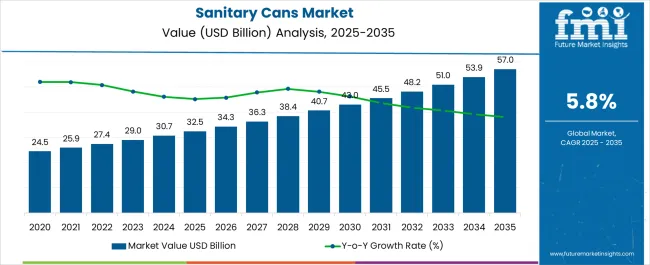

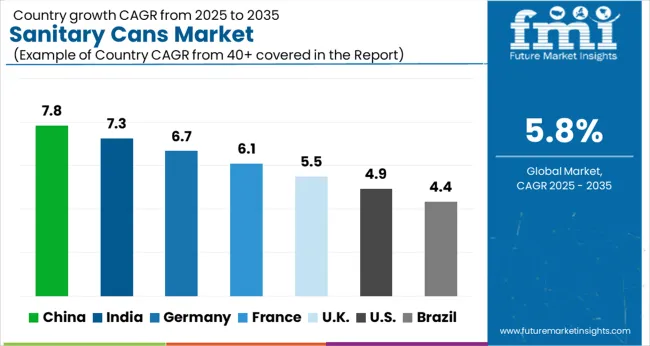

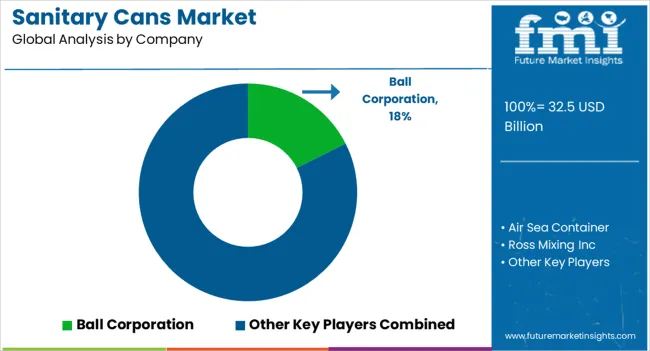

The Sanitary Cans Market is estimated to be valued at USD 32.5 billion in 2025 and is projected to reach USD 57.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

| Metric | Value |

|---|---|

| Sanitary Cans Market Estimated Value in (2025 E) | USD 32.5 billion |

| Sanitary Cans Market Forecast Value in (2035 F) | USD 57.0 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The sanitary cans market is witnessing consistent growth, fueled by increasing demand for hygienic storage solutions across food, pharmaceutical, and industrial sectors. Regulatory emphasis on contamination-free packaging, combined with consumer expectations for durability and reusability, has driven the shift toward more specialized and standardized sanitary containers.

The rising need for aseptic handling in food processing, cleanroom environments, and chemical handling has further encouraged adoption of sealed and easy-to-clean cans. Advancements in material science and precision manufacturing have enabled the production of lightweight yet robust sanitary cans with enhanced sealing integrity.

The market is also being supported by sustainability goals, with end-users showing preference for recyclable metals and long-lasting container solutions that reduce packaging waste. As industries prioritize safe, traceable, and compliant handling of sensitive substances, demand for sanitary cans is expected to remain strong across both developed and emerging markets.

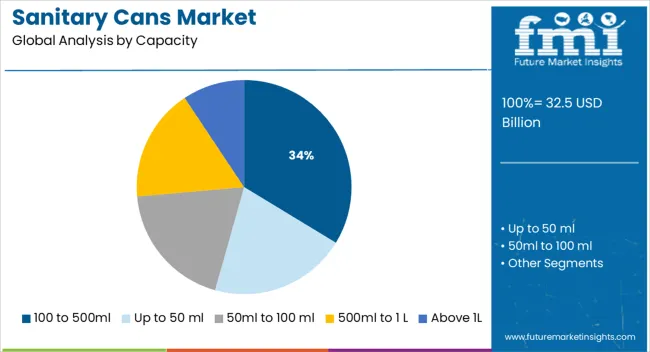

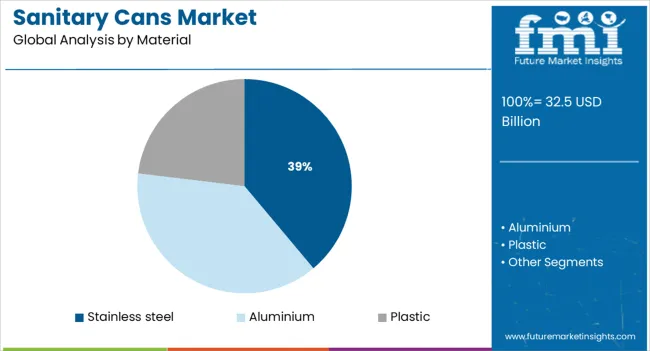

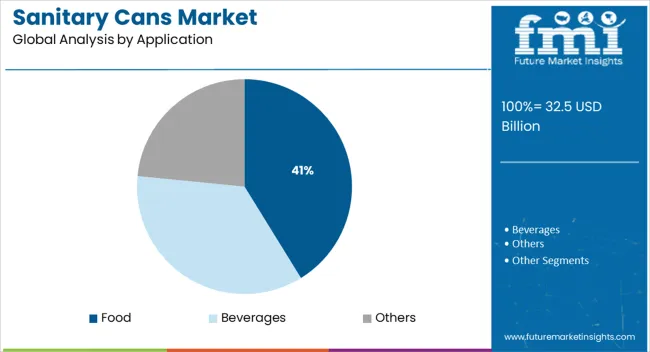

The market is segmented by Capacity, Material, and Application and region. By Capacity, the market is divided into 100 to 500ml, Up to 50 ml, 50ml to 100 ml, 500ml to 1 L, and Above 1L. In terms of Material, the market is classified into Stainless steel, Aluminium, and Plastic. Based on Application, the market is segmented into Food, Beverages, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 100 to 500ml capacity range is projected to account for 33.7% of total revenue in 2025, making it the leading segment by capacity. This range is favored due to its versatility in handling small to moderate volumes, particularly in sectors requiring portion-controlled or single-use dispensing.

In food and beverage industries, this size range ensures better inventory control, reduced product spoilage, and improved hygiene in production and distribution lines. The compact form factor allows ease of transportation and storage while meeting sanitary standards for direct and indirect food contact.

Its dominance is further reinforced by widespread usage in pharmaceutical sampling, laboratory applications, and niche industrial settings where minimal exposure and safe containment are essential.

Stainless steel is anticipated to dominate the market with a 38.9% revenue share in 2025, making it the leading material used in sanitary cans. This material’s corrosion resistance, non-reactivity, and strength have positioned it as a standard in applications where hygiene and durability are paramount.

Stainless steel’s ease of cleaning and ability to withstand repeated sterilization cycles without degradation have made it ideal for food processing, biotechnology, and chemical storage. The material also supports traceability and regulatory compliance in critical industries due to its inert composition.

As global safety protocols tighten and demand grows for sustainable, long-lasting solutions, stainless steel remains the preferred choice for manufacturers aiming to reduce lifecycle costs and material waste.

The food industry is expected to contribute 41.2% of total market revenue in 2025, ranking it as the leading application segment in the sanitary cans market. This growth is attributed to heightened regulatory scrutiny around food safety and the need for contamination-free storage and transportation.

Sanitary cans provide a controlled environment that supports shelf-life extension and preserves ingredient integrity. Their adoption has increased in ready-to-eat meals, sauces, condiments, and powdered ingredients, where packaging must meet both functional and hygienic standards.

Food producers are also leaning toward sanitary cans for automated filling lines and batch-controlled packaging processes, where precision and reliability are essential. As consumer demand rises for safely processed and packaged food, the food segment continues to drive consistent demand for sanitary-grade container systems.

Health conscious people are increasingly demanding food products which are free from microbes and other contaminants. Hence, food & packaging companies are investing in product development activities in order to offer products that ensure effectiveness of quality.

Packaging solutions such as sanitary cans are result of innovation in packaging technology that suits the solution required by the global market. With increase in demand for food & beverages products, the global demand for sanitary cans is expected to see a positive growth.

Sanitary cans improves the shelf life of food & beverages products, which helps in preserving the nutritional value of products. Easy and convenient recycling of sanitary cans further support the sustainability objectives of the sanitary cans manufacturers and end users.

Manufacturing technology used in the production of sanitary cans has undergone changes over the years. Technological advancements have considerably reduced the dependence of manual labor. Earlier cans were manufactured entirely by manual labor. A piece of tinplate was used to make the body of the sanitary cans.

The shape of the sanitary cans was achieved through roller which soldered the overlapping edges of tinplate sheets. Modern technology has enabled manufacturing of sanitary cans with advanced designs. Sanitary cans manufacturers have implemented crimped ends in order to enhance the functionality of sanitary cans.

Sanitary cans further involve rubber gaskets that are being replaced with rubber and gum which acts as a sealing element. With the changing trend, shaping and decorative finishes of sanitary cans are attracting consumers. Sanitary cans, which are beautifully designed, have a positive impact on consumers.

Recycling factor of sanitary cans has increased its demand in the market. Sanitary cans which are made up of metals like steel and aluminium can be easily recycled. Cans are mostly preferred for production as these can be easily recycled and easy for preserving food & beverages items.

Manufacturers are further considering producing sanitary cans that have material properties favourable for food products. Due to changing trends, consumers are increasingly preferring ready to eat food products.

The global sanitary cans market is segmented in 5 key regions including North America, Latin America, Europe, Middle East and Africa (MEA) and Asia Pacific (APAC). The North America sanitary cans market is expected to emerge as the most attractive market segment globally. The market share for North America sanitary cans market is estimated to contribute the highest share in revenue of global market for sanitary cans.

Asia Pacific and Europe are expected to follow North America as key geographic regions for sanitary cans market. However, the Europe sanitary cans market is expected to show a stagnant growth rate due to saturated market opportunities and availability of advanced packaging systems.

Asia Pacific is resultantly emerging as key market region for sanitary cans in terms of growing business opportunities. The Asia Pacific sanitary cans market is expected to see a growth in demand particularly coming from emerging regions of South East Asian countries including Indonesia, Thailand and Philippines.

The ASEAN sanitary cans market is anticipated to create huge growth opportunities for sanitary cans manufacturers and suppliers in the ASEAN market for sanitary cans.

Some of the key players in sanitary cans market are Ball Corporation, Air Sea Container, Ross Mixing Inc, Canfab Packaging, Freund Container & Supply/A Div of Berlin packaging, Bennett Manufacturing Company, Inc.

The global sanitary cans market is estimated to be valued at USD 32.5 billion in 2025.

The market size for the sanitary cans market is projected to reach USD 57.0 billion by 2035.

The sanitary cans market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in sanitary cans market are 100 to 500ml, up to 50 ml, 50ml to 100 ml, 500ml to 1 l and above 1l.

In terms of material, stainless steel segment to command 38.9% share in the sanitary cans market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sanitary Pump and Valve Market Size and Share Forecast Outlook 2025 to 2035

Sanitary Food & Beverage Packaging Market Size and Share Forecast Outlook 2025 to 2035

Sanitary Butterfly Valve Market Size and Share Forecast Outlook 2025 to 2035

Sanitary Napkin Vending Machine Market Analysis - Trends, Growth & Forecast 2025 to 2035

Ceramic Sanitary Ware Market Trends & Forecast 2025 to 2035

Reusable Sanitary Pads Market Growth - Size, Demand & Forecast 2025 to 2035

Positive Displacement Sanitary Pumps Market Size and Share Forecast Outlook 2025 to 2035

Cans Market Analysis – Innovations & Industry Forecast 2025 to 2035

Tin Cans Market

Bowl Cans Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Bowl Cans Manufacturers

Food Cans Market

Beer Cans Market

Paint Cans Market Size and Share Forecast Outlook 2025 to 2035

Jerry Cans Market Size and Share Forecast Outlook 2025 to 2035

Drink Cans Market Insights - Growth & Trends 2025 to 2035

Industry Share & Competitive Positioning in Jerry Cans

Market Share Insights of Paint Can Manufacturers

2 Piece Cans Market Size and Share Forecast Outlook 2025 to 2035

Beta-Glucans Market Trends – Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA