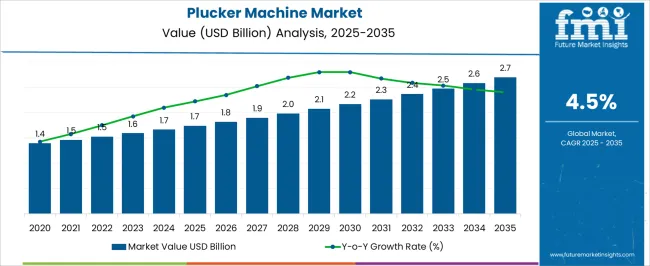

The Plucker Machine Market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 2.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Plucker Machine Market Estimated Value in (2025 E) | USD 1.7 billion |

| Plucker Machine Market Forecast Value in (2035 F) | USD 2.7 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The Plucker Machine market is exhibiting consistent growth, driven by rising demand for automation in poultry and meat processing sectors. This growth is being influenced by increasing labor costs, hygiene compliance requirements, and the need for time-efficient operations in small and mid-sized processing units. Press releases from machinery manufacturers and insights from industry associations suggest that the adoption of plucker machines is expanding due to their role in streamlining processing while ensuring product consistency.

Companies are focusing on material durability, ease of maintenance, and compliance with food safety standards, which is prompting end-users to shift toward advanced models. Further momentum is being observed due to increased investment in meat processing infrastructure and the rising number of small-scale commercial farms globally.

The future outlook remains positive as businesses adopt mechanized solutions to improve operational efficiency and meet output demands Advancements in motor efficiency and equipment design are also contributing to increased product uptake, shaping long-term growth in the market.

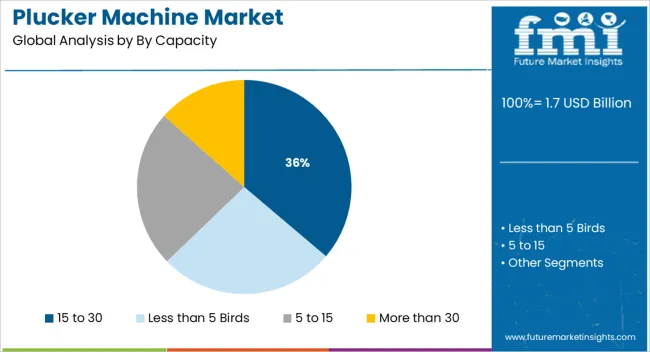

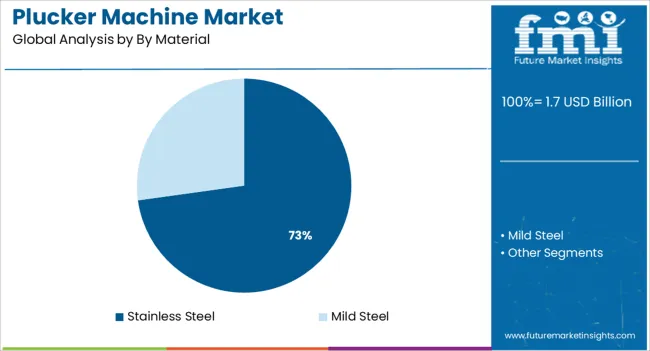

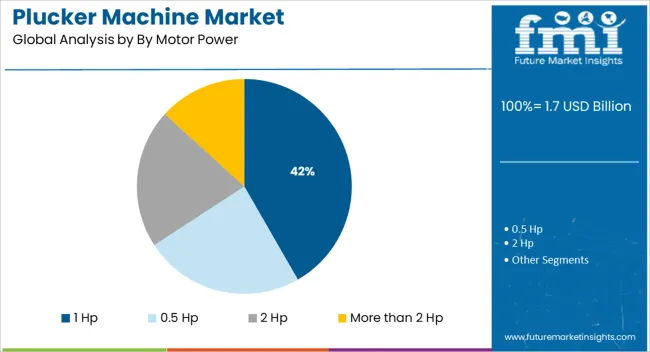

The market is segmented by By Capacity, By Material, and By Motor Power and region. By By Capacity, the market is divided into 15 to 30, Less than 5 Birds, 5 to 15, and More than 30. In terms of By Material, the market is classified into Stainless Steel and Mild Steel. Based on By Motor Power, the market is segmented into 1 Hp, 0.5 Hp, 2 Hp, and More than 2 Hp. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 15 to 30 capacity segment is projected to account for 36.2% of the Plucker Machine market revenue share in 2025, positioning it as the leading capacity category. This growth is being driven by the segment’s suitability for small to medium-scale processing operations where moderate throughput is required. The segment has been preferred by poultry farms and local processors due to its balance between affordability, footprint, and output volume.

According to technical product specifications shared by manufacturers, machines in this range offer optimal efficiency for operations that do not demand industrial-level capacity but still require consistency and speed. Their compact size and ease of maintenance have contributed to increased adoption among emerging market users and mobile processing units.

Industry updates suggest that these machines align well with compliance standards and are often designed with user-friendly features, further encouraging their usage These characteristics have reinforced the segment’s strong positioning in the overall market.

The stainless steel segment is expected to dominate with a 72.8% revenue share in the Plucker Machine market in 2025. This dominance is attributed to the material’s durability, resistance to corrosion, and compliance with food safety norms. Insights from industry-specific machinery publications highlight that stainless steel construction is widely adopted due to its long lifecycle, easy sanitization, and robustness in high-moisture processing environments.

Manufacturers have consistently emphasized stainless steel in their product design to align with HACCP and other regulatory frameworks. The segment’s growth has also been supported by its low maintenance cost and ability to withstand intensive, repetitive cleaning routines.

Stakeholders in food processing prioritize hygiene and reliability, both of which are ensured by stainless steel machines In addition, the perception of premium quality associated with stainless steel products has positively influenced purchasing decisions, further strengthening its position as the preferred material choice in the market.

The 1 Hp motor power segment is projected to hold 41.7% of the Plucker Machine market revenue share in 2025, making it the leading motor power segment. Its leadership is being driven by its suitability for mid-capacity operations and its balance of performance with energy efficiency. As highlighted in machinery product briefs and manufacturer demonstrations, 1 Hp motors offer sufficient power to handle standard processing loads while keeping electricity consumption within economical limits.

This motor capacity is particularly favored in regions with limited infrastructure, where consistent power supply is a concern and overpowered systems may be inefficient or impractical. Feedback from commercial users indicates that 1 Hp machines offer reliable speed, manageable noise levels, and low operational complexity, making them ideal for daily use.

The segment’s steady growth is also being supported by competitive pricing, widespread availability, and adaptability across different machine capacities These factors collectively have ensured the continued preference for 1 Hp motor-powered plucker machines.

Plucker machines are being used by fast food restaurants quickly to meet client demand effectively and quickly. Popular fast food restaurants like KFC, Domino's, McDonald's Corporation, and Taco Bell are expanding into new countries. Over the projection period, this is likely to increase the adoption of plucker machine.

The top manufacturers of plucker machines concentrate on developing state-of-the-art processing equipment. Due to this newly created machinery, several products made of bird meat now have extended shelf lives.

Additionally, plucker machine industry advancements help items retain the majority of their nutrients while reducing quality loss and avoiding disease contamination. Therefore, it is anticipated that the industry's innovative concepts are likely to boost the demand for plucker machine.

When compared to the 4% CAGR recorded between 2020 and 2025, the sheep-handling equipment business is predicted to expand at a 4.5% CAGR between 2025 and 2035. The average growth of the market is expected to be approx 62.2% between 2025 and 2035.

| Year | Market Value |

|---|---|

| 2020 | USD 1,203 million |

| 2024 | USD 1,465.7 million |

| 2025 | USD 1,524.7 million |

Short-term Growth (2025 to 2029): in many countries, where many individuals are assumed to have shifted to a plant-based diet, the vegan trend is obvious. This created numerous opportunities for the plucker machine manufacturers.

Medium-term Growth (2035 to 2035): the numerous health benefits of goods made from meat are a contributing factor in the rising demand for plucker machines.

Long-term Growth (2035 to 2035): a number of extra nutrients are present in chicken meat products that support reproductive and cognitive function. Longer term, this is likely to be advantageous for the market.

As red meat consumption drops due to health concerns, there is likely to be an increase in demand for chicken products with high levels of protein. For processed poultry products, high-quality equipment is required, which is projected to drive the sales of plucker machines.

These reasons would likely lead to a 1.55X increase in the plucker machine sector between 2025 and 2035. FMI analysts predict that the market would be worth USD 2,474 million by 2035's end.

Aside from quality, the size of the plucking is likely to be valued most highly by poultry farms and other end customers. Restaurant and residential sectors are also seeing an increase in demand for less than 5 capacity.

Mobility and flexibility are adding more value to the plucking machine adoption trends. As it requires less space to adjust, less than 5 capacity machines are expected to lead the market during the forecast period.

Due to its ease of cleaning, stainless steel continues to be in high demand by 2035. In addition, consumers' concern about contracting the avian flu highlights the need for hygiene, which makes stainless steel's ability to be disinfected a good choice.

Due to its top-notch components and durable construction, the stainless steel plucker machine has a long lifespan. Additionally, stainless steel pluckers are more durable than those made of mild steel, which makes them a dominant segment in the industry.

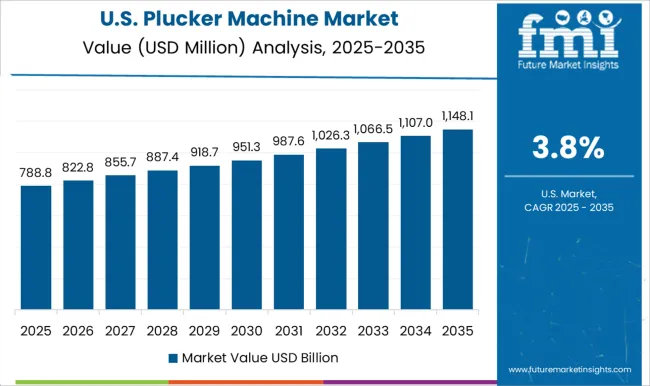

With a share of 30.3%, the plucker machine business in the United States is worth USD 1.7 million in 2025.

Demand for plucker machines has increased as more poultry processing factories embrace this technology, contributing to the market's steady rise in the US. As the need for convenience and efficiency in the poultry processing sector continues to develop, the market share is expected to grow further.

According to the USA Department of Agriculture (USDA), there are 4,500 plucking machines in use in the country's poultry processing business by 2024, up from roughly 1,500 in 2000.

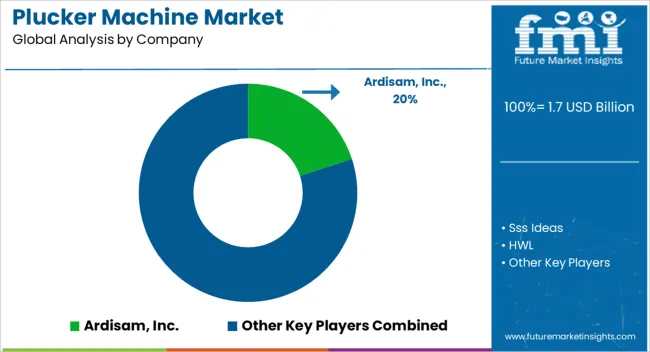

Key producers of the plucking machines, including Chore-Time, Viscon, and Stork, produce the vast majority of plucking machines in the United States. With around 60% of the market share, Chore-Time dominates as the top producer.

These businesses sell a range of machinery, from large-scale models to small-scale pluckers. Additionally, a number of businesses in the USA provide aftermarket options for plucking machines, including replacement components, upkeep and repair services, and system upgrades.

| Attributes | Statistics |

|---|---|

| UK Market Value 2025 | USD 138.5 million |

| UK Market Value 2035 | USD 221.9 million |

| UK Market Share (2025 to 2035) | 9.1% |

| UK Market CAGR (2025 to 2035) | 4.8% |

Germany was leading the Europe market with USD 281.3 million. The UK followed Germany in terms of producing meat and poultry, where a lot of equipment is required and a lot of profit is made.

Rising fast food and restaurant chain sales, as well as increased processed meat consumption, are driving demand for better-processed meat. Additionally, increased per capita income and consumer trends toward value-added food are essential factors in driving plucker machine sales.

Consumers in the country are starting to recognize the advantages of meat products, such as their high protein content and immunity-boosting qualities. The market's present share has also increased as a result of technological advancements in the equipment business, particularly in the poultry sector.

Technological developments in the food processing industry are correlated to the profit margins of the plucker machine companies. This includes the integration of all process equipment into a single piece to minimize labor needs and increase hygiene.

Growing food processing automation is projected to present the biggest opportunity for the UK plucker machine industry.

| Country | China |

|---|---|

| Market Share (2025) | 8.4% |

| CAGR (2025 to 2035) | 3.6% |

| Market Value (2035) | USD 181.8 million |

| Country | India |

|---|---|

| Market Share (2025) | 3.4% |

| CAGR (2025 to 2035) | 5.3% |

| Market Value (2035) | USD 85.9 million |

It is also projected that government actions to support the poultry farming sector provide lucrative opportunities to the plucker machine manufacturers.

For instance, the Indian government declared a 100% increase in the import tax on frozen chicken and turkey beginning in 2024. The country's poultry farming business is probably going to gain from the legislation.

The market was growing at a value of USD 51.3 million in 2025. Another element influencing the market expansion is technical development in plucker machines, which increases their productivity and lowers operational costs.

Over the forecast period, China is expected to experience Asia Pacific's most encouraging growth rate, with a value of USD 127.57 million. In order to meet the high consumer demand in the nation, the main manufacturer focuses on creating processed meat and poultry items.

Automation, intelligence, and digitization are the three most evident advancements in the Chinese food industry today, particularly in the field of poultry plucking. As fewer young people are prepared to work in slaughterhouses, the labor pool is likewise shrinking. As a result, the plucker machine is becoming much more widely used.

The need for tools used in plucking procedures is expected to rise as customers' propensity to consume meat and related products increases globally. Recent entrants in the plucker machine companies think that enhancing their competitive edge is essential to maintaining technical leadership.

They heavily engage in Research and Development, in addition to focusing on new launches in order to gain a foothold in the global poultry plucker market.

Startup moving forward: Kiinns (Israel)

In food production lines, Kiinns suggests a technique for keeping food apart from the machinery that prepares it. The startup's totally biodegradable separation technique enhances the cleanliness and food safety of the processing facilities. Every processing cycle uses clean equipment, removing any germs, allergies, or cleaning agents that might have been left behind.

A developing market in the food service industry is the plucker machine sector. The adoption of plucker machines helps businesses boost output, cut expenses, and enhance product quality.

Many companies are now integrating plucker machines in their product lines due to the advantages they have over traditional methods of processing chicken. Plucker machines can swiftly and effectively process vast numbers of chickens, speeding up production and lowering costs.

Sales of plucker machines are expected to remain high, as more businesses profit from what this equipment has to offer. To increase the effectiveness and performance of their machines, key players in the plucker machine market are spending money on research and development. This makes the machines more affordable to a wider range of clients and encourages innovation in the industry.

As restaurants become knowledgeable about the advantages of these devices to prepare their chicken, the popularity of plucker machines is also rising in this industry.

Additionally, Plucker machines are more adaptable than conventional techniques because they can process a variety of foods, such as fruits and vegetables. The market share of plucker machines is expected to grow as more firms try to take advantage of what the machines have to offer.

Businesses invest money in R&D to raise the caliber of their products and the productivity of their machinery. As the market growth of plucker machines is expected to be high, food service businesses have more scope for innovations.

Recent Developments

The global plucker machine market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the plucker machine market is projected to reach USD 2.7 billion by 2035.

The plucker machine market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in plucker machine market are 15 to 30, less than 5 birds, 5 to 15 and more than 30.

In terms of by material, stainless steel segment to command 72.8% share in the plucker machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Duck Plucker Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Chicken Plucker Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Machine Tool Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Machine Tool Touch Probe Market Analysis - Size, Growth, and Forecast 2025 to 2035

Machine Mount Market Analysis - Size & Industry Trends 2025 to 2035

Machine Control System Market Growth – Trends & Forecast 2025 to 2035

Machine Automation Controller Market Growth – Trends & Forecast 2025 to 2035

Machine-to-Machine (M2M) Connections Market – IoT & Smart Devices 2025 to 2035

Machine Safety Market Analysis by Component, Industry, and Region Through 2035

Key Players & Market Share in Machine Glazed Paper Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA