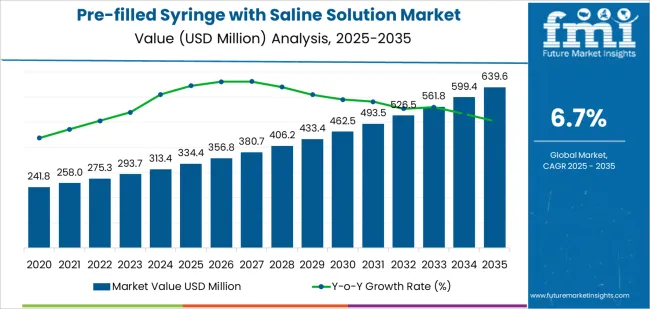

The global pre-filled syringe with saline solution market is valued at USD 334.4 million in 2025 and is projected to reach USD 639.6 million by 2035, reflecting a CAGR of 6.7%. Early growth is driven by increasing demand for saline solutions in emergency medical services, hospital settings, and home healthcare. Pre-filled syringes offer the advantages of convenience, precision, and reduced risk of contamination, making them a preferred choice for healthcare providers. The market benefits from ongoing advancements in syringe design, including safety features such as integrated needles and tamper-evident seals, which increase patient safety and ease of use in medical environments.

Through the later years of the forecast period, growth remains steady as hospitals and healthcare institutions continue to adopt pre-filled saline syringes for intravenous administration and other medical applications. As patient care becomes more streamlined, the use of pre-filled syringes reduces medication errors, accelerates treatment times, and supports the growing trend of at-home care. Manufacturers continue to innovate with better materials for syringe barrels and plungers, improving ease of use and reducing costs. By 2035, ongoing improvements in packaging, delivery systems, and global healthcare infrastructure sustain the market's upward trajectory.

Between 2025 and 2030, the Pre-Filled Syringe with Saline Solution Market grows from USD 334.4 million to USD 462.5 million, forming a peak-to-trough pattern influenced by changes in healthcare infrastructure, regulatory approvals, and product uptake. The trough appears in the early years (2025 to 2027) with slower incremental gains in the USD 10 to 15 million range, primarily driven by limited product awareness and regulatory hurdles. This phase marks the early adoption stage where key stakeholders (hospitals, clinics, and pharmacies) gradually implement pre-filled syringes for saline solution administration, with growth driven by basic usage in clinics and for emergency care.

From 2027 to 2030, the market enters an upward growth trajectory marked by stronger demand for pre-filled syringes, moving from USD 334.4 million to USD 462.5 million. The peak occurs around 2029 to 2030, as demand surges with broader adoption across multiple therapeutic areas such as chronic disease management, inpatient treatments, and vaccination programs. Advances in syringe design, increased regulatory approvals, and the shift toward single-use, ready-to-use devices, as well as convenience and safety considerations, lead to rapid market expansion. Yearly increases of USD 28 to 32 million signify this peak in growth, highlighting an acceleration in both volume and value.

By 2035, the market continues to climb from USD 462.5 million to USD 639.6 million, reinforcing sustained momentum as product standardization, cost-efficiency in manufacturing, and stronger healthcare system integration ensure continuous market growth.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 334.4 million |

| Market Forecast Value (2035) | USD 639.6 million |

| Forecast CAGR (2025 to 2035) | 6.7% |

The pre-filled syringe with saline solution market is expanding as hospitals, clinics, and home care providers seek efficient, ready-to-use flushing systems for intravenous (IV) catheters. These syringes eliminate the need for manual preparation, reducing contamination risk, improving patient safety, and streamlining the workflow in busy healthcare environments. They are especially beneficial in maintaining catheter patency and reducing the risk of occlusions and infections, which is vital in critical care. With the rising incidence of chronic diseases requiring regular intravenous therapy and the increasing volume of outpatient care, demand for pre-filled syringes is increasing. Manufacturers are enhancing the syringes with improved materials and packaging for greater stability, sterility, and ease of use. This is driving consistent growth across healthcare systems, particularly in regions with a high prevalence of outpatient and home-based IV therapies.

Market growth is also supported by advances in pre-filled syringe technology, such as the use of less-leachable polymers and optimized saline formulations, ensuring patient safety. The global market is expected to see substantial growth, with regions like Europe and North America leading due to their advanced healthcare infrastructure and increasing adoption of pre-filled syringe systems. Despite the higher manufacturing cost compared to traditional syringes, the demand for pre-filled saline syringes remains robust due to their ability to minimize human error and improve operational efficiency in both clinical and home settings.

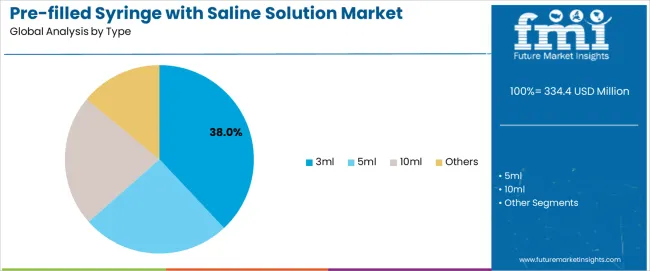

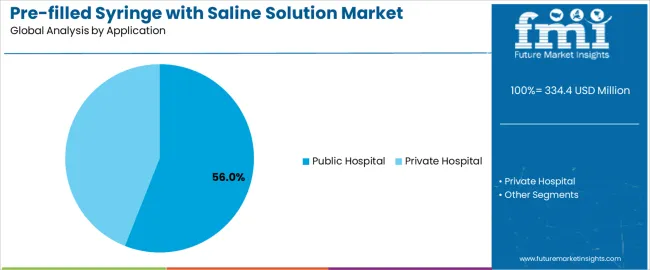

The pre-filled syringe with saline solution market is segmented by type, application, and region. By type, the market is divided into 3ml, 5ml, 10ml, and other capacities. Based on application, it is categorized into public hospitals, private hospitals, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions reflect varying treatment protocols, clinical requirements, and regional healthcare infrastructure that influence the adoption of pre-filled saline syringes in medical settings.

The 3ml segment accounts for approximately 38.0% of the global pre-filled syringe with saline solution market in 2025, making it the leading type category. This position is driven by the widespread use of 3ml syringes in routine medical procedures, including injections for hydration, medication administration, and diagnostic tests, where precise, smaller doses are often required. The 3ml syringe is the standard size for a wide range of procedures, including those performed in outpatient clinics, emergency rooms, and during patient transfers in hospital settings.

Manufacturers design 3ml syringes with enhanced safety features such as needle shields, and ergonomic designs for ease of use in both single and multi-dose scenarios. Adoption is strong in public hospitals and outpatient clinics, where the need for compact, efficient syringes for frequent use across a broad range of patients is essential. The 3ml segment maintains its lead because it aligns with clinical protocols for intravenous, subcutaneous, and intramuscular injections, and is compatible with a broad array of medications and treatments. Its compact size ensures portability and ease of storage, which further contributes to its widespread use in various healthcare settings.

The public hospital segment represents about 56.0% of the total pre-filled syringe with saline solution market in 2025, making it the dominant application category. This position reflects the central role public hospitals play in the administration of saline solutions for various treatments, from intravenous hydration to pre-surgical preparation. Public hospitals often handle a high volume of patients, requiring reliable, sterile, and cost-effective saline solutions for routine medical procedures and emergency interventions.

Pre-filled syringes with saline solution are essential in public hospitals due to their convenience and reduced risk of cross-contamination, as well as their ability to streamline treatment processes in busy hospital environments. The segment benefits from government healthcare policies that emphasize efficiency and cost containment, as well as the increasing focus on patient safety. Adoption is particularly high in North America, Europe, and East Asia, where public hospitals serve a large and diverse patient population. The segment retains its leading share because public hospitals are major centers for routine medical care, where the high demand for saline injections and solutions creates sustained need for pre-filled syringes in both emergency and scheduled treatments.

The pre filled syringe with saline solution market is growing as healthcare providers and home care users adopt ready to use saline flush syringes to improve safety, efficiency and workflow. These syringes are primarily used to flush vascular access devices, reduce contamination risk and support IV therapy protocols. Growth is supported by rising hospitalisation rates, increasing use of vascular devices and emphasis on infection control standards. Adoption is moderated by higher unit cost compared with multi use vials, logistical needs for sterile supply chains and competition from conventional vial and syringe systems. Manufacturers are enhancing packaging, reducing extractables/leachables and streamlining sterile fill processes to meet growing demand.

Demand is driven by the need to reduce catheter related bloodstream infections (CRBSIs) and medication preparation errors in hospital and outpatient settings. Pre filled saline syringes provide unit dose convenience, reduce handling steps and minimise contamination of IV systems. As use of central lines, PICC lines and other vascular access devices increases, hospitals prioritise solutions that support flushing protocols and minimise nursing time. Additionally, growing home care support for patients with vascular access further expands demand for ready to use saline devices outside traditional hospital settings.

Experimental adoption is restrained by cost considerations, as pre filled saline syringes are typically more expensive per dose than bulk vials. Health care facilities under budget pressure may delay transition. Some settings face supply chain challenges around sterilised single use devices and require adjustments in inventory management. Smaller outpatient clinics or resource constrained markets may rely on manual preparation of saline flush solutions. Moreover, performance concerns (e.g., shelf life, material compatibility with saline) or perceived marginal benefit over conventional methods slow uptake in some regions.

Key trends include adoption of advanced packaging materials that reduce risk of extractables and leachables, and growth of pre filled syringes sized for home care or ambulatory use rather than only hospital settings. Manufacturers are introducing lower volume (e.g., 3 mL) and higher volume (e.g., 10 mL) variants to match clinical protocols. Increased demand is seen in Asia Pacific as hospitals modernise and infection control standards rise. Additionally, digital tracking (e.g., RFID) and direct distribution to outpatient or home care settings reduce logistic delays and improve inventory visibility.

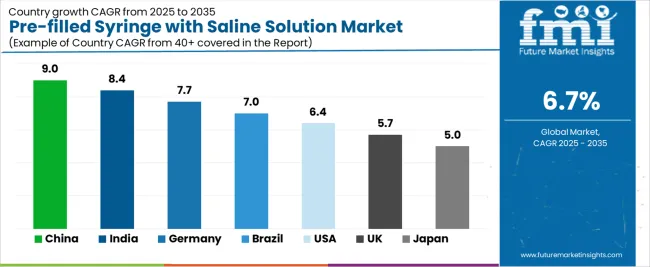

| Country | CAGR (%) |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| Brazil | 7.0% |

| USA | 6.4% |

| UK | 5.7% |

| Japan | 5.0% |

The Pre-Filled Syringe with Saline Solution Market is expanding steadily across global healthcare sectors, with China leading at a 9.0% CAGR through 2035, driven by growing healthcare infrastructure, increasing demand for injectable medications, and advancements in pre-filled syringe technology. India follows at 8.4%, supported by rising healthcare access, expanding pharmaceutical production, and a focus on reducing healthcare-associated infections.

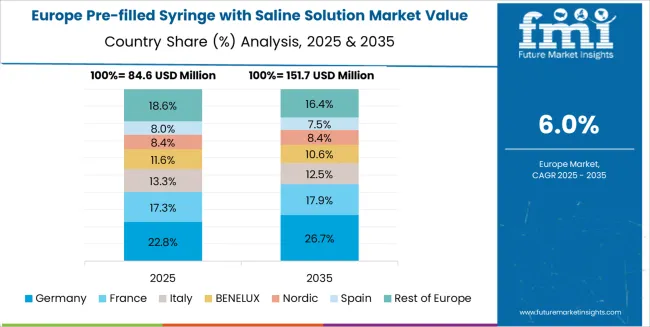

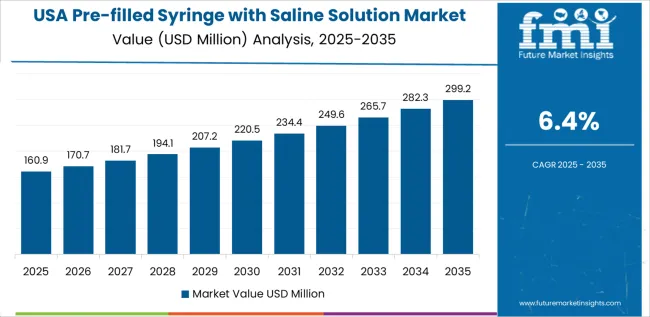

Germany records 7.7%, benefiting from strict regulatory standards, high demand for safe, ready-to-use injection solutions, and strong adoption in both hospital and outpatient settings. Brazil grows at 7.0%, driven by improvements in medical device accessibility and increased patient care needs. The USA, at 6.4%, remains a mature market emphasizing innovation in pre-filled syringe design, patient convenience, and product safety, while the UK (5.7%) and Japan (5.0%) focus on high-quality, reliable delivery systems tailored for chronic conditions and clinical environments.

China is projected to grow at a CAGR of 9% through 2035 in the pre-filled syringe with saline solution market. Expanding healthcare infrastructure, increased hospitalisation rates, and rising demand for minimally invasive procedures fuel demand for pre-filled syringes. Local manufacturers focus on optimising production processes to meet regulatory standards while improving syringe design for patient comfort. Healthcare providers prefer pre-filled syringes due to their ease of use, reduced risk of contamination, and reduced preparation time. The market is further supported by government investments in public health and vaccination programs.

India is projected to grow at a CAGR of 8.4% through 2035 in the pre-filled syringe with saline solution market. The increasing prevalence of chronic diseases, along with a growing geriatric population, drives demand for injectable solutions. Manufacturers are focusing on expanding production capabilities to meet rising demand for injectable therapies, particularly for conditions requiring regular administration such as diabetes and rheumatoid arthritis. Healthcare institutions and pharmacies prefer pre-filled syringes for their efficiency, safety, and convenience. Additionally, the shift toward self-administration devices further boosts market growth in both urban and rural settings.

Germany is projected to grow at a CAGR of 7.7% through 2035 in the pre-filled syringe with saline solution market. Stringent regulatory standards for drug safety and quality control drive the demand for high-quality, pre-filled syringes. German manufacturers ensure their products meet EU regulatory guidelines for pharmaceuticals and medical devices, driving innovation in syringe design and materials. Healthcare institutions use pre-filled syringes to improve efficiency, minimise contamination risks, and reduce the potential for dosing errors. Increased adoption in clinical settings, including hospitals and outpatient clinics, further supports market growth.

Brazil is projected to grow at a CAGR of 7% through 2035 in the pre-filled syringe with saline solution market. Growing medical awareness and access to healthcare services are boosting demand for safe and convenient medication delivery methods. Pre-filled syringes are increasingly used in hospitals, clinics, and homecare settings for chronic condition management, reducing the need for healthcare personnel during administration. Market growth is also driven by a shift toward injectable biologic therapies and improved medical devices, which have gained popularity for treating conditions such as autoimmune diseases and cancer.

USA is projected to grow at a CAGR of 6.4% through 2035 in the pre-filled syringe with saline solution market. High demand for injectable treatments and a growing preference for self-administration boost the adoption of pre-filled syringes. Manufacturers focus on improving convenience features, such as auto-disable mechanisms, to enhance safety and prevent needle-stick injuries. Healthcare providers and patients value the ease of use and minimal preparation required with pre-filled syringes. Market growth is supported by increased use in outpatient settings, especially for patients managing chronic conditions such as diabetes and arthritis.

UK is projected to grow at a CAGR of 5.7% through 2035 in the pre-filled syringe with saline solution market. The adoption of patient-centric innovations, such as easy-to-use pre-filled syringes, is increasing due to the rising preference for self-medication in chronic disease management. Healthcare providers support this shift by encouraging patients to self-administer medications at home, reducing hospital visits. The market also benefits from advancements in syringe technology, such as smaller, more comfortable needles, and improved delivery systems. This growth is aligned with the UK's focus on expanding home healthcare options.

Japan is projected to grow at a CAGR of 5% through 2035 in the pre-filled syringe with saline solution market. Changing lifestyles and the rise in conditions such as diabetes, hypertension, and other chronic diseases increase the need for injectable treatments. Pre-filled syringes offer convenient solutions for home use, reducing the need for frequent healthcare visits. Japanese healthcare providers adopt these devices for their ease of use, ensuring patients follow their prescribed regimens with minimal effort. The market is further driven by the increasing use of biologic therapies and a growing ageing population.

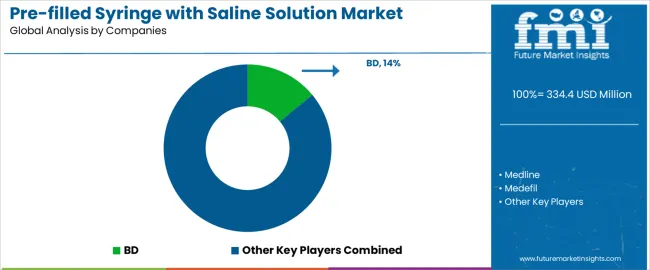

The global pre-filled syringe with saline solution market is moderately competitive, with leading manufacturers supplying pre-filled syringes for medical applications, including intravenous (IV) injections, wound care, and emergency treatment. BD, Medline, and Medefil hold strong positions through their well-established distribution networks and high-quality pre-filled syringes, designed for ease of use, precise dosage, and patient safety. B. Braun and Cardinal Health expand the market with reliable, sterilized syringes that cater to hospitals, clinics, and homecare settings, ensuring compliance with regulatory standards and enhancing operational efficiency. Nipro Corporation and Polymed Medical Devices contribute to regional supply with cost-effective solutions that address growing demand in emerging markets and provide customized syringe configurations.

Weigao Group, Jiangsu Embrace Science & Technology Development, Nangkuang Pharmaceutical, and Jiangsu Caina Medical offer specialized pre-filled syringes with saline solutions tailored for localized and global distribution, while Anhui Tiankang Medical Technology strengthens market competition with innovations aimed at reducing contamination risks and enhancing syringe design. Competition in this market is shaped by syringe material quality, needle safety, packaging integrity, and precise dosing features. Strategic differentiation depends on manufacturing efficiency, regulatory compliance, and the ability to provide integrated solutions for healthcare providers. As healthcare delivery shifts toward outpatient care and home-based treatments, manufacturers with scalable production capabilities, product standardization, and safety innovations will be positioned for long-term competitiveness

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type | 3ml, 5ml, 10ml, Others |

| Application | Public Hospitals, Private Hospitals |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ additional countries |

| Key Companies Profiled | BD, Medline, Medefil, B. Braun, Cardinal Health, Nipro Corporation, Polymed Medical Devices, Weigao Group, Jiangsu Embrace Science & Technology Development, Nangkuang Pharmaceutical, Jiangsu Caina Medical, Anhui Tiankang Medical Technology |

| Additional Attributes | Dollar sales by type and application, regulatory compliance across regions, syringe capacity preferences, advancements in syringe design and material usage, market penetration in public vs private healthcare settings, e-commerce distribution trends, integration with home healthcare systems, infection control strategies, price point variability. |

East Asia

Europe

North America

South Asia

Latin America

Middle East & Africa

Eastern Europe

The global pre-filled syringe with saline solution market is estimated to be valued at USD 334.4 million in 2025.

The market size for the pre-filled syringe with saline solution market is projected to reach USD 639.6 million by 2035.

The pre-filled syringe with saline solution market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in pre-filled syringe with saline solution market are 3ml, 5ml, 10ml and others.

In terms of application, public hospital segment to command 56.0% share in the pre-filled syringe with saline solution market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Syringes and Injectable Drugs Packaging Market Size and Share Forecast Outlook 2025 to 2035

Syringe Scale Magnifiers Market Size and Share Forecast Outlook 2025 to 2035

Syringe Labels Market Size and Share Forecast Outlook 2025 to 2035

Syringes Market Analysis - Growth & Demand 2025 to 2035

Syringeless Injector Market Analysis – Size, Share & Forecast 2025-2035

Syringe Filling Machine Market from 2024 to 2034

Syringe Trays Market

BFS Syringes Market Analysis - Size & Growth Forecast 2025 to 2035

MENA Syringes & Cannula Market Size and Share Forecast Outlook 2025 to 2035

Oral Syringe Market

Safety Syringe Market Size and Share Forecast Outlook 2025 to 2035

Plastic Syringe Market Trends & Healthcare Innovations 2025 to 2035

Slip Tip Syringe Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Slip Tip Syringe Providers

Prefilled Syringe Drug Molecule Market Analysis - Size, Share, and Forecast 2025 to 2035

Luer Lock Syringe Market Size and Share Forecast Outlook 2025 to 2035

Irrigation Syringe Market Size and Share Forecast Outlook 2025 to 2035

Hypodermic Syringes Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Hypodermic Syringes Market Share & Industry Leaders

Single-Use Syringe Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA