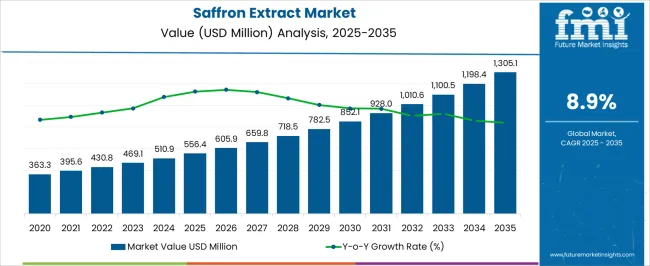

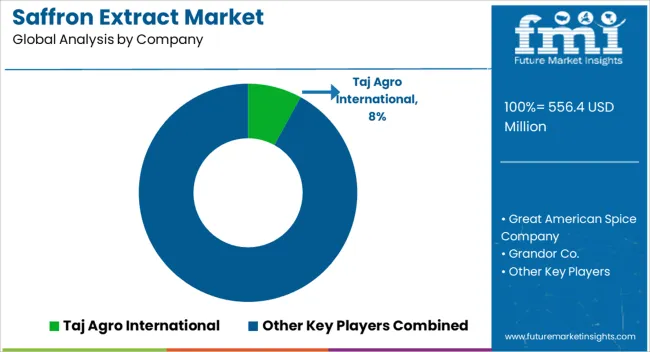

The saffron extract market is estimated to be valued at USD 556.4 million in 2025 and is projected to reach USD 1305.1 million by 2035, registering a compound annual growth rate (CAGR) of 8.9% over the forecast period.

The growth curve of this market demonstrates a steady upward trajectory that reflects both consistent demand expansion and widening adoption across multiple end-use industries. Starting at USD 363.3 million in 2024, the market shows sequential gains year-over-year, reaching beyond USD 605.9 million by 2026 and continuing to climb with notable momentum, surpassing USD 1,010.6 million by 2032 before closing in on its 2035 projection. Unlike a flat or irregular trend, this curve suggests a sustained acceleration phase where growth is being propelled by increasing consumer awareness of natural health supplements, rising use of saffron extract in cosmetics and pharmaceuticals, and broader application in nutraceutical formulations.

The progression also signals that premiumization of food and beverage categories is contributing to adoption, particularly as saffron extract is recognized for its antioxidant and anti-inflammatory properties. Moreover, the gradual steepening in the curve from 2029 onward indicates that scalability and penetration into emerging markets will likely play a stronger role in later years. This consistent upward slope underscores both stability and resilience, positioning saffron extract as a high-value natural ingredient market with long-term potential across regions.

| Metric | Value |

|---|---|

| Saffron Extract Market Estimated Value in (2025 E) | USD 556.4 million |

| Saffron Extract Market Forecast Value in (2035 F) | USD 1305.1 million |

| Forecast CAGR (2025 to 2035) | 8.9% |

The saffron extract market occupies a strong but niche position across multiple parent industries, holding distinct percentages that highlight its influence within health, food, and cosmetic segments. Within the broader botanical extracts industry, saffron extract commands nearly 6–7% share, supported by its premium positioning and limited supply. In the nutraceuticals and dietary supplements segment, its share stands at about 4–5%, where it is valued for mood-enhancing and antioxidant benefits that make it a favored ingredient in capsules, powders, and functional blends. The food flavoring and beverage additives category accounts for around 3–4% share contribution from saffron extract, where its unique taste and natural coloring properties are highly regarded in premium and ethnic formulations.

In the cosmetics and personal care sector, saffron extract represents close to 2–3% share, primarily in formulations targeting skin brightening, anti-aging, and luxury beauty applications. Within the global spice derivatives industry, saffron extract makes up roughly 1–2% share, constrained by high production costs but recognized for unmatched aroma and sensory characteristics. Its market strength is underpinned by consumer willingness to pay a premium for authenticity, coupled with expanding adoption in wellness products, gourmet foods, and high-end cosmetics. Limited cultivation areas, labor-intensive harvesting, and strict quality certification remain defining factors that influence both growth potential and competitive differentiation, ensuring saffron extract maintains its identity as a high-value specialty ingredient.

The market is experiencing sustained expansion, driven by increasing consumer awareness regarding natural health products and the rising application of saffron across food, beverage, cosmetic, and pharmaceutical sectors. Demand has been further supported by the shift toward clean-label and plant-based ingredients, with saffron extract valued for its antioxidant, anti-inflammatory, and therapeutic properties. Advancements in processing and extraction technologies have improved the purity, potency, and stability of saffron-based products, enhancing their appeal to both manufacturers and consumers.

Growing disposable incomes in emerging economies, coupled with expanding e-commerce distribution channels, have widened market reach. Additionally, strategic collaborations between saffron producers and nutraceutical or cosmetic companies have facilitated product innovation and diversification.

Regulatory approvals for saffron extract use in functional food and wellness applications are further reinforcing adoption As premium natural ingredients continue to gain consumer preference, the saffron extract market is anticipated to maintain strong growth momentum, supported by evolving health trends and expanding application portfolios.

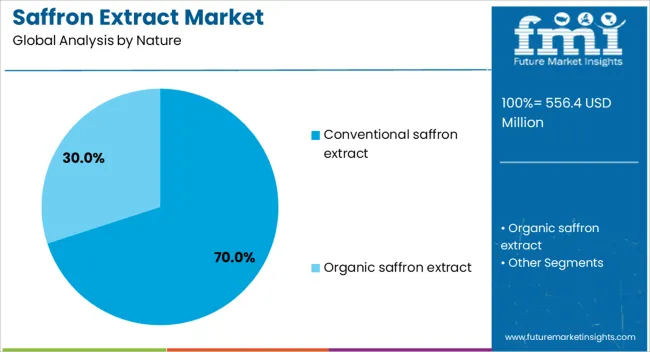

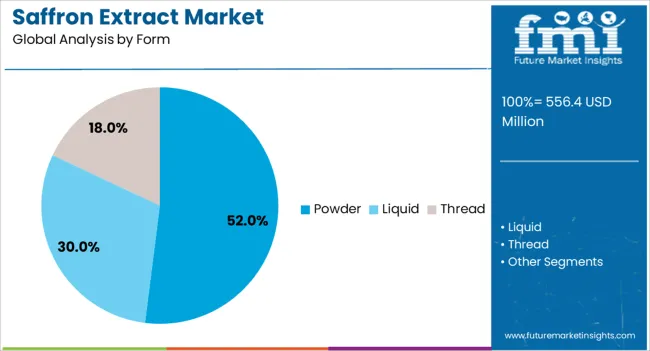

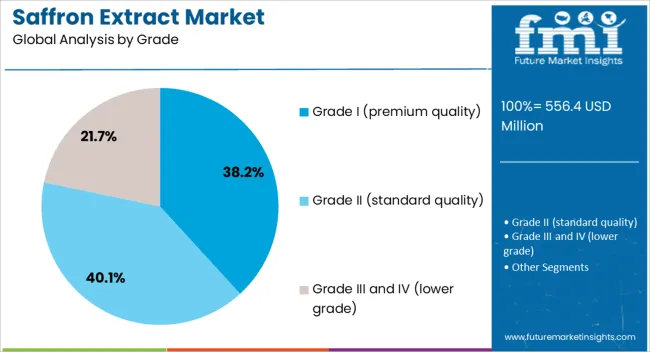

The saffron extract market is segmented by nature, form, grade, application, and geographic regions. By nature, saffron extract market is divided into conventional saffron extract and organic saffron extract. In terms of form, saffron extract market is classified into powder, liquid, and thread. Based on grade, saffron extract market is segmented into grade I (premium quality), grade II (standard quality), and grade III and IV (lower grade). By application, saffron extract market is segmented into food & beverage (incl. functional foods, drinks), pharmaceutical and healthcare, cosmetics and personal care, and others. Regionally, the saffron extract industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The conventional saffron extract segment is projected to hold 70% of the saffron extract market revenue share in 2025, making it the leading nature segment. Its dominance has been driven by the strong supply base, established farming practices, and cost advantages compared to organic alternatives. Widespread cultivation in traditional saffron-growing regions has ensured consistent availability and competitive pricing, which has supported large-scale adoption in food processing, flavoring, and cosmetic formulations. Conventional saffron extract has also benefited from well-established trade networks and reliable quality assurance systems that meet commercial requirements. In addition, the segment’s compatibility with a broad range of processing methods and formulations has enhanced its market position. The ability to maintain color, aroma, and bioactive compounds during industrial processing has reinforced its use among manufacturers seeking both quality and affordability As demand continues to expand in mainstream applications, the conventional segment remains a preferred choice for cost-effective yet high-quality saffron extract procurement.

The powder form segment is anticipated to account for 52% of the market revenue share in 2025, emerging as the leading form category. Its prominence has been supported by ease of storage, extended shelf life, and superior stability during transportation compared to liquid or paste formats. Powdered saffron extract offers versatility for incorporation into diverse applications, including culinary, nutraceutical, and cosmetic products, without altering texture or consistency. Its standardized concentration and dosing convenience have made it highly suitable for industrial-scale manufacturing. The form’s lower susceptibility to spoilage and degradation has contributed to reduced wastage and improved cost efficiency for producers. Additionally, powder-based formats are well-suited for online retail and global exports, given their lightweight packaging and reduced logistical complexity As food, beverage, and supplement manufacturers prioritize operational efficiency and consistency in product quality, the powder form of saffron extract is expected to maintain its competitive edge in the global market.

The Grade I premium quality segment is expected to represent 38.20% of the market revenue share in 2025, holding the leading position in the grade category. This leadership is attributed to the superior purity, high crocin content, and vibrant color associated with Grade I saffron, which commands premium pricing in global markets. Such high-grade extract is favored in luxury culinary products, high-end cosmetics, and specialized health supplements where quality and efficacy are critical. The segment’s growth has been supported by increasing consumer willingness to invest in premium natural ingredients and the association of Grade I saffron with authenticity and traditional heritage. Rigorous quality control, including certification and grading standards, has reinforced buyer confidence, particularly in export markets. Moreover, rising demand in niche wellness and gourmet sectors has driven higher adoption of Grade I extracts despite their premium cost This focus on unmatched sensory and therapeutic qualities continues to secure the segment’s dominant market position.

Saffron extract is strengthening its role in health, food, and beauty industries, supported by authenticity and premium appeal. Supply limitations and quality certification remain defining factors shaping competitive positioning.

Saffron extract demand has been rising due to its growing adoption in nutraceuticals, functional foods, and herbal supplements. The extract has been recognized for mood enhancement, cognitive support, and antioxidant benefits, which has encouraged its use in dietary formulations worldwide. Manufacturers have been capitalizing on premium branding strategies as consumers seek natural and authentic alternatives over synthetic formulations. The market strength is also influenced by heightened preference for saffron-based ingredients in energy boosters, digestive health supplements, and stress management blends. Increasing interest from pharmaceutical companies has further expanded the extract’s role in clinical research, strengthening its credibility. This has positioned saffron extract as a sought-after bioactive compound across diverse wellness categories, helping it secure wider applications.

The saffron extract industry continues to face constraints linked to its high cultivation cost and limited production capacity. Harvesting saffron remains labor-intensive, requiring handpicking of delicate stigmas, which contributes to premium pricing across global markets. Price volatility has been another challenge, influenced by fluctuating yields in key producing countries such as Iran, India, and Spain. Counterfeit products and adulteration have raised concerns in the supply chain, prompting stricter certifications and traceability measures. Export regulations and complex logistics associated with quality preservation have also limited wider availability in mass markets. Despite such hurdles, buyers with high purchasing power continue to favor authentic saffron extracts, ensuring that pricing pressures do not weaken its luxury positioning.

Applications of saffron extract have been broadening in gourmet foods, beverages, and luxury cosmetics. Food manufacturers prefer it for natural flavoring, rich coloring, and its premium aura, especially in high-value cuisines and ethnic recipes. Beverage formulators have adopted saffron in wellness teas, infused drinks, and premium functional beverages. In cosmetics, saffron extract has been positioned as an effective brightening and anti-aging agent, incorporated into creams, serums, and oils. Beauty brands rely on saffron’s traditional heritage, which enhances product appeal in both Asian and Western markets. Expansion into these categories demonstrates saffron extract’s cross-sector adaptability, enabling companies to diversify applications while leveraging its unique sensory and therapeutic attributes that competitors find difficult to replicate.

The saffron extract sector is characterized by limited but influential players competing through quality certifications, authenticity guarantees, and regional sourcing strategies. Companies emphasize geographic indication labeling and advanced testing to highlight purity levels. Investment in research-backed claims has emerged as a key competitive tool, with firms highlighting saffron’s benefits for mood balance and eye health. Product portfolios have been expanded through capsules, powders, and liquid formats to meet varied consumer preferences. Premium positioning has ensured brand loyalty despite higher prices, with new entrants facing challenges in meeting strict quality benchmarks. Looking ahead, saffron extract is expected to retain its high-value niche, supported by its authenticity, traditional heritage, and expanding clinical validation across industries.

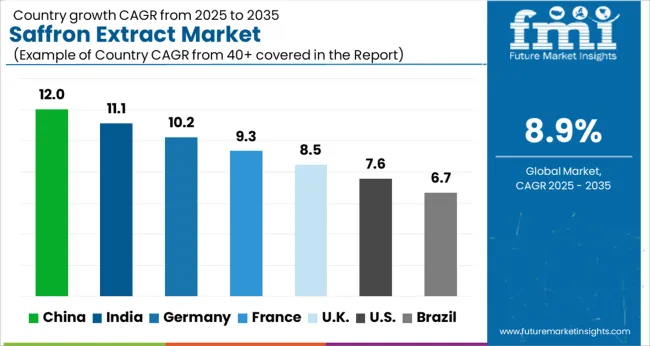

| Country | CAGR |

|---|---|

| China | 12.0% |

| India | 11.1% |

| Germany | 10.2% |

| France | 9.3% |

| UK | 8.5% |

| USA | 7.6% |

| Brazil | 6.7% |

The saffron extract market is projected to expand at a global CAGR of 8.9%, with growth dynamics varying across major economies. China leads at 12.0%, establishing its position as the highest growth contributor due to rising interest in saffron-based wellness formulations and functional beverages. India follows at 11.1%, supported by strong cultural acceptance of saffron in food and ayurvedic preparations, which provides a solid base for both domestic and export demand. France posts 9.3%, where saffron’s role in gourmet food and wellness-focused dietary supplements is expanding steadily. The United Kingdom shows growth at 8.5%, reflecting increasing usage in beverages, flavoring, and personal care blends. The United States trails at 7.6%, impacted by mature dietary supplement consumption and higher reliance on imports for saffron-based ingredients. These variations highlight stronger momentum in BRICS economies compared with OECD peers, where cultural heritage and expanding wellness markets have created higher growth premiums. Overall, the market remains defined by premium positioning, authenticity, and expanding functional applications across health, food, and cosmetics, making saffron extract a distinctive niche within the global botanical sector.

The United Kingdom is positioned to post a CAGR of 8.5% during 2025–2035, slightly below the global 8.9% baseline. During 2020–2024, growth was near 7.8% as adoption in culinary, nutraceutical, and cosmetic segments increased incrementally. The move from about 7.8% to 8.5% is explained by greater integration of saffron extracts in functional foods and premium beverages, rising consumer health awareness, and improved supply chain stability through imports from Spain and Iran. Regulatory approvals for health claims and certification of origin standards have strengthened consumer trust and supported adoption. In my assessment, steady private-label uptake and premium product positioning continue to drive incremental sales without pressuring margins.

China is positioned to post a CAGR of 12.0% during 2025–2035, above the global 8.9% baseline. During 2020–2024, growth was near 10.8% as traditional herbal remedies, functional foods, and high-end cosmetics increasingly incorporated saffron extracts. The rise from about 10.8% to 12.0% is explained by investments in extraction capacities, expansion of domestic value-added product manufacturing, and government-backed promotion of plant-based health ingredients. In my view, rising export demand and private-label adoption by domestic wellness brands sustain a high-growth trajectory and strengthen long-term revenue visibility.

India is projected to deliver a CAGR of 11.1% for 2025–2035, above the global 8.9% baseline. During 2020–2024, growth hovered around 9.6% as domestic consumption in traditional medicine, functional foods, and nutraceutical segments expanded. The lift from roughly 9.6% to 11.1% is explained by improvements in cultivation practices in Jammu and Kashmir, investment in processing units, and optimized logistics to urban centers. In my assessment, uptake by nutraceutical brands and organized export channels supports steady adoption and sustained revenue expansion.

France is positioned to post a CAGR of 9.3% during 2025–2035, above the global 8.9% benchmark. During 2020–2024, growth was near 8.1% as high-end culinary usage, natural food colorants, and cosmetic applications increased steadily. The move from about 8.1% to 9.3% is explained by integration into premium food products, rising interest in botanical wellness items, and efficient import channels from Spain and Iran. In my assessment, established retail networks and niche gourmet adoption reinforce steady revenue expansion without aggressive price competition.

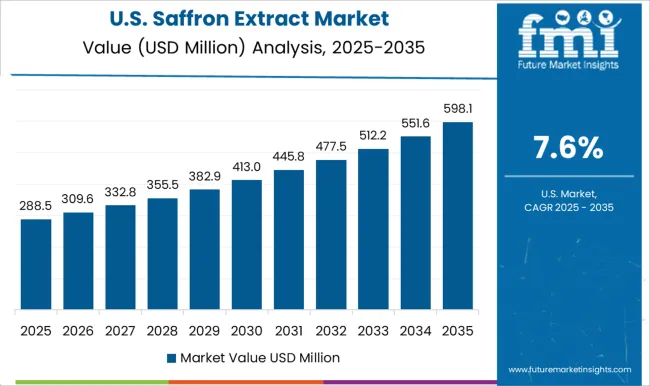

The United States is projected to achieve a CAGR of 7.6% during 2025–2035, slightly below the global 8.9% baseline. During 2020–2024, growth was near 6.9% as adoption in health-oriented beverages, natural colorants, and premium supplements increased gradually. The rise from about 6.9% to 7.6% is explained by increasing penetration of online retail channels, adoption in functional beverage formulations, and greater consumer awareness of saffron benefits. In my view, quality assurance and educational campaigns reinforce trust, supporting steady long-term uptake.

The saffron extract market is characterized by the presence of several global leaders alongside major regional and local producers, including Taj Agro International, Great American Spice Company, Grandor Co., Noor Brand Saffron, and Esfedan Saffron Co. These companies are engaged in intense competition, focusing on product quality, traceability, cost optimization, and reliable sourcing from high-grade saffron-producing regions to maintain competitiveness. Taj Agro International maintains a strong position through vertically integrated operations, covering cultivation, extraction, and packaging, ensuring consistent extract quality. Great American Spice Company emphasizes proprietary extraction techniques and diversified product lines catering to culinary, nutraceutical, and cosmetic applications.

Grandor Co. and Noor Brand Saffron leverage extensive distribution networks across key markets, strengthening regional presence and brand recognition. Esfedan Saffron Co. focuses on premium and organic-certified extracts to differentiate offerings and command higher margins. Competitive strategies in the sector include strategic partnerships with cultivators, investment in advanced extraction technologies, and development of value-added formulations. Future success in saffron extract production and distribution will depend on securing high-quality raw material, maintaining quality standards, and expanding adoption in functional food, beverage, and cosmetic applications, making operational efficiency and strategic positioning critical for market leadership.

| Item | Value |

|---|---|

| Quantitative Units | USD 556.4 million |

| Nature | Conventional saffron extract and Organic saffron extract |

| Form | Powder, Liquid, and Thread |

| Grade | Grade I (premium quality), Grade II (standard quality), and Grade III and IV (lower grade) |

| Application | Food & beverage (incl. functional foods, drinks), Pharmaceutical and healthcare, Cosmetics and personal care, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Taj Agro International, Great American Spice Company, Grandor Co., Noor Brand Saffron, Esfedan Saffron Co., and Other regional / local extract makers |

| Additional Attributes | Dollar sales, share by product type, share by form, regional consumption patterns, growth drivers in culinary, nutraceutical, and cosmetic segments, competitive benchmarking, pricing trends, distribution channels, regulatory compliance, and import-export dynamics. |

The global saffron extract market is estimated to be valued at USD 556.4 million in 2025.

The market size for the saffron extract market is projected to reach USD 1,305.1 million by 2035.

The saffron extract market is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types in saffron extract market are conventional saffron extract and organic saffron extract.

In terms of form, powder segment to command 52.0% share in the saffron extract market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Analysis and Growth Projections for Saffron Market

Saffron Beer Market Growth - Premium Brewing Innovations 2025 to 2035

Saffron Derivatives Market Analysis by Product Type, Form, Application, Distribution Channel, and Region Through 2035

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Extraction Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Extracts and Distillates Market

Sage Extract Market Size and Share Forecast Outlook 2025 to 2035

Fume Extractor Market Size and Share Forecast Outlook 2025 to 2035

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Kale Extract Skincare Market Size and Share Forecast Outlook 2025 to 2035

Wine Extract Market Size and Share Forecast Outlook 2025 to 2035

Amla Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dust Extractor Market Growth – Trends & Forecast 2025 to 2035

Data Extraction Software Market

Peony Extract Brightening Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Peony Extracts for Brightening Market Size and Share Forecast Outlook 2025 to 2035

Algae Extracts Market Size and Share Forecast Outlook 2025 to 2035

Juice Extraction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Yucca Extract Market Size and Share Forecast Outlook 2025 to 2035

Maple Extracts Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA