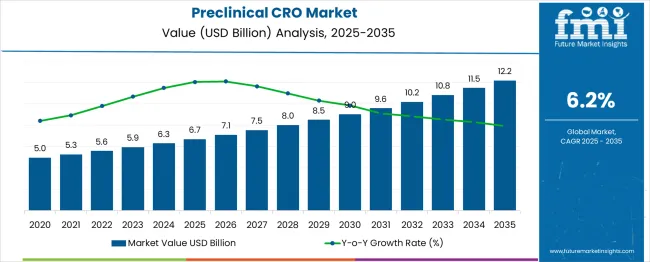

The preclinical CRO market is expected to grow from USD 6.7 billion in 2025 to USD 12.2 billion in 2035, registering a compound annual growth rate (CAGR) of 6%. Annual values indicate relatively low growth between 2020 and 2022, rising from USD 5.0 billion to USD 5.6 billion, likely due to cautious R&D spending and early-stage adoption of outsourcing. Higher-than-average growth is observed in 2026–2027 and 2032–2033, with values increasing from USD 6.7 billion to USD 7.5 billion and USD 10.2 billion to USD 10.8 billion, driven by increased pharmaceutical R&D investment, regulatory approvals, and rising demand for efficient preclinical testing solutions.

Quick Stats for Preclinical CRO Market

| Metric | Value |

| Estimated Value in (2025E) | USD 6.7 billion |

| Forecast Value in (2035F) | USD 12.2 billion |

| Forecast CAGR (2025 to 2035) | 6% |

The preclinical CRO market demonstrates notable variations in annual growth, despite an overall rise from USD 6.7 billion in 2025 to USD 12.2 billion in 2035 at a CAGR of 6%. Early in the forecast period, growth remains subdued, with values increasing from USD 5.0 billion in 2020 to USD 5.6 billion in 2022, reflecting cautious outsourcing adoption, limited R&D budgets, and regulatory bottlenecks. Growth accelerates moderately between 2023 and 2025, reaching USD 6.7 billion, supported by expanding clinical pipelines and outsourcing of preclinical toxicology and pharmacology studies.

Higher-than-average growth occurs in 2026–2027, with values rising from USD 6.7 billion to USD 7.5 billion, driven by increased pharmaceutical R&D investments and demand for high-throughput preclinical testing platforms. Similarly, 2032–2033 records a notable uptick, with the market growing from USD 10.2 billion to USD 10.8 billion, fueled by regulatory approvals for novel therapies and adoption of integrated CRO services. Periodic slower growth, such as USD 8.5 billion to USD 9.0 billion in 2030–2031, corresponds to economic uncertainties and regional supply chain constraints. These patterns highlight the market’s sensitivity to R&D spending cycles, regulatory changes, and technological adoption, providing manufacturers and investors with critical insights for strategic planning.

Market expansion is being supported by the increasing complexity of drug development processes and the corresponding demand for specialized research expertise. Modern pharmaceutical companies are increasingly focused on outsourcing preclinical activities to reduce costs, access advanced technologies, and accelerate time-to-market for new therapeutics. The proven expertise of CROs in conducting complex studies and regulatory compliance makes them preferred partners for pharmaceutical and biotechnology companies.

The growing emphasis on personalized medicine and precision therapeutics is driving demand for advanced preclinical models and testing methodologies. Companies' preference for comprehensive services that combine multiple research capabilities with regulatory expertise is creating opportunities for innovative service offerings. The rising influence of regulatory requirements and quality standards is also contributing to increased adoption of specialized CRO services across different therapeutic areas and development stages.

The market is segmented by service, model type, end-use, and region. By service, the market is divided into toxicology testing, bioanalysis and DMPK studies, safety pharmacology, compound management, and others. Based on model type, the market is categorized into Patient Derived Organoid (PDO) Model, Patient derived xenograft model, in vitro ADME, in-vivo PK, process R&D, custom synthesis, medicinal chemistry, computational chemistry, and others. In terms of end-use, the market is segmented into biopharmaceutical companies, government and academic institutes, and medical device companies. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The toxicology testing segment is projected to account for 22% of the preclinical CRO market in 2025, maintaining its position as a cornerstone service offering. Pharmaceutical companies increasingly recognize the need for comprehensive safety evaluations to meet stringent regulatory requirements prior to clinical trials. Toxicology testing provides detailed assessment of potential adverse effects, dose tolerability, and long-term safety profiles, addressing both regulatory and risk management objectives. This service underpins most preclinical programs and ensures robust safety data generation. With ongoing updates in regulatory guidelines and growing emphasis on patient safety, toxicology testing continues to drive preclinical CRO demand across diverse therapeutic areas.

Patient Derived Organoid (PDO) models are projected to account for 59% of the preclinical CRO model type demand in 2025, highlighting their importance as a preferred platform for advanced drug testing. Researchers favor PDO models for their ability to replicate patient-specific tissue architecture, provide accurate disease simulation, and improve drug response predictability. These models are positioned as innovative tools that enhance translational relevance from preclinical studies to clinical applications. Adoption is supported by the rise of precision medicine initiatives and integration with genomics, transcriptomics, and proteomics, allowing researchers to develop targeted therapies with higher confidence and efficiency. PDO models continue to lead in preclinical research sophistication.

The biopharmaceutical companies end-use segment is expected to contribute 70% of the preclinical CRO market in 2025, reflecting the sector’s dominant role in outsourced research activities. Biopharma firms increasingly rely on CRO partnerships to access specialized expertise, advanced technologies, and cost-effective preclinical solutions, allowing them to focus on core drug discovery strategies. Outsourcing provides access to scalable capabilities, regulatory guidance, and accelerated development timelines. Strong collaboration between CROs and biopharmaceutical companies ensures comprehensive study design, execution, and reporting. As competitive pressures and regulatory expectations intensify, biopharma companies continue to drive demand for high-quality preclinical services, making them the primary growth engine of the market.

The preclinical CRO market is advancing rapidly due to increasing pharmaceutical R&D investments and growing demand for specialized research expertise., The market faces challenges including regulatory complexity, quality control requirements, and competition from in-house research capabilities. Innovation in research technologies and strategic partnership models continue to influence service delivery and market expansion patterns.

The growing adoption of artificial intelligence and machine learning technologies is enabling CROs to enhance research efficiency and provide more accurate predictive models. Advanced technologies offer improved data analysis capabilities, faster research timelines, and better decision-making support that influence drug development strategies. Automation and digital platforms are driving research productivity and enabling CROs to handle larger and more complex research programs.

Modern preclinical CROs are incorporating personalized medicine approaches and precision research models to enhance drug development success rates. These approaches improve the relevance of research findings while providing better translation to clinical applications and targeting specific patient populations. Advanced research models also enable combination research programs that deliver multiple research endpoints in integrated study designs.

| Country | CAGR (2025-2035) |

| China | 8.4% |

| India | 7.7% |

| Germany | 7.1% |

| France | 6.5% |

| U.K. | 5.9% |

| U.S. | 5.3% |

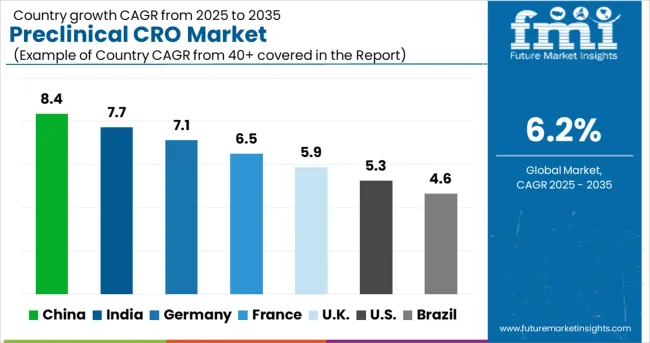

The preclinical CRO market is experiencing robust growth globally, with China leading at an 8.4% CAGR through 2035, driven by expanding pharmaceutical industry, increasing R&D investments, and growing adoption of outsourced research services. India follows closely at 7.7%, supported by strong biotechnology sector, skilled research workforce, and increasing demand for cost-effective research solutions. Germany shows steady growth at 7.1%, emphasizing quality research services and advanced biotechnology capabilities. France records 6.5%, focusing on innovative research models and pharmaceutical industry partnerships. The UK shows 5.9% growth, prioritizing regulatory expertise and specialized research services.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

The preclinical contract research organization market in China is projected to expand at a CAGR of 8.4% through 2035, driven by rapid pharmaceutical sector growth and increasing reliance on outsourced preclinical research solutions. Expanding biotechnology infrastructure, state-of-the-art laboratories, and a highly skilled scientific workforce are creating substantial demand for specialized research services. Domestic and international contract research organizations are investing in advanced facilities and integrated service capabilities to cater to pharmaceutical companies across tier-1 and tier-2 cities. Strong government policies promoting life sciences research and innovation are supporting quality service adoption and accelerating the development of technologically advanced preclinical research platforms.

The preclinical contract research organization market in India is expected to grow at a CAGR of 7.7% through 2035, fueled by cost-competitive service offerings, growing pharmaceutical industry investments, and availability of skilled scientific personnel. The country is becoming an attractive destination for international pharmaceutical companies seeking high-quality outsourced preclinical research at optimized costs. Domestic contract research organizations are enhancing infrastructure and capabilities to meet increasing demand from multinational and local pharmaceutical clients. Strong collaborations between Indian research institutions and global pharmaceutical players are accelerating adoption of advanced research methodologies and regulatory-compliant preclinical studies, further strengthening the market landscape.

\

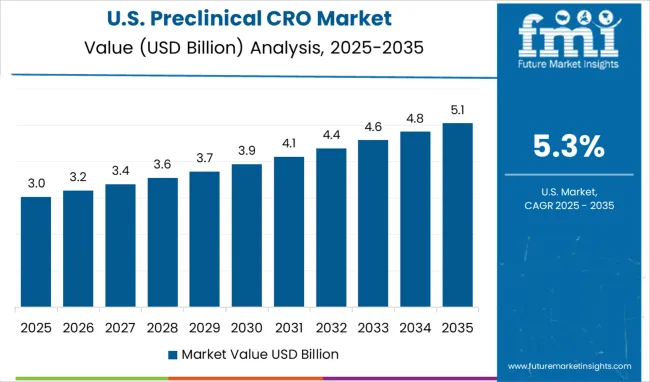

The preclinical contract research organization market in the United States is projected to grow at a CAGR of 5.3%, supported by a mature pharmaceutical sector, advanced laboratory infrastructure, and strong regulatory oversight. U.S. pharmaceutical companies increasingly rely on integrated preclinical research services for early-stage drug development, encompassing toxicology, pharmacology, and efficacy studies. Demand for services leveraging cutting-edge technologies, including artificial intelligence and high-throughput screening, is expanding. Contract research organizations are focusing on comprehensive offerings that meet strict regulatory requirements while providing accurate, reproducible results to support accelerated drug development timelines.

The preclinical contract research organization market in Germany is expected to expand at a CAGR of 7.1% through 2035, driven by the country's strong focus on research excellence, scientific rigor, and regulatory compliance. German pharmaceutical and biotechnology companies prioritize high-quality preclinical research services that deliver reliable, reproducible results. Domestic and international contract research organizations are investing in precision research capabilities, advanced laboratory infrastructure, and innovative testing methodologies to meet evolving client needs. Strategic collaborations between pharmaceutical companies and research organizations are enhancing service innovation, reinforcing Germany's leadership in science-driven preclinical research solutions.

The preclinical contract research organization market in the United Kingdom is projected to grow at a CAGR of 5.9% through 2035, supported by a strong life sciences ecosystem, regulatory expertise, and innovation in research methodologies. British pharmaceutical companies are increasingly adopting outsourced preclinical services for early-stage drug discovery and development, seeking specialized capabilities in toxicology, pharmacology, and efficacy evaluation. The market is characterized by high standards for service quality, regulatory compliance, and scientific credibility. Contract research organizations are expanding capabilities, adopting digital solutions, and forming strategic partnerships to provide comprehensive preclinical research platforms that cater to diverse pharmaceutical and biotechnology client requirements.

The preclinical contract research organization market in France is expected to expand at a CAGR of 6.5% through 2035, driven by the country’s strong pharmaceutical research heritage, scientific expertise, and emphasis on regulatory compliance. French pharmaceutical and biotechnology companies increasingly rely on contract research organizations for specialized preclinical services that encompass toxicology, pharmacology, and efficacy testing. Investments in state-of-the-art laboratories, innovative research technologies, and integrated service capabilities are enabling CROs to deliver high-quality preclinical studies. Collaboration between domestic and international players is enhancing service scope, promoting innovation, and ensuring compliance with European and global regulatory standards, strengthening the market position of France as a center for advanced preclinical research.

Considerable investments are being made in advanced research platforms, cutting-edge laboratory technologies, and highly skilled scientific expertise. State-of-the-art facilities are being developed, while strategic collaborations and partnerships are being pursued to deliver reliable, comprehensive, and timely preclinical research solutions. Emphasis is placed on service quality, operational efficiency, scientific rigor, and global reach to enhance service portfolios and strengthen competitive positioning.

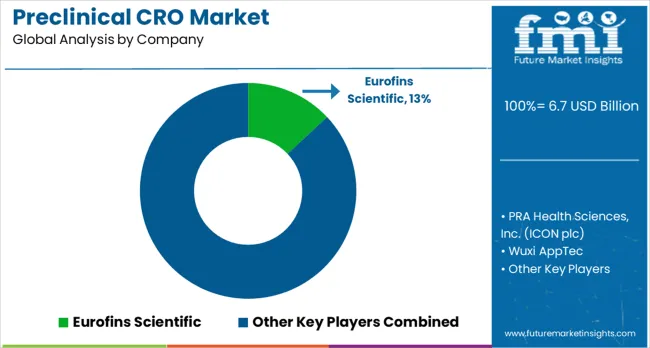

Eurofins Scientific maintains a leading role in the market, capturing an estimated 13% of global value. Comprehensive preclinical research services are offered with particular focus on quality assurance, standardized protocols, and regulatory compliance across multiple therapeutic areas. PRA Health Sciences Inc. delivers integrated research solutions, leveraging therapeutic domain expertise, global laboratory networks, and scalable operational capabilities. Wuxi AppTec provides end-to-end drug development services with focus on efficiency, cost-effectiveness, and timely delivery of preclinical data. Medpace Inc. emphasizes specialized research services combining therapeutic knowledge with regulatory insights to meet complex study requirements.

Global operations are maintained by Charles River Laboratories International Inc. and Thermo Fisher Scientific (PPD division), offering broad preclinical service portfolios spanning multiple development stages and therapeutic areas. Labcorp applies integrated laboratory testing, advanced analytics, and high-throughput capabilities to support drug discovery and development pipelines. Crown Bioscience provides specialized in vivo and in vitro research models with a strong focus on oncology, immunology, and personalized medicine applications. Intertek Group Plc delivers comprehensive testing and preclinical research services, highlighting regulatory expertise, quality assurance, and compliance standards. Technical brochures emphasize scientific capabilities, validated processes, laboratory infrastructure, and collaborative research approaches, collectively reinforcing competitive positioning and market influence in the preclinical CRO landscape.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 6.7 billion |

| Service Outlook | Toxicology Testing, Bioanalysis and DMPK studies, Safety Pharmacology, Compound Management, Others |

| Model Type Outlook | Patient Derived Organoid (PDO) Model, Patient derived xenograft model, In vitro ADME, In-vivo PK, Process R&D, Custom Synthesis, Medicinal Chemistry, Computational Chemistry, Others |

| End-use Outlook | Biopharmaceutical Companies, Government and Academic Institutes, Medical Device Companies |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Eurofins Scientific, PRA Health Sciences Inc., Wuxi AppTec, Medpace Inc., Charles River Laboratories International Inc., PPD, Labcorp, Crown Bioscience, Intertek Group Plc, and SGA SA |

| Additional Attributes | Dollar sales by service type and research model, regional demand trends, competitive landscape, client preferences for GLP versus non-GLP services, integration with regulatory compliance and quality assurance positioning, innovations in research technologies, AI integration, and specialized therapeutic area expertise |

Service Outlook:

Model Type Outlook:

End-use Outlook:

Region:

The global preclinical cro market is estimated to be valued at USD 6.7 billion in 2025.

The market size for the preclinical cro market is projected to reach USD 12.2 billion by 2035.

The preclinical cro market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in preclinical cro market are toxicology testing, _glp, _non-glp, bioanalysis and dmpk studies, _in vitro adme, _in-vivo pk, compound management, _process r&d, _custom synthesis, _others, chemistry, _medicinal chemistry, _computation chemistry, safety pharmacology and others.

In terms of model type outlook , patient derived organoid (pdo) model segment to command 59.0% share in the preclinical cro market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Preclinical Ultrasound Systems Market Size and Share Forecast Outlook 2025 to 2035

Preclinical MRI Equipment Market Size and Share Forecast Outlook 2025 to 2035

Preclinical Medical Device Testing Services Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Market Leaders & Share in the Preclinical Medical Device Testing Services Industry

Preclinical Imaging Market

UK Preclinical Medical Device Testing Services Market Outlook – Share, Growth & Forecast 2025-2035

China Preclinical Medical Device Testing Services Market Insights – Trends, Demand & Growth 2025-2035

India Preclinical Medical Device Testing Services Market Report – Trends & Innovations 2025-2035

Germany Preclinical Medical Device Testing Services Industry Analysis from 2025 to 2035

United States Preclinical Medical Device Testing Services Market Trends – Growth, Demand & Analysis 2025-2035

Cross-species Organ Transplantation Market Forecast and Outlook 2025 to 2035

Cross Interconnection Protection Box Market Size and Share Forecast Outlook 2025 to 2035

Crotonic Acid Market Size and Share Forecast Outlook 2025 to 2035

Cross Corner Industrial Bags Market Size and Share Forecast Outlook 2025 to 2035

Cross-Linked Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Crowdsourced Security Market Size and Share Forecast Outlook 2025 to 2035

Crowdsourced Testing Market Size and Share Forecast Outlook 2025 to 2035

Crown Caps Market Size and Share Forecast Outlook 2025 to 2035

Cross-Border Road Transport Market Size and Share Forecast Outlook 2025 to 2035

Crown Glass Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA