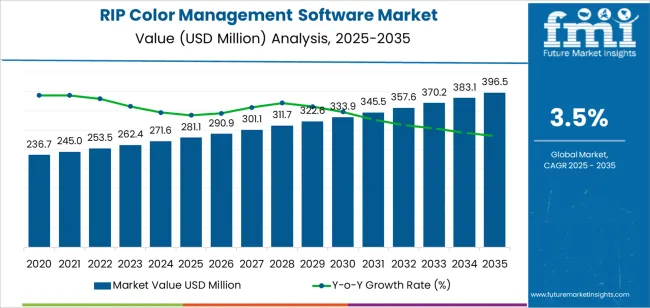

The RIP (Raster Image Processor) color management software market is forecast to grow from USD 281.1 million in 2025 to USD 396.6 million by 2035, reflecting a CAGR of 3.5%. RIP color management software plays a critical role in the printing industry by ensuring color accuracy and consistency across different devices and mediums, from digital files to physical prints. The growing demand for high-quality print outputs, particularly in commercial printing, packaging, and signage, will drive the market’s steady growth. Additionally, with the shift towards digitization and the increasing importance of brand consistency in marketing, the demand for robust color management solutions will continue to rise.

The market is also benefiting from the increasing adoption of digital printing technologies, which require advanced RIP software to manage and process high-resolution images and ensure accurate color reproduction. As industries like advertising, publishing, and textile printing continue to innovate and demand more precise control over color output, the RIP color management software market will experience steady, incremental growth through the forecast period. Additionally, the increasing focus on automated workflows and sustainability in the printing sector will further drive the demand for software that optimizes both production efficiency and color consistency.

The peak-to-trough analysis of the RIP color management software market highlights the fluctuations in the market’s growth rate over the forecast period from 2025 to 2035, identifying the moments when growth accelerates (peaks) or decelerates (troughs). The market will experience consistent, gradual growth with minor fluctuations, but no drastic peaks or troughs due to the relatively stable demand for color management solutions in the printing industry.

From 2025 to 2030, the market will grow steadily from USD 281.1 million to USD 322.6 million, adding USD 41.5 million in value over the first five years. The early peak in this phase is expected around 2027-2028 when advancements in digital printing technologies and the rise of e-commerce with customized printing services create a temporary surge in demand for RIP software. After this peak, the growth will slightly decelerate but will still remain positive.

Between 2030 and 2035, the market will continue to grow from USD 322.6 million to USD 396.6 million, reflecting steady, continued demand for software in color management. The trough in this phase may occur in the early 2030s, as adoption rates for the technology reach a more stable plateau. After the trough, the growth trajectory will stabilize and continue its upward trend as the market matures and the adoption of color management software becomes more widespread across various industries. Overall, the market’s growth will remain gradual with minor peaks and troughs, indicating steady, sustained expansion over the forecast period.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 281.1 million |

| Market Forecast Value (2035) | USD 396.6 million |

| Forecast CAGR (2025 to 2035) | 3.5% |

The RIP (Raster Image Processor) color management software market is expanding as organizations in commercial printing, packaging, textile printing, and large-format media increasingly demand solutions that deliver accurate color reproduction and streamlined workflow automation. These software systems enable color space conversion, color correction, and matching across devices, ensuring consistency from image source through to output device. The market is projected to grow steadily, driven by increasing demand for high-quality, consistent print output across various media types and industries.

Another major driver is the shift toward digital and on-demand printing, which requires sophisticated RIP color management tools to handle complex image files, varied substrates, and multi-device coordination. Advances in cloud deployment, artificial intelligence-based profiling, and integration with enterprise workflows enhance the value proposition of these systems. Additionally, smaller print operations adopting digital press technologies are contributing to market growth by upgrading legacy systems. However, challenges such as high software licensing costs, integration complexity with existing print infrastructure, and competition from free or open-source RIP tools may limit growth in certain segments. Despite these challenges, the need for precise color management and efficient print workflows continues to drive the market forward.

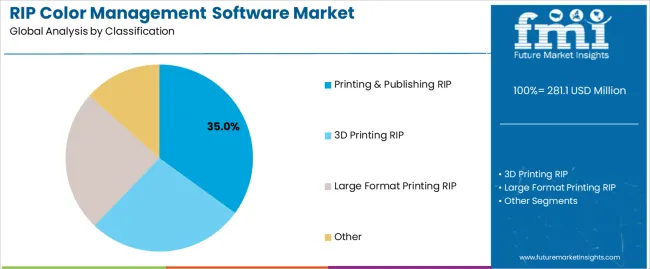

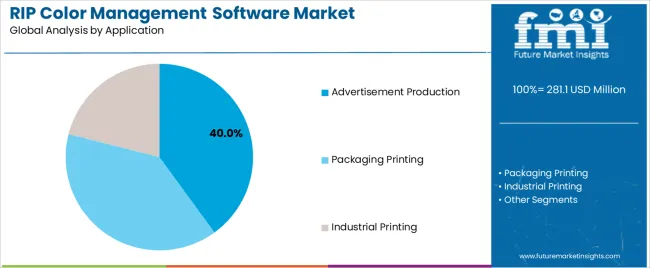

The RIP color management software market is segmented by classification and application. The leading classification is printing & publishing RIP, which holds 35% of the market share, while the dominant application segment is advertisement production, accounting for 40% of the market. These segments play a crucial role in the growth of the market, driven by the increasing demand for high-quality color management solutions in printing and digital production, particularly in advertising and packaging.

The printing & publishing RIP classification leads the RIP color management software market with a 35% share. Printing & publishing RIP software is essential for converting digital files into printable formats, ensuring accurate color reproduction, and maintaining color consistency across different media types. This type of RIP software is widely used in the commercial printing industry, where precise color management is critical to meeting customer expectations for high-quality prints in publications, brochures, and other printed materials.

The demand for printing & publishing RIP software is driven by the need for efficient workflows, enhanced color accuracy, and consistency across various print jobs. As the printing industry continues to embrace digital technologies and larger-scale production processes, the need for advanced RIP software to handle complex color management tasks remains strong. This classification is expected to maintain its leadership due to the ongoing importance of color precision in the publishing and commercial printing sectors.

The advertisement production application segment is the leading segment in the RIP color management software market, accounting for 40% of the market share. Advertisement production requires high-quality print materials that represent brand colors accurately, which makes color management crucial in the production of banners, posters, billboards, and other promotional materials. RIP software helps ensure that the color consistency is maintained across various media and printing devices, making it an essential tool in the advertising industry.

The rise in digital advertising, coupled with the increasing demand for large-format prints, has driven the adoption of RIP color management software in advertisement production. Companies in the advertising industry require precise color matching and the ability to print on various substrates, which makes RIP software a key enabler of high-quality production. As advertising continues to rely on large and vibrant printed materials, the advertisement production sector will continue to drive demand for advanced RIP color management solutions.

The RIP (Raster Image Processor) color management software market is expanding as digital printing workflows increasingly demand precise color reproduction, workflow automation and compatibility across devices. This software enables accurate color space conversion, color correction and consistency from image creation to final output. As applications such as packaging printing, large format signage and industrial printing grow, the value of robust RIP color management solutions rises. Meanwhile, pressures such as budget constraints, competition from integrated software bundles and rapid evolution of printing technologies affect how players position offerings and adopt new capabilities.

Several key drivers support growth in this market. First, the rise of high volume, high speed digital printing in packaging, advertising displays and industrial graphics increases demand for software that ensures color accuracy and brand consistency. In these environments, inconsistencies in output undermine quality and trigger reprint costs, pushing users toward advanced RIP color management solutions. Second, the shift toward integrated workflows, where RIP engines link to color management modules, prepress automation and cloud based platforms, elevates the importance of specialized software. Third, growth in emerging printing markets such as textile printing, large format signage and small runs drives the need for flexible, cost effective RIP color management solutions. Altogether, these factors create strong momentum for vendor innovation and adoption.

Despite favorable drivers, the market faces several constraints. The higher cost of advanced software licenses, especially for features such as cloud deployment, AI enabled profiling or multi device color workflows, can limit access for smaller print service providers or in cost sensitive regions. Integration complexity is also a barrier: RIP color management modules must interface with diverse print engines, color profiles, substrates and standards, which increases deployment effort and training needs. In addition, rapidly evolving print equipment standards and form factors may shorten software lifecycles and increase risk for users investing in solutions. Finally, competition from bundled RIP modules or OEM embedded software may reduce standalone market potential.

Emerging trends in this market include growing adoption of artificial intelligence and machine learning based color correction and profiling, enabling automatic optimization based on substrate, ink and print system feedback. Another trend is migration to cloud based RIP color management platforms, supporting distributed print operations, remote monitoring and subscription models rather than perpetual licenses. There is also increasing focus on multi device, hybrid workflows where one RIP system must manage large format, textile and packaging print jobs, driving modular, scalable software architectures. Geographic growth in regions such as Asia Pacific and Latin America offers new opportunity as print service providers upgrade digital infrastructure and seek improved color workflows.

The RIP (Raster Image Processor) color management software market is experiencing growth due to the increasing need for precise and consistent color reproduction in printing and imaging industries. RIP software plays a crucial role in optimizing and managing color accuracy and quality during the printing process, making it indispensable in industries such as digital printing, packaging, textiles, and graphic design. As demand for high-quality printed materials grows across sectors, the need for reliable and advanced RIP color management solutions is rising.

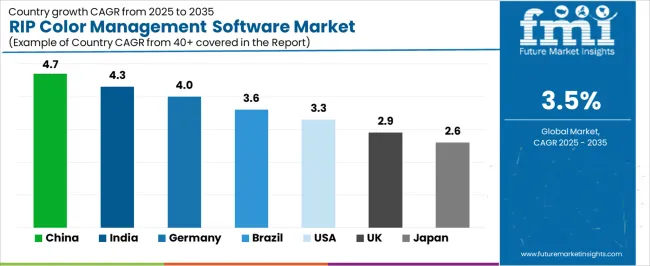

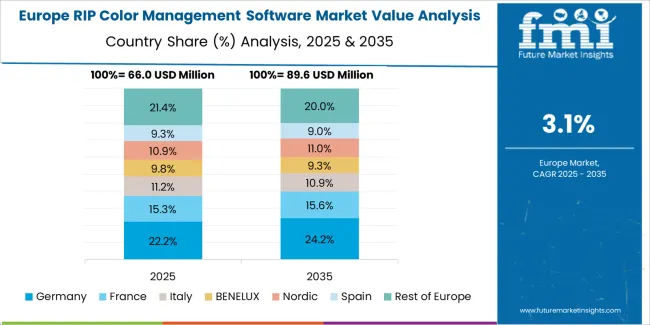

Countries with large manufacturing and printing industries, such as China and India, are seeing significant market growth, while developed economies like the USA and Germany are also witnessing steady demand driven by the modernization of printing technologies and the increasing use of color-managed workflows. This analysis explores the factors driving the growth of the RIP color management software market across various countries.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 4.7% |

| India | 4.3% |

| Germany | 4% |

| Brazil | 3.6% |

| USA | 3.3% |

| United Kingdom | 2.9% |

| Japan | 2.6% |

China leads the RIP color management software market with a CAGR of 4.7%. The country’s rapidly expanding manufacturing and printing sectors are key drivers of this market growth. China is a global leader in industries like textiles, packaging, and electronics, all of which require high-quality printing solutions. As the demand for precision color management in these sectors rises, the need for reliable RIP color management software is growing.

Additionally, China’s increasing adoption of digital printing technologies and e-commerce packaging solutions is driving the demand for color management software. The government’s emphasis on improving industrial efficiency and modernizing the manufacturing sector further supports the need for advanced RIP solutions to meet international standards for color accuracy and consistency. As China’s printing and design industries continue to grow, the demand for RIP color management software will remain strong.

India’s RIP color management software market is growing at a CAGR of 4.3%. India’s booming printing and packaging industries, coupled with the increasing demand for digital printing technologies, are fueling the adoption of RIP color management software. As India expands its manufacturing capabilities and modernizes its printing infrastructure, businesses are increasingly turning to RIP solutions to ensure high-quality color accuracy in their printing processes.

The rise of e-commerce, which has led to increased packaging needs, and the growing demand for customized printing solutions in various sectors, including textiles, packaging, and advertising, further drive the need for effective color management. As India continues to modernize its printing technologies, the demand for RIP color management software will continue to grow, ensuring steady market expansion.

Germany’s RIP color management software market is projected to grow at a CAGR of 4.0%. Germany, known for its advanced manufacturing and engineering industries, has a well-established printing and packaging sector, which drives the demand for high-quality RIP color management solutions. The country’s ongoing investment in digital printing technologies, along with its commitment to precision and quality, contributes to the steady growth of the RIP color management software market.

Germany’s strong focus on sustainability in the printing and packaging industries, particularly through reducing waste and improving color consistency, further fuels the demand for RIP software. As Germany continues to innovate in printing technologies and color management workflows, the market for RIP color management software will continue to grow, driven by the need for enhanced printing processes and color accuracy.

Brazil’s RIP color management software market is expected to grow at a CAGR of 3.6%. Brazil’s printing and packaging industries are expanding, fueled by the country’s growing consumer goods sector and increased demand for high-quality printed materials. As Brazil invests in modernizing its printing technology, businesses are increasingly adopting advanced RIP color management software to ensure consistent and accurate color reproduction across various applications.

The growth of digital printing and e-commerce packaging in Brazil is also contributing to the rising demand for RIP software. With the need for custom packaging, marketing materials, and textiles, color management has become essential to meet the expectations of international clients and maintain consistent quality. As Brazil continues to expand its manufacturing and printing capabilities, the demand for RIP color management software will continue to rise.

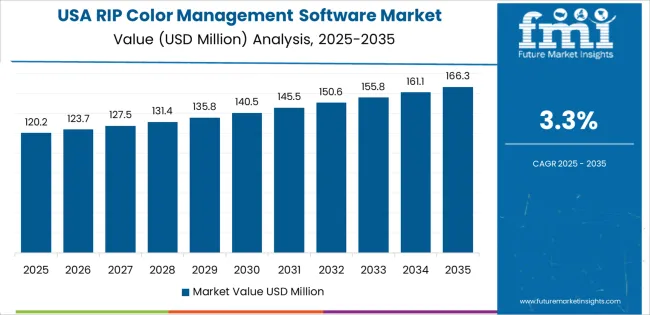

The United States has a projected CAGR of 3.3% for the RIP color management software market. The U.S. printing industry, particularly in sectors like advertising, publishing, and packaging, continues to see steady growth. As businesses demand higher precision in color reproduction, RIP color management software is becoming essential for managing complex color workflows and ensuring print consistency.

The U.S. market is also being influenced by the increasing use of digital printing technologies and the growing demand for customized and high-quality printed materials. As the printing and design industries in the U.S. continue to evolve, the need for reliable RIP solutions to meet color management standards will support continued growth in the market.

The United Kingdom’s RIP color management software market is projected to grow at a CAGR of 2.9%. The UK’s well-established printing and packaging industries, along with its focus on design and quality, contribute to the steady demand for RIP color management solutions. The country’s investment in digital printing technologies and the growing focus on sustainability in printing practices further drives the market for RIP color management software.

The UK’s adoption of eco-friendly and energy-efficient printing technologies, combined with the need for precise color accuracy in various sectors, ensures continued demand for RIP solutions. As the UK continues to innovate in printing technologies and digital workflows, the RIP color management software market will see sustained growth.

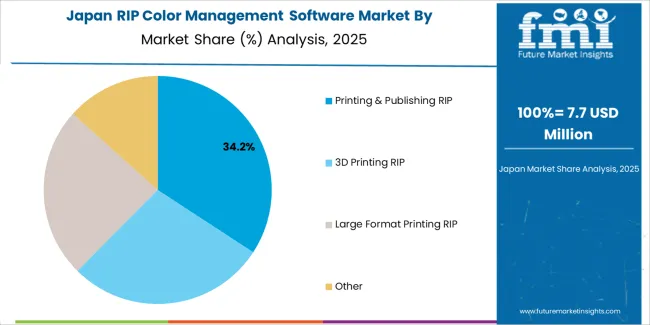

Japan’s RIP color management software market is expected to grow at a CAGR of 2.6%. Japan has a strong printing and packaging industry, driven by its technological advancements and demand for high-quality printed materials. The country’s focus on precision, high-quality production, and innovation in digital printing technologies contributes to the increasing adoption of RIP color management software.

Japan’s demand for customized and precise printing solutions, particularly in sectors like electronics, automotive, and packaging, further drives the need for reliable RIP software. As Japan continues to embrace digital and eco-friendly printing technologies, the demand for RIP color management software is expected to grow, although at a slower pace compared to emerging markets. The market will continue to expand as Japan modernizes its printing infrastructure and improves its color management workflows.

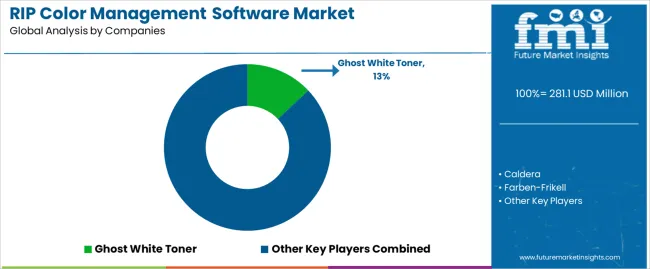

In the RIP color management software market, companies such as Ghost White Toner (holding around 13% share), Caldera, Farben Frikell, Graphic Competence Center Deutschland, Roland DG, Onyx Graphics, IGEPA Systems, Ergosoft AG, Mimaki Engineering, Seiko Epson Corporation, GMG Color, Kothari Infotech, OneVision Software AG, Hybrid Software Group, Kornit Digital, SAi, Electronics for Imaging, Wasatch Computer Technology, Serendipity Software Pty, and Shenzhen Hosonsoft compete for position. The global market was valued at approximately USD 273 million in 2024 and is forecast to reach about USD 347 million by 2031, reflecting a compound annual growth rate (CAGR) of around 3.5%.

Competitive strategies among these firms revolve around three main themes. First, product innovation is emphasised. Vendors differentiate via advanced color calibration, device-link ICC workflows, cloud-connected profiling, and algorithmic color-matching to reduce print errors and ensure brand-color fidelity. Second, integration and ecosystem positioning matter. Many companies bundle RIP software with print-output hardware, target large format, textile, packaging or signage verticals, and support hybrid printing environments.

Third, regional and service-model reach is critical. Firms expand into emerging markets, support multiple languages and substrates, and offer subscription or SaaS-type licensing along with maintenance and profile libraries. Brochures typically highlight software features such as automatic spot-color replacement, colour gamut preview, layout and nesting support, output-device driver compatibility, and workflow-automation capabilities. By aligning their value propositions-accurate colour output, operational efficiency, and workflow integration-these companies aim to capture share in the evolving RIP color management software market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Classification | Printing & Publishing RIP, 3D Printing RIP, Large Format Printing RIP, Other |

| Application | Advertisement Production, Packaging Printing, Industrial Printing |

| Key Companies Profiled | Ghost White Toner, Caldera, Farben-Frikell, Graphic Competence Center Deutschland, Roland DG, Onyx Graphics, IGEPA Systems, Ergosoft AG, Mimaki Engineering, Seiko Epson Corporation, GMG Color, Kothari Infotech, OneVision Software AG, Hybrid Software Group, Kornit Digital, SAi, Electronics for Imaging, Wasatch Computer Technology, Serendipity Software Pty, Shenzhen Hosonsoft |

| Additional Attributes | The market analysis includes dollar sales by classification and application categories. It also covers regional adoption trends across major markets. The competitive landscape highlights key manufacturers in the RIP color management software market, with innovations in software solutions for printing and publishing, 3D printing, and large format printing. Trends in the growing demand for advanced color management in advertisement production, packaging printing, and industrial printing are explored, along with advancements in software features, printing accuracy, and workflow optimization. |

The global RIP color management software market is estimated to be valued at USD 281.1 million in 2025.

The market size for the RIP color management software market is projected to reach USD 396.5 million by 2035.

The RIP color management software market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in RIP color management software market are printing & publishing rip, 3d printing rip, large format printing RIP and other.

In terms of application, advertisement production segment to command 40.0% share in the RIP color management software market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ripeness Indicator Labels Market Size and Share Forecast Outlook 2025 to 2035

Ripening Cultures Market Analysis by Type, Form, Application, Distribution Channel, and Region Forecast Through 2035

RIP Software Market Size and Share Forecast Outlook 2025 to 2035

Triptorelin Market Analysis by Drug Type, Application, Distribution Channel, Mode, and Region through 2035

Grip Tape Market Insights – Growth & Trends 2024-2034

Grip Seal Bags Market

Triple X Syndrome Management Market Size and Share Forecast Outlook 2025 to 2035

Peripheral Intravenous Catheter Market Size and Share Forecast Outlook 2025 to 2035

Peripheral T-Cell Lymphoma Treatment Market Size and Share Forecast Outlook 2025 to 2035

Strip Pack Market Size and Share Forecast Outlook 2025 to 2035

Peripheral Embolization Device Market Size and Share Forecast Outlook 2025 to 2035

Peripheral Vascular Devices Market Size and Share Forecast Outlook 2025 to 2035

Peripheral Vascular Stent Market Analysis - Size, Trends & Forecast 2025 to 2035

Strip Pack Laminates Market – Trends & Forecast 2025 to 2035

Strip Warmers Market - Precision Heating for Commercial Kitchens 2025 to 2035

Peripheral Angioplasty Market Analysis - Share, Size, and Forecast 2025 to 2035

Peripherally Inserted Central Catheter Analysis by Product Type by Indication and by End User through 2035

Market Share Breakdown of Leading Strip Pack Laminates Manufacturers

Peripheral Micro Catheters Market Trends – Industry Forecast 2024-2034

Peripheral Neuritis Treatment Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA