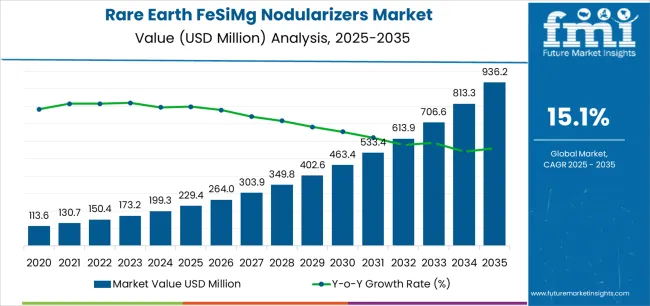

The global rare earth FeSiMg nodularizers market is projected to reach USD 941.2 million by 2035, recording an absolute increase of USD 711.8 million over the forecast period. The rare earth FeSiMg nodularizers market is valued at USD 229.4 million in 2025 and is expected to grow at a CAGR of 15.1% over the assessment period. The overall market size is expected to grow by nearly 4.1 times during the same period, supported by increasing demand for ductile iron castings across automotive, machinery, and infrastructure applications worldwide, driving demand for efficient nodularizing solutions and increasing investments in foundry technology modernization projects globally.

Rare earth FeSiMg nodularizers represent specialized metallurgical additives that transform grey cast iron into ductile iron through spheroidization of graphite structures. These materials combine ferrosilicon, magnesium, and rare earth elements in precise proportions to achieve controlled nodular graphite formation during molten iron treatment. The nodularization process enables production of ductile iron components with superior mechanical properties including tensile strength 2-3 times higher than grey cast iron, excellent impact resistance for safety-critical applications, and enhanced machinability for complex component manufacturing. Automotive applications require nodularizers that deliver consistent spheroidization across production batches to ensure component reliability in engine blocks, transmission housings, and suspension components subjected to cyclic loading throughout vehicle service life.

The rare earth FeSiMg nodularizers market expansion reflects fundamental shifts in foundry metallurgy toward higher-performance casting materials across industrial sectors. Machine tool manufacturers specify ductile iron for machine frames and structural components requiring vibration damping properties combined with dimensional stability under thermal cycling conditions. Aerospace applications adopt ductile iron for non-structural aircraft components and ground support equipment where weight optimization must balance with strength requirements and cost constraints. Energy sector infrastructure including wind turbine hubs, pipeline fittings, and valve bodies relies on ductile iron castings treated with rare earth nodularizers to achieve mechanical properties specified for demanding service environments involving pressure cycling and corrosion exposure.

Technology advancement in rare earth metallurgy enables next-generation nodularizers with improved magnesium recovery and reduced material consumption. Heavy rare earth formulations incorporating cerium and lanthanum provide superior fade resistance, maintaining nodularization effectiveness throughout extended holding periods in foundry operations. Light rare earth compositions optimize cost-performance balance for high-volume automotive casting applications where consistent nodule count and size distribution determine component quality. Advanced alloy designs combining multiple rare earth elements with controlled magnesium content allow foundries to tailor nodularizer selection to specific iron chemistry and casting process parameters.

Government regulations promoting emissions reduction and material efficiency accelerate demand for ductile iron castings treated with advanced nodularizers. European Union End-of-Life Vehicle directives create preference for recyclable iron castings over aluminum alternatives in automotive applications where component recovery supports circular economy objectives. Infrastructure investment programs in developing economies specify ductile iron for water distribution systems and sewage infrastructure, driving nodularizer consumption in pipe and fitting production. Industrial equipment safety standards mandate ductile iron for pressure-containing components, requiring foundries to maintain strict nodularization quality control using certified rare earth additives.

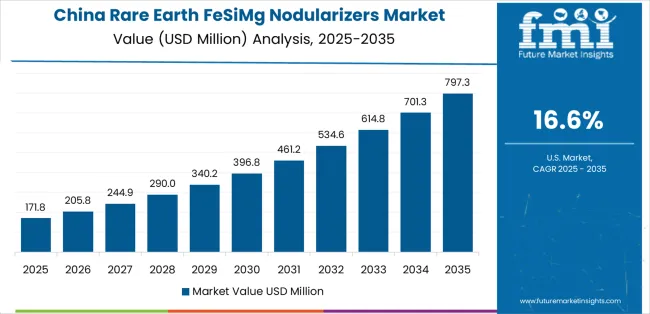

Between 2025 and 2030, the rare earth FeSiMg nodularizers market is projected to expand from USD 229.4 million to USD 536.3 million, resulting in a value increase of USD 306.9 million, which represents 43.1% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for automotive ductile iron castings and infrastructure component production, product innovation in rare earth alloy compositions and magnesium recovery optimization, as well as expanding integration with automated foundry treatment systems and quality control technologies. Companies are establishing competitive positions through investment in rare earth element sourcing infrastructure, metallurgical research capabilities, and strategic partnerships with foundry operations and casting end users.

From 2030 to 2035, the rare earth FeSiMg nodularizers market is forecast to grow from USD 536.3 million to USD 941.2 million, adding another USD 404.9 million, which constitutes 56.9% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized nodularizer formulations, including ultra-low magnesium variants for thin-wall casting applications and engineered rare earth blends tailored for specific iron chemistries, strategic collaborations between nodularizer producers and foundry equipment manufacturers, and an enhanced focus on process efficiency and material yield optimization. The growing emphasis on sustainable manufacturing and circular economy principles will drive demand for advanced, high-performance nodularizer solutions across diverse ductile iron casting applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 229.4 million |

| Market Forecast Value (2035) | USD 941.2 million |

| Forecast CAGR (2025-2035) | 15.1% |

The rare earth FeSiMg nodularizers market grows by enabling foundries to achieve superior ductile iron quality and consistent mechanical properties while meeting demanding application requirements across industrial sectors. Casting producers face mounting pressure to deliver reliable ductile iron components with predictable performance characteristics, with rare earth nodularizer solutions typically providing 15-20% improvement in nodule uniformity compared to conventional magnesium-only treatments, making advanced nodularization technologies essential for quality assurance and customer satisfaction. The ductile iron adoption movement creates demand for specialized nodularizers that can achieve consistent spheroidization across diverse iron chemistries while maintaining cost-effectiveness in high-volume production environments.

Government initiatives promoting infrastructure development and manufacturing competitiveness drive adoption in automotive, machine tools, and energy applications, where nodularizer performance has a direct impact on casting quality and component reliability. The global shift toward lightweight vehicle design paradoxically accelerates nodularizer demand as automakers replace steel fabrications with high-strength ductile iron castings offering comparable performance at reduced total cost. However, rare earth element supply chain vulnerabilities and price fluctuations may constrain adoption rates among cost-sensitive foundries and regions with limited access to reliable nodularizer suppliers operating with consistent quality standards.

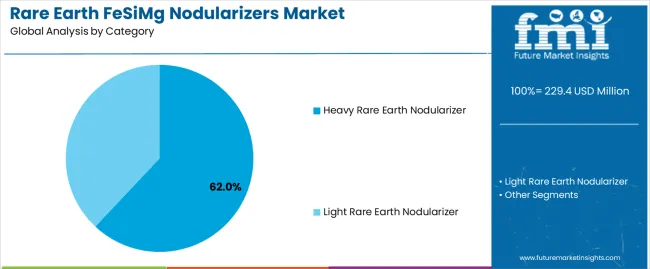

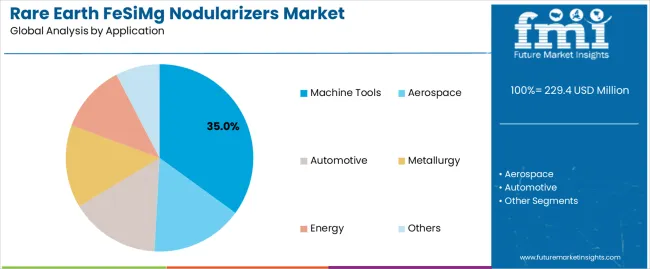

The rare earth FeSiMg nodularizers market is segmented by category, application, and region. By category, the rare earth FeSiMg nodularizers market is divided into heavy rare earth nodularizer and light rare earth nodularizer. Based on application, the rare earth FeSiMg nodularizers market is categorized into machine tools, aerospace, automotive, metallurgy, energy, and others. Regionally, the rare earth FeSiMg nodularizers market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

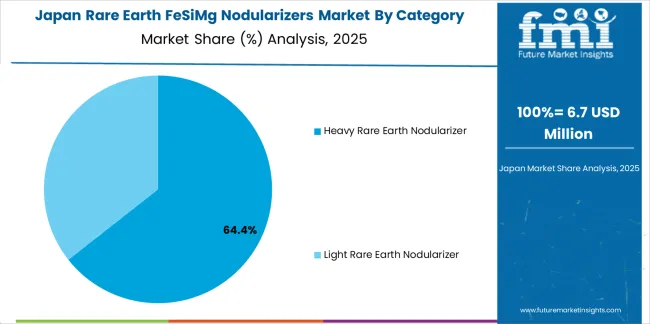

The heavy rare earth nodularizer segment represents the dominant force in the rare earth FeSiMg nodularizers market, capturing approximately 62.0% of total market share in 2025. This advanced category encompasses formulations featuring cerium, lanthanum, and other heavy rare earth elements combined with ferrosilicon and magnesium, delivering comprehensive nodularization performance with excellent fade resistance and extended treatment effectiveness. The heavy rare earth nodularizer segment leads through its superior metallurgical stability during extended holding periods, proven effectiveness across diverse iron chemistries and sulfur contents, and compatibility with both ladle treatment and in-stream addition methods used in modern foundry operations.

The light rare earth nodularizer segment maintains a substantial 38.0% market share, serving foundries that require cost-optimized solutions through formulations with lower rare earth element content suitable for standard ductile iron production applications. Key advantages driving the heavy rare earth nodularizer segment include superior fade resistance maintaining nodularization effectiveness for 45-60 minutes compared to 20-30 minutes for standard formulations, enhanced desulfurization capabilities enabling treatment of higher-sulfur iron charges without pre-treatment requirements, improved nodule uniformity across casting sections delivering consistent mechanical properties in complex geometries, and reduced magnesium consumption through more efficient spheroidization chemistry lowering total treatment costs in high-volume foundry operations.

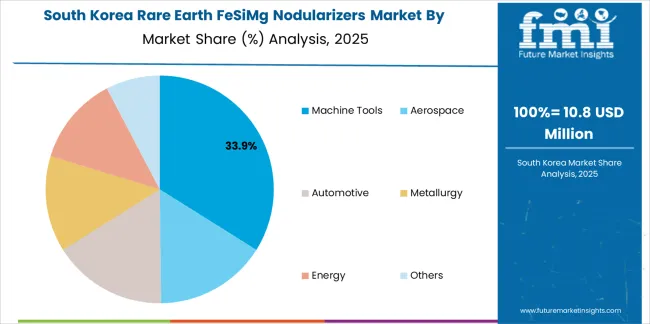

Machine tools applications dominate the rare earth FeSiMg nodularizers market with approximately 35.0% market share in 2025, reflecting the extensive deployment across machine frames, structural components, and precision casting applications requiring excellent dimensional stability and vibration damping characteristics. The machine tools segment leads through deployment in CNC machine bases, precision grinding equipment components, and heavy-duty machining center structures requiring high strength-to-weight ratios combined with superior casting integrity.

The automotive segment represents 28.0% market share through applications in engine blocks, transmission housings, suspension components, and structural castings. Aerospace accounts for 15.0% market share, while metallurgy holds 12.0%, energy represents 6.0%, and other applications collectively account for 4.0% market share. Key market dynamics supporting application preferences include machine tools requiring exceptional dimensional stability with thermal expansion characteristics matching steel components for precision assembly, automotive applications demanding high-volume production consistency with stringent mechanical property specifications across production batches, aerospace emphasizing weight optimization combined with reliable mechanical performance in certified supply chains, and energy sector infrastructure requiring corrosion resistance and pressure-containing capabilities in valve bodies and pipeline components subjected to demanding service conditions.

The market is driven by three concrete demand factors tied to casting quality requirements and industrial growth. First, automotive lightweighting initiatives create increasing requirements for high-strength ductile iron castings, with vehicle manufacturers replacing steel fabrications and aluminum castings with optimized ductile iron components offering 20-30% weight reduction compared to steel while maintaining comparable mechanical properties at lower total cost including manufacturing and material expenses. Second, infrastructure investment programs drive ductile iron pipe and fitting production, with global water distribution system modernization requiring 8-12 million tons annually of ductile iron castings treated with nodularizers to achieve specified mechanical properties and service life expectations. Third, wind energy expansion requires large ductile iron castings for turbine hubs and structural components, with offshore installations demanding castings treated with premium nodularizers to achieve mechanical properties specified for fatigue resistance under cyclic loading throughout 25-year design life.

Market restraints include rare earth element supply concentration affecting price stability and availability assurance, particularly for cerium and lanthanum sourced predominantly from limited geographic regions subject to export policy changes and trade restrictions. Technical complexity in optimizing nodularizer treatment parameters poses challenges for foundries, as achieving target nodule count specifications between 80-120 nodules per square millimeter requires precise control of magnesium addition rates, treatment temperatures, and holding time management. Quality consistency challenges across nodularizer production batches create additional barriers, since composition variations in rare earth content or particle size distribution can significantly impact spheroidization effectiveness and casting mechanical properties.

Key trends indicate accelerated adoption in Asia Pacific markets, particularly China and India where government programs support foundry modernization and automotive manufacturing expansion requiring reliable ductile iron casting supply chains. Technology advancement trends toward engineered rare earth blends optimizing specific nodularization mechanisms, reduced-magnesium formulations minimizing violent reaction hazards while maintaining spheroidization effectiveness, and integrated treatment systems combining nodularizers with inoculants in single-addition protocols enable next-generation foundry process optimization. However, the market faces potential disruption if alternative casting materials including compacted graphite iron or advanced aluminum alloys achieve cost-performance parity with ductile iron in key application segments currently driving nodularizer demand growth.

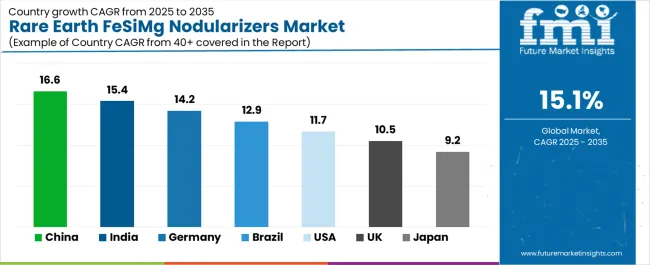

| Country | CAGR (2025-2035) |

|---|---|

| China | 16.6% |

| India | 15.4% |

| Germany | 14.2% |

| Brazil | 12.9% |

| USA | 11.7% |

| UK | 10.5% |

| Japan | 9.2% |

The rare earth FeSiMg nodularizers market is gaining momentum worldwide, with China taking the lead thanks to aggressive foundry expansion programs and automotive production growth. Close behind, India benefits from infrastructure development initiatives and manufacturing sector expansion, positioning itself as a strategic growth hub in the Asia Pacific region. Germany shows strong advancement, where established foundry industry and precision casting expertise strengthen its role in European metal casting supply chains. The USA demonstrates robust growth through automotive casting demand and infrastructure modernization programs, signaling continued investment in ductile iron production capabilities. Meanwhile, Japan stands out for its precision casting focus and quality-driven manufacturing with advanced metallurgical control, while UK continues to record consistent progress driven by foundry technology advancement and industrial casting applications. Together, China and India anchor the global expansion story, while established markets build stability and technical sophistication into the market growth path.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

China demonstrates the strongest growth potential in the Rare Earth FeSiMg Nodularizers Market with a CAGR of 16.6% through 2035. The country leads through comprehensive foundry expansion programs, automotive manufacturing growth, and infrastructure development driving adoption of advanced nodularization technologies. Growth is concentrated in major industrial regions, including Shandong, Jiangsu, Hebei, and Liaoning, where foundries and casting producers are implementing quality improvement programs for automotive supply and export markets. Distribution channels through ferroalloy distributors, direct foundry relationships, and metal trading companies expand deployment across automotive component casting, machine tool manufacturing, and infrastructure pipe production applications. The country's strategic positioning in rare earth element production provides competitive advantages for domestic nodularizer manufacturers through integrated supply chains and cost-effective raw material access.

Key market factors:

In the Gujarat, Maharashtra, Tamil Nadu, and Punjab industrial regions, the adoption of rare earth FeSiMg nodularizer systems is accelerating across automotive component foundries, infrastructure pipe manufacturing, and machine tool casting operations, driven by Make in India manufacturing initiatives and increasing quality standards for industrial castings. The market demonstrates strong growth momentum with a CAGR of 15.4% through 2035, linked to comprehensive foundry development and increasing focus on ductile iron technology adoption. Indian foundries are implementing advanced nodularization practices and metallurgical quality control to improve casting reliability while meeting international standards for automotive export markets including North America and Europe. The country's National Infrastructure Pipeline creates sustained demand for ductile iron castings, while increasing emphasis on manufacturing competitiveness drives adoption of premium nodularizers enabling consistent quality achievement.

Germany's advanced foundry sector demonstrates sophisticated implementation of rare earth FeSiMg nodularizer systems, with documented case studies showing 18-25% improvement in casting quality consistency through optimized treatment protocols. The country's foundry infrastructure in major production regions, including North Rhine-Westphalia, Bavaria, Baden-Württemberg, and Lower Saxony, showcases integration of nodularization technologies with existing casting production systems, leveraging expertise in metallurgical control and precision manufacturing. German foundries emphasize process reliability and mechanical property assurance, creating demand for premium nodularizer sources that support automotive quality requirements and machinery component specifications. The market maintains strong growth through focus on technical excellence and export market service, with a CAGR of 14.2% through 2035.

Key development areas:

The Brazilian market leads in foundry development based on integration with infrastructure programs and automotive manufacturing expansion driving demand for reliable ductile iron castings. The country shows solid potential with a CAGR of 12.9% through 2035, driven by water infrastructure investment and vehicle production growth across major industrial regions, including São Paulo, Minas Gerais, Rio Grande do Sul, and Paraná. Brazilian foundries are adopting advanced nodularizers for compliance with mechanical property specifications in infrastructure applications, particularly in ductile iron pipe production requiring corrosion resistance and pressure-containing capabilities. Technology deployment channels through ferroalloy distributors, technical service providers, and direct foundry relationships expand coverage across diverse casting market segments.

Leading market segments:

The US market leads in advanced casting technology based on integration with automotive manufacturing and sophisticated foundry metallurgy for enhanced component performance. The country shows solid potential with a CAGR of 11.7% through 2035, driven by automotive casting requirements and infrastructure modernization across major foundry regions, including the Midwest automotive corridor, Southeast manufacturing clusters, and Great Lakes industrial areas. American foundries are adopting specialized nodularizers for compliance with automotive specifications in demanding applications, particularly in safety-critical components requiring validated mechanical properties and in heavy-duty truck applications operating under severe service conditions. Technology deployment channels through ferroalloy suppliers, technical service partnerships, and direct foundry relationships expand coverage across automotive and industrial casting operations.

Leading market segments:

The UK market demonstrates sophisticated implementation focused on precision casting applications and engineered component production, with documented integration of nodularizer technologies achieving differentiated performance in automotive and aerospace foundry operations. The country maintains steady growth momentum with a CAGR of 10.5% through 2035, driven by automotive supply chain integration and manufacturing quality emphasis aligned with export market requirements. Major foundry regions, including West Midlands, Yorkshire, and Scotland, showcase advanced casting capabilities where nodularization programs integrate seamlessly with existing production infrastructure and quality assurance systems.

Key market characteristics:

In Aichi, Osaka, and Hiroshima industrial regions, foundries are implementing rare earth FeSiMg nodularizer programs to enhance casting quality and meet precision manufacturing requirements, with documented case studies showing integration in automotive component production and machine tool casting operations. The market shows solid growth potential with a CAGR of 9.2% through 2035, linked to Japanese automotive industry quality standards, precision casting capabilities, and emphasis on metallurgical control excellence. Japanese foundries are adopting specialized nodularizer formulations and advanced treatment technologies to maintain mechanical property specifications while achieving target nodule characteristics in demanding casting applications.

Market development factors:

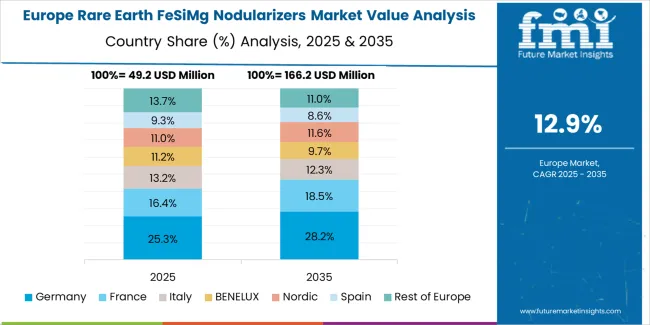

The rare earth FeSiMg nodularizers market in Europe is projected to grow from USD 78.3 million in 2025 to USD 314.8 million by 2035, registering a CAGR of 14.8% over the forecast period. Germany is expected to maintain its leadership position with a 31.2% market share in 2025, declining slightly to 30.5% by 2035, supported by its advanced foundry industry and major casting production centers including Ruhr Valley and Bavarian manufacturing clusters. France follows with a 20.5% share in 2025, projected to reach 21.0% by 2035, driven by comprehensive automotive casting infrastructure and machinery component production. The United Kingdom holds a 16.8% share in 2025, expected to decrease to 16.2% by 2035 through established foundry operations and automotive supply chain integration. Italy commands a 13.0% share, while Spain accounts for 9.0% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 9.5% to 10.3% by 2035, attributed to increasing nodularizer adoption in Eastern European foundries and emerging casting production facilities implementing ductile iron technology programs.

The Japanese rare earth FeSiMg nodularizers market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of heavy rare earth formulations and precision treatment systems with existing automotive foundry infrastructure across engine component casting, transmission housing production, and safety-critical structural casting applications. Japan's emphasis on metallurgical consistency and process control drives demand for premium nodularizer solutions that support automotive quality standards and mechanical property specifications in demanding casting applications. The market benefits from strong partnerships between international nodularizer suppliers and domestic foundry operations including major automotive component producers, creating comprehensive technology ecosystems that prioritize treatment optimization and quality assurance. Foundry centers in Aichi, Osaka, Hiroshima, and other major automotive manufacturing regions showcase advanced casting implementations where nodularization programs achieve precise nodule count control while maintaining mechanical property targets essential for component certification.

The South Korean rare earth FeSiMg nodularizers market is characterized by growing international technology provider presence, with companies maintaining significant positions through comprehensive technical service and metallurgical support capabilities for automotive and industrial casting applications. The market demonstrates increasing emphasis on casting quality consistency and automotive component reliability, as Korean foundries increasingly demand advanced nodularizers that integrate with domestic casting production and sophisticated quality control systems deployed across major automotive supply chain operations. Regional ferroalloy producers are gaining market share through strategic partnerships with international rare earth suppliers, offering specialized services including Korean foundry standard compliance support and application-specific treatment protocol development for automotive casting operations. The competitive landscape shows increasing collaboration between multinational nodularizer companies and Korean foundry technology specialists, creating hybrid service models that combine international metallurgical expertise with local casting integration knowledge and automotive quality system requirements.

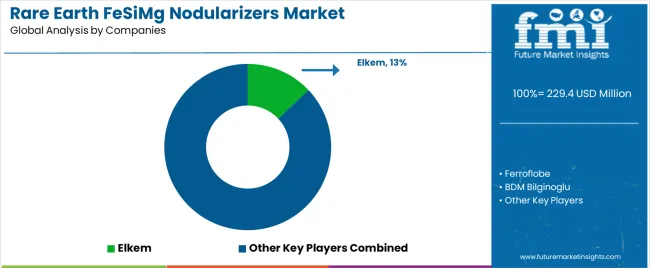

The rare earth FeSiMg nodularizers market features approximately 25-30 meaningful players with moderate fragmentation, where the top three companies control roughly 32-37% of global market share through established rare earth sourcing relationships and comprehensive product portfolios. Competition centers on rare earth element composition optimization, technical service quality, and supply chain reliability rather than price competition alone. Elkem leads with approximately 13.0% market share through its comprehensive ferroalloy portfolio including specialized nodularizer grades for diverse foundry applications.

Market leaders include Elkem, Ferroflobe, and BDM Bilginoglu, which maintain competitive advantages through decades of ferroalloy production experience, established rare earth element procurement infrastructure ensuring supply continuity, and deep expertise in foundry metallurgy supporting customer process optimization, creating trust and reliability advantages with automotive and industrial foundries. These companies leverage research capabilities in rare earth metallurgy and magnesium reaction chemistry alongside ongoing technical support relationships to defend market positions while expanding into emerging markets and specialty casting applications.

Challengers encompass Kastwel Foundries and Advanced Alloys & Manufacturing, which compete through specialized nodularizer formulations and strong regional presence in key foundry markets. Product specialists, including Westbrook Resource Ltd, Lalwani Ferroalloy, and Longnan Longyi Heavy Re Technology, focus on specific rare earth compositions or regional market segments, offering differentiated capabilities in heavy rare earth blends, customized treatment protocols, and localized technical service delivery.

Regional players and emerging ferroalloy producers create competitive pressure through localized production advantages and rapid response capabilities, particularly in high-growth markets including China and India, where proximity to foundry clusters provides advantages in logistics costs and technical service accessibility. Market dynamics favor companies that combine reliable product quality with comprehensive metallurgical support offerings that address the complete nodularization process from treatment protocol development through quality troubleshooting and mechanical property optimization.

Rare earth FeSiMg nodularizers represent critical metallurgical additives that enable foundries to achieve 15-20% improvement in nodule uniformity compared to conventional magnesium-only treatments, delivering superior ductile iron quality and consistent mechanical properties with enhanced fade resistance in demanding foundry applications. With the market projected to grow from USD 229.4 million in 2025 to USD 941.2 million by 2035 at a 15.1% CAGR, these specialized materials offer compelling advantages for machine tools applications (35.0% market share), automotive (28.0% share), and foundry operations seeking reliable spheroidization performance with extended treatment effectiveness. Scaling market adoption and technology advancement requires coordinated action across rare earth producers, ferroalloy manufacturers, foundry operations, end-use industries, and sustainable metallurgy investment capital.

| Item | Value |

|---|---|

| Quantitative Units | USD 229.4 million |

| Category | Heavy Rare Earth Nodularizer, Light Rare Earth Nodularizer |

| Application | Machine Tools, Aerospace, Automotive, Metallurgy, Energy, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Elkem, Ferroflobe, BDM Bilginoglu, Kastwel Foundries, Advanced Alloys & Manufacturing, Westbrook Resource Ltd, Lalwani Ferroalloy, Longnan Longyi Heavy Re Technology, Jiangsu Yafeng Alloy Material, Xi'an Qinli Alloy & Material |

| Additional Attributes | Dollar sales by category and application segments, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with ferroalloy manufacturers and foundry supply chains, production facility requirements and specifications, integration with foundry treatment systems and quality control programs, innovations in rare earth metallurgy and magnesium encapsulation technologies, and development of specialized nodularizers with enhanced fade resistance and process safety capabilities. |

The global rare earth fesimg nodularizers market is estimated to be valued at USD 229.4 million in 2025.

The market size for the rare earth fesimg nodularizers market is projected to reach USD 936.2 million by 2035.

The rare earth fesimg nodularizers market is expected to grow at a 15.1% CAGR between 2025 and 2035.

The key product types in rare earth fesimg nodularizers market are heavy rare earth nodularizer and light rare earth nodularizer.

In terms of application, machine tools segment to command 35.0% share in the rare earth fesimg nodularizers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rare Gas Market Size and Share Forecast Outlook 2025 to 2035

Rare Disease Clinical Trials Market Size and Share Forecast Outlook 2025 to 2035

Rare Sugar Market Size and Share Forecast Outlook 2025 to 2035

Rare NRG1 Fusion Market Size and Share Forecast Outlook 2025 to 2035

Rare Neurological Disease Treatment Market Report – Demand, Growth & Industry Outlook 2025-2035

Rare Inflammatory Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Rare Gastrointestinal Diseases Treatment Market Trends and Forecast 2025 to 2035

Industry Share Analysis for Rare Neurological Disease Treatment Providers

Rare Disease Gene Therapy Market

Rare-earth Barium Copper Oxide (REBCO) Wire Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Rare Earth Elements Companies

Rare Earth Metals Market Demand & Trends 2024-2034

Infrared Heating Pad Market Size and Share Forecast Outlook 2025 to 2035

Infrared Thermography Market Size and Share Forecast Outlook 2025 to 2035

Infrared Thermometer Market Growth – Trends & Forecast 2025 to 2035

Infrared Search and Track (IRST) Systems Market Analysis - Growth & Forecast 2025 to 2035

Infrared Sensors Market Analysis – Growth & Trends 2025 to 2035

Infrared (IR) LEDs Market by Component by Application & Region Forecast till 2035

Infrared Imaging Market

Mid-infrared Lasers Market Analysis - Growth & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA