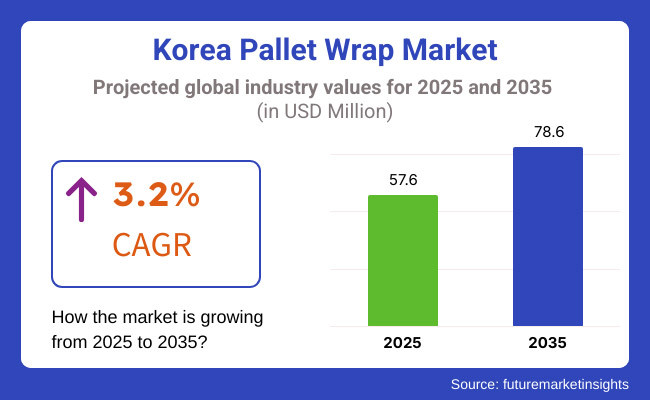

The pallet wrap market in Korea is expected to witness stable growth, registering a CAGR of 3.2% from 2025 to 2035. The pallet wrap industry in Korea are expected to reach a staggering USD 57.6 million by 2025 and USD 78.6 million in 2035. This growth is mostly due to the growing demand for packaging solutions that are water-resistant, long-lasting, and effective to protect products during storage and transit.

Sectors such as logistics, food & beverage, pharmaceuticals, and e-commerce drive this growth. These trends have increased the need for pallet wrap companies to develop cost-effective, stretchable wrapping films, including biodegradable and high-performance options. Moreover, government regulations promoting the use of sustainable packaging materials are also encouraging manufacturers to use eco-friendly pallet wraps.

Demand varies by region, but significant consumption is mainly driven by industrial centers in Gyeonggi-do and Busan Provinces. Automated stretch-wrapping solutions are also anticipated to boost industry efficiency as technologies evolve, contributing to the Korea's growing role in pallet wrap manufacturing and technology development.

Between 2020 and 2024, investment in the Korean pallet wrap industry focused on enhancing packaging efficiency and improving consumer protection through the development of cost-effective, durable materials and advanced wrapping technologies. Manufacturers began prioritizing the production of dimensions for more affordable solutions as demands from logistics and e-commerce industries shifted.

Ensure the products are safe during transportation by focusing on durable materials and flexibility. Gen Z received increased exposure to corporate social responsibility policies and practices, especially in terms of sustainability and eco-friendly materials, which aligning with society's growing environmental concerns the rising concern of society for the environment.

Between 2025 and 2035, technological advancements and the need for sustainability will significantly change the sector. New trends, such as deploying sensors in pallet wraps for real-time tracking, are forecast to go mainstream. Simultaneously, the industry will see a surge in the use of biodegradable and recyclable materials due to the implementation of stricter environmental standards.

The goal of the initiative is to make it easier to design automated warehouse and logistics solutions. This will involve a paradigm shift that considers the growing demand for sustainable materials, automation in logistics, and enhanced load stability, further establishing Korea's pallet wrap industry as a leader in innovative packaging solutions.

| Key Drivers | Key Restraints |

|---|---|

| Increasing demand for load stability and supply chain efficiency. | High operational costs associated with advanced wrapping technologies. |

| Technological advancements, such as machine-compatible stretch films and nanotechnology-enhanced wraps, improving load containment and reducing film consumption. | Environmental concerns regarding plastic waste, leading to stricter regulations. |

| Rising e-commerce activities, boosting the need for efficient packaging solutions. | Availability of alternative packaging solutions like strapping and shrink wrapping. |

| Growth in the food and beverage industry requiring secure and hygienic packaging. | Price fluctuations in raw materials such as polyethylene affecting production costs. |

| Expanding pharmaceutical sector with strict packaging standards driving demand for high-performance pallet wraps. | Limited recycling infrastructure, making it difficult to manage plastic waste effectively. |

| Adoption of biodegradable and recyclable stretch films due to sustainability concerns. | Low awareness and reluctance to switch to eco-friendly alternatives due to cost concerns. |

| Development of smart pallet wrap solutions with RFID and barcode tracking for enhanced supply chain visibility. | Competition from regional manufacturers offering low-cost pallet wrap alternatives. |

Impact Assessment of Key Drivers

| Key Drivers | Impact Level |

|---|---|

| Increasing demand for load stability and supply chain efficiency. | High |

| Technological advancements in machine-compatible and nanotechnology-enhanced wraps. | High |

| Rising e-commerce activities boosting demand for efficient packaging. | High |

| Growth in the food and beverage industry requiring secure and hygienic packaging. | Medium |

| Expanding pharmaceutical sector with strict packaging standards. | High |

| Adoption of biodegradable and recyclable stretch films. | High |

| Development of smart pallet wrap solutions with RFID and barcode tracking. | Medium |

| Government incentives for sustainable packaging solutions. | High |

| Increasing preference for lightweight yet durable stretch films. | Medium |

| Advancements in automated pallet wrapping machines. | High |

Impact of Key Restraints

| Key Restraints | Impact Level |

|---|---|

| High operational costs of advanced wrapping technologies. | High |

| Environmental concerns and stricter plastic waste regulations. | High |

| Availability of alternative packaging solutions like strapping and shrink wrapping. | Medium |

| Price fluctuations in raw materials affecting production costs. | High |

| Limited recycling infrastructure for plastic waste management. | High |

| Low awareness and reluctance to adopt eco-friendly alternatives. | Medium |

| Competition from regional low-cost manufacturers. | High |

| Resistance to automation in small and mid-sized businesses. | Medium |

| Stringent import/export regulations affecting supply chain dynamics. | Medium |

| Limited availability of high-performance resins for stretch film manufacturing. | Medium |

Based on thickness, the Korea pallet wrap sector is segmented, each category serving a different industrial need. This makes it ideal for industries that require secure load transport, ensuring longer durability and strength, making it extensive to such industries where the utmost secure load is essential to be moved. The 15- to 30-mm option remains a favorite at the shops, and, as before, it offered the best balance between coverage and containment. It has a wide use case in logistics and warehousing.

The 31 to 45 mm segment targets niche applications requiring better puncture resistance and greater stretchability. Wraps above 54 mm provide the superior protection and are most commonly used in heavy-duty applications and high-value goods requiring the highest levels of transit protection.

Product type drives segment growth, with hard wrap rolls and machine rolls leading the way. For smaller-scale operations and flexible packaging needs, rigid wrap rolls offer a manual wrapping alternative. Conversely, machine rolls have been seeing greater adoption owing to trends in industrial packaging automation. Large-scale logistics and distribution centers prefer them because they can handle a large number of parcels efficiently and with minimal material waste.

Based on the type of film, we segment the pallet wrap landscape into two categories: blown film and cast film. Because it is made of a thicker material and requires more strength, it provides more support for irregularly shaped products. Its elasticity helps provide better support for the cargo, making it safe for transport. Visual product inspection applications quickly accept cast film due to its high clarity and excellent unwinding properties. Due to its uniform thickness and ease of handling, fully automated lines commonly use it.

Selecting the right material is essential for pallet wraps, with polyethylene being the most commonly used plastic because of its cost-effectiveness, flexibility, and recyclability. Polypropylene films offer excellent moisture and chemical resistance, making them suitable for use in industries needing making them suitable for industries needing protection against environmental factors against environmental factors.

The PVDC-based wraps are known for their high barrier properties, thus extending the shelf life of perishables. Designed for specialized applications requiring enhanced tensile strength and resistance to extreme conditions, polyamide wraps contribute to the diversification of Korea’s pallet wrap industry to the material landscape of Korea’s pallet wrap industry.

End-use industries, spanning a wide range of sectors, influence demand for pallet wraps. Pallet wraps are used in the food and beverage industry to preserve food hygiene and freshness and ensure the safe transit of sensitive goods. Pharmaceutical companies are increasingly using high-performance wraps to meet many stringent regulations and to keep their products intact.

The chemical and fertilizer industries utilize heavy-duty wrapping solutions to prevent leaks in packaging and protect against contamination during storage and shipment. Pallet wraps that balance durability and presentation are essential for personal care and cosmetics firms to ensure damage-free product delivery. Manufacturers of consumer goods require flexible and price-effective wrapping solutions to optimize storage and retail distribution.

The automotive industry uses more specialized pallet wraps to protect sensitive equipment from dust, moisture, and mechanical damage. Anti-static and high-barrier wraps are particularly important for electrical and electronics manufacturers, who use them to protect sensitive equipment and ensure product quality at every stage of the supply chain.

South Gyeongsang is an industrial and logistics hub that creates demand for a high-performance pallet wraps. The manufacturing base, which includes automotive and electronics industries, is a key to growth in the province. Demand for machine-compatible wrap solutions is being driven by exports on the rise and the implementation of automated packaging systems.

Businesses are increasing recycling rates and shifting to biodegradable and recyclable films due to sustainability programs. Growing investment in smart packaging technologies and improving supply chain efficiency will also boost demand in 2025. Major ports provide the facility for international trading, and as such, South Gyeongsang has been a key contributor to the pallet wrap sector in Korea.

The pallet wrap market in North Jeolla is primarily driven by its agricultural and food processing industriesWe anticipate a significant increase in the region's need for sanitary, moisture-barrier wrapping in 2025 to safeguard perishable goods. Additionally, logistics improvements and the expansion of cold storage facilities will enable further adoption of stretch film solutions.

In line with Korea’s sustainability initiatives and global regulatory trends, businesses will face increasing pressure to adopt eco-friendly packaging solutions. The Korean government and global regulations will continue to pressure businesses to use sustainable packaging solutions.

We expect North Jeolla to establish a stable segment due to the surge in agricultural and processed food exports. Shifting toward automation in packaging operations will increase demand for cost-effective and durable pallet wrap solutions.

South Jeolla also has a diverse industrial base, manufacturing chemicals and fertilizers as well as consumer goods. Now, its expanding logistics sector drives demand for robust, puncture-resistant pallet wraps. The segment is expected to grow in 2025 as firms adopt high-stretch, stretchable films that help secure heavy shipments within the industry.

Sustainability efforts will drive interest in recyclable and biodegradable wrap materials. The increasing use of hands-free automation of hands-free automation and smart tracking systems, in addition to an increasingly digital, data-driven supply chain reliance, will lead businesses to prefer efficient, high-performance wrap solutions.

Further fueling sector growth is South Jeolla’s access to important transportation routes, which is more likely to ensure a continued steady demand for advanced pallet wrap technologies.

The pallet wrap market in Jeju's economy is largely based on tourism, agriculture, and seafood. Moisture-proof and sanitary coverings, especially in the food and beverage industry, will continue to be a key factor in demand in 2025. The increase in exports of seafood and specialty agricultural items will lead to a growing requirement for strong and sturdy bundling.

Government initiatives to encourage sustainable materials will also facilitate the adoption of sustainable pallet wrap solutions among end users. The growing modernization of logistics infrastructure in Jeju will enable investments in automation and advanced packaging technologies, supporting the expansion. The developing pallet wrap sector on the island will be driven by the island's evolving focus on sustainability and quality assurance.

The Korea pallet wrap industry is moderately consolidated, with a shift of large-scale manufacturers as well as most small to medium players in the industry. Although a few larger players dominate the sector, especially in performance and machine-friendly wraps, smaller regional players continue to thrive, meeting the regional demand, making the segment overall very dynamic and competitive.

There are several reasons behind this moderate fragmentation:

Entry Cost: The barriers to entry are lower compared to high-tech industries, allowing pallet wrap manufacturing to have a large base with relatively simple extrusion and film processing facilities. Nevertheless, the consolidation of the premium segments is an outcome of relatively huge investments in high-tech materials such as biodegradable wraps or multi layered stretch films.

Access to Accessibility Technology: Standard pallet wrap manufacturing does not require highly complex technology and therefore can be easily accessible by many producers. However, the development of high-performance films requires specialized equipment and R&D investment. The specialized equipment and research and development efforts have been the focus of larger manufacturers investing in high-performance pallet wrap materials.

Technical Expertise: While most pallet wrap manufacturing is straightforward, technical expertise is crucial in developing specialty, high-performance, or sustainable grades. The ability of large firms to investigate R & D drives the consolidation at the industry's top end.

Regulation: The industry is also changing because of rising environmental regulation along with government-issued incentives that promote sustainable packaging solutions. Biodegradable and recyclable wraps help companies maintain tangibly competitive average costs, and smaller companies face difficulty in compliance, ultimately leading to an industry shift to established players.

Relatively Easier Access to Funding: Established key players, such as large corporations and international players, find it easier to secure funding for investments in advanced materials and automation. That has led to smaller manufacturers relying on government subsidies or regional investments, which differ by location and demand.

A few top companies, known as Tier 1 players, dominate 90% of the pallet wrap industry in Korea. This dominance comes from their large investments in research, advanced manufacturing techniques, and extensive distribution networks. Such market concentration creates high entry barriers for smaller companies, leading to an industry dominated by a few major firms.

Several companies maintained strong performance and successfully adapted to industry trends in 2024. Several key companies maintained strong market positions in 2024. At the Korea Pack 2024 exhibition in Seoul, Smart Wasp Intelligent Technology introduced the VI 'Orange' series as a key entry into the Korean market.

Reusable, recyclable, and compostable event packaging innovations at the same event showcase sustainable solutions with a commitment to reducing environmental impact. These trends show that the leading companies in innovation and sustainability are looking to cement their position in the industry.

The Korea pallet wrap companies are adopting sustainability and technology to keep their competitive edge. For instance, participating in Korea Pack 2024 reaffirmed Stelda's pursuit to produce sustainable packaging solutions that resonate with global sustainability trends. That helps not only to mitigate regulatory pressures but also with higher consumer demand for sustainable products.

New startups are also starting to make an impact, bringing efficient and sustainable solutions. Smart Wasp Intelligent Technology showcased their "Orange" series at Korea Pack 2024, demonstrating their commitment to smart manufacturing and automation. New entrants are focusing on specialized markets and sustainability to establish themselves in a competitive landscape.

The Korea pallet wrap sector in 2024 is dominated and consolidated, with both established players and startups vying for prominence and focusing on sustainability and technological innovations to address changing requirements in the industry.

| Category | Market Share (%) |

|---|---|

| Top 3 Players (Berry Global, Amcor, Sigma Plastics Group) | ~15% |

| Next 7 Leading Players (AEP Industries, Paragon Films) | ~16% |

| Top 10 Players (Combined) (Berry Global Inc.,Amcor plc, Sigma Plastics Group, AEP Industries Inc., Paragon Films Inc., Intertape Polymer Group Inc., Scientex Berhad, Coveris Holdings S.A., Anchor Packaging Inc., and Mondi Group) | 31% |

| Next 20 Companies (Combined) | 41% |

| Other Companies | 28% |

>15 mm, 15 to 30 mm, 31 to 45 mm, and >45 mm

Hard Wrap Rolls and Machine Rolls

Blown Film and Cast Film

Polyethylene, Polypropylene, PVDC, and Polyamide

Food & Beverages, Pharmaceuticals, Chemical & Fertilizers, Personal Care & Cosmetics, Consumer Goods, Automotive, and Electrical & Electronics

South Gyeongsang, North Jeolla, South Jeolla ,and Jeju

Growing e-commerce, supply chain optimization, and the requirement for safe packaging are major drivers that are fueling the demand for pallet wrap in Korea.

There are many sectors that utilize pallet wrap the most, like food & beverages, pharmaceuticals, consumer goods, and automotive industries, which depend significantly on pallet wrap.

The industry has both robust domestic producers and large international packaging firms.

The industry is being influenced by eco-friendly materials, biodegradable films, and high-tech stretch wraps.

Table 1: Korea Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Korea Industry Analysis and Outlook Volume (Tons) Forecast by Region, 2019 to 2034

Table 3: Korea Industry Analysis and Outlook Value (US$ Million) Forecast by Thickness, 2019 to 2034

Table 4: Korea Industry Analysis and Outlook Volume (Tons) Forecast by Thickness, 2019 to 2034

Table 5: Korea Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 6: Korea Industry Analysis and Outlook Volume (Tons) Forecast by Product Type, 2019 to 2034

Table 7: Korea Industry Analysis and Outlook Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 8: Korea Industry Analysis and Outlook Volume (Tons) Forecast by Material Type, 2019 to 2034

Table 9: Korea Industry Analysis and Outlook Value (US$ Million) Forecast by Film Type, 2019 to 2034

Table 10: Korea Industry Analysis and Outlook Volume (Tons) Forecast by Film Type, 2019 to 2034

Table 11: Korea Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 12: Korea Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2019 to 2034

Table 13: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Thickness, 2019 to 2034

Table 14: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Forecast by Thickness, 2019 to 2034

Table 15: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 16: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Forecast by Product Type, 2019 to 2034

Table 17: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 18: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Forecast by Material Type, 2019 to 2034

Table 19: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Film Type, 2019 to 2034

Table 20: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Forecast by Film Type, 2019 to 2034

Table 21: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 22: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2019 to 2034

Table 23: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Thickness, 2019 to 2034

Table 24: North Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Thickness, 2019 to 2034

Table 25: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 26: North Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Product Type, 2019 to 2034

Table 27: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 28: North Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Material Type, 2019 to 2034

Table 29: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Film Type, 2019 to 2034

Table 30: North Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Film Type, 2019 to 2034

Table 31: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 32: North Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2019 to 2034

Table 33: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Thickness, 2019 to 2034

Table 34: South Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Thickness, 2019 to 2034

Table 35: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 36: South Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Product Type, 2019 to 2034

Table 37: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 38: South Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Material Type, 2019 to 2034

Table 39: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Film Type, 2019 to 2034

Table 40: South Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Film Type, 2019 to 2034

Table 41: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 42: South Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2019 to 2034

Table 43: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Thickness, 2019 to 2034

Table 44: Jeju Industry Analysis and Outlook Volume (Tons) Forecast by Thickness, 2019 to 2034

Table 45: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 46: Jeju Industry Analysis and Outlook Volume (Tons) Forecast by Product Type, 2019 to 2034

Table 47: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 48: Jeju Industry Analysis and Outlook Volume (Tons) Forecast by Material Type, 2019 to 2034

Table 49: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Film Type, 2019 to 2034

Table 50: Jeju Industry Analysis and Outlook Volume (Tons) Forecast by Film Type, 2019 to 2034

Table 51: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 52: Jeju Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2019 to 2034

Table 53: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Forecast by Thickness, 2019 to 2034

Table 54: Rest of Korea Industry Analysis and Outlook Volume (Tons) Forecast by Thickness, 2019 to 2034

Table 55: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 56: Rest of Korea Industry Analysis and Outlook Volume (Tons) Forecast by Product Type, 2019 to 2034

Table 57: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 58: Rest of Korea Industry Analysis and Outlook Volume (Tons) Forecast by Material Type, 2019 to 2034

Table 59: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Forecast by Film Type, 2019 to 2034

Table 60: Rest of Korea Industry Analysis and Outlook Volume (Tons) Forecast by Film Type, 2019 to 2034

Table 61: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 62: Rest of Korea Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2019 to 2034

Figure 1: Korea Industry Analysis and Outlook Value (US$ Million) by Thickness, 2024 to 2034

Figure 2: Korea Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 3: Korea Industry Analysis and Outlook Value (US$ Million) by Material Type, 2024 to 2034

Figure 4: Korea Industry Analysis and Outlook Value (US$ Million) by Film Type, 2024 to 2034

Figure 5: Korea Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 6: Korea Industry Analysis and Outlook Value (US$ Million) by Region, 2024 to 2034

Figure 7: Korea Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 8: Korea Industry Analysis and Outlook Volume (Tons) Analysis by Region, 2019 to 2034

Figure 9: Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 10: Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 11: Korea Industry Analysis and Outlook Value (US$ Million) Analysis by Thickness, 2019 to 2034

Figure 12: Korea Industry Analysis and Outlook Volume (Tons) Analysis by Thickness, 2019 to 2034

Figure 13: Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by Thickness, 2024 to 2034

Figure 14: Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Thickness, 2024 to 2034

Figure 15: Korea Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 16: Korea Industry Analysis and Outlook Volume (Tons) Analysis by Product Type, 2019 to 2034

Figure 17: Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 18: Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 19: Korea Industry Analysis and Outlook Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 20: Korea Industry Analysis and Outlook Volume (Tons) Analysis by Material Type, 2019 to 2034

Figure 21: Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 22: Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 23: Korea Industry Analysis and Outlook Value (US$ Million) Analysis by Film Type, 2019 to 2034

Figure 24: Korea Industry Analysis and Outlook Volume (Tons) Analysis by Film Type, 2019 to 2034

Figure 25: Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by Film Type, 2024 to 2034

Figure 26: Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Film Type, 2024 to 2034

Figure 27: Korea Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 28: Korea Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 29: Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 30: Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 31: Korea Industry Analysis and Outlook Attractiveness by Thickness, 2024 to 2034

Figure 32: Korea Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 33: Korea Industry Analysis and Outlook Attractiveness by Material Type, 2024 to 2034

Figure 34: Korea Industry Analysis and Outlook Attractiveness by Film Type, 2024 to 2034

Figure 35: Korea Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 36: Korea Industry Analysis and Outlook Attractiveness by Region, 2024 to 2034

Figure 37: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Thickness, 2024 to 2034

Figure 38: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 39: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Material Type, 2024 to 2034

Figure 40: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Film Type, 2024 to 2034

Figure 41: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 42: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Thickness, 2019 to 2034

Figure 43: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Analysis by Thickness, 2019 to 2034

Figure 44: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Thickness, 2024 to 2034

Figure 45: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Thickness, 2024 to 2034

Figure 46: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 47: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Analysis by Product Type, 2019 to 2034

Figure 48: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 49: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 50: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 51: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Analysis by Material Type, 2019 to 2034

Figure 52: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 53: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 54: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Film Type, 2019 to 2034

Figure 55: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Analysis by Film Type, 2019 to 2034

Figure 56: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Film Type, 2024 to 2034

Figure 57: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Film Type, 2024 to 2034

Figure 58: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 59: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 60: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 61: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 62: South Gyeongsang Industry Analysis and Outlook Attractiveness by Thickness, 2024 to 2034

Figure 63: South Gyeongsang Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 64: South Gyeongsang Industry Analysis and Outlook Attractiveness by Material Type, 2024 to 2034

Figure 65: South Gyeongsang Industry Analysis and Outlook Attractiveness by Film Type, 2024 to 2034

Figure 66: South Gyeongsang Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 67: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Thickness, 2024 to 2034

Figure 68: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 69: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Material Type, 2024 to 2034

Figure 70: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Film Type, 2024 to 2034

Figure 71: North Jeolla Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 72: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Thickness, 2019 to 2034

Figure 73: North Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Thickness, 2019 to 2034

Figure 74: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Thickness, 2024 to 2034

Figure 75: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Thickness, 2024 to 2034

Figure 76: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 77: North Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Product Type, 2019 to 2034

Figure 78: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 79: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 80: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 81: North Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Material Type, 2019 to 2034

Figure 82: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 83: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 84: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Film Type, 2019 to 2034

Figure 85: North Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Film Type, 2019 to 2034

Figure 86: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Film Type, 2024 to 2034

Figure 87: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Film Type, 2024 to 2034

Figure 88: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 89: North Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 90: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 91: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 92: North Jeolla Industry Analysis and Outlook Attractiveness by Thickness, 2024 to 2034

Figure 93: North Jeolla Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 94: North Jeolla Industry Analysis and Outlook Attractiveness by Material Type, 2024 to 2034

Figure 95: North Jeolla Industry Analysis and Outlook Attractiveness by Film Type, 2024 to 2034

Figure 96: North Jeolla Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 97: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Thickness, 2024 to 2034

Figure 98: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 99: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Material Type, 2024 to 2034

Figure 100: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Film Type, 2024 to 2034

Figure 101: South Jeolla Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 102: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Thickness, 2019 to 2034

Figure 103: South Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Thickness, 2019 to 2034

Figure 104: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Thickness, 2024 to 2034

Figure 105: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Thickness, 2024 to 2034

Figure 106: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 107: South Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Product Type, 2019 to 2034

Figure 108: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 109: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 110: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 111: South Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Material Type, 2019 to 2034

Figure 112: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 113: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 114: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Film Type, 2019 to 2034

Figure 115: South Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Film Type, 2019 to 2034

Figure 116: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Film Type, 2024 to 2034

Figure 117: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Film Type, 2024 to 2034

Figure 118: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 119: South Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 120: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 121: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 122: South Jeolla Industry Analysis and Outlook Attractiveness by Thickness, 2024 to 2034

Figure 123: South Jeolla Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 124: South Jeolla Industry Analysis and Outlook Attractiveness by Material Type, 2024 to 2034

Figure 125: South Jeolla Industry Analysis and Outlook Attractiveness by Film Type, 2024 to 2034

Figure 126: South Jeolla Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 127: Jeju Industry Analysis and Outlook Value (US$ Million) by Thickness, 2024 to 2034

Figure 128: Jeju Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 129: Jeju Industry Analysis and Outlook Value (US$ Million) by Material Type, 2024 to 2034

Figure 130: Jeju Industry Analysis and Outlook Value (US$ Million) by Film Type, 2024 to 2034

Figure 131: Jeju Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 132: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Thickness, 2019 to 2034

Figure 133: Jeju Industry Analysis and Outlook Volume (Tons) Analysis by Thickness, 2019 to 2034

Figure 134: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Thickness, 2024 to 2034

Figure 135: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Thickness, 2024 to 2034

Figure 136: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 137: Jeju Industry Analysis and Outlook Volume (Tons) Analysis by Product Type, 2019 to 2034

Figure 138: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 139: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 140: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 141: Jeju Industry Analysis and Outlook Volume (Tons) Analysis by Material Type, 2019 to 2034

Figure 142: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 143: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 144: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Film Type, 2019 to 2034

Figure 145: Jeju Industry Analysis and Outlook Volume (Tons) Analysis by Film Type, 2019 to 2034

Figure 146: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Film Type, 2024 to 2034

Figure 147: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Film Type, 2024 to 2034

Figure 148: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 149: Jeju Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 150: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 151: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 152: Jeju Industry Analysis and Outlook Attractiveness by Thickness, 2024 to 2034

Figure 153: Jeju Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 154: Jeju Industry Analysis and Outlook Attractiveness by Material Type, 2024 to 2034

Figure 155: Jeju Industry Analysis and Outlook Attractiveness by Film Type, 2024 to 2034

Figure 156: Jeju Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 157: Rest of Korea Industry Analysis and Outlook Value (US$ Million) by Thickness, 2024 to 2034

Figure 158: Rest of Korea Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 159: Rest of Korea Industry Analysis and Outlook Value (US$ Million) by Material Type, 2024 to 2034

Figure 160: Rest of Korea Industry Analysis and Outlook Value (US$ Million) by Film Type, 2024 to 2034

Figure 161: Rest of Korea Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 162: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Analysis by Thickness, 2019 to 2034

Figure 163: Rest of Korea Industry Analysis and Outlook Volume (Tons) Analysis by Thickness, 2019 to 2034

Figure 164: Rest of Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by Thickness, 2024 to 2034

Figure 165: Rest of Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Thickness, 2024 to 2034

Figure 166: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 167: Rest of Korea Industry Analysis and Outlook Volume (Tons) Analysis by Product Type, 2019 to 2034

Figure 168: Rest of Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 169: Rest of Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 170: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 171: Rest of Korea Industry Analysis and Outlook Volume (Tons) Analysis by Material Type, 2019 to 2034

Figure 172: Rest of Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 173: Rest of Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 174: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Analysis by Film Type, 2019 to 2034

Figure 175: Rest of Korea Industry Analysis and Outlook Volume (Tons) Analysis by Film Type, 2019 to 2034

Figure 176: Rest of Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by Film Type, 2024 to 2034

Figure 177: Rest of Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Film Type, 2024 to 2034

Figure 178: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 179: Rest of Korea Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 180: Rest of Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 181: Rest of Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 182: Rest of Korea Industry Analysis and Outlook Attractiveness by Thickness, 2024 to 2034

Figure 183: Rest of Korea Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 184: Rest of Korea Industry Analysis and Outlook Attractiveness by Material Type, 2024 to 2034

Figure 185: Rest of Korea Industry Analysis and Outlook Attractiveness by Film Type, 2024 to 2034

Figure 186: Rest of Korea Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Korea Automotive Performance Tuning and Engine Remapping Service Industry Size and Share Forecast Outlook 2025 to 2035

Korea Smart Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Korea Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Korea Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Korea Isomalt Industry – Market Trends & Industry Growth 2025 to 2035

Korea Probiotic Supplement Industry – Industry Insights & Demand 2025 to 2035

Korea Calcium Supplement Market is segmented by form,end-use, application and province through 2025 to 2035.

The Korea Non-Dairy Creamer Market in Korea is segmented by form, nature, flavor, type, base, end-use, packaging, distribution channel, and province through 2025 to 2035.

Korea Women’s Intimate Care Market Analysis - Size, Share & Trends 2025 to 2035

Korea Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Korea Visitor Management System Market Growth – Trends & Forecast 2025 to 2035

Korea fiber optic gyroscope market Growth – Trends & Forecast 2025 to 2035

Korea Event Management Software Market Insights – Demand & Growth Forecast 2025 to 2035

Korea Submarine Cable Market Insights – Demand & Forecast 2025 to 2035

Last-mile Delivery Software Market in Korea – Trends & Forecast through 2035

Korea HVDC Transmission System Market Trends & Forecast 2025 to 2035

Korea Base Station Antenna Market Growth – Trends & Forecast 2025 to 2035

Smart Space Market Analysis in Korea-Demand & Growth 2025 to 2035

Korea Banking-as-a-Service (BaaS) Platform Market Growth – Trends & Forecast 2025 to 2035

Korea I2C Bus Market Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA