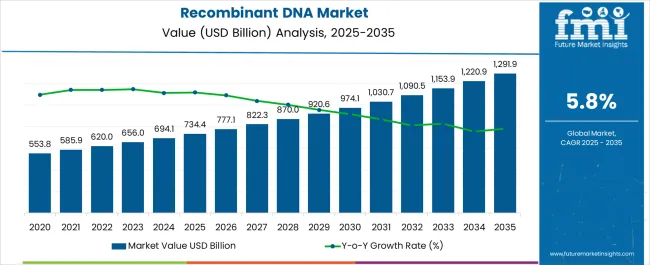

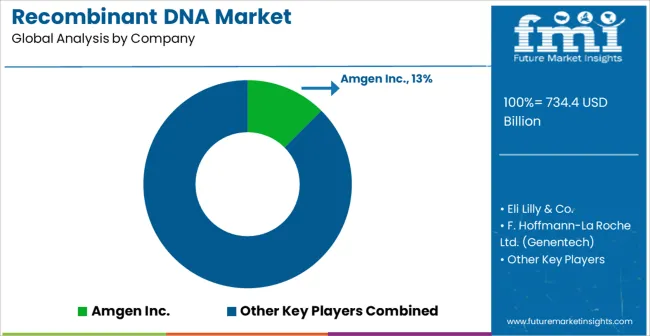

The Recombinant DNA Market is estimated to be valued at USD 734.4 billion in 2025 and is projected to reach USD 1291.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

| Metric | Value |

|---|---|

| Recombinant DNA Market Estimated Value in (2025 E) | USD 734.4 billion |

| Recombinant DNA Market Forecast Value in (2035 F) | USD 1291.9 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The Recombinant DNA market is experiencing significant growth, driven by increasing demand for genetically engineered therapies and biopharmaceutical innovations. Rising prevalence of chronic diseases, infectious conditions, and genetic disorders is driving the need for novel and effective treatments. Advancements in molecular biology, gene editing technologies, and bioengineering techniques are enhancing the development of recombinant DNA products with improved efficacy and safety profiles.

The market is further supported by increasing investments from both public and private sectors in research and development, as well as collaborations between biotechnology firms and academic institutions. Regulatory frameworks supporting the development and commercialization of genetically engineered products are improving clinical adoption. The integration of recombinant DNA technologies in drug development pipelines is enabling targeted therapies and personalized medicine solutions.

Growing awareness about the potential of recombinant DNA applications in healthcare, coupled with technological advancements in large-scale production and quality control, is shaping market dynamics As the biotechnology and pharmaceutical sectors expand globally, recombinant DNA products are expected to maintain strong adoption, positioning the market for sustained growth over the coming decade.

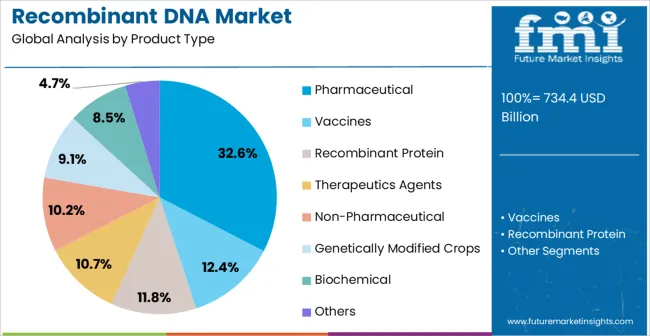

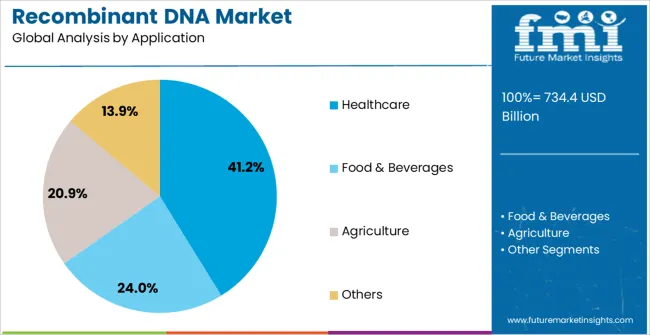

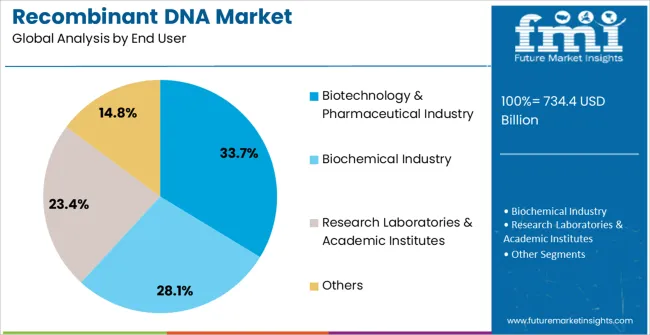

The recombinant dna market is segmented by product type, application, end user, and geographic regions. By product type, recombinant dna market is divided into Pharmaceutical, Vaccines, Recombinant Protein, Therapeutics Agents, Non-Pharmaceutical, Genetically Modified Crops, Biochemical, and Others. In terms of application, recombinant dna market is classified into Healthcare, Food & Beverages, Agriculture, and Others. Based on end user, recombinant dna market is segmented into Biotechnology & Pharmaceutical Industry, Biochemical Industry, Research Laboratories & Academic Institutes, and Others. Regionally, the recombinant dna industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pharmaceutical product type segment is projected to hold 32.6% of the Recombinant DNA market revenue in 2025, establishing it as the leading product type. This dominance is being driven by the increasing adoption of recombinant DNA-based drugs in the treatment of various diseases, including cancer, autoimmune disorders, and infectious conditions. Advanced drug design enabled by recombinant DNA technologies allows for precise targeting of disease pathways, improving therapeutic outcomes while reducing adverse effects.

The ability to scale production for clinical and commercial applications enhances accessibility and cost-effectiveness, reinforcing its adoption. Pharmaceutical companies are leveraging recombinant DNA products to develop next-generation biologics and vaccines, expanding their portfolios and meeting growing healthcare demands.

Continuous advancements in gene expression systems, protein engineering, and purification processes have strengthened reliability and consistency in production, supporting wider implementation As healthcare systems prioritize personalized medicine and biologic therapies, the pharmaceutical segment is expected to maintain its market leadership, driven by ongoing innovation and strong clinical acceptance.

The healthcare application segment is anticipated to account for 41.2% of the market revenue in 2025, making it the largest application area. Growth is being driven by increasing integration of recombinant DNA technologies in diagnostics, therapeutics, and preventive care. Healthcare providers are leveraging recombinant DNA products to improve treatment accuracy, disease monitoring, and patient outcomes.

Advances in recombinant DNA research enable the development of vaccines, gene therapies, and biologic drugs that can target specific genetic or pathological conditions. Regulatory approvals and clinical validation of recombinant DNA applications are enhancing adoption in hospitals, specialty clinics, and research centers. The ability to personalize treatments and improve efficacy while reducing side effects strengthens the value proposition of recombinant DNA applications in healthcare.

Increasing awareness among healthcare professionals about genetic-based therapies, combined with rising patient demand for advanced treatment options, is further accelerating growth As healthcare infrastructure expands globally and precision medicine becomes more widespread, the healthcare application segment is expected to remain the primary driver of market revenue.

The biotechnology and pharmaceutical industry end-user segment is projected to hold 33.7% of the market revenue in 2025, establishing it as the leading end-user category. Growth is being driven by the increasing use of recombinant DNA technologies in research and development pipelines for novel therapeutics, biologics, and vaccines. Biotechnology and pharmaceutical companies are adopting these technologies to develop scalable, high-quality products while meeting regulatory standards and reducing development timelines.

Investment in advanced laboratory infrastructure, gene editing platforms, and automated production systems is further supporting adoption. The ability to leverage recombinant DNA for drug discovery, preclinical testing, and large-scale production improves operational efficiency and accelerates market entry.

Partnerships and collaborations between biotech firms, academic institutions, and pharmaceutical companies are expanding innovation and commercialization opportunities As demand for targeted therapies, biologics, and personalized medicine rises, the biotechnology and pharmaceutical industry segment is expected to maintain its leading position, driven by ongoing technological advancements and strategic investments in recombinant DNA applications.

Recombinant DNA technology or Genetic Engineering is a process in which creation and manipulation of DNA sequences in a specific order resulting in genetically modified organism and product. The recombinant DNA technology is a functional application of biotechnology that expanded to include innovative and expansive sciences such as genomics, applied immunology, development of pharmaceutical therapeutics and diagnostic tools.

There are several biological techniques used to make recombinant DNA. The potential usage of recombinant DNA in conventional and non- conventional application such as medicinal, agricultural and industrial. In medicine, Recombinant DNA has been used to mass-production of insulin, Follistim, human growth hormones, monoclonal antibodies, human albumin, vaccines, and other drugs.

The major recombinant DNA products available in the pharmaceutical market with high market share are insulin, vaccines, and monoclonal antibodies. Industrial applications include useful protein or enzyme production on a large scale The beginning of recombinant DNA technology directed a new platform for the production of a wide range of therapeutic agents in sufficient quantities for human use.

Over the past years, recombinant DNA Products has witnessed tremendous growth in medical field (production of recombinant drugs and therapeutics) and industrial segment (production of Enzyme and biochemicals). The overall global recombinant DNA market expected to shows prominent growth over the forecast period.

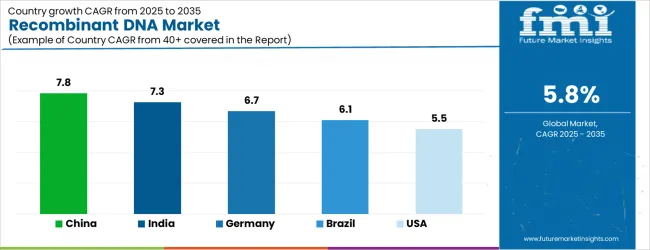

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| Brazil | 6.1% |

| USA | 5.5% |

| UK | 4.9% |

| Japan | 4.4% |

The Recombinant DNA Market is expected to register a CAGR of 5.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.8%, followed by India at 7.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 4.4%, yet still underscores a broadly positive trajectory for the global Recombinant DNA Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.7%. The USA Recombinant DNA Market is estimated to be valued at USD 263.2 billion in 2025 and is anticipated to reach a valuation of USD 263.2 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 39.7 billion and USD 22.0 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 734.4 Billion |

| Product Type | Pharmaceutical, Vaccines, Recombinant Protein, Therapeutics Agents, Non-Pharmaceutical, Genetically Modified Crops, Biochemical, and Others |

| Application | Healthcare, Food & Beverages, Agriculture, and Others |

| End User | Biotechnology & Pharmaceutical Industry, Biochemical Industry, Research Laboratories & Academic Institutes, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amgen Inc., Eli Lilly & Co., F. Hoffmann-La Roche Ltd. (Genentech), GenScript, Horizon Discovery, Merck KGaA, New England Biolabs, Novartis AG, Novo Nordisk A/S, Pfizer Inc., Sanofi, Syngene International, and Thermo Fisher Scientific |

The global recombinant DNA market is estimated to be valued at USD 734.4 billion in 2025.

The market size for the recombinant DNA market is projected to reach USD 1,291.9 billion by 2035.

The recombinant DNA market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in recombinant DNA market are pharmaceutical, vaccines, recombinant protein, therapeutics agents, non-pharmaceutical, genetically modified crops, biochemical and others.

In terms of application, healthcare segment to command 41.2% share in the recombinant DNA market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DNA Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

DNA Microarray Market Forecast Outlook 2025 to 2035

DNA Methylation Conversion Kit Market Size and Share Forecast Outlook 2025 to 2035

Recombinant Human Serum Albumin Market Size and Share Forecast Outlook 2025 to 2035

Recombinant Human Oncostatin M Reagent Market Size and Share Forecast Outlook 2025 to 2035

DNA-Modified Plant Extracts Market Analysis - Size and Share Forecast Outlook 2025 to 2035

DNA-Repair Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

DNA Chromatography Chips Market Size and Share Forecast Outlook 2025 to 2035

DNA Methylation Market Size and Share Forecast Outlook 2025 to 2035

DNA Polymerase Market Analysis - Size, Share, and Forecast 2025 to 2035

DNA Sequencing Services Market Trends - Growth & Forecast 2025 to 2035

DNA Synthesis Market Growth - Trends & Forecast 2025 to 2035

DNA-Based Skin Care Market – Trends & Forecast 2025 to 2035

DNA/RNA Extraction Market Growth & Demand 2025 to 2035

DNA Sequencing Electrophoresis Systems Market

DNA modifying agents Market

Recombinant Vaccines Market Analysis – Trends & Future Outlook 2018-2028

cDNA Synthesis Market

Pet DNA Testing Market Analysis by Animal Type, Sample Type, Test Type, End User and Region: Forecast for 2025 to 2035

Japan DNA Polymerase Market Analysis – Growth, Applications & Outlook 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA