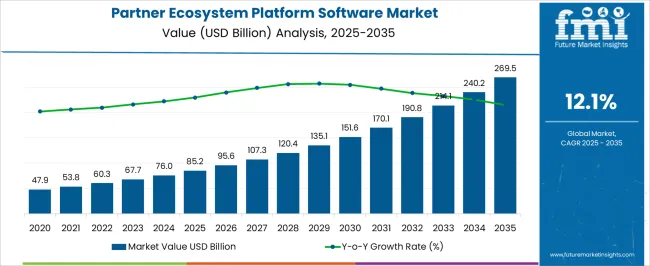

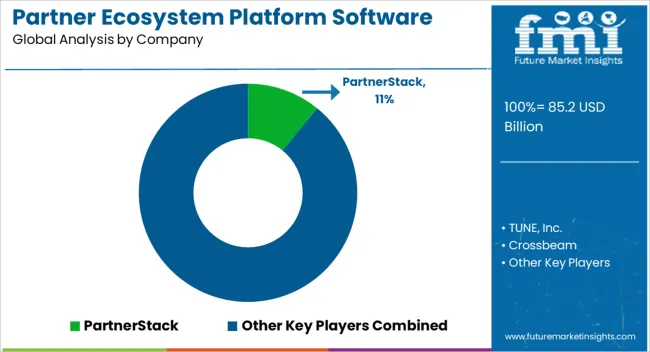

The Partner Ecosystem Platform Software Market is estimated to be valued at USD 85.2 billion in 2025 and is projected to reach USD 269.5 billion by 2035, registering a compound annual growth rate (CAGR) of 12.1% over the forecast period.

| Metric | Value |

|---|---|

| Partner Ecosystem Platform Software Market Estimated Value in (2025 E) | USD 85.2 billion |

| Partner Ecosystem Platform Software Market Forecast Value in (2035 F) | USD 269.5 billion |

| Forecast CAGR (2025 to 2035) | 12.1% |

The partner ecosystem platform software market is progressing at a rapid pace, supported by enterprises’ increasing need to streamline partner management, accelerate joint sales opportunities, and enhance data-driven decision-making. Industry briefings and technology publications have underlined how organizations are leveraging these platforms to unify fragmented partner operations and gain visibility into ecosystem-driven revenue.

Cloud technology has played a pivotal role in enabling scalability, integration with CRM and ERP systems, and delivering real-time collaboration tools. Additionally, growing complexity in partner networks across industries such as software, telecom, and professional services has amplified the demand for platforms that automate workflows, improve account intelligence, and reduce channel conflicts.

Investor calls from technology companies have emphasized strong momentum in cloud-based deployments and feature sets that deliver measurable ROI in revenue co-creation. Looking ahead, the market is expected to be driven by continuous innovation in AI-powered partner analytics, predictive account mapping, and ecosystem orchestration tools, ensuring wider adoption across global enterprises.

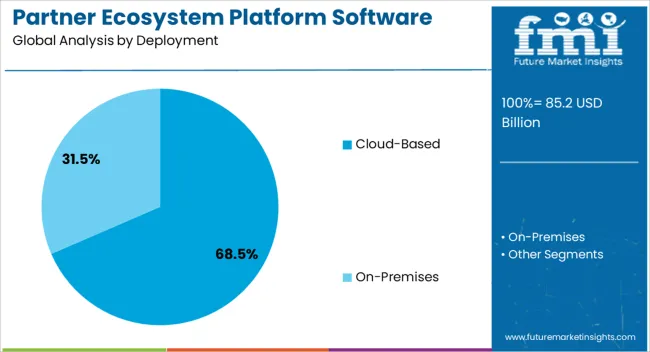

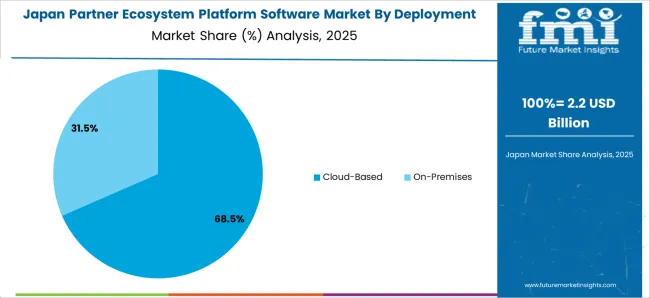

The Cloud-Based segment is projected to capture 68.5% of the partner ecosystem platform software market revenue in 2025, maintaining its leadership due to flexibility, integration ease, and cost-effectiveness. Organizations have increasingly opted for cloud deployment models to enable seamless collaboration across geographically dispersed partner networks.

The scalability of cloud platforms has allowed enterprises to onboard new partners rapidly while minimizing upfront infrastructure costs. Technology updates from software providers have emphasized robust security protocols and compliance certifications, further strengthening trust in cloud adoption.

Moreover, cloud-based deployments have facilitated real-time data sharing, performance tracking, and partner enablement, which are essential for ecosystem-driven growth strategies. As enterprises continue to accelerate digital transformation initiatives, the Cloud-Based segment is expected to remain dominant, supported by its ability to deliver agility, interoperability, and continuous feature enhancements.

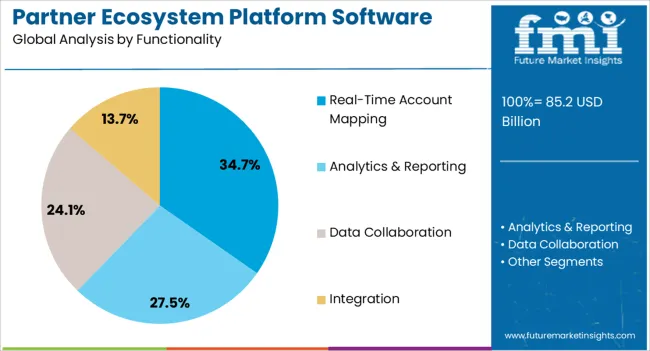

The Real-Time Account Mapping segment is projected to account for 34.7% of the partner ecosystem platform software market revenue in 2025, leading functionality preferences due to its role in improving sales alignment and partner collaboration. This feature enables organizations to identify overlapping opportunities, uncover whitespace accounts, and reduce redundancy in partner outreach.

Business technology forums and company disclosures have highlighted how real-time account mapping has helped enterprises achieve faster deal cycles and higher conversion rates by ensuring coordinated go-to-market strategies. The increasing demand for data transparency and actionable partner insights has reinforced adoption, particularly among enterprises managing complex multi-partner engagements.

Integration of AI and advanced analytics has further enhanced account mapping accuracy, enabling proactive identification of new revenue opportunities. With growing emphasis on ecosystem-led sales models and account intelligence, the Real-Time Account Mapping segment is expected to maintain its importance as a core driver of functionality adoption within partner ecosystem platforms.

| Historical CAGR (2020 to 2025) | 9.3% |

|---|---|

| Forecast CAGR (2025 to 2035) | 12.2% |

The partner ecosystem platform software market has demonstrated a commendable historical growth with a CAGR of 9.3% from 2020 to 2025. The promising expansion reflects the boom in recognition of the pivotal role these platforms play in fostering collaboration and propelling efficiency across various industries.

The forecasted CAGR of 12.2% from 2025 to 2035 suggests an even more accelerated pace of evolution. The projection underscores the burgeoning demand for innovative solutions that prioritize consumer-centric approaches, positioning the industry to profoundly impact not only the construction sector but also a broader array of industries worldwide.

The anticipated surge in growth signals a fundamental shift towards more interconnected and streamlined ecosystems, where businesses prioritize partnerships and seamless integration. As companies seek to navigate the ascendence of complex operational landscapes and adapt to evolving consumer preferences,

The forecasted trajectory underscores the imperative for organizations to invest in adaptable, scalable solutions that facilitate collaboration and propel sustained competitive advantage in an ever-changing market landscape.

The below section shows the leading segment. Based on the deployment, the cloud-based segment is accounted to hold a market share of 68.7% in 2025. Based on functionality, the analytics & reporting segment is accounted to hold a market share of 34.6% in 2025.

| Category | Market Share in 2025 |

|---|---|

| Cloud-based | 68.7% |

| Analytics and Reporting | 34.6% |

Based on the deployment, the cloud-based segment is accounted to hold a market share of 68.7% in 2025.

The segment underscores the rapid adoption of cloud computing solutions in the industry. Cloud-based deployment offers unparalleled scalability, flexibility, and cost-effectiveness compared to traditional on-premises solutions.

Organizations are majorly drawn to cloud-based platforms for their ability to rapidly deploy and scale infrastructure, as well as their support for remote collaboration and access.

The substantial market share of the segment reflects a broader trend toward digital transformation and the migration of critical business functions to the cloud.

Based on functionality, the analytics and reporting segment is accounted to hold a market share of 34.6% in 2025.

The segment reflects the growing importance of data-driven decision-making within modern enterprises. Analytics and reporting functionalities empower organizations to derive actionable insights from vast amounts of data generated within partner ecosystems.

By leveraging advanced analytics tools, businesses can gain deeper visibility into their operations, identify emerging trends, and optimize performance. The segmental prominence underscores the important role of analytics in augmenting strategic decision-making, enhancing operational efficiency, and maintaining competitive advantage in the dynamic business landscape.

The table describes the top five countries ranked by revenue, with Australia holding the top position. Australia dominates the partner ecosystem platform software industry by leveraging platforms across diverse sectors like mining, finance, and healthcare.

With a focus on collaboration, operational efficiency, and innovation, the firms in Australia propel supply chain resilience and regulatory compliance, creating value in an interconnected global landscape.

The industry is led significantly by sales of partner ecosystem platform software industry in Australia, China, and Japan. Asia Pacific region, thus, emerges as a key industry at a global level.

Forecast CAGRs from 2025 to 2035

| Countries | CAGR |

|---|---|

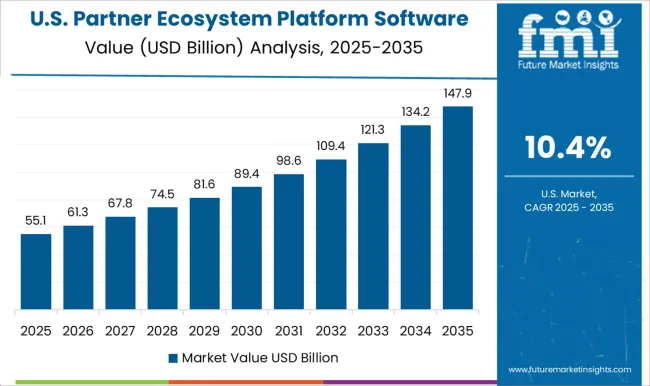

| The United States | 6.3% |

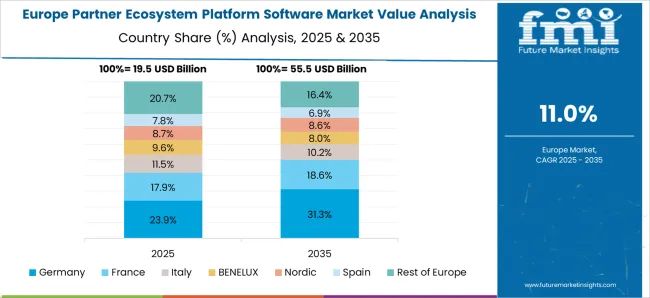

| Germany | 7.7% |

| Japan | 8% |

| China | 12.7% |

| Australia | 15.7% |

In the United States, the partner ecosystem platform software industry finds extensive application across various industries, particularly in sectors such as technology, finance, healthcare, and manufacturing.

In this highly competitive industry, organizations leverage ecosystem platforms to streamline partner collaborations, enhance supply chain visibility, and augment innovation.

With a focus on customer-centricity and digital transformation, United States companies utilize these platforms to deliver personalized experiences, optimize operational efficiency, and gain a competitive edge in the industry.

In Germany, known for its robust industrial base and emphasis on precision engineering, partner ecosystem platform software plays an important role in facilitating collaboration among diverse stakeholders within the manufacturing sector.

The companies of Germany leverage ecosystem platforms to integrate suppliers, streamline production processes, and accelerate time-to-market for new products.

In the context of Industry 4.0 initiatives, these platforms enable the seamless integration of data from sensors and IoT devices, driving real-time insights and predictive maintenance capabilities.

In Japan, renowned for its technological prowess and commitment to innovation, the partner ecosystem platform software sector is utilized across a wide range of industries, including automotive, electronics, and retail.

The companies leverage ecosystem platforms to foster closer partnerships with suppliers, distributors, and customers, propelling agility, responsiveness, and customer satisfaction.

With a focus on kaizen and lean principles, Japanese organizations use these platforms to optimize value chains, minimize waste, and enhance overall operational excellence.

In China, experiencing rapid economic growth and digital transformation, partner ecosystem platform software is widely adopted by companies seeking to capitalize on the burgeoning industrial opportunities of the company.

The firms utilize ecosystem platforms to build robust partner networks, expand industrial reach, and drive cross-border collaborations.

With a focus on innovation and scalability, the companies leverage these platforms to fuel business expansion, adapt to changing industrial dynamics, and compete effectively in both domestic and global ecosystems.

In Australia, known for its dynamic business environment and emphasis on innovation, the partner ecosystem platform software sector is utilized across diverse sectors such as mining, agriculture, finance, and healthcare.

The companies leverage ecosystem platforms to enhance collaboration with partners, suppliers, and customers, driving operational efficiency, supply chain resilience, and regulatory compliance.

With a focus on sustainability and digital transformation, organizations use these platforms to propel innovation, optimize resource utilization, and create value for stakeholders in a widely interconnected world.

The partner ecosystem platform software industry is fiercely competitive, driven by established players like Microsoft, Salesforce, Oracle, and SAP. These giants leverage expansive resources and robust product suites to maintain dominance.

Niche players and startups offering specialized solutions challenge incumbents with innovative offerings. Technological innovation, including AI and analytics integration, is paramount for differentiation.

Success hinges on robust partnership ecosystems, seamless integration capabilities, and a customer-centric approach. Regulatory compliance also shapes competition, particularly in highly regulated sectors.

To thrive, companies must continually innovate, prioritize customer needs, and adapt to evolving market dynamics. Some of the key developments are

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 75.97 billion |

| Projected Market Valuation in 2035 | USD 240.2 billion |

| Value-based CAGR 2025 to 2035 | 12.2% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered |

North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East and Africa |

| Key Market Segments Covered |

Deployment, Functionality, Region |

| Key Countries Profiled |

The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled |

PartnerStack; Partnered; Tune; Crossbeam; HubSpot; Impact; Mirakl; Partnerize; Alliance board; Apideck |

The market is classified into Cloud-based and On-premises.

The report consists of key domains, such as Real-time Account Mapping, Analytics & Reporting, Data Collaboration, and Integration

Analysis of the market has been carried out in key countries of North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East and Africa.

The global partner ecosystem platform software market is estimated to be valued at USD 85.2 billion in 2025.

The market size for the partner ecosystem platform software market is projected to reach USD 269.5 billion by 2035.

The partner ecosystem platform software market is expected to grow at a 12.1% CAGR between 2025 and 2035.

The key product types in partner ecosystem platform software market are cloud-based and on-premises.

In terms of functionality, real-time account mapping segment to command 34.7% share in the partner ecosystem platform software market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Partner Relationship Management (PRM) Market Analysis by Type, Deployment Mode, Enterprise Size, Industry, and Region Through 2035

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network SD-WAN Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Radio (SDR) Market Size and Share Forecast Outlook 2025 to 2035

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Networking SDN Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Anything (SDx) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Data Center Market Size and Share Forecast Outlook 2025 to 2035

Software Containers Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Application And Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Camera (SDC) Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Software Distribution Industry

Software Distribution Market Analysis by Deployment Type, by Organization Size and by Industry Vertical Through 2035

Software-Defined WAN Market - Growth & Forecast through 2034

Software Defined Video Networking Market

UK Software Distribution Market Analysis – Size & Industry Trends 2025-2035

VPN Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA