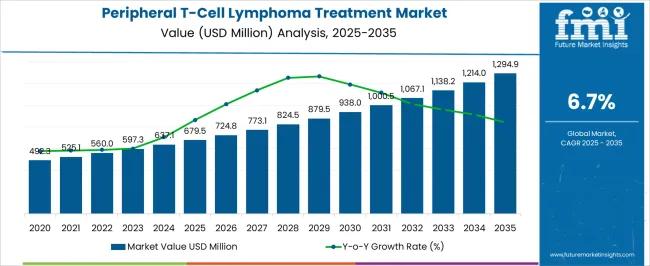

The Peripheral T-Cell Lymphoma Treatment Market is estimated to be valued at USD 679.5 million in 2025 and is projected to reach USD 1294.9 million by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period.

| Metric | Value |

|---|---|

| Peripheral T-Cell Lymphoma Treatment Market Estimated Value in (2025 E) | USD 679.5 million |

| Peripheral T-Cell Lymphoma Treatment Market Forecast Value in (2035 F) | USD 1294.9 million |

| Forecast CAGR (2025 to 2035) | 6.7% |

The Peripheral T-Cell Lymphoma treatment market is experiencing steady growth due to the increasing prevalence of aggressive and rare forms of T-cell lymphoma across both developed and emerging regions. The current market scenario reflects a rising demand for advanced therapies capable of improving patient survival while minimizing adverse effects. Factors such as growing awareness of early diagnosis, enhanced healthcare infrastructure, and the availability of novel therapeutic options are shaping the future outlook of the market.

Increasing investment in oncology research and the development of targeted therapies have contributed to better patient outcomes, thereby encouraging adoption. The market is also influenced by the integration of personalized medicine approaches and treatment regimens tailored to specific lymphoma subtypes.

As the incidence of Peripheral T-Cell Lymphoma rises globally, and diagnostic techniques improve, the demand for effective treatments is expected to sustain growth Future opportunities lie in the expansion of treatment access through specialized healthcare centers and advanced therapy distribution channels that facilitate timely patient care and adherence to recommended protocols.

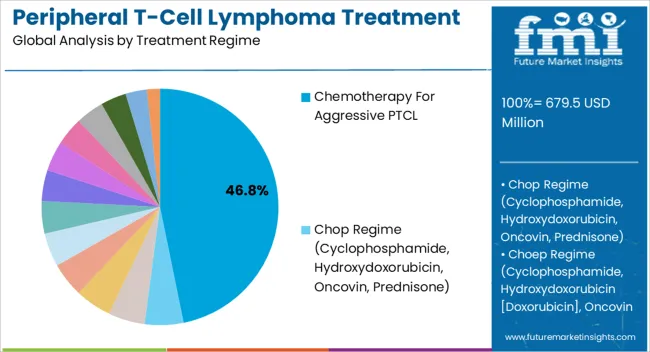

The peripheral t-cell lymphoma treatment market is segmented by treatment regime, distribution channel, and geographic regions. By treatment regime, peripheral t-cell lymphoma treatment market is divided into Chemotherapy For Aggressive PTCL, Chop Regime (Cyclophosphamide, Hydroxydoxorubicin, Oncovin, Prednisone), Choep Regime (Cyclophosphamide, Hydroxydoxorubicin [Doxorubicin], Oncovin [Vincristine], Etoposide, Prednisone), Epoch (Etoposide, Prednisone, Oncovin [Vincristine], Cyclophosphamide, Hydroxydoxorubicin [Doxorubicin]), Hyper-Cvad (Cyclophosphamide, Oncovin [Vincristine], Adriamycin [Doxorubicin], Dexamethasone), Chemotherapy For Relapsed/Refractory PTCL, Ice (Ifosfamide, Carboplatin, Etoposide), Dhap (High-Dose Cytarabine [Ara-C], Dexamethasone, Cisplatin [Platinol-Aq]), Eshap (Etoposide, Methylprednisolone, Cytarabine [Ara-C], Cisplatin [Platinol-Aq]), Gnd (Gemcitabine, Navelbine, Dexamethasone), Targeted Therapy For Relapsed/Refractory PTCL, Histone Deacetylase (Hdac) Inhibitors (Beleodaq, Istodax), and Metabolic Inhibitors (Folotyn). In terms of distribution channel, peripheral t-cell lymphoma treatment market is classified into Hospitals and Cancer Specialty Clinics. Regionally, the peripheral t-cell lymphoma treatment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Chemotherapy for Aggressive PTCL treatment regime is projected to account for 46.80% of the Peripheral T-Cell Lymphoma treatment market revenue share in 2025, making it the leading therapy segment. This dominance has been driven by its established efficacy in managing aggressive subtypes and its widespread adoption in clinical practice. Chemotherapy continues to be preferred due to its ability to rapidly reduce tumor burden and improve survival outcomes in patients diagnosed with aggressive disease.

The segment has benefited from enhancements in combination therapy protocols and supportive care measures that mitigate toxicity, thereby improving tolerability and patient adherence. Additionally, the historical clinical evidence supporting chemotherapy in first-line and relapse settings has reinforced physician confidence and treatment standardization.

As novel agents and targeted therapies are increasingly integrated into treatment plans, chemotherapy remains a backbone option, particularly in hospitals and specialized oncology centers The segment is expected to maintain its leadership position as treatment strategies continue to evolve while retaining the need for proven cytotoxic regimens.

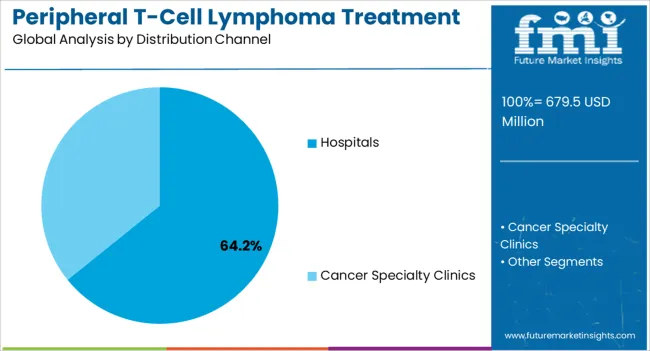

The Hospitals distribution channel is estimated to hold 64.20% of the Peripheral T-Cell Lymphoma treatment market revenue in 2025, positioning it as the dominant channel for therapy delivery. This prominence is attributed to hospitals’ capacity to provide comprehensive oncology care, including diagnosis, administration of complex chemotherapy regimens, and continuous patient monitoring.

The growth of this segment has been supported by increasing investments in hospital infrastructure, the expansion of hematology-oncology departments, and the availability of trained medical personnel capable of managing aggressive lymphomas. Hospitals offer centralized treatment delivery, which facilitates adherence to treatment protocols, supports the management of adverse effects, and allows for real-time monitoring of patient responses.

Furthermore, hospitals are preferred for the administration of intensive therapy regimens due to their ability to provide supportive care, such as transfusions and infection management As the prevalence of Peripheral T-Cell Lymphoma rises and healthcare systems expand capacity for specialized care, hospitals are expected to continue leading the distribution of treatment, reinforcing their role as critical access points for effective therapy delivery.

According to Non-Hodgkin’s Lymphoma Classification Project (CDC), peripheral T-cell lymphoma patients constitute 6%-7% of the total non-Hodgkin lymphoma patients in the USA Peripheral T-cell lymphoma (PTCL) is an aggressive and uncommon type of non-Hodgkin lymphoma. Peripheral T-cell lymphoma affects lymphocytes, particularly T-cell and natural killer cells and generally affects people over 60 years of age.

Peripheral T-cell lymphoma is uncommon in the USA and relatively high number of patients are found in Asia, Africa and Caribbean, primarily due to exposure to Epstein-Barr virus (EBV) and the human T-cell leukemia virus-1 (HTLV-1). Unlike other types of non-Hodgkin lymphoma, peripheral T-cell lymphoma is not well understood and thus have limited treatment options. Most of the peripheral T-cell lymphoma patients require salvage treatment and bone marrow transplant. Peripheral T-cell lymphoma treatment outcomes with conventional chemotherapy regimens have been poor.

However, new genetic and molecular testing techniques for peripheral T-cell lymphoma have enabled the development of targeted therapies for peripheral T-cell lymphoma treatment. Newly diagnosed peripheral T-cell lymphoma patents are generally treated with anthracycline-based combination chemotherapy, including doxorubicin, hydroxydoxorubicin etc.

However, a common standard care for peripheral T-cell lymphoma treatment has not been identified due to heterogeneity of the disease. Recently, some of the biologic treatments such as Beleodaq, Folotyn, Istodax etc. have been approved by the FDA for relapsed or refractory peripheral T-cell lymphoma, which are expected to bring considerable change to peripheral T-cell lymphoma treatment space.

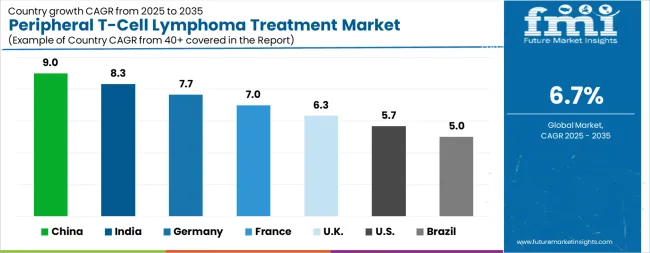

| Country | CAGR |

|---|---|

| China | 9.0% |

| India | 8.3% |

| Germany | 7.7% |

| France | 7.0% |

| UK | 6.3% |

| USA | 5.7% |

| Brazil | 5.0% |

The Peripheral T-Cell Lymphoma Treatment Market is expected to register a CAGR of 6.7% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 9.0%, followed by India at 8.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 5.0%, yet still underscores a broadly positive trajectory for the global Peripheral T-Cell Lymphoma Treatment Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.7%. The USA Peripheral T-Cell Lymphoma Treatment Market is estimated to be valued at USD 254.3 million in 2025 and is anticipated to reach a valuation of USD 441.0 million by 2035. Sales are projected to rise at a CAGR of 5.7% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 37.1 million and USD 17.1 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 679.5 Million |

| Treatment Regime | Chemotherapy For Aggressive PTCL, Chop Regime (Cyclophosphamide, Hydroxydoxorubicin, Oncovin, Prednisone), Choep Regime (Cyclophosphamide, Hydroxydoxorubicin [Doxorubicin], Oncovin [Vincristine], Etoposide, Prednisone), Epoch (Etoposide, Prednisone, Oncovin [Vincristine], Cyclophosphamide, Hydroxydoxorubicin [Doxorubicin]), Hyper-Cvad (Cyclophosphamide, Oncovin [Vincristine], Adriamycin [Doxorubicin], Dexamethasone), Chemotherapy For Relapsed/Refractory PTCL, Ice (Ifosfamide, Carboplatin, Etoposide), Dhap (High-Dose Cytarabine [Ara-C], Dexamethasone, Cisplatin [Platinol-Aq]), Eshap (Etoposide, Methylprednisolone, Cytarabine [Ara-C], Cisplatin [Platinol-Aq]), Gnd (Gemcitabine, Navelbine, Dexamethasone), Targeted Therapy For Relapsed/Refractory PTCL, Histone Deacetylase (Hdac) Inhibitors (Beleodaq, Istodax), and Metabolic Inhibitors (Folotyn) |

| Distribution Channel | Hospitals and Cancer Specialty Clinics |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

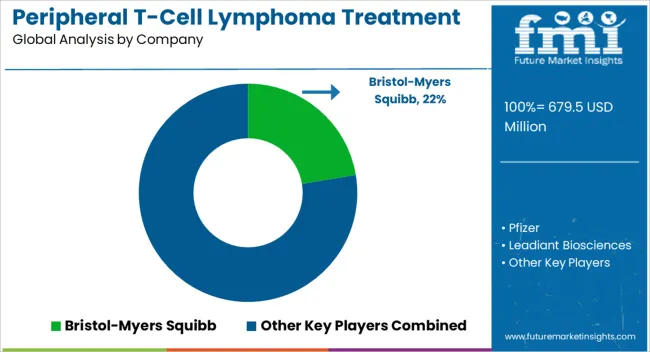

| Key Companies Profiled | Bristol-Myers Squibb, Pfizer, Leadiant Biosciences, Pacira Pharmaceuticals (Skyepharma), Spectrum Pharmaceuticals, Merck, and Genmab AS. |

The global peripheral t-cell lymphoma treatment market is estimated to be valued at USD 679.5 million in 2025.

The market size for the peripheral t-cell lymphoma treatment market is projected to reach USD 1,294.9 million by 2035.

The peripheral t-cell lymphoma treatment market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in peripheral t-cell lymphoma treatment market are chemotherapy for aggressive ptcl, chop regime (cyclophosphamide, hydroxydoxorubicin, oncovin, prednisone), choep regime (cyclophosphamide, hydroxydoxorubicin [doxorubicin], oncovin [vincristine], etoposide, prednisone), epoch (etoposide, prednisone, oncovin [vincristine], cyclophosphamide, hydroxydoxorubicin [doxorubicin]), hyper-cvad (cyclophosphamide, oncovin [vincristine], adriamycin [doxorubicin], dexamethasone), chemotherapy for relapsed/refractory ptcl, ice (ifosfamide, carboplatin, etoposide), dhap (high-dose cytarabine [ara-c], dexamethasone, cisplatin [platinol-aq]), eshap (etoposide, methylprednisolone, cytarabine [ara-c], cisplatin [platinol-aq]), gnd (gemcitabine, navelbine, dexamethasone), targeted therapy for relapsed/refractory ptcl, histone deacetylase (hdac) inhibitors (beleodaq, istodax) and metabolic inhibitors (folotyn).

In terms of distribution channel, hospitals segment to command 64.2% share in the peripheral t-cell lymphoma treatment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Peripheral Intravenous Catheter Market Size and Share Forecast Outlook 2025 to 2035

Peripheral Embolization Device Market Size and Share Forecast Outlook 2025 to 2035

Peripheral Vascular Devices Market Size and Share Forecast Outlook 2025 to 2035

Peripheral Vascular Stent Market Analysis - Size, Trends & Forecast 2025 to 2035

Peripheral Angioplasty Market Analysis - Share, Size, and Forecast 2025 to 2035

Peripherally Inserted Central Catheter Analysis by Product Type by Indication and by End User through 2035

Peripheral Micro Catheters Market Trends – Industry Forecast 2024-2034

Peripheral Neuritis Treatment Market

Computer Peripherals Market Size and Share Forecast Outlook 2025 to 2035

Demand for Peripherally Inserted Central Catheter in Japan Size and Share Forecast Outlook 2025 to 2035

Continuous Peripheral Nerve Block Catheter Market Growth – Trends & Forecast 2025-2035

Film and TV IP Peripherals Market Size and Share Forecast Outlook 2025 to 2035

Game IP Licensed Peripherals Market Size and Share Forecast Outlook 2025 to 2035

Cutaneous T-cell Lymphoma (CTLC) Market

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA