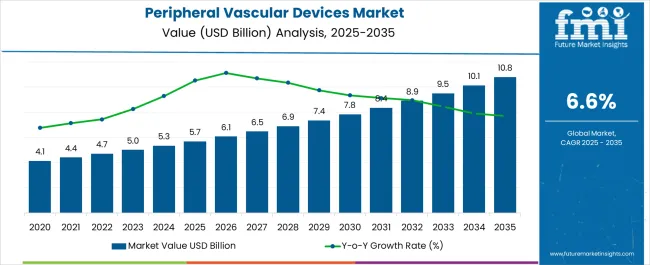

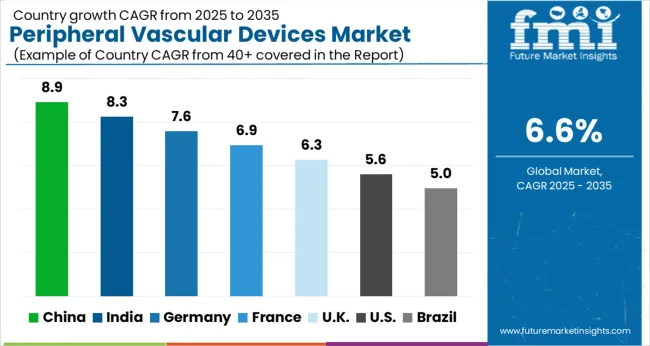

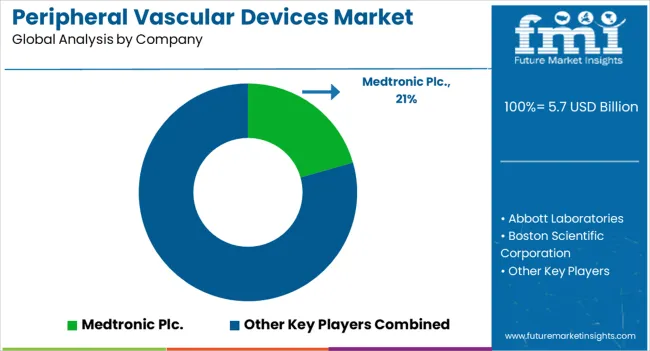

The Peripheral Vascular Devices Market is estimated to be valued at USD 5.7 billion in 2025 and is projected to reach USD 10.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period.

| Metric | Value |

|---|---|

| Peripheral Vascular Devices Market Estimated Value in (2025 E) | USD 5.7 billion |

| Peripheral Vascular Devices Market Forecast Value in (2035 F) | USD 10.8 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The peripheral vascular devices market is undergoing structural advancement, propelled by the increasing global incidence of vascular disorders, aging demographics, and expanding access to minimally invasive treatments. Healthcare systems are progressively shifting toward outpatient vascular interventions, encouraged by reimbursement reforms and technological innovations that reduce procedural risks.

The introduction of next-generation bioresorbable scaffolds, drug-eluting stents, and image-guided atherectomy systems has enhanced clinical efficacy while improving patient safety. Rising demand for early diagnosis and preventive vascular screenings is also influencing procurement priorities across hospitals and ambulatory surgical centers.

Future growth is expected to benefit from the convergence of AI-enabled diagnostic platforms, hybrid catheter labs, and personalized endovascular therapies, which are reshaping the standard of care in vascular disease management.

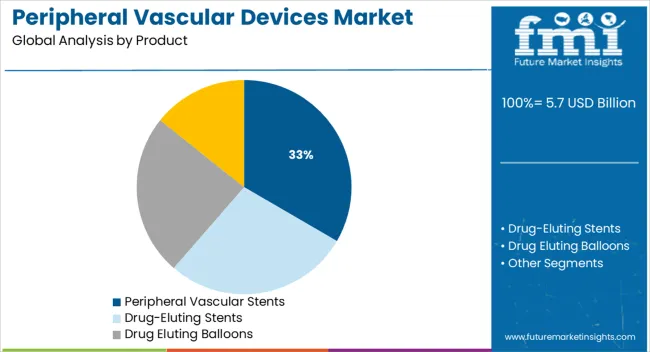

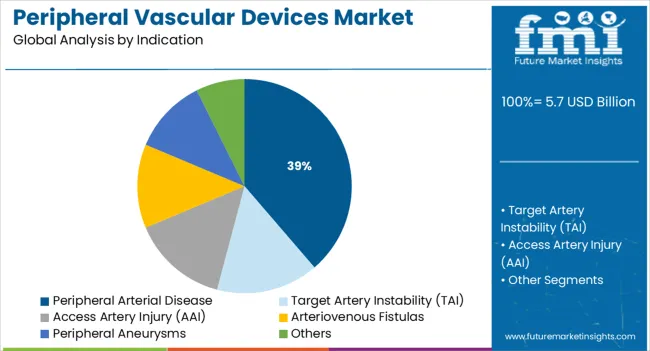

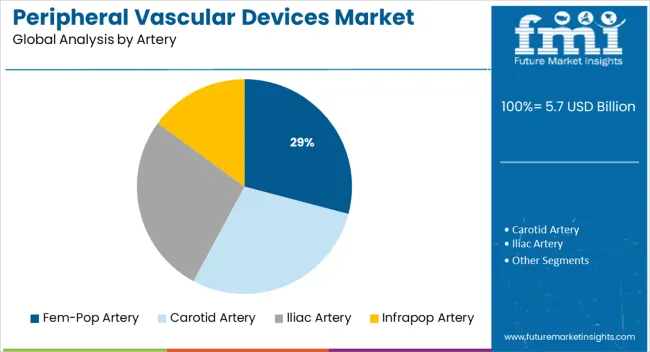

The market is segmented by Product, Indication, Artery, and End User and region. By Product, the market is divided into Peripheral Vascular Stents, Drug-Eluting Stents, Drug Eluting Balloons, and Peripheral Vascular Bioresorbable Scaffolds. In terms of Indication, the market is classified into Peripheral Arterial Disease, Target Artery Instability (TAI), Access Artery Injury (AAI), Arteriovenous Fistulas, Peripheral Aneurysms, and Others. Based on Artery, the market is segmented into Fem-Pop Artery, Carotid Artery, lliac Artery, and Infrapop Artery. By End User, the market is divided into Hospitals, Ambulatory Surgical Centers/Outpatients, and Cardiac Catheterization Labs. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Peripheral vascular stents are projected to account for 33.4% of the total market share in 2025, making them the leading product segment. This dominance is being driven by their critical role in restoring vessel patency and preventing restenosis in peripheral artery disease cases.

Advances in stent materials such as nitinol and drug-eluting alloys have significantly improved flexibility, radial strength, and long-term durability. The increased adoption of endovascular techniques over open surgery has reinforced demand for stents, especially in complex arterial regions.

Regulatory approvals for bioresorbable and next-generation covered stents are expanding their clinical use, particularly in patients with high restenosis risk. Hospitals and vascular specialists are prioritizing stent-based therapies due to their reduced hospital stay, procedural time, and enhanced patient outcomes.

Peripheral arterial disease (PAD) is expected to represent 38.7% of total market revenue in 2025, positioning it as the top indication driving device usage. The rising global burden of diabetes, obesity, and sedentary lifestyles has elevated PAD prevalence, particularly in aging populations.

Early-stage detection aided by ankle-brachial index screening and duplex ultrasonography is accelerating treatment initiation. The segment’s growth is further supported by the increasing shift toward minimally invasive PAD management, which includes balloon angioplasty, stenting, and atherectomy.

Reimbursement support and awareness campaigns targeting at-risk groups are improving diagnosis rates and driving procedural volumes. Continued emphasis on limb preservation strategies and chronic total occlusion treatments are also contributing to PAD’s leading position within the vascular device landscape.

The femoral-popliteal (fem-pop) artery region is projected to hold 29.1% of the overall market share by 2025, emerging as the most treated arterial segment within peripheral vascular interventions. This region is especially prone to occlusions due to mechanical stress, vessel tortuosity, and calcification, which demand high-performance devices.

Device manufacturers have responded with flexible, long-length stents, drug-coated balloons, and atherectomy catheters tailored to the fem-pop anatomy. The ability to deliver durable outcomes in these challenging lesions has made the fem-pop artery a focal point for innovation and clinical trials.

Additionally, increasing clinical evidence and physician preference for minimally invasive interventions over bypass surgery are expanding the use of specialized devices in fem-pop procedures. As procedural volumes rise in ambulatory care settings, the fem-pop segment is expected to remain a core contributor to overall market growth.

The market value for peripheral vascular devices was approximately 52.0% of the overall USD 5.3 Billion of the global stents market in 2024. The sales of peripheral vascular devices expanded at a CAGR of 4.4% from 2012 to 2024, owing to a high incidence of cardiovascular disease burden, globally.

Minimally invasive endovascular procedures to expand the artery opening, such as angioplasty or atherectomy, are currently employed more frequently than bypass surgery as the initial treatment strategy for PAD. The two primary forms of endovascular therapies for PAD are balloon angioplasty with stenting and atherectomy. Endovascular therapy or vascular surgery can be used to treat patients with severe PAD.

A large volume of the population worldwide suffers from critical limb ischemia (CLI), the most severe form of peripheral arterial disease (PAD). While endovascular therapy has been the first choice of treatment in the majority of cases, there is still a range of barriers to the best treatment of diseases such as infrapopliteal (IP) disease.

Endovascular therapy outcomes have significantly improved as technology has advanced. Several innovative technologies are now being developed, including intravascular lithotripsy, percutaneous femoropopliteal bypass, paclitaxel-eluting stents, and the adventitial delivery of anti-restenosis medicines.

As the world's population has grown, so has the demand for healthcare services. Due to an increase in the senior population, the number of individuals suffering from cardiovascular disorders has continually increased. As a result, the demand for devices used in the treatment of cardiovascular disorders has increased. Peripheral vascular devices can be used to treat a variety of heart and arterial problems.

Additionally, technological developments have had a favorable impact on the market shares for peripheral vascular devices. Moreover, the rapid growth of the healthcare industry in developing nations has a beneficial impact on the peripheral vascular devices market growth.

Thus, owing to the aforementioned factors, the global peripheral vascular devices market is expected to grow at a CAGR of 6.6% during the forecast period from 2025 to 2035.

The market for peripheral vascular devices is set to be presented with opportunistic growth over the forecast period. This growth is expected to be owed to the introduction of novel products, such as upgraded drug-eluting vascular stents.

The FDA granted Boston Scientific an investigational device exemption (IDE) in 2020 to initiate a global, pivotal study of the Eluvia drug-eluting stent. EluviaTM Drug-Eluting Vascular Stent System was designed exclusively for the treatment of peripheral artery disease, and in 2020, the USA Food and Drug Administration (FDA) authorized its Premarket Approval (PMA) application.

Stents were first created as a tube that could be inserted intraluminally out of a metal alloy. Bare metal stents (BMSs), coated stents, and drug-eluting stents (DESs) are all types of stents that have evolved in recent years. They may also be self-expanding and balloon expandable. Stents are currently mostly made of nickel and titanium, stainless steel, cobalt chromium, or nickel and titanium.

Biodegradable polymers have been used to create bioabsorbable stents. Although the concept of a bioabsorbable material holds promise, it has not been established in randomized controlled studies and has not demonstrated enhanced or equivalent patency when compared to endarterectomy and PTA.

With the research and development required to improve the outcomes over more standardized approaches, the key players are presented with lucrative prospects for advancement.

The growth of the peripheral vascular devices market is restricted by factors that include device recall activities, device limitations, and the high cost of advanced devices. Medtronic issued the FDA’s most serious type of medical device recall, Class I, in response to reports of injuries associated with its HawkOne system for clearing blocked arteries.

About 95,000 devices sold to the United States of America since 2020 were subject to the recall, which Medtronic announced in early December 2024. Moreover, the material cost composition of peripheral vascular devices is greater within institutional settings, and the high-cost burden of adoption of these devices is a factor, which hinders the overall market.

Additionally, device limitations during the surgical procedure further pose a restrictive impact on the market expansion. Several procedures utilizing drug-eluting balloons come with the risk of occurrence of restenosis after treatment.

Keeping the above factors into consideration, the global market for peripheral vascular stents is subject to repression, in terms of growth, over the forecast period.

The USA dominates the North American region with a total market share of about 94.5% in 2024 and is expected to continue to experience the same growth throughout the forecast period. With a large population suffering from cardiovascular disorders, the product adoption rate for peripheral vascular devices is quite high within the country, thus propelling the USA into being the largest contributor towards the growth of the global peripheral vascular stents market.

China holds approximately 56.5% share of the East Asia market in 2024 and is projected to display growth at a lucrative CAGR of 8.5% during the forecast period. China presents lucrative prospects for the growth of the overall market, owing to a prospective, multicenter, randomized, and controlled, superiority trial done at 14 hospitals in China as part of the FREEWAY-CHINA project.

The objective of this study was to assess the effectiveness and safety of the FREEWAY paclitaxel-coated balloon. According to the study, the FREEWAY paclitaxel-coated balloon outperformed the uncoated balloon in Chinese patients' target lesion revascularization at the 6- and 12-month mark. With established device adaptability and efficacy in the demographic, the market is poised to be fuelled by future product adoption within the country.

Germany is set to exhibit a CAGR of nearly 6.0% in the European peripheral vascular devices market during the forecast period. The market expansion in Germany is owed to the large geriatric population, advanced medical device technology and research, and a high prevalence of chronic diseases.

Peripheral vascular stents are expected to present high growth at a CAGR of 6.0% by the end of the forecast period. With angioplasty procedures, the use of peripheral vascular stents is adapted for implantation into the artery for the removal of calcified lesions. A large disease population globally calls for a greater number of procedures involving the adoption of peripheral vascular stents, thus promoting this segment’s overall market value.

Peripheral arterial disease holds a revenue share of 30.3% in the global market in 2024. Growing urban lifestyle, as well as a large population consuming alcohol and tobacco, are factors propelling the development of peripheral arterial disease. This segment thus holds a major focus within the market.

iliac artery holds a global revenue share of around 48.1% in 2024. Claudication and/or critical limb ischemia are primarily caused by aortoiliac disease, which has a prevalence of up to 10% in the general population and up to 20% in people over the age of 70 (Annals of Vascular Surgery, 2020). Peripheral artery disease includes aortoiliac occlusive disease.

A substantial portion of the global market for peripheral vascular devices is focused on the iliac artery segment due to increased concerns about this condition.

Hospitals hold the highest market share of about 60.4% during the year 2024. The growing prevalence of chronic and infectious diseases, as well as the associated increasing volumes of surgical procedures, have driven this segment to be a dominant fragment, propelling sales of the overall peripheral vascular devices market.

The overall market is highly fragmented, with multiple rivals in the peripheral vascular device production sphere. These companies are using techniques such as mergers and acquisitions, partnerships and collaborations, and new product releases to meet consumer demand and expand their customer base.

Similarly, recent developments related to companies manufacturing peripheral vascular devices, have been tracked by the team at Future Market Insights, which are available in the full report.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2012 to 2024 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; and Middle East & Africa |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Argentina, United Kingdom, Germany, Italy, Russia, Spain, France, BENELUX, Nordic countries, India, Thailand, Indonesia, Malaysia, Japan, China, South Korea, Australia, New Zealand, Turkey, GCC, Israel, North Africa, and South Africa |

| Key Market Segments Covered | Product, Indication, Artery, End User, and Region |

| Key Companies Profiled | Abbott Laboratories; Boston Scientific Corporation; Cook Medical Inc.; MicroPort Scientific Corporation (Endovastec™); Medtronic Plc.; Cardinal Health, Inc.; B. Braun Melsungen AG; BIOTRONIK SE & Co. KG; Becton, Dickinson, and Company; W. L. Gore & Associates Inc.; Getinge AB; Terumo Corp; Kyoto Medical Planning Co Ltd; iVascular S.L.U; AMG International GmbH; ENDOCOR GmbH; Meril Life Sciences Pvt. Ltd.; Nano Therapeutics Pvt Ltd; Koninklijke Philips N.V.; REVA Medical |

| Pricing | Available upon Request |

The global peripheral vascular devices market is estimated to be valued at USD 5.7 billion in 2025.

The market size for the peripheral vascular devices market is projected to reach USD 10.8 billion by 2035.

The peripheral vascular devices market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in peripheral vascular devices market are peripheral vascular stents, _self-expanding stents, _balloon expanding stents, _covered stents, drug-eluting stents, drug eluting balloons and peripheral vascular bioresorbable scaffolds.

In terms of indication, peripheral arterial disease segment to command 38.7% share in the peripheral vascular devices market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Peripheral Intravenous Catheter Market Size and Share Forecast Outlook 2025 to 2035

Peripheral T-Cell Lymphoma Treatment Market Size and Share Forecast Outlook 2025 to 2035

Peripheral Embolization Device Market Size and Share Forecast Outlook 2025 to 2035

Peripheral Angioplasty Market Analysis - Share, Size, and Forecast 2025 to 2035

Peripherally Inserted Central Catheter Analysis by Product Type by Indication and by End User through 2035

Peripheral Micro Catheters Market Trends – Industry Forecast 2024-2034

Peripheral Neuritis Treatment Market

Peripheral Vascular Stent Market Analysis - Size, Trends & Forecast 2025 to 2035

Computer Peripherals Market Size and Share Forecast Outlook 2025 to 2035

Continuous Peripheral Nerve Block Catheter Market Growth – Trends & Forecast 2025-2035

Vascular Sheath Group Market Size and Share Forecast Outlook 2025 to 2035

Vascular Patches Market Forecast and Outlook 2025 to 2035

Vascular Access System Market Size and Share Forecast Outlook 2025 to 2035

Vascular Parkinsonism Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vascular Boot Market Trends and Forecast 2025 to 2035

The Vascular Ulcer Treatment Market Is Segmented by Ulcer Type, Treatment and Distribution Channel from 2025 To 2035

Vascular Dementia Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel, and Region through 2035

Vascular Imaging Systems Market Growth - Trends & Forecast 2025 to 2035

Vascular Access Catheters Market - Growth & Forecast 2025 to 2035

Vascular Endothelial Growth Factor Inhibitor Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA