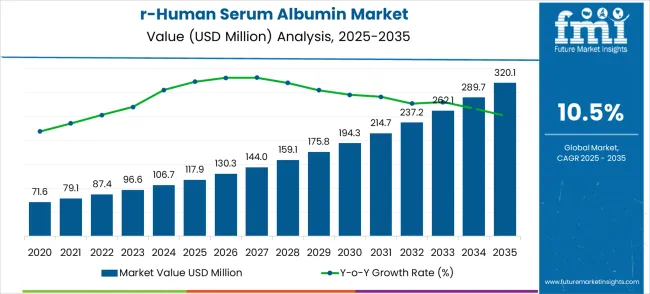

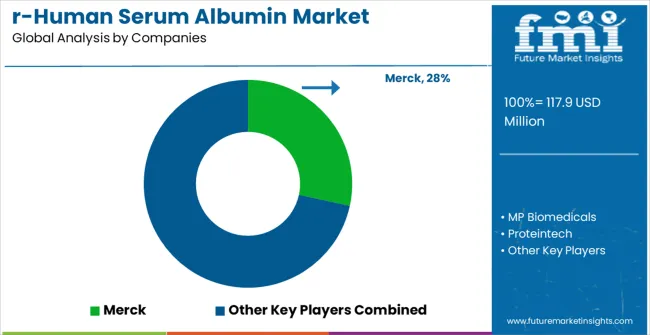

The recombinant human serum albumin market is estimated at USD 117.9 million in 2025 and is projected to reach USD 320.1 million by 2035, recording a CAGR of 10.5%. The market demonstrates steady year-on-year growth driven by demand from biopharmaceutical research, therapeutic applications, and laboratory use. Revenue trends indicate consistent increases from USD 71.6 million in 2020 to USD 117.9 million in 2025, reflecting gradual adoption in preclinical and clinical studies. The expanding use of recombinant proteins in drug formulation and cell therapy research underpins this growth trajectory, establishing recombinant human serum albumin as a critical reagent across multiple biomedical and laboratory workflows.

| Metric | Value |

|---|---|

| Recombinant Human Serum Albumin Market Value (2025) | USD 117.9 million |

| Recombinant Human Serum Albumin Market Forecast Value (2035) | USD 320.1 million |

| Recombinant Human Serum Albumin Market Forecast CAGR | 10.5% |

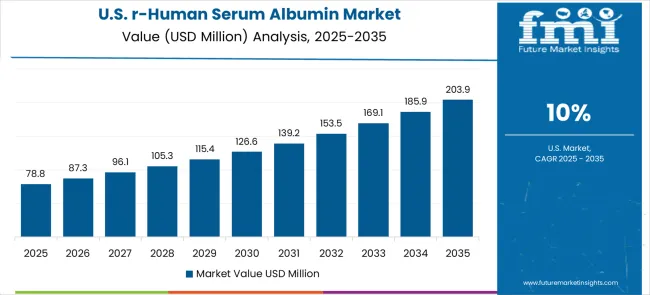

Between 2025 and 2030, the market rises from USD 117.9 million to USD 194.3 million, showing an annual increase of roughly 10.4–10.5%. This phase reflects growing investments in biologics and increased reliance on high-purity serum albumin in experimental and therapeutic formulations. Laboratories and biopharmaceutical companies are prioritizing consistency and reproducibility in their experiments, leading to greater adoption of recombinant human serum albumin. The revenue increments during these years indicate that early-stage market growth is fueled primarily by research demand and emerging applications in regenerative medicine and drug delivery studies.

The period from 2030 to 2035 marks an accelerated growth phase, with market values climbing from USD 194.3 million to USD 320.1 million. During this stage, adoption expands beyond conventional laboratory research to advanced therapeutic, diagnostic, and biopharmaceutical applications. The recombinant reagent is increasingly integrated into drug formulation, chronic disease modeling, and immune-response studies. Year-on-year growth remains consistent at approximately 10.5%, reflecting strong market acceptance and the maturation of recombinant human serum albumin as a core reagent for both academic research and commercial biopharmaceutical development.

The recombinant HSA market is expanding rapidly, driven by biologics growth, regenerative medicine, and safer alternatives to plasma-derived albumin. By 2035, these pathways together unlock USD 15–20 billion in incremental revenue opportunities, with China, India, and Europe leading adoption.

rHSA provides superior stability for monoclonal antibodies, vaccines, and cell therapies, avoiding risks from plasma-derived sources. Largest near-term pool: USD 4.0–5.5 billion

As demand for stem cell therapies, CAR-T, and tissue engineering accelerates, rHSA becomes a critical supplement in serum-free media. Expected pool: USD 3.0–4.0 billion

Used as a blocking agent and stabilizer in immunoassays, molecular diagnostics, and rapid test kits. Incremental pool: USD 2.0–2.5 billion

Low-cost, scalable expression platforms (yeast, rice, tobacco) can reduce COGS and expand affordability across Asia & emerging markets. Value pool: USD 1.5–2.2 billion

Clinical-grade rHSA is essential for autologous cell therapies and advanced biologics in oncology and rare diseases. Opportunity pool: USD 1.5–2.0 billion

Positioning rHSA as virus-free, animal-free, and ethically sourced enables premium pricing and faster regulatory approvals. Adds USD 1.0–1.3 billion

China and India are rapidly scaling biologics and vaccine manufacturing, creating disproportionate demand. Regional pool: USD 0.8–1.2 billion

Partnerships with pharma, CDMOs, and academic institutes accelerate adoption and create exclusivity opportunities. Disruptive pool: USD 0.5–0.8 billion

Market expansion is being supported by the rapid increase in biopharmaceutical research and development activities worldwide and the corresponding need for reliable, consistent protein reagents in cell culture applications. Modern biotechnology relies on precise protein formulations to ensure proper cell growth, differentiation, and product expression in therapeutic manufacturing processes. Even minor variations in albumin quality can significantly impact cell culture performance, making recombinant alternatives essential for maintaining batch-to-batch consistency and regulatory compliance.

The growing complexity of cell and gene therapy development and increasing safety concerns are driving demand for animal-free, well-characterized protein products from certified suppliers with appropriate quality systems. Regulatory agencies are increasingly requiring detailed documentation of raw materials used in therapeutic manufacturing to ensure patient safety and product efficacy. Manufacturing requirements and pharmaceutical industry specifications are establishing standardized quality criteria that require specialized production capabilities and validated testing procedures.

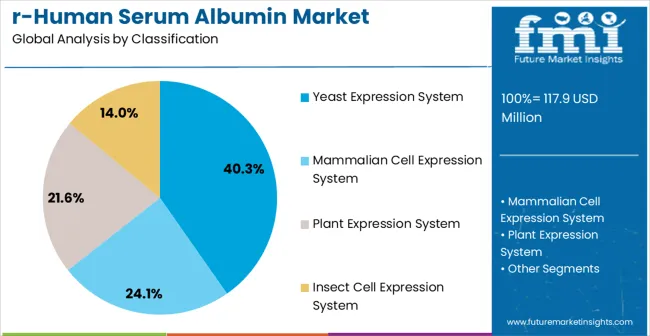

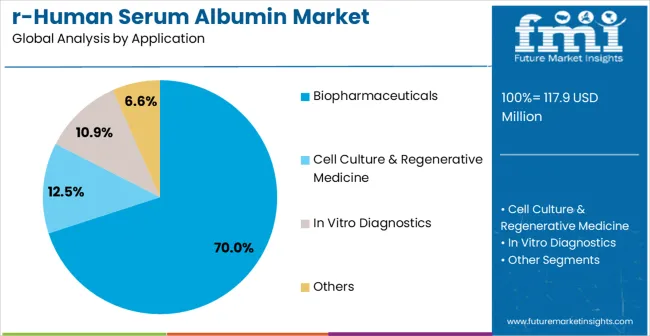

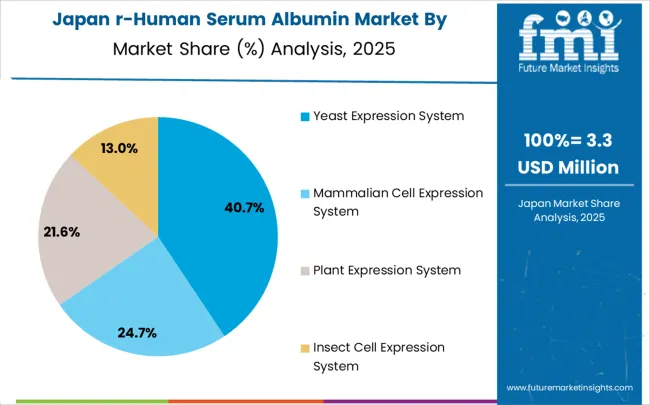

The market is segmented by expression system, application, end user, and region. By expression system, the market is divided into yeast expression system, mammalian cell expression system, plant expression system, and insect cell expression system. Based on application, the market is categorized into biopharmaceuticals, cell culture and regenerative medicine, in vitro diagnostics, and others. In terms of end user, the market is segmented into pharmaceutical companies, biotechnology companies, research institutes, and contract research organizations. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The yeast expression system is expected to hold a 40.3% share of the recombinant human serum albumin (rHSA) market in 2025, making it the leading production method. Its dominance stems from the scalability, cost-effectiveness, and proven efficiency of yeast-based platforms, particularly Pichia pastoris and Saccharomyces cerevisiae. Yeast expression systems enable high-yield production while ensuring post-translational modifications comparable to human proteins, a critical factor in therapeutic and biopharmaceutical applications. In addition, yeast cells are robust, easy to culture, and adaptable to industrial-scale fermentation, allowing manufacturers to achieve consistent quality and regulatory compliance.

Their ability to facilitate protein folding and secretion reduces downstream processing costs, further strengthening their market position.

The biopharmaceuticals segment is forecasted to be the largest consumer of recombinant human serum albumin (rHSA) in 2025, capturing approximately 70% of the total market, reflecting its indispensable role in drug development and formulation. Albumin serves as a multifunctional excipient, widely used for protein stabilization, solubilization, and drug delivery. In biologics development, rHSA prevents protein aggregation, extends shelf-life, and ensures formulation consistency, making it essential in monoclonal antibody, vaccine, and therapeutic protein manufacturing. Its applications extend to oncology, immunology, and rare disease therapies, where albumin is leveraged for nanoparticle conjugation and controlled release systems.

The rising number of biologics entering clinical pipelines, coupled with increasing approvals of albumin-based drug delivery platforms, is fueling demand. Unlike plasma-derived albumin, recombinant variants offer a safer and pathogen-free alternative, eliminating the risks of viral transmission and supply variability. This makes them highly preferred in regulated pharmaceutical markets.

The recombinant human serum albumin (rHSA) market is driven by rising demand from biopharmaceutical research, cell therapies, and gene therapy applications, where high-purity, animal-free albumin ensures protein stabilization and reduces contamination risks. Technological advancements in expression systems, purification, and quality monitoring enhance consistency, support modified albumin variants, and improve manufacturing efficiency. Market growth is restrained by high production costs, need for specialized facilities, and varying global regulatory requirements. Key trends include expanding adoption in advanced therapies, development of stable albumin variants with extended half-life, and increasing collaborations between manufacturers and biopharmaceutical companies to accelerate product availability and market penetration.

The growing deployment of cell and gene therapies is driving demand for high-quality, animal-free culture media components that support specialized cell expansion and manufacturing processes. Recombinant albumin provides essential protein stabilization and cell protection functions without the contamination risks associated with animal-derived products. These applications are particularly valuable for therapeutic cell manufacturing and gene therapy vector production that require stringent quality controls and defined media compositions.

Market growth is restrained by the high costs and complexity of recombinant albumin production. Specialized facilities, advanced purification systems, and stringent quality controls are required to maintain protein consistency. Scaling up manufacturing while meeting regulatory standards adds operational challenges. Expression systems need optimization for yield and purity, and regional regulatory variations further complicate commercialization. These factors increase costs and limit broader adoption, particularly in emerging markets.

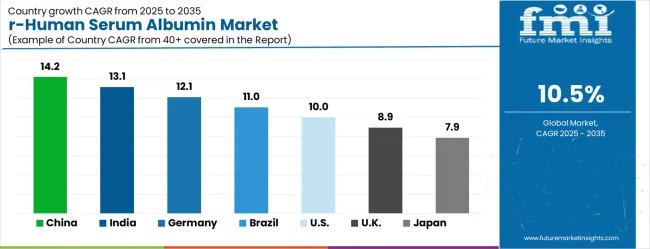

| Country | CAGR (2025–2035) |

|---|---|

| China | 14.2% |

| India | 13.1% |

| Germany | 12.1% |

| Brazil | 11% |

| United States | 10% |

| United Kingdom | 8.9% |

| Japan | 7.9% |

The recombinant human serum albumin (RHSA) market, growth rates vary by country, reflecting differing stages of biotechnology and pharmaceutical development. China leads with a 5.9% CAGR, driven by large-scale pharmaceutical manufacturing and strong government initiatives in biotech expansion. India follows at 5.5%, supported by rising research activity, academic-industry collaboration, and pharmaceutical export growth. Germany shows steady progress at 5.1%, leveraging its advanced manufacturing systems and strict regulatory standards. Brazil grows at 4.6%, benefiting from facility modernization and increasing adoption of recombinant proteins in research. The United States posts a solid 4.2% CAGR, emphasizing quality, innovation, and FDA compliance. The United Kingdom grows at 3.7%, reflecting strong research institutions and biotech innovation programs. Finally, Japan, with 3.3% CAGR, expands more slowly but focuses on specialized, high-quality applications such as diagnostics and regenerative medicine. This landscape highlights rapid growth in emerging economies and steady, compliance-driven growth in mature markets.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from recombinant human serum albumin in China is projected to account for 14.2% CAGR of the global market, driven by rapid expansion of pharmaceutical manufacturing and increasing investment in biotechnology research infrastructure. The country's growing biopharmaceutical sector and expanding cell culture applications are creating significant demand for high-quality recombinant proteins. Major biotechnology companies and research institutions are establishing comprehensive protein production capabilities to support domestic pharmaceutical development and export markets. Government biotechnology development programs and regulatory modernization initiatives are facilitating market expansion and encouraging adoption of advanced expression systems.

Revenue from recombinant human serum albumin in India is expanding to capture 13.1% CAGR of the global market, supported by increasing biotechnology research activities and growing pharmaceutical manufacturing sector development. The country's expanding academic research infrastructure and increasing collaboration between universities and industry are driving demand for specialized protein reagents. Contract research organizations and biotechnology companies are gradually establishing production capabilities to serve both domestic and international markets. Government initiatives supporting biotechnology development and pharmaceutical export growth are creating opportunities for market expansion.

Demand for recombinant human serum albumin in Germany accounts for 12.1% CAGR of the global market, supported by the country's emphasis on pharmaceutical innovation and precision manufacturing capabilities. German biotechnology companies are implementing advanced expression systems and purification technologies that meet stringent quality standards and regulatory requirements. The market is characterized by focus on technical excellence, comprehensive quality documentation, and compliance with European pharmaceutical regulations. Research institutions and pharmaceutical companies maintain strong demand for premium-grade albumin products.

Revenue from recombinant human serum albumin in Brazil is growing to represent 11.0% CAGR, driven by increasing pharmaceutical industry development and expanding biotechnology research capabilities. The country's established pharmaceutical manufacturing sector is gradually incorporating recombinant protein technologies to support drug development and production activities. Academic institutions and research centers are increasing their use of animal-free culture media components. Government support for biotechnology development and pharmaceutical industry modernization programs are facilitating market growth and technology adoption.

Demand for recombinant human serum albumin in the USA accounts for 10.0% CAGR, driven by advanced biotechnology research infrastructure and stringent pharmaceutical manufacturing requirements. American pharmaceutical companies and research institutions maintain high demand for premium-grade albumin products that meet FDA regulatory standards. The market benefits from established supply chains, comprehensive quality systems, and strong emphasis on product consistency and documentation. Biotechnology companies are developing specialized albumin variants for targeted therapeutic applications.

Demand for recombinant human serum albumin in the UK represents 8.9% CAGR, supported by strong pharmaceutical research capabilities and established biotechnology sector development. British research institutions and pharmaceutical companies maintain consistent demand for high-quality albumin products in drug development applications. The market is characterized by emphasis on research excellence, regulatory compliance, and collaboration between academic institutions and industry partners. Government support for biotechnology innovation and pharmaceutical development continues to drive market participation.

Demand for recombinant human serum albumin in Japan accounts for 7.9% CAGR, driven by advanced pharmaceutical industry requirements and sophisticated biotechnology research infrastructure. Japanese companies focus on high-quality albumin products for specialized applications including diagnostics and regenerative medicine. The market benefits from stringent quality standards, comprehensive regulatory frameworks, and strong emphasis on product consistency. Research institutions and pharmaceutical companies maintain steady demand for premium-grade albumin products.

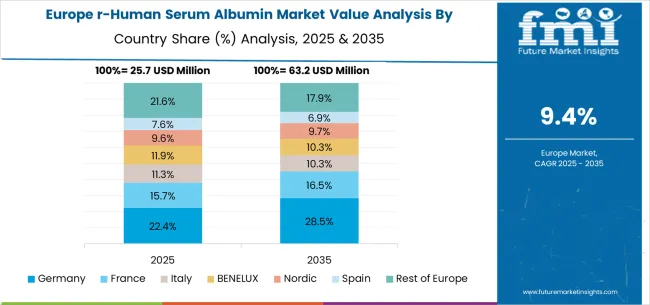

The recombinant human serum albumin (rHSA) market in Europe is forecast to expand from USD 25.7 million in 2025 to USD 63.2 million by 2035, reflecting a CAGR of 9.4% over the forecast period. Germany will lead, increasing from 22.4% in 2025 to 28.5% by 2035, supported by its advanced pharmaceutical manufacturing base, biotechnology innovation, and regulatory leadership. France will hold 15.7% in 2025, rising slightly to 16.5% by 2035, reflecting consistent demand for pharmaceutical and diagnostic applications. Italy will represent 11.3% in 2025, improving to 12.5% by 2035, supported by investments in medical research and therapeutic biotechnology.

The BENELUX region will account for 11.9% in 2025, softening to 10.3% by 2035, showing moderate adoption but slower growth compared to Germany and France. The Nordic countries will hold 9.6% in 2025, steady at 9.7% by 2035, driven by demand in regenerative medicine and biotechnology applications. Spain will contribute 7.6% in 2025, easing to 6.9% by 2035, reflecting modest adoption of recombinant albumin in diagnostics. Meanwhile, the Rest of Europe will decline from 21.6% in 2025 to 17.9% by 2035, reflecting a stronger consolidation of market demand in Germany and France.

The recombinant human serum albumin market is defined by competition among biotechnology companies, pharmaceutical suppliers, and specialty reagent manufacturers. Companies are investing in advanced expression systems, scalable production platforms, standardized quality processes, and specialized product variants to deliver consistent, reliable, and cost-effective albumin solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and market presence.

Merck operates globally, providing comprehensive recombinant albumin solutions integrated with biotechnology research and pharmaceutical development applications. MP Biomedicals offers specialized albumin products with emphasis on quality consistency and regulatory compliance. Proteintech delivers high-quality recombinant proteins with focus on research applications and custom solutions. InVitria provides innovative serum-free media components with advanced albumin formulations.

Sino Biological offers extensive recombinant protein portfolios with emphasis on Asian market development. Reprokine specializes in recombinant protein production with focus on cost-effective manufacturing. ACROBiosystems provides high-quality research reagents with comprehensive quality documentation. Assay Genie, Cell Biologics, Sartorius AG, Yeasen, MedChemExpress, Abcam, and Basic Pharma offer specialized albumin products, standardized quality procedures, and reliable supply capabilities across global and regional networks.

| Items | Values |

|---|---|

| Quantitative Units | USD 117.9 million |

| Expression System | Yeast Expression System, Mammalian Cell Expression System, Plant Expression System, Insect Cell Expression System |

| Application | Biopharmaceuticals, Cell Culture & Regenerative Medicine, In Vitro Diagnostics, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, and 40+ countries |

| Key Companies Profiled | Merck, MP Biomedicals, Proteintech, InVitria, Sino Biological, Reprokine, ACROBiosystems, Assay Genie, Cell Biologics, Sartorius AG, Yeasen, MedChemExpress, Abcam, Basic Pharma |

| Additional Attributes | Dollar sales by expression system, application, and end user, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established biotechnology companies and emerging suppliers, buyer preferences for quality consistency versus cost optimization, integration with advanced expression systems and purification technologies, innovations in protein engineering and specialized albumin variants, and adoption of automated production platforms with real-time quality monitoring and batch consistency controls. |

The global recombinant human serum albumin market is estimated to be valued at USD 117.9 million in 2025.

The market size for the recombinant human serum albumin market is projected to reach USD 320.1 million by 2035.

The recombinant human serum albumin market is expected to grow at a 10.5% CAGR between 2025 and 2035.

The key product types in recombinant human serum albumin market are yeast expression system, mammalian cell expression system, plant expression system and insect cell expression system.

In terms of application, biopharmaceuticals segment to command 70.0% share in the recombinant human serum albumin market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Recombinant DNA Market Size and Share Forecast Outlook 2025 to 2035

Recombinant Vaccines Market Analysis – Trends & Future Outlook 2018-2028

Recombinant Human Oncostatin M Reagent Market Size and Share Forecast Outlook 2025 to 2035

Prokaryotic Recombinant Protein Market

Human Torso Simulator Market Size and Share Forecast Outlook 2025 to 2035

Human Transferrin Detection Kit Market Size and Share Forecast Outlook 2025 to 2035

Human Papilloma Virus Testing Market Size and Share Forecast Outlook 2025 to 2035

Human-Centric Lighting Market Size and Share Forecast Outlook 2025 to 2035

Human Identification Market Size and Share Forecast Outlook 2025 to 2035

Human Immunodeficiency Virus Type 1 (HIV 1) Market Size and Share Forecast Outlook 2025 to 2035

Humanoid Robot Market Size and Share Forecast Outlook 2025 to 2035

Humanized Mouse Model Market Size and Share Forecast Outlook 2025 to 2035

Human Milk Oligosaccharides Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Human Combinatorial Antibody Libraries (HuCAL) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Human Growth Hormone (HGH) Treatment and Drugs Market Trends - Growth & Forecast 2025 to 2035

Human Augmentation Technology Market Growth - Trends & Forecast 2025 to 2035

Key Companies & Market Share in the Human Milk Oligosaccharides Sector

Human RSV Treatment Market Insights - Innovations & Forecast 2025 to 2035

Human Osteoblasts Market – Growth & Forecast 2024-2034

Human Capital Management Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA