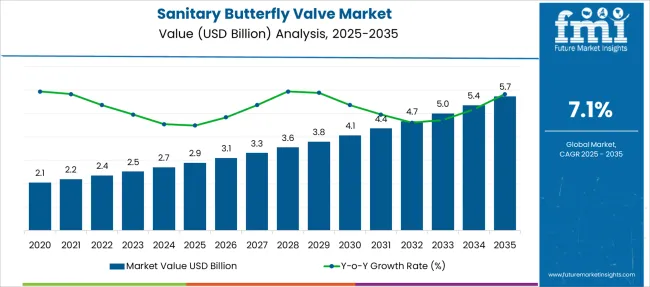

The Sanitary Butterfly Valve Market is estimated to be valued at USD 2.9 billion in 2025 and is projected to reach USD 5.7 billion by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period.

| Metric | Value |

|---|---|

| Sanitary Butterfly Valve Market Estimated Value in (2025 E) | USD 2.9 billion |

| Sanitary Butterfly Valve Market Forecast Value in (2035 F) | USD 5.7 billion |

| Forecast CAGR (2025 to 2035) | 7.1% |

The sanitary butterfly valve market is witnessing steady expansion due to increasing demand for reliable fluid control solutions in the food, pharmaceutical, and beverage industries. Growing focus on hygiene and contamination prevention has prompted manufacturers to adopt valves that offer sanitary design and easy maintenance.

Advances in valve technology have improved performance with better sealing and automation options. The preference for materials that ensure corrosion resistance and product safety has also contributed to market growth. As production processes become more automated, the need for valves compatible with pneumatic systems has increased.

Infrastructure investments and the expansion of food and beverage processing plants globally are further fueling demand. The market outlook remains positive as industry standards tighten and the focus on quality control intensifies. Segmental growth is expected to be led by pneumatic butterfly valves, valve construction using stainless steel, and medium-sized valves ranging from 2 to 6 inches.

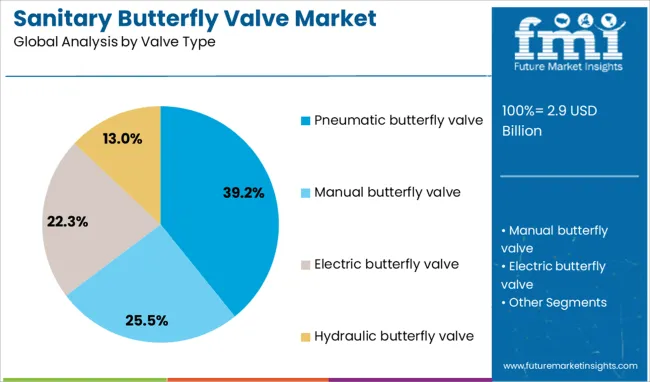

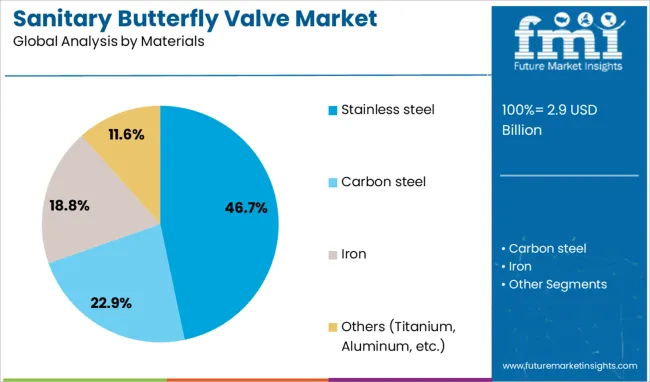

Valve type, materials, size, operation mechanism, end use, and distribution channel and geographic regions segment the sanitary butterfly valve market. The sanitary butterfly valve market is divided by valve type into Pneumatic butterfly valve, Manual butterfly valve, Electric butterfly valve, and Hydraulic butterfly valve. The sanitary butterfly valve market is classified into Stainless steel, Carbon steel, Iron, and Others (Titanium, Aluminum, etc.).

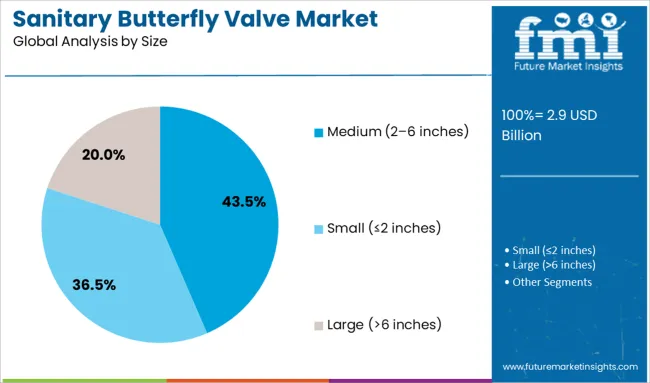

Based on the size, the sanitary butterfly valve market is segmented into Medium (2–6 inches), Small (≤2 inches), and Large (>6 inches). By operation mechanism of the sanitary butterfly valve market is segmented into Automatic, Manual, and Semi-automatic. By end use, the sanitary butterfly valve market is segmented into Food and beverage, Dairy, Brewing, Cosmetic manufacturing, General hygiene process, Water treatment, and Others.

The distribution channel of the sanitary butterfly valve market is segmented into Direct and Indirect. Regionally, the sanitary butterfly valve industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pneumatic butterfly valve segment is projected to hold 39.2% of the market revenue in 2025 maintaining its position as the preferred valve type. The growth of this segment has been driven by the demand for valves that provide fast and accurate flow control with remote operation capabilities. Pneumatic actuation allows for automation integration, which improves process efficiency and reduces manual intervention.

This valve type is favored in industries requiring precise control under sanitary conditions and where contamination risk must be minimized. The increasing adoption of automated processing lines in food and pharmaceutical manufacturing has further reinforced the position of pneumatic butterfly valves.

Their reliability and ease of installation have made them the go-to choice for modern sanitary valve applications.

Stainless steel valves are projected to account for 46.7% of the sanitary butterfly valve market revenue in 2025 positioning them as the leading material segment. Stainless steel has been preferred due to its excellent corrosion resistance durability and hygienic properties which are critical in sanitary applications.

The material withstands frequent cleaning processes and exposure to aggressive cleaning agents without degrading. Its inert nature prevents contamination of fluids, maintaining product purity.

Manufacturers and end users have consistently chosen stainless steel to comply with stringent industry regulations and quality standards. The longevity and low maintenance requirements of stainless steel valves further contribute to their market dominance. As hygiene standards ris,e the stainless steel segment is expected to sustain its leading role.

The medium size segment, ranging from 2 to 6 inches, is projected to capture 43.5% of the market revenue in 2025, establishing it as the dominant size category. This range is widely used in processing lines where space constraints and flow requirements demand compact and versatile valve solutions.

Medium-sized valves offer a balance between flow capacity and installation convenience, making them suitable for various sanitary applications. The adaptability of this size range across food, pharmaceutical, and beverage manufacturing has driven its popularity.

Furthermore, the medium size allows for easier integration into automated systems and standard piping layouts. With continuous process optimization and plant expansion,s the medium size segment is anticipated to maintain strong growth.

The sanitary butterfly valve market is expanding due to strong demand in food, beverage, and pharmaceutical industries where hygiene compliance is critical. Growth is reinforced by increasing automation in fluid handling systems and preference for easy-maintenance valves. Opportunities lie in high-performance alloy-based valves and smart actuation technologies for clean-in-place systems.

Trends include the integration of remote monitoring features and rising demand for compact, lightweight designs in processing plants. However, challenges such as high initial investment, stringent regulatory certification, and material cost fluctuations continue to limit market adoption in cost-sensitive regions.

Market growth is being driven by strict hygiene regulations and rising output in dairy, brewery, and pharmaceutical sectors. In 2024, sanitary butterfly valves were widely installed in new beverage lines across Asia-Pacific to ensure efficient cleaning and contamination prevention.

Food processors favored these valves for their quick maintenance and cost efficiency compared to diaphragm alternatives. It is strongly believed that increasing investment in automated production facilities and global enforcement of sanitary standards will maintain strong demand for butterfly valves across liquid handling applications.

Opportunities have emerged in advanced sanitary valves featuring corrosion-resistant alloys and actuator integration for automated flow control. In 2025, pharmaceutical companies adopted stainless steel and duplex alloy valves in sterile processing facilities to improve durability under aggressive cleaning chemicals.

Automated valves with pneumatic or electric actuators gained traction in large-scale breweries for reducing downtime during cleaning cycles. It is considered that manufacturers offering robust materials, quick-change seal designs, and integrated control systems will capture premium segments seeking reliability and efficiency in production environments.

Emerging trends show a clear shift toward valves with compact, lightweight bodies and digital connectivity for process optimization. In 2024, food processors implemented valves equipped with position sensors and communication modules to support predictive maintenance in CIP systems.

Demand for compact valves in modular skid units grew as processors redesigned layouts for efficiency. It is widely believed that manufacturers delivering valves with digital compatibility, quick installation features, and long-life elastomer seals will outperform competitors in markets emphasizing cost control and hygienic performance.

The market faces constraints from rising stainless steel costs and complex certification requirements for food and pharmaceutical applications. In 2024, several small-scale dairy equipment manufacturers reported procurement delays due to extended validation timelines and increased expenses associated with alloy components.

Additionally, uncertainty in elastomer availability impacted large-volume orders for sanitary valve replacements. It is considered that without cost-stable sourcing strategies and faster compliance processes, adoption in smaller facilities and emerging markets may remain limited despite increasing demand for hygienic processing infrastructure.

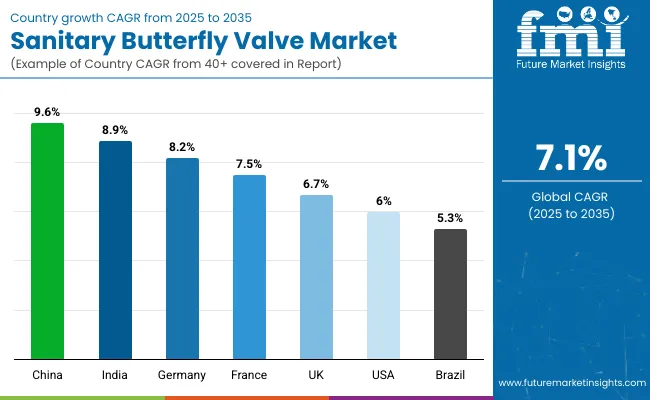

| Country | CAGR |

|---|---|

| China | 9.6% |

| India | 8.9% |

| Germany | 8.2% |

| France | 7.5% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

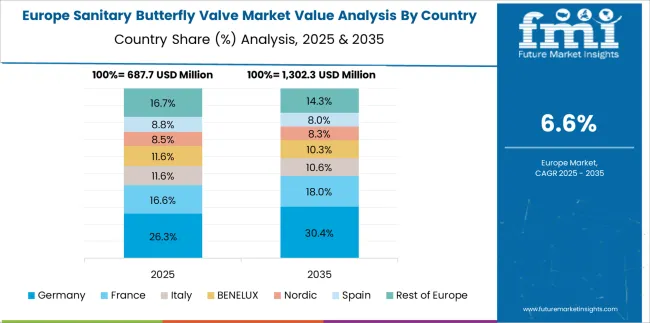

The global sanitary butterfly valve market is projected to grow at a 7.1% CAGR during 2025–2035. China leads at 9.6%, fueled by rapid expansion in food processing, beverage bottling, and biopharmaceutical sectors. India follows at 8.9%, supported by dairy infrastructure upgrades and rising investments in hygienic fluid control systems. France records 7.5% CAGR, reflecting strong regulatory compliance and modernization in food and chemical plants.

The UK grows at 6.7%, while the United States posts 6.0%, influenced by system retrofitting and adherence to FDA and EHEDG standards. Growth divergence highlights Asia’s higher capital investment in hygienic manufacturing and advanced process automation compared to incremental upgrades in mature markets.

China dominates the global sanitary butterfly valve market with a projected 9.6% CAGR through 2035. This expansion is driven by increased demand from food and beverage plants, breweries, and pharmaceutical manufacturing units, all requiring efficient fluid control systems. Major domestic producers offer cost-effective stainless steel valves with CIP/SIP compatibility, while global leaders target premium automation-integrated solutions.

The market also benefits from strong government support for food safety compliance and rising beverage exports. Digital valve monitoring and predictive maintenance integration are emerging trends in advanced facilities.

India is expected to post an 8.9% CAGR, driven by rapid modernization of dairy processing units and expanding packaged food operations. Government initiatives under “Make in India” encourage domestic production of stainless steel valves with international certification standards.

Adoption in breweries and soft drink bottling lines has surged due to the focus on contamination-free operations. Indian OEMs emphasize affordable designs for regional markets, while global brands dominate automation-driven segments for large-scale food and pharma plants. Continuous investment in cleanroom-compatible systems reinforces future opportunities.

France records a 7.5% CAGR, underpinned by high regulatory pressure to ensure food-grade safety and hygienic fluid handling. Strong demand comes from wineries, specialty food plants, and cosmetics manufacturing facilities that require precision control systems.

Advanced automation in production lines has boosted adoption of valves with pneumatic actuators and remote monitoring capabilities. French manufacturers are innovating with energy-efficient actuators and lightweight stainless steel configurations for ease of cleaning and quick installation.

The UK market is forecast to grow at 6.7% CAGR through 2035, with moderate expansion in food, beverage, and pharmaceutical segments. Adoption in breweries and dairy facilities remains strong, supported by retailer-driven hygiene compliance. Retrofit projects for aging process lines have increased demand for quick-installation, low-maintenance sanitary butterfly valves.

IoT-enabled valve monitoring is gaining popularity for predictive maintenance across advanced facilities. Local distributors focus on compact designs compatible with small-scale operations, while global players lead with fully automated solutions.

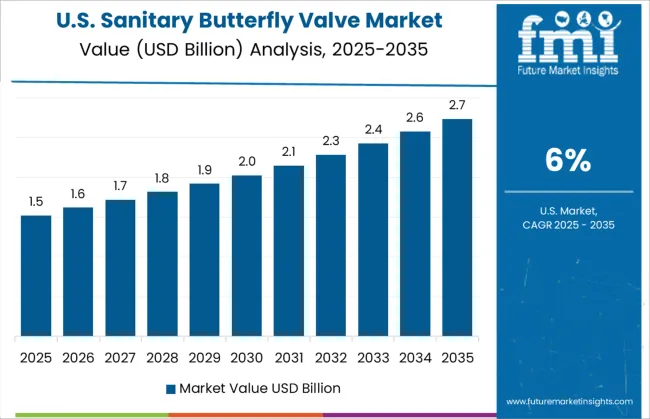

The USA sanitary butterfly valve market is expected to grow at 6.0% CAGR, driven by regulatory mandates for hygienic operations across dairy, meat processing, and pharmaceutical sectors. The transition from traditional shut-off systems to quick-acting butterfly valves enhances operational efficiency. Investments in automation for large-scale food plants have accelerated the demand for actuator-integrated sanitary valves. Manufacturers are introducing FDA and 3A-compliant valves with advanced sealing materials for CIP/SIP cycles. Retrofitting in legacy systems and the rise of ready-to-drink beverage lines offer additional growth opportunities.

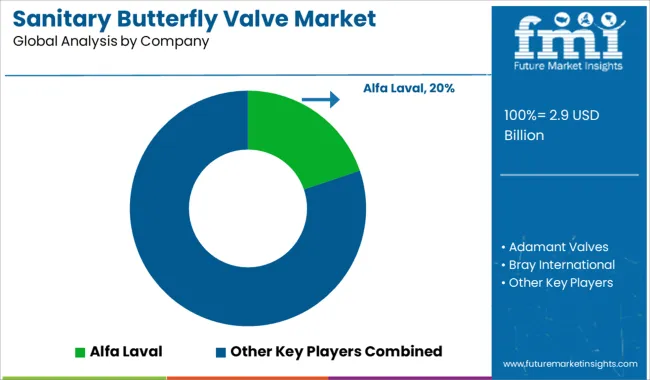

The sanitary butterfly valve market is moderately consolidated, with Alfa Laval recognized as a leading player due to its comprehensive range of hygienic flow control solutions for food, beverage, dairy, and pharmaceutical applications. The company’s focus on superior sealing, durability, and easy cleanability has made it a preferred choice for critical sanitary processes. Key players include Adamant Valves, Bray International, Crane, Dairy Pharma Valve, Dixon Valve & Coupling, Donjoy Technology, GEA Group, INOXCN Group, J&O Fluid Control, QILI Holding Group, SPX FLOW, Velan, Wenzhou Nuomeng Technology, and Zhejiang Lianghai Valve.

These manufacturers specialize in designing butterfly valves with stainless steel construction, polished surfaces, and compliance with stringent sanitary standards such as 3-A, FDA, and EHEDG for use in clean-in-place (CIP) and sterilize-in-place (SIP) systems. Market growth is driven by rising demand for hygienic processing equipment across food processing, pharmaceuticals, and biotechnology sectors, supported by strict safety and quality regulations.

Leading companies are investing in automation-ready valve designs, advanced gasket technologies, and smart monitoring features for real-time performance tracking. Trends include the development of lightweight, energy-efficient actuators and modular valve systems to improve operational flexibility. Asia-Pacific is expected to see the fastest growth due to the expansion of dairy and beverage industries, while North America and Europe maintain strong adoption driven by high hygiene standards.

In March 2024, Valworx announced an expanded sanitary butterfly valve lineup featuring highly polished 316L internals and FDA-approved seals. Compatible across their actuator series, this enhanced offering provides hygienic performance and immediate stock availability, catering to food, beverage, biotech, and pharmaceutical processing systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.9 Billion |

| Valve Type | Pneumatic butterfly valve, Manual butterfly valve, Electric butterfly valve, and Hydraulic butterfly valve |

| Materials | Stainless steel, Carbon steel, Iron, and Others (Titanium, Aluminum, etc.) |

| Size | Medium (2–6 inches), Small (≤2 inches), and Large (>6 inches) |

| Operation Mechanism | Automatic, Manual, and Semi-automatic |

| End Use | Food and beverage, Dairy, Brewing, Cosmetic manufacturing, General hygiene process, Water treatment, and Others |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Alfa Laval, Adamant Valves, Bray International, Crane, Dairy Pharma Valve, Dixon Valve & Coupling, Donjoy Technology, GEA Group, INOXCN Group, J&O Fluid Control, QILI Holding Group, SPX FLOW, Velan, Wenzhou Nuomeng Technology, and Zhejiang Lianghai Valve |

| Additional Attributes | Dollar sales segmented by valve type (wafer, lug, threaded, actuated), material (stainless steel, carbon steel, titanium), and application (food & beverage, pharma, biotech). Regional demand trends highlight North America and Europe dominance, with APAC expanding rapidly. Buyers prefer hygienic, cleanable, quick-install valves integrated with CIP/SIP automation. Innovations include smart sanitary valves featuring IoT-enabled sensors, real-time flow monitoring, predictive maintenance, and FDA-compliant coatings. Competitive landscape includes global players and niche specialists focusing on high-grade alloys and precision actuation solutions. |

The global sanitary butterfly valve market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the sanitary butterfly valve market is projected to reach USD 5.7 billion by 2035.

The sanitary butterfly valve market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in sanitary butterfly valve market are pneumatic butterfly valve, manual butterfly valve, electric butterfly valve and hydraulic butterfly valve.

In terms of materials, stainless steel segment to command 46.7% share in the sanitary butterfly valve market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sanitary Food & Beverage Packaging Market Size and Share Forecast Outlook 2025 to 2035

Sanitary Cans Market Size and Share Forecast Outlook 2025 to 2035

Sanitary Napkin Vending Machine Market Analysis - Trends, Growth & Forecast 2025 to 2035

Sanitary Pump and Valve Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Sanitary Ware Market Trends & Forecast 2025 to 2035

Reusable Sanitary Pads Market Growth - Size, Demand & Forecast 2025 to 2035

Positive Displacement Sanitary Pumps Market Size and Share Forecast Outlook 2025 to 2035

Butterfly Valves Market Analysis by Type, Mechanism, Function, Applications, and Region through 2035

Valve Grinder Market Size and Share Forecast Outlook 2025 to 2035

Valve Seat Inserts Market Size and Share Forecast Outlook 2025 to 2035

Valve Driver Market Size and Share Forecast Outlook 2025 to 2035

Valve Remote Control Systems Market Analysis by Type, Application and Region - Forecast for 2025 to 2035

Valve Positioner Market Growth – Trends & Forecast (2024-2034)

Valve Cover Gasket Market

Valve Sack Market

ESD Valve Market Forecast and Outlook 2025 to 2035

EGR Valve Market

HVAC Valve Market Size and Share Forecast Outlook 2025 to 2035

Flat Valve Caps And Closures Market Size and Share Forecast Outlook 2025 to 2035

Gate Valve Market Growth – Trends & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA