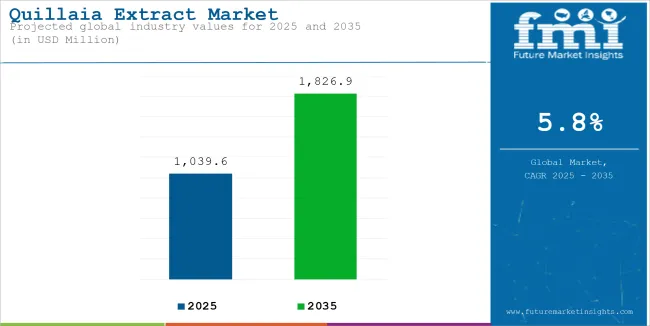

The global market is poised to reach a value of USD 1,039.6 Million by 2025 and it is projected to reach a value of USD 1,826.9 Million by 2035, reflecting a compound annual growth rate of 5.8% over the assessment period 2025 to 2035.

The scenario prevailing over the Quillaia extract has experience a revolutionary change in the last few years merely due to certain factors that has put this compound on the spotlight. Since clients are switching from synthetic chemical standards and looking for natural, functional, and nutritional ingredients in today’s global landscapes, it has become a valuable solution for various industries.

To the manufacturers, considering the great sphere potential, efforts have been made in the right directions in order to gain and fortify a proper industry position. There is for instance the capacity expansion approach through which the production capacities were built to its current levels to meet the increasing international demand. Some of the strategists have employed strategies that will improve their production, guaranteeing customers with a stable supply of quality Quillaia extract.

In tandem with the two early and larger scale capacity increases, manufacturers have been hard at work actively seeking new uses and formulations. Recognizing best the uniquely superb characteristics of the foaming properties of this compound has seen it added to countless products including those used in personal care, to food and even in baking. This diversification has enabled manufacturers to meet the growing and developing demands and expectations of these consumers who are much inclined to products with utility and beauty.

Consumers demands for functional and nutritive ingredients have been pegged as a major reason for the demand. Today’s consumer is well aware of the things that they use, the effect it has on their health and on their lives. Quillaia extract as a natural product with versatile functionalities has become the preferred option for the selective SCs who are avoiding the use of synthetic or artificial additives in their products.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 1,039.6 million |

| Projected Global Industry Value (2035F) | USD 1,826.9 million |

| Value-based CAGR (2025 to 2035) | 5.8% |

Moreover, the consumer demand for natural resources has deeply stimulated change in the industry. The impact of consumer values, coupled with increased awareness of the impact of consumer decision on the physical environment and personal health has led consumers to shift to better values. Consumers have moved towards this direction where they prefer products manufactured by applying greenhouse techniques and naturality of the substance used in Quillaia extract have encouraged manufacturers to sell this substance as the best natural additive in their products.

The industry looks set to further grow at a global level because of the ongoing efforts of manufacturers to increase their production capability, diversify application and to respond to the increase in demand from consumers who prefer healthy, organic products. With the focus on natural, functional, and nutritive value of the ingredients, market share will also gain significant opportunities to further strengthen its status as an essential ingredient for various products.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global industry. This analysis reveals crucial shifts in performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 5.5% (2024 to 2034) |

| H2 2024 | 5.7% (2024 to 2034) |

| H1 2025 | 5.6% (2025 to 2035) |

| H2 2025 | 5.9% (2025 to 2035) |

The global industry's predicted compound annual growth rate (CAGR) over a semi-annual period from 2025 to 2035 is shown in the above table. The business is anticipated to grow at a CAGR of 5.5% in the first half (H1) of 2024 and then slightly faster at 5.7% in the second half (H2) of the same year. The CAGR is anticipated to decrease somewhat to 5.6% in the first half of 2025 and continues to grow at 5.9% in the second half. The industry saw a decline of 38 basis points in the first half (H1 2025) and an increase of 51 basis points in the second half (H2 2025).

Diversification into Personal Care Products

The exploration, replication, and usage of natural sudsy and emulsifying agents in personal care items keep accumulating for major corporations due to the high demand for plant-based options for shampoos, soaps, and skincare. They help in gentle and sudsing washing of the products and are in much demand by environmentally concerned consumers towards more organic and sustainable formulations. Their appeal lies in having multiple functionalities aiding in texture build up and product stability. They fall quite in terms of use at the time of the popularity of the notion of clean beauty.

Most sourcing as well as making would register a top-notch in the order of factors to be considered in using these as components with other aesthetically pleasing wows, a brand would not only exploit them to cater to those buyers who are inclined to ecological purchases but as well distinguish itself in a highly competitive sector. This diversification offers companies an opportunity where they can develop a more extensive reach of customers and further allow innovation and growth within the personal care segment with cashing in on the inherent benefits of natural ingredients.

Expansion in Functional Beverage Applications

Innovative uses of natural foaming agents in nutraceuticals are the latest innovation in health related drinks. The characteristic of these natural substances makes them create new textures and aesthetics in sports drinks, protein shakes, and soda pop. More immaterially, all these elements contribute toward stability, adding to the sensory impression for the consumer.

These are among the features that companies seek to capture in responding to the demand for indulgent, better-for-you refreshments. The natural stabilizers are very versatile and would possibly enable manufacturers to vary their products into quite daring formulations which might even be lower in sugar and with fewer calories that will attract the health-conscious buyer.

As the functional beverage category continues to evolve, these innovations will position these companies in the leadership roles across the market in providing functionality, natural ingredients, and consumer appeal in their products. This trend thus results showcasing how health, convenience, and impulsivity conspire in strengthening the beverage industry.

Focus on High-Purity Extracts for Pharmaceutical Use

Companies seek concentrated plant-derived ingredients for more specific pharmaceutical applications like making vaccine adjuvants and therapeutic formulations. These ingredients can enhance the effectiveness of drug treatment because they are perceived as having immune-boosting properties. Manifold through the growing demand for plant-based health solutions, manufacturers are now investing in advanced plant counts-extraction technology to achieve consistent quality and potency.

The focus not only supports drug development but is also in keeping with notions calling for the use of natural and sustainable bulk materials in industry. Such highly pure plant-derived constituents are interesting to the pharmaceutical industry looking for alternatives to man-made ones in terms of efficacy and biocompatibility. By focusing on the purity and completeness of the extracts, it becomes integral in innovation in developing vaccines, for treating chronic diseases, for creating wellness products. It brings out the growing synergy between the pharmaceutical and natural ingredient sectors.

Development of Organic and Non-GMO Product Lines

Thirdly, shifting consumer preferences for products with fewer additives have impacted food manufacturing thrusting into forms new organic and non-GMO products. These formulations do away with fears of synthetic pesticides, genetically modified foods, chemicals and unhealthy additives and presents a clean, safe, healthy option. Certification as organic or non-GMO adds to brand credibility and expands its opportunities on the market. These products follow trends associated with the protection of the environment and therefore are appealing to such buyers.

Businesspeople are capitalizing on these advancements to penetrate premium customer niche that is ready and willing to spend premium prices for quality and supposed ethical products. This trend also enables manufacturers to address the legal provision in managing their production and selling of products and remain relevant in the worldwide business landscape. The search for organic and non-GMO products is a manifestation of a gradual change in customer attitudes and suppliers’ approaches.

Strategic Partnerships with Sustainable Forestry Initiatives

For a competent and moral supply in the raw material, corporations are partnering with green foresting campaigns. Such collaborations contribute to responsible procurement and sustainability as well as the flow of plant-based products into the future. Minimizing the depletion of forest resources and meeting consumers’ expectations of being environmentally conscious are some ways through which the manufacturers work with certified forestry programs.

This approach not only affects positive changes on the stability of the supply chain but also develops brand image especially among the environmentally conscious buyers. Businesses are placing increasing focus on supply chain sustainability, and they are evidencing this focus with certifications and supply chain visibility.

On this account, it helps to stem increasing criticism over some companies’ involvement in deforestation and other unethical phenomena while putting brands forward as welfare-minded. The trend is characteristic of the growing industry justice, where business development and consideration of the environment complement one another.

Innovation in Food and Beverage Stabilization Techniques

Stabilization advancement in the food and the beverages industry continues to redefine the quality and perception of consumers. Nature-emulsifying agents are being used more today because they help to achieve the right texture, increase shelf life and keep the final product as consistent as possible, without the use of synthetic compounds.

All these are in response to consumers’ demand in the clean-label philosophy where they look at the least processed food. These stabilizers also offer great flexibility that enables processors to try out new applications- from plant-based desserts to light calorie beverages that are equally functional and attractive. Business are also coming up to meet the need of allergen free and natural processed foods making their consumers base more diverse.

Interestingly, these natural stabilizers have fitted well to meet the emerging demands of the food industry in aspects such as synergistic effects and cost consideration in the food science. Such trend emphasizes the need to intensify innovation and focus on the development of superior solutions that meet the needs of consumers in the segment of food and beverages.

The Quillaia extract sphere is in a constant state of growth from the previous years, and especially sales have exhibited a sound rising trend from the years 2020 to 2024. This period has seen an uptrend in demand mainly occasioned by enhanced consumer trends on natural, functional and sustainable ingredients across all sectors. future demand projections from 2025 to 2035 looks even more encouraging therefore implying a huge potential.

Forecast expectations for the demand of this incredibly useful material persist to increase because a wide array of parties can utilize it. Not only can Quillaia extract comply with the changing needs of the market, but it is also a natural and environmentally friendly ingredient, making it a valuable ingredient in the coming years.

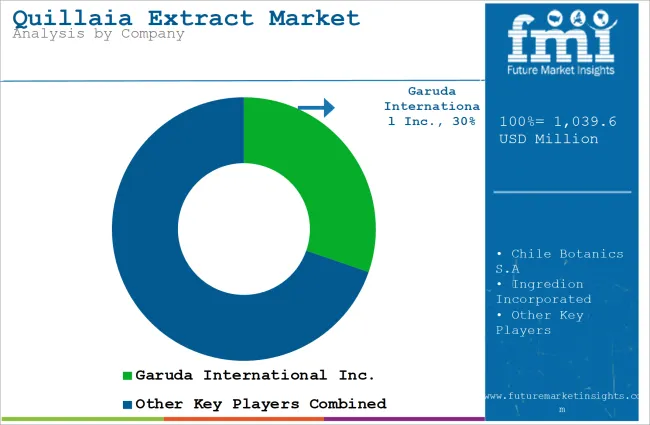

The industry is characterized by a two-tier structure, which includes both organized and unorganized players. Leading companies such as Garuda International Inc., Chile Botanics S.A, Ingredion Incorporated, Baja Yucca Company, Naturex S.A, ;Alfa Chemicals, Desert King International, Quillaja Green Biosolutions, Givaudan SA, Natural Response S.A., Others some players dominate the organized segment that accounts for 65% of sales in the industry. Multinational corporations (MNCs) that have target segment revenue greater than 8 million USD belong to these groupings and they maintain their arena presence in this way because they have large volumes of production capacities, high-tech infrastructure and various products.

These well-regulated players have strict distribution networks and can be found in every corner of the world thereby; resulting to huge penetration globally. Their modernized research labs on the other hand enhance innovations enabling them to introduce a range of extracts with regard to changing trends among health aware consumers who are conscious about their diet.

On the contrary, local participants with target segment revenue below 8 million USD form the unorganized part that contributes up to 35% of total sales of market within this category. These smaller companies may lack global coverage but are vital for specific areas. Working in niche community allows them offer particular goods fitted for diverse domestic preferences or specialized dietary needs. In many cases, these entities adjust quickly according to fads in consumer tastes which results into unique and exceptional product mix.

This makes sure that there is dynamism as well as competitiveness within industry due to existence of both big and small firms. This variety brings on board multiple developments along with a wide range of options being made available satisfying different customers across all regions worldwide. This means that the industry has good prospects given its innovative nature coupled with growing trend towards healthier alternatives.

The following table shows the estimated growth rates of the significant five geographies sales. USA, Japan and Australia are set to exhibit high consumption, recording CAGRs of 3.9%, 4.7% and 6.1%, respectively, through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| United States | 3.9% |

| Japan | 4.7% |

| Australia | 6.1% |

Among all the craft beverage products, the USA is at the forefront of integrating natural emulsifiers and foaming agents that enhance product demand. Some of the applications for these ingredients by craft brewers, emerging soft drink producers or artisanal alcohol manufacturers are the formation of stable foams, surface textures or mouthfeel and sensory characteristics. Such factors create aesthetic value in products, which will give the consumer a high level of drinking experience. In addition to these functions, the functional characteristics of differentiated ingredients help in the establishment of flavor release and uniformity hence their importance in top shelf beverages.

This thus wraps up the general consumer trend towards better quality, genuine and innovative products that do not tamper with natural quality. With an increasing trend of consumers focusing more on craft beverages, brand that adapt from plant-based ingredients as a point of Doğu in a congested market, is evident on how tradition can blend with innovation.

In Japan, while substantializing texture and presentation in traditional confectionery and traditional confectionery respectively put pressure on the use of natural emulsifiers. Sweets such as mochi, yokan and wagashi require extreme attention to texture and smoothness, properties improved by plant based additives.

Finally, these emulsifiers provide stability in textures - to make sure the finished products retain the desired soft or firm texture. This trend complies with the general Japanese concept in cuisine, that is, the concept of conforming to tradition but at the same time innovating. In this way, finally providing stability and increased quality of the shelves to consumers from all over the world that appreciate natural and quality ingredients.

Furthermore, the global demand for Japanese sweets has fuelled the producers to devise ways of producing a different version ideally for the exportation. The proper incorporation of plant-based components retains the traditional aspects of these confections and at the same time pays attention to the today’s and healthy aspects of the culture.

There has been a trend in Australia for consumers to engage more in plant based diets and in response manufacturers have looked to natural stabilizers to mimic dairy creaminess. They enhance smooth mouthfeel characteristics of agro-food products including almond milk, oat milk and vegan cheeses essential for consumer appreciation.

The transition to natural stabilisers responds to the sector trends of clean labelling, allergens free, and environmentally friendly foods. Never before have Australians embraced plant-based products as they are doing so now due to the general healthy/wellness consciousness as well as the sustainability aspect.

That the trend is in agreement with such functional ingredients as natural emulsifiers shows that manufacturers can churn out quality products that conform to specific dietaries. Facilitating meat imitations that can be tasted, textured, and stably enjoyed, these innovations have become instrumental to mainstream plant-based diets for households or cafés throughout the country.

| Segment | Value Share (2025) |

|---|---|

| Type 2 (Extract Type) | 68.3% |

Type two extracts have been seen to be more dominant because of the high percentage of saponin concentrations which make this product to be unique and more advantageous in its multiform application in other industries. These extracts are commonly used in the production of food, beverages and personal care products because of their excellent foaming, emulsifying and stabilizing characteristic. In functional beverages they affect texture and foam which make aesthetic appeal better and in cosmetics provide natural surfactant properties to meet with the consumer requirement of plant-derived products.

Also, due to their high activity they are used in the composition of certain drugs, for example, in vaccines adjuvants where the effectiveness is a key characteristic. By this, there is the ability to deliver the desired performance every day across such diverse applications makes Type 2 extracts the best bet. The nimble motions and gross compatibility with clean label trends cement their primary position as key players in meeting contemporary consumer and industrial requirements.

| Segment | Value Share (2025) |

|---|---|

| Foaming Agent (Function) | 61.2% |

Quillaia extract which is a surface acting agent that comes from Quillaia saponaria tree remains the market leader in the foaming agent market. This polymeric material has outstanding characteristics of foaming and is used across diverse applications such as personal care products and the food industry.

This increase in the demand for Quillaia extract must therefore come down to the results showing that the substance can form stable, long-lasting structures out of foam. This property makes this product desirable in industries that require a uniform, light coloured foam such as; shampoo, shower gel and beer industries. Furthermore, that it belongs to natural origin has also added increased consumer appeal especially with the recent rise in green chemistry products.

Each player in the global Quillaia extract sphere shares a compelling storyline of varied players trying their luck in this very lucrative casino. The unprecedented properties in foaming that have made the Quillaia extract a trend-setting item in the industry may cease in appreciation as the industry confronts staggering hurdles in upgrading its facility, ever-revolving consumer preferences, and regulatory demands.

Fresh players into the game segment include attempts in the exploration of innovative formulations and applications to differentiate themselves in this competitive industry. However, they are pinned down by the entrenched players; with immense experience and vast networks in product distribution channels, accomplishment becomes a sure affair. To succeed in this most vibrant business segment, a firm, which is able to churn out the goods in consistency of high quality and reliability, should be well attuned to trends.

By Extract type industry has been categorised into Type 1 and Type 2.

Key functionalities like Foaming Agent, Flavouring Agent and Emulsifying Agent are considered after the research.

By form sector has been segmented as Powder and Liquid.

End user industries like Food and Beverage, Cosmetics & Personal Care, Pharmaceutical, Animal Feed and Others are included in the report.

By sales channel industry has been categorised into Offline Sales Channel (Supermarkets/Hypermarkets, Departmental Stores, Convenience Store and Others) and Online Sales Channel (Company Website and E-commerce Platform)

Industry analysis has been carried out in key countries of North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, and Oceania

The industry valuation reported by FMI in 2025 is 1,039.6 million USD.

Expected business valuation in 2035 is 1,826.9 million USD

The CAGR for last 4 years is about 5.5%

The projected CAGR between 2025 to 2035 is 5.8%.

Table 01: Global Quillaia Extract Market Value (US$ Mn) Forecast by Region, 2017-2032

Table 02: Global Quillaia Extract Market Volume (MT) Forecast by Region, 2017-2032

Table 03: Global Quillaia Extract Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 04: Global Quillaia Extract Market Volume (MT) Forecast by Type, 2017-2032

Table 05: Global Quillaia Extract Market Value (US$ Mn) Forecast by Function, 2017-2032

Table 06: Global Quillaia Extract Market Volume (MT) Forecast by Function, 2017-2032

Table 07: Global Quillaia Extract Market Value (US$ Mn) Forecast by Form, 2017-2032

Table 08: Global Quillaia Extract Market Volume (MT) Forecast by Form, 2017-2032

Table 09: Global Quillaia Extract Market Value (US$ Mn) Forecast by End Use Industry, 2017-2032

Table 10: Global Quillaia Extract Market Volume (MT) Forecast by End Use Industry, 2017-2032

Table 11: Global Quillaia Extract Market Value (US$ Mn) Forecast by Sales Channel, 2017-2032

Table 12: Global Quillaia Extract Market Volume (MT) Forecast by Sales Channel, 2017-2032

Table 13: North America Quillaia Extract Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 14: North America Quillaia Extract Market Volume (MT) Forecast by Country, 2017-2032

Table 15: North America Quillaia Extract Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 16: North America Quillaia Extract Market Volume (MT) Forecast by Type, 2017-2032

Table 17: North America Quillaia Extract Market Value (US$ Mn) Forecast by Function, 2017-2032

Table 18: North America Quillaia Extract Market Volume (MT) Forecast by Function, 2017-2032

Table 19: North America Quillaia Extract Market Value (US$ Mn) Forecast by Form, 2017-2032

Table 20: North America Quillaia Extract Market Volume (MT) Forecast by Form, 2017-2032

Table 21: North America Quillaia Extract Market Value (US$ Mn) Forecast by End Use Industry, 2017-2032

Table 22: North America Quillaia Extract Market Volume (MT) Forecast by End Use Industry, 2017-2032

Table 23: North America Quillaia Extract Market Value (US$ Mn) Forecast by Sales Channel, 2017-2032

Table 24: North America Quillaia Extract Market Volume (MT) Forecast by Sales Channel, 2017-2032

Table 25: Latin America Quillaia Extract Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 26: Latin America Quillaia Extract Market Volume (MT) Forecast by Country, 2017-2032

Table 27: Latin America Quillaia Extract Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 28: Latin America Quillaia Extract Market Volume (MT) Forecast by Type, 2017-2032

Table 29: Latin America Quillaia Extract Market Value (US$ Mn) Forecast by Function, 2017-2032

Table 30: Latin America Quillaia Extract Market Volume (MT) Forecast by Function, 2017-2032

Table 31: Latin America Quillaia Extract Market Value (US$ Mn) Forecast by Form, 2017-2032

Table 32: Latin America Quillaia Extract Market Volume (MT) Forecast by Form, 2017-2032

Table 33: Latin America Quillaia Extract Market Value (US$ Mn) Forecast by End Use Industry, 2017-2032

Table 34: Latin America Quillaia Extract Market Volume (MT) Forecast by End Use Industry, 2017-2032

Table 35: Latin America Quillaia Extract Market Value (US$ Mn) Forecast by Sales Channel, 2017-2032

Table 36: Latin America Quillaia Extract Market Volume (MT) Forecast by Sales Channel, 2017-2032

Table 37: Europe Quillaia Extract Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 38: Europe Quillaia Extract Market Volume (MT) Forecast by Country, 2017-2032

Table 39: Europe Quillaia Extract Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 40: Europe Quillaia Extract Market Volume (MT) Forecast by Type, 2017-2032

Table 41: Europe Quillaia Extract Market Value (US$ Mn) Forecast by Function, 2017-2032

Table 42: Europe Quillaia Extract Market Volume (MT) Forecast by Function, 2017-2032

Table 43: Europe Quillaia Extract Market Value (US$ Mn) Forecast by Form, 2017-2032

Table 44: Europe Quillaia Extract Market Volume (MT) Forecast by Form, 2017-2032

Table 45: Europe Quillaia Extract Market Value (US$ Mn) Forecast by End Use Industry, 2017-2032

Table 46: Europe Quillaia Extract Market Volume (MT) Forecast by End Use Industry, 2017-2032

Table 47: Europe Quillaia Extract Market Value (US$ Mn) Forecast by Sales Channel, 2017-2032

Table 48: Europe Quillaia Extract Market Volume (MT) Forecast by Sales Channel, 2017-2032

Table 49: East Asia Quillaia Extract Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 50: East Asia Quillaia Extract Market Volume (MT) Forecast by Country, 2017-2032

Table 51: East Asia Quillaia Extract Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 52: East Asia Quillaia Extract Market Volume (MT) Forecast by Type, 2017-2032

Table 53: East Asia Quillaia Extract Market Value (US$ Mn) Forecast by Function, 2017-2032

Table 54: East Asia Quillaia Extract Market Volume (MT) Forecast by Function, 2017-2032

Table 55: East Asia Quillaia Extract Market Value (US$ Mn) Forecast by Form, 2017-2032

Table 56: East Asia Quillaia Extract Market Volume (MT) Forecast by Form, 2017-2032

Table 57: East Asia Quillaia Extract Market Value (US$ Mn) Forecast by End Use Industry, 2017-2032

Table 58: East Asia Quillaia Extract Market Volume (MT) Forecast by End Use Industry, 2017-2032

Table 59: East Asia Quillaia Extract Market Value (US$ Mn) Forecast by Sales Channel, 2017-2032

Table 60: East Asia Quillaia Extract Market Volume (MT) Forecast by Sales Channel, 2017-2032

Table 61: South Asia Quillaia Extract Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 62: South Asia Quillaia Extract Market Volume (MT) Forecast by Country, 2017-2032

Table 63: South Asia Quillaia Extract Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 64: South Asia Quillaia Extract Market Volume (MT) Forecast by Type, 2017-2032

Table 65: South Asia Quillaia Extract Market Value (US$ Mn) Forecast by Function, 2017-2032

Table 66: South Asia Quillaia Extract Market Volume (MT) Forecast by Function, 2017-2032

Table 67: South Asia Quillaia Extract Market Value (US$ Mn) Forecast by Form, 2017-2032

Table 68: South Asia Quillaia Extract Market Volume (MT) Forecast by Form, 2017-2032

Table 69: South Asia Quillaia Extract Market Value (US$ Mn) Forecast by End Use Industry, 2017-2032

Table 70: South Asia Quillaia Extract Market Volume (MT) Forecast by End Use Industry, 2017-2032

Table 71: South Asia Quillaia Extract Market Value (US$ Mn) Forecast by Sales Channel, 2017-2032

Table 72: South Asia Quillaia Extract Market Volume (MT) Forecast by Sales Channel, 2017-2032

Table 73: Oceania Quillaia Extract Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 74: Oceania Quillaia Extract Market Volume (MT) Forecast by Country, 2017-2032

Table 75: Oceania Quillaia Extract Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 76: Oceania Quillaia Extract Market Volume (MT) Forecast by Type, 2017-2032

Table 77: Oceania Quillaia Extract Market Value (US$ Mn) Forecast by Function, 2017-2032

Table 78: Oceania Quillaia Extract Market Volume (MT) Forecast by Function, 2017-2032

Table 79: Oceania Quillaia Extract Market Value (US$ Mn) Forecast by Form, 2017-2032

Table 80: Oceania Quillaia Extract Market Volume (MT) Forecast by Form, 2017-2032

Table 81: Oceania Quillaia Extract Market Value (US$ Mn) Forecast by End Use Industry, 2017-2032

Table 82: Oceania Quillaia Extract Market Volume (MT) Forecast by End Use Industry, 2017-2032

Table 83: Oceania Quillaia Extract Market Value (US$ Mn) Forecast by Sales Channel, 2017-2032

Table 84: Oceania Quillaia Extract Market Volume (MT) Forecast by Sales Channel, 2017-2032

Table 85: MEA Quillaia Extract Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 86: MEA Quillaia Extract Market Volume (MT) Forecast by Country, 2017-2032

Table 87: MEA Quillaia Extract Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 88: MEA Quillaia Extract Market Volume (MT) Forecast by Type, 2017-2032

Table 89: MEA Quillaia Extract Market Value (US$ Mn) Forecast by Function, 2017-2032

Table 90: MEA Quillaia Extract Market Volume (MT) Forecast by Function, 2017-2032

Table 91: MEA Quillaia Extract Market Value (US$ Mn) Forecast by Form, 2017-2032

Table 92: MEA Quillaia Extract Market Volume (MT) Forecast by Form, 2017-2032

Table 93: MEA Quillaia Extract Market Value (US$ Mn) Forecast by End Use Industry, 2017-2032

Table 94: MEA Quillaia Extract Market Volume (MT) Forecast by End Use Industry, 2017-2032

Table 95: MEA Quillaia Extract Market Value (US$ Mn) Forecast by Sales Channel, 2017-2032

Table 96: MEA Quillaia Extract Market Volume (MT) Forecast by Sales Channel, 2017-2032

Figure 01: Global Quillaia Extract Market Value (US$ Mn) by Type, 2022-2032

Figure 02: Global Quillaia Extract Market Value (US$ Mn) by Function, 2022-2032

Figure 03: Global Quillaia Extract Market Value (US$ Mn) by Form, 2022-2032

Figure 04: Global Quillaia Extract Market Value (US$ Mn) by End Use Industry, 2022-2032

Figure 05: Global Quillaia Extract Market Value (US$ Mn) by Sales Channel, 2022-2032

Figure 06: Global Quillaia Extract Market Value (US$ Mn) by Region, 2022-2032

Figure 07: Global Quillaia Extract Market Value (US$ Mn) Analysis by Region, 2017-2032

Figure 08: Global Quillaia Extract Market Volume (MT) Analysis by Region, 2017-2032

Figure 09: Global Quillaia Extract Market Value Share (%) and BPS Analysis by Region, 2022-2032

Figure 10: Global Quillaia Extract Market Y-o-Y Growth (%) Projections by Region, 2022-2032

Figure 11: Global Quillaia Extract Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 12: Global Quillaia Extract Market Volume (MT) Analysis by Type, 2017-2032

Figure 13: Global Quillaia Extract Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 14: Global Quillaia Extract Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 15: Global Quillaia Extract Market Value (US$ Mn) Analysis by Function, 2017-2032

Figure 16: Global Quillaia Extract Market Volume (MT) Analysis by Function, 2017-2032

Figure 17: Global Quillaia Extract Market Value Share (%) and BPS Analysis by Function, 2022-2032

Figure 18: Global Quillaia Extract Market Y-o-Y Growth (%) Projections by Function, 2022-2032

Figure 19: Global Quillaia Extract Market Value (US$ Mn) Analysis by Form, 2017-2032

Figure 20: Global Quillaia Extract Market Volume (MT) Analysis by Form, 2017-2032

Figure 21: Global Quillaia Extract Market Value Share (%) and BPS Analysis by Form, 2022-2032

Figure 22: Global Quillaia Extract Market Y-o-Y Growth (%) Projections by Form, 2022-2032

Figure 23: Global Quillaia Extract Market Value (US$ Mn) Analysis by End Use Industry, 2017-2032

Figure 24: Global Quillaia Extract Market Volume (MT) Analysis by End Use Industry, 2017-2032

Figure 25: Global Quillaia Extract Market Value Share (%) and BPS Analysis by End Use Industry, 2022-2032

Figure 26: Global Quillaia Extract Market Y-o-Y Growth (%) Projections by End Use Industry, 2022-2032

Figure 27: Global Quillaia Extract Market Value (US$ Mn) Analysis by Sales Channel, 2017-2032

Figure 28: Global Quillaia Extract Market Volume (MT) Analysis by Sales Channel, 2017-2032

Figure 29: Global Quillaia Extract Market Value Share (%) and BPS Analysis by Sales Channel, 2022-2032

Figure 30: Global Quillaia Extract Market Y-o-Y Growth (%) Projections by Sales Channel, 2022-2032

Figure 31: Global Quillaia Extract Market Attractiveness by Type, 2022-2032

Figure 32: Global Quillaia Extract Market Attractiveness by Function, 2022-2032

Figure 33: Global Quillaia Extract Market Attractiveness by Form, 2022-2032

Figure 34: Global Quillaia Extract Market Attractiveness by End Use Industry, 2022-2032

Figure 35: Global Quillaia Extract Market Attractiveness by Sales Channel, 2022-2032

Figure 36: Global Quillaia Extract Market Attractiveness by Region, 2022-2032

Figure 37: North America Quillaia Extract Market Value (US$ Mn) by Type, 2022-2032

Figure 38: North America Quillaia Extract Market Value (US$ Mn) by Function, 2022-2032

Figure 39: North America Quillaia Extract Market Value (US$ Mn) by Form, 2022-2032

Figure 40: North America Quillaia Extract Market Value (US$ Mn) by End Use Industry, 2022-2032

Figure 41: North America Quillaia Extract Market Value (US$ Mn) by Sales Channel, 2022-2032

Figure 42: North America Quillaia Extract Market Value (US$ Mn) by Country, 2022-2032

Figure 43: North America Quillaia Extract Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 44: North America Quillaia Extract Market Volume (MT) Analysis by Country, 2017-2032

Figure 45: North America Quillaia Extract Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 46: North America Quillaia Extract Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 47: North America Quillaia Extract Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 48: North America Quillaia Extract Market Volume (MT) Analysis by Type, 2017-2032

Figure 49: North America Quillaia Extract Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 50: North America Quillaia Extract Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 51: North America Quillaia Extract Market Value (US$ Mn) Analysis by Function, 2017-2032

Figure 52: North America Quillaia Extract Market Volume (MT) Analysis by Function, 2017-2032

Figure 53: North America Quillaia Extract Market Value Share (%) and BPS Analysis by Function, 2022-2032

Figure 54: North America Quillaia Extract Market Y-o-Y Growth (%) Projections by Function, 2022-2032

Figure 55: North America Quillaia Extract Market Value (US$ Mn) Analysis by Form, 2017-2032

Figure 56: North America Quillaia Extract Market Volume (MT) Analysis by Form, 2017-2032

Figure 57: North America Quillaia Extract Market Value Share (%) and BPS Analysis by Form, 2022-2032

Figure 58: North America Quillaia Extract Market Y-o-Y Growth (%) Projections by Form, 2022-2032

Figure 59: North America Quillaia Extract Market Value (US$ Mn) Analysis by End Use Industry, 2017-2032

Figure 60: North America Quillaia Extract Market Volume (MT) Analysis by End Use Industry, 2017-2032

Figure 61: North America Quillaia Extract Market Value Share (%) and BPS Analysis by End Use Industry, 2022-2032

Figure 62: North America Quillaia Extract Market Y-o-Y Growth (%) Projections by End Use Industry, 2022-2032

Figure 63: North America Quillaia Extract Market Value (US$ Mn) Analysis by Sales Channel, 2017-2032

Figure 64: North America Quillaia Extract Market Volume (MT) Analysis by Sales Channel, 2017-2032

Figure 65: North America Quillaia Extract Market Value Share (%) and BPS Analysis by Sales Channel, 2022-2032

Figure 66: North America Quillaia Extract Market Y-o-Y Growth (%) Projections by Sales Channel, 2022-2032

Figure 67: North America Quillaia Extract Market Attractiveness by Type, 2022-2032

Figure 68: North America Quillaia Extract Market Attractiveness by Function, 2022-2032

Figure 69: North America Quillaia Extract Market Attractiveness by Form, 2022-2032

Figure 70: North America Quillaia Extract Market Attractiveness by End Use Industry, 2022-2032

Figure 71: North America Quillaia Extract Market Attractiveness by Sales Channel, 2022-2032

Figure 72: North America Quillaia Extract Market Attractiveness by Country, 2022-2032

Figure 73: Latin America Quillaia Extract Market Value (US$ Mn) by Type, 2022-2032

Figure 74: Latin America Quillaia Extract Market Value (US$ Mn) by Function, 2022-2032

Figure 75: Latin America Quillaia Extract Market Value (US$ Mn) by Form, 2022-2032

Figure 76: Latin America Quillaia Extract Market Value (US$ Mn) by End Use Industry, 2022-2032

Figure 77: Latin America Quillaia Extract Market Value (US$ Mn) by Sales Channel, 2022-2032

Figure 78: Latin America Quillaia Extract Market Value (US$ Mn) by Country, 2022-2032

Figure 79: Latin America Quillaia Extract Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 80: Latin America Quillaia Extract Market Volume (MT) Analysis by Country, 2017-2032

Figure 81: Latin America Quillaia Extract Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 82: Latin America Quillaia Extract Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 83: Latin America Quillaia Extract Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 84: Latin America Quillaia Extract Market Volume (MT) Analysis by Type, 2017-2032

Figure 85: Latin America Quillaia Extract Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 86: Latin America Quillaia Extract Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 87: Latin America Quillaia Extract Market Value (US$ Mn) Analysis by Function, 2017-2032

Figure 88: Latin America Quillaia Extract Market Volume (MT) Analysis by Function, 2017-2032

Figure 89: Latin America Quillaia Extract Market Value Share (%) and BPS Analysis by Function, 2022-2032

Figure 90: Latin America Quillaia Extract Market Y-o-Y Growth (%) Projections by Function, 2022-2032

Figure 91: Latin America Quillaia Extract Market Value (US$ Mn) Analysis by Form, 2017-2032

Figure 92: Latin America Quillaia Extract Market Volume (MT) Analysis by Form, 2017-2032

Figure 93: Latin America Quillaia Extract Market Value Share (%) and BPS Analysis by Form, 2022-2032

Figure 94: Latin America Quillaia Extract Market Y-o-Y Growth (%) Projections by Form, 2022-2032

Figure 95: Latin America Quillaia Extract Market Value (US$ Mn) Analysis by End Use Industry, 2017-2032

Figure 96: Latin America Quillaia Extract Market Volume (MT) Analysis by End Use Industry, 2017-2032

Figure 97: Latin America Quillaia Extract Market Value Share (%) and BPS Analysis by End Use Industry, 2022-2032

Figure 98: Latin America Quillaia Extract Market Y-o-Y Growth (%) Projections by End Use Industry, 2022-2032

Figure 99: Latin America Quillaia Extract Market Value (US$ Mn) Analysis by Sales Channel, 2017-2032

Figure 100: Latin America Quillaia Extract Market Volume (MT) Analysis by Sales Channel, 2017-2032

Figure 101: Latin America Quillaia Extract Market Value Share (%) and BPS Analysis by Sales Channel, 2022-2032

Figure 102: Latin America Quillaia Extract Market Y-o-Y Growth (%) Projections by Sales Channel, 2022-2032

Figure 103: Latin America Quillaia Extract Market Attractiveness by Type, 2022-2032

Figure 104: Latin America Quillaia Extract Market Attractiveness by Function, 2022-2032

Figure 105: Latin America Quillaia Extract Market Attractiveness by Form, 2022-2032

Figure 106: Latin America Quillaia Extract Market Attractiveness by End Use Industry, 2022-2032

Figure 107: Latin America Quillaia Extract Market Attractiveness by Sales Channel, 2022-2032

Figure 108: Latin America Quillaia Extract Market Attractiveness by Country, 2022-2032

Figure 109: Europe Quillaia Extract Market Value (US$ Mn) by Type, 2022-2032

Figure 110: Europe Quillaia Extract Market Value (US$ Mn) by Function, 2022-2032

Figure 111: Europe Quillaia Extract Market Value (US$ Mn) by Form, 2022-2032

Figure 112: Europe Quillaia Extract Market Value (US$ Mn) by End Use Industry, 2022-2032

Figure 113: Europe Quillaia Extract Market Value (US$ Mn) by Sales Channel, 2022-2032

Figure 114: Europe Quillaia Extract Market Value (US$ Mn) by Country, 2022-2032

Figure 115: Europe Quillaia Extract Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 116: Europe Quillaia Extract Market Volume (MT) Analysis by Country, 2017-2032

Figure 117: Europe Quillaia Extract Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 118: Europe Quillaia Extract Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 119: Europe Quillaia Extract Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 120: Europe Quillaia Extract Market Volume (MT) Analysis by Type, 2017-2032

Figure 121: Europe Quillaia Extract Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 122: Europe Quillaia Extract Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 123: Europe Quillaia Extract Market Value (US$ Mn) Analysis by Function, 2017-2032

Figure 124: Europe Quillaia Extract Market Volume (MT) Analysis by Function, 2017-2032

Figure 125: Europe Quillaia Extract Market Value Share (%) and BPS Analysis by Function, 2022-2032

Figure 126: Europe Quillaia Extract Market Y-o-Y Growth (%) Projections by Function, 2022-2032

Figure 127: Europe Quillaia Extract Market Value (US$ Mn) Analysis by Form, 2017-2032

Figure 128: Europe Quillaia Extract Market Volume (MT) Analysis by Form, 2017-2032

Figure 129: Europe Quillaia Extract Market Value Share (%) and BPS Analysis by Form, 2022-2032

Figure 130: Europe Quillaia Extract Market Y-o-Y Growth (%) Projections by Form, 2022-2032

Figure 131: Europe Quillaia Extract Market Value (US$ Mn) Analysis by End Use Industry, 2017-2032

Figure 132: Europe Quillaia Extract Market Volume (MT) Analysis by End Use Industry, 2017-2032

Figure 133: Europe Quillaia Extract Market Value Share (%) and BPS Analysis by End Use Industry, 2022-2032

Figure 134: Europe Quillaia Extract Market Y-o-Y Growth (%) Projections by End Use Industry, 2022-2032

Figure 135: Europe Quillaia Extract Market Value (US$ Mn) Analysis by Sales Channel, 2017-2032

Figure 136: Europe Quillaia Extract Market Volume (MT) Analysis by Sales Channel, 2017-2032

Figure 137: Europe Quillaia Extract Market Value Share (%) and BPS Analysis by Sales Channel, 2022-2032

Figure 138: Europe Quillaia Extract Market Y-o-Y Growth (%) Projections by Sales Channel, 2022-2032

Figure 139: Europe Quillaia Extract Market Attractiveness by Type, 2022-2032

Figure 140: Europe Quillaia Extract Market Attractiveness by Function, 2022-2032

Figure 141: Europe Quillaia Extract Market Attractiveness by Form, 2022-2032

Figure 142: Europe Quillaia Extract Market Attractiveness by End Use Industry, 2022-2032

Figure 143: Europe Quillaia Extract Market Attractiveness by Sales Channel, 2022-2032

Figure 144: Europe Quillaia Extract Market Attractiveness by Country, 2022-2032

Figure 145: East Asia Quillaia Extract Market Value (US$ Mn) by Type, 2022-2032

Figure 146: East Asia Quillaia Extract Market Value (US$ Mn) by Function, 2022-2032

Figure 147: East Asia Quillaia Extract Market Value (US$ Mn) by Form, 2022-2032

Figure 148: East Asia Quillaia Extract Market Value (US$ Mn) by End Use Industry, 2022-2032

Figure 149: East Asia Quillaia Extract Market Value (US$ Mn) by Sales Channel, 2022-2032

Figure 150: East Asia Quillaia Extract Market Value (US$ Mn) by Country, 2022-2032

Figure 151: East Asia Quillaia Extract Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 152: East Asia Quillaia Extract Market Volume (MT) Analysis by Country, 2017-2032

Figure 153: East Asia Quillaia Extract Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 154: East Asia Quillaia Extract Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 155: East Asia Quillaia Extract Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 156: East Asia Quillaia Extract Market Volume (MT) Analysis by Type, 2017-2032

Figure 157: East Asia Quillaia Extract Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 158: East Asia Quillaia Extract Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 159: East Asia Quillaia Extract Market Value (US$ Mn) Analysis by Function, 2017-2032

Figure 160: East Asia Quillaia Extract Market Volume (MT) Analysis by Function, 2017-2032

Figure 161: East Asia Quillaia Extract Market Value Share (%) and BPS Analysis by Function, 2022-2032

Figure 162: East Asia Quillaia Extract Market Y-o-Y Growth (%) Projections by Function, 2022-2032

Figure 163: East Asia Quillaia Extract Market Value (US$ Mn) Analysis by Form, 2017-2032

Figure 164: East Asia Quillaia Extract Market Volume (MT) Analysis by Form, 2017-2032

Figure 165: East Asia Quillaia Extract Market Value Share (%) and BPS Analysis by Form, 2022-2032

Figure 166: East Asia Quillaia Extract Market Y-o-Y Growth (%) Projections by Form, 2022-2032

Figure 167: East Asia Quillaia Extract Market Value (US$ Mn) Analysis by End Use Industry, 2017-2032

Figure 168: East Asia Quillaia Extract Market Volume (MT) Analysis by End Use Industry, 2017-2032

Figure 169: East Asia Quillaia Extract Market Value Share (%) and BPS Analysis by End Use Industry, 2022-2032

Figure 170: East Asia Quillaia Extract Market Y-o-Y Growth (%) Projections by End Use Industry, 2022-2032

Figure 171: East Asia Quillaia Extract Market Value (US$ Mn) Analysis by Sales Channel, 2017-2032

Figure 172: East Asia Quillaia Extract Market Volume (MT) Analysis by Sales Channel, 2017-2032

Figure 173: East Asia Quillaia Extract Market Value Share (%) and BPS Analysis by Sales Channel, 2022-2032

Figure 174: East Asia Quillaia Extract Market Y-o-Y Growth (%) Projections by Sales Channel, 2022-2032

Figure 175: East Asia Quillaia Extract Market Attractiveness by Type, 2022-2032

Figure 176: East Asia Quillaia Extract Market Attractiveness by Function, 2022-2032

Figure 177: East Asia Quillaia Extract Market Attractiveness by Form, 2022-2032

Figure 178: East Asia Quillaia Extract Market Attractiveness by End Use Industry, 2022-2032

Figure 179: East Asia Quillaia Extract Market Attractiveness by Sales Channel, 2022-2032

Figure 180: East Asia Quillaia Extract Market Attractiveness by Country, 2022-2032

Figure 181: South Asia Quillaia Extract Market Value (US$ Mn) by Type, 2022-2032

Figure 182: South Asia Quillaia Extract Market Value (US$ Mn) by Function, 2022-2032

Figure 183: South Asia Quillaia Extract Market Value (US$ Mn) by Form, 2022-2032

Figure 184: South Asia Quillaia Extract Market Value (US$ Mn) by End Use Industry, 2022-2032

Figure 185: South Asia Quillaia Extract Market Value (US$ Mn) by Sales Channel, 2022-2032

Figure 186: South Asia Quillaia Extract Market Value (US$ Mn) by Country, 2022-2032

Figure 187: South Asia Quillaia Extract Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 188: South Asia Quillaia Extract Market Volume (MT) Analysis by Country, 2017-2032

Figure 189: South Asia Quillaia Extract Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 190: South Asia Quillaia Extract Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 191: South Asia Quillaia Extract Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 192: South Asia Quillaia Extract Market Volume (MT) Analysis by Type, 2017-2032

Figure 193: South Asia Quillaia Extract Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 194: South Asia Quillaia Extract Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 195: South Asia Quillaia Extract Market Value (US$ Mn) Analysis by Function, 2017-2032

Figure 196: South Asia Quillaia Extract Market Volume (MT) Analysis by Function, 2017-2032

Figure 197: South Asia Quillaia Extract Market Value Share (%) and BPS Analysis by Function, 2022-2032

Figure 198: South Asia Quillaia Extract Market Y-o-Y Growth (%) Projections by Function, 2022-2032

Figure 199: South Asia Quillaia Extract Market Value (US$ Mn) Analysis by Form, 2017-2032

Figure 200: South Asia Quillaia Extract Market Volume (MT) Analysis by Form, 2017-2032

Figure 201: South Asia Quillaia Extract Market Value Share (%) and BPS Analysis by Form, 2022-2032

Figure 202: South Asia Quillaia Extract Market Y-o-Y Growth (%) Projections by Form, 2022-2032

Figure 203: South Asia Quillaia Extract Market Value (US$ Mn) Analysis by End Use Industry, 2017-2032

Figure 204: South Asia Quillaia Extract Market Volume (MT) Analysis by End Use Industry, 2017-2032

Figure 205: South Asia Quillaia Extract Market Value Share (%) and BPS Analysis by End Use Industry, 2022-2032

Figure 206: South Asia Quillaia Extract Market Y-o-Y Growth (%) Projections by End Use Industry, 2022-2032

Figure 207: South Asia Quillaia Extract Market Value (US$ Mn) Analysis by Sales Channel, 2017-2032

Figure 208: South Asia Quillaia Extract Market Volume (MT) Analysis by Sales Channel, 2017-2032

Figure 209: South Asia Quillaia Extract Market Value Share (%) and BPS Analysis by Sales Channel, 2022-2032

Figure 210: South Asia Quillaia Extract Market Y-o-Y Growth (%) Projections by Sales Channel, 2022-2032

Figure 211: South Asia Quillaia Extract Market Attractiveness by Type, 2022-2032

Figure 212: South Asia Quillaia Extract Market Attractiveness by Function, 2022-2032

Figure 213: South Asia Quillaia Extract Market Attractiveness by Form, 2022-2032

Figure 214: South Asia Quillaia Extract Market Attractiveness by End Use Industry, 2022-2032

Figure 215: South Asia Quillaia Extract Market Attractiveness by Sales Channel, 2022-2032

Figure 216: South Asia Quillaia Extract Market Attractiveness by Country, 2022-2032

Figure 217: Oceania Quillaia Extract Market Value (US$ Mn) by Type, 2022-2032

Figure 218: Oceania Quillaia Extract Market Value (US$ Mn) by Function, 2022-2032

Figure 219: Oceania Quillaia Extract Market Value (US$ Mn) by Form, 2022-2032

Figure 220: Oceania Quillaia Extract Market Value (US$ Mn) by End Use Industry, 2022-2032

Figure 221: Oceania Quillaia Extract Market Value (US$ Mn) by Sales Channel, 2022-2032

Figure 222: Oceania Quillaia Extract Market Value (US$ Mn) by Country, 2022-2032

Figure 223: Oceania Quillaia Extract Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 224: Oceania Quillaia Extract Market Volume (MT) Analysis by Country, 2017-2032

Figure 225: Oceania Quillaia Extract Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 226: Oceania Quillaia Extract Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 227: Oceania Quillaia Extract Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 228: Oceania Quillaia Extract Market Volume (MT) Analysis by Type, 2017-2032

Figure 229: Oceania Quillaia Extract Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 230: Oceania Quillaia Extract Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 231: Oceania Quillaia Extract Market Value (US$ Mn) Analysis by Function, 2017-2032

Figure 232: Oceania Quillaia Extract Market Volume (MT) Analysis by Function, 2017-2032

Figure 233: Oceania Quillaia Extract Market Value Share (%) and BPS Analysis by Function, 2022-2032

Figure 234: Oceania Quillaia Extract Market Y-o-Y Growth (%) Projections by Function, 2022-2032

Figure 235: Oceania Quillaia Extract Market Value (US$ Mn) Analysis by Form, 2017-2032

Figure 236: Oceania Quillaia Extract Market Volume (MT) Analysis by Form, 2017-2032

Figure 237: Oceania Quillaia Extract Market Value Share (%) and BPS Analysis by Form, 2022-2032

Figure 238: Oceania Quillaia Extract Market Y-o-Y Growth (%) Projections by Form, 2022-2032

Figure 239: Oceania Quillaia Extract Market Value (US$ Mn) Analysis by End Use Industry, 2017-2032

Figure 240: Oceania Quillaia Extract Market Volume (MT) Analysis by End Use Industry, 2017-2032

Figure 241: Oceania Quillaia Extract Market Value Share (%) and BPS Analysis by End Use Industry, 2022-2032

Figure 242: Oceania Quillaia Extract Market Y-o-Y Growth (%) Projections by End Use Industry, 2022-2032

Figure 243: Oceania Quillaia Extract Market Value (US$ Mn) Analysis by Sales Channel, 2017-2032

Figure 244: Oceania Quillaia Extract Market Volume (MT) Analysis by Sales Channel, 2017-2032

Figure 245: Oceania Quillaia Extract Market Value Share (%) and BPS Analysis by Sales Channel, 2022-2032

Figure 246: Oceania Quillaia Extract Market Y-o-Y Growth (%) Projections by Sales Channel, 2022-2032

Figure 247: Oceania Quillaia Extract Market Attractiveness by Type, 2022-2032

Figure 248: Oceania Quillaia Extract Market Attractiveness by Function, 2022-2032

Figure 249: Oceania Quillaia Extract Market Attractiveness by Form, 2022-2032

Figure 250: Oceania Quillaia Extract Market Attractiveness by End Use Industry, 2022-2032

Figure 251: Oceania Quillaia Extract Market Attractiveness by Sales Channel, 2022-2032

Figure 252: Oceania Quillaia Extract Market Attractiveness by Country, 2022-2032

Figure 253: MEA Quillaia Extract Market Value (US$ Mn) by Type, 2022-2032

Figure 254: MEA Quillaia Extract Market Value (US$ Mn) by Function, 2022-2032

Figure 255: MEA Quillaia Extract Market Value (US$ Mn) by Form, 2022-2032

Figure 256: MEA Quillaia Extract Market Value (US$ Mn) by End Use Industry, 2022-2032

Figure 257: MEA Quillaia Extract Market Value (US$ Mn) by Sales Channel, 2022-2032

Figure 258: MEA Quillaia Extract Market Value (US$ Mn) by Country, 2022-2032

Figure 259: MEA Quillaia Extract Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 260: MEA Quillaia Extract Market Volume (MT) Analysis by Country, 2017-2032

Figure 261: MEA Quillaia Extract Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 262: MEA Quillaia Extract Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 263: MEA Quillaia Extract Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 264: MEA Quillaia Extract Market Volume (MT) Analysis by Type, 2017-2032

Figure 265: MEA Quillaia Extract Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 266: MEA Quillaia Extract Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 267: MEA Quillaia Extract Market Value (US$ Mn) Analysis by Function, 2017-2032

Figure 268: MEA Quillaia Extract Market Volume (MT) Analysis by Function, 2017-2032

Figure 269: MEA Quillaia Extract Market Value Share (%) and BPS Analysis by Function, 2022-2032

Figure 270: MEA Quillaia Extract Market Y-o-Y Growth (%) Projections by Function, 2022-2032

Figure 271: MEA Quillaia Extract Market Value (US$ Mn) Analysis by Form, 2017-2032

Figure 272: MEA Quillaia Extract Market Volume (MT) Analysis by Form, 2017-2032

Figure 273: MEA Quillaia Extract Market Value Share (%) and BPS Analysis by Form, 2022-2032

Figure 274: MEA Quillaia Extract Market Y-o-Y Growth (%) Projections by Form, 2022-2032

Figure 275: MEA Quillaia Extract Market Value (US$ Mn) Analysis by End Use Industry, 2017-2032

Figure 276: MEA Quillaia Extract Market Volume (MT) Analysis by End Use Industry, 2017-2032

Figure 277: MEA Quillaia Extract Market Value Share (%) and BPS Analysis by End Use Industry, 2022-2032

Figure 278: MEA Quillaia Extract Market Y-o-Y Growth (%) Projections by End Use Industry, 2022-2032

Figure 279: MEA Quillaia Extract Market Value (US$ Mn) Analysis by Sales Channel, 2017-2032

Figure 280: MEA Quillaia Extract Market Volume (MT) Analysis by Sales Channel, 2017-2032

Figure 281: MEA Quillaia Extract Market Value Share (%) and BPS Analysis by Sales Channel, 2022-2032

Figure 282: MEA Quillaia Extract Market Y-o-Y Growth (%) Projections by Sales Channel, 2022-2032

Figure 283: MEA Quillaia Extract Market Attractiveness by Type, 2022-2032

Figure 284: MEA Quillaia Extract Market Attractiveness by Function, 2022-2032

Figure 285: MEA Quillaia Extract Market Attractiveness by Form, 2022-2032

Figure 286: MEA Quillaia Extract Market Attractiveness by End Use Industry, 2022-2032

Figure 287: MEA Quillaia Extract Market Attractiveness by Sales Channel, 2022-2032

Figure 288: MEA Quillaia Extract Market Attractiveness by Country, 2022-2032

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Analyzing Quillaia Extract Market Share & Key Trends

Market Dynamics Positively Affecting UK Quillaia Extract Sales Value.

Market Trends Driving Positive Growth in European Quillaia Extract Sales

Asia Pacific Quillaia Extract Market Insights – Size, Demand & Industry Trends 2025-2035

Extraction Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Extracts and Distillates Market

Sage Extract Market Size and Share Forecast Outlook 2025 to 2035

Fume Extractor Market Size and Share Forecast Outlook 2025 to 2035

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Kale Extract Skincare Market Size and Share Forecast Outlook 2025 to 2035

Wine Extract Market Size and Share Forecast Outlook 2025 to 2035

Amla Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dust Extractor Market Growth – Trends & Forecast 2025 to 2035

Data Extraction Software Market

Lipid Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Peony Extract Brightening Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Peony Extracts for Brightening Market Size and Share Forecast Outlook 2025 to 2035

Algae Extracts Market Size and Share Forecast Outlook 2025 to 2035

Juice Extraction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Yucca Extract Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA