The sanitary pump and valve market is witnessing consistent growth driven by the expanding food and beverage, pharmaceutical, and biotechnology industries. The rising focus on hygiene standards, contamination prevention, and regulatory compliance has strengthened the adoption of sanitary-grade fluid handling systems. Current dynamics are influenced by the modernization of processing plants, automation in fluid transfer operations, and increased investments in cleanroom technologies.

The future outlook remains positive as demand for efficient and corrosion-resistant components continues to grow across critical applications. Manufacturers are emphasizing innovation in materials, design optimization, and energy-efficient operation to meet stringent quality standards.

Growth rationale is supported by the need for reliable fluid control systems that ensure product integrity, operational safety, and cost efficiency Integration of smart monitoring systems and predictive maintenance technologies is expected to enhance equipment performance and extend service life, thereby sustaining steady market expansion and ensuring strong penetration across end-use industries.

| Metric | Value |

|---|---|

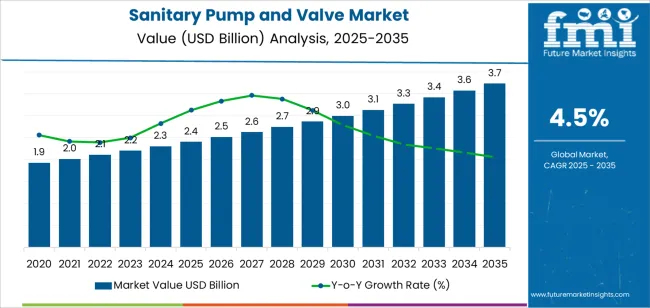

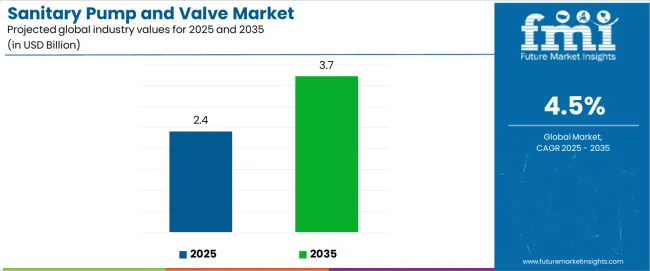

| Sanitary Pump and Valve Market Estimated Value in (2025 E) | USD 2.4 billion |

| Sanitary Pump and Valve Market Forecast Value in (2035 F) | USD 3.7 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

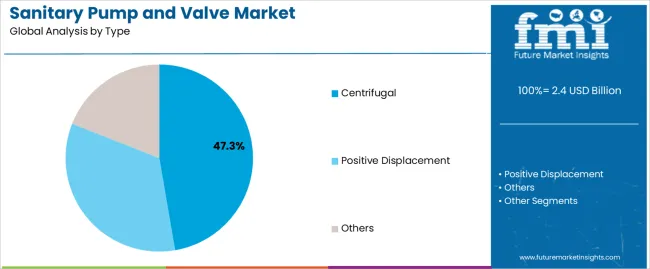

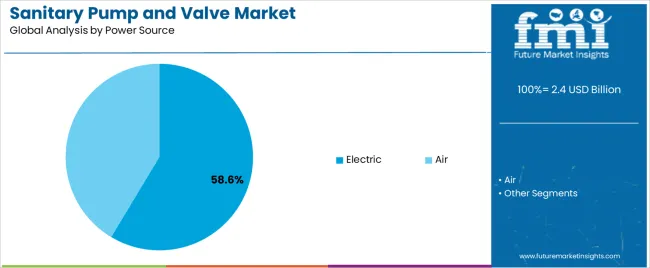

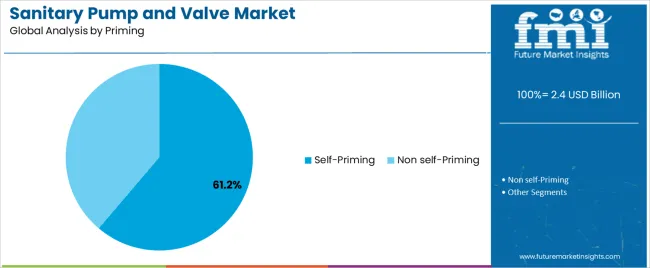

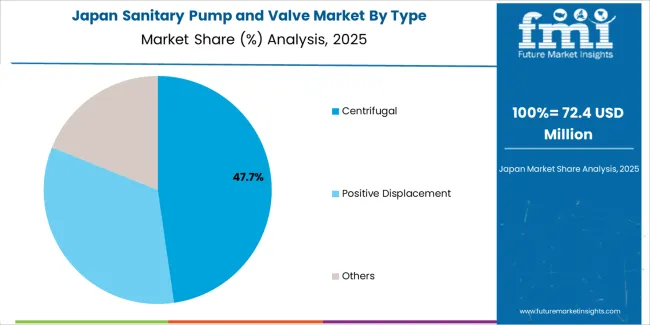

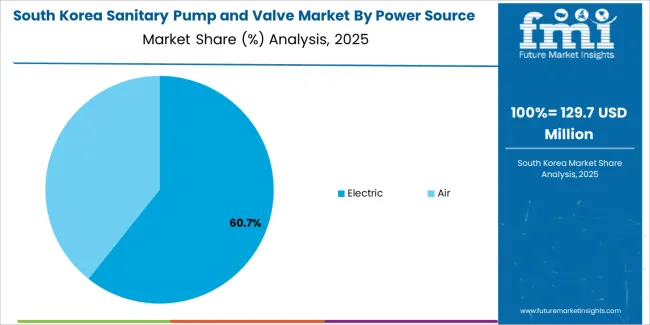

The market is segmented by Type, Power Source, Priming, and End Use Industry and region. By Type, the market is divided into Centrifugal, Positive Displacement, and Others. In terms of Power Source, the market is classified into Electric and Air. Based on Priming, the market is segmented into Self-Priming and Non self-Priming. By End Use Industry, the market is divided into Dairy, Processed Foods, Non-Alcoholic Beverages, Pharmaceuticals, Alcoholic Beverages, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The centrifugal segment, accounting for 47.30% of the type category, has been leading due to its operational efficiency, high flow capacity, and suitability for a wide range of sanitary applications. Its dominance is supported by low maintenance requirements and compatibility with clean-in-place systems, making it a preferred choice in the food, beverage, and pharmaceutical sectors.

Demand has been reinforced by consistent product performance, reduced downtime, and ease of integration into automated process lines. Manufacturers are investing in material enhancements and precision engineering to ensure compliance with sanitary design standards.

The segment’s growth is expected to remain stable as industries continue to adopt centrifugal pumps for both hygienic and high-capacity applications, ensuring its continued leadership within the market.

The electric segment, holding 58.60% of the power source category, has emerged as the dominant type owing to its high energy efficiency, ease of control, and consistent operational performance. The segment benefits from advancements in motor technology and smart control systems that enable better process regulation and lower energy consumption.

Its growing adoption is driven by the widespread use of automated systems in modern processing facilities, where electric-powered units provide precise flow management and reliability. Regulatory emphasis on energy conservation has further supported its use across key industries.

The segment’s expansion is expected to be reinforced by ongoing technological innovation and infrastructure modernization, maintaining its strong market share in the coming years.

The self-priming segment, representing 61.20% of the priming category, has maintained its leading position due to its superior operational convenience and ability to handle air-liquid mixtures efficiently. Its design eliminates the need for manual priming, reducing downtime and maintenance costs.

The segment has gained traction in industries that require frequent fluid transfers and quick startup operations, such as dairy and beverage processing. Improved engineering and sealing mechanisms have enhanced performance reliability under varying pressure conditions.

The preference for self-priming systems is expected to remain strong, supported by the global shift toward automation and sanitary design improvements This ensures continued market dominance and widespread adoption across processing and hygienic manufacturing environments.

The global demand for the sanitary pump and valve market was estimated to reach a valuation of USD 1.9 billion in 2020, according to a report from Future Market Insights (FMI). From 2020 to 2025, the sanitary pump and valve market witnessed significant growth, registering a CAGR of 6.5%.

| Historical CAGR 2020 to 2025 | 6.5% |

|---|---|

| Forecast CAGR 2025 to 2035 | 4.6% |

The application of advanced predictive maintenance technology is a new development in the sanitary pump and valve industry. Manufacturers are now able to anticipate certain equipment problems before they happen, allowing for preventive maintenance and reducing downtime, by utilizing machine learning algorithms and sensor data. This invention is a great asset to the industry as it increases overall dependability, lowers maintenance costs, and boosts operational efficiency.

Artistic Trends that Enhances the Visual Appeal of Sanitary Pump and Valve to Boost Growth

There is a rising demand for sanitary pumps and valves that not only work well but also improve the aesthetics of their surroundings as companies prioritize aesthetics alongside utility.

This tendency is especially noticeable in high end hospitality industries like spas, hotels, and restaurants where patrons want both elegant design and excellent service. To satisfy picky customers, manufacturers are experimenting with innovative design strategies, adding sleek lines, high end finishes, and customizable choices.

Usage of Sanitary Pump and Valve in Space Exploration to be a Huge Market Opportunity

The sanitary pump and valve market has an exceptional opportunity to develop beyond terrestrial applications given the growing interest in space exploration. Small and light pump and valve solutions are crucial for space missions and interplanetary colonies, where weight and volume are important factors.

Manufacturers are pushed to create novel designs that can endure the rigors of space while increasing efficiency and dependability. Companies may put themselves at the pinnacle of space exploration technology by adopting this unconventional driver, creating new opportunities for expansion and cooperation within the aerospace sector.

Cost Fluctuations and Abnormalities in the Supply Chains to Impede the Market Growth

Few restraints of the market are:

This section focuses on providing detailed analysis of two particular market segments for sanitary pump and valve, the dominant type and the significant power source. The two main segments discussed below are the positive displacement and air power source.

| Type | Positive Displacement |

|---|---|

| Market Share in 2025 | 81.7% |

The positive displacement sanitary pump and valve is anticipated to register a 4.4% CAGR through 2035. Positive displacement sanitary pump and valve are expected to become more popular because of their accurate and reliable fluid handling qualities. This makes them perfect for delicate applications in the food, pharmaceutical, and biotechnology sectors.

By ensuring precise dosage and cautious product handling, these pumps preserve the integrity and quality of the product. Their construction reduces agitation and shear, which is essential for maintaining the delicate properties of delicate fluids and increasing their marketability in the sanitary sector.

| Power Source | Air |

|---|---|

| CAGR from 2025 to 2035 | 4.2% |

From 2025 to 2035, the air power source segment is likely to garner a 4.2% CAGR.

The sanitary pump and valve market is expected to be dominated by air power sources because of their sustainability and adaptability.

They provide dependable and efficient functioning without requiring external power sources, therefore lowering reliance on fuel or electricity. Air power sources are positioned well in the market because they fulfill strict cleanliness requirements and minimize environmental effect, which is in line with the industry's focus on eco-friendly solutions.

This section will go into detail on the sanitary pump and valve markets in a few key countries, including the United States, the United Kingdom, China, Japan and South Korea. This segment will focus on the key factors that are driving up demand in these countries for sanitary pump and valve.

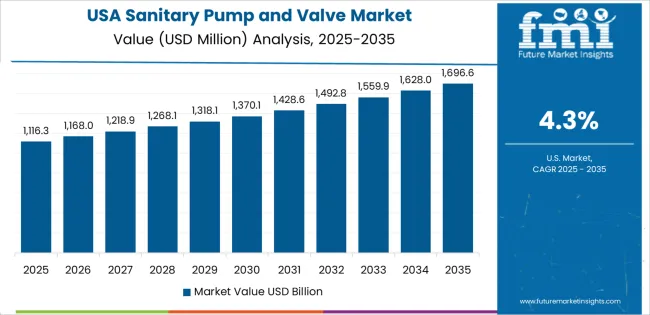

| Countries | Forecast CAGR from 2025 to 2035 |

|---|---|

| The United States | 4.8% |

| The United Kingdom | 5.4% |

| China | 5.6% |

| Japan | 5.9% |

| South Korea | 7% |

The United States sanitary pump and valve ecosystem is anticipated to gain a CAGR of 4.8% through 2035. Factors that are bolstering the growth are:

The sanitary pump and valve market in the United Kingdom is expected to expand with a 5.4% CAGR through 2035. The factors pushing the growth are:

The sanitary pump and valve ecosystem in China is anticipated to develop with a 5.6% CAGR from 2025 to 2035. The drivers behind this growth are:

The sanitary pump and valve industry in Japan is anticipated to reach a 5.9% CAGR from 2025 to 2035. The drivers propelling growth forward are:

The sanitary pump and valve ecosystem in South Korea is likely to evolve with a 7% CAGR during the forecast period. The factors bolstering the growth are:

In order to achieve strict hygiene requirements and improve product efficiency and dependability, leading businesses in the global sanitary pump and valve market are embracing innovation via the integration of modern technologies. They guarantee regulatory compliance by concentrating on material and design advancements.

The goal of research and development is to present innovative solutions that are suited to a variety of industrial requirements, such as those in the biotechnology, pharmaceutical, and food and beverage industries. Eco friendly production methods and energy efficient goods are used to highlight sustainability, coupled with customer centric strategies that offer customized solutions and thorough after sales care.

By bringing modern innovations like IoT integration for remote monitoring, predictive maintenance algorithms, and creative materials, startups in the sanitary pump and valve market are disrupting the market. They put agility first, responding to changing market demands with scalable solutions, faster deployment times, and more affordable options than established providers. The key players in this market include:

Significant advancements in the sanitary pump and valve market are being made by key market participants, and these include:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.5% from 2025 to 2035 |

| Market value in 2025 | USD 2.4 billion |

| Market value in 2035 | USD 3.7 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Type, Power Source, Priming, End User Industry, End User |

| Region Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

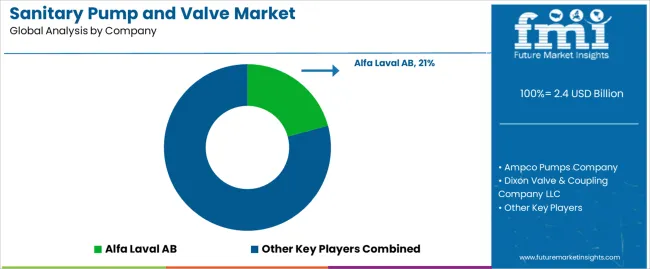

| Key Companies Profiled | Alfa Laval AB; Ampco Pumps Company; Dixon Valve & Coupling Company LLC; Dover Corporation; GEA Group Aktiengesellschaft; Holland Applied Technologies, Inc.; IDEX Corporation; KSB SE & Co. KGaA; SPX Corporation; Tapflo Group |

| Customization Scope | Available on Request |

The global sanitary pump and valve market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the sanitary pump and valve market is projected to reach USD 3.7 billion by 2035.

The sanitary pump and valve market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in sanitary pump and valve market are centrifugal, positive displacement and others.

In terms of power source, electric segment to command 58.6% share in the sanitary pump and valve market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sanitary Food & Beverage Packaging Market Size and Share Forecast Outlook 2025 to 2035

Sanitary Cans Market Size and Share Forecast Outlook 2025 to 2035

Sanitary Napkin Vending Machine Market Analysis - Trends, Growth & Forecast 2025 to 2035

Sanitary Butterfly Valve Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Sanitary Ware Market Trends & Forecast 2025 to 2035

Reusable Sanitary Pads Market Growth - Size, Demand & Forecast 2025 to 2035

Positive Displacement Sanitary Pumps Market Size and Share Forecast Outlook 2025 to 2035

Pump Jack Market Forecast Outlook 2025 to 2035

Pump Testers Market Size and Share Forecast Outlook 2025 to 2035

Pumpjacks Market Size and Share Forecast Outlook 2025 to 2035

Pumps Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Seed Protein Market Size and Share Forecast Outlook 2025 to 2035

Pumped Hydro Storage Market Size and Share Forecast Outlook 2025 to 2035

Pump Tubes Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Pie Spices Market Analysis - Size, Share, and Forecast 2025 to 2035

Pump Condiment Dispensers Market - Effortless Portion Control 2025 to 2035

Pumpkin Spice Products Market Trends - Seasonal Demand & Growth 2025 to 2035

Pump Feeders Market Growth - Trends & Forecast 2025 to 2035

Pump and Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Pump and Dispenser Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA