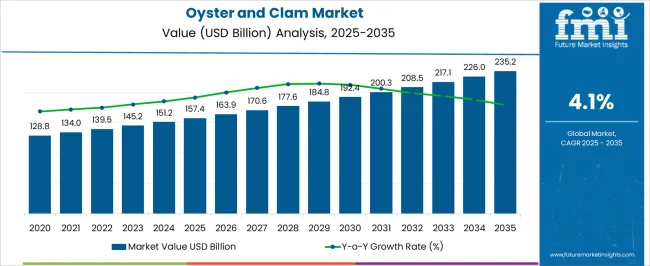

The global oyster and clam market is projected at USD 157.4 billion in 2025 and is anticipated to reach USD 235.2 billion by 2035, expanding at a CAGR of 4.1% over the forecast period. A rolling CAGR analysis highlights the year-on-year growth trends and the incremental shifts that define the market’s expansion across the decade. In the initial phase, from USD 128.8 billion to USD 151.2 billion, the rolling CAGR remains moderate, reflecting stable demand driven by established aquaculture operations, regional seafood consumption, and steady export activity.

Between USD 157.4 billion and USD 184.8 billion, a slight acceleration in rolling CAGR is observed as technological improvements in cultivation, improved disease management, and sustainable harvesting practices contribute to incremental productivity gains. Moving into the latter half of the period, from USD 192.4 billion to USD 235.2 billion, the rolling CAGR continues at a consistent pace, supported by rising health awareness, increasing demand for protein-rich diets, and expansion into emerging markets with growing seafood consumption.

The rolling CAGR analysis reveals that while growth remains steady throughout the decade, periods of incremental acceleration coincide with operational improvements, strategic market expansion, and the adoption of modern processing and logistics practices. This insight empowers producers, distributors, and investors to anticipate growth patterns, optimize supply chains, and strategically allocate resources to capitalize on market opportunities as the oyster and clam sector matures through 2035.

| Metric | Value |

|---|---|

| Oyster and Clam Market Estimated Value in (2025 E) | USD 157.4 billion |

| Oyster and Clam Market Forecast Value in (2035 F) | USD 235.2 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The oyster and clam market is closely influenced by five interconnected parent markets that collectively drive its adoption and long-term growth. The largest contributor is the seafood and aquaculture market, which accounts for about 40% share, as oysters and clams are cultivated extensively to meet demand for fresh, frozen, and processed seafood products consumed globally. The food service and hospitality sector contributes around 25%, driven by the prominence of oysters and clams in fine-dining restaurants, seafood restaurants, and catering services where premium offerings and specialty dishes attract consumer interest. The frozen and processed food market holds close to 15% influence, supported by the growing consumption of value-added seafood products, ready-to-cook meals, and packaged shellfish that provide convenience and extended shelf life. The nutraceutical and functional food sector adds nearly 12%, as oysters and clams are rich in minerals, vitamins, and bioactive compounds that are increasingly used in health supplements and fortified foods. The cosmetics and personal care ingredients market contributes close to 8%, as shellfish-derived extracts find applications in collagen, peptides, and skincare formulations.

The distribution of market influence shows that aquaculture production and food service remain the backbone of the oyster and clam market, while processed foods, nutraceuticals, and cosmetic applications continue to expand their commercial relevance.

The oyster and clam market is experiencing steady expansion, driven by rising global seafood consumption, growing awareness of nutritional benefits, and increasing demand for premium aquatic delicacies. Health-conscious consumers are fueling interest in high-protein, low-fat marine products, with oysters and clams being recognized for their rich mineral content and omega-3 fatty acids.

The market is also benefiting from improvements in aquaculture practices and sustainable harvesting, which ensure consistent supply and better quality. Freshness, traceability, and eco-certifications are becoming critical purchase drivers, especially in retail and restaurant settings.

The future outlook is optimistic, supported by growth in seafood-based cuisine popularity, rising exports, and innovations in cold-chain logistics that extend product shelf life. As global palates expand and seafood becomes more integrated into daily diets, demand for both wild and farm-raised oyster and clam products is expected to remain robust.

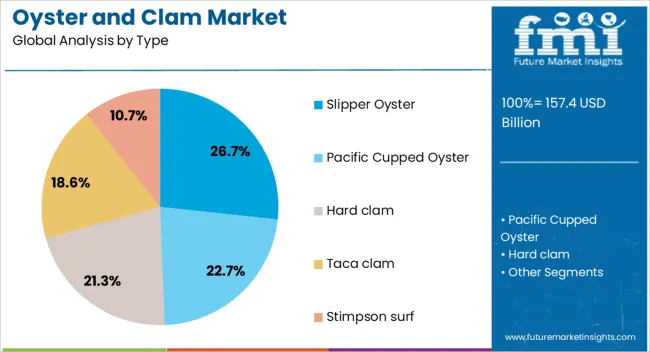

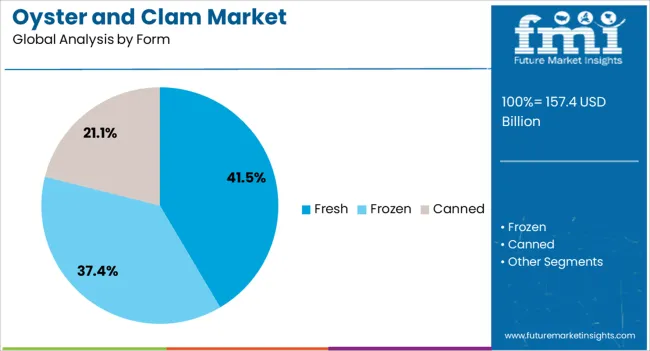

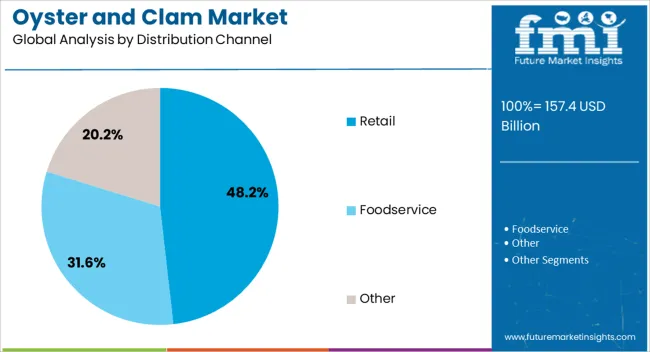

The oyster and clam market is segmented by type, form, distribution channel, and geographic regions. By type, oyster and clam market is divided into Slipper Oyster, Pacific Cupped Oyster, Hard clam, Taca clam, and Stimpson surf. In terms of form, oyster and clam market is classified into Fresh, Frozen, and Canned. Based on distribution channel, oyster and clam market is segmented into Retail, Foodservice, and Other. Regionally, the oyster and clam industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The slipper oyster segment accounts for 27% of the market share within the type category, positioning it as a leading variety due to its availability, distinctive flavor, and adaptability to aquaculture. Known for its mild taste and ease of cultivation, slipper oysters are widely preferred in several regional cuisines and continue to gain traction in both domestic and export markets.

Advances in farming techniques and water management have supported the reliable production of slipper oysters, ensuring quality and sustainability. Their affordability compared to other oyster types has also contributed to their widespread use across foodservice and retail sectors.

As consumer interest in regional and specialty shellfish rises, slipper oysters are expected to maintain strong market visibility, particularly in Asia-Pacific and coastal regions where consumption is deeply rooted in local culinary traditions.

The fresh form segment leads with a 42% share of the market, reflecting strong consumer preference for unprocessed, high-quality oyster and clam offerings. Fresh products are often associated with superior taste, nutritional retention, and premium appeal, making them highly sought after in both restaurant and home cooking applications.

The expansion of cold chain infrastructure and improved packaging technologies has significantly increased the accessibility and safety of fresh shellfish. Retailers and seafood distributors are focusing on freshness as a key value proposition, investing in quick processing and rapid delivery systems.

Seasonal promotions, live shellfish counters, and interactive displays further enhance customer engagement in the fresh segment. This preference for freshness is expected to remain consistent, especially in regions where seafood plays a central role in traditional diets and culinary experiences.

The retail segment dominates the distribution channel category with a 48% share, underlining its importance in bringing oyster and clam products to end consumers. Supermarkets, specialty seafood stores, and online grocery platforms are enhancing accessibility through expanded product assortments, transparent labeling, and quality assurance.

Convenience, brand visibility, and promotional campaigns continue to drive sales in the retail space, particularly for pre-packaged or ready-to-cook formats. As consumer shopping habits evolve with a preference for home-cooked meals and traceable seafood sources, retail outlets have strengthened their supply chains and storage capabilities to support this demand.

The growth of e-commerce in seafood delivery and the emergence of direct-to-consumer models are expected to reinforce the retail segment’s leadership. Continued investments in cold logistics and digital retail platforms are likely further to accelerate the retail-driven consumption of oysters and clams.

The oyster and clam market is being shaped by rising seafood consumption, growth in aquaculture, applications in nutraceuticals, and regional expansion with export opportunities. Increasing demand from gourmet cuisine and health-conscious consumers is driving production and adoption. Aquaculture practices ensure consistent supply, improve quality, and stabilize operations. Nutraceutical and functional food applications are opening new high-value markets for shellfish products. Regional growth and international trade are enhancing accessibility and market penetration. Together, these dynamics are supporting steady expansion, creating investment opportunities, and reinforcing the market’s role in global seafood and health food sectors.

The market is witnessing growth due to increasing global demand for seafood, particularly oysters and clams. These shellfish are highly valued in gourmet cuisine and fine dining restaurants for their taste, texture, and nutritional benefits. Rising consumer preference for high-protein, low-fat, and mineral-rich food products is driving consumption. Seafood festivals, culinary events, and premium dining experiences are promoting oysters and clams as luxury and delicacy items. Aquaculture and controlled harvesting techniques are being adopted to meet growing demand. The expanding popularity of seafood in urban and semi-urban areas is supporting consistent market growth and encouraging investments in production infrastructure.

Aquaculture and controlled farming of oysters and clams are contributing to market expansion by ensuring year-round availability and consistent quality. Farmers are employing selective breeding, improved water management, and disease control methods to enhance yield and shellfish size. Coastal regions with optimal water conditions are becoming hubs for oyster and clam cultivation. Technological interventions, such as floating cages, spat collectors, and water monitoring systems, are improving operational efficiency. The shift from wild harvesting to managed aquaculture reduces environmental pressure and stabilizes supply. These practices enable producers to meet both domestic and export market demand, supporting market growth and long-term industry sustainability.

Oysters and clams are being increasingly incorporated into nutraceuticals and health-oriented food products due to their rich content of zinc, omega-3 fatty acids, and other micronutrients. Dietary supplements, fortified foods, and functional beverages are leveraging shellfish-derived extracts to promote immunity, cardiovascular health, and overall wellness. The growing awareness of nutrient-dense foods and preventive healthcare is boosting demand. Pharmaceutical and health food companies are exploring processing methods to maintain bioactive compound integrity. By diversifying applications beyond traditional seafood consumption, the oyster and clam market is expanding its value chain and attracting interest from both food and health-focused industries.

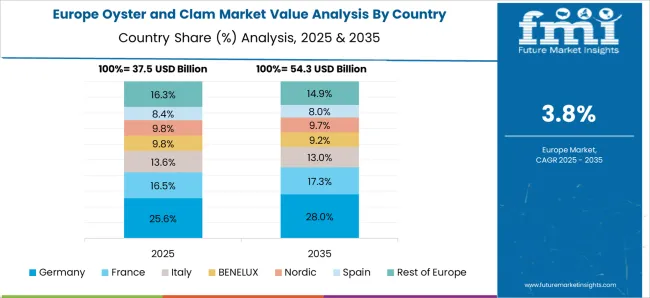

The oyster and clam market is experiencing regional growth due to rising consumption in North America, Europe, and Asia-Pacific regions. Coastal and aquaculture-friendly countries are increasing production capacities to serve local and international markets. Export demand is rising from regions with limited shellfish cultivation but high seafood consumption. Supply chain optimization, cold storage, and transportation infrastructure are improving product freshness and accessibility. Partnerships between local producers and international distributors are strengthening market reach. Regional expansion, combined with increasing consumer awareness of quality and nutritional benefits, is enhancing trade opportunities and positioning oysters and clams as both premium and functional seafood products globally.

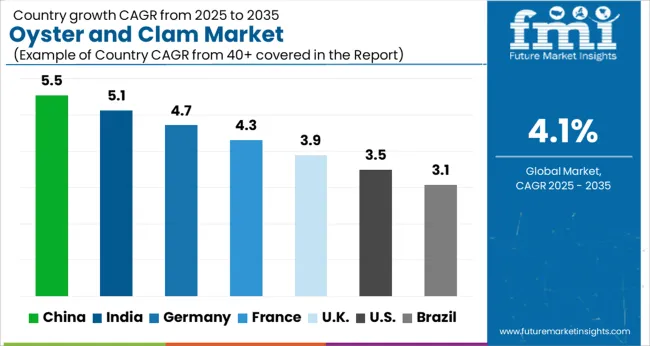

| Country | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

The global oyster and clam market is projected to grow at a CAGR of 4.1% from 2025 to 2035. China leads with 5.5%, followed by India at 5.1%, Germany at 4.7%, the UK at 3.9%, and the USA at 3.5%. Growth is driven by increasing seafood consumption, rising demand for premium shellfish, and expansion of aquaculture practices. BRICS countries, particularly China and India, are scaling hatchery operations, cultivation techniques, and processing facilities to meet domestic and export demand. OECD nations such as Germany, the UK, and the USA emphasize quality standards, sustainable harvesting methods, and value-added product development to enhance market competitiveness. The analysis spans over 40+ countries, with the leading markets detailed below.

The oyster and clam market in China is projected to grow at a CAGR of 5.5% from 2025 to 2035, supported by increasing domestic consumption, expanding aquaculture, and rising export demand. Coastal regions are investing in modern farming practices to improve yield, quality, and disease resistance. High consumer preference for seafood in both fresh and processed forms drives adoption, while integration of cold-chain logistics ensures freshness and wider market reach. Government initiatives promoting sustainable aquaculture and seafood safety regulations further encourage market expansion. China’s role as a major seafood exporter strengthens the commercial potential of oysters and clams.

The oyster and clam market in India is expected to grow at a CAGR of 5.1% from 2025 to 2035, driven by coastal aquaculture expansion and increasing seafood consumption. Advances in oyster and clam farming, including hatcheries and sustainable cultivation techniques, enhance production efficiency and quality. Rising consumer preference for seafood in urban and semi-urban regions, along with growing exports, supports market growth. Government initiatives promoting coastal aquaculture and seafood trade, combined with improved cold-chain infrastructure, are boosting the availability and freshness of oysters and clams. Investment in disease management and feed technology further strengthens production capabilities.

The oyster and clam market in Germany is projected to grow at a CAGR of 4.7% from 2025 to 2035, supported by strong consumer demand for high-quality seafood and sustainable sourcing. Aquaculture operations and import partnerships ensure a steady supply of oysters and clams to meet restaurant, retail, and foodservice needs. Food safety regulations and quality certification standards further enhance market credibility. Growing awareness of seafood health benefits, paired with premium dining trends, drives consumption. Investments in cold-chain logistics and distribution networks enable efficient handling and extend shelf life, supporting both domestic consumption and export requirements.

The oyster and clam market in the UK is expected to grow at a CAGR of 3.9% from 2025 to 2035, fueled by increasing seafood consumption and premium dining trends. Domestic aquaculture and imported oysters and clams cater to both retail and hospitality sectors. Consumer preference for fresh and sustainably sourced seafood encourages the adoption of high-quality aquaculture products. Government regulations on seafood safety, traceability, and quality standards ensure market reliability. Investments in processing, packaging, and cold-chain logistics further support growth by maintaining product freshness and extending shelf life across local and international markets.

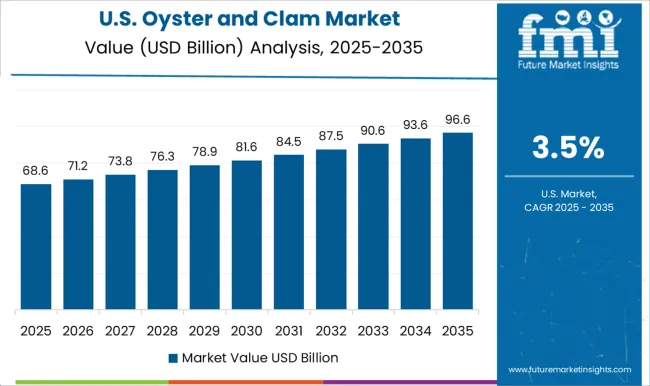

The oyster and clam market in the USA is projected to grow at a CAGR of 3.5% from 2025 to 2035, supported by increasing seafood consumption, coastal aquaculture expansion, and import supplementation. Domestic oyster and clam farming, particularly in regions like the Gulf Coast and Pacific Northwest, is complemented by advanced hatchery techniques to improve yield and quality. Rising consumer preference for fresh, sustainably sourced, and ready-to-eat seafood drives demand. Government regulations on seafood safety, labeling, and sustainability certification enhance market trust. Efficient cold-chain distribution and logistics infrastructure facilitate wider domestic and export market penetration.

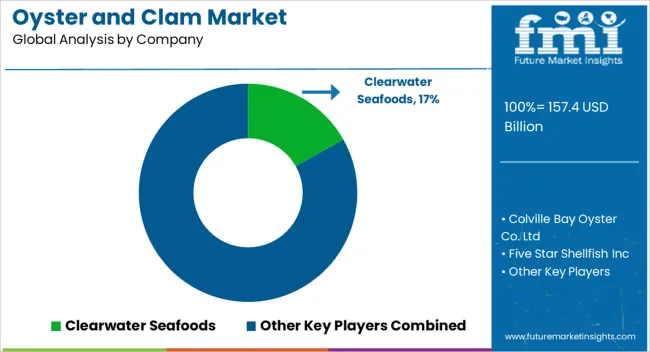

Competition in the oyster and clam market is shaped by aquaculture expertise, product quality, and supply chain efficiency. Clearwater Seafoods, Colville Bay Oyster Co. Ltd, Five Star Shellfish Inc, High Liner Foods, Island Creek Oysters, Mazetta Company, LLC, Pacific Seafood, Pangea Shellfish Company, Royal Hawaiian Seafood, Taylor Shellfish Farms, Ward Oyster Company, and Woodstown Bay Shellfish Ltd lead by offering fresh, frozen, and value-added oyster and clam products. Product differentiation is achieved through species selection, size grading, sustainable harvesting practices, and specialized processing methods such as shucked, canned, and packaged shellfish, ensuring high-quality offerings for retail, foodservice, and export markets.

Mid-tier and regional players focus on niche segments including premium oysters, heritage clam varieties, and ready-to-cook preparations, providing unique offerings for discerning consumers and gourmet markets. Operational efficiency, cold chain management, and traceability systems further enhance product reliability and market trust. Strategies across leading companies emphasize vertical integration, quality certification, and distribution network expansion. Advanced aquaculture practices, biosecure cultivation, and rigorous quality control protocols are leveraged as key differentiators to maintain consistency, safety, and flavor profile. Differentiation is reinforced through innovative packaging, extended shelf-life solutions, and premium branding targeted at restaurants, supermarkets, and international buyers. Companies aim to balance high-quality production with cost efficiency, ensuring timely supply to meet consumer demand while adhering to regulatory standards and environmental guidelines. The market reflects strong competition based on product freshness, species variety, and operational reliability, where global and regional players maintain leadership by providing consistent, high-quality oysters and clams.

Continuous innovation in aquaculture techniques, sustainable harvesting practices, and value-added processing support market growth, while customer-centric strategies, enhanced traceability, and optimized distribution efficiency reinforce competitive positioning. The oyster and clam market exhibits a dynamic landscape characterized by quality, reliability, and consumer preferences.

| Item | Value |

|---|---|

| Quantitative Units | USD 157.4 Billion |

| Type | Slipper Oyster, Pacific Cupped Oyster, Hard clam, Taca clam, and Stimpson surf |

| Form | Fresh, Frozen, and Canned |

| Distribution Channel | Retail, Foodservice, and Other |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Clearwater Seafoods, Colville Bay Oyster Co. Ltd, Five Star Shellfish Inc, High Liner Foods, Island Creek Oysters, Mazetta Company, LLC, Pacific Seafood, Pangea Shellfish Company, Royal Hawaiian Seafood, Taylor Shellfish Farms, Ward Oyster Company, and Woodstown Bay Shellfish Ltd |

| Additional Attributes | Dollar sales, share, species demand, regional production, consumption trends, competitor landscape, pricing patterns, aquaculture vs wild catch, distribution channels, export-import dynamics, value-added product adoption, regulatory compliance. |

The global oyster and clam market is estimated to be valued at USD 157.4 billion in 2025.

The market size for the oyster and clam market is projected to reach USD 235.2 billion by 2035.

The oyster and clam market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in oyster and clam market are slipper oyster, pacific cupped oyster, hard clam, taca clam and stimpson surf.

In terms of form, fresh segment to command 41.5% share in the oyster and clam market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA