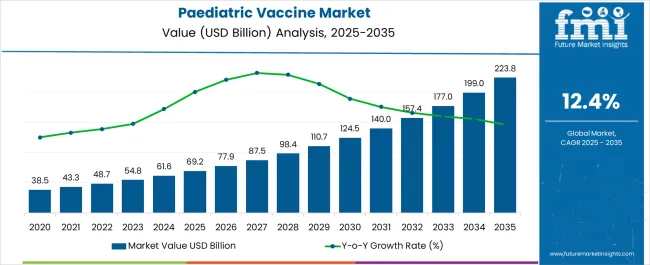

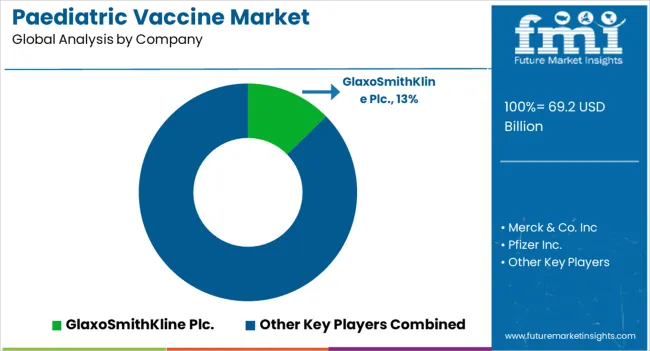

The Paediatric Vaccine Market is estimated to be valued at USD 69.2 billion in 2025 and is projected to reach USD 223.8 billion by 2035, registering a compound annual growth rate (CAGR) of 12.4% over the forecast period.

| Metric | Value |

|---|---|

| Paediatric Vaccine Market Estimated Value in (2025 E) | USD 69.2 billion |

| Paediatric Vaccine Market Forecast Value in (2035 F) | USD 223.8 billion |

| Forecast CAGR (2025 to 2035) | 12.4% |

The paediatric vaccine market is experiencing steady expansion, supported by national immunization programs, rising awareness of preventive healthcare, and advancements in vaccine technology. Global health agencies and government reports have emphasized the importance of early childhood immunization to control infectious diseases and reduce mortality rates. Substantial investments by pharmaceutical companies in paediatric vaccine R&D, coupled with partnerships between public health organizations and private sector entities, have strengthened vaccine accessibility worldwide.

Advancements in vaccine delivery systems, cold chain infrastructure, and regulatory approvals have further improved adoption. Moreover, population growth in emerging economies and expanding government funding for immunization drives have accelerated vaccine uptake.

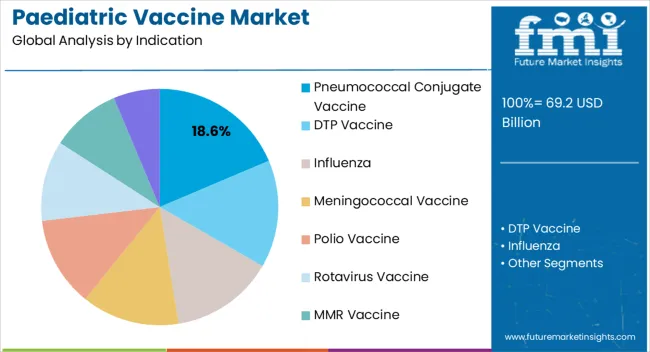

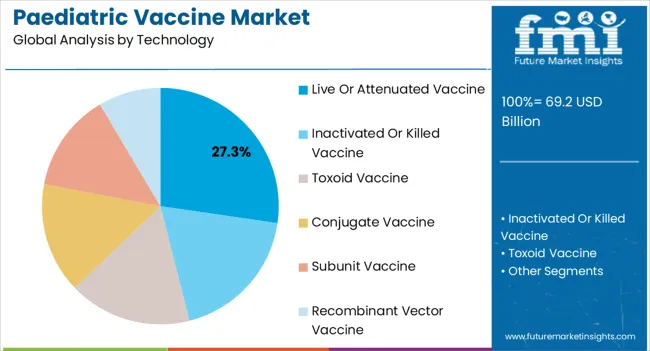

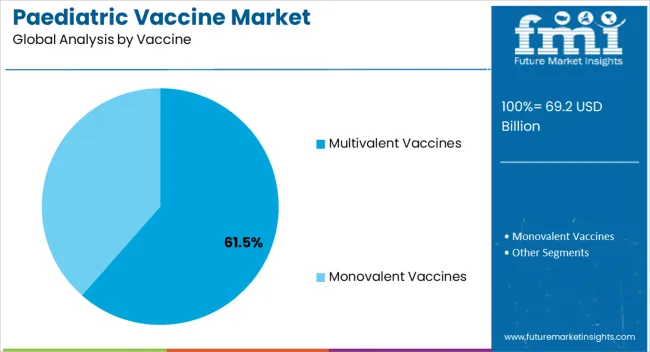

Looking ahead, technological progress in multivalent formulations, improved safety profiles, and broader disease coverage are expected to shape the next phase of market growth. The market’s segmental leadership is anticipated to remain concentrated in pneumococcal conjugate vaccines by indication, live or attenuated vaccines by technology, and multivalent vaccines by product category, reflecting their efficacy, established clinical acceptance, and cost-effectiveness in paediatric care.

The pneumococcal conjugate vaccine segment is projected to account for 18.60% of the paediatric vaccine market revenue in 2025, maintaining its relevance as a key immunization category. Growth in this segment has been supported by the high global incidence of pneumococcal infections, which are a leading cause of morbidity and mortality in children under five.

Clinical studies and health organization data have highlighted the role of pneumococcal vaccines in preventing severe illnesses such as pneumonia, meningitis, and bacteremia. Governments and global health agencies have prioritized pneumococcal vaccination in routine immunization schedules, providing widespread public sector support.

Additionally, funding from international alliances and non-governmental organizations has improved accessibility in low- and middle-income countries. With proven efficacy in reducing disease burden and strong backing from global immunization initiatives, the pneumococcal conjugate vaccine segment is expected to sustain its share in the paediatric vaccine market.

The live or attenuated vaccine segment is projected to contribute 27.30% of the paediatric vaccine market revenue in 2025, holding a leading share due to its long-standing clinical effectiveness. This segment’s strength has been based on the ability of live attenuated vaccines to induce strong, durable immune responses that often require fewer doses.

Paediatric immunization programs have favored these vaccines for their proven record in controlling diseases such as measles, mumps, and rubella. Research publications have documented the role of live attenuated vaccines in achieving herd immunity within child populations, further justifying their widespread use.

Advances in vaccine formulation and safety monitoring have enhanced their acceptance among healthcare providers and parents alike. As emerging infectious threats continue to highlight the importance of robust paediatric immunization, live or attenuated vaccines are expected to remain a critical part of global vaccination strategies, ensuring sustained demand for this technology segment.

The multivalent vaccines segment is projected to hold 61.50% of the paediatric vaccine market revenue in 2025, securing its dominance within the product category. Growth of this segment has been driven by the clinical and operational benefits of combining protection against multiple pathogens into a single shot.

Healthcare systems have prioritized multivalent vaccines for their efficiency in reducing the number of injections required, thereby improving compliance among children and acceptance among parents. Public health authorities have integrated multivalent vaccines into immunization programs to optimize coverage while minimizing resource utilization.

Moreover, pharmaceutical manufacturers have invested heavily in developing advanced multivalent formulations, which provide broader disease coverage and better safety profiles. These vaccines also contribute to cost savings in storage, distribution, and administration. With ongoing innovations in combination vaccine platforms and increasing demand for simplified immunization schedules, the multivalent vaccines segment is expected to retain its leading position in the paediatric vaccine market.

The paediatric vaccine market grew at a rate of 9.7% during the historical period from 2020 to 2025. Increasing awareness about vaccines, the development of vaccines for children, the rising rate of approval for vaccines, and other factors are all suggested to contribute to the market's rapid growth.

Diseases that attack weakened immune systems, such as Rubella, Hepatitis A, and Hepatitis B, continue to pose threats to children. The demand for paediatric vaccines will continue unabated over the forecast period due to the prevalence of these diseases.

| Historical CAGR | 9.7% |

|---|---|

| Forecast CAGR | 13.1% |

The arrival of the pandemic resulted in a growing demand for paediatric vaccines, which greatly boosted the market. The paediatric vaccine market expanded to USD 48,816.7 million in 2025.

The pandemic also had a negative impact on the paediatric market. While the Covid-19 vaccine helped the market, other paediatric vaccines experienced lower demand. The Covid-19 vaccines were also not suitable for children in the initial stages, losing out on a huge section of the market. However, the pandemic reinforced the need for proper preventative care in the minds of the people.

The paediatric vaccine market is expected to grow at a robust rate of 13.1% CAGR over the forecast period. By 2035, the market is predicted to reach USD 184,706.7 million.

Innovations with the help of technology are predicted to drive the market for paediatric vaccines. Gene vaccines are developed with the help of new technology, infusing DNA and RNA to combat diseases. Gene vaccines have found acceptance during the historical period, and their growth is expected to continue over the forecast period.

The rollout of vaccines for COVID-19 during the historical period initially excluded children from the list of beneficiaries. However, vaccines are being tested and approved for use on children, and thus the paediatric market is able to target a big section of the population.

While monovalent vaccines continue to enjoy a major share of the market, there has been a growing demand for bivalent or combination vaccines. Combination vaccines combine the effects of two vaccines in one go and are thus recognized to save people’s time. As the number of vaccines grows, combination vaccines are also expected to increase in popularity due to their multi-effectiveness.

The paediatric vaccine market can be divided into the following segments: indication, technology, vaccine type, and end users. Shedding light on these segments is useful in determining the nature of the products and users of the vaccines. These insights also shed light on the preferences of users and manufacturers in the paediatric vaccine market.

The pneumococcal vaccine is the most represented of the vaccines by indication. It enjoyed a 32.5% share in the global market in 2025, up from 31.9% in 2024.

The pneumococcal vaccine is recommended to be given to children by no less an authority than the World Health Organization (WHO). The use of pneumococcal vaccine can help prevent cases of pneumonia, meningitis, and sepsis. Thus, the pneumococcal vaccine is in high demand.

The pneumococcal vaccine is expected to grow rapidly over the forecast period. As efforts are being expanded toward shielding children from harmful diseases, the value and demand of pneumococcal vaccines are experiencing an upward trajectory.

| Attributes | Details |

|---|---|

| Top Indication | Pneumococcal Vaccine |

| Market Share in 2025 | 32.5% |

Conjugate vaccines make up the highest market share in terms of technology in the paediatric vaccines market. In 2025, they made up 32.8% of the market share, up from 32% in 2024.

Paediatric vaccine producers rely on conjugate vaccines. They have a track record of being effective, like the Hib conjugate vaccine, which has fought meningitis convincingly. Another example is the typhoid conjugate vaccine, which has proven to reduce the risk of typhoid fever and is WHO-recommended. Conjugate vaccines are thus expected to grow rapidly over the forecast period.

| Attributes | Details |

|---|---|

| Top Technology | Conjugate Vaccines |

| Market Share in 2025 | 32.8% |

Monovalent vaccines are more popular than multivalent vaccines. They held a share of 73.6% of the market in 2025.

Monovalent vaccines have historically been the most produced of all vaccines. Their growth is expected to continue over the forecast period. Monovalent vaccine shielding against mumps, rubella, and COVID-19 is predicted to be higher in demand over the projected period. However, multivalent vaccines are also rising. Quadrivalent vaccines are used against the threat of influenza, while new bivalent vaccines have been approved to combat COVID-19.

| Attributes | Details |

|---|---|

| Top Type | Monovalent Vaccine |

| Market Share in 2025 | 73.6% |

Institutional health centres are the most common end-use sector for paediatric vaccines. They enjoyed a significant share of the market in 2025, taking up 72.9% of the share, up from 72.3% in 2024.

Institutional health centres have qualified staff for the administration of paediatric vaccines and are trusted institutions. They also have the support of the government.

| Attributes | Details |

|---|---|

| Top End-use Sector | Institutional health centers |

| Market Share in 2025 | 72.9% |

In the paediatric vaccine market, North America and Europe continue to lead the market share. In 2025, North America held 24.3% of the market share, while Europe held sway over 26.1%.

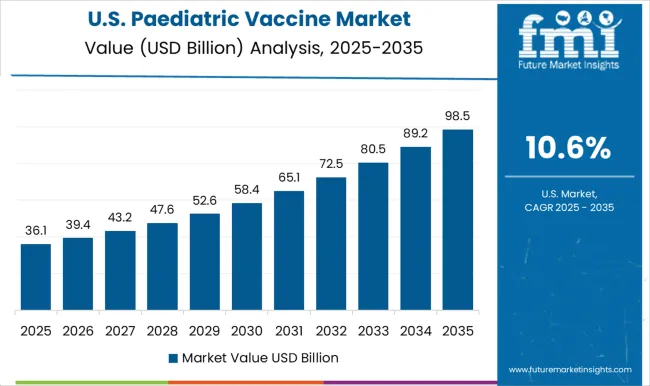

The USA is the leading market in North America. It is poised to continue its positive upward trajectory over the forecast period. In Europe, meanwhile, the United Kingdom market is expected to grow at a rapid rate.

Some of the highest growth rates are predicted for the Asia-Pacific. The Chinese and Indian paediatric vaccine markets are expected to boom during the forecast period. The high population in these countries is a significant factor contributing to the rising demand for vaccines.

| Countries | Market Share in 2025 |

|---|---|

| United States | 17.9% |

| China | 19.6% |

| India | 19.2% |

| United Kingdom | 16.1% |

| Australia | 9.4% |

The United States continues to hold the largest market share in the North American market. In the overall paediatric vaccines market, the United States held a market share of 17.9% in 2025.

Healthcare facilities have improved drastically, thus providing better avenues for the distribution of paediatric vaccines. There has also been a growing consciousness among the people of the importance of vaccinations. People are aware of the risks posed to children due to various diseases and are thus willing to resort to vaccines to ward them off. There has also been an increased investment in research and development, which is aiding the cause of paediatric vaccines in the United States.

China experienced the effects of Covid-19 severely. Thus, there is a high volume of paediatric patients. In these circumstances, there is a growing demand for paediatric vaccines. In addition to Covid-19, threats of meningitis, diphtheria, pertussis, and tetanus are also present. This is leading to the rising demand for vaccines like the meningococcal vaccine and the DTaP vaccine.

China’s paediatric vaccine market is expected to soar during the forecast period. It held a 19.6% share of the global market in 2025.

There is also a high volume of paediatric patients in India. As the population is booming, the number of people at risk of diseases is also increasing. Thus, the paediatric vaccine market is being propelled by the rising number of childbirths in India.

The Indian market held a share of 19.2% of the global market in 2025. Leading campaigns by the government are helping the paediatric vaccine market in India. There is a raised acknowledgment of the need for paediatric vaccines, and the market is expected to grow at a substantial rate over the forecast period.

The United Kingdom market is another market where campaigns have played a key role. Initiatives have been taken to increase immunization among the people. The government has launched programs to increase the number of vaccinated children.

The United Kingdom paediatric vaccine market held a share of 16.1% of the global market in 2025. The steps taken by the health authorities in the United Kingdom will drive the market growth during the projected period.

In the Australian market, paediatric vaccines are in demand as there is fear over the outbreak of diseases. Steps have been taken to make the paediatric population more immunized through vaccines.

The Australian paediatric vaccine market held a share of 9.4% of the global market in 2025. Some of the diseases the Australian people want paediatric vaccines for are COVID-19, Tetanus, and Hepatitis B.

The paediatric vaccine suppliers are increasingly leveraging the benefits of collaborations. Partnerships with healthcare institutions, mergers with other manufacturers in the market, acquisitions, and collaborative strategies are some of the strategies adopted by paediatric vaccine suppliers.

The paediatric vaccines market does not feature manufacturers that are highly dominant. Instead, the market is fragmented, with several key players enjoying their share of the pie. The producers of paediatric vaccines are also receiving increasing approvals from health regulators to distribute their vaccines.

Recent Developments in the Paediatric Vaccine Market

Key Companies in the Paediatric Vaccine Market

The global paediatric vaccine market is estimated to be valued at USD 69.2 billion in 2025.

The market size for the paediatric vaccine market is projected to reach USD 223.8 billion by 2035.

The paediatric vaccine market is expected to grow at a 12.4% CAGR between 2025 and 2035.

The key product types in paediatric vaccine market are pneumococcal conjugate vaccine, dtp vaccine, influenza, meningococcal vaccine, polio vaccine, rotavirus vaccine, mmr vaccine and varicella virus vaccine.

In terms of technology, live or attenuated vaccine segment to command 27.3% share in the paediatric vaccine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Paediatric Oncology Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Paediatric Wheelchairs Market Size and Share Forecast Outlook 2025 to 2035

Paediatric Sports Medicine Market Size and Share Forecast Outlook 2025 to 2035

Paediatric Spasticity Treatment Market Size and Share Forecast Outlook 2025 to 2035

Paediatric influenza treatment market Size and Share Forecast Outlook 2025 to 2035

Paediatric & Neonatal Testing Kits Market – Growth & Forecast 2025 to 2035

Paediatric Respiratory Syncytial Virus Infection Market Growth - Trends & Forecast 2025 to 2035

Paediatric Neuropsychiatric Disorders Treatment Market

Paediatric Respiratory Disease Therapeutics Market

Vaccine Preservatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vaccine Stabilizers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vaccine Vial Rubber Stopper Market Size and Share Forecast Outlook 2025 to 2035

Vaccine Transport Carrier Market Size and Share Forecast Outlook 2025 to 2035

Vaccine Shippers Market Size and Share Forecast Outlook 2025 to 2035

Vaccines Market Insights - Trends, Growth & Forecast 2025 to 2035

Vaccine Packaging Market Growth - Demand & Forecast 2024 to 2034

Vaccine Ampoules Market

Dog Vaccine Market Size and Share Forecast Outlook 2025 to 2035

Cat Vaccines Market Size and Share Forecast Outlook 2025 to 2035

Fish Vaccines Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA